Professional Documents

Culture Documents

India - Marico - Q1 Strong Quarter Management Upbeat

India - Marico - Q1 Strong Quarter Management Upbeat

Uploaded by

Vidhi SharmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India - Marico - Q1 Strong Quarter Management Upbeat

India - Marico - Q1 Strong Quarter Management Upbeat

Uploaded by

Vidhi SharmaCopyright:

Available Formats

02 AUG 2019 Quarterly Update

NOW ON APP

BUY

Research at your

MARICO finger tips

FMCG Target Price: Rs 420

Rating system revised. Refer last page

Strong quarter; management upbeat

Marico’s Q1FY20 print was stronger than expected on all counts with CMP : Rs 363

superior quality of earnings (robust operational performance/beat Potential Upside : 16%

despite 32% YoY jump in A&P). Domestic business delivered good

performance (ex-Saffola), while IBD also posted a healthy quarter

(on both volume/margin fronts). MARKET DATA

No. of Shares : 1,291 mn

While management alluded to some slowdown in demand conditions, it Free Float : 40%

was optimistic on pick-up in revenue growth momentum in H2FY20 Market Cap : Rs 468 bn

(6-8% volume guidance for FY20) and more upbeat on margin 52-week High / Low : Rs 397 / Rs 286

Avg. Daily vol. (6mth) : 1.9 mn shares

expansion (19%+ margin, even as it maintains strong spends in A&P to

Bloomberg Code : MRCO IB Equity

support strong NPD funnel). We increase our estimates by 3-4% as we

Promoters Holding : 60%

bake in higher margin (RM tailwinds and lower price deflation).

FII / DII : 27% / 6%

We upgrade the stock to BUY from ADD with revised TP of Rs 420 (from

Rs 380) as we roll over to June-21 (target P/E of 40x).

Consolidated results – above expectations operational performance: Q1FY20 print was above our expectations led by

domestic volume delivery at 6% YoY (vs. our estimate of 5%); we highlight the key beats – (1) domestic FMCG growth at

7% YoY was 2% above our estimate led by higher-than-expected price/mix-led growth (lower deflation in Parachute and

VAHO) and higher-than-expected volume growth, (2) within core brands, while Saffola was below expectations (3%

volume growth), other core brands like Parachute (9% volume growth) and VAHO (volume growth of 7% and 11% value

growth despite ~5% price cut on weighted average basis initiated in Q4FY19 in VAHO portfolio) beat expectations and

(3) comparable EBITDA growth was 5% above our estimates on standalone basis and 7% above our estimates on

consolidated basis aided by lower other expense and higher gross margin despite elevated A&P spends.

Consolidated net revenue grew 7% YoY to Rs 21.6 bn (1% above our estimate), comparable EBITDA adjusted for

Ind-AS 116 grew 27% YoY to Rs 4.5 bn (7% above our estimate) and recurring PAT grew 28% YoY to Rs 3.3 bn (8%

above our estimate; aided by lower tax rate – down ~160 bps YoY). Reported PAT increased 20% due to one-time

expense of Rs 190 mn towards VRS scheme offered to employees at Kanjikode (Kerala) plant.

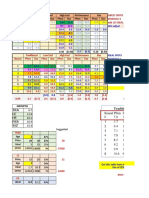

Financial summary (Consolidated) Key drivers (%)

Y/E March FY18 FY19 FY20E FY21E FY19 FY20E FY21E

Sales (Rs mn) 63,222 73,336 79,222 87,891 Dom. CBP rev growth 15.5 7.5 10.2

Adj PAT (Rs mn) 8,145 9,285 11,265 12,825 Int. rev growth 15.5 11.0 12.0

Con. EPS* (Rs) - - 8.7 10.1 Cons Gross margin 45.2 48.4 48.3

EPS (Rs) 6.3 7.2 8.7 9.9 Cons EBITDA margin 17.4 19.4 19.9

Change YOY (%) 2.0 14.1 21.3 13.8

P/E (x) 57.5 50.4 41.5 36.5

Price performance

RoE (%) 33.5 33.5 35.7 36.9 140

Sensex Marico

RoCE (%) 41.1 40.8 44.0 46.4

120

EV/E (x) 40.8 36.1 29.8 26.1

DPS (Rs) 4.2 4.8 5.5 6.3 100

Source: *Consensus broker estimates, Company, Axis Capital 80

Jul-18 Oct-18 Jan-19 Apr-19 Jul-19

Anand Shah Executive Director – Consumer Gaurav Jogani AVP – Consumer

anand.shah@axiscap.in 91 22 4325 1142 gaurav.jogani@axiscap.in 9122 43251124

Axis Capital is available on Bloomberg (AXCP<GO>), Reuters.com, Firstcall.com and Factset.com 01

EMISPDF in-spjainmr from 61.8.139.218 on 2019-09-28 09:58:23 BST. DownloadPDF.

Downloaded by in-spjainmr from 61.8.139.218 at 2019-09-28 09:58:23 BST. EMIS. Unauthorized Distribution Prohibited.

02 AUG 2019 Quarterly Update

MARICO

FMCG

Exhibit 1: Consolidated quarterly results (Rs mn)

Reported Chg (%) Chg (%) Comp. Chg (%) Axis Est Chg (%)

Q1'20 Q1'19 YoY Q4'19 QoQ Q1'20 YoY Q1'20 Axis Est.

Net operating income 21,660 20,268 7 16,090 35 21,660 7 21,360 1

Material cost (11,370) (11,696) (3) (8,200) 39 (11,370) (3) (11,330) 0

Gross Profit 10,290 8,572 20 7,890 30 10,290 20 10,030 3

Employee cost (1,270) (1,147) 11 (1,170) 9 (1,270) 11 (1,285) (1)

Advertising and promotion (2,190) (1,657) 32 (1,530) 43 (2,190) 32 (2,028) 8

Other expenditure (2,220) (2,219) 0 (2,360) (6) (2,340) 5 (2,502) (6)

Total expenditure (17,050) (16,719) 2 (13,260) 29 (17,170) 3 (17,145) 0

EBITDA 4,610 3,549 30 2,830 63 4,490 27 4,215 7

Other income 280 240 17 280 - 280 17 295 (5)

Interest (120) (53) 127 (80) 50 (80) 51 (75) 7

Depreciation (350) (224) 56 (290) 21 (260) 16 (252) 3

Pretax profits 4,420 3,512 26 2,740 61 4,430 26 4,183 6

Tax (1,080) (913) 18 (560) 93 (1,080) 18 (1,105) (2)

Minority Interest (80) (42) - (50) 60 (80) 91 (45) 78

Recurring PAT (after MI) 3,260 2,557 27 2,130 53 3,270 28 3,033 8

Extraordinary items (190) 0 1,880 (190) 0

Net profit (reported) 3,070 2,557 20 4,010 (23) 3,080 20 3,033 2

EPS 2.5 2.0 27 1.7 53 2.5 27 2.4 7

Ratios (% of net operating revenues)

Gross Margin (%) 47.5 42.3 521 bps 49.0 -153 bps 47.5 521 bps 47.0 55 bps

EBITDA margin (%) 21.3 17.5 377 bps 17.6 369 bps 20.7 321 bps 19.7 99 bps

Material cost 52.5 57.7 -522 bps 51.0 152 bps 52.5 -522 bps 53.0 -56 bps

Employee cost 5.9 5.7 20 bps 7.3 -141 bps 5.9 20 bps 6.0 -16 bps

Advertising and promotion 10.1 8.2 193 bps 9.5 60 bps 10.1 193 bps 9.5 61 bps

Other expenditure 10.2 10.9 -70 bps 14.7 -442 bps 10.8 -15 bps 11.7 -92 bps

Income tax rate (% of PBT) 24.4 26.0 -157 bps 20.4 399 bps 24.4 -163 bps 26.4 -204 bps

Source: Company, Axis Capital

Exhibit 2: Domestic volume growth

20

(%)

15 12.4

10.5 10.0 9.4

10 8.4 8.0 8.0 8.0

6.0 5.5 6.0 6.0

5.0

5 3.4

1.0

0

(5)

(4.0)

(10) (9.0)

Q1FY16

Q2FY16

Q3FY16

Q1FY17

Q2FY17

Q3FY17

Q1FY18

Q2FY18

Q1FY19

Q2FY19

Q4FY19

Q1FY20

Q4FY16

Q4FY17

Q3FY18

Q4FY18

Q3FY19

Source: Company, Axis Capital

Axis Capital is available on Bloomberg (AXCP<Go>), Reuters.com, Firstcall.com and Factset.com 02

EMISPDF in-spjainmr from 61.8.139.218 on 2019-09-28 09:58:23 BST. DownloadPDF.

Downloaded by in-spjainmr from 61.8.139.218 at 2019-09-28 09:58:23 BST. EMIS. Unauthorized Distribution Prohibited.

02 AUG 2019 Quarterly Update

MARICO

FMCG

Exhibit 3: Standalone quarterly results (Rs mn)

Reported Chg (%) Chg (%) Comp. Chg (%) Axis Est Chg (%)

Q1'20 Q1'19 YoY Q4'19 QoQ Q1'20 YoY Q1'20E Axis Est.

Net operating income 17,770 16,846 5 12,900 38 17,770 5 17,492 2

Material cost (9,970) (10,248) (3) (7,040) 42 (9,970) (3) (9,899) 1

Gross Profit 7,800 6,599 18 5,860 33 7,800 18 7,593 3

Employee cost (860) (773) 11 (750) 15 (860) 11 (850) 1

Advertising and promotion (1,630) (1,266) 29 (1,050) 55 (1,630) 29 (1,520) 7

Other expenditure (1,820) (1,810) 1 (1,870) (3) (1,900) 5 (1,991) (5)

Total expenditure (14,280) (14,096) 1 (10,710) 33 (14,360) 2 (14,259) 1

EBITDA 3,490 2,750 27 2,190 59 3,410 24 3,233 5

Other income 260 230 13 970 (73) 260 13 270 (4)

Interest (80) (24) 231 (50) 60 (50) 107 (45) 11

Depreciation (290) (190) 53 (250) 16 (230) 21 (210) 10

Pretax profits 3,380 2,766 22 2,860 18 3,390 23 3,248 4

Tax (680) (617) 10 (440) 55 (680) 10 (731) (7)

PAT 2,700 2,149 26 2,420 12 2,710 26 2,517 8

Extraordinary items (190) 0 1,880 (190) 0 #DIV/0!

Net profit (reported) 2,510 2,149 17 4,300 (42) 2,520 17 2,517 0

EPS 2.1 1.7 26 1.9 12 2.1 26 2.0 7

Costs as a % of sales

Gross Margin (%) 43.9 39.2 472 bps 45.4 -154 bps 43.9 472 bps 43.4 48 bps

OPM (%) 19.6 16.3 331 bps 17.0 266 bps 19.2 286 bps 18.5 70 bps

Material cost 56.1 60.8 -473 bps 54.6 153 bps 56.1 -473 bps 56.6 -49 bps

Employee cost 4.8 4.6 25 bps 5.8 -98 bps 4.8 25 bps 4.9 -2 bps

Advertising and promotion 9.2 7.5 165 bps 8.1 103 bps 9.2 165 bps 8.7 48 bps

Other expenditure 10.2 10.7 -51 bps 14.5 -426 bps 10.7 -6 bps 11.4 -69 bps

Income tax rate (%) 20.1 22.3 -219 bps 15.4 473 bps 20.1 -225 bps 22.5 -245 bps

Source: Company, Axis Capital

India business update

♦ Parachute CNO rigid sales grew 8% YoY led by 9% volume growth (above our

estimate of 5% volume growth, even on a high base of 9% for Q1FY19) and

1% price/mix-led deflation, however low-margin non-focused brands of CNO

portfolio declined in double digits in a correcting copra price environment.

Management highlighted that it gained more than 240 bps volume market

share during the quarter. Overall volume market share of CNO rose to 60%

(March 2019 MAT). Management remains confident of sustaining the

medium-term guidance of 5-7% volume growth based on run-rate for past few

quarters led by tactical interventions initiated to maintain the value proposition.

On Copra, it highlighted that it expects ~18-20% deflation in Copra prices

from FY19 levels, however, there could be some price reversal from October

onwards and it could gain in such a scenario given its quality sourcing

capabilities and ability to procure quantities vs. the unorganized segment.

Domestic volume growth would have been higher by ~1.5% excluding the

decline in low-priced CNO portfolio.

♦ VAHO posted some recovery in volume growth to 7% (post declining to 1% in

Q4FY19) and 11% value growth (despite an ~5% weighted average price cut

in Q4FY19); management attributed the sluggishness in VAHO to

underperformance in the premium portfolio owing to slowdown in overall

consumption. However, market gains sustained and it witnessed gains of

148 bps volume market share and 120 bps value market keeping it positive on

the underlying strength of the franchise. On a MAT basis, the company

consolidated its market leadership with volume share at ~34% and value share

at ~27%.

Axis Capital is available on Bloomberg (AXCP<Go>), Reuters.com, Firstcall.com and Factset.com 03

EMISPDF in-spjainmr from 61.8.139.218 on 2019-09-28 09:58:23 BST. DownloadPDF.

Downloaded by in-spjainmr from 61.8.139.218 at 2019-09-28 09:58:23 BST. EMIS. Unauthorized Distribution Prohibited.

02 AUG 2019 Quarterly Update

MARICO

FMCG

Nihar Shanti Amla Badam retained its no.1 position in volumes in the value

added hair oil category and gained 176 bps in volume market share. Nihar

Naturals Sarson Kesh Tel garnered volume market share of 13% in the

perfumed mustard oil. Parachute Advansed Aloe Vera Enriched Coconut Hair

Oil now scaled up to a pan-India level. The brand has garnered sizeable

market share in its key market and Marico looks to invest aggressively behind

the brand. Hair & Care was re-launched in its classical pack and fragrance in

prototype markets and subsequently extended across the country.

♦ Saffola franchise posted a weak quarter with 3% volume growth (6% value

growth, significantly below our estimates); growth was impacted due to

sluggishness in the urban general trade channel, while modern trade and e

commerce channel continued to post strong growth. Management also

highlighted that interplay between different channels was impacting the growth;

hence, it introduced a special price pack for general trade to remove this

disparity. However, the move so far hasn’t yielded any result and has led to

lower volume growth YoY due to lower promotional volumes. Management

continues to monitor the situation and continues to re-work is strategy to

revive Saffola.

♦ The healthy foods franchise posted 38% value growth for the quarter (Oats

business grew by 20%) aided by several new launches under the ‘Saffola

FITTIFY Gourmet’ range and Coco Soul. Both these brands have gained positive

consumer traction. During the quarter, the company also prototyped Saffola

Perfect Nashta comprising a range of 3-minute ready-to-cook mixes of

traditional Indian breakfasts such as idli, dosa, upma (semolina) and poha (rice

flakes). The range is being test marketed in modern trade and select general

trade channels in Delhi. Management is targeting overall revenue of Rs 4-5 bn

from the foods portfolio in the next 4-5 years.

♦ Premium hair nourishment grew 28% YoY in Q1FY20 (up 55% for FY19). Livon

Serums continue to sustain strong growth led by growth in sachets, MT and

e-commerce and higher contribution from new variants (Livon Serums for Dry

and Unruly Hair, Livon Serum Colour Protect and Livon Shake and Spray

Serum). The initial reception for True Roots Botanical Hair Tonic has not met

company’s expectations, but the company will continue to invest towards brand

visibility and focus GTM to drive growth in select markets.

♦ Male grooming segment continues to witness weak performance and had a flat

quarter post 3% growth in Q4FY19 led by weak performance in deodorants

excluding which the franchise grew in double digits. The company called out

that it doesn’t expect any medium term concerns for the male grooming

franchise given healthy traction in hair gels, hair waxes and the Set Wet Studio

X range.

♦ Kaya Youth O2 range launched in premium skin care category: In Q4, Marico

launched the Kaya Youth O2 range in the premium skincare space. The range

includes day cream, face wash, face wipes and micellar water. Brand has been

launched in general trade in Mumbai, modern trade in the top 8 metros and e-

commerce across India. A beauty advisor program has been rolled out in

around 70 stores, which has helped the brand gain visibility.

♦ On overall demand environment, management did indicate of sluggishness in

demand especially led by tight liquidity situation in the wholesale trade.

However, it remains confident of delivering on its 6-8% volume growth in FY20

Axis Capital is available on Bloomberg (AXCP<Go>), Reuters.com, Firstcall.com and Factset.com 04

EMISPDF in-spjainmr from 61.8.139.218 on 2019-09-28 09:58:23 BST. DownloadPDF.

Downloaded by in-spjainmr from 61.8.139.218 at 2019-09-28 09:58:23 BST. EMIS. Unauthorized Distribution Prohibited.

02 AUG 2019 Quarterly Update

MARICO

FMCG

led by strong NPD funnel and aggressive participation in bottom-of-pyramid in

VAHO. The company highlighted that it is looking for dramatic transformation

of urban GT and is looking through building rural distribution which would be a

moat in the long term.

♦ Rural GT grew 4% and continued to outpace urban GT growth which declined

5%. MT sales grew 30% YoY. E-commerce almost doubled, although on a

low base.

♦ Amid key raw materials, Copra was down 25% YoY (down 13% QoQ), rice

bran oil was down 12%, while LLP and HDPE declined 1% and 21%

respectively; management does expect some rebound in Copra prices from

October which is generally the off-season for Copra harvesting.

Exhibit 4: Parachute rigid pack volume growth

20

(%) 15.0 15.0

15 12.0

11.0

9.0 9.0 9.0

10 8.0

7.0

8.0

6.0 6.0

4.0

5

0

(1.0)

(5)

(5.0)

(6.0)

(10)

(9.0)

(15)

Q1FY16

Q2FY16

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q1FY18

Q2FY18

Q3FY18

Q4FY18

Q2FY19

Q3FY19

Q4FY19

Q1FY20

Q3FY16

Q4FY17

Q1FY19

Source: Company, Axis Capital

Exhibit 5: VAHO volume growth

25 (%) 21.0

20

14.0 15.0

15 11.0 11.0 12.0 11.0

9.0 10.0

10 8.0 8.0 7.0 7.0

5.0

5 1.0

0

(5)

(10) (8.0)

(15) (12.0)

Q1FY16

Q2FY16

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q3FY18

Q4FY18

Q1FY19

Q2FY19

Q4FY19

Q1FY20

Q3FY16

Q4FY16

Q1FY18

Q2FY18

Q3FY19

Source: Company, Axis Capital

Axis Capital is available on Bloomberg (AXCP<Go>), Reuters.com, Firstcall.com and Factset.com 05

EMISPDF in-spjainmr from 61.8.139.218 on 2019-09-28 09:58:23 BST. DownloadPDF.

Downloaded by in-spjainmr from 61.8.139.218 at 2019-09-28 09:58:23 BST. EMIS. Unauthorized Distribution Prohibited.

02 AUG 2019 Quarterly Update

MARICO

FMCG

Exhibit 6: Saffola volume growth

20 (%) 17.0

18.0

16 13.0

11.0

12 10.0

8.0

8 6.0 6.0

5.0

4.0 4.0

3.0 3.0

4 2.0

0.0

0

(4) (1.0)

(8)

(9.0)

(12)

Q2FY16

Q3FY16

Q4FY16

Q2FY17

Q3FY17

Q2FY18

Q3FY18

Q1FY19

Q2FY19

Q3FY19

Q1FY20

Q1FY16

Q1FY17

Q4FY17

Q1FY18

Q4FY18

Q4FY19

Source: Company, Axis Capital

International business update

♦ Revenue grew 9% YoY to Rs 4.35 bn (cc growth at 7%) with volume growth at

~6% (~8% in Q4FY19); adjusting for one-time trade inventory correction in

Gulf business cc growth would have been 9%. Operating margin (before

corporate allocation) stood at 27% YoY, up 490 bps YoY. The operating

margin improvement was largely led by gross margin improvement and

partially negated increase in A&P spends. Company expects to maintain

international margin at 18%-20% (up from 16-17% guidance earlier) and

plough back savings to drive growth.

♦ Bangladesh (46% of international sales) cc growth was 11%. Parachute

coconut oil grew by 5% in cc terms (maintained market leadership at 84%

volume market share, down by ~200 bps QoQ). Non-coconut oil (revenue

contribution at 30% for FY19) portfolio grew strong 29% in cc in Q1 (33% in

FY19). Management is confident of delivering double-digit cc growth in this

geography in the medium term. With the strong growth witnessed in the

non-coconut portfolio and recent initiatives of new product launches,

management is confident that its contribution will exceed 35% over next

two years.

♦ South East Asia (26% of international sales), mainly Vietnam and Myanmar,

grew by 8% YoY growth in cc terms (4% YoY in Q4FY19). Vietnam posted

11% cc growth in Q1 (10% in FY19) led by healthy growth in both male

shampoos and deodorants. Foods business also rebounded post a sluggish

FY19. Management expects steady (earlier double digit) cc growth in the

medium term from this geography.

♦ MENA (15% of international sales) declined in double digits in Q1FY20 in cc

terms mainly due to one-time inventory correction in the Middle East business;

adjusting for it, MENA business grew by 2% in cc terms. Egypt had a flat

quarter. However, management has highlighted challenging macros in these

geographies and remains cautiously optimistic about the medium term outlook

in these markets.

♦ South Africa (8% of international sales) saw a muted quarter (including Isoplus),

with only 6% cc growth in Q1.

Axis Capital is available on Bloomberg (AXCP<Go>), Reuters.com, Firstcall.com and Factset.com 06

EMISPDF in-spjainmr from 61.8.139.218 on 2019-09-28 09:58:23 BST. DownloadPDF.

Downloaded by in-spjainmr from 61.8.139.218 at 2019-09-28 09:58:23 BST. EMIS. Unauthorized Distribution Prohibited.

02 AUG 2019 Quarterly Update

MARICO

FMCG

Exhibit 7: 1-Yr forward P/E band Exhibit 8: 1-Yr forward EV/EBITDA band

fwd PE (x) Mean fwd EV-E (x) Mean

50 +1 SD -1 SD 36 +1 SD -1 SD

(x) (x)

45 32

40 28

35 24

30 20

Jul-16

Jul-17

Jul-18

Jul-19

Oct-16

Oct-17

Oct-18

Jan-17

Jan-18

Jan-19

Apr-18

Apr-16

Apr-17

Apr-19

Jul-16

Jul-17

Jul-18

Jul-19

Oct-16

Oct-17

Oct-18

Jan-17

Jan-18

Jan-19

Apr-16

Apr-17

Apr-18

Apr-19

Source: Bloomberg, Axis Capital Source: Bloomberg, Axis Capital

Axis Capital is available on Bloomberg (AXCP<Go>), Reuters.com, Firstcall.com and Factset.com 07

EMISPDF in-spjainmr from 61.8.139.218 on 2019-09-28 09:58:23 BST. DownloadPDF.

Downloaded by in-spjainmr from 61.8.139.218 at 2019-09-28 09:58:23 BST. EMIS. Unauthorized Distribution Prohibited.

02 AUG 2019 Quarterly Update

MARICO

FMCG

Financial summary (Consolidated)

Profit & loss (Rs mn) Cash flow (Rs mn)

Y/E March FY18 FY19 FY20E FY21E Y/E March FY18 FY19 FY20E FY21E

Net sales 63,222 73,336 79,222 87,891 Profit before tax 11,171 12,619 15,306 17,653

Other operating income - - - - Depreciation & Amortisation 891 964 1,110 1,240

Total operating income 63,222 73,336 79,222 87,891 Chg in working capital (3,065) 210 120 (287)

Cost of goods sold (33,482) (40,177) (40,907) (45,434) Cash flow from operations 5,545 10,180 11,680 12,597

Gross profit 29,740 33,159 38,315 42,457 Capital expenditure (1,271) (1,620) (1,188) (1,292)

Gross margin (%) 47.0 45.2 48.4 48.3 Cash flow from investing 169 (3,510) 127 379

Total operating expenses (18,362) (20,366) (22,927) (24,984) Equity raised/ (repaid) - - - -

EBITDA 11,378 12,793 15,387 17,474 Debt raised/ (repaid) 692 397 (240) (500)

EBITDA margin (%) 18.0 17.4 19.4 19.9 Dividend paid (6,357) (6,820) (8,223) (9,345)

Depreciation (891) (964) (1,110) (1,240) Cash flow from financing (5,675) (6,530) (8,750) (10,097)

EBIT 10,487 11,829 14,278 16,234 Net chg in cash 39 140 3,057 2,880

Net interest (162) (238) (286) (252)

Other income 846 1,028 1,315 1,671 Key ratios

Profit before tax 11,171 12,619 15,306 17,653 Y/E March FY18 FY19 FY20E FY21E

Total taxation (2,896) (3,164) (3,827) (4,590) OPERATIONAL

Tax rate (%) 25.9 25.1 25.0 26.0 FDEPS (Rs) 6.3 7.2 8.7 9.9

Profit after tax 8,276 9,455 11,480 13,063 CEPS (Rs) 7.0 7.9 9.6 10.9

Minorities (131) (170) (215) (239) DPS (Rs) 4.2 4.8 5.5 6.3

Profit/ Loss associate co(s) - - - - Dividend payout ratio (%) 67.4 66.0 63.0 62.9

Adjusted net profit 8,145 9,285 11,265 12,825 GROWTH

Adj. PAT margin (%) 12.9 12.7 14.2 14.6 Net sales (%) 6.8 16.0 8.0 10.9

Net non-recurring items - - - - EBITDA (%) (1.9) 12.4 20.3 13.6

Reported net profit 8,145 9,285 11,265 12,825 Adj net profit (%) 2.0 14.0 21.3 13.8

FDEPS (%) 2.0 14.1 21.3 13.8

Balance sheet (Rs mn) PERFORMANCE

Y/E March FY18 FY19 FY20E FY21E RoE (%) 33.5 33.5 35.7 36.9

Paid-up capital 1,291 1,290 1,290 1,290 RoCE (%) 41.1 40.8 44.0 46.4

Reserves & surplus 24,138 28,700 31,741 35,221 EFFICIENCY

Net worth 25,429 29,990 33,031 36,511 Asset turnover (x) 3.2 3.2 3.3 3.6

Borrowing 3,093 3,490 3,250 2,750 Sales/ total assets (x) 1.6 1.7 1.6 1.6

Other non-current liabilities 394 320 336 360 Working capital/ sales (x) 0.1 0.1 0.1 0.1

Total liabilities 29,041 33,910 36,942 40,184 Receivable days 19.7 25.7 22.0 21.0

Gross fixed assets 13,582 14,720 15,908 17,200 Inventory days 106.4 85.1 86.9 84.9

Less: Depreciation (2,478) (3,250) (4,360) (5,600) Payable days 57.8 56.9 58.6 59.3

Net fixed assets 11,103 11,470 11,549 11,601 FINANCIAL STABILITY

Add: Capital WIP 268 450 450 450 Total debt/ equity (x) 0.1 0.1 0.1 0.1

Total fixed assets 11,372 11,920 11,999 12,051 Net debt/ equity (x) (0.2) (0.2) (0.3) (0.4)

Total Investment 5,428 4,500 4,500 4,500 Current ratio (x) 2.0 2.2 2.3 2.3

Inventory 15,109 14,110 15,193 16,374 Interest cover (x) 64.9 49.8 49.8 64.4

Debtors 3,406 5,170 4,775 5,057 VALUATION

Cash & bank 2,001 5,520 8,577 11,457 PE (x) 57.5 50.4 41.5 36.5

Loans & advances 700 790 853 947 EV/ EBITDA (x) 40.8 36.1 29.8 26.1

Current liabilities 11,682 13,510 14,649 16,312 EV/ Net sales (x) 7.3 6.3 5.8 5.2

Net current assets 12,241 15,610 18,564 21,754 PB (x) 18.4 15.6 14.2 12.8

Other non-current assets - 1,880 1,880 1,880 Dividend yield (%) 1.2 1.3 1.5 1.7

Total assets 29,041 33,910 36,942 40,184 Free cash flow yield (%) 0.9 1.8 2.2 2.4

Source: Company, Axis Capital Source: Company, Axis Capital

Axis Capital is available on Bloomberg (AXCP<Go>), Reuters.com, Firstcall.com and Factset.com 08

EMISPDF in-spjainmr from 61.8.139.218 on 2019-09-28 09:58:23 BST. DownloadPDF.

Downloaded by in-spjainmr from 61.8.139.218 at 2019-09-28 09:58:23 BST. EMIS. Unauthorized Distribution Prohibited.

02 AUG 2019 Quarterly Update

MARICO

FMCG

Axis Capital Limited is registered with the Securities & Exchange Board of India (SEBI) as “Research Analyst” with SEBI-registration

number INH000002434 and which registration is valid till it is suspended or cancelled by the SEBI.

DISCLAIMERS / DISCLOSURES

The following Disclosures are being made in compliance with the SEBI Research Analyst Regulations 2014 (herein after referred to as the Regulations).

1. Axis Capital Limited (ACL), the Research Entity (RE) as defined in the Regulations, is engaged in the business of Investment banking, Stock broking and

Distribution of Mutual Fund products.

2. ACL is registered with the Securities & Exchange Board of India (SEBI) for its investment banking and stockbroking business activities and with the

Association of Mutual Funds of India (AMFI) for distribution of financial products.

3. ACL has no material adverse disciplinary history as on the date of publication of this report

4. ACL and / or its affiliates do and seek to do business including investment banking with companies covered in its research re ports. As a result, the

recipients of this report should be aware that ACL may have a conflict of interest that may affect the objectivity of this report. Investors should not

consider this report as the only factor in making their investment decision.

5. The research analyst or any of his / her family members or relatives may have financial interest or any other material conflict of interest in the subject

company of this research report.

6. The research analyst has not served as director / officer, etc. in the subject company in the last 12-month period ending on the last day of the month

immediately preceding the date of publication of this research report.

7. The RE and / or the research analyst or any of his / her family members or relatives may have actual / beneficial ownership exceeding 1% or more,

of the securities of the subject company as at the end of the month immediately preceding the date of publication of this research report.

8. In the last 12-month period ending on the last day of the month immediately preceding the date of publication of this research report ACL or any of its

associates may have:

i. Received compensation for investment banking, merchant banking or stock broking services or for any other services from the subject company

of this research report and / or;

ii. Managed or co-managed public offering of the securities from the subject company of this research report and / or;

iii. Received compensation for products or services other than investment banking, merchant banking or stockbroking services from the subject

company of this research report.

9. The other disclosures / terms and conditions on which this research report is being published are as under:

i. This document is prepared for the sole use of the clients or prospective clients of ACL who are / proposed to be registered in India. It may be

also be accessed through financial websites by those persons who are usually enabled to access such websites. It is not for sale or distribution

to the general public.

ii. This document is provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision.

iii. Nothing in this document should be construed as investment or financial advice, or advice to buy / sell or solicitation to buy / sell the securities

of companies referred to therein.

iv. The intent of this document is not to be recommendatory in nature

v. The investment discussed or views expressed may not be suitable for all investors. Each recipient of this document should make such

investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this

document (including the merits and risks involved), and should consult its own advisors to determine the suitability, merits and risks of such an

investment.

vi. ACL has not independently verified all the information given in this document. Accordingly, no representation or warranty, express or implied,

is made as to the accuracy, completeness or fairness of the information and opinions contained in this document

vii. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alternations to this

statement as may be required from time to time without any prior approval

viii. Subject to the disclosures made herein above, ACL, its affiliates, their directors and the employees may from time to time, effect or have effected

an own account transaction in, or deal as principal or agent in or for the securities mentioned in this document. They may perform or seek to

perform investment banking or other services for, or solicit investment banking or other business from, any company referred to in this report.

Each of these entities functions as a separate, distinct entity, independent of each other. The recipient shall take this into account before

interpreting the document.

ix. This report has been prepared on the basis of information, which is already available in publicly accessible media or developed through

analysis of ACL. The views expressed are those of analyst and the Company may or may not subscribe to all the views expressed therein

x. This document is being supplied to the recipient solely for information and may not be reproduced, redistributed or passed on, directly or

indirectly, to any other person or published, copied, in whole or in part, for any purpose and the same shall be void where prohibited.

Axis Capital is available on Bloomberg (AXCP<Go>), Reuters.com, Firstcall.com and Factset.com 09

EMISPDF in-spjainmr from 61.8.139.218 on 2019-09-28 09:58:23 BST. DownloadPDF.

Downloaded by in-spjainmr from 61.8.139.218 at 2019-09-28 09:58:23 BST. EMIS. Unauthorized Distribution Prohibited.

02 AUG 2019 Quarterly Update

MARICO

FMCG

xi. Neither the whole nor part of this document or copy thereof may be taken or transmitted into the United States of America “U.S. Persons”

(except to major US institutional investors (“MII”)), Canada, Japan and the People’s Republic of China (China) or distributed or redistributed,

directly or indirectly, in the United States of America (except to MII), Canada, Japan and China or to any resident thereof.

xii. Where the report is distributed within the United States ("U.S.") it is being distributed pursuant to a chaperoning agreement with Axis USA, LLC

pursuant to Rule 15a-6. The distribution of this document in other jurisdictions may be restricted by law, and persons into whose possession this

document may come shall inform themselves about, and observe, any such restrictions.

xiii. Neither the Firm, not its directors, employees, agents or representatives shall be liable for any damages whether direct or indirect, incidental,

special or consequential including but not limited to loss of capital, revenue or profits that may arise from or in connection with the use of the

information.

xiv. Copyright of this document vests exclusively with Axis Capital Limited.

Research Disclosure - NOTICE TO US INVESTORS:

This report was prepared, approved, published and distributed by Axis Capital Limited, a company located outside of the United States (a “non-US

Company”). This report is distributed in the U.S. by Axis Capital USA LLC, a U.S. registered broker dealer, which assumes res ponsibility for the research

report’s content, and is meant only for major U.S. institutional investors (as defined in Rule 15a-6 under the U.S. Securities Exchange Act of 1934 (the

“Exchange Act”)) pursuant to the exemption in Rule 15a-6 and any transaction effected by a U.S. customer in the securities described in this report must be

effected through Axis Capital USA LLC rather than with or through the non-US Company.

Neither the report nor any analyst who prepared or approved the report is subject to U.S. legal requirements or the Financial Industry Regulatory Authority,

Inc. (“FINRA”) or other regulatory requirements pertaining to research reports or research analysts. The non-US Company is not registered as a broker-

dealer under the Exchange Act or is a member of the Financial Industry Regulatory Authority, Inc. or any other U.S. self-regulatory organization. The non-US

Company is the employer of the research analyst(s) responsible for this research report. The research analysts preparing this report are resident outside the

United States and are not associated persons of any US regulated broker-dealer and therefore the analyst(s) is/are not subject to supervision by a US

broker-dealer, and are not required to satisfy the regulatory licensing requirements of FINRA or required to otherwise comply with US rules or regulations

regarding, among other things, communications with a subject company, public appearances and trading securities held by a research analyst account.

The non-US Company will refrain from initiating follow-up contacts with any recipient of this research report that does not qualify as a Major Institutional

Investor, or seek to otherwise induce or attempt to induce the purchase or sale of any security addressed in this research report by such recipient.

ANALYST DISCLOSURES

1. The analyst(s) declares that neither he/ his relatives have a Beneficial or Actual ownership of > 1% of equity of subject company/ companies;

2. The analyst(s) declares that he has no material conflict of interest with the subject company/ companies of this report;

3. The research analyst (or analysts) certifies that the views expressed in the research report accurately reflect such research analyst's personal views

about the subject securities and issuers; and

4. The research analyst (or analysts) certifies that no part of his or her compensation was, is, or will be directly or indirectly related to the specific

recommendations or views contained in the research report.

Axis Capital is available on Bloomberg (AXCP<Go>), Reuters.com, Firstcall.com and Factset.com 010

EMISPDF in-spjainmr from 61.8.139.218 on 2019-09-28 09:58:23 BST. DownloadPDF.

Downloaded by in-spjainmr from 61.8.139.218 at 2019-09-28 09:58:23 BST. EMIS. Unauthorized Distribution Prohibited.

02 AUG 2019 Quarterly Update

MARICO

FMCG

Axis Capital Limited

Axis House, C2, Wadia International Centre, P.B Marg, Worli, Mumbai 400 025, India.

Tel:- Board +91-22 4325 2525; Dealing +91-22 2438 8861-69;

Fax:- Research +91-22 4325 1100; Dealing +91-22 4325 3500

New Rating system effective 12 April, 2019 Previous Rating system

DEFINITION OF RATINGS DEFINITION OF RATINGS

Ratings Expected absolute returns over 12 months Ratings Expected absolute returns over 12 months

BUY More than 15% BUY More than 10%

ADD Between 5% to 15% HOLD Between 10% and -10%

REDUCE Between 5% to -10 % SELL More than -10%

SELL More than -10%

Note: For a transitory period from 12 April 2019 until 30 June 2019, the new rating system and the previous rating system will be used in parallel.

New research will be published under the new rating methodology, but existing recommendations will only be changed to the new rating system as and

when new research is published in ordinary course of business.

Marico (MRCO.BO, MRCO IN) Price and Recommendation History

CMP Buy Add Hold Reduce Sell Under Review Not Rated

450 (Rs)

400

350

300

250

200

150

100

50

0

Nov-16

Feb-17

Nov-17

Feb-18

Feb-19

Nov-18

Dec-18

Dec-16

Dec-17

Oct-16

Oct-17

Oct-18

May-17

May-18

May-19

Aug-17

Aug-18

Aug-19

Aug-16

Jan-17

Apr-17

Jul-17

Jan-18

Apr-18

Jul-18

Jan-19

Jul-19

Apr-19

Mar-17

Mar-18

Mar-19

Jun-17

Jun-18

Jun-19

Sep-18

Sep-16

Sep-17

Dat e Tar ge t P r i ce Re co Dat e Tar ge t P r i ce Re co Dat e Tar ge t P r i ce Re co Dat e Tar ge t P r i ce Re co

5-Aug-16 230 Sell 19-Jun-17 250 Sell 19-Dec-17 260 Sell 9-Jul-18 310 Hold

4-Oct-16 230 Sell 11-Jul-17 250 Sell 4-Jan-18 280 Sell 4-Aug-18 340 Hold

18-Oct-16 230 Sell 21-Jul-17 250 Sell 18-Jan-18 280 Sell 10-Oct-18 345 Buy

28-Oct-16 230 Sell 1-Aug-17 255 Sell 12-Feb-18 290 Hold 1-Nov-18 360 Buy

2-Feb-17 225 Sell 17-Aug-17 255 Sell 19-Feb-18 290 Hold 16-Nov-18 360 Buy

22-Feb-17 225 Sell 21-Aug-17 255 Sell 21-Mar-18 290 Hold 28-Nov-18 410 Buy

12-Apr-17 225 Sell 3-Oct-17 255 Sell 9-Apr-18 290 Hold 5-Dec-18 410 Buy

19-Apr-17 225 Sell 5-Oct-17 255 Sell 23-Apr-18 290 Hold 7-Jan-19 410 Buy

2-May-17 250 Sell 17-Oct-17 255 Sell 3-May-18 310 Hold 5-Feb-19 410 Buy

19-May-17 250 Sell 30-Oct-17 260 Sell 29-May-18 310 Hold 6-May-19 380 Add

23-May-17 250 Sell 13-Nov-17 260 Sell 5-Jun-18 310 Hold

9-Jun-17 250 Sell 16-Nov-17 260 Sell 27-Jun-18 310 Hold

Source: Axis Capital

Axis Capital is available on Bloomberg (AXCP<Go>), Reuters.com, Firstcall.com and Factset.com 011

EMISPDF in-spjainmr from 61.8.139.218 on 2019-09-28 09:58:23 BST. DownloadPDF.

Downloaded by in-spjainmr from 61.8.139.218 at 2019-09-28 09:58:23 BST. EMIS. Unauthorized Distribution Prohibited.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Chosen by Chaim Potok PDFDocument3 pagesThe Chosen by Chaim Potok PDFgregory e bautista20% (5)

- 04 Excel File - Capsim Capstone - Best Strategy - COMPETITION 5.0Document76 pages04 Excel File - Capsim Capstone - Best Strategy - COMPETITION 5.0Vidhi Sharma0% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Reinventing Dhara: Strategic Brand ManagementDocument52 pagesReinventing Dhara: Strategic Brand ManagementVidhi SharmaNo ratings yet

- Selling On The Internet May 2020 - AparajitaDocument47 pagesSelling On The Internet May 2020 - AparajitaVidhi SharmaNo ratings yet

- Move Over G7, It's Time For A New and Improved G11: Long ShadowDocument16 pagesMove Over G7, It's Time For A New and Improved G11: Long ShadowVidhi SharmaNo ratings yet

- The Importance of Forex Reserves For RBI, Economy: Job Scene BrightensDocument16 pagesThe Importance of Forex Reserves For RBI, Economy: Job Scene BrightensVidhi SharmaNo ratings yet

- The Significance of Household Financial Savings: A Second Wave?Document16 pagesThe Significance of Household Financial Savings: A Second Wave?Vidhi SharmaNo ratings yet

- The-effect-of-Covid-19-on-GCT 2020Document28 pagesThe-effect-of-Covid-19-on-GCT 2020Vidhi SharmaNo ratings yet

- Amazon 14 PrinciplesDocument6 pagesAmazon 14 PrinciplesVidhi Sharma100% (1)

- Insights For Brands: What Is India Searching For?Document29 pagesInsights For Brands: What Is India Searching For?Vidhi SharmaNo ratings yet

- Spotify Rebranding PDFDocument4 pagesSpotify Rebranding PDFVidhi SharmaNo ratings yet

- OLR 19-20 NewStoreDocument21 pagesOLR 19-20 NewStoreVidhi SharmaNo ratings yet

- Feasibility ReportDocument32 pagesFeasibility ReportVidhi SharmaNo ratings yet

- As Coronavirus Deepens Inequality, Inequality Worsens Its Spread - The New York TimesDocument9 pagesAs Coronavirus Deepens Inequality, Inequality Worsens Its Spread - The New York TimesVidhi SharmaNo ratings yet

- HCC Annual ReportDocument194 pagesHCC Annual ReportVidhi SharmaNo ratings yet

- Tata InvicTAS Schedule 2019 PDFDocument1 pageTata InvicTAS Schedule 2019 PDFVidhi SharmaNo ratings yet

- FNB Zambia - Foreign Tax Reporting Form - Legal EntitiesDocument6 pagesFNB Zambia - Foreign Tax Reporting Form - Legal Entitiesmunshimbwe munshimbweNo ratings yet

- 1Z0-1073-22 Oracle Inventory Cloud 22 Implementation AlfabeticoDocument52 pages1Z0-1073-22 Oracle Inventory Cloud 22 Implementation AlfabeticoDavid LopezNo ratings yet

- Smart. Savvy. Successful.: Media Kit 2018Document11 pagesSmart. Savvy. Successful.: Media Kit 2018apschabbaNo ratings yet

- The Cash Price or Delivered Price of The Property or Service To Be Acquired (2) The Amounts, If Any, To Be Credited As Down Payment And/or Trade-InDocument2 pagesThe Cash Price or Delivered Price of The Property or Service To Be Acquired (2) The Amounts, If Any, To Be Credited As Down Payment And/or Trade-InJaneth NavalesNo ratings yet

- Exxon Mobil Company AnalysisDocument6 pagesExxon Mobil Company AnalysisMacharia NgunjiriNo ratings yet

- Solved All of The Following Statements Regarding Leases Are True Except PDFDocument1 pageSolved All of The Following Statements Regarding Leases Are True Except PDFAnbu jaromiaNo ratings yet

- Gef India Private Limited: 2010 Launching A New Brand of Edible Oil Case StudyDocument4 pagesGef India Private Limited: 2010 Launching A New Brand of Edible Oil Case StudyrunjunNo ratings yet

- Trees and NeighborsDocument6 pagesTrees and NeighborsNelson Chan Chee-KianNo ratings yet

- Sonus Faber Price List Valid From October 2018 PDFDocument21 pagesSonus Faber Price List Valid From October 2018 PDFVOLCOVNo ratings yet

- Corrugated Today 0922Document43 pagesCorrugated Today 0922MLNo ratings yet

- Accounting For Taxes 6Document7 pagesAccounting For Taxes 6charlene kate bunaoNo ratings yet

- Uns W Student GuideDocument27 pagesUns W Student Guidemmm123No ratings yet

- 5RST Assessment GuidanceDocument10 pages5RST Assessment GuidanceIsraa Hani100% (1)

- Job DesignDocument2 pagesJob DesignSamek BhamboreNo ratings yet

- The Liquidity Problem: A Case of Café Coffee Day EnterpriseDocument6 pagesThe Liquidity Problem: A Case of Café Coffee Day Enterprisearsh4786No ratings yet

- SP18Document74 pagesSP18bbNo ratings yet

- Red Hat Enterprise Linux 7 Selinux User'S and Administrator'S GuideDocument184 pagesRed Hat Enterprise Linux 7 Selinux User'S and Administrator'S GuidedfrediNo ratings yet

- Smiths Group PLC - Key PeopleDocument8 pagesSmiths Group PLC - Key PeoplenishantNo ratings yet

- Case Study 5Document2 pagesCase Study 5Aeilin AgotoNo ratings yet

- B CHAPTER-2 Oct26-1Document5 pagesB CHAPTER-2 Oct26-1Manjiro SanoNo ratings yet

- Quarterly Update - June 2021Document5 pagesQuarterly Update - June 2021Chaitanya Jagarlapudi100% (1)

- Republic of The Philippines - Energy Regulatory CommissionDocument7 pagesRepublic of The Philippines - Energy Regulatory CommissionKhenan James NarismaNo ratings yet

- Swing Trade Pro 2.0: The 5-Step Swing Trading BlueprintDocument15 pagesSwing Trade Pro 2.0: The 5-Step Swing Trading BlueprintPinky BhagwatNo ratings yet

- New Vendor Registration Form - VER - 2 3Document4 pagesNew Vendor Registration Form - VER - 2 3keyurNo ratings yet

- Analisis Kualitas Situs Web Pejabat Pengelola Informasi Dan Dokumentasi (Ppid) Perpustakaan Nasional Ri MenggunakanDocument10 pagesAnalisis Kualitas Situs Web Pejabat Pengelola Informasi Dan Dokumentasi (Ppid) Perpustakaan Nasional Ri MenggunakanDea Widya HutamiNo ratings yet

- Philippine Mining Investment OpportunitiesDocument51 pagesPhilippine Mining Investment OpportunitieswfarenasbNo ratings yet

- Sweta Kumari Marketing ManagementDocument8 pagesSweta Kumari Marketing ManagementswetaNo ratings yet

- Open Group Standard: Togaf 9.1 Translation Glossary: English - FrenchDocument45 pagesOpen Group Standard: Togaf 9.1 Translation Glossary: English - FrenchhananNo ratings yet

- General Proposal EditedDocument13 pagesGeneral Proposal EditedRecious NguluvheNo ratings yet