Professional Documents

Culture Documents

102 Profitadjustments

Uploaded by

angie aggenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

102 Profitadjustments

Uploaded by

angie aggenCopyright:

Available Formats

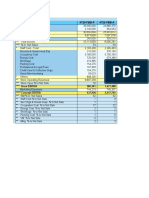

FYTD12(July-Dec.

2011)

Store #102

Pre-Adjustments Adjustment Post-Adjust.

Gross Sales 2,313,050

Retail Sales(GRS) (91%) 2,104,876 -35% 1,368,169

Licensee Sales (9%) 208,174

Net Profit 292,148

Discounts 54,449

Taxes(29% of Gross Sales) 670,499 29% of Adj. GRS 369,769

Net Sales 1,588,101

Total COG 991,789

COG for Retail Sales(91%) 902,527 -35% 586,643

COG for Licensee Sales(9%) 89,261

Sal./Comm. 79,734

Benefits 43,000

Supplies 219

Direct Expenses

Communication 231

Utilities 5,881

Rent 48,017

Repair/Main. 0

Printing 340

Other Purchased Services 2,927

Other Goods/Services 450

Direct Allocations 462

Freight Arb. -17,564 add 17564 0

Freight 15,156

Bankcard Fees 15,879 -9% 14,449

Travel 47

Total Direct Expenses 1,186,568 797,556

Inderect Expenses 108,096

Breakage 954

+ Adjusted GRS 1,368,169

- 17% of Adj. GRS 232,588

- Adj. Total Direct Expenses 797,556

- Indirect Expenses 108,096

- Breakage 954

- 29% of Adj. GRS 396,769

= Net Income -166,840 (for 6 months)

This is with the assumptions:

1. Loss of 35% in Gross Retail Sales

2. Paying a total of 46% tax on Gross Retail Sales

3. Loss of 100% of Licensee Sales

You might also like

- Official Line Up ChristmasDocument3 pagesOfficial Line Up ChristmasGerard DGNo ratings yet

- Manual of HeraldryDocument146 pagesManual of HeraldryTrung Tiên100% (1)

- Bharani Nakshatra Unique Characteristics and CompatibilityDocument5 pagesBharani Nakshatra Unique Characteristics and Compatibilityastroprophecy100% (2)

- Mett International Pty LTD Financial Forecast 3 Year SummaryDocument134 pagesMett International Pty LTD Financial Forecast 3 Year SummaryJamilexNo ratings yet

- The Chesscafe Puzzle Book 2Document277 pagesThe Chesscafe Puzzle Book 2Alpha Wolf100% (3)

- Organization Theory and Design 12th Edition Ebook PDFDocument41 pagesOrganization Theory and Design 12th Edition Ebook PDFlouise.merrill249100% (37)

- Topic 3 The Scope of Operational AuditDocument4 pagesTopic 3 The Scope of Operational AuditPotato Commissioner100% (1)

- Case IDocument20 pagesCase ICherry KanjanapornsinNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Court of Ages, Armistice and Accord Letters Patent, Notice of ReconciliationDocument6 pagesCourt of Ages, Armistice and Accord Letters Patent, Notice of ReconciliationCindy Kay CurrierNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Salazar v. CFIDocument2 pagesSalazar v. CFILouie BruanNo ratings yet

- Powerol - Monthly MIS FormatDocument34 pagesPowerol - Monthly MIS Formatdharmender singhNo ratings yet

- Managment Accounting KKDocument8 pagesManagment Accounting KKkishlay kumarNo ratings yet

- Horizontal & Vertical Analysis of Maruti Suzuki India LTDDocument17 pagesHorizontal & Vertical Analysis of Maruti Suzuki India LTDBerkshire Hathway coldNo ratings yet

- Add: Purchases Net of Scheme Cost (Including F. Goods Purchases)Document12 pagesAdd: Purchases Net of Scheme Cost (Including F. Goods Purchases)rinku10431No ratings yet

- HBR Case ReviewDocument6 pagesHBR Case ReviewVarun KNo ratings yet

- PandL 2022-23Document2 pagesPandL 2022-23ranjanamalhari384No ratings yet

- Textiles and Export CaseDocument6 pagesTextiles and Export CaseSaravana KumarNo ratings yet

- Accltd.: Income & Expenditure Summary: Dec 2010 - Dec 2019: Non-Annualised: Rs. CroreDocument6 pagesAccltd.: Income & Expenditure Summary: Dec 2010 - Dec 2019: Non-Annualised: Rs. Crorehardik aroraNo ratings yet

- SECUREX (PVT.) Limited: Statement of Comprehensive Income For The Year Ended 29 February 2016 2016 Notes TakaDocument4 pagesSECUREX (PVT.) Limited: Statement of Comprehensive Income For The Year Ended 29 February 2016 2016 Notes TakaBiplob K. SannyasiNo ratings yet

- Scheiner and Square DDocument9 pagesScheiner and Square DHeni Oktavianti0% (1)

- CR AssignmentDocument16 pagesCR AssignmentWaleed KhalidNo ratings yet

- Apple - Annual ReportDocument5 pagesApple - Annual ReportVeni GuptaNo ratings yet

- Nyse Aan 1998Document18 pagesNyse Aan 1998gaja babaNo ratings yet

- Advance Tax-Basis PeriodDocument6 pagesAdvance Tax-Basis PeriodFunshoNo ratings yet

- Hero Model - Equivalue 2Document48 pagesHero Model - Equivalue 2Neha RadiaNo ratings yet

- Projected Income StatementDocument4 pagesProjected Income StatementRavi DhillonNo ratings yet

- Casabuena Financial PlanDocument3 pagesCasabuena Financial PlanShane Daphnie SegoviaNo ratings yet

- Statement of OperationsDocument1 pageStatement of Operations227230No ratings yet

- Baldwin Bicycle CompanyDocument7 pagesBaldwin Bicycle CompanyIndustry ReportNo ratings yet

- Answer 1 Joyce TilyenjiDocument4 pagesAnswer 1 Joyce TilyenjiANDREW MAZIMBANo ratings yet

- Hindustan Unilever Limited Projections For Balance Sheet, Profit and Loss and Cash Flow StatementDocument24 pagesHindustan Unilever Limited Projections For Balance Sheet, Profit and Loss and Cash Flow StatementArjjun BalasubramanianNo ratings yet

- Costs of Real EstateDocument14 pagesCosts of Real EstatePrincess Syra PunzalanNo ratings yet

- Financial TTDocument4 pagesFinancial TTJamilexNo ratings yet

- P& L Statment 2009-10Document7 pagesP& L Statment 2009-10syedommayedNo ratings yet

- Pvatepla q3 2023 enDocument14 pagesPvatepla q3 2023 enrogercabreNo ratings yet

- PidiliteDocument16 pagesPidilitesamay gargNo ratings yet

- NestleDocument4 pagesNestleChhavi KhandujaNo ratings yet

- 2020-08 Financial StatementsDocument7 pages2020-08 Financial StatementsDenis GonzálezNo ratings yet

- Auditing Problem Test Bank 1 AnsDocument9 pagesAuditing Problem Test Bank 1 AnsJayson CerradoNo ratings yet

- Topic 10-12 Alk (Hitungannya)Document6 pagesTopic 10-12 Alk (Hitungannya)Daffa Permana PutraNo ratings yet

- Cipla P& LDocument2 pagesCipla P& LNEHA LALNo ratings yet

- AQ - 20230226212627 - Aquila SA EN Consolidated Financial Results Preliminary 2022Document6 pagesAQ - 20230226212627 - Aquila SA EN Consolidated Financial Results Preliminary 2022teoxysNo ratings yet

- HUL AnalysisDocument4 pagesHUL AnalysisSaurabh SinghNo ratings yet

- Latihan Soal 1Document1 pageLatihan Soal 1Anggraeni AyuningtyasNo ratings yet

- Financials 9Document4 pagesFinancials 9Sagar ChaurasiaNo ratings yet

- CCCL Fin ModelDocument165 pagesCCCL Fin ModelMuhammad “Muhack” MustafaNo ratings yet

- FA Additional Assignment 2Document7 pagesFA Additional Assignment 2lisha luoNo ratings yet

- AscascaDocument9 pagesAscascaDhruba DasNo ratings yet

- Attock Refinery FM Assignment#3Document13 pagesAttock Refinery FM Assignment#3Vishal MalhiNo ratings yet

- Notes: To The Financial StatementsDocument2 pagesNotes: To The Financial StatementsAkshayNo ratings yet

- 3 - March 2018Document152 pages3 - March 2018Mella ChairunnissaNo ratings yet

- Tata Motors LTD (TTMT IN) - AdjustedDocument15 pagesTata Motors LTD (TTMT IN) - AdjustedAswini Kumar BhuyanNo ratings yet

- Advanced Info Service PCL (ADVANC TB) - AdjustedDocument12 pagesAdvanced Info Service PCL (ADVANC TB) - AdjustedYounG TerKNo ratings yet

- Reformulated Income Statement of Century Ply: Operating RevenueDocument2 pagesReformulated Income Statement of Century Ply: Operating RevenueBhoomika GuptaNo ratings yet

- Fund Flow Statement - Feb-21Document128 pagesFund Flow Statement - Feb-21Suneet GaggarNo ratings yet

- Estados Financieros Colgate. Analísis Vertical y HorizontalDocument5 pagesEstados Financieros Colgate. Analísis Vertical y HorizontalXimena Isela Villalpando BuenoNo ratings yet

- MBA 640 - Week 4 - Final Project Milestone OneDocument3 pagesMBA 640 - Week 4 - Final Project Milestone Onewilhelmina baxterNo ratings yet

- GUE GUL - Overheads 2023Document111 pagesGUE GUL - Overheads 2023John Bryan HernandoNo ratings yet

- Accounts Assignement 21MBA0106Document4 pagesAccounts Assignement 21MBA0106TARVEEN DuraiNo ratings yet

- Ara ReportDocument60 pagesAra Reportvineeth singhNo ratings yet

- Tramaine McCray Jan - December Financials Working Updated 3 PDFDocument1 pageTramaine McCray Jan - December Financials Working Updated 3 PDFZeeshan PervaizNo ratings yet

- Aayush Agrawal PGPM-021-002 Disha Vishwakarma PGPM-021-019 Needhi Nagwekar PGPM-021-029 Vaibhav PGPM-021-059Document24 pagesAayush Agrawal PGPM-021-002 Disha Vishwakarma PGPM-021-019 Needhi Nagwekar PGPM-021-029 Vaibhav PGPM-021-059Needhi NagwekarNo ratings yet

- Financials For Marapangi Property - 2022Document2 pagesFinancials For Marapangi Property - 2022marivic buenaflorNo ratings yet

- IndusDocument5 pagesIndusFateen HabibNo ratings yet

- Financial ManagementDocument4 pagesFinancial ManagementHara KimNo ratings yet

- Monte Carlo Fashions Ltd. Forecast - UPDATEDDocument26 pagesMonte Carlo Fashions Ltd. Forecast - UPDATEDsanket patilNo ratings yet

- Julius Caesar LitChartDocument30 pagesJulius Caesar LitChartCric FreakNo ratings yet

- ESFP Morale OfficerDocument64 pagesESFP Morale OfficerbrunogasperinNo ratings yet

- RN LP202Document1 pageRN LP202rkrishnanforuNo ratings yet

- Physical Education: DepedDocument67 pagesPhysical Education: DepedAj AntonioNo ratings yet

- Tempo Runs Vs Interval TrainingDocument2 pagesTempo Runs Vs Interval TrainingeeumchemNo ratings yet

- St. Paul University Philippines: Tuguegarao City, Cagayan 3500Document8 pagesSt. Paul University Philippines: Tuguegarao City, Cagayan 3500Kenneth Villanueva LagascaNo ratings yet

- 1basic Concepts of Growth and DevelopmentDocument100 pages1basic Concepts of Growth and Developmentshweta nageshNo ratings yet

- Unit 2: Detailed Architecture and Runtime: Lesson: Business ExampleDocument36 pagesUnit 2: Detailed Architecture and Runtime: Lesson: Business ExamplerajendrakumarsahuNo ratings yet

- Rustamji Institute of Technology: Predictive Analytics On Health CareDocument12 pagesRustamji Institute of Technology: Predictive Analytics On Health CareOcean BluuNo ratings yet

- GUide To OVERCOme ModuleDocument3 pagesGUide To OVERCOme ModuleMark SordanNo ratings yet

- English For Academic and Professional Purposes: Bulan National High SchoolDocument12 pagesEnglish For Academic and Professional Purposes: Bulan National High SchoolPhiona GeeNo ratings yet

- Fere Proposal 1Document30 pagesFere Proposal 1molla fentaye100% (1)

- Timberjack Parts Case IDocument4 pagesTimberjack Parts Case ISethNo ratings yet

- 1 LiverDocument10 pages1 LiverAlbino Fulgencio Santos III100% (1)

- The India of My Dreams Indira GandhiDocument13 pagesThe India of My Dreams Indira GandhinandinieJain100% (1)

- Japanese Teens As Producers of Street FashionDocument14 pagesJapanese Teens As Producers of Street FashionMishiko OsishviliNo ratings yet

- Ma. Cecilia A. Belga Ma. Cecilia A. BelgaDocument2 pagesMa. Cecilia A. Belga Ma. Cecilia A. BelgaBelga MANo ratings yet

- Evidence Summary NotesDocument2 pagesEvidence Summary NotesMemai AvilaNo ratings yet

- List Two (2) Areas of Legislative and Regulatory Context of An Organisation and Briefly Describe What They InvolveDocument19 pagesList Two (2) Areas of Legislative and Regulatory Context of An Organisation and Briefly Describe What They InvolveTanveer MasudNo ratings yet

- Acebedo - Optical - Co. - Inc. - v. - Court - of - AppealsDocument31 pagesAcebedo - Optical - Co. - Inc. - v. - Court - of - AppealsAtheena Marie PalomariaNo ratings yet

- English 4 - ST3 - Q1Document2 pagesEnglish 4 - ST3 - Q1manuel100% (1)

- Self-Care: Good For You and Your Work: Ellen Newman Projects Coordinator Hunter Institute of Mental HealthDocument36 pagesSelf-Care: Good For You and Your Work: Ellen Newman Projects Coordinator Hunter Institute of Mental HealthErwin Y. CabaronNo ratings yet