Professional Documents

Culture Documents

Financial Accounting Topics from College of Modern Sciences

Uploaded by

Rubab MirzaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting Topics from College of Modern Sciences

Uploaded by

Rubab MirzaCopyright:

Available Formats

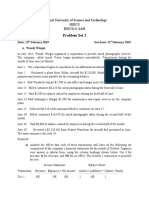

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Financial Accounting 2013-2014

Q#01(A): Why is Financial Accounting is referred as a language of Business?

Q#01(B): Which information a Balance sheet comprises of? Explain each briefly.

Q#02:Thefollowingaccountswiththeir net balance have been taken from the ledger of Ali Enterprises

ason31"December, 2013:

Accounts payable Rs. 26,000 Drawing Rs. 28,000

Accounts receivable 42,000 Marketable Securities 20,000

Building 195,000 Notes Payable 30,000

Bond Payable 140,000 Acc: Dep: Building 38,000

Bank overdraft 20,000 Furniture 80,000

Sales 630,000 Sales Return 12,000

Office supplies 16,000 Purchase Discount 26,000

Utility expenses 28,000 M/Inventory (Beg) 63,000

Freight in 3,000 Purchase Return 8,000

Cash 222,000 Sales Discount 18,000

Capital 327,000 Salaries Expense 80,000

Purchase 420,000 Octrol on purchase 7,000

Advertising Expanse 5,000 Prepaid rent 36,000

Debentures Payable 150,000 Insurance in Transit 2,000

Land 90,000 Interest Expenses 54,000

Acc: Dep: Furniture 26,000

Additional Data:

The un-sold merchandising inventory as on December 31, 2003 is Rs. 35,000.

Required: Prepare Multiple Steps income Statement & Classified Balance Sheet

Q#3: Adnan Enterprises had the following trial balance accounts with the balance for the December 31, 2013:

Accounts Receivable 15,000 Office Equipment 6000

Advertising Expanses 600 Prepaid Insurance 1920

Automobile Expanses 3560 Prepaid Rent 7200

Account Payable 720 Capital ???

Automobile 16000 Drawing 47000

Accumulated depreciation-office 1140 Sales Commission Revenue 60000

Equipment

Accumulated depreciation-Automobile 4000 Management Service Revenue 4800

Bank Overdraft 9000 Miscellaneous Expanse 400

Cash 25000 Salaries Expanse 39960

Office Supplies 600 Unearned Management Fees 3120

Adjustment data at December 31, 2013:

a) Insurance expired for the period Rs. 960

b) Rent Expense for the year Rs. 4800

c) Depreciation on office equipment Rs. 720 and automobile Rs. 3200

d) Salaries incurred but unpaid as of December 31, Rs. 6660

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

e) Supplies on hand on December 31, Rs. 200

f) Unearned management fees were received and recorded on October 01, 2013. The advance payment of

covered six months management of an apartment building

Required: Prepare necessary Adjusting Entries in the Adjustment Column and complete the Adjustment Trial

Balance.

Q#4: The cash in bank for Zaheer & Company at 31st January of the current year indicates a balance of

Rs. 6,674.55 after both the cash receipt journal and cheque register has been posted. The bank statement indicates

a balance of Rs. 9,966.85 on 31st January. Comparison of the bank statement and the accompanying cancel|ed

cheques and advises with records revealed the following reconciling items:

1. A deposit of Rs. 1,226.16 representing the receipts of 31st January, had been too late to appear on the bank

statement

2. Cheques outstanding totaled Rs. 4,125.36

3. A cheque for Rs. 591=returned with the statement had been recorded in the cheque register as Rs. 95. The

cheque was for the payment of an obligation to Nizamani Equipment Corporation on account for the purchase of

store equipment

4. A cheque for Rs. 150/= drawn by Suhail Brothers had been erroneously charged by the bank from the

companies account

5. The bank collected from Aamir & Company Rs. 512/= on bill left for collection. A face value of the bill Rs. 500.

6. Bank service charges for January amounted Rs. 4.90/-

Required: Prepare a Bank Reconciliation Statement and journalize necessary entries.

Q#05: On October 01, 2013, Melton Company acquired and placed into use new equipment costing Rs. 105,000.

The equipment has a useful life of five years and an estimated salvage value of Rs. 5,000. It is estimated that

equipment will produce 2,000,000 units of product during its life In the last quarter of 2013, the equipment

produced 120,000 units of product.

Required: (A) Compute the depreciation for the last quarter of 2013 using each of the following methods: 1. Units

of-Production 2. Sum-of-the-years-digits 3. Double-dedining-balance

(B) Describe the conditions in which each of the above three methods would be most appropriate

Q#6 Write short notes on the following:

1. Bad Debts 02. Works sheet 03. Tangible Assets 04. Prepaid Expenses

Financial Accounting 2011-2012 & 2012-2013

Q#1 (a): four different companies W,X,Y,Z show the same balance sheet data at the beginning and end of the

year. These data excessive of the amount of the capital, are summarized as follows:

TOTAL ASSETS TOTAL LIABILITIES

Beginning of the year Rs. 275,000/- Rs. 80,000/-

End of the year Rs. 320,000/- Rs. 85,000/-

On the basis of above data and the following additional information for year, determine the net income or net loss

of each company for the year.

Company W: The Company had made no additional investments in the business and no withdrawal from the

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

business

Company X: The Company had made no additional investments in the business but had withdrawal Rs. 25,000/-

Company Y: The Company had made no additional investment of Rs. 50,000/- but had made no withdrawal.

Company Z: The Company had made no additional investment of Rs. 48,000/- and had withdrawn Rs. 35,000/-

Q#1(b) for the fiscal year, net sale for Rs. 975,000/- and net purchase were of Rs. 650,000/- merchandising

inventory at the beginning of the year was Rs. 75,000/- and at the end of the year Rs, 80,000/- determine the

following amounts:

a) Merchandising available for the sale.

b) Cost of merchandise sold.

c) Gross profit.

d) Merchandise inventory listed on the Balance Sheet t End of the year.

Q#2 the two trial balance of Zaidi Enterprises as of December 31, 2002 one before adjustments and other after

adjustment

Are as follows:

UNADJUSTED ADJUSTED

Dr. Cr. Dr. Cr.

8,000 8,000

Account Receivable 3,200 3,200

Supplies 8,450 3,240

Prepaid Rent 7,200 1,200

Prepaid Insurance 1,800 650

40,000 40,000

Building 96,000 96,000

Acc. Dep-Building 62,400 67,200

Trucks 82,000 82,000

Acc. Dep- Trucks 32,800 36,900

Accounts Payable 7,120 1,450

Salaries Payable __________ 920

Taxes Payable __________

Zaidi’s Capital 100,000 100,000

Retained earning 20,400 20,400

Zaidi’s Drawings 20,500 20,500

Service Fee Earned 116,680 116,680

Salary Expanse 67,200 68,650

Rent Expanse __________ 6,000

Supplies Expanse __________ 5,210

Dep. Expanse- Building __________ 4,800

Dep. Expanse- Trucks __________ 4,100

Utility Expanse 3,700 3,920

Taxes Expanses 600 1,520

Insurance Expanse __________ 1,150

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Miscl. Expenses 780 780

TOTAL 339,430 339,430 350,920 350,920

INSTRUCTIONS:

Present the required eight adjusting journal entries & complete Worksheet

Q#3 Using the data of Q#2, you are required prepare Income Statement, Classified Balance Sheet & necessary

Closing Entries.

Q#4 the following bank reconciliation statement information pertain to ABC Enterprises.

I.Deposit in transit Rs. 16,700/=

II.Note collected by the bank Rs. 11,100/=, the value of note is Rs. 10,000.

III.Outstanding checks Rs. 18,780

IV.Check for Rs. 2,000 charged by the bank as Rs. 20,000

V.Bank service charges Rs. 170/=

VI.Check of a customer returned by the bank to depositor because of insufficient fund Rs. 740.

VII.Check drawn by depositor for Rs. 67,00/= but recorded in check register as Rs. 7600/=

Required

I.Identify each of the above recording items ad additions and deduction in the balance of bank statement or the

Balance of depositor’s records.

II.Records necessary entries in the depositors (ABC-Enterprises) account.

Q#5 Savana Company purchased a spot-welding machine on July 2005 at a cash cost of 42,300 on the same date,

installation charges of 2,800 were paid. The machine has an expected useful life 10 years and an estimated salvage

value of 3,800. The same machine was sold on June 2007 for Rs. 28,400.

Required

Record the journal Entries on July 2007 against the sale of machine using:

I.Straight line method of depreciation

II.Sum of the year digits (SYD) method of depreciation

III.Double declining method of depreciation.

Q#6 Write short notes on any five of the following

Financial Accounting Retained Earning Depreciation

Fixed Assets Adjusted Trial Balance Accrued Revenues

Unearned Revenues

Financial Accounting 2011-2012

Q#1 financial Accounting is one of the fundamentals activities of every business organizations that gathers

economic information about itd activities and that summarizes information and communicates to its interested

parties. Explain

Q#2 The following data are for Ahmed Lamps Enterprises;

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Account Receivable Rs. 48,300 Account payable Rs. 15,900

Accumulated Dep: (Building)

Rs. 33,000 Accumulated Dep: Furniture

11,120

Advertising Expense 12,000 Bank Overdraft 22,000

57,200 Ahmed Capital 220,180

Drawing 30,000 Delivery Expenses 4,600

Interest Revenue 60,000

Interest Expanse 2,000 Debentures payable 80,000

Merchandising Inventory 41,600 Mortgage Payable 20,000

(1/1/12)

otes Receivable 70,000 Office Salaries Expenses 74,000

Octroi on Merchandising 3,000 Purchases 312,900

Inventory

Prepaid Insurance 2,900 Purchases Returned 1,400

Purchase Discount 2,600 Store Building 110,000

Store Furniture 55,600 551,500

Sales Returned 2,000 Sales Discount 3,700

Utility Expanses 64,000 Transportation 4,300

Additional Data: Cost of merchandising inventories on hand; December 31, 2012 Rs. 55,500

Required: Prepare multiple steps income statements and classified Balance sheet on December 31, 2012

Q#3 cash in the bank Account for ABC Enterprises at December 31, 2002 indicates a balance of Rs. 12,192.50 the

bank statement indicates a balance of Rs. 19,955.65 on same date. The comparison of bank statement and

accompanying cancelled cheques and memorandum with the record revealed the following reconciling items;

a. A deposit of Rs. 4015.20 representing the receipts of December 31 had been made too late to appear on the

statement (Late deposits)

b. Cheques outstanding total Rs. 9090.75

c. The bank had collected for ABC Enterprises Rs. 3045/= on a note left for collection. The face value of note

was Rs. 3000/=

d. The cheque drawn for Rs. 470/= had been erroneously charged by the bank as Rs. 740/=

e. A cheque for Rs. 72.50 returned with the statement had been recorded in the cheque register as Rs. 7.25

f. Bank service charges for December Rs. 22.15/=

Required: Prepare a Bank- Reconciliation Statements.

Q#4 the following are the transactions pertaining to Allowance for uncollectible account.

A company’s allowance for uncollectable account had a credit balance of Rs. 10,115 on December 31, 2012. On that

day and during the current year it completed the following transactions;

December 31, 2012 Provided on additions to allowance for uncollectible account equal to 1%

of the year’s sale of Rs. 11,400,000/=

January 10, 2013 Learned that Kamal and sons had gone out of business leaving no asset. Wide off his Rs.

2115/= account as uncollectable

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

February 15, 2013 Kamal and sons paid Rs. 1,000/= of the account written off on January 10.

March 20, 2013 Made a compound entry to write off these account; Umaias Brothers Rs. Rs. 3950, Zaidi

Enterprises Rs. 2790 and Babar Co: Rs 4,000/=

March 31, 2013 Estimated the Allowance for uncollectable account equal to 1% of the period’s sale of

1,570,000/=

Required: Record necessary adjusting entries on December 31, 2012 and March 31, 2013 and also record the other

journal entries and maintain the allowance for uncollectable account.

Q#5 (a) Ali enterprises purchase a delivery van for Rs. 150,000/= Jan 01, 2008 the van was estimated to have

service life of 05 years and residual value of Rs. 30,000/=

Compute the depreciation for first three year using;

I.Sum of the years digits methods

II.Double declining balance method

Q#5 (b) equipment costing Rs. 44,000/= on which 30,000 of accumulated Depreciation had been rwecorded

was disposed off on Jan 02, 2013. What journal entries are required to record the equipments disposition under

each of the following assumption.

a. Equipment was sold for Rs. 18,000/= each

b. Equipment was sold for Rs. 11,600/= each

c. The equipment was retired from services and hauled to the junkyard. No material was salvaged.

Q#6 What, why and when adjusting entries are prepared. Explain with examples

Financial Accounting 2012-2013

Q#1 prepare the transactions, then record in general journal and post only cash entries in cash account of six

columns (Self Balancing Ledger), connecter to following possible effects (the amount of each transaction may be

given at your own):

1. Increase in assets and increase in Owner’s equity.

2. Increase in assets increase in another assets and increase in revenue.

3. Decrease in asset and Decrease in revenue.

4. Decrease in asset, increase in asset and increase in liability

5. Increase in asset, decrease in liability and increase in Owner’s Equity.

Q#2 On December 31, 2012, the close of fiscal year for Board Corporation, the company’s ledger contains the

following account with balances:

Account payable Rs. 44,900 Rs. 90,000

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

count Receivable 102,000 Marketable Sec: 45,000 Addition

Acc. Dep. Furniture 3,600 Notes Payable 24,000 al

Acc. Dep. Building 16,000 Notes Receivable 33,000 informa

Building 160,000 Office Supplies 3,600 tion:

Bonds Payable 125,000 Office Supplies Expense 4,200 In

57,000 Purchases 574,575 addition

Capital Stock Purchases Return 3,000 to

Dividend 50,000 Purchase Discount 1,635 account

Acc. Dep. Furniture 3,600 Prepaid Insurance 2,100 balance

Acc. Dep. Building == 9,000 Rent Expanse 25,200 given

Debenture Payable 85,000 Retained Expense 106,400 above, it

Freight in 18,000 879,000 is

Furniture 60,000 Sales Return 5,000 determi

M. Inventory (Beg.) 86,700 Sales Discount 7,000 ned by

Income Tax Payable 40,000 Salaries Expanse 87,000 count

Income Tax Expanses 40,000 Wages Expanse 31,200 that

Insurance Expanse 24,000 mercha

Insurance-in-Transit 12,000 ndise

inventory as on December 31, 2012 amounted to Rs. 107,640/-

Required: Prepare the trial balance in sequence order.

Q#3 Using the data of question#2, Prepare necessary closing/adjusting entries and Classified Balance Sheet.

Q#4 state briefly (not more than half page) any five of the following:

Financial Accounting Current Assets Ledger

Closing Entries Worksheet Unearned Revenue

Accrued Expenses

Q#5

It is a March 31, 2013; Fry Company is ready to prepare its March Bank Reconciliation.

The following information is available:

(1)

Company Cash Account

March 01, Balance Rs. 14,175 Checks 6,500

Deposits 25,734

(2)Bank Statement, March 31:

Balance, March01_____________________________________________Rs. 15,400

Deposits_____________________________________________________ 25,599

Checks Cleared _______________________________________________ 27,059

NSF Check (Customer X) _______________________________________ 50

Note collected for depositor (including interest, Rs. 40) ________________ 840

Interest on bank balance ________________________________________ 18

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Bank Service Charge___________________________________________ 7

(3) Additional Information:

(a) On deposit by the company was Rs. 10 overstated by the company; it was recorded correctly by the bank.

(b) The bank cleared Rs. 89 check as Rs. 98; it has not been corrected by the bank.

(c) End of February: Deposits outstanding Rs. 775; checks outstanding Rs. 2,000.

Required: Prepare a Bank Reconciliation for March and give necessary journal entries

Q#6 (A)

The accounting records of Ahmed Brothers are maintained on the basis of a fiscal year ending April 30. The

following facts are to be used for making Adjusting Entries before the accounts are closed and financial statements

are prepared at April 30.

1. Ahmed Brothers purchased a machine on Jan 01, of the current year for Rs. 24,000/-. The machine had an

estimated life of 08 years and salvage value of Rs. 2,000/-.

2. A 36 months Fire Insurance Policy had been purchased on April 01, of current year. The premium of Rs. 43,200/-

for the entire life of policy had been paid on April 01 and recorded as Prepaid Insurance

3. A portion of the land owned had been leased on February 01, of the current year toa service station operator at

a yearly rent of Rs. 14,400/- one year rent was collected in advance at the date of the lease and credited to

unearned rental revenue.

4. A bus to carry guest to and from the airport has been rented on April 19 from Murtaza Rent a Bus at a daily rate

of Rs. 775/-. No rental payment had yet been made.

5. On April 12, a room having a rent of Rs. 500/- per day was rented to a guest; the amount of rent had yet not

been collected till April 30.

Required: Prepare adjusting journal entries.

Q#6 (B)

ABC Enterprises purchased and put into use a machine on Jan 01, 2010, at a total cost of Rs. 130,000/-. The

machine was estimated to have salvage value of Rs. 5,000/- and 10 years life. It was also estimated that machine

would produce One Million units of product during its life. The machine produced 90,000 units in 2010, 110,000

units in 2011, and 125,000 units in 2012. Required: Prepare a chart showing depreciation, accumulated

depreciation and book value of the machine usingthe following methods:

a. Units of Production

b. Double Declining Balance

Financial Accounting 2009-2010

Q#1 The following transaction took place in Pat Campbell Crop Dusting Corporation during the month of June 2010,

the month of establishment of the corporation.

June 1 Campbell deposited $80,000 cash in a bank account in the name of the business

June 2 Purchase a crop dusting aircraft from utility aircraft for $220,000. Made a $40,000 cash

drawn payment and issued a note payable for $180,000

June 4 Paid Woodrow aircraft $8,500 to rant office and hanger space for the month.

June 15 Billed customers $8,320 for crop dusting service rendered during the first half of June.

June 15 Paid $5,880salaries to employees for services rendered during the first half of the June.

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

June 18Paid Hannigan‘s Hanger $1,890 for maintenance and repair services.

June 25Collected $4,910 of the amounts billed to customers on June 15.

June 30Billed customers $16,450 for crop dusting service rendered during the second half of the month.

June 30Paid $6,000 salaries to employees for services rendered during the second half of the month.

June 30Received a fuel bill from Henry’s Feer & Fuel for $2,510 of aircraft fuel purchased during June. This amount is

due by July 10.

June 30Campbell withdrew $2,000 cash from the business for personal use.

List of account titles used by Campbell Crop Dusting were as follows.

Account receivable Aircraft

Notes payable Accounts payable Pat Campbell, Capital

Pat Campbell, DrawingCrop Dusting Revenue Maintenance Expense

Fuel Expense Salaries Expanse Rent Expense

Instructions:

a) Prepare journal entries.

b) Post to ledger accounts.

Q#2 Refer the data from Q#01, and prepare a trial balance at June 30, 2010 and compute the following.

Total assets Total Liabilities Total stockholders’ equity

Q#3 The operations of Hempstead realty consists of obtaining of houses being offered for sale by owners,

advertising these house, and showing them to prospective buyers. The company earns revenue in the form of

commissions. The building and office equipment used in the business were acquired on January 1st of the current

year and were immediately placed in use. Useful life of the building was estimated to be 30 years and that of the

office equipment 5 years. The company closes its account monthly; on March 31st of the current year, the trial

balance is as follows:

HEMPTED REALTY

Trial Balance

March 31, 20XX

Cash 29,750

Account receivable 7,500

Office supplies 850

Land 30,000

Building 90,000

Accumulated depreciation: $500

Building

Office equipment 21,000

Accumulated depreciation: office 700

equipment

Account repayable 14,750

M. Valentino, Capital 126,650

M. Valentino, Drawing 4,500

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Commissions earned 50,000

Advertising expense 900

Automobile rental expense 500

Salaries expense 7,000

Telephone expense 600

192,600 192,600

From the trial balance and supplementary data given, prepare the following as of march 31, 20XX.

a) Adjusting entries for depreciation during March of building and office equipment.

b) Adjusting entry to recognize as expense the cost of office supplies used in March. At the end of March, the

supplies at hand are estimated to have a cost of Rs. 500.

c) Adjusted trial balance.

Q#4 Refer the data Q#2 and prepare the following as of March 31, 20XX

a) Income statement and statement of owner’s equity for the month of March, and a balance sheet at March

31.

b) Closing entries

c) After closing Trial Balance

Q#5 make the necessary entries for each of the following as of March 31, 20XX

On April 1st the Star Company received Rs. 15,400 for a three year subscription to its political newsletter. The

firm closes its books once a year on Dec 31st. make the entry to record the record the receipt of the subscription

and the adjusting entry at Dec 31st. the firm uses an account called Unearned Subscription Revenue .

Q#6 Define any five of the following terms.

Statement of cash Retained earnings Depreciation Inventory

flows

Subsidiary Worksheet Unearned revenue

Financial Accounting 2008-2009

Q#1 Enumerate main objects of Financial Accounting, stating how it helps the management in making sound

business decisions.

Q#2 Describe, at least six main functions of GENERAL JOURNAL.

Q#3 A comparison of CASH book (bank column) of Alpha Traders with their Bank statement for the month of

December, 2009 indicates that bank balance as her cash book was Rs. 30,000/= while according to Bank statement,

it was Rs. 37,000/=. The following causes of disagreement were noted:

1. A cheque of Rs. 4,000 was deposited into bank but it was collected by bank.

2. A cheque of Rs. 2,000 was issued but not presented to bank for payment

3. Bank charges of Rs. 2,000 were not recorded in cash book

4. Direct deposit of cash of 7,000 by a customer into bank was not recorded in cash book

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Required: Bank Reconciliation statement.

Q#4 pass necessary GENERAL JOURNAL entries to rectify the following ERRORS.

a) An office equipment costing Rs. 80,000 was wrongly debited to purchases account.

b) Cash of Rs. 50,000 received from Ali Hassan was credited to Wali Hassan account

c) Cash of Rs. 43,000 actually received from a debater was recorded as Rs. 34,000.

d) Rs. 4,000 spent on repairs of office furniture were debited to office Furniture account.

Q#5 listed below are Ten Balance Sheet Account of ABC Traders as on June 30, 2009.

Automobile 850,000 (6) Loan payable 170,00

A/P 145,000 (7) Cash Bank Balances 60,000

N.P. for the year 200,000 (8) Accounts Receivable 150,000

Office Equipment 80,000 (9) Drawings 100,000

Owner’s (opening) capital 200,000 (10) Furniture 75,000

th

REQUIRED: classified Balance Sheet of ABC Traders as at 30 June, 2009 by rearranging the information given

above.

Q#6 write short note in the following.

Accounting Cycle Ten Column work sheet

Working capital and its ratio. Basic Financial Statement

Financial Accounting 2011-2012

Q#1 (a) What is financial accounting?

(b) List and briefly define the three functional areas of accounting

Q#2 (a) Answer each of the following independent questions.

• The star company’s asserts equal Rs. 62,000 and its stockholder’s equity totals Rs. 32,000.what is the amount

of its liabilities?

• The liabilities of Khan Company are Rs. 35,200 and its owner’s equity is Rs. 25,800. What is the amount of its

assets?

• IBA Corporation started in July with assets of Rs. 160,000 and liabilities of Rs. 100,000. During the month of

July S.H.E increased by Rs. 34,000 and liabilities decrease by Rs. 20,000. What is the amount of total assets at the ed

of July?

(b) classify the following accounts as assets , liabilities or stock holder’s equity. If you do not think that the item

would be recognized as any of the above, so state and give your reasons.

• Cash

• Notes payable

• Accounts payable

• Accounts receivable

• A trade mark

• Capital stock

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

• A firm’s good management

• Land

Q#3 (a) what information does the balance sheet report?

(b) The following data available for Johan supply store as of June 30, 2000.

(1) The purchase cost of all equipment owned by the store was Rs. 20,000 when making the purchase, a note for

Rs. 18,000 was given to the supplier. An additional payment of Rs. 2000 has subsequently been made on the note.

(2) Several years ago the company purchased a plot of land for Rs. 100,000 cash, to be used for future store

expansion. Although the land has yet to be used, the company still owns it. Recently it has been appraised at Rs.

140,000

(3) Supplies on hand cost Rs. 15,000

(4) John owned various suppliers Rs. 12,000.

(5) When the firm was organized, capital stock of Rs. 50,000 was issued.

(6) Various individuals owned the firm Rs. 2,500.

(7) Retained earnings amounted to Rs. 70,000.

(8) The firm had inventory for resale of Rs. 10,000.

(9) The firm had some cash in a checking account but was unable to determine the amount. All other items have

been given to you.

Required: prepare a balance sheet for John Supply store as of June 30, 2000.

Q#4 (a) What is the purpose of income statement?

(b) The revenue, expense and related accounts of the IBA Corporation for the year ended June 30, 2012 are

listed below:

Advertising expense Rs. 2500

Beginning retained earnings 42750

Cost of goods sold 25000

Delivery expense 6850

Insurance expense 100

Interest expanse 500

Repairs and maintenance 2500

expanse

Sales 75000

Salaries expanse 5000

Supplies expanse 750

Tax rate 30%

Depreciation expense 10000

Indicates selling expenses. Other expanses besides interest are general and administrative. Included in the salaries

of Rs. 5000 are Rs. 1000 of dividend s paid to the owner, IBA Corporation.

Required:

a) Prepare in good form a single – step income statement.

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

b) Prepare in good form a multistep income statement.

c) Prepare in good form a retained earnings statement.

Q#5 Make analysis of the following transaction for IBA Corporation.

1. Acquired inventory on credit, Rs. 10,000.

2. Acquired store equipment for Rs. 4000 cash plus Rs. 11000 trade credit.

3. Sold unneeded showcase to neighbor for Rs. 1000 on open account

4. Returned inventory to supplier for full credit Rs. 800.

5. Paid cash to creditors Rs. 4000

6. Collected cash from debtors Rs. 700

7. Sales on credit Rs. 160000.

8. Paid rent for three months in advance Rs. 6000.

Q#6 Write the short notes on the following.

a) Trial balance

b) Ledger

c) Balance Sheet

Financial Accounting 2010-2011

Q#1 How do the Dishonors Note Receivable and Discounted Note Receivable differ? How is each reported in the

balance Sheet?

Q#2 Information necessary for the preparation of Bank Reconciliation Statement and related adjusting entries for

XYZ Corporation at December31, 2009 is listed below.

1. The balance as per record of XYZ Corporation is Rs. 8353.90.

2. The bank statement shows the balance of Rs. 9168.57 as of Dec. 31, 2009

3. Two debit memoranda accompanied the bank statement, one for Rs. 13 were for services charges and other

for Rs. 864.60 covering NSF cheque. The cheque was issued by Umair Enterprises as credit customer.

4. Cheque No 0876 for Rs. 456.3 had been erroneously recorded as Rs. 465.3 in the cash payment journal ands

cheque No. 0654 for Rs. 77.44 has been recorded as Rs. 44.77. The cheque 0654 was for the telephone bill and

cheque No. 876 was for the payment of creditor.

5. The credit memoranda for Rs. 2070 representing the processed of Rs. 2000, 6% interest bearing note issued

in Dec of the last year, collected by bank from Ahsan and sons. Bank deducted the remaining amount for collection

charges.

6. The collection charges for Rs. 126 (not applicable for XYZ Corporation) was erroneously deducted from the

account.

7. Cash receipts of Dec 31, 2009 amounting Rs. 585.25 were mailed to bank too late does not include to

December statement

8. Cheques outstanding as of Dec 2009 were Rs. 358.

Required: Bank Reconciliation Statement and also present necessary journal entries.

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Q#3 the following transaction are related to Uncollectable account. All were completed during the year 2009.

1. Wrote off Rs. 7480, balance owned by BPA enterprises with no asset.

2. Received Rs. 6290 of the balance Rs. 9290, owned by Ahmed Company, a bankrupt, wrote off the remaining

as uncollectable.

3. Reinstated the amount of XYZ Brothers that had been written off in the last year and received Rs. 5000 cash

in full payment

4. Received Rs. 800 from Mahmood and Sons that had been written off two years earlier Rs. 1600.

The allowance for uncollectable account indicates a cr balance of Rs. 14270as on Jan, 01 2009.

Required: Present necessary general journal and adjusting journal entries, assuming that the estimated allowance

for uncollectable account as of Dec 31, 2009 is Rs. 65000.

Q#4 (a): XYZ Corporation acquired and put into use a machine on January 01, 2006 at the cost of Rs. 82000. The

machine was estimated to have a scraped value of Rs. 2000. It was also estimated that machine would produce 01

million unit of product during its life of 15 years. The machine produced 90000 units in year 2006, 1,10000 units in

2007 and 125,000 units in 2008.

Required: compute the amount of depreciation and book value using the following methods:

a. Units of production b. double declining balance

Q#4 (b) On January 01 2003 XYZ corporation purchase a delivery truck of Rs.1,200,000 for cash the truck has an

estimated life of 20 years and salvage value of Rs. 150,000. The depreciation of truck is being computed using

straight line method.

Required: prepare journal entries on record the disposal of truck on June 2008under each of the following

conditions.

1. The truck was sold for Rs. 300,000.

2. The truck was sold for Rs. 800,000.

3. The truck was stolen and insurance processed of Rs. 570,00 were accepted.

Q#5 The operations of Hempstead really consists of obtaining of houses being offered for sale by owners,

advertising these house and showing them to prospective buyers. The company earns revenues in form of

commissions. The building and office equipment used in the business were acquired on January 1st of the current

year and were immediately placed in use. Useful life of the building was estimated to be 30 years and that of the

office equipment 5 years. The company closes its accounts monthly on march 31st of the current year, the trial

balance is as follows:

HEMPTED REALTY

Trial Balance

March 31. 20XX

29750

Accounts Receivable 7500

Office Supplies 850

Land 30000

Building 90000

Accumulated depreciation: Building Rs. 500

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Office equipment 21000

Accumulated depreciation: Office 700

equipment

Accounts repayable 14750

M. Valentino, Capital 126650

M. Valentino, drawing 4500

Commsion earned 50000

Advertising expense 900

Automobile rental expanse 500

Salaries expanse 7000

Telephone expense 600

192600 192600

From the trial balance and supplementary data given, prepare the following as of March 31, 20XX.

a) Adjusting entries for depreciation during March of building and office equipment.

b) Adjusting entry to recognize as expense the cost of office supplies used in March. At the end of March the

supplies at hand are estimated to have a cost of Rs. 500

c) Adjust trial balance.

Q#6 Write the short note on the following.

1. Accrued Expenses 2. Subsidiary Ledger 3. Petty Cash Fund

Financial Accounting 2008-2009

Q#1 (a) Accounting is believed as a language of business, fluency in this language is needed in the new

millennium. Discuss this statement.

Q#1 (b) Explain time period and business entity concepts.

Q#2 several years ago Mantina started on art supply store called Martina’s art. The store has been very

successful, and profit for the last year reached a new high. Mantina asks you to help her to prepare on income

statement and balance sheet for the current year and gives you the following information:

Total sales Rs. 800,000

Cost of goods sold ?

Salaries expanse 60,000

Rent expense 40,000

Advertising expense 10,000

Taxes 57,000

Net income 133,000

Cash 25,000

Receivable 40,000

Inventory ?

Land 215,000

Total Assets 370,000

Accounts payable 30,000

Salaries Payable 10,000

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Capital Stock 100,000

Retained Earning Jan: 1, 2002 97,000

beginning of period.

Required: assuming that all the items are listed above, prepare:

a) An income statement for the year ended December 31st, 2008

b) A balance Sheet at December 31st, 2008.

Q#3 (a) what do we mean when we say that Accounting is a means rather than an end?

(b) what kind of organizations, in addition to businesses, use accounting information?

Q#4 (a) what is the purpose of income statement?

The revenue, expense and related accounts of the IBA Corporation for the year ended Jan 30, 2008 are listed

below:

Advertise expanse* Rs. 2500

Beginning retained earnings 42750

Cost of goods sold 25000

Delivery expense* 6850

Depreciation expanse 10000

Insurance expanse 1000

Interest expense 500

Repairing and maintenance expense 2500

Sales 75000

Salaries expense* 5000

Supplies expense 750

Tax rate 30%

*indicates selling expense. Other expanses besides interest are general and administrative the salaries of Rs. 5000

are Rs. 10000 of dividends paid to the owner, IBA Corporation.

Required:

(a) Prepare in good from a single-step income statement. (b) Prepare in good from a multistep statement. (c)

prepare in good form a retained earnings statement.

Q#5 (a) explain briefly why each of the following groups might be interested in the financial statement of a business

I.Creditors II. Potential investors III. Labor union

Q#5 (b) presented below is the basic accounting equation. Determine the missing amounts

ASSETS = LIABILITY + OWNER’S EQUITY

(a). Rs. 90000 Rs. 50000 ?

Rs. 48000 Rs. 70000

(c). Rs.94000 ? Rs. 72000

Q#5 (c) The Ace cleaners has the following balance sheet items.

Accounts payable cash Cleaning Equipment Cleaning Supplies

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Accounts payable Notes Payable Salaries Payable H.Ace Capital

Requirement: Classify each items as an asset liability or Owner’s equity

Q#6 prepare an income statement from the following accounts balance, and then a statement of owner equity for

Star Painting Contractors for the year ended December 31st 2008.

T. Start painting capital 31st Dec. 2008

27,200 t Exp. 9,600

T. Star Drawing 18,000 Adv. Exp. 3,200

Painting fees earned 140,000 Dep. Exp. 1,200

Paint and supplies Exp. 27,500 Painting Exp.

Sales Expanses 66,800

Q#7 (a) write short notes on any three of the following

1. Balance sheet

2. Income statement.

3. Worksheet.

4. Bank Reconciliation

Q#7 (b) discuss stapes involved in Accounting Cycle

Financial Accounting 2004

Q#1 what is the purpose of Financial Accounting? Identify and define each of the components of the basic

accounting equation.

Q#2 the trial balance of Rehman Sales Company, as of 31st December 2003 is presented below:

Cash 73200

Amounts receivable 11000

Merchandise Inventory 33000

Supplies 3600

Prepared insurance 1400

Equipment 10000

Accumulated Depreciation 2000

Account Payable 14200

Rehman-Capital 22500

Rehman-Drawings 3000

Purchases 117000

Salaries Expanses 18000

Rent expenses 4000

Advertising expenses 2600

Misc: Expense 4700

Sales 244000

Sales Returns 1200

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Total Rs: 282700 282700

Instructions: prepare ten column worksheet, using the following additional information for year- end adjustments:-

a) Merchandise inventory on December 31st was Rs. 28600.

b) Supplies inventory on December 31st was Rs. 1100.

c) Insurance expired during the year was Rs. 950.

d) Depreciation for the current year was Rs. 750.

e) Salaries accrued on December 31st was . 350.

Q#3 Distinguishes between the following:-

i.Prepare expanse and accrued expense.

ii.Perpetual and periodic inventory systems.

Q#4 (a) record the following entries in the general journal of a cleaning company:

i.Invested Rs. 12000 cash in the business.

ii.Paid Rs. 1000 for office furniture

iii.Bought equipment costing Rs. 8000 on account.

iv.Received Rs. 2200 in cleaning income.

v.Pair 25% of the amount owned on the equipment.

Q#4 (b) based upon the balance below, prepare entries to close out

i.Revenue accounts.

ii.Expense accounts

iii.Expense and income summary

iv.Drawing account

Aslam-Capital Rs. 22000, Aslam-Drawing Rs. 6000, Service Revenue Rs. 12000, intrest income Rs. 1500, salaries

expense Rs. 8000, rent expense Rs. 4000, interest expenses Rs. 2000, Depreciation expense Rs. 3000.

Q #5 Irfan Company acquired an asset on 1st January 1995 at a cost of Rs. 2800, with an estimated useful life of 10

years and a salvage value of Rs. 500. Find the annual depreciation for the first two years, using the (a) straight-line

method, (b) sum-of-the-year’s-digits method (c) Double declining balance method. (Show your computations).

Q#6 (a) on 1st January 2002 Mustafa Corporation was organized with an authorization of 5000 shares of 6%

preferred stock of Rs. 100 par and 1000 shares if Rs. 25 par common stock. Record the following transactions.

January 10th: Sold half of the common stock at Rs. 28 for cash.

January 25th: issued 2000 share of preferred and 1000 shares of common at par in exchange for land and building

with fair market value of Rs. 140000 and Rs. 85000 respectively.

March 30th: sold the balance of the preferred stock for cash at Rs. 105

Q#6 (b) present the stock holder’s equity section of the balance sheet as on March 30th.

Q#7 write short note on any three of the following:

(i) Accounting Cycle (ii) Intangible Assets

(iii) Formation of corporation (iv) Rules of Debiting and Crediting the Account.

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Computer Orientation And Packages

Q # 1(a) Describe historical background for the origination of innovative & dynamic

Computing. Mention major inventions of each generation of commercial computing.

(b) " Information Technology is very dynamic field comprises on different inter linked

Branches. “Elaborate different branches with the practical applications of IT in commercial sectors.

Q # 2. What do you know about server-based and peer-to-peer network architecture?

Describe the broad concept of Internet and also discuss major services of Internet with their implementable

advantages and drawbacks.

Q # 3. (a) Elaborate the concept of Database management system. Also mention major

Functions of DBMS.

(b) What is Operating System? Define major types and functions of Operating system.

Q # 4. (a) List and define basic and alternative input devices of computer.

(b) What is the role of computer storage devices? List and describe magnetic and optical storage devices.

Q # 5. (a) What is Network topology? List and define major types of network topologies.

(b) Convert the following.

i. (1011011)2 = ( ) 10

ii. (420420)10 = ( ) 2

Q # 6. (a) Describe the following MS Excel functions with suitable examples:

(i) POWER (ii) DATE (iii) MIN (iv) MOD

(b). List any five container tags of HTML with their attributes.

Computer Orientation And Packages 2012-2013

Q#1 Explain why it is essential to learn about computers today and discuss how computers are very much

integrated into our bus messes and personal lives.

Q#2 (a) Describe major innovations of computer generations.

(b) List & describe the factors affecting the processing speed of Computer

System

Q#3 (a) what is Operating System? Describe the operating system's role in running software programs.

(b) Elaborate five types of utility software which enhance the operating system

Q#4 (a) What is network topology? Describe with examples and illustrations four most common network

topologies

(b) Describe the following text code schemes.

i. EBCDIC

ii. ASCII

iii. Unicode

Q#5 (a) Attempt the following:

(i) How a CRT monitor displays images

(ii) Convert (01000010)2 into decimal

(b) Differentiate the following:

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

(i) Primary storage devices v/s Secondary Storage Devices

(ii) CISC v/s RISC Processors

(iii) Dot Matrix Printers v/s Ink Jet Printers

(iv) Passive Matrix LCD v/s Active Matrix LCD.

(v) Level-I (LI) v/s Level-2 (L2) Cache

Q#6 (a) Write any five shortcut keys with their purpose used in MS-PowerPoint.

(b) Write any five SQL statements to access the MS-Access Database.

(c) Elaborate any five MS Excel functions with suitable examples.

Computer Orientation And Packages 2011-12&2012-13

Q#0l. (a) Describe historical background for the origination of computing Mention major

Inventions of each generation of commercial computing

(b) Define Information Technology with its branches? Elaborate major applications of

Information Technology in era of Business with examples.

Q#02. (a) What is Database? Mention main infarction performed by DBMS.

(b) What is computer network? List and describe network topologies.

Q#03. (a) Draw Information processing cycle Define major elements of information processing

cycle.

(b) List main parts of the CPU. Which Component do you think most important? Justify

your answer with arguments.

Q # 4. (a) Differentiate the following:

(i) Bar code reader v/s MICK (ii) Micro V/s Mini Computer (iii) Bespoke v/s Generic software products (iv) Compiler

v/s Interpreter

(b) Differentiate e between Server based and Peer to peer network architecture

Q # 5. (a) What is Operating System? Describe any five functions of Operating System.

(b) What do you know about computer languages? Differentiate between high level and low level languages.

Compulsory. Question

Q#6

i.Steps in Website Development Life Cycle

ii.Any five shortcut keys of MS PowerPoint with their purpose

iii.Types of Computers according to their size and capacity

iv. Three common variants of the mouse

v.Any five SQL statement of MS-Access database

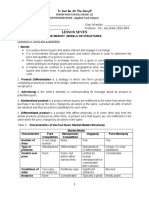

A B C D E F G

Emp id Emp name Designation Basic pay 20% of basic pay Allowance Gross salary

1120 Ahmed Manager 30000

1. Write the formula of Calculating 20% of basic pay in cell E4.

2. Write the write the formula of calculating allowance in cell F4

a) If 20% of basic pay>=5000 then allowance must be freeze on 5000 in cell F4.

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

b) If 20% of basic pay<5000 then calculated allowance must be in cell F4.

3. Write e the formula of calculating gross salary in cell G4 by adding basic pay and allowance.

Computer Orientation And Packages 2010-2011

Q:1 (a) what is computer system? Discuss the role of computers in the processing of Business

transactions in an organization.

(b) What is utility software? Name and elaborate any four utility software. `

Q#2 (a) Describe conventional -background of the origination of computing. Mention

major inventions of each generation of commercial computing.

(b) List and describe functions performed by database management system.

Q#3 (a) what is computer network? How computer networks are structured?

(b) list and define three hardware factors affecting processing speed of a computer.

Q#4 (a) List and describe four most popular text code systems for representing data into computers.

(b) Mention how a computer outputs sound

Q#5 (a) Differentiate the following:

(i.) Cache memory v/s virtual memory (ii) MICK v/s OCR

(iii) CISC v/s RISC processor

(b) List

(i) Four criteria while evaluating monitors (ii) Types of ROM (iii) two reasons why computers use the binary number

system. (iv) Three best-known families of CPUs

(v) Main types of auxiliary storage devices

Q#6 (a)

1 2 3 4 5 Total percentage Grade Remarks

For the data mentioned in MS-Excel Sheet given above:

(i) Write the formula for calculating total in cell G4.

(ii) Write the formula for calculating percentage in cell H4.

(iii) Write the formula of Grade on the basis for the value in cell H4 for

Following conditions:

A =87 – 100

B =72– 86

C = 60 - 71

FaiI below 60

(b) Write the number of rows; columns and cells in excel 2007.

(c) Determine the value of the following functions;

POWER (4,3) (ii) MOD(3O,4) (iii) Date(2012,5,18)

(d) The value of cell C8 is 31/21/2012 and cell D8 is 5/21/2011. Then which type of value will exist for the

expression C8- D8?

(i) Alphabetic (ii) Date (iii) Numeric

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

(e) The value of cell G9 is 6/22/2012 Calculate the value for the expression W + 5.

(f) Write the Excel function names to calculate the following:

(i) Arithmetic Mean (ii) Standard Deviation (iii) Smallest Value

(g) Elaborate the purpose of Sum(a3:al2)/count(a3:a12)

(h) Write the SQL statements in MS Access database commands:

(i) Select (ii) Insert (iii) Update

Computer Orientation And Packages 2009-2010

Q#1Explainbrieflyclassificationsofcomputerswithexamples(Computersfor

Organizations and Computer for Individuals)

Q#2. List and define the factors that effect the process deed of computer.

Q#3 discuss the features that need to be considered while purchasing operating system. Discuss any three operating

systems with examples.

Q#4 Explain briefly varieties of network with suitable examples.

Q#5 Differentiateanythreeofthefollowing.

1.CRTMonitorsandFlatPanelMonitors

2.Active LCDandPassiveLCDscreens

3.ImpactandNon-Impactprinters-

4.TrueMeshtopologyandHybridMeshtopology

5.HAN andLANareanetworks.

Q#6.Describeanythreeofthefollowing.

I.Plotters

II.Dyesublimation printers

III.Ergonomics

IV.Internet history

V.Topology

Computer Orientation And Packages 2008-2009

Q#1 what is computer? Discuss component of computer system with examples.

Q#2 define & different any three of the following.

I.CRT Monitors and LCD Monitors

II.True mesh topology and Hybrid Mesh Topology.

III.Dot matrix and hybrid mesh topology

IV.RAM && ROM

Q#3 discuss classification of the computer (computer for individuals and computers for organizations) with

suitable examples.

Q#4 (a) explain briefly the history of internet

(b) Define any three of the following in short.

i. protocol ii. Web site

iii. Web portal iv. Search engine

Q#5 what is network? Discuss the varieties of network (LAN, CAN, MAN, WAN, GAN) with suitable example .

Q#6 Discuss different operating system and their features with examples.

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Computer Orientation And Packages 2011-2012

Q#1 (a) describe five common type of computer system

(b) List and describe different factors which affect computers’ processing

Q#2 (a) Define the main two parts of the CPU and explain how they work together

(b) List and elaborate four characteristics while comparing monitors.

Q#3 (a) Differentiate the following:

(i) Static RAM and SDRAM

(ii) Passive matrix LCD v/s Active Matrix LCD

(iii) Level-1 (L-1) v/s Level-2 (L-2) Cache

(iv) Workstations v/s Personal computers.

Q#4 (a) what id network topology? Describe in short four most common network topologies

(b) How network are structured?

(c) List four examples of network operating system

Q#5 (a) Differentiate between magnetic disk & optical disk. Also explain how data is stored on the surface of

magnetic and optical disk.

(b) list and describe four most popular text code system for representing data into the computer

Q#6 Do as Direct

I.Write any six types of computers for an individual users

II.Mention any eight serviced of the internet

III.Describe any five MS Excel function with proper examples

IV.Elaborate with suitable example any five statement to access the MS-Access database

V.Mention the role of operating system in running software programs

VI.List four components found in most graphical user interfaces

VII.Write any five DMBS software names and any four ERP software name.

Managerial communication 2013-14

Q#1 What managerial communication is all about? Validate the magnitude of communication in modern business

organizations.

Q#2 List the business writing principles. Argue the ways in which “consideration” and “clarity” may be indicated in

the message.

Q#3just draw the diagram clearly mentioning the ingredients of “mechanical details” and “general appearance” of

an excellent business letter.

Q#4 list and explain the functions performed by a democratic leader before the business meeting, during the

business meeting and after the business meeting.

Q#5 list the followings:

I. Functions of sales letter

II. Sales letter systems or series

III. Distinction between the sales and sales promotion letter.

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Q#6 list and discuss the different organizational plans which you opt for business letter and why? How do opening

and closing influence a business letter?

Managerial communication 2011-2012 & 2012-2013

Q#1 people in the world are not exactly alike. As a result, meaning of the sender’s message and the receiver’s

response are affected by multiple of the factors. Identify them and explain

Q#2 most of the important transaction in a business enterprise either initially or ultimately take the form of letter.

What points will you consider for the physical make up of a business letter relating principally to its “mechanical

details” and “general appearance”.

Q#3 how inquiry letter can be made effective? Discuss the kinds of inquiry letters. List the points which are to be

following while replying the inquiry letters.

Q#4 List the tools of oral presentation. List and explain the methods of delivering the effective speech.

Q#5 High light subject matter of managerial communication. “Managerial communication is the oxygen of the

business organization. Discuss logically

Q#6 list the explain the steps involved in the process of planning the effective messages. Illustrate the checklist for

organizational plans using the “deductive and inductive” approach.

Managerial communication2012-2013

Q#1 what is the subject matter of the managerial communication. In what ways managerial communication plays

an effective roles in business activities? Explain.

Q#2 write the capsule checklist of the classification of business report and discuss the elements involved in formal

report.

Q#3 the opening and closing paragraphs of a written message are considered to be very important. Discuss the

guidelines for making these two paragraphs effective.

Q#4 list and discuss the elements of mechanical details and general appearance of a business letter with respect to

their importance.

Q#5 write a note on the good qualities of effective sentences and paragraphs in any written communication.

Q#6 what is the significance of listening in oral communication? List and discuss the good listening habits and

common faults of listening.

Managerial communication 2011-2012

Q#1 Draw the capsule checklist of a good communication with respect to its significance in business

correspondence.

Q#2 check the fog index of two pieces of business writing ---one that you consider easy to read and one that is

difficult. Then tell the class how the fog index of each agrees with your readability level. Uses pattern from this list.

a) Letter form a company to a customer

b) Annual report

c) Magazine read by member of the profession which is your major.

d) Article on the front page of your daily newspaper

e) The wall street journal.

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Q#3 bring to class an example of a written business message that conveys an unfavorable nonverbal message, and

bring a second written message that conveys a favorable nonverbal message, state specific reasons for your

evaluation.

Q#4 when you meticulously apply the basis of effective business communication the common sense, you can

continue to ripen your communication ability. Gauge the statement

Q#5 label the dissimilar legal risks and worries that may occur in business communication. What are the safe-

guards against each risk?

Q#6 list the followings:

a) Sales letter systems

b) Parts of formal report

c) Tools of oral presentation

d) Indention styles and punctuation

e) Parts of deductive & inductive approaches

Managerial communication 2010-2011

Q#1 What is the importance and benefits of effective communication? Highlight the importance of internal and

external communication.

Q#2 List the seven C’s of effective communication. Discuss the principle of completeness and consideration in

detail with suitable example.

Q#3 Define intercultural communication. Discuss the implication of internal communication in the different

societies.

Q#4 Discuss the five planning steps of preparing effective business messages. Discuss the basic organizational plans

and approaches in transferring business messages.

Q#5 List and explain the characteristics of a good business letter in detail.

Q#6 Discuss the job application process. Also explain the different steps which are kept in mind while preparing the

written job presentation.

Managerial communication 2008-2009

Q#1 what is the subject matter of the managerial communication. in what ways managerial communication plays

effective roles in business activities? Explain

Q#2 the opening and closing paragraphs of a written message are considered to be very important. Discuss the

guidelines for making these two paragraphs achieve their respective purposes.

Q#3 write a note on the good qualities of effective sentences and paragraphs in any written communication.

Q#4 list and discuss the elements of mechanical details and genera; appearance of a business letter with respect to

their importance.

Q#5 write the capsule checklist of the classification of business reports and discuss the elements involved in formal

report.

Managerial communication2007-2008

Q#1 write the concept of communication. Describe the salient features of effective business communication

Q#2 Illustrate the capsule checklist of business writing principles.

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Q#3sometimes business communication is quite complex and imperfect, the malfunctions can occur easily and

may result in miscommunication” elaborate.

Q#4 Illustrate an appropriate diagram of the appearance and design of business messages. Explain

Q#5 write the classification of business reports. Write a formal report on declining sale of the regional branch of

your company.

Q#6 briefly explain the significance of listening. What are the common listening faults? Explain

Managerial communication2009-2010 & 2010-2011

Q#1 high light the subject matter of effective Business communication. “Effective business communication is the

oxygen of the business organization. Discuss logically.

Q#2 list and explain briefly the characteristics of a good business letter.

Q#3 Most of the business transaction either initially or ultimately take the form of business letter. What point will

you consider for the physical make up of a business letter relating principally to its “Mechanical details” and

“General appearance”?

Q#4 people in the world are not exactly alike. As a result, meaning of the sender’s message and the receiver’s

response are affected by multiple of the factors. Identify them and explain.

Q#5 on overviewing the register of accounts receivable you come to know that one of your credit customer has an

outstanding balance of Rs. 1,00,000.00 which is overdue by three months. For demanding the payments in a week,

write him series of letters in a systematic way including the ultimate action.

Q#6 list and explain the nine positive roles a participant can play in a meeting suggested by William M. Sattler and

N.Edd. Miller.

Managerial communication2011-2012

Q#1 Discuss the concepts/nature of communication. “the quality of communication determines the extent of the

success of a business”. Discuss.

Q#2 People in the world are not exactly like, meaning of the sender’s message and the receiver’s as a result

response are affected by multiple of the factors. Identify them and explain.

Q#3 list and explain the good qualities of effective sentence and paragraphs in any written communication.

Q#4 enumerates the different legal risk and complications that may occur in managerial communication. What are

the possible safeguards against each risk?

Q#5 decipher the following

“Tell them what you are going to tell them. Then tell them. Then tell them what you have told them”.

Q#6 Write short notes on any three of the following:

a) Outlining and organizing the message

b) Sales and sales promotion letter

c) Job application with resume

d) Inquiry letter

Managerial communication2009-2010

Q#1 when you diligently apply the basics of effective business communication with common sense, you can

continue to improve your communication ability. Evaluate the statement

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

COLLEGE OF MODERN SCIENCES

ST

THE 1 AFFILIATED COLLEGE OF SINDH UNIVERSITY, JAMSHORO

MASTER OF BUSINESS ADMINISTRATION [HONS]

EVENING, PART I, 1st SEMESTER

BATCH - 33

Q#2 Bring to class an example of a written business message that conveys a favorable nonverbal message. State

specific reasons for your evaluations

Q#3 check the fog index of two pieces of business written---one that you consider easy to read and one that is

difficult. Then tell the class how the fog index of each agrees with your readability level. Use example from this list:

a) Letter from a company to a consumer.

b) Annual report

c) Magazine read by member of the profession which is your major.

d) Article on the front page of your daily newspaper.

e) The wall street journal.

Q#4 Summarize the capsule checklist for good-news message and bad-news messages.

Q#5 “because of the wide variety of business reports, they can be and have been defined and classified in a variety

of ways”. Elaborate the statement by sketching suitable diagram.

Q#6 Decipher the following statement:

“Tell them what you are going to tell them. Then tell them. Then tell them what you have told them”.

Mgt. 2015

1. What is Management? Explain the functions of Mgt.

2. Discuss the characteristics and importance of organizational culture.

3. Explain green Management and how organisations can go green.

4. What is motivation and briefly Explain the early theories of motivation.

5. Compare and contrast Approaches to goal setting and planning.

6. Discuss contemporary issues in managing human resources.

Website: www.cmshyd.edu.pk Facebook: Cmshyderabad Contact: 022-3810784-5/ 0332-3810784

You might also like

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Accounting Assignment 04A 207Document10 pagesAccounting Assignment 04A 207Aniyah's RanticsNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Money Mastermind Vol 1 PDFDocument283 pagesMoney Mastermind Vol 1 PDFKatya SivkovaNo ratings yet

- DabbawalaDocument25 pagesDabbawalaAks Anurag100% (2)

- Job AnalysisDocument2 pagesJob Analysisvandnaprateek100% (1)

- Coke and Pepsi Case AnalysisDocument4 pagesCoke and Pepsi Case AnalysisKeeley Q JianNo ratings yet

- Activity - Chapter 6 - Statement of Cash FlowsDocument4 pagesActivity - Chapter 6 - Statement of Cash FlowsKaren RiraoNo ratings yet

- CMA Exam Questions on Accounting Principles and Business CommunicationDocument51 pagesCMA Exam Questions on Accounting Principles and Business Communicationzia4000100% (1)

- Cap II Group I RTP Dec2023Document84 pagesCap II Group I RTP Dec2023pratyushmudbhari340No ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- Jomo Kenyatta University Accounting Exam QuestionsDocument4 pagesJomo Kenyatta University Accounting Exam QuestionsFRANCISCA AKOTHNo ratings yet

- 4 6026199395324659830Document30 pages4 6026199395324659830Beka Asra100% (1)

- ISC Accounts 11Document2 pagesISC Accounts 11Sriyaa SunkuNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- (ACC 2023)Xii Target Paper by Sir Irfan JanDocument36 pages(ACC 2023)Xii Target Paper by Sir Irfan JanmohsinbeforwardNo ratings yet

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- Teamwork For Ibl1201Document16 pagesTeamwork For Ibl1201Thanh Phat Nguyen MyNo ratings yet

- Intermediate Acctg Review-1Document3 pagesIntermediate Acctg Review-1Anonymous QWaWnuMNo ratings yet

- Accounting and Auditing For CooperativesDocument3 pagesAccounting and Auditing For CooperativesfaithNo ratings yet

- BFC 3125 Financial Accounting IDocument5 pagesBFC 3125 Financial Accounting Ikorirenock764No ratings yet

- Accounting 1 Funal F 20Document3 pagesAccounting 1 Funal F 20Pak KhNo ratings yet

- 18516BCH201 - Exam Paper-For Trial Exam (2013) - Sec BDocument5 pages18516BCH201 - Exam Paper-For Trial Exam (2013) - Sec Bakki3004No ratings yet

- Punjab Univ B.Com Past Papers Qs Advanced Financial Accounting 2010-18Document3 pagesPunjab Univ B.Com Past Papers Qs Advanced Financial Accounting 2010-18irfanNo ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- D16. CAP - II - Dec - 2022 - CAP - II - Group - IDocument48 pagesD16. CAP - II - Dec - 2022 - CAP - II - Group - IBharat KhanalNo ratings yet

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- Solution 5Document29 pagesSolution 5HariNo ratings yet

- CMA Exam Principles of AccountingDocument4 pagesCMA Exam Principles of AccountingMohammad ShahidNo ratings yet

- Sample Midterm Exam With SolutionDocument17 pagesSample Midterm Exam With Solutionq mNo ratings yet

- Ugmbcc04 - Business AccountingDocument4 pagesUgmbcc04 - Business AccountingShreya MitraNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- Quiz - Single EntryDocument2 pagesQuiz - Single EntryGloria BeltranNo ratings yet

- Fragment M 11Document7 pagesFragment M 11sm munNo ratings yet

- FIA132 - Supplementary and Special Assessment NOVEMBER 2022Document8 pagesFIA132 - Supplementary and Special Assessment NOVEMBER 2022kaityNo ratings yet

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- Icandocumentsnovemebr 2017 Pathfinder Skills PDFDocument179 pagesIcandocumentsnovemebr 2017 Pathfinder Skills PDFDaniel AdegboyeNo ratings yet

- 6.1 Class Work Question On PGBPDocument5 pages6.1 Class Work Question On PGBPRakNo ratings yet

- Accounting principles checklist for Allama Iqbal Open UniversityDocument4 pagesAccounting principles checklist for Allama Iqbal Open Universityilyas muhammadNo ratings yet

- Acc. For D.M. MQP April 2021Document4 pagesAcc. For D.M. MQP April 2021Rohith RNo ratings yet

- Adjusting Entries & Questions PDFDocument18 pagesAdjusting Entries & Questions PDFshahroz QadriNo ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- 0438Document7 pages0438murtaza5500No ratings yet

- 2017-12 ICMAB FL 001 PAC Year Question December 2017Document3 pages2017-12 ICMAB FL 001 PAC Year Question December 2017Mohammad ShahidNo ratings yet

- MT Principles of Accounting Fall 2023 UGDocument5 pagesMT Principles of Accounting Fall 2023 UGwww.kazimarzanjsbmsc570No ratings yet

- 5401Document6 pages5401ArumNo ratings yet

- 2ND Puc Accountancy QPDocument5 pages2ND Puc Accountancy QPSuhail AhmedNo ratings yet

- Auditing Problem Assignment Lyeca JoieDocument12 pagesAuditing Problem Assignment Lyeca JoieEsse ValdezNo ratings yet

- Preparing Financial StatementsDocument14 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- (EN) Problem Mojakoe AK1Document11 pages(EN) Problem Mojakoe AK1gebbyNo ratings yet

- MEFA Nov2003 RR211701Document10 pagesMEFA Nov2003 RR211701Nizam Institute of Engineering and Technology LibraryNo ratings yet

- Inp 2211 Accounts Question Paper PDFDocument8 pagesInp 2211 Accounts Question Paper PDFSachin ChourasiyaNo ratings yet

- FA Weekend TestDocument5 pagesFA Weekend TestIryne MerrieNo ratings yet

- 2019-04 ICMAB FL 001 PAC Year Question April 2019Document3 pages2019-04 ICMAB FL 001 PAC Year Question April 2019Mohammad ShahidNo ratings yet

- 63 Question PaperDocument4 pages63 Question PaperSam NayakNo ratings yet

- Answer All Questions in Part A. Answer Three Questions Only in Part BDocument13 pagesAnswer All Questions in Part A. Answer Three Questions Only in Part BHazim BadrinNo ratings yet

- Accounting Principles Pilot TestDocument6 pagesAccounting Principles Pilot TestNguyễn Thị Ngọc AnhNo ratings yet

- ACCOUNT- 1Document6 pagesACCOUNT- 1kakajumaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Problem Set 2Document2 pagesProblem Set 2Rubab MirzaNo ratings yet

- Spring 2019 Semester Accounting PlannerDocument2 pagesSpring 2019 Semester Accounting PlannerRubab MirzaNo ratings yet

- Problem Set 6 BS CS 6Document3 pagesProblem Set 6 BS CS 6Rubab MirzaNo ratings yet

- Problem Set 1 UpdatedDocument2 pagesProblem Set 1 UpdatedRubab MirzaNo ratings yet