Professional Documents

Culture Documents

Financial Accounting Punjab University: Question Paper 2010

Uploaded by

ZeeShan IqbalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting Punjab University: Question Paper 2010

Uploaded by

ZeeShan IqbalCopyright:

Available Formats

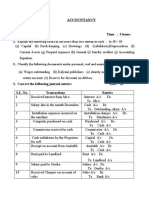

Financial Accounting Punjab University

2009 - 2018

B.Com Part 1 Past Papers

Question Paper 2010

Paper Code BC 304

Time : 3 Hours Marks: 100

Note: Attempt any five questions. All questions carry equal marks.

Question No.1

On 1st January, 2010 Abdullah sold goods to Omer for Rs 60, 000 Omer paid Rs 12, 000 in cash

and three bills for balance. The first bill for Rs. 14, 00 at one month the second for Rs 16, 000 at

two months and the third for the balance amount at three months

Abdullah endorsed 1st bill to Akram his creditor on 2nd January in full settlement of Rs 14, 200,

discounted the 2nd bill at his bank for Rs. 15, 840 and retained the third bill till maturity.

The first bill is met at maturity. The second bill is dishonored and Rs. 200 being paid as noting

charges. Abdullah charges Rs..300 for interest and draw on Omer a forth bill for the amount at

three months. At maturity the 3rd bill was renewed with interest of 10% p.a. for three months. The

5th bill was duly accepted by Omer. The fourth and fifth bills were met on maturity.

Required: Journal entries in the books of Abdullah

Question No. 2

From the following particulars prepare Bank Reconciliation Statement of Mr. Hamza as at

31st December 2009.

(a). Bank overdraft as per Bank Statement Rs. 4,700.

(b). Cheques issued prior to 31st December amounted to Rs, 1, 800 of which cheques of Rs. 1, 050

have so far been presented to the bank.

(c). Interest on over draft for six months ending on 31st December Rs. 235 debited in the bank

Statement.

(d). Cheque paid into Bank but not cleared and credited by the Bank were Rs. 3, 250

(e). Bank charges debited in the Bank Statement amounted to Rs. 65.

(f). Interest and dividends on investments, etc, collected and credited by the, bank in the Bank

Statement amounted to Rs 350.

(g). A cheque for Rs. 220 received from a customer and entered in the bank column of the cash

Book was omitted to be paid into the bank.

(h). A customer has directly paid Rs. 350 to our banker in the settlement of his account

Website: www.paksights.com Facebook: fb.com/bcomstudymaterial Page 6

Financial Accounting Punjab University

2009 - 2018

B.Com Part 1 Past Papers

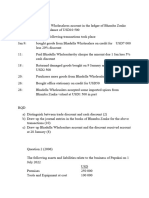

Question No. 3

The following balances appeared in the Books of Sania on 31st December, 2008.

Rs Rs

Building 70,000 Carriage on purchase 1,291

Car 12,000 Carnage on sales 800

Furniture 1,640 Reserve to bed debts 1,320

Sundry debtors 15,600 Establishment 2,135

Sundry creditors 18,852 Taxes &insurance 783

Stock 340 15,040 Interest (Cr) 340

Cash in hand 988 Bad debts 613

Cash at bank 14,534 Audit fee 400

Bills receivable 5,844 General charges 3,950

Bills payable 6,930 Traveling expenses 325

Purchases 85,522 Discount (Dr) 620

Sales 922 121,850 Investments 8,922

Capital 285 92,000 Sales Return 285

Required: Prepare Trading and Profit and Loss Account of Income statement for the year ended

31st December, 2008, and balance sheet as on that date. In doing so take the following matters into

consideration

(i). Stock on 31st December 2008 amounted to Rs 15, 550

(ii). Depreciate Motorcar at 20 % and Furniture at 10 %

(iii). Increase Bad Debts Reserve by 5 per cent on sundry Debtors

(iv). Salaries Rs. 500 and Taxes Rs. 150 are outstanding.

(v). Unexpired insurance Rs 50

(vi). Interest accrued on Investments Rs. 120

(vii). Rent due for a portion of the Building let Rs 150

(viii). A hill receivable for Rs 500 was discounted in December, 2008 but was not due till January

2009.

Website: www.paksights.com Facebook: fb.com/bcomstudymaterial Page 7

Financial Accounting Punjab University

2009 - 2018

B.Com Part 1 Past Papers

Question No. 4

Ms. Affaf finds excess debit of Rs 800 in the trial balance. She places the difference to a newly

opened suspense account to balance the trail balance. Later she discovers the following

discrepancies.

(a) An item of Sale for Rs 5, 900 was posted to the sale a/c at 9, 500.

(b)The total of the sales returns book has been added Rs 100 short

(c) An amount of Rs 3, 700 received from a customer has been credited to his account as Rs. 7,

300.

(d) Rs. 150, 000 paid for purchase of building has been charged to the ordinary purchase account.

(e) A sum of Rs 9, 500 written off from building a/c as depreciation has not been posted to

depreciation a/c.

(f) An amount received from a debtor of Rs. 9.700 has been debited to his account as Rs. 7, 900.

Required: Give the rectifying entries and prepare the Suspense Account. State also the ultimate

effect of these correcting entries on the profit of the business.

Question No. 5

Suleman keeps his books on single entry system. His statement of Assets and Liabilities as on 31st

December 2007 is as follows:

Assets Rs Liabilities Rs

Land and buildings 40,000 Sundry creditors 130,

Furniture &fixtures 200 6,000 Loan from money Lender 113,

Plant &machinery 800 110,000 Other liabilities 26,

Stock 18,400

Sundry debtors 151,000

Cash 16,600

342,000

270,000

His drawings during the year amount to Rs.6000. land and building are to be depreciated by 2%,

furniture and fixture by 10% and plant and machinery by 10%. Sundry debtors are to be reduced by

2%. He has used Rs. 1600worth of stock of his business for private purposes. During the year 2007

he sold some of his household furniture for Rs. 2000 and paid this into his business bank account.

His capital at beginning of the year was Rs. 60,000.

Draw up his statement of profit and loss of the year ended 31st December 2007.

Website: www.paksights.com Facebook: fb.com/bcomstudymaterial Page 8

Financial Accounting Punjab University

2009 - 2018

B.Com Part 1 Past Papers

Question No. 6

The partnership of A, B and C who are sharing profits and losses in the proportion of 4/9, 2/9

and 1/3 is dissolved on 1st April 2005. Their balance sheet of 31st March was as follows:

Assets Rs Rs Liabilities Rs

Cash in hand 1,500 Sundry creditors 4,500

Cash at bank 2,250 Bills payable 2,050

Bills Receivable 2,800 A’ s loan 2,000

Investments 12,000 Capitals

Debtors 15,500 A : 34,000

Stock 9,700 B : 23,000

Furniture 1,850 C : 1,500 58,500

Machinery 7,500 Reserve fund 6,300

Stock 9,700 Profit and loss 2,250

75,600 75,600

The assets realized – investment 15% less, Bills receivable and debtors Rs. 14, 100, Stock 25%

less, Furniture Rs. 1, 025, Machinery Rs. 4, 300 and Buildings Rs. 13, 200. The cost of realization

was Rs.300. All the liabilities were paid off. C becomes bankrupt and Rs. 512 only is received from

his estate full settlement of his indebtedness to his indebtedness to the firm. Partners are paid off.

Show the realization account and capital accounts of the partners:

(i) When capitals of the partners are fixed amounts and

(ii) When the capitals are not filed.

Question No. 7

Discuss in details the following accounting concepts:

Separate entity concept

Dual aspect’ concept

Matching concept

Going concern concept

Cost concept

Question No. 8

Define worksheet. Explain its various columns. Elaborate its importance in the modern accounting?

Website: www.paksights.com Facebook: fb.com/bcomstudymaterial Page 9

You might also like

- Financial Accounting Punjab University: Question Paper 2009Document5 pagesFinancial Accounting Punjab University: Question Paper 2009Abrar AliNo ratings yet

- 11-Acc PP1Document11 pages11-Acc PP1adityatiwari122006No ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- FR2 Past Papers 24 AttemptsDocument107 pagesFR2 Past Papers 24 AttemptsAbdullah FarooqiNo ratings yet

- Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Document4 pagesExplain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Anita PanigrahiNo ratings yet

- Financial Accounting exam questionsDocument3 pagesFinancial Accounting exam questionsVishwas Srivastava 371No ratings yet

- CK Shah VUAPURWATA Mid-Semester Exam Q&ADocument26 pagesCK Shah VUAPURWATA Mid-Semester Exam Q&Aangel100% (1)

- Sample Question Paper IN AccountancyDocument7 pagesSample Question Paper IN AccountancyRahul TyagiNo ratings yet

- Punjab University B.Com Part 1 Past Paper 2015 QuestionDocument5 pagesPunjab University B.Com Part 1 Past Paper 2015 QuestionPraver MalhotraNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument4 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument3 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- Financial Accounting Punjab University: Question Paper 2018Document4 pagesFinancial Accounting Punjab University: Question Paper 2018aneebaNo ratings yet

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- Accounts (A)Document3 pagesAccounts (A)Sameer Gupta100% (1)

- Paper II Financial Accounting IIDocument7 pagesPaper II Financial Accounting IIPoonam JainNo ratings yet

- Co 2101Document3 pagesCo 2101PRIYA LAKSHMANNo ratings yet

- Reg. No.: Sub. Code: DJB 2 CDocument6 pagesReg. No.: Sub. Code: DJB 2 CHARINIVEERAPPANNo ratings yet

- LHU8Q Olopr DaisyAcountXIDocument35 pagesLHU8Q Olopr DaisyAcountXIDido MuczNo ratings yet

- CBSE Class 11 Accountancy WorksheetDocument3 pagesCBSE Class 11 Accountancy WorksheetyashNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- Worksheet 5 NMIMSDocument4 pagesWorksheet 5 NMIMSvipulNo ratings yet

- ISC Accounts 11Document2 pagesISC Accounts 11Sriyaa SunkuNo ratings yet

- Basics of Accounting - Theory and Questions Handout # 2Document6 pagesBasics of Accounting - Theory and Questions Handout # 2Kaali CANo ratings yet

- QuestionsDocument9 pagesQuestionsalexkioko708No ratings yet

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- 11th AccountsDocument8 pages11th AccountsShubham sumbriaNo ratings yet

- Bcom Semester Iii Accounts Mega Revision Cum Suggestion PDFDocument6 pagesBcom Semester Iii Accounts Mega Revision Cum Suggestion PDFAvirup ChakrabortyNo ratings yet

- 5627Document8 pages5627MS 7No ratings yet

- Model Question Paper - 2011 Class - XII Subject - AccountancyDocument6 pagesModel Question Paper - 2011 Class - XII Subject - AccountancyKunal AggarwalNo ratings yet

- AFH Important questionDocument6 pagesAFH Important questionmanassadashiv013No ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Double Entry System and Trial BalanceDocument11 pagesDouble Entry System and Trial BalanceKavitha Kavi KaviNo ratings yet

- Accounting Principles Pilot TestDocument6 pagesAccounting Principles Pilot TestNguyễn Thị Ngọc AnhNo ratings yet

- .Archivetemp8 - Financial Accounting (Old Syllabus)Document2 pages.Archivetemp8 - Financial Accounting (Old Syllabus)aneebaNo ratings yet

- Accounts Test 23 Mar QPDocument3 pagesAccounts Test 23 Mar QPnavyabearad2715No ratings yet

- Class 11 Accounts Half Yearly SPDocument9 pagesClass 11 Accounts Half Yearly SPRakesh AgarwalNo ratings yet

- 13 Single Entry and Incomplete Records Additional ExercisesDocument5 pages13 Single Entry and Incomplete Records Additional ExercisesAditya Hemani100% (1)

- ACC 1101 EXAM: INTRO TO ACCOUNTING IDocument4 pagesACC 1101 EXAM: INTRO TO ACCOUNTING IJoseph OndariNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- Register No. H 1972 - Principles of Accounting Exam QuestionsDocument7 pagesRegister No. H 1972 - Principles of Accounting Exam QuestionsAswinBhimaNo ratings yet

- Review QuestionsDocument9 pagesReview QuestionsGamaya EmmanuelNo ratings yet

- Accounts Paper 1 June 2001Document11 pagesAccounts Paper 1 June 2001BRANDON TINASHENo ratings yet

- Question BankDocument31 pagesQuestion BankmahendrabpatelNo ratings yet

- MBA-Final AccountsDocument4 pagesMBA-Final AccountskanikaNo ratings yet

- 11 Accounts Sample Paper 2Document15 pages11 Accounts Sample Paper 2Techy ParasNo ratings yet

- Accounting 1 Funal F 20Document3 pagesAccounting 1 Funal F 20Pak KhNo ratings yet

- Accountancy CLASS-XI-WPS OfficeDocument7 pagesAccountancy CLASS-XI-WPS Officemaruthesh.vNo ratings yet

- 11 April Account Subjective Question'Document3 pages11 April Account Subjective Question'Nishant NepalNo ratings yet

- Accountancy June 2008 EngDocument8 pagesAccountancy June 2008 EngPrasad C MNo ratings yet

- ACCO 30103 CORPLIQ-Statement of Affairs and Deficiency Statement 04-2022Document3 pagesACCO 30103 CORPLIQ-Statement of Affairs and Deficiency Statement 04-2022Zyrille Corrine GironNo ratings yet

- Revision Questions-1Document6 pagesRevision Questions-1stanleymudzamiri8No ratings yet

- UCO1501Document4 pagesUCO1501PRIYA LAKSHMANNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationDocument3 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 1st SimulationKashifNo ratings yet

- Financial Accounting DocumentsDocument104 pagesFinancial Accounting DocumentsHarsh 21COM1555No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Job & NTS Test PreparationDocument155 pagesJob & NTS Test PreparationShaheen Books50% (2)

- CSS Current Affairs MCQs 2018-19 EditionDocument54 pagesCSS Current Affairs MCQs 2018-19 EditionTahir NabeelNo ratings yet

- Accounting Short Question Notes Part IDocument52 pagesAccounting Short Question Notes Part IZeeShan IqbalNo ratings yet

- Accounting For Doubtful DebtsDocument2 pagesAccounting For Doubtful DebtsZeeShan IqbalNo ratings yet

- 832927600Document4 pages832927600ZeeShan IqbalNo ratings yet

- CH 1 IntroDocument5 pagesCH 1 IntroJawad AhmadNo ratings yet

- Press Release - 24 Aug 2023Document2 pagesPress Release - 24 Aug 2023rock6hard7No ratings yet

- Mankind Pharma Limited RHPDocument588 pagesMankind Pharma Limited RHPArmeet ChhatwalNo ratings yet

- How To Draft Publicity Guidelines For Product and Corporate Ads During An IPODocument14 pagesHow To Draft Publicity Guidelines For Product and Corporate Ads During An IPODinesh GadkariNo ratings yet

- Tranfer PricingDocument36 pagesTranfer PricingSrikrishna DharNo ratings yet

- UPS Swot AnalysisDocument12 pagesUPS Swot AnalysisJennyParraNo ratings yet

- Indian Institute of Management Udaipur: Master of Business Administration 2020-22Document3 pagesIndian Institute of Management Udaipur: Master of Business Administration 2020-22Aishwarya OgreyNo ratings yet

- Business English | E Class: Strategic Thinking Crucial for Strategic Planning SuccessDocument7 pagesBusiness English | E Class: Strategic Thinking Crucial for Strategic Planning SuccessCerah PasandiniNo ratings yet

- ICS Organizational StructureDocument11 pagesICS Organizational Structureczarisse escalonaNo ratings yet

- Ebook PDF Coremacroeconomics Third Edition by Eric Chiang PDFDocument41 pagesEbook PDF Coremacroeconomics Third Edition by Eric Chiang PDFcarla.shurtliff473100% (37)

- SCF Furniture Marketing PlanDocument31 pagesSCF Furniture Marketing PlanDaniella Mae ElipNo ratings yet

- This Study Resource Was: Use The Following Information For The Next Two QuestionsDocument2 pagesThis Study Resource Was: Use The Following Information For The Next Two QuestionsClaudette Clemente100% (1)

- Divya PDFDocument3 pagesDivya PDFedivyaNo ratings yet

- MarriottDocument10 pagesMarriottimwkyaNo ratings yet

- Human Resource Management - Aerospace IndustryDocument13 pagesHuman Resource Management - Aerospace IndustryMackNo ratings yet

- Towards Sustainability: The Third Age of Green MarketingDocument19 pagesTowards Sustainability: The Third Age of Green MarketingVxcz1No ratings yet

- India's Growing ParticipationDocument3 pagesIndia's Growing ParticipationAnonymous ceYk4p4No ratings yet

- Contemporary Logistics: Twelfth Edition, Global EditionDocument47 pagesContemporary Logistics: Twelfth Edition, Global EditionEge GoksuzogluNo ratings yet

- SRM 4 Step ProcessDocument53 pagesSRM 4 Step Processex4182No ratings yet

- AP Problems 2012Document22 pagesAP Problems 2012Jake Manansala0% (1)

- Esop Memo and OrderDocument44 pagesEsop Memo and Orderbuckybad2No ratings yet

- ACCT 60100 - Fall 2020 - Pioneer October Case Solution - Presentation PDFDocument12 pagesACCT 60100 - Fall 2020 - Pioneer October Case Solution - Presentation PDFTruckNo ratings yet

- Software Engineering - Presentation For Group 1 EditedDocument17 pagesSoftware Engineering - Presentation For Group 1 EditedBrilliant Billykash KashuwareNo ratings yet

- IT Architecture Diagram - Use of Common SymbolsDocument9 pagesIT Architecture Diagram - Use of Common SymbolsHarihar Viswanathan100% (1)

- Ferrell Hirt Ferrell: A Changing WorldDocument36 pagesFerrell Hirt Ferrell: A Changing WorldYogha IndraNo ratings yet

- Principles of Marketing ReviewerDocument42 pagesPrinciples of Marketing ReviewerJwyneth Royce DenolanNo ratings yet

- Global Talent ManagementDocument6 pagesGlobal Talent ManagementRentaro :DNo ratings yet

- Ethics in Software DevelopmentDocument52 pagesEthics in Software Developmentgrace bulawitNo ratings yet

- Argumentative Essay ExampleDocument2 pagesArgumentative Essay Exampleapi-264112842100% (2)

- Global Strategy Development and ImplementationDocument25 pagesGlobal Strategy Development and ImplementationVipul NimbolkarNo ratings yet