Professional Documents

Culture Documents

CTA Ruling Upholds Tax on Management Fees Paid to Foreign Corporation

Uploaded by

Francise Mae Montilla MordenoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CTA Ruling Upholds Tax on Management Fees Paid to Foreign Corporation

Uploaded by

Francise Mae Montilla MordenoCopyright:

Available Formats

4.

PHILAMLIFE vs CA GR SP 31283, April 25,1995 RULING:

we agree with respondent court's ruling

PHILIPPINE AMERICAN LIFE INSURANCE COMPANY,

INC., ET AL., petitioner, vs. HON. COURT OF TAX Section 37. Income from Services within the

APPEALS, AND THE COMMISSIONER OF INTERNAL Philippines,

REVENUE, respondent.

FACTS: A. Gross income from sources within the Philippines — the

following items of gross income shall be treated as gross

Petitioner Philippine American Life Insurance Co., Inc. income from source within the Philippines.

(PHILAMLIFE) a domestic corporation entered into a (1) . . .

Management Services Agreement with American (2) . . .

International Reinsurance Co., Inc. (AIRCO), a non-resident (3) . . .

foreign corporation with principal place of business in

(4) Rentals and royalties — Rentals and royalties

Pembroke, Bermuda, whereby, effective January 1, 1972,

from properties located in the Philippines or from

for a fee of not exceeding $250,000.00 per annum, any interest in such property, including rentals or

‘where AIRCO shall supply technical and commercial royalties for —

information, knowledge, advice, assistance o services in (a) . . .

(b) . . .

connection with technical management or administration

(c) The supply of scientific, technical,

of an insurance business.

industrial or commercial knowledge or

AIRCO subsequently merged with Amereican International informations;

Group inc (AIGI) with AIGI as the ssuccessor-in-interes in (d) The supply of any assistance that is

auxiliary and subsidiary to, and is

AIRCOs Management Services Agreement with Philamlife.

furnished as a means of enabling the

Respondent CIR issued in favor of Philamlife a tax credit application or enjoyment of, any property,

memo in the amount o p643,125 representing erroneous or right as is mentioned in paragraph (a),

payment of withholding tax at source on remittances to any such equipment as is mentioned in

paragraph (b) or any such knowledge or

AIGI for services rendered abroad.

information as is mentioned in paragraph

Hence Philamlife sought for a refund. (c); or

(e) . . .

Without waiting for respondent to resolve the claim for (f) Technical advice, assistance or services

refund, petitioners filed a petition with the CTA seeking rendered in connection with the technical

for refund. management and administration of any

scientific, industrial or commercial

During the pendency of the case, respondent derived undertaking, venture, project of scheme;

Philamlifes claim for refund and cancelled the tax Credit and

Memo issued to Philamlife and requested the latter to pay (g) . . .

the amount pf P613 125 as deficiency withholding tax.

Petitioners filed before the CTA seeking annulment of such A reading of the various management services enumerated

assessment. in the said Management Services Agreement will show that

they can easily fall under any of the aforequoted expanded

CTA ruled in facor of CIR. meaning of royalties.

petitioners insist that there is no legal nor factual bias for Basically, from the heading 'Investments' to 'Personnel',

the respondent court to conclude that the compensation the services call for the supply by the non-resident foreign

paid for advisory services rendered outside the Philippines corporation of technical and commercial information,

to petitioner AIGI, a non-resident foreign corporation not knowledge, advice, assistance or services in connection

engaged in trade or business in the Philippines, is with technical management or administration of an

considered "rentals and royalties from properties located insurance business — a commercial undertaking.

in the Philippines" pursuant to Section 37 (a) (4) of the Therefore, the income derived for the services performed

National Internal Revenue Code.. by AIGI for PHILAMLIFE under the said management

contract shall be considered as income from services

Petitioners contend that petitioner AIGI is not covered by within the Philippines.

the above provision of the Tax Code considering that it has

no properties located in the Philippines from which rentals AIGI being a non-resident foreign corporation not engaged

and royalties can be derived. in trade or business in the Philippines 'shall pay a tax equal

to thirty-five (35%) percent of the gross income received

ISSUE: The definition of royalty will be touched in during each taxable year from all sources within the

deciding the issue of WON compensation paid for advisory Philippines as interest, dividends, rents, royalties

services rendered outside the Philippines to petitioner (including remuneration for technical services), salaries,

AIGI, a non-resident foreign corporation not engaged in premiums, annuities, emoluments or other fixed or

trade or business in the Philippines, is considered "rentals determinable annual, periodical or casual gains, profits

and royalties from properties located in the Philippines" and income and capital gains: . . . (Section 12(6) (I) of the

National Internal Revenue Code. (Underscoring for

emphasis).

You might also like

- SITUS of TAXATION for Services Rendered AbroadDocument2 pagesSITUS of TAXATION for Services Rendered AbroadEmmanuel YrreverreNo ratings yet

- Philippine Life Insurance Company Tax Case on Advisory Services IncomeDocument2 pagesPhilippine Life Insurance Company Tax Case on Advisory Services IncomeEllen Glae DaquipilNo ratings yet

- Passive Royalty Income TaxDocument2 pagesPassive Royalty Income TaxTeacherEliNo ratings yet

- CIR V CTA Smith Kilne & Fresh OverseasDocument2 pagesCIR V CTA Smith Kilne & Fresh OverseasGRNo ratings yet

- Bir 123-13Document1 pageBir 123-13Lizzette Dela PenaNo ratings yet

- Philippine Acetylene Co. Inc vs. CirDocument2 pagesPhilippine Acetylene Co. Inc vs. Cirbrendamanganaan100% (1)

- Javier v. Ancheta (CTA) ruling on erroneous bank transfer as taxable incomeDocument1 pageJavier v. Ancheta (CTA) ruling on erroneous bank transfer as taxable incomeGSSNo ratings yet

- Ruling - CIR V FilinvestDocument1 pageRuling - CIR V FilinvestryanmeinNo ratings yet

- CIR v. Hedcor Sibulan, Inc.Document2 pagesCIR v. Hedcor Sibulan, Inc.SophiaFrancescaEspinosa100% (1)

- Applying Arm's Length Standard to Inter-Company LoansDocument2 pagesApplying Arm's Length Standard to Inter-Company Loansbedan100% (1)

- HSBC Wins Dispute Over Railroad Tie Tax LienDocument3 pagesHSBC Wins Dispute Over Railroad Tie Tax LienCarlo Beltran ValerioNo ratings yet

- BIR Ruling on Tax Treatment of Capital Gains from Corporate LiquidationDocument1 pageBIR Ruling on Tax Treatment of Capital Gains from Corporate LiquidationmatinikkiNo ratings yet

- Digitel v. Pangasinan DIGESTDocument4 pagesDigitel v. Pangasinan DIGESTkathrynmaydevezaNo ratings yet

- Smith-Bell Co. Vs CIRDocument1 pageSmith-Bell Co. Vs CIRAthena SantosNo ratings yet

- Local Tax Double Taxation CaseDocument1 pageLocal Tax Double Taxation CaseEmmanuel YrreverreNo ratings yet

- 3M PhilippinesDocument2 pages3M PhilippinesKarl Vincent Raso100% (1)

- Plaintiff disputes arbitration awards in insurance claimsDocument3 pagesPlaintiff disputes arbitration awards in insurance claimschappy_leigh118No ratings yet

- 005 - Collector v. YusecoDocument2 pages005 - Collector v. YusecoJaerelle HernandezNo ratings yet

- Garrison et al. vs. Court of Appeals: Supreme Court rules that while US nationals employed in Philippine naval bases are exempt from income tax, they are still required to file Income Tax ReturnsDocument5 pagesGarrison et al. vs. Court of Appeals: Supreme Court rules that while US nationals employed in Philippine naval bases are exempt from income tax, they are still required to file Income Tax ReturnsMuslimeenSalamNo ratings yet

- CIR Vs Stanley PHDocument2 pagesCIR Vs Stanley PHAnneNo ratings yet

- BIR Ruling 27-02Document2 pagesBIR Ruling 27-02erikagcv100% (1)

- CIR vs CTA and Smith Kline - Deduction of Home Office Overhead Expenses Not Limited to Contract AmountDocument1 pageCIR vs CTA and Smith Kline - Deduction of Home Office Overhead Expenses Not Limited to Contract AmountMini U. SorianoNo ratings yet

- Zamora Vs Su JR 1990Document2 pagesZamora Vs Su JR 1990Ruperto A. Alfafara IIINo ratings yet

- PNOC v. CA (G.R. No. 109976. April 26, 2005.)Document2 pagesPNOC v. CA (G.R. No. 109976. April 26, 2005.)Emmanuel Yrreverre100% (1)

- Cir Vs CA, 203 Scra 72Document11 pagesCir Vs CA, 203 Scra 72Dario G. TorresNo ratings yet

- Philamlife V Cta Case DigestDocument2 pagesPhilamlife V Cta Case DigestAnonymous BvmMuBSwNo ratings yet

- Javier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesDocument7 pagesJavier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesRean Raphaelle GonzalesNo ratings yet

- Regulations on Income Tax for Foreign Currency Deposits and Offshore BankingDocument2 pagesRegulations on Income Tax for Foreign Currency Deposits and Offshore BankingmatinikkiNo ratings yet

- Kepco Vs CIR Case DigestDocument2 pagesKepco Vs CIR Case DigestFrancisca Paredes100% (1)

- Nippon Life Insurance Co., Inc. v. CIR, CTA Case No. 6142, February 4, 2002Document21 pagesNippon Life Insurance Co., Inc. v. CIR, CTA Case No. 6142, February 4, 2002EnzoGarcia100% (1)

- Limpan Vs CIRDocument5 pagesLimpan Vs CIRBenedick LedesmaNo ratings yet

- Commissioner Vs CastanedaDocument6 pagesCommissioner Vs CastanedaLizzette Dela PenaNo ratings yet

- BIR Ruling No. 206-90Document2 pagesBIR Ruling No. 206-90Raiya Angela100% (2)

- RMC 27-2011Document0 pagesRMC 27-2011Peggy SalazarNo ratings yet

- 11) CIR V American Airlines 180 SCRA 274Document1 page11) CIR V American Airlines 180 SCRA 274gel94No ratings yet

- CASE17THc - Hospital de San Juan de Dios Vs Pasay CityDocument1 pageCASE17THc - Hospital de San Juan de Dios Vs Pasay CityMico TanNo ratings yet

- 10 Wise Co v. MeerDocument2 pages10 Wise Co v. MeerkresnieanneNo ratings yet

- 22 - Consti2-Manila Electric V Yatco GR 45697 - DigestDocument1 page22 - Consti2-Manila Electric V Yatco GR 45697 - DigestOjie SantillanNo ratings yet

- Cesar v. Areza and Lolita B. Areza Vs - Express Savings Bank, Inc. and Michael PotencianoDocument4 pagesCesar v. Areza and Lolita B. Areza Vs - Express Savings Bank, Inc. and Michael PotencianoSam SaripNo ratings yet

- Cir V. Philippine Airlines, Inc. (2009) : PartiesDocument3 pagesCir V. Philippine Airlines, Inc. (2009) : PartiesAila AmpNo ratings yet

- Hotel Specialist (Tagaytay), Inc. vs. CIRDocument2 pagesHotel Specialist (Tagaytay), Inc. vs. CIRElaine Belle OgayonNo ratings yet

- Part H 2 - CIR vs. Procter GambleDocument2 pagesPart H 2 - CIR vs. Procter GambleCyruz TuppalNo ratings yet

- CIR vs. Mitsubishi MetalDocument3 pagesCIR vs. Mitsubishi MetalHonorio Bartholomew Chan100% (1)

- Fahrenbach vs. PangilinanDocument1 pageFahrenbach vs. PangilinanReynaldo Fajardo YuNo ratings yet

- Philippine Power Plant Tax CaseDocument2 pagesPhilippine Power Plant Tax Caseralph_atmosfera100% (1)

- Facts: Respondent Euro-Philippines Airline Services, Inc. (Euro-Phil) Is An ExclusiveDocument2 pagesFacts: Respondent Euro-Philippines Airline Services, Inc. (Euro-Phil) Is An ExclusiveAnne100% (1)

- Northwest Orient Air V CA - DigestDocument3 pagesNorthwest Orient Air V CA - DigestJubelle AngeliNo ratings yet

- CIR v. CitytrustDocument2 pagesCIR v. Citytrustpawchan02No ratings yet

- 40 Nippon Life V CIRDocument2 pages40 Nippon Life V CIRMae SampangNo ratings yet

- Deductions for Stockholder Relations FeesDocument2 pagesDeductions for Stockholder Relations FeesRoyalhighness18No ratings yet

- CIR vs. Raul Gonzales (Digest)Document2 pagesCIR vs. Raul Gonzales (Digest)Bam Bathan100% (1)

- Guillen vs. Canon PDFDocument2 pagesGuillen vs. Canon PDFmcris101No ratings yet

- CIR v. Palanca, G.R. No. L-16626, October 29, 1966, 18 SCRA 496Document3 pagesCIR v. Palanca, G.R. No. L-16626, October 29, 1966, 18 SCRA 496SophiaFrancescaEspinosaNo ratings yet

- CIR Vs Construction Resources of Asia, IncDocument2 pagesCIR Vs Construction Resources of Asia, Inclyka timanNo ratings yet

- TAXATION 1 - Hopewell Power V CommissionerDocument3 pagesTAXATION 1 - Hopewell Power V CommissionerSuiNo ratings yet

- 47 - Nagrampa V PeopleDocument2 pages47 - Nagrampa V Peopleakiko komodaNo ratings yet

- CIR Petition to Reconsider Ruling on Donor's Tax for Japanese Parent Company Capital InfusionDocument10 pagesCIR Petition to Reconsider Ruling on Donor's Tax for Japanese Parent Company Capital InfusionAlvin AgullanaNo ratings yet

- Heirs of Ochoa vs. G&S TransportDocument6 pagesHeirs of Ochoa vs. G&S TransportYodh Jamin OngNo ratings yet

- Estate Tax Dispute Over Deficiency and PenaltiesDocument2 pagesEstate Tax Dispute Over Deficiency and PenaltiesChaMcbandNo ratings yet

- Philamlife V. Cta DoctrineDocument1 pagePhilamlife V. Cta DoctrineChiiNo ratings yet

- Orendain vs. BFHomes, Inc., G.R. No. 146313, Oct. 31, 2006Document1 pageOrendain vs. BFHomes, Inc., G.R. No. 146313, Oct. 31, 2006Francise Mae Montilla MordenoNo ratings yet

- Macariola vs. AsuncionDocument12 pagesMacariola vs. AsuncionFrancise Mae Montilla MordenoNo ratings yet

- Manila Prince Hotel vs. GSISDocument11 pagesManila Prince Hotel vs. GSISFrancise Mae Montilla MordenoNo ratings yet

- Francisco vs. House of RepresentativesDocument55 pagesFrancisco vs. House of RepresentativesFrancise Mae Montilla MordenoNo ratings yet

- People vs. PerfectoDocument6 pagesPeople vs. PerfectoFrancise Mae Montilla MordenoNo ratings yet

- Republic of The Philippines Vs CA JurisdictionDocument1 pageRepublic of The Philippines Vs CA JurisdictionFrancise Mae Montilla MordenoNo ratings yet

- Ventura vs. Abuda, 708 SCRA 640 (2013)Document2 pagesVentura vs. Abuda, 708 SCRA 640 (2013)Francise Mae Montilla MordenoNo ratings yet

- Civil Liberties Union, Petitioner, vs. The Executive SecretaryDocument15 pagesCivil Liberties Union, Petitioner, vs. The Executive SecretaryJerry SerapionNo ratings yet

- Hontiveros V RTCDocument1 pageHontiveros V RTCFrancise Mae Montilla MordenoNo ratings yet

- Heirs of Tabia Vs CADocument1 pageHeirs of Tabia Vs CAFrancise Mae Montilla MordenoNo ratings yet

- People vs. Mariano, 71 SCRA 604Document1 pagePeople vs. Mariano, 71 SCRA 604Francise Mae Montilla MordenoNo ratings yet

- 10.herrera Vs BollosDocument1 page10.herrera Vs BollosFrancise Mae Montilla MordenoNo ratings yet

- Tijam vs. Sibonghanoy, G.R. No. L-21450, April 15, 1968Document1 pageTijam vs. Sibonghanoy, G.R. No. L-21450, April 15, 1968Francise Mae Montilla MordenoNo ratings yet

- Supreme Court rules TRO not needed to suspend Sandiganbayan caseDocument1 pageSupreme Court rules TRO not needed to suspend Sandiganbayan caseBoom EbronNo ratings yet

- Pilhino Sales Corporation vs. Spouses Paguirigan Jurisdiction CaseDocument1 pagePilhino Sales Corporation vs. Spouses Paguirigan Jurisdiction CaseRussellNo ratings yet

- Brett Vs IACDocument1 pageBrett Vs IACFrancise Mae Montilla MordenoNo ratings yet

- Pearson Vs IACDocument1 pagePearson Vs IACFrancise Mae Montilla Mordeno100% (1)

- Aquino Vs DelizoDocument1 pageAquino Vs DelizoChanel GarciaNo ratings yet

- Magbaleta vs. Gonong, 76 SCRA 511Document2 pagesMagbaleta vs. Gonong, 76 SCRA 511Francise Mae Montilla MordenoNo ratings yet

- 94 Kalaw vs. FernandezDocument2 pages94 Kalaw vs. FernandezFrancise Mae Montilla MordenoNo ratings yet

- Republic Vs CADocument1 pageRepublic Vs CAFrancise Mae Montilla MordenoNo ratings yet

- Zulueta Vs Pan American World AirwaysDocument1 pageZulueta Vs Pan American World AirwaysFrancise Mae Montilla MordenoNo ratings yet

- Matias vs. Dagdag G.R. No. 109975, February 9, 2001Document1 pageMatias vs. Dagdag G.R. No. 109975, February 9, 2001Francise Mae Montilla MordenoNo ratings yet

- Capili Vs PeopleDocument1 pageCapili Vs PeopleFrancise Mae Montilla MordenoNo ratings yet

- Lilius vs. Manila Railroad Co., 62 Phil. 56Document1 pageLilius vs. Manila Railroad Co., 62 Phil. 56Francise Mae Montilla MordenoNo ratings yet

- Mallion vs. AlcantaraDocument1 pageMallion vs. AlcantaraFrancise Mae Montilla MordenoNo ratings yet

- Antonio Vs ReyesDocument1 pageAntonio Vs ReyesFrancise Mae Montilla MordenoNo ratings yet

- 82 Buenaventura Vs CADocument1 page82 Buenaventura Vs CAFrancise Mae Montilla Mordeno100% (1)

- 95 Republic Vs PangasinanDocument1 page95 Republic Vs PangasinanFrancise Mae Montilla MordenoNo ratings yet

- Harding Vs Commercial Union Assistance CoDocument1 pageHarding Vs Commercial Union Assistance CoFrancise Mae Montilla MordenoNo ratings yet

- ContractDocument3 pagesContracthamidu athumaniNo ratings yet

- Ang, Andre Payslip 7.30.23Document1 pageAng, Andre Payslip 7.30.23Chz Trinh VoNo ratings yet

- ABS-CBN v. CTA, G.R. No. L-52306, 12 October 1981Document10 pagesABS-CBN v. CTA, G.R. No. L-52306, 12 October 1981Jennilyn Gulfan YaseNo ratings yet

- Akun Untuk Kasus BaruDocument4 pagesAkun Untuk Kasus BaruIkaaRiskaaNo ratings yet

- Smart Choice Super Employer AigDocument85 pagesSmart Choice Super Employer AigrkNo ratings yet

- Fundamentals of Income TaxationDocument11 pagesFundamentals of Income TaxationJane100% (1)

- Allowances-info-document-02-04-2024Document2 pagesAllowances-info-document-02-04-2024pradhankumarmukeshNo ratings yet

- Tax Formula and Tax Determination An Overview of Property TransactionsDocument23 pagesTax Formula and Tax Determination An Overview of Property TransactionsJames Riley Case100% (1)

- Introducing "Kanz Ul Askari" Family Takaful Certificate!Document2 pagesIntroducing "Kanz Ul Askari" Family Takaful Certificate!Arslan AliNo ratings yet

- Main Irs Form W 2 Wage and Tax StatementDocument11 pagesMain Irs Form W 2 Wage and Tax Statementjeffery lamarNo ratings yet

- Features of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Document4 pagesFeatures of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Soumyaranjan SwainNo ratings yet

- Socso Information: Contribution'S RatesDocument4 pagesSocso Information: Contribution'S Ratesmail4theinfo989No ratings yet

- Business Math 11 - 12 q2 Clas 3 Joseph AurelloDocument10 pagesBusiness Math 11 - 12 q2 Clas 3 Joseph AurelloKim Yessamin Madarcos100% (1)

- RBS Annual Report 2020Document60 pagesRBS Annual Report 2020Akena RichardNo ratings yet

- MNG 4105-Compensation & Benefits: ACADEMIC YEAR 2020/2021Document21 pagesMNG 4105-Compensation & Benefits: ACADEMIC YEAR 2020/2021Card CardNo ratings yet

- Survey Questionnaire: Tax AwarenessDocument3 pagesSurvey Questionnaire: Tax Awarenessaashir ch100% (1)

- True or FalseDocument2 pagesTrue or FalseJonalene CalaraNo ratings yet

- Lecture Notes On Payroll Accounting Payroll AccountingDocument4 pagesLecture Notes On Payroll Accounting Payroll AccountingOdult Chan100% (2)

- Sources of Public Finance: Taxation-Most Important Source of Public Income. COMPULSARY!! No Direct Benefits To Tax-PayerDocument6 pagesSources of Public Finance: Taxation-Most Important Source of Public Income. COMPULSARY!! No Direct Benefits To Tax-PayerSaurabh SumanNo ratings yet

- Tax Laws Direct Tax Suppliment June2023Document77 pagesTax Laws Direct Tax Suppliment June2023Disha GuptaNo ratings yet

- Non-Profit Financial Statement PresentationDocument48 pagesNon-Profit Financial Statement Presentationnabila dhiyaNo ratings yet

- Ramchrisen H. Haveria, Petitioner, vs. Social Security System, Corazon de La Paz, and Leonora S. Nuque, RespondentsDocument2 pagesRamchrisen H. Haveria, Petitioner, vs. Social Security System, Corazon de La Paz, and Leonora S. Nuque, RespondentsViolet Blue100% (1)

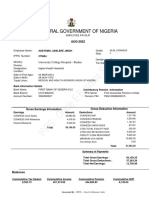

- IPPIS - Oracle E-Business Suite: Federal Government of NigeriaDocument1 pageIPPIS - Oracle E-Business Suite: Federal Government of NigeriaHalleluyah HalleluyahNo ratings yet

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- CSS ProfileDocument10 pagesCSS ProfiledayieltskhonglaytienchetlienNo ratings yet

- Factors Affecting Wage &salaryDocument4 pagesFactors Affecting Wage &salaryYogesh DevmoreNo ratings yet

- certification ETHICSDocument22 pagescertification ETHICSranjitdhillon770No ratings yet

- Investment Proof Guidelines - Fy 2021-22Document14 pagesInvestment Proof Guidelines - Fy 2021-22vibha sharmaNo ratings yet

- Rule-75 of Bihar Service CodeDocument1 pageRule-75 of Bihar Service CodeDharmraj SumanNo ratings yet

- Anna Mae Mateo vs. Coca-Cola Bottler Philippines, IncDocument2 pagesAnna Mae Mateo vs. Coca-Cola Bottler Philippines, IncAlelie MalazarteNo ratings yet

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (86)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:From EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Rating: 5 out of 5 stars5/5 (2)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- Expert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceFrom EverandExpert Secrets: The Underground Playbook for Creating a Mass Movement of People Who Will Pay for Your AdviceRating: 5 out of 5 stars5/5 (363)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (20)

- Anything You Want: 40 lessons for a new kind of entrepreneurFrom EverandAnything You Want: 40 lessons for a new kind of entrepreneurRating: 5 out of 5 stars5/5 (46)

- Without a Doubt: How to Go from Underrated to UnbeatableFrom EverandWithout a Doubt: How to Go from Underrated to UnbeatableRating: 4 out of 5 stars4/5 (23)

- Don't Start a Side Hustle!: Work Less, Earn More, and Live FreeFrom EverandDon't Start a Side Hustle!: Work Less, Earn More, and Live FreeRating: 4.5 out of 5 stars4.5/5 (30)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (795)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (708)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursFrom EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursRating: 4.5 out of 5 stars4.5/5 (23)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisFrom EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisRating: 4.5 out of 5 stars4.5/5 (3)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (24)

- Get Scalable: The Operating System Your Business Needs To Run and Scale Without YouFrom EverandGet Scalable: The Operating System Your Business Needs To Run and Scale Without YouRating: 5 out of 5 stars5/5 (1)

- The Kingdom Driven Entrepreneur's Guide: Doing Business God's WayFrom EverandThe Kingdom Driven Entrepreneur's Guide: Doing Business God's WayRating: 5 out of 5 stars5/5 (42)

- Invention: A Life of Learning Through FailureFrom EverandInvention: A Life of Learning Through FailureRating: 4.5 out of 5 stars4.5/5 (28)

- Think BIG and Kick Ass in Business and LifeFrom EverandThink BIG and Kick Ass in Business and LifeRating: 4.5 out of 5 stars4.5/5 (236)

- The Corporate Startup: How established companies can develop successful innovation ecosystemsFrom EverandThe Corporate Startup: How established companies can develop successful innovation ecosystemsRating: 4 out of 5 stars4/5 (6)

- Creating Competitive Advantage: How to be Strategically Ahead in Changing MarketsFrom EverandCreating Competitive Advantage: How to be Strategically Ahead in Changing MarketsRating: 5 out of 5 stars5/5 (2)

- How to Prospect, Sell and Build Your Network Marketing Business with StoriesFrom EverandHow to Prospect, Sell and Build Your Network Marketing Business with StoriesRating: 5 out of 5 stars5/5 (21)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeFrom EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeRating: 5 out of 5 stars5/5 (22)