Professional Documents

Culture Documents

Accounting 1 Funal F 20

Uploaded by

Pak KhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting 1 Funal F 20

Uploaded by

Pak KhCopyright:

Available Formats

Capital Uniersity of Science and Technology

Department of Management Sciences

ACCB2003 – Principles of Accounting 1

Final Examinatin - BBA (S1, S2)

Semester: Fall 2020 Max Marks:40

Date: ` 14/01/2021 Time: 2 Hrs. 30 Mins.

Instructor Name: Nasir Rasool

Instructions:

• This exam carries 40% weightage towards the final evaluation.

• Write your name and registration number on each of your answer sheet.

• Write the honor statement given in files section, at the start of your final exam.

• This examination is being conducted in extra ordinary circumstances so I expect that all

students will exhibit higher moral standards.

Name: Reg. No.

Part 1

Question - 1 (CLO - 2) (10 Marks)

Part A (6 Marks)

Following balances are available from the books of Friends Enterprises as on 31 December 2018:`

Machinery Rs. 1,500,000

Office Equipment 800,000

Debtors 550,000

Accumulated Depreciation on Machinery 800,000

Accumulated Deprecation on Office Equipment 280,000

Provision for Bad Debts 5,500

Cash in Hand 500,000

Following Transactions were carried out during 2019:

Feb 1 Purchased new machinery Rs. 300,000

Apr 1 An office laptop was stolen its cost was Rs. 60,000 and accumulated depreciation was Rs.

30,000.

June 1 Bad debts written off Rs. 4,000.

Oct 10 Sold goods on credit Rs. 10,000

Nov 10 Payment was made to debtors Rs.40,000 in cash.

Additional Information:

1. Machinery is depreciated at 10% of cost.

2. Office equipment is depreciated at 20% of cost.

3. Provision for bad debts should be adjusted to 3% of debtors as on 31 December 2019.

Required:

a. Record the transactions in relevant ledger accounts

b. Show the closing entries at the end of year 2019

c. Show the relevant portion of profit and loss account and balance sheet at the end of year 2019.

ACCB2003– Principles of Accounting I Page 1 of 3

Part B (4 Marks)

Briefly discuss the reasons for charging depreciation and creating provision for bad debts at the end of every

accounting period

Part 2

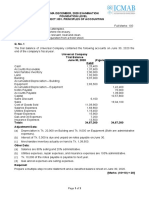

Question - 2 (CLO - 2) (10 Marks)

Prepare an Income Statement for the year ended 31 December 2018 and a Balance Sheet as at that

date from the following Trial Balance:

ALVIN Enterprises

Trial Balance on 31 December 2018

Debit Rs. Credit Rs.

Drawings and Capital 30,000 150,000

Loan From HBL - 586,800

Purchases and Sales 650,000 1,000,000

Debtors and Creditors 71,000 61,000

Return Inwards and Return Outwards 4,500 5,500

Discount Allowed and Discount Received 4,800 6,000

Land and Building 150,000 -

Furniture and Fittings 30,000 -

Motor Vehicle 600,000 -

Stock 29,000 -

Cash in Hand 2,000 -

Cash at Bank 105,000 -

Wages and Salaries 90,000 -

Carriage Expenses 42,000 -

Light, Heat and Water Expenses 22,000 -

Rent Income - 23,000

General Expenses 40,000 -

Telephone and Postage 9,000 -

Advertisement 10,000 -

Insurance 3,000

Accumulated Depreciation on Furniture and Fittings 10,000

Accumulated Depreciation on Motor Vehicles 50,000

Total 1,892,300 1,892,300

Adjustments at end of the year:

• Closing Stock, Rs. 90,000

• Land and building are depreciated at 10% of cost, furniture and fittings are depreciated at

20% of book value and motor vehicles are depreciated at 20% of cost.

• Accrued Salaries Rs. 10,000.

• Adjust provision for bad debts to 2% of debtors.

• Prepaid Insurance, Rs. 500.

• Rent received in advance Rs. 5,000

• General expenses payable Rs. 200

ACCB2003– Principles of Accounting I Page 2 of 3

Part 3

Question - 3 (CLO - 3) (10 Marks)

30 June 2020 Balance as per cash book: your registration number.

Following information was extracted after careful review of the data:

Cheques issued but not presented:

Cheque number 5487 Rs. 50,000

Cheque number 2487 Rs. 120,000

Cheque number 7785 Rs. 30,000

Cheque collected but not credited

Cheque number 4576 Rs. 180,000

Cheque number 4571 Rs. 220,000

Cheque number 7458 Rs. 180,000

Bank charges/taxes deducted by the bank

Withholding Tax Rs. 16000

ATM Charges Rs. 1500

Other bank Charges Rs. 2500

Dishonored Cheques

Cheque No. 2251 Rs. 100000

Cheque No. 1125 Rs. 140000

Required:

Prepare a bank reconciliation statement starting with cash book balance

Part 4

Question - 4 (CLO - 3) (10 Marks)

Describe the following accounting concepts and principles:

a. Principle of objective evidence

b. Matching Concept

c. Separate Entity Concept

d. Materiality Principle

ACCB2003– Principles of Accounting I Page 3 of 3

You might also like

- Darden Case Book 2019-2020 PDFDocument155 pagesDarden Case Book 2019-2020 PDFJwalant MehtaNo ratings yet

- Acc 621 Assign 2022Document5 pagesAcc 621 Assign 2022Sarah Precious NkoanaNo ratings yet

- Learning Objective 25-1: Chapter 25 Short-Term Business DecisionsDocument93 pagesLearning Objective 25-1: Chapter 25 Short-Term Business DecisionsMarqaz Marqaz0% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Rig Inspections: Lloyd's Register Energy - DrillingDocument2 pagesRig Inspections: Lloyd's Register Energy - DrillingShraddhanand MoreNo ratings yet

- Sample HSE PolicyDocument1 pageSample HSE Policykoo langot67% (3)

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Accounting S1Document2 pagesAccounting S1muhammad muzzammilNo ratings yet

- Human Resources 3Document104 pagesHuman Resources 3Harsh 21COM1555No ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- FAC511S - Financial Accounting 101 - 2nd Opportunity - January 2017Document6 pagesFAC511S - Financial Accounting 101 - 2nd Opportunity - January 2017Uno VeiiNo ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- Topic Wise Test Accounting From Incomplete RecordsDocument4 pagesTopic Wise Test Accounting From Incomplete RecordsChinmay GokhaleNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- CU Leaked Paper Financial Accounting-IDocument5 pagesCU Leaked Paper Financial Accounting-Idarindainsaan420No ratings yet

- ISC Accounts 11Document2 pagesISC Accounts 11Sriyaa SunkuNo ratings yet

- SCC 4000 Assessment 1 - 2021 Information 1LMDocument5 pagesSCC 4000 Assessment 1 - 2021 Information 1LMOdzulaho DemanaNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- MBA and MBA (Banking & Finance) : Mmpc-004: Accounting For ManagersDocument3 pagesMBA and MBA (Banking & Finance) : Mmpc-004: Accounting For ManagersMishra FamilyNo ratings yet

- 15-Mca-Or-Accounting and Financial ManagementDocument4 pages15-Mca-Or-Accounting and Financial ManagementSRINIVASA RAO GANTANo ratings yet

- FMA Assignment 01Document5 pagesFMA Assignment 01Dejen TagelewNo ratings yet

- Accounting NumaricalDocument7 pagesAccounting NumaricalMuhamamd Asfand YarNo ratings yet

- HW 16433Document2 pagesHW 16433Abdullah Khan100% (1)

- A2.1 April2023Document7 pagesA2.1 April2023thuyhangg0209No ratings yet

- BFC 3125 Financial Accounting IDocument5 pagesBFC 3125 Financial Accounting Ikorirenock764No ratings yet

- MBA (E), Part-I, 1st Semester-2Document27 pagesMBA (E), Part-I, 1st Semester-2Rubab MirzaNo ratings yet

- Revision Questions-1Document6 pagesRevision Questions-1stanleymudzamiri8No ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- IGNOU ms04 AnsDocument12 pagesIGNOU ms04 AnsmiestalinNo ratings yet

- 5401Document6 pages5401ArumNo ratings yet

- 12 Ut 1,2Document7 pages12 Ut 1,2Soni soniyaNo ratings yet

- Model-Financial Accounting - Set1 - CZ21ADocument4 pagesModel-Financial Accounting - Set1 - CZ21AJuli SunNo ratings yet

- Cash Accrual Single EntryDocument3 pagesCash Accrual Single EntryJustine GuilingNo ratings yet

- Basic Principles of Accounting: National Law University Odisha, CuttackDocument2 pagesBasic Principles of Accounting: National Law University Odisha, CuttackAnanya SonakiyaNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Financial Accounting Punjab University: Question Paper 2010Document4 pagesFinancial Accounting Punjab University: Question Paper 2010ZeeShan IqbalNo ratings yet

- 221 REQUIREMENT For Summer Class 1Document2 pages221 REQUIREMENT For Summer Class 1Lealyn CuestaNo ratings yet

- ACC 281 SEMINAR QUESTIONS Version 2Document8 pagesACC 281 SEMINAR QUESTIONS Version 2Joel SimonNo ratings yet

- MEFA Nov2003 RR211701Document10 pagesMEFA Nov2003 RR211701Nizam Institute of Engineering and Technology LibraryNo ratings yet

- AC3202 WK2 Exercises (22:23A)Document9 pagesAC3202 WK2 Exercises (22:23A)Long LongNo ratings yet

- Accounting and Auditing For CooperativesDocument3 pagesAccounting and Auditing For CooperativesfaithNo ratings yet

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- BCOMSC - Accounting 1 - 15-Jan-24 - S1Document8 pagesBCOMSC - Accounting 1 - 15-Jan-24 - S1blessingmudarikwa2No ratings yet

- Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesAttempt Any Four Questions. All Questions Carry Equal MarksVishwas Srivastava 371No ratings yet

- AFA End Examination 2021-2022Document6 pagesAFA End Examination 2021-2022sebastian mlingwaNo ratings yet

- Audit of LiabilitiesDocument6 pagesAudit of LiabilitiesandreamrieNo ratings yet

- Activity - Preparation of Financial StatementsDocument4 pagesActivity - Preparation of Financial StatementsJoy ValenciaNo ratings yet

- Adjusting Entries & Questions PDFDocument18 pagesAdjusting Entries & Questions PDFshahroz QadriNo ratings yet

- Financial Accounting AssignmentDocument6 pagesFinancial Accounting Assignmentpunya guptaNo ratings yet

- 2020-12 ICMAB FL 001 PAC Year Question December 2020Document3 pages2020-12 ICMAB FL 001 PAC Year Question December 2020Mohammad ShahidNo ratings yet

- 2017-12 ICMAB FL 001 PAC Year Question December 2017Document3 pages2017-12 ICMAB FL 001 PAC Year Question December 2017Mohammad ShahidNo ratings yet

- Contentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFDocument4 pagesContentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFJoseph OndariNo ratings yet

- DSR Mock Test - 1 - Ca FoundationDocument5 pagesDSR Mock Test - 1 - Ca Foundationmaskguy001No ratings yet

- Audit of Inventories and Trade Payables BA 123 Exercise Set BDocument6 pagesAudit of Inventories and Trade Payables BA 123 Exercise Set BBecky GonzagaNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document4 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)ilyas muhammadNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- Make-Up AssignmentDocument5 pagesMake-Up AssignmentRileyNo ratings yet

- PSAF April 2022Document27 pagesPSAF April 2022Gen AbulkhairNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document7 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)AREEZA BATOOL M.Sc. Information TechnologyNo ratings yet

- Dissolution + Single EntryDocument18 pagesDissolution + Single EntryOm JainNo ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- Management Programme: MS-04: Accounting and Finance For ManagersDocument5 pagesManagement Programme: MS-04: Accounting and Finance For Managersanon_323108No ratings yet

- Analytical Reasoning Paper BBADocument4 pagesAnalytical Reasoning Paper BBAPak KhNo ratings yet

- Accounting II FinalDocument6 pagesAccounting II FinalPak KhNo ratings yet

- Capital University of Science and Technology: Honor StatementDocument7 pagesCapital University of Science and Technology: Honor StatementPak KhNo ratings yet

- Project Analytical-1Document4 pagesProject Analytical-1Pak KhNo ratings yet

- Accounting 2 Groups (Section 1)Document2 pagesAccounting 2 Groups (Section 1)Pak KhNo ratings yet

- DataDocument200 pagesDataAnshu GuptaNo ratings yet

- In Re Facebook - Petition To Appeal Class Cert Ruling PDFDocument200 pagesIn Re Facebook - Petition To Appeal Class Cert Ruling PDFMark JaffeNo ratings yet

- Preboard 1 Plumbing ArithmeticDocument8 pagesPreboard 1 Plumbing ArithmeticMarvin Kalngan100% (1)

- Chapter 11 Regaining Customer Confidence Through Customer Service and Service RecoveryDocument24 pagesChapter 11 Regaining Customer Confidence Through Customer Service and Service Recoverymarco delos reyesNo ratings yet

- MKT 310 Assignment 2 by Yerbol BolatDocument5 pagesMKT 310 Assignment 2 by Yerbol BolatYerbol BolatNo ratings yet

- The Global Interstate SystemDocument12 pagesThe Global Interstate SystemGina GieNo ratings yet

- Leave Policy Related To Staff of Safina Children HomeDocument2 pagesLeave Policy Related To Staff of Safina Children HomehamzaNo ratings yet

- Chapter 03 PPT 3Document39 pagesChapter 03 PPT 3kjw 2No ratings yet

- Labor Cost Per Bell Will Be Rs. 1 Variable Overheads 100% of Labor CostDocument3 pagesLabor Cost Per Bell Will Be Rs. 1 Variable Overheads 100% of Labor CostanushkaNo ratings yet

- Unemployment Newspaper ArticleDocument3 pagesUnemployment Newspaper ArticleWwil DuNo ratings yet

- Principles of Operations Management 9th Edition Heizer Test BankDocument34 pagesPrinciples of Operations Management 9th Edition Heizer Test Bankelmerthuy6ns76100% (25)

- A Project On DetergentDocument47 pagesA Project On Detergentmldc2011100% (1)

- Australian Optometry TAM Stands at $4.2bnDocument5 pagesAustralian Optometry TAM Stands at $4.2bnabeNo ratings yet

- RHDdqokooufm I1 EeDocument14 pagesRHDdqokooufm I1 Eedeshdeepak srivastavaNo ratings yet

- Employer Branding: Understanding Employer Attractiveness of IT CompaniesDocument8 pagesEmployer Branding: Understanding Employer Attractiveness of IT CompaniesCửu ÂmNo ratings yet

- Globalization - Definition: According To Ritzer (2011)Document5 pagesGlobalization - Definition: According To Ritzer (2011)ARNOLD II A. TORRESNo ratings yet

- Chapter 7 (II) - Current Asset ManagementDocument23 pagesChapter 7 (II) - Current Asset ManagementhendraxyzxyzNo ratings yet

- Hapter Quiz EntrepreneurshipDocument10 pagesHapter Quiz EntrepreneurshipStan DitonaNo ratings yet

- Annual Barangay Youth Investment Program Monitoring FormDocument3 pagesAnnual Barangay Youth Investment Program Monitoring FormJaimeh AnnabelleNo ratings yet

- Maybank Market Strategy For InvestmentsDocument9 pagesMaybank Market Strategy For InvestmentsjasbonNo ratings yet

- Class Discussion - Case Study IKEADocument2 pagesClass Discussion - Case Study IKEASneha SamuelNo ratings yet

- Test Questions: True/FalseDocument50 pagesTest Questions: True/FalseThảo Ngân ĐoànNo ratings yet

- Arijit Bose - KMBDocument3 pagesArijit Bose - KMBArijit BoseNo ratings yet

- UntitledDocument11 pagesUntitledHannah Bea AlcantaraNo ratings yet

- Turkey DataDocument499 pagesTurkey DataisaNo ratings yet

- Business Plan - Potato MilkDocument29 pagesBusiness Plan - Potato MilkTania TahminNo ratings yet