Professional Documents

Culture Documents

CALCULATE WACC Using Comparable Companies Unlevered Beta

Uploaded by

jeganathan0 ratings0% found this document useful (0 votes)

26 views1 pageWACC Calculator

Original Title

WACC Calculator

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWACC Calculator

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views1 pageCALCULATE WACC Using Comparable Companies Unlevered Beta

Uploaded by

jeganathanWACC Calculator

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

WACC Calculator

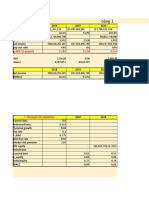

WACC Calculation Comparable Companies Unlevered Beta

Capital Structure Company Levered Beta Debt Equity Debt/Equity Tax Rate Unlevered Beta

Debt to Total Capitalization 50.00% A 1.23 520 1125 46.22% 25% 0.91

Equity to Total Capitalization 50.00% B 1.31 500 868 57.60% 27.5% 0.92

Debt / Equity 100.00% C 1.15 460 788 58.41% 28% 0.81

D 1.12 600 1125 53.33% 21% 0.79

Cost of Equity E 1.25 450 900 50.00% 21% 0.90

Risk Free Rate 2.33% Median 1.23 53.33% 0.90

Equity Risk Premium 8.00%

Levered Beta 1.62

Cost of Equity 15.30%

Cost of Debt

Cost of Debt 5.00%

Tax Rate 19.0%

After Tax Cost of Debt 4.05%

WACC 9.68%

This file is for educational purposes only.

Veristrat Infotech Ltd.

https://www.veristrat.com/

Veristrat Inc.®. All rights reserved.

You might also like

- 4 V's of OperationDocument6 pages4 V's of OperationRahul Agarwal85% (20)

- Marriott Corporation - K - AbridgedDocument9 pagesMarriott Corporation - K - AbridgedDurgaprasad Velamala100% (5)

- M&M Pizza With 20% TaxDocument5 pagesM&M Pizza With 20% TaxAnkitNo ratings yet

- 2014 03 22 Caso Frozen Food Costo de CapitalDocument6 pages2014 03 22 Caso Frozen Food Costo de CapitalAbdul wahabNo ratings yet

- Marriot CaseStudyDocument17 pagesMarriot CaseStudySambhav SamNo ratings yet

- SWOT Analysis: (Name / Logo)Document7 pagesSWOT Analysis: (Name / Logo)jeganathanNo ratings yet

- WACC Calculator: WACC Calculation Comparable Companies Unlevered BetaDocument1 pageWACC Calculator: WACC Calculation Comparable Companies Unlevered Betahassan1993No ratings yet

- Capital Structure: Debt To Total Capitalization Equity To Total CapitalizationDocument2 pagesCapital Structure: Debt To Total Capitalization Equity To Total CapitalizationAcxel Andres AltuveNo ratings yet

- Calculate Your WACCDocument2 pagesCalculate Your WACCRabia HashimNo ratings yet

- WACC CalculatorDocument4 pagesWACC CalculatormayankNo ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialKnightspageNo ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialJim MacaoNo ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly Confidentialvane rondinaNo ratings yet

- Calculadora WACCDocument2 pagesCalculadora WACCmarcos.hernandezNo ratings yet

- Capital Structure and Leverage (D. Bañas)Document6 pagesCapital Structure and Leverage (D. Bañas)DAISYBELLE S. BAÑASNo ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialJeane Mae Boo0% (1)

- Food Distribution LBO Deleverage AnalysisDocument12 pagesFood Distribution LBO Deleverage AnalysismartinsiklNo ratings yet

- WACC Calculation Comparable Companies Unlevered Beta Capital StructureDocument1 pageWACC Calculation Comparable Companies Unlevered Beta Capital StructureIkramNo ratings yet

- DCF Modelling - WACC - CompletedDocument1 pageDCF Modelling - WACC - Completed2203037No ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly Confidentialvyasmusic0% (1)

- BetawaccDocument1 pageBetawaccamro_baryNo ratings yet

- WACC Calculations (With Solution)Document4 pagesWACC Calculations (With Solution)hukaNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesShubham SharmaNo ratings yet

- betawaccDocument1 pagebetawaccDj (Dj)No ratings yet

- betawaccDocument1 pagebetawaccSachin KulkarniNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesSaadatNo ratings yet

- Marriot Corporation: The Cost of Capital: 1.598 Re-Levered BDocument1 pageMarriot Corporation: The Cost of Capital: 1.598 Re-Levered BAhmad AliNo ratings yet

- Marriot Corporation: The Cost of Capital: 1.598 Re-Levered BDocument1 pageMarriot Corporation: The Cost of Capital: 1.598 Re-Levered BAhmad AliNo ratings yet

- BetawaccDocument1 pageBetawaccRajesh KatyalNo ratings yet

- BetawaccDocument1 pageBetawaccwelcome2jungleNo ratings yet

- Estimating WACC using comparable companiesDocument1 pageEstimating WACC using comparable companiesgraskoskirNo ratings yet

- BetawaccDocument1 pageBetawaccMuhammad Ahsan MukhtarNo ratings yet

- BetawaccDocument1 pageBetawaccNabarun BhattacharyaNo ratings yet

- Estimating WACC using comparable companiesDocument1 pageEstimating WACC using comparable companiesmspanskiNo ratings yet

- MAD AssignmentDocument4 pagesMAD AssignmentSWETHA LAGISETTINo ratings yet

- BetawaccDocument1 pageBetawaccOmar GhaniNo ratings yet

- WACC CalculatorDocument11 pagesWACC CalculatorshountyNo ratings yet

- SBI Income Statement AnalysisDocument36 pagesSBI Income Statement AnalysisNaman KalraNo ratings yet

- Airthreads Valuation Case Study Excel File PDF FreeDocument18 pagesAirthreads Valuation Case Study Excel File PDF Freegoyalmuskan412No ratings yet

- Pricing Week 4&5Document23 pagesPricing Week 4&5Sanket Sourav BalNo ratings yet

- Marriott WACC and Divisional Cost of Capital AnalysisDocument15 pagesMarriott WACC and Divisional Cost of Capital AnalysisSaadatNo ratings yet

- Air Thread Case FinalDocument49 pagesAir Thread Case FinalJonathan GranowitzNo ratings yet

- Total Liabilities / Assets (In Figures) RS.: Particulars 2009 1540319785 Shareholder's FundsDocument4 pagesTotal Liabilities / Assets (In Figures) RS.: Particulars 2009 1540319785 Shareholder's FundsShakti TokasNo ratings yet

- Emv Case Study 1Document8 pagesEmv Case Study 1ViddhiNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- A B19049 Assignment 3Document9 pagesA B19049 Assignment 3Shrey BhalaNo ratings yet

- Wacc ProjectDocument8 pagesWacc ProjectSubhash PandeyNo ratings yet

- A. What Is The Company's Cost of Equity Capital?Document8 pagesA. What Is The Company's Cost of Equity Capital?thalibritNo ratings yet

- DCF Valuation TemplateDocument15 pagesDCF Valuation TemplateDEV DUTT VASHIST 22111116No ratings yet

- BetasDocument7 pagesBetasJulio Cesar ChavezNo ratings yet

- Financial Analysis and Valuation of a Vietnamese CompanyDocument3 pagesFinancial Analysis and Valuation of a Vietnamese CompanyĐình Thịnh LêNo ratings yet

- Weighted Average Cost of Capital (WACC) : Ultra TechDocument6 pagesWeighted Average Cost of Capital (WACC) : Ultra TechNipsi DasNo ratings yet

- Target ExerciseDocument18 pagesTarget ExerciseJORGE PUENTESNo ratings yet

- BetasDocument10 pagesBetasVilmaCastilloMNo ratings yet

- Marriot Corporation: Cost of Capital Calculation for DivisionsDocument3 pagesMarriot Corporation: Cost of Capital Calculation for DivisionsAhmad AliNo ratings yet

- Projections 2023Document8 pagesProjections 2023DHANAMNo ratings yet

- DF1 601 Individual AssignmentDocument5 pagesDF1 601 Individual AssignmentIan KipropNo ratings yet

- Clase 6 de Abril 2021Document12 pagesClase 6 de Abril 2021Wendy Paola Arrieta EscobarNo ratings yet

- 93 Optimal Risky PortfolioDocument6 pages93 Optimal Risky Portfoliomridul tiwariNo ratings yet

- Synchronized Multi-Load Balancer With Fault Tolerance in CloudDocument8 pagesSynchronized Multi-Load Balancer With Fault Tolerance in CloudjeganathanNo ratings yet

- Reflective Report 3Document2 pagesReflective Report 3jeganathanNo ratings yet

- Reflective Report 1Document4 pagesReflective Report 1jeganathanNo ratings yet

- Journal of King Saud University - Computer and Information SciencesDocument24 pagesJournal of King Saud University - Computer and Information SciencesjeganathanNo ratings yet

- Data Mining Applications in Healthcare Sector A StudyDocument7 pagesData Mining Applications in Healthcare Sector A StudyMuhja MufidahNo ratings yet

- Reflective Report 3Document2 pagesReflective Report 3jeganathanNo ratings yet

- Reflective Report 2Document3 pagesReflective Report 2jeganathanNo ratings yet

- Business Analytics For Project Management: ContentDocument4 pagesBusiness Analytics For Project Management: ContentjeganathanNo ratings yet

- Customer Continuity and Growth Part 3Document5 pagesCustomer Continuity and Growth Part 3jeganathanNo ratings yet

- HRM Alignment: Ensuring Vision, Mission and GoalsDocument3 pagesHRM Alignment: Ensuring Vision, Mission and GoalsjeganathanNo ratings yet

- Customer Continuity and Growth Part 2Document4 pagesCustomer Continuity and Growth Part 2jeganathanNo ratings yet

- HRM Part 1Document4 pagesHRM Part 1jeganathanNo ratings yet

- Business Analytics For Project ManagementDocument5 pagesBusiness Analytics For Project Managementjeganathan100% (1)

- Business analytics and risk management for projectsDocument3 pagesBusiness analytics and risk management for projectsjeganathanNo ratings yet

- Work Breakdown StructureDocument6 pagesWork Breakdown StructureG-SamNo ratings yet

- HRM in Context: Micromanagement CapabilitiesDocument3 pagesHRM in Context: Micromanagement CapabilitiesjeganathanNo ratings yet

- Raw Materials PlanningDocument11 pagesRaw Materials PlanningjeganathanNo ratings yet

- OperationsManagement-Zara Case StudyDocument24 pagesOperationsManagement-Zara Case StudyjeganathanNo ratings yet

- Customer Continuity and Growth Part 1Document5 pagesCustomer Continuity and Growth Part 1jeganathanNo ratings yet

- Balanced ScorecardDocument2 pagesBalanced ScorecardjeganathanNo ratings yet

- (Project Title) : Earned Value Analysis ReportDocument4 pages(Project Title) : Earned Value Analysis ReportjeganathanNo ratings yet

- Motivation EmployeesMBADocument8 pagesMotivation EmployeesMBAjeganathanNo ratings yet

- Research Proposal Stealth MarketingDocument36 pagesResearch Proposal Stealth MarketingjeganathanNo ratings yet

- Reflective StudyDocument8 pagesReflective StudyjeganathanNo ratings yet

- Critical Path MethodDocument3 pagesCritical Path MethodjeganathanNo ratings yet

- GartnerDocument6 pagesGartnerjeganathanNo ratings yet

- Apple 9Document2 pagesApple 9jeganathanNo ratings yet