Professional Documents

Culture Documents

Weighted Average Cost of Capital (WACC) Calculator: Strictly Confidential

Uploaded by

Jim Macao0 ratings0% found this document useful (0 votes)

27 views3 pagesOriginal Title

WACC Calculator

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly Confidential

Uploaded by

Jim MacaoCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

Weighted Average Cost of Capital (WACC) Calculator Strictly Confidential

Notes

This Excel model is for educational purposes only and should not be used for any other reason.

All content is Copyright material of CFI Education Inc.

https://corporatefinanceinstitute.com/

© 2019 CFI Education Inc.

All rights reserved. The contents of this publication, including but not limited to all written material, content layout, images, formulas, and code, are protected under international copyright and trademark laws.

No part of this publication may be modified, manipulated, reproduced, distributed, or transmitted in any form by any means, including photocopying, recording, or other electronic or mechanical methods,

© Corporate Finance Institute®. All rights reserved.

WACC Calculator

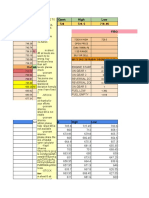

WACC Calculation Comparabl

Capital Structure Company

Debt to Total Capitalization 29.00% Company A

Equity to Total Capitalization 71.00% Company B

Debt / Equity 40.85% Company C

Company D

Cost of Equity Company E

Risk Free Rate 2.50% Median

Equity Risk Premium 6.00%

Levered Beta 1.19

Cost of Equity 9.62%

Cost of Debt

Cost of Debt 7.50%

Tax Rate 31.00%

After Tax Cost of Debt 5.18%

WACC 8.33%

This file is for educational purposes only. E&OE

Corporate Finance Institute®

https://corporatefinanceinstitute.com/

Comparable Companies Unlevered Beta

Levered Beta Debt Equity Debt/Equity Tax Rate Unlevered Beta

1.23 520 1,125 46.22% 31% 0.93

1.31 500 868 57.60% 30% 0.93

1.15 460 788 58.41% 29% 0.81

1.12 600 1,125 53.33% 33% 0.83

1.25 450 900 50.00% 30% 0.93

1.23 53.33% 0.93

You might also like

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialKnightspageNo ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly Confidentialvane rondinaNo ratings yet

- WACC CalculatorDocument4 pagesWACC CalculatormayankNo ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialJeane Mae Boo0% (1)

- Capital Structure: Debt To Total Capitalization Equity To Total CapitalizationDocument2 pagesCapital Structure: Debt To Total Capitalization Equity To Total CapitalizationAcxel Andres AltuveNo ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly Confidentialvyasmusic0% (1)

- WACC Calculator: WACC Calculation Comparable Companies Unlevered BetaDocument1 pageWACC Calculator: WACC Calculation Comparable Companies Unlevered BetajeganathanNo ratings yet

- Capital Structure Debt / Equity 40.85% Cost of Equity Median Cost of Equity 9.62% Cost of Debt After Tax Cost of Debt 5.18% Wacc 8.33%Document2 pagesCapital Structure Debt / Equity 40.85% Cost of Equity Median Cost of Equity 9.62% Cost of Debt After Tax Cost of Debt 5.18% Wacc 8.33%Rabia HashimNo ratings yet

- WACC Calculator: WACC Calculation Comparable Companies Unlevered BetaDocument1 pageWACC Calculator: WACC Calculation Comparable Companies Unlevered Betahassan1993No ratings yet

- Calculadora WACCDocument2 pagesCalculadora WACCmarcos.hernandezNo ratings yet

- WACC Workout FullDocument29 pagesWACC Workout Fulldevilcaeser2010No ratings yet

- Financial Synergy Valuation TemplateDocument4 pagesFinancial Synergy Valuation TemplateAkshat PrakashNo ratings yet

- Financial Synergy Valuation Template 1Document2 pagesFinancial Synergy Valuation Template 1Luthfi MNo ratings yet

- Group 10 FMDocument12 pagesGroup 10 FMVaibhav AroraNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementVaibhav AroraNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementVaibhav AroraNo ratings yet

- Group 10Document12 pagesGroup 10Vaibhav AroraNo ratings yet

- WACC Calculation Comparable Companies Unlevered Beta Capital StructureDocument1 pageWACC Calculation Comparable Companies Unlevered Beta Capital StructureIkramNo ratings yet

- Capital Structure and Leverage (D. Bañas)Document6 pagesCapital Structure and Leverage (D. Bañas)DAISYBELLE S. BAÑASNo ratings yet

- DCF Modelling - WACC - CompletedDocument1 pageDCF Modelling - WACC - Completed2203037No ratings yet

- WACC CalculatorDocument11 pagesWACC CalculatorshountyNo ratings yet

- Valuation Model1 by Mihir KumarDocument15 pagesValuation Model1 by Mihir KumarMannaNo ratings yet

- Team MembersDocument8 pagesTeam MembersUyen HoangNo ratings yet

- Executive Summary: S11158164 S11157500 S11157427 S11159403 S11158400Document12 pagesExecutive Summary: S11158164 S11157500 S11157427 S11159403 S11158400Navin N Meenakshi ChandraNo ratings yet

- A. What Is The Company's Cost of Equity Capital?Document8 pagesA. What Is The Company's Cost of Equity Capital?thalibritNo ratings yet

- Project Appraisal and FinancingDocument6 pagesProject Appraisal and Financingreanand007No ratings yet

- 3 6 1+Calculating+the+WACCDocument12 pages3 6 1+Calculating+the+WACCLeonardo VettorazzoNo ratings yet

- Foodtree LBO Deleverage: FinancialsDocument12 pagesFoodtree LBO Deleverage: FinancialsmartinsiklNo ratings yet

- Capital StructureDocument29 pagesCapital StructureNawazish KhanNo ratings yet

- Kotak Infrastructure and Economic Reform FundDocument14 pagesKotak Infrastructure and Economic Reform FundArmstrong CapitalNo ratings yet

- Capital Struture Analysis Oman CompaniesDocument9 pagesCapital Struture Analysis Oman CompaniesSalman SajidNo ratings yet

- BetawaccDocument1 pageBetawaccSachin KulkarniNo ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesSaadatNo ratings yet

- BetawaccDocument1 pageBetawaccDj (Dj)No ratings yet

- Estimating The Weighted Average Cost of Capital: Comparable CompaniesDocument1 pageEstimating The Weighted Average Cost of Capital: Comparable CompaniesShubham SharmaNo ratings yet

- Company-Specific Risk Premiums (American Bankruptcy Insitute, 2010) PDFDocument100 pagesCompany-Specific Risk Premiums (American Bankruptcy Insitute, 2010) PDFMichael SmithNo ratings yet

- BetawaccDocument1 pageBetawaccamro_baryNo ratings yet

- CH 4 - in ClassDocument3 pagesCH 4 - in ClassJOSEPH MICHAEL MCGUINNESSNo ratings yet

- MAD AssignmentDocument4 pagesMAD AssignmentSWETHA LAGISETTINo ratings yet

- M. Corporate FinanceDocument62 pagesM. Corporate FinanceMd. Tauhidur Rahman 07-18-45No ratings yet

- First Solar Inc. Ratio ComparisonsDocument7 pagesFirst Solar Inc. Ratio ComparisonsSameer ChoudharyNo ratings yet

- PvtdiscrateDocument4 pagesPvtdiscrateapi-3763138No ratings yet

- BetawaccDocument1 pageBetawaccOmar GhaniNo ratings yet

- 2 CorpDocument40 pages2 CorpMR MARWANE OFFICIELNo ratings yet

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetNo ratings yet

- BetawaccDocument1 pageBetawaccRajesh KatyalNo ratings yet

- BetawaccDocument1 pageBetawaccNabarun BhattacharyaNo ratings yet

- BetawaccDocument1 pageBetawaccmspanskiNo ratings yet

- BetawaccDocument1 pageBetawaccwelcome2jungleNo ratings yet

- BetawaccDocument1 pageBetawaccgraskoskirNo ratings yet

- BetawaccDocument1 pageBetawaccMuhammad Ahsan MukhtarNo ratings yet

- 4 The Firm's Capital Structure and Degree of LeverageDocument9 pages4 The Firm's Capital Structure and Degree of LeverageMariel GarraNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Accenture PLC: Financial Model and ValuationDocument23 pagesAccenture PLC: Financial Model and ValuationNidhi DangiNo ratings yet

- Group 2 Marriott SlideDocument47 pagesGroup 2 Marriott SlideIbraheem RabeeNo ratings yet

- Liquidity FundDocument3 pagesLiquidity Fundtangkc09No ratings yet

- Kongkaikai 10 Writing Materials#Document7 pagesKongkaikai 10 Writing Materials#abiramieNo ratings yet

- Group 6 Project MADocument32 pagesGroup 6 Project MAPhạm Kỳ DuyênNo ratings yet

- Common Size Analysis TemplateDocument4 pagesCommon Size Analysis TemplateMuhammad FarooqNo ratings yet

- Credit Risk Management: How to Avoid Lending Disasters and Maximize EarningsFrom EverandCredit Risk Management: How to Avoid Lending Disasters and Maximize EarningsNo ratings yet

- Refinery Acquisition ModelDocument316 pagesRefinery Acquisition ModelJim MacaoNo ratings yet

- Refining: Outline Refinery Processes Refining Markets: Capacity, Cost, Investment Optimization of Refinery OperationsDocument49 pagesRefining: Outline Refinery Processes Refining Markets: Capacity, Cost, Investment Optimization of Refinery OperationsJim MacaoNo ratings yet

- Capital Cost Estimation 2 Jan 23Document20 pagesCapital Cost Estimation 2 Jan 23mgkvprNo ratings yet

- Cost EstimationDocument29 pagesCost Estimationgeorgiadisg100% (4)

- Econ 2Document16 pagesEcon 2ediabcNo ratings yet

- Refinery DCF ModelDocument20 pagesRefinery DCF ModelSumitAggarwal100% (3)

- Refinery Acquisition ModelDocument316 pagesRefinery Acquisition ModelJim MacaoNo ratings yet

- Simple Financial ModelDocument59 pagesSimple Financial Modelmincho4104No ratings yet

- Advanced: Oil & Gas ModellingDocument6 pagesAdvanced: Oil & Gas ModellingJim MacaoNo ratings yet

- Production of Gas by YearDocument6 pagesProduction of Gas by YearJim MacaoNo ratings yet

- OilGas DCF NAV ModelDocument21 pagesOilGas DCF NAV ModelbankiesoleNo ratings yet

- Airport-Finance of TravelDocument28 pagesAirport-Finance of Travelkarthiks12008658No ratings yet

- Refining Capacity Study FE0000516 - FinalReportDocument323 pagesRefining Capacity Study FE0000516 - FinalReportjeedan100% (1)

- Key Fundraising Issues Placement AgentsDocument28 pagesKey Fundraising Issues Placement AgentsJim MacaoNo ratings yet

- Key Fundraising Issues Placement AgentsDocument28 pagesKey Fundraising Issues Placement AgentsJim MacaoNo ratings yet

- The Private Equity CookbookDocument164 pagesThe Private Equity CookbookJim MacaoNo ratings yet

- Best Practices in Due Diligence Greenwich RoundtableDocument76 pagesBest Practices in Due Diligence Greenwich RoundtableWindsor1801No ratings yet

- Emerging Manager: Feature: Are You Experienced? Survey: Pe/Vc Emerging Managers Survey: Institutional InvestorsDocument32 pagesEmerging Manager: Feature: Are You Experienced? Survey: Pe/Vc Emerging Managers Survey: Institutional InvestorsJim MacaoNo ratings yet

- Cargo Airport Financing PDFDocument16 pagesCargo Airport Financing PDFJim MacaoNo ratings yet

- Cargo Airport Financing PDFDocument16 pagesCargo Airport Financing PDFJim MacaoNo ratings yet

- GE and YPF Secure Financing For Two Fastpower Projects in ArgentinaDocument4 pagesGE and YPF Secure Financing For Two Fastpower Projects in ArgentinaJim MacaoNo ratings yet

- Cargo Airport Financing PDFDocument16 pagesCargo Airport Financing PDFJim MacaoNo ratings yet

- Formation of Private Equity FundsDocument39 pagesFormation of Private Equity FundsJim Macao100% (1)

- Kuwait 2020 Health Report PDFDocument27 pagesKuwait 2020 Health Report PDFJim MacaoNo ratings yet

- Non U S Investment Funds and Managers Legal and Regulatory Issues When Raising Capital in The United States 19581 PDFDocument29 pagesNon U S Investment Funds and Managers Legal and Regulatory Issues When Raising Capital in The United States 19581 PDFJim MacaoNo ratings yet

- KLSC BDU Kuwait Healthcare Report 2019 VF PDFDocument16 pagesKLSC BDU Kuwait Healthcare Report 2019 VF PDFJim MacaoNo ratings yet

- Colombia Project Finance - Getting The Deal Through - GTDT PDFDocument19 pagesColombia Project Finance - Getting The Deal Through - GTDT PDFJim MacaoNo ratings yet

- Delta Capital - Investor Presentation - 2017-01-16 - v3Document24 pagesDelta Capital - Investor Presentation - 2017-01-16 - v3Jim MacaoNo ratings yet

- Private Equity International - 2017 PerspectivesDocument48 pagesPrivate Equity International - 2017 PerspectivesJim MacaoNo ratings yet

- FCCB 1Document6 pagesFCCB 1krishr25No ratings yet

- Ordinar Y LevelDocument16 pagesOrdinar Y LevelPantuan SizweNo ratings yet

- Solman 12 Second EdDocument23 pagesSolman 12 Second Edferozesheriff50% (2)

- Tesco PLC (Group 7)Document23 pagesTesco PLC (Group 7)Jingquan (Adele) ZhaoNo ratings yet

- Midterm Exam of Managerial Economics 2022Document4 pagesMidterm Exam of Managerial Economics 2022dayeyoutai779No ratings yet

- Sun Microsystems Case PDFDocument30 pagesSun Microsystems Case PDFJasdeep SinghNo ratings yet

- PMP Formulas Pocket GuideDocument2 pagesPMP Formulas Pocket GuideTalha FarooqiNo ratings yet

- Group 1 The Channel ParticipantsDocument65 pagesGroup 1 The Channel ParticipantsMary Rose BuaronNo ratings yet

- 2-200-97A Workbook With Solutions - Midterm - MAJ 20 Août 2017Document38 pages2-200-97A Workbook With Solutions - Midterm - MAJ 20 Août 2017Aya AzanarNo ratings yet

- Risk & Return PDFDocument5 pagesRisk & Return PDFAminul shuvoNo ratings yet

- NB Renaissance Partners S.À R.L. SICAV-RAIF - NBRP Fund III (Master)Document77 pagesNB Renaissance Partners S.À R.L. SICAV-RAIF - NBRP Fund III (Master)Georgio Romani100% (1)

- Associate Wealth Manager AWMDocument8 pagesAssociate Wealth Manager AWMShweta ChhabraNo ratings yet

- STOCK VICHAR GANN CalculatorDocument154 pagesSTOCK VICHAR GANN Calculatorudhaya kumarNo ratings yet

- Accounting System in India-IgnouDocument32 pagesAccounting System in India-IgnouSakshi TiwariNo ratings yet

- IAS 1 Presentation Financial Statements 2019Document32 pagesIAS 1 Presentation Financial Statements 2019José Alberto MartínezNo ratings yet

- Capital Budgeting and Estimating Cash Flows Capital Budgeting and Estimating Cash FlowsDocument29 pagesCapital Budgeting and Estimating Cash Flows Capital Budgeting and Estimating Cash FlowsMoqadus SeharNo ratings yet

- Accounting 4 Note Payable and Debt RestructureDocument2 pagesAccounting 4 Note Payable and Debt RestructurelorenNo ratings yet

- Q1 Handout Module-4Document3 pagesQ1 Handout Module-4Chaeyo SonNo ratings yet

- Advance Accounting Session 2Document68 pagesAdvance Accounting Session 2ۦۦ FrancisNo ratings yet

- Income Taxes (Ias - 12) : Page 1 of 25Document25 pagesIncome Taxes (Ias - 12) : Page 1 of 25ErslanNo ratings yet

- Market Opportunity AnalysisDocument27 pagesMarket Opportunity AnalysisRuby CabralNo ratings yet

- About Way2wealth GroupDocument9 pagesAbout Way2wealth GroupSabah MemonNo ratings yet

- Idx-Annually 2017Document198 pagesIdx-Annually 2017Defira SharafinaNo ratings yet

- IA 2 Chapter 5 ActivitiesDocument12 pagesIA 2 Chapter 5 ActivitiesShaina TorraineNo ratings yet

- A'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 14 & 15Document7 pagesA'lla Zahwa Andewi Nugraheni - 464977 - Tugas FM CH 14 & 15PRA MBANo ratings yet

- Weekly Commentary BlackRockDocument6 pagesWeekly Commentary BlackRockelvisgonzalesarceNo ratings yet

- Mtrading Ebook 10 RulesDocument14 pagesMtrading Ebook 10 RulesIndika WithanageNo ratings yet

- Please List Team Members BelowDocument35 pagesPlease List Team Members BelowHarshit Verma17% (6)

- F9 Question Bank Answers-BeckerDocument153 pagesF9 Question Bank Answers-BeckerRanjisi chimbanguNo ratings yet

- Lecture Outline: Share-Based Compensation and Earnings Per ShareDocument3 pagesLecture Outline: Share-Based Compensation and Earnings Per ShareFranz AppleNo ratings yet