Professional Documents

Culture Documents

Chapter 07 Swaps

Uploaded by

steven smithOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 07 Swaps

Uploaded by

steven smithCopyright:

Available Formats

Chapter 7

Swaps

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 1

Nature of Swaps

A swap is an agreement to exchange

cash flows at specified future times

according to certain specified rules

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 2

An Example of a “Plain Vanilla” Interest

Rate Swap

An agreement by Microsoft to receive 6-

month LIBOR & pay a fixed rate of 5% per

annum every 6 months for 3 years on a

notional principal of $100 million

Next slide illustrates cash flows that could

occur (Day count conventions are not

considered)

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 3

One Possible Outcome for Cash

Flows to Microsoft (Table 7.1, page 150)

Date LIBOR Floating Cash Fixed Cash Net Cash

Flow Flow Flow

Mar 5, 2012 4.20%

Sep 5, 2012 4.80% +2.10 −2.50 −0.40

Mar 5, 2013 5.30% +2.40 −2.50 −0.10

Sep 5, 2013 5.50% +2.65 −2.50 + 0.15

Mar 5, 2014 5.60% +2.75 −2.50 +0.25

Sep 5, 2014 5.90% +2.80 −2.50 +0.30

Mar 5, 2015 +2.95 −2.50 +0.45

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 4

Typical Uses of an Interest Rate

Swap

Converting a liability from

fixed rate to floating rate

floating rate to fixed rate

Converting an investment from

fixed rate to floating rate

floating rate to fixed rate

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 5

Intel and Microsoft (MS)

Transform a Liability (Figure 7.2, page 151)

5%

5.2%

Intel MS

LIBOR+0.1%

LIBOR

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 6

Financial Institution is Involved

(Figure 7.4, page 152)

4.985% 5.015%

5.2%

Intel F.I. MS

LIBOR+0.1

LIBOR LIBOR %

Financial Institution has two offsetting

swaps

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 7

Intel and Microsoft (MS) Transform an

Asset (Figure 7.3, page 152)

5%

4.7%

Intel MS

LIBOR-0.2%

LIBOR

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 8

Financial Institution is Involved

(See Figure 7.5, page 153)

4.985% 5.015%

4.7%

Intel F.I. MS

LIBOR-0.2%

LIBOR LIBOR

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 9

Quotes By a Swap Market Maker

(Table 7.3, page 154)

Maturity Bid (%) Offer (%) Swap Rate (%)

2 years 6.03 6.06 6.045

3 years 6.21 6.24 6.225

4 years 6.35 6.39 6.370

5 years 6.47 6.51 6.490

7 years 6.65 6.68 6.665

10 years 6.83 6.87 6.850

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 10

Day Count

A day count convention is specified for for

fixed and floating payment

For example, LIBOR is likely to be actual/360

in the US because LIBOR is a money market

rate

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 11

Confirmations

Confirmations specify the terms of a

transaction

The International Swaps and Derivatives has

developed Master Agreements that can be

used to cover all agreements between two

counterparties

Governments now require central clearing to

be used for most standardized derivatives

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 12

The Comparative Advantage Argument

(Table 7.4, page 156)

• AAACorp wants to borrow floating

• BBBCorp wants to borrow fixed

Fixed Floating

AAACorp 4.0% 6 month LIBOR − 0.1%

BBBCorp 5.2% 6 month LIBOR + 0.6%

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 13

The Swap (Figure 7.6, page 157)

4.35%

4%

AAACorp BBBCorp

LIBOR+0.6%

LIBOR

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 14

The Swap when a Financial

Institution is Involved (Figure 7.7, page 157)

4.33% 4.37%

4%

AAACorp F.I BBBCorp

. LIBOR+0.6%

LIBOR LIBOR

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 15

Criticism of the Comparative

Advantage Argument

The 4.0% and 5.2% rates available to AAACorp

and BBBCorp in fixed rate markets are 5-year

rates

The LIBOR−0.1% and LIBOR+0.6% rates

available in the floating rate market are six-

month rates

BBBCorp’s fixed rate depends on the spread

above LIBOR it borrows at in the future

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 16

The Nature of Swap Rates

Six-month LIBOR is a short-term AA borrowing

rate

The 5-year swap rate has a risk corresponding to

the situation where 10 six-month loans are made

to AA borrowers at LIBOR

This is because the lender can enter into a swap

where income from the LIBOR loans is

exchanged for the 5-year swap rate

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 17

Using Swap Rates to Bootstrap the

LIBOR/Swap Zero Curve

Consider a new swap where the fixed rate is the

swap rate

When principals are added to both sides on the final

payment date the swap is the exchange of a fixed

rate bond for a floating rate bond

The floating-rate rate bond is worth par. The swap is

worth zero. The fixed-rate bond must therefore also

be worth par

This shows that swap rates define par yield bonds

that can be used to bootstrap the LIBOR (or

LIBOR/swap) zero curve

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 18

Example of Bootstrapping the

LIBOR/Swap Curve (Example 7.1, page 160)

6-month, 12-month, and 18-month

LIBOR/swap rates are 4%, 4.5%, and 4.8%

with continuous compounding.

Two-year swap rate is 5% (semiannual)

2.5e −0.04×0.5 + 2.5e −0.045×1.0 + 2.5e −0.048×1.5

−2 R

+ 102.5e = 100

The 2-year LIBOR/swap rate, R, is 4.953%

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 19

Valuation of an Interest Rate Swap

Initially interest rate swaps are worth close

to zero

At later times they can be valued as the

difference between the value of a fixed-rate

bond and the value of a floating-rate bond

Alternatively, they can be valued as a

portfolio of forward rate agreements (FRAs)

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 20

Valuation in Terms of Bonds

The fixed rate bond is valued in the usual way

The floating rate bond is valued by noting that

it is worth par immediately after the next

payment date

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 21

Valution of Floating-Rate Bond

Value = PV

of L+k* at t*

Value = Value = L

L+k*

0 t*

Valuation First Pmt Second

Date Date Pmt Date Maturity

Floating Date

Pmt =k*

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 22

Example

Pay six-month LIBOR, receive 8% (s.a.

compounding) on a principal of $100 million

Remaining life 1.25 years

LIBOR rates for 3-months, 9-months and 15-

months are 10%, 10.5%, and 11% (cont

comp)

6-month LIBOR on last payment date was

10.2% (s.a. compounding)

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 23

Valuation Using Bonds (page 161)

Time Bfix cash Bfl cash Disc PV PV

flow flow factor Bfix Bfl

0.25 4.0 105.100 0.9753 3.901 102.505

0.75 4.0 0.9243 3.697

1.25 104.0 0.8715 90.640

Total 98.238 102.505

Swap value = 98.238 − 102.505 = −4.267

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 24

Valuation in Terms of FRAs

Each exchange of payments in an interest

rate swap is an FRA

The FRAs can be valued on the

assumption that today’s forward rates are

realized

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 25

Valuation of Example Using FRAs

(page 163)

Time Fixed Floating Net Cash Disc PV

cash flow cash flow Flow factor Bfl

0.25 4.0 -5.100 -1.100 0.9753 -1.073

0.75 4.0 -5.522 -1.522 0.9243 -1.407

1.25 4.0 -6.051 -2.051 0.8715 -1.787

Total -4.267

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 26

Overnight Indexed Swaps

Fixed rate for a period is exchanged for the

geometric average of the overnight rates

Should OIS rate equal the LIBOR rate? A

bank can

Borrow $100 million in the overnight market,

rolling forward for 3 months

Enter into an OIS swap to convert this to the 3-

month OIS rate

Lend the funds to another bank at LIBOR for 3

months

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 27

Overnight Indexed Swaps continued

...but it bears the credit risk of another bank in

this arrangement

The OIS rate is now regarded as a better proxy

for the short-term risk-free rate than LIBOR

The excess of LIBOR over the OIS rate is the

LIBOR-OIS spread. It is usually about 10 basis

points but spiked at an all time high of 364 basis

points in October 2008

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 28

An Example of a Currency Swap

An agreement to pay 5% on a sterling

principal of £10,000,000 & receive 6% on

a US$ principal of $18,000,000 every year

for 5 years

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 29

Exchange of Principal

In an interest rate swap the principal is not

exchanged

In a currency swap the principal is usually

exchanged at the beginning and the end of

the swap’s life

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 30

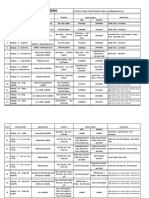

The Cash Flows (Table 7.7, page 166)

Date Dollar Cash Flows Sterling cash flow

(millions) (millions)

Feb 1, 2011 -18.0 +10.0

Feb 1, 2012 +1.08 −0.50

Feb 1, 2012 +1.08 −0.50

Feb 1, 2014 +1.08 −0.50

Feb 1, 2015 +1.08 −0.50

Feb 1, 2016 +19.08 −10.50

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 31

Typical Uses of a

Currency Swap

Convert a liability in one currency to a

liability in another currency

Convert an investment in one currency to

an investment in another currency

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 32

Comparative Advantage May Be

Real Because of Taxes

General Electric wants to borrow AUD

Quantas wants to borrow USD

Cost after adjusting for the differential impact

of taxes

USD AUD

General Electric 5.0% 7.6%

Quantas 7.0% 8.0%

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 33

Valuation of Currency Swaps

Like interest rate swaps, currency swaps can

be valued either as the difference between 2

bonds or as a portfolio of forward contracts

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 34

Example

All Japanese LIBOR/swap rates are 4%

All USD LIBOR/swap rates are 9%

5% is received in yen; 8% is paid in dollars.

Payments are made annually

Principals are $10 million and 1,200 million

yen

Swap will last for 3 more years

Current exchange rate is 110 yen per dollar

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 35

Valuation in Terms of Bonds (Table 7.9,

page 169)

Time Cash Flows ($) PV ($) Cash flows (yen) PV (yen)

1 0.8 0.7311 60 57.65

2 0.8 0.6682 60 55.39

3 0.8 0.6107 60 53.22

3 10.0 7.6338 1,200 1,064.30

Total 9.6439 1,230.55

Value of Swap = 1230.55/110 − 9.6439 = 1.5430

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 36

Valuation in Terms of Forwards

(Table 7.10, page 170)

Time $ cash Yen cash Forward Yen cash Net Present

flow flow Exch rate flow in $ Cash value

Flow

1 -0.8 60 0.009557 0.5734 -0.2266 -0.2071

2 -0.8 60 0.010047 0.6028 -0.1972 -0.1647

3 -0.8 60 0.010562 0.6337 -0.1663 -0.1269

3 -10.0 1200 0.010562 12.6746 +2.6746 2.0417

Total 1.5430

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 37

Swaps & Forwards

A swap can be regarded as a convenient

way of packaging forward contracts

Although the swap contract is usually

worth close to zero at the outset, each of

the underlying forward contracts are not

worth zero

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 38

Credit Risk

A swap is worth zero to a company initially

At a future time its value is liable to be either positive or

negative

The company has credit risk exposure only when its

value is positive

Some swaps are more likely to lead to credit risk

exposure than others

What is the situation if early forward rates have a

positive value?

What is the situation when the early forward rates have

a negative value?

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 39

Other Types of Swaps

Floating-for-floating interest rate swaps,

amortizing swaps, step up swaps, forward

swaps, constant maturity swaps,

compounding swaps, LIBOR-in-arrears

swaps, accrual swaps, diff swaps, cross

currency interest rate swaps, equity swaps,

extendable swaps, puttable swaps,

swaptions, commodity swaps, volatility

swaps……..

Options, Futures, and Other Derivatives, 8th Edition,

Copyright © John C. Hull 2012 40

You might also like

- 5 1 ItdsDocument47 pages5 1 ItdsNg WeiquanNo ratings yet

- CH 07 Hull OFOD9 TH EditionDocument39 pagesCH 07 Hull OFOD9 TH EditionwangyuNo ratings yet

- Swaps: Course: FINC6073 Lab Trading Simulation Effective Period: September 2016Document49 pagesSwaps: Course: FINC6073 Lab Trading Simulation Effective Period: September 2016Cecilia JesselynNo ratings yet

- Swaps: Options, Futures, and Other Derivatives 6Document29 pagesSwaps: Options, Futures, and Other Derivatives 6Deepti GuptaNo ratings yet

- Swaps: Options, Futures, and Other Derivatives, 8th Edition, 1Document40 pagesSwaps: Options, Futures, and Other Derivatives, 8th Edition, 1trevorsum123No ratings yet

- CH 07 Hull Fundamentals 7 The DDocument36 pagesCH 07 Hull Fundamentals 7 The Disha19309No ratings yet

- InvestmentsHull2022 03Document25 pagesInvestmentsHull2022 03Barna OsztermayerNo ratings yet

- CH 07 Hull Fundamentals 8 The DDocument47 pagesCH 07 Hull Fundamentals 8 The DjlosamNo ratings yet

- SwapsDocument13 pagesSwapsHitesh ShadijaNo ratings yet

- Ch05 SwapsDocument41 pagesCh05 SwapsArjun GirishNo ratings yet

- Swaps: Options, Futures, and Other John C. Hull 2008Document13 pagesSwaps: Options, Futures, and Other John C. Hull 2008Asim Ali FidaNo ratings yet

- SwapDocument37 pagesSwapRitik MishraNo ratings yet

- CH 04 Hull OFOD7 TH EdDocument29 pagesCH 04 Hull OFOD7 TH EdDebjit GhoshNo ratings yet

- SwapsDocument38 pagesSwapsNavleen KaurNo ratings yet

- Trading in Financial Markets: Lecture 2aDocument34 pagesTrading in Financial Markets: Lecture 2aPhương KiềuNo ratings yet

- Ch04金融衍生工具8thEditionDocument47 pagesCh04金融衍生工具8thEdition佳文No ratings yet

- Interest RatesDocument28 pagesInterest RatesFirly IrhamniNo ratings yet

- RMFD Swaps: Anshul JainDocument18 pagesRMFD Swaps: Anshul JainParth DhingraNo ratings yet

- FIN30014 Financial Risk Management Interest Rate Currency SwapsDocument33 pagesFIN30014 Financial Risk Management Interest Rate Currency SwapsJason DanielNo ratings yet

- Swap RevisedDocument36 pagesSwap RevisedrigilcolacoNo ratings yet

- Chapter 4 [Interest Rate] Lecture FileDocument55 pagesChapter 4 [Interest Rate] Lecture FileKobir HossainNo ratings yet

- Swap Valuation Practice ProblemsDocument3 pagesSwap Valuation Practice ProblemsebbamorkNo ratings yet

- Chap 7Document63 pagesChap 7Avanish VermaNo ratings yet

- Section 3 - SwapsDocument49 pagesSection 3 - SwapsEric FahertyNo ratings yet

- Chapter 1 - Introduction - SVDocument18 pagesChapter 1 - Introduction - SVThu UyenNo ratings yet

- SwapsDocument29 pagesSwapsDnyaneshNo ratings yet

- Topic 5 Swaps Shorter VersionDocument25 pagesTopic 5 Swaps Shorter VersionAngie Natalia Llanos MarinNo ratings yet

- CH 08 Hull OFOD11 TH EditionDocument13 pagesCH 08 Hull OFOD11 TH EditionNirvana BoyNo ratings yet

- Understanding Swaps: Interest Rate, Currency, ValuationDocument33 pagesUnderstanding Swaps: Interest Rate, Currency, ValuationAshish SaxenaNo ratings yet

- Interest rate swap gains and losses calculationDocument4 pagesInterest rate swap gains and losses calculationsandesh SandeshNo ratings yet

- LIBOR FinsightsDocument5 pagesLIBOR Finsightssiddharth samaddarNo ratings yet

- Corporate Risk Management Sessions 17 & 18Document33 pagesCorporate Risk Management Sessions 17 & 18rajvisinghiNo ratings yet

- Swap - Worked Out Examples V02Document32 pagesSwap - Worked Out Examples V02Harshit DwivediNo ratings yet

- Example SwapDocument10 pagesExample SwapThanh Huyền TrầnNo ratings yet

- Chapter 4 - Swaps - 2022 - SDocument51 pagesChapter 4 - Swaps - 2022 - SĐức Nam TrầnNo ratings yet

- Final Final Mock BFD Winter 2022Document7 pagesFinal Final Mock BFD Winter 2022Mohammad AtherNo ratings yet

- Hull OFOD10 e Solutions CH 07Document12 pagesHull OFOD10 e Solutions CH 07Vishal GoyalNo ratings yet

- Chapter 8 SecuritizationDocument22 pagesChapter 8 SecuritizationJeevan TejaNo ratings yet

- CH 09 Hull OFOD9 TH EditionDocument18 pagesCH 09 Hull OFOD9 TH Editionseanwu95No ratings yet

- Swaps 1Document22 pagesSwaps 1Robert AxelordNo ratings yet

- TCN Roundtable 20101012 FoleyDocument30 pagesTCN Roundtable 20101012 FoleySheila EnglishNo ratings yet

- CH 4Document16 pagesCH 422011663No ratings yet

- Swap ExampleDocument9 pagesSwap Examplekapoorraghav7777No ratings yet

- Currency Swaps Guide - DFA 4212Document10 pagesCurrency Swaps Guide - DFA 4212ne002No ratings yet

- Company Swap Rates to Equalize AttractivenessDocument3 pagesCompany Swap Rates to Equalize AttractivenessAn Kou0% (1)

- Currency & Interest Rate Swaps: International Financial ManagementDocument34 pagesCurrency & Interest Rate Swaps: International Financial ManagementAlexandru DavidNo ratings yet

- ProblemsDocument3 pagesProblemsshreya chapagainNo ratings yet

- International: Financial ManagementDocument35 pagesInternational: Financial ManagementRomi AlfikriNo ratings yet

- Chapter 13 Currency and Interest Rate SwapsDocument24 pagesChapter 13 Currency and Interest Rate SwapsaS hausjNo ratings yet

- CH 09 Hull OFOD9 TH EditionDocument18 pagesCH 09 Hull OFOD9 TH EditionPhonglinh WindNo ratings yet

- FMP IvDocument119 pagesFMP IvmohamedNo ratings yet

- Chapter 8: Swaps ExplainedDocument23 pagesChapter 8: Swaps ExplainedChau NguyenNo ratings yet

- Understanding Interest Rate SwapsDocument46 pagesUnderstanding Interest Rate SwapsHien ThuNo ratings yet

- Bank Regulation and Basel I, II, IIIDocument43 pagesBank Regulation and Basel I, II, IIIJelena VujasinNo ratings yet

- Sample Questions For SWAPDocument4 pagesSample Questions For SWAPKarthik Nandula100% (1)

- Bonds Payable SlidesDocument53 pagesBonds Payable Slidesayesha125865No ratings yet

- Understanding Interest Rate SwapsDocument12 pagesUnderstanding Interest Rate SwapsUbraj NeupaneNo ratings yet

- What Is A Foreign Currency Convertible Bond (FCCB) ?Document19 pagesWhat Is A Foreign Currency Convertible Bond (FCCB) ?Mahendra PratapNo ratings yet

- Actuarial Finance: Derivatives, Quantitative Models and Risk ManagementFrom EverandActuarial Finance: Derivatives, Quantitative Models and Risk ManagementNo ratings yet

- Chapter 14 TheBlack-Scholes-MertonDocument19 pagesChapter 14 TheBlack-Scholes-Mertonsteven smithNo ratings yet

- Testing Taylor'S Rule To Examine Monetary Policy Regarding Bank Rate, Inflation and Output Gap of Bangladesh: 1972-2016Document11 pagesTesting Taylor'S Rule To Examine Monetary Policy Regarding Bank Rate, Inflation and Output Gap of Bangladesh: 1972-2016steven smithNo ratings yet

- Chapter Eleven: Corporate Performance, Governance, and Business EthicsDocument18 pagesChapter Eleven: Corporate Performance, Governance, and Business Ethicssteven smithNo ratings yet

- Chapter-7: Strategy and TechnologyDocument23 pagesChapter-7: Strategy and Technologysteven smithNo ratings yet

- Chapter 13 Wiener Processes and PDFDocument29 pagesChapter 13 Wiener Processes and PDFsteven smithNo ratings yet

- Corporate Strategy: Horizontal Integration, Vertical Integration, and Strategic OutsourcingDocument17 pagesCorporate Strategy: Horizontal Integration, Vertical Integration, and Strategic Outsourcingsteven smithNo ratings yet

- Options StrategiesDocument18 pagesOptions StrategiesShuting Teoh0% (1)

- Binomial Pricing MethodDocument25 pagesBinomial Pricing MethodShuting TeohNo ratings yet

- Real Estate XM MeemDocument2 pagesReal Estate XM Meemsteven smithNo ratings yet

- Trade, Industry Drive Bangladesh GrowthDocument22 pagesTrade, Industry Drive Bangladesh Growthsteven smithNo ratings yet

- Ank Palermo Business Advisors Pty LTD Current & Historical Company ExtractDocument4 pagesAnk Palermo Business Advisors Pty LTD Current & Historical Company ExtractFlinders TrusteesNo ratings yet

- JRS Vs Imperial InsuranceDocument2 pagesJRS Vs Imperial InsuranceStephanie ValentineNo ratings yet

- (A) When The Options Are Exercised by All The EmployeesDocument2 pages(A) When The Options Are Exercised by All The EmployeesanjaliNo ratings yet

- Artgiven Nos. 1-14Document32 pagesArtgiven Nos. 1-14AJSINo ratings yet

- Derivatives: Types of Derivative ContractsDocument20 pagesDerivatives: Types of Derivative ContractsXandarnova corpsNo ratings yet

- 5 - Peran Board Tugas Dan Tanggung Jawab - BOD, BOC Dan Organ DekomDocument53 pages5 - Peran Board Tugas Dan Tanggung Jawab - BOD, BOC Dan Organ DekomDede AndriNo ratings yet

- How an American Hedge Fund Manager Turned $26 Million into $2.6 Billion in Days Predicting COVID-19 PandemicDocument5 pagesHow an American Hedge Fund Manager Turned $26 Million into $2.6 Billion in Days Predicting COVID-19 PandemicAswat A M Wasi100% (1)

- A) +lsë CK/FW, HFN FHL / Clgoldttf Ps LJZN) If0F: Ljifo K - J) ZMDocument11 pagesA) +lsë CK/FW, HFN FHL / Clgoldttf Ps LJZN) If0F: Ljifo K - J) ZMdevi ghimireNo ratings yet

- 5-5-23 f124 cf-2453 Law AnsDocument2 pages5-5-23 f124 cf-2453 Law Ansindian kingNo ratings yet

- Directors': Maithan Alloys LimitedDocument9 pagesDirectors': Maithan Alloys LimitedAnshuman RoutNo ratings yet

- Coaching Actuaries Exam IFM Suggested Study Schedule: Phase 1: LearnDocument7 pagesCoaching Actuaries Exam IFM Suggested Study Schedule: Phase 1: LearnAndrew SaundersNo ratings yet

- One Man CompanyDocument14 pagesOne Man CompanyA.VignaeshwarNo ratings yet

- Shareholders EquityDocument51 pagesShareholders EquityIsmail Hossain100% (2)

- Hostile TakeoversDocument7 pagesHostile TakeoversJohn Ryan DunnNo ratings yet

- Business Law Exam Questions PDFDocument4 pagesBusiness Law Exam Questions PDFchavoNo ratings yet

- Coram: Hon'ble Member (Judicial) Shri V.P. Singh Hon'ble Member (Technical) Shri Rajesh SharmaDocument13 pagesCoram: Hon'ble Member (Judicial) Shri V.P. Singh Hon'ble Member (Technical) Shri Rajesh SharmaWaterways ShipyardNo ratings yet

- Types of business ownership in Malaysia guideDocument3 pagesTypes of business ownership in Malaysia guideMardhiah Ramlan0% (1)

- Fred Inc and Herman Corporation Formed A Business Combination OnDocument1 pageFred Inc and Herman Corporation Formed A Business Combination OnBube KachevskaNo ratings yet

- Baring Bank CaseDocument16 pagesBaring Bank CaseArjun GunasekaranNo ratings yet

- OPTION STRATEGIESDocument2 pagesOPTION STRATEGIESSameer Shinde100% (1)

- Ladia NotesDocument125 pagesLadia NotesAngel VirayNo ratings yet

- Role of Private Life Insurance Companies in IndiaDocument19 pagesRole of Private Life Insurance Companies in IndiaRohit BundelaNo ratings yet

- Advanced Financial Management Class NoteDocument336 pagesAdvanced Financial Management Class NoteGARUIS MELINo ratings yet

- DerivativesDocument111 pagesDerivativesMuhammad Moazzam JavaidNo ratings yet

- Project On CompanyDocument33 pagesProject On CompanyRishabh kumarNo ratings yet

- Equity - Daily Calls SheetDocument239 pagesEquity - Daily Calls SheetAmit ThreemteamNo ratings yet

- Post Buy Back Offer (Company Update)Document2 pagesPost Buy Back Offer (Company Update)Shyam SunderNo ratings yet

- Banking Business ProcessDocument1 pageBanking Business Processrajat_rathNo ratings yet

- Lux Gov SatDocument36 pagesLux Gov SatLuxembourgAtaGlanceNo ratings yet

- Harden V Benguet Case DigestDocument4 pagesHarden V Benguet Case DigestDeneb DoydoraNo ratings yet

![Chapter 4 [Interest Rate] Lecture File](https://imgv2-1-f.scribdassets.com/img/document/719540148/149x198/7e9127a983/1712118628?v=1)