Professional Documents

Culture Documents

E10-8 Advance

Uploaded by

cindy chandra0 ratings0% found this document useful (0 votes)

28 views1 pageADVANCE ACCOUNTING

Original Title

E10-8 ADVANCE

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentADVANCE ACCOUNTING

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views1 pageE10-8 Advance

Uploaded by

cindy chandraADVANCE ACCOUNTING

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

Cindy/201850046

E10-8

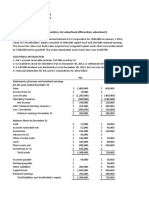

a. Journal Entries

Loss on Transfer Asset $52,700 Computation :

Allowance for Uncollectibles $8,700 ( $48.700 - $40.000 )

Property and Equipment $24,000 ($142.000 - $118.000 )

Goodwill $20,000

Retained Earnings $52,700

Loss on Transfer Asset $52,700

Common Stock ( $20 ) $200,000 ($20 × 10,000)

Common Stock ( $4 ) $40,000 ($4 × 10,000)

Reorganization Capital $160,000

10% Bonds Payable $130,000

Loss on Restructuring of Debt $24,000

Common Stock $24,000 (6,000 shares × $4)

8% Bonds Payable $130,000

Reorganization Capital $134,000 ($81,300 + $52,700)

Retained Earnings $134,000

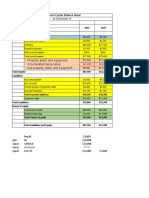

b. Balance Sheet

Crane Company Balance Sheet

December 31. 2015

Cash $33,000

Accounts Receivable $52,500

Less : Allowance For Uncollectible -$12,500 $40,000

Inventory $71,000

Property and Equipment $118,000

TOTAL ASSETS $262,000

Accounts Payable $66,000

8% Bonds Payable, due 6/30/22 $130,000

Common Stock, $4 Par, 16,000 Shares $64,000

Reorganization Capital * $2,000

TOTAL EQUITIES $262,000

*($160,000 – $24,000 - $134,000)

You might also like

- Chapter 13.Document6 pagesChapter 13.perdana findaNo ratings yet

- Working CapitalDocument6 pagesWorking CapitalElizabeth Sanabria AriasNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Exhibit 17. Goodwill Calculation and The Consolidated Balance SheetDocument4 pagesExhibit 17. Goodwill Calculation and The Consolidated Balance SheetЭниЭ.No ratings yet

- Tugas Kelompok Akuntansi Ke 4Document10 pagesTugas Kelompok Akuntansi Ke 4grup apa iniNo ratings yet

- Chapter 4 Problems SolutionsDocument7 pagesChapter 4 Problems SolutionsRosShanique ColebyNo ratings yet

- واجب متوسطه 2 مسائل الواجب الثالثDocument5 pagesواجب متوسطه 2 مسائل الواجب الثالثmode.xp.jamelNo ratings yet

- Chapter 10 Exercise 6Document11 pagesChapter 10 Exercise 6Tri HartonoNo ratings yet

- Consolidated Balance Sheet and WorksheetDocument10 pagesConsolidated Balance Sheet and Worksheetgina amsyarNo ratings yet

- Feed Back Kuis Akl Praktikum (Uts)Document5 pagesFeed Back Kuis Akl Praktikum (Uts)KiwidNo ratings yet

- Tugas Konsold - Inf. Keu - Yohanes Anindra Bagas W - 142180132Document8 pagesTugas Konsold - Inf. Keu - Yohanes Anindra Bagas W - 142180132Yohanes BagasNo ratings yet

- Exercise For Financial Statement Analysis and RatiosDocument15 pagesExercise For Financial Statement Analysis and RatiosViren JoshiNo ratings yet

- Acca110 Adorable Ac21 As03Document6 pagesAcca110 Adorable Ac21 As03Shaneen AdorableNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- In Class Excel - 825 - WorkingDocument98 pagesIn Class Excel - 825 - WorkingIanNo ratings yet

- Sherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingDocument7 pagesSherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingSTEFANI NUGRAHANo ratings yet

- Accounting Problems with SolutionsDocument22 pagesAccounting Problems with Solutionsbusiness docNo ratings yet

- (Quiz Uas Take Home) Akl-1 PDFDocument7 pages(Quiz Uas Take Home) Akl-1 PDFStephani ElvinaNo ratings yet

- Chapter 23 Statement of Cash Flows Multiple Choice With SolutionsDocument10 pagesChapter 23 Statement of Cash Flows Multiple Choice With SolutionsHossein Parvardeh50% (2)

- Net Cash Flow in Operating ActivitiesDocument1 pageNet Cash Flow in Operating ActivitiesMary Ann AmparoNo ratings yet

- Business Combination ExercisesDocument5 pagesBusiness Combination ExercisesmmNo ratings yet

- P4-3 WPDocument4 pagesP4-3 WPAna LailaNo ratings yet

- Tugas Asdos AklDocument6 pagesTugas Asdos AklNicholas AlexanderNo ratings yet

- 417 Assignment #1Document26 pages417 Assignment #1Gloria GuanNo ratings yet

- Financial Management (Problems)Document12 pagesFinancial Management (Problems)Prasad GowdNo ratings yet

- Solutions Ch08Document19 pagesSolutions Ch08KyleNo ratings yet

- Accounting 423 Professor Kang: Practice Problems For Chapter 2 Consolidation of Financial StatementsDocument14 pagesAccounting 423 Professor Kang: Practice Problems For Chapter 2 Consolidation of Financial StatementsJoel Christian MascariñaNo ratings yet

- Pembahasan Tugas AKLDocument8 pagesPembahasan Tugas AKLyashmutjabbar25No ratings yet

- Chapter 2: Fund AccountingDocument13 pagesChapter 2: Fund AccountingPhượng TrầnNo ratings yet

- Tugas TM 8 Abdul Azis Faisal 041611333243Document4 pagesTugas TM 8 Abdul Azis Faisal 041611333243Abdul AzisNo ratings yet

- (123doc) Question Financial Statement AnalysisDocument9 pages(123doc) Question Financial Statement AnalysisUyển's MyNo ratings yet

- CIE587 HW2 TemplateDocument11 pagesCIE587 HW2 TemplateahmadNo ratings yet

- Chapter - 1Document23 pagesChapter - 1Kumar AmitNo ratings yet

- Akl P4.3 & P4.4Document18 pagesAkl P4.3 & P4.4Dhivena JeonNo ratings yet

- Horse Vet LLC financial statements and cash flows 2012-2011Document2 pagesHorse Vet LLC financial statements and cash flows 2012-2011Patricia RodriguesNo ratings yet

- Ch2 TB Moodle 20201030Document6 pagesCh2 TB Moodle 20201030Wang JukNo ratings yet

- P6Document3 pagesP6Jessica HutabaratNo ratings yet

- Financial Analysis of Amazom - Inc CompanyDocument9 pagesFinancial Analysis of Amazom - Inc Companyshepherd junior masasiNo ratings yet

- Consolidated financial statements for Paper and Scissor companiesDocument6 pagesConsolidated financial statements for Paper and Scissor companiesgina amsyarNo ratings yet

- ACC 3003- Final Exam Revision- Solution (7)Document22 pagesACC 3003- Final Exam Revision- Solution (7)falnuaimi001No ratings yet

- Cash FlowDocument1 pageCash FlowJannatul IsfaqNo ratings yet

- Latihan Soal With DiscussionDocument6 pagesLatihan Soal With DiscussionNicolas ErnestoNo ratings yet

- ACC 3003- Review (2)Document22 pagesACC 3003- Review (2)falnuaimi001No ratings yet

- Corporate Finance II Homework AnalysisDocument3 pagesCorporate Finance II Homework AnalysisB M Rakib HassanNo ratings yet

- P4-12 AnswerDocument5 pagesP4-12 AnswerPutri Apriliana100% (1)

- 14-Copy of NURFC Financial AnalysisDocument9 pages14-Copy of NURFC Financial AnalysisCOASTNo ratings yet

- (Ch3) Gina Purdiyanti - 20181211031 AKL3Document17 pages(Ch3) Gina Purdiyanti - 20181211031 AKL3gina amsyarNo ratings yet

- Catapang Hazel Ann E.Document4 pagesCatapang Hazel Ann E.Johnlloyd BarretoNo ratings yet

- Accounting for margin of safety, break-even pointDocument5 pagesAccounting for margin of safety, break-even pointRheu ReyesNo ratings yet

- Practice Questions and Answers: Financial AccountingDocument18 pagesPractice Questions and Answers: Financial AccountingFarah NazNo ratings yet

- Examination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash FlowDocument2 pagesExamination Question and Answers, Set C (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- For December 31 20x1 The Balance Sheet of Baxter Corporation Was As FollowsDocument4 pagesFor December 31 20x1 The Balance Sheet of Baxter Corporation Was As Followslaale dijaanNo ratings yet

- Week 13 - SoalDocument3 pagesWeek 13 - SoalHeidi ParamitaNo ratings yet

- Pangestu Jalu Bagaskoro F0317079Document2 pagesPangestu Jalu Bagaskoro F0317079Geroro D'PhoenixNo ratings yet

- Sherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanDocument6 pagesSherlin - 198110790 - Tugas 1 Akuntansi Keuangan LanjutanSherlin KhuNo ratings yet

- Lurch Company's 2010 financial statementsDocument5 pagesLurch Company's 2010 financial statementsmohitgaba19No ratings yet

- Pacilio Securtiy Service Accounting EquationDocument11 pagesPacilio Securtiy Service Accounting EquationKailash KumarNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Performance Measurement in Decentralized Organizations: ERLINDA SACHARISSA (201850021) CINDY (201850046)Document37 pagesPerformance Measurement in Decentralized Organizations: ERLINDA SACHARISSA (201850021) CINDY (201850046)cindy chandraNo ratings yet

- Financial Ratio Analysis: PT Indosat TBKDocument3 pagesFinancial Ratio Analysis: PT Indosat TBKcindy chandraNo ratings yet

- Name: Cindy Number: 201850046 12.5 Consider The Following Items of Income and Expense and State: Whether They Bear ADocument1 pageName: Cindy Number: 201850046 12.5 Consider The Following Items of Income and Expense and State: Whether They Bear Acindy chandraNo ratings yet

- Name: Cindy Number: 201850046 12.5 Consider The Following Items of Income and Expense and State: Whether They Bear ADocument1 pageName: Cindy Number: 201850046 12.5 Consider The Following Items of Income and Expense and State: Whether They Bear Acindy chandraNo ratings yet

- Presentation of Financial Statements IAS 1 (Revised) : International Financial Reporting StandardsDocument67 pagesPresentation of Financial Statements IAS 1 (Revised) : International Financial Reporting Standardscindy chandraNo ratings yet

- HW 6Document3 pagesHW 6cindy chandraNo ratings yet

- AIS 1 IC B controls weaknesses threats recommendationsDocument6 pagesAIS 1 IC B controls weaknesses threats recommendationscindy chandraNo ratings yet

- HW 7Document2 pagesHW 7cindy chandraNo ratings yet

- AISDocument5 pagesAIScindy chandraNo ratings yet

- Accounting Information System 12 Edition Solution Manual CH15Document39 pagesAccounting Information System 12 Edition Solution Manual CH15Bayoe Ajip100% (1)

- AISDocument5 pagesAIScindy chandraNo ratings yet

- AISDocument5 pagesAIScindy chandraNo ratings yet

- Chapter 14 - Solution ManualDocument33 pagesChapter 14 - Solution ManualMuhammad Syafiq Haidzir100% (3)

- Accounting Information System 12edition Romney Solution Manual Chapter 13Document34 pagesAccounting Information System 12edition Romney Solution Manual Chapter 13Bayoe Ajip67% (3)