Professional Documents

Culture Documents

Financial Management

Uploaded by

Hara Kim0 ratings0% found this document useful (0 votes)

6 views4 pagesFinancial Management; Horizontal and Vertical

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial Management; Horizontal and Vertical

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views4 pagesFinancial Management

Uploaded by

Hara KimFinancial Management; Horizontal and Vertical

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

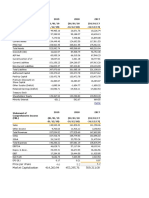

Horizontal Analysis of Balance

Sheet For the Year 2021 & 2022

ASSETS 2021 2022 Amount Percentage

Increase Increase

(Decrease) (Decrease)

Current Assets:

Cash 4,976,330 2,869,876 -2,106,454 -42.33%

Petty Cash 10,000 10,000 0 0.00%

Accounts receivable 7,127,853 4,180,016 -2,947,837 -41.36%

Finish Goods Inventory 392,300 312,029 -80,271 -20.46%

Work In Process Inventory 545,117 428,519 -116,598 -21.39%

Raw Materials Inventory 134,280 94,159 -40,121 -29.88%

Indirect Materials Inventory 76,749 53,818 -22,931 -29.88%

Office Supplies 2,487 2,195 -292 -11.74%

Prepaid Rent 652,800 652,800 0 0.00%

Total Current Assets 13,917,916 8,603,412 -5,314,504 -38.18%

Non-current Assets:

Property, Plant & 3,434,400 3,434,400 0 0.00%

Equipment

Less: Accumulated 1,192,572 596,286 -596,286 -50.00%

Depreciation

Total Non-current Assets 2,241,828 2,838,118 596,290 26.60%

Total Assets 16,159,744 11,441,526 -4,718,218 -29.20%

Liabilities and Equity

Current Liabilities:

Accounts Payable 1,253,458 423,379 -830,079 -66.22%

Income tax payable 1,235,689 450,329 -785,360 -63.56%

Salaries Payable 274,528 258,375 -16,153 -5.88%

SS premiums payable 24,449 22,638 -1,811 -7.41%

Philhealth premiums 4,118 3,813 -305 -7.41%

payable

Pag-ibig premiums payable 6,496 5,800 -696 -10.71%

EC premium payable 594 530 -64 -10.77%

Utilities payable 13,414 11,836 -1,578 -11.76%

Repair and & maintenance 472 417 -55 -11.65%

payable

Advertising payable 3,955 3,490 -465 -11.76%

Total current liabilities 2,817,171 1,180,605 -1,636,566 -58.09%

Shareholders' Equity:

Ordinary Shares 9,000,000 9000000 0 0.00%

Retained Earnings 4,342,573 1,260,921 -3,081,652 -70.96%

Total Equity 13,342,573 10,260,921 -3,081,652 -23.10%

Total Liabilities & Equity 16,159,744 11,441,526 -4,718,218 -29.20%

To interpret Cash:

Peso change = 2,869,876 – 4,976,330 = (P2,106,454)

Percentage Change = -2,106,454\4,976,330 = -42.33%

This is evaluated that Cash decreased by P2,106,454. This represents a decline of 42.33% from

the year 2021.

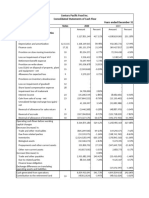

Horizontal Analysis of Income

Statement For the year 2021 & 2022

2,021 2,022 Amount Increase Percentage

(Decrease) Increase

(Decrease)

Sales 24,331,395 16,720,063 -7,611,332 -31.28%

Less: Cost of Good Sold 13,002,527 9,972,432 -3,030,095 -23.30%

Gross Profit 11,328,867 6,747,631 -4,581,236 -40.44%

Less: Operating 4,267,789 4,174,323 -93,466 -2.19%

Expenses

Operating Income 7,061,079 2,573,307 -4,487,772 -63.56%

Less: Income Tax of 2,118,324 771,992 -1,346,332 -63.56%

30%

Net Income after Tax 4,942,755 1,801,315 -3,141,440 -63.56%

To interpret Sales:

Peso change = 16,720,063 – 24,331,395 = (P7,611,332)

Percentage change = -7,611,332\24,331,395 = -31.28%

This is evaluated that Sales decreased by P7,611,332. This represents a decline of 31.28% from

the year 2021.

Vertical Analysis of Income

Statement As of December 31, 2021

Percentage (Item\Net

Sales)

Sales 24,331,395 100.00%

Less: Cost of Good Sold 13,002,527 53.44%

Gross Profit 11,328,867 46.56%

Less: Operating Expenses 4,267,789 17.54%

Operating Income 7,061,079 29.02%

Less: Income Tax of 30% 2,118,324 8.71%

Net Income after Tax 4,942,755 20.31%

The above may be evaluated as flows:

The Cost of Goods Sold is 53.44% of Sales. The Company has a gross profit rate of 46.56%.

Operating expenses are 17.54% of Sales.

The Company earns income of P0.20 for every peso of sales.

Gross Profit generated for every peso of sale is 0.46.

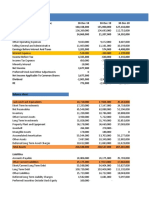

Vertical Analysis of Balance

Sheet As of December 31, 2021

ASSETS 2021 Percentage

(Item/Total

Assets)

Current Assets:

Cash 4,976,330 30.79%

Petty Cash 10,000 0.06%

Accounts receivable 7,127,853 44.11%

Finish Goods Inventory 392,300 2.43%

Work In Process Inventory 545,117 3.37%

Raw Materials Inventory 134,280 0.83%

Indirect Materials Inventory 76,749 0.47%

Office Supplies 2,487 0.02%

Prepaid Rent 652,800 4.04%

Total Current Assets 13,917,916 86.13%

Non-current Assets:

Property, Plant & Equipment 3,434,400 21.25%

Less: Accumulated Depreciation 1,192,572 7.38%

Total Non-current Assets 2,241,828 13.87%

Total Assets 16,159,744 100.00%

Liabilities and Equity

Current Liabilities:

Accounts Payable 1,253,458 7.76%

Income tax payable 1,235,689 7.65%

Salaries Payable 274,528 1.70%

SS premiums payable 24,449 0.15%

Philhealth premiums payable 4,118 0.03%

Pag-ibig premiums payable 6,496 0.04%

EC premium payable 594 0.00%

Utilities payable 13,414 0.08%

Repair and & maintenance payable 472 0.00%

Advertising payable 3,955 0.02%

Total current liabilities 2,817,171 17.43%

Shareholders' Equity:

Ordinary Shares 9,000,000 55.69%

Retained Earnings 4,342,573 26.87%

Total Equity 13,342,573 82.57%

Total Liabilities & Equity 16,159,744 100.00%

The above may be evaluated as follows:

The largest component of Asset is Account Receivable at 44.11%, followed by Cash which is

30.79%.

Office supplies is the smallest component at 0.02%.

On the other hand, 17.43% of Asset are financed by debt and the remaining 82.57% is

financed by Equity.

You might also like

- Dollars and Sales AnalysisDocument5 pagesDollars and Sales AnalysisXimena Isela Villalpando BuenoNo ratings yet

- STI Education Systems Holdings Inc. Consolidated StatementsDocument20 pagesSTI Education Systems Holdings Inc. Consolidated StatementschenlyNo ratings yet

- Kohinoor Chemical Company LTD.: Horizontal AnalysisDocument19 pagesKohinoor Chemical Company LTD.: Horizontal AnalysisShehreen ArnaNo ratings yet

- Ginebra San Miguel Inc. Financial Position 2020-2019Document1 pageGinebra San Miguel Inc. Financial Position 2020-2019Venus PalmencoNo ratings yet

- Emperador Inc. and Subsidiaries 2016 and 2015 Financial StatementsDocument25 pagesEmperador Inc. and Subsidiaries 2016 and 2015 Financial StatementschenlyNo ratings yet

- AOFSDocument15 pagesAOFS1abd1212abdNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- Analysis of Statement of Profit or LossDocument4 pagesAnalysis of Statement of Profit or LossShehzad QureshiNo ratings yet

- Eco Lounge Projected Income StatementsDocument136 pagesEco Lounge Projected Income StatementsJeremiah GonzagaNo ratings yet

- Lincoln Electric Itw - Cost Management ProjectDocument7 pagesLincoln Electric Itw - Cost Management Projectapi-451188446No ratings yet

- Income Statement & Financial Position SummaryDocument6 pagesIncome Statement & Financial Position Summaryrhiscel cereligiaNo ratings yet

- Pilipinas Shell Vertical and Horizontal AnalysisDocument7 pagesPilipinas Shell Vertical and Horizontal Analysismaica G.No ratings yet

- Finacial Position FINALDocument4 pagesFinacial Position FINALLenard TaberdoNo ratings yet

- Financial - Analysis (SCI and SFP)Document4 pagesFinancial - Analysis (SCI and SFP)Joshua BristolNo ratings yet

- Phil HealthDocument9 pagesPhil Healthlorren ramiroNo ratings yet

- BSBFIM601 Assessment 1: Sales and Profit BudgetsDocument8 pagesBSBFIM601 Assessment 1: Sales and Profit Budgetsprasannareddy9989100% (1)

- Quiz 1 Acco 204 - GonzagaDocument17 pagesQuiz 1 Acco 204 - GonzagaLalaine Keendra GonzagaNo ratings yet

- Comprehensive IT Industry Analysis - ProjectDocument52 pagesComprehensive IT Industry Analysis - ProjectdhruvNo ratings yet

- Financial Performance and Position Analysis 2017-2019Document6 pagesFinancial Performance and Position Analysis 2017-2019Chananya SriromNo ratings yet

- Final Ma Jud Ni FinancialsDocument78 pagesFinal Ma Jud Ni FinancialsMichael A. BerturanNo ratings yet

- Income Statement FINALDocument2 pagesIncome Statement FINALLenard TaberdoNo ratings yet

- HDFC Bank - FM AssignmentDocument9 pagesHDFC Bank - FM AssignmentaditiNo ratings yet

- PHILEX - V and H AnalysisDocument8 pagesPHILEX - V and H AnalysisHilario, Jana Rizzette C.No ratings yet

- Excel Bav Vinamilk C A 3 Chúng TaDocument47 pagesExcel Bav Vinamilk C A 3 Chúng TaThu ThuNo ratings yet

- Financial StatementsDocument12 pagesFinancial StatementsDino DizonNo ratings yet

- Statement of Cash Flow 2021 Cash Flow From Operating Activities 2021 2020Document6 pagesStatement of Cash Flow 2021 Cash Flow From Operating Activities 2021 2020Rica CatanguiNo ratings yet

- Horizontal and Vertical AnalysisDocument3 pagesHorizontal and Vertical AnalysisJane Ericka Joy MayoNo ratings yet

- Annual Balance Sheet and Profit Loss AnalysisDocument6 pagesAnnual Balance Sheet and Profit Loss AnalysisSANDHALI JOSHI PGP 2021-23 BatchNo ratings yet

- Financial Model SolvedDocument29 pagesFinancial Model SolvedSaad KhanNo ratings yet

- Financial Statement and AnalysisDocument6 pagesFinancial Statement and AnalysisPhilip LarozaNo ratings yet

- Key Financial Ratios of HCL TechnologiesDocument9 pagesKey Financial Ratios of HCL TechnologiesshirleyNo ratings yet

- Valuation - CocacolaDocument14 pagesValuation - CocacolaLegends MomentsNo ratings yet

- PGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1Document26 pagesPGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1nidhidNo ratings yet

- Partial Financial Statement and Analysis of San Miguel CorporationDocument3 pagesPartial Financial Statement and Analysis of San Miguel CorporationKaithleen Coreen EbaloNo ratings yet

- FinalDocument14 pagesFinalsakthiNo ratings yet

- HORIZON Analytical Procedure AppendixDocument5 pagesHORIZON Analytical Procedure AppendixWinny PoeNo ratings yet

- Horizontal SFPDocument17 pagesHorizontal SFPJanefren Pada EdilloNo ratings yet

- Unit 2Document79 pagesUnit 2Carlos Abadía MorenoNo ratings yet

- Analisis KeuanganDocument13 pagesAnalisis KeuanganMichael SaragiNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisMohammad Abid MiahNo ratings yet

- NidaDocument4 pagesNidaseerat fatimahNo ratings yet

- Hablon Production Center Statement of Financial Performance For The Years Ended December 31Document41 pagesHablon Production Center Statement of Financial Performance For The Years Ended December 31angelica valenzuelaNo ratings yet

- Test 2023Document12 pagesTest 2023paingheinkhanttNo ratings yet

- Financial Statement and AnalysisDocument7 pagesFinancial Statement and AnalysisPhilip LarozaNo ratings yet

- Financial Table Analysis of ZaraDocument9 pagesFinancial Table Analysis of ZaraCeren75% (4)

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisShailyn AngcayNo ratings yet

- Century Pacific Food Inc. Consolidated Statements of Cash Flow AnalysisDocument5 pagesCentury Pacific Food Inc. Consolidated Statements of Cash Flow AnalysisKei SenpaiNo ratings yet

- Credit Memo For Gas Authority of IndiaDocument15 pagesCredit Memo For Gas Authority of IndiaKrina ShahNo ratings yet

- 3F Rice and Eggs Supply Projected Cash Flows For September 2019 To December 2021 Pre-Operation 2019 2020 2021Document4 pages3F Rice and Eggs Supply Projected Cash Flows For September 2019 To December 2021 Pre-Operation 2019 2020 2021Bea Cassandra EdnilaoNo ratings yet

- VERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Document8 pagesVERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Touqeer HussainNo ratings yet

- CH-3 Finance (Parth)Document11 pagesCH-3 Finance (Parth)princeNo ratings yet

- SPEEDAV MOTOR PARTS HARDWARE PROFITABILITYDocument23 pagesSPEEDAV MOTOR PARTS HARDWARE PROFITABILITYJay ArNo ratings yet

- WiproDocument9 pagesWiprorastehertaNo ratings yet

- Shoppers Stop Financial Model - 24july2021Document23 pagesShoppers Stop Financial Model - 24july2021ELIF KOTADIYANo ratings yet

- Unit 5Document40 pagesUnit 5siyumbwanNo ratings yet

- All Number in Thousands)Document7 pagesAll Number in Thousands)Lauren LoshNo ratings yet

- Nestle Group Balance Sheet and Income Statement Analysis 2018-2017Document7 pagesNestle Group Balance Sheet and Income Statement Analysis 2018-2017ablay logene50% (2)

- Reformulated Income Statement of Century Ply: Operating RevenueDocument2 pagesReformulated Income Statement of Century Ply: Operating RevenueBhoomika GuptaNo ratings yet

- Ratio Analysis of Engro Vs NestleDocument24 pagesRatio Analysis of Engro Vs NestleMuhammad SalmanNo ratings yet

- Asset Based ValuationDocument38 pagesAsset Based ValuationMagic ShopNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument43 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeAhmed El KhateebNo ratings yet

- Statement of Changes in Equity: Fabm IiDocument12 pagesStatement of Changes in Equity: Fabm IiAlyssa Nikki VersozaNo ratings yet

- Impact of IBC on Bank ProfitabilityDocument38 pagesImpact of IBC on Bank ProfitabilityAakanksha AgarwalNo ratings yet

- Education: Does Not Come by ChanceDocument51 pagesEducation: Does Not Come by ChanceAsNo ratings yet

- Answer Key Chapter 6 Corporate LiquidationDocument11 pagesAnswer Key Chapter 6 Corporate Liquidationkaren perrerasNo ratings yet

- Ignou Eco - 2 Solved Assignment 218-19Document34 pagesIgnou Eco - 2 Solved Assignment 218-19NEW THINK CLASSESNo ratings yet

- FM - Introduction To FMDocument23 pagesFM - Introduction To FMSHANMUGHA SHETTY S SNo ratings yet

- Balance Sheet of DR Reddys Laboratories: - in Rs. Cr.Document14 pagesBalance Sheet of DR Reddys Laboratories: - in Rs. Cr.Anand MalashettiNo ratings yet

- Chapter+3 the+Adjusting+ProcessDocument61 pagesChapter+3 the+Adjusting+ProcessOrkun Kızılırmak100% (1)

- Church Finance - Class NotesDocument16 pagesChurch Finance - Class NotesSamuel PettitNo ratings yet

- DCF and Pensions The Footnotes AnalystDocument10 pagesDCF and Pensions The Footnotes Analystmichael odiemboNo ratings yet

- Ratio AnalysisDocument25 pagesRatio Analysismba departmentNo ratings yet

- Objectives of Financial Statements Analysis: Happened During A Particular Period of Time, Most Users Are Concerned AboutDocument20 pagesObjectives of Financial Statements Analysis: Happened During A Particular Period of Time, Most Users Are Concerned AboutKarla OñasNo ratings yet

- Acco 30053 - Audit of Ppe - MarpDocument10 pagesAcco 30053 - Audit of Ppe - MarpBanna SplitNo ratings yet

- Cfas Problem 8 3 PDFDocument3 pagesCfas Problem 8 3 PDFAzuh ShiNo ratings yet

- PT JayatamaDocument67 pagesPT JayatamaAminadap. SIL.TNo ratings yet

- 1 Ratio ProblemDocument3 pages1 Ratio ProblemChandni AgrawalNo ratings yet

- Financial Statement Analysis: MGT-537 Dr. Hafiz Muhammad Ishaq 32Document77 pagesFinancial Statement Analysis: MGT-537 Dr. Hafiz Muhammad Ishaq 32gazmeerNo ratings yet

- Profile-Foreign Banks-Credit Agricole Corporate and Investment BankDocument1 pageProfile-Foreign Banks-Credit Agricole Corporate and Investment BankAnimesh LodhaNo ratings yet

- AAPL DCF ValuationDocument12 pagesAAPL DCF ValuationthesaneinvestorNo ratings yet

- W3 B Statement of FInancial PositionDocument36 pagesW3 B Statement of FInancial PositionKristine DiceNo ratings yet

- Accounting Cheat SheetsDocument4 pagesAccounting Cheat SheetsGreg BealNo ratings yet

- Suzlon Announces Q2 FY23 ResultsDocument27 pagesSuzlon Announces Q2 FY23 ResultsAhaana guptaNo ratings yet

- Financial Management Session 9Document19 pagesFinancial Management Session 9Khushi HemnaniNo ratings yet

- Akuntansi P1 - 2A Esti FatmawatiDocument4 pagesAkuntansi P1 - 2A Esti FatmawatiEsti FatmawatiNo ratings yet

- Institute of Business Management Final Assessment - Spring 2020Document6 pagesInstitute of Business Management Final Assessment - Spring 2020Shaheer KhurramNo ratings yet

- Audit ProceduresDocument36 pagesAudit ProceduresRoshaan AhmadNo ratings yet

- 1-6 Statement of Cash FlowDocument26 pages1-6 Statement of Cash FlowHazel Joy DemaganteNo ratings yet

- Ross Fundamentals of Corporate Finance 13e CH10 PPTDocument36 pagesRoss Fundamentals of Corporate Finance 13e CH10 PPTАлиNo ratings yet