Professional Documents

Culture Documents

International COrporate Bank v. CA

Uploaded by

wenny capplemanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

International COrporate Bank v. CA

Uploaded by

wenny capplemanCopyright:

Available Formats

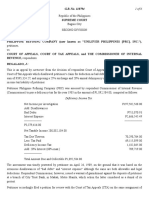

6. G.R. No.

129910 September 5, 2006

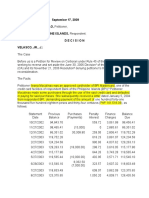

THE INTERNATIONAL CORPORATE BANK, 7-4535700-6 8-24-81 Antonio Lisan 95,100.00

INC., petitioner,

vs. 7-4697902-2 9-18-81 Ace Enterprises, Inc. 96,000.00

COURT OF APPEALS and PHILIPPINE NATIONAL

7-4697925-6 9-18-81 Golden City Trading 93,030.00

BANK, respondents.

7-4697011-6 10-02-81 Wintrade Marketing 90,960.00

DECISION

7-4697909-4 10-02-81 ABC Trading, Inc. 99,300.00

CARPIO, J.:

7-4697922-3 10-05-81 Golden Enterprises 96,630.00

The Case

The checks were deposited on the following dates for the

Before the Court is a petition for review1 assailing the 9 following accounts:

August 1994 Amended Decision2 and the 16 July 1997

Resolution3 of the Court of Appeals in CA-G.R. CV No. Check Number Date Account Deposited

Deposited

25209.

7-3694621-4 7-23-81 CA 0060 02360 3

The Antecedent Facts

7-3694609-6 7-28-81 CA 0060 02360 3

The case originated from an action for collection of sum of

money filed on 16 March 1982 by the International 7-3666224-4 8-4-81 CA 0060 02360 3

Corporate Bank, Inc.4 ("petitioner") against the Philippine

National Bank ("respondent"). The case was raffled to the 7-3528348-4 8-11-81 CA 0060 02360 3

then Court of First Instance (CFI) of Manila, Branch 6. The

7-3666225-5 8-11-81 SA 0061 32331 7

complaint was amended on 19 March 1982. The case was

eventually re-raffled to the Regional Trial Court of Manila, 7-3688945-6 8-17-81 CA 0060 30982 5

Branch 52 ("trial court").

7-4535674-1 8-26-81 CA 0060 02360 3

The Ministry of Education and Culture issued 15

checks5 drawn against respondent which petitioner accepted 7-4535675-2 8-27-81 CA 0060 02360 3

for deposit on various dates. The checks are as follows:

7-4535699-5 8-31-81 CA 0060 30982 5

Check Date Payee Amount

7-4535700-6 8-24-81 SA 0061 32331 7

Number

7-4697902-2 9-23-81 CA 0060 02360 3

7-3694621-4 7-20-81 Trade Factors, Inc. P 97,500.00

7-4697925-6 9-23-81 CA 0060 30982 5

7-3694609-6 7-27-81 Romero D. Palmares 98,500.50

7-4697011-6 10-7-81 CA 0060 02360 3

7-3666224-4 8-03-81 Trade Factors, Inc. 99,800.00

7-4697909-4 10-7-81 CA 0060 30982 56

7-3528348-4 8-07-81 Trade Factors, Inc. 98,600.00

After 24 hours from submission of the checks to respondent

7-3666225-5 8-10-81 Antonio Lisan 98,900.00

for clearing, petitioner paid the value of the checks and

7-3688945-6 8-10-81 Antonio Lisan 97,700.00 allowed the withdrawals of the deposits. However, on 14

October 1981, respondent returned all the checks to

7-4535674-1 8-21-81 Golden City Trading 95,300.00

petitioner without clearing them on the ground that they

7-4535675-2 8-21-81 Red Arrow Trading 96,400.00

were materially altered. Thus, petitioner instituted an action

for collection of sums of money against respondent to

7-4535699-5 8-24-81 Antonio Lisan 94,200.00 recover the value of the checks.

Negotiable Instruments Page 1

The Ruling of the Trial Court We do not think so.

The trial court ruled that respondent is expected to use Obviously, such bank cannot be held liable for its failure to

reasonable business practices in accepting and paying the return the check in question not later than the next regular

checks presented to it. Thus, respondent cannot be faulted clearing. However, this Court is of the opinion and so holds

for the delay in clearing the checks considering the ingenuity that it could still be held liable if it fails to exercise due

in which the alterations were effected. The trial court diligence in verifying the alterations made. In other words,

observed that there was no attempt from petitioner to verify such bank would still be expected, nay required, to make the

the status of the checks before petitioner paid the value of proper verification before the 24-hour regular clearing

the checks or allowed withdrawal of the deposits. According period lapses, or in cases where such lapses may be deemed

to the trial court, petitioner, as collecting bank, could have inevitable, that the required verification should be made

inquired by telephone from respondent, as drawee bank, within a reasonable time.

about the status of the checks before paying their value.

Since the immediate cause of petitioner’s loss was the lack of The implication of the rule that a check shall be returned

caution of its personnel, the trial court held that petitioner is within the 24-hour clearing period is that if the collecting

not entitled to recover the value of the checks from bank paid the check before the end of the aforesaid 24-hour

respondent. clearing period, it would be responsible therefor such that if

the said check is dishonored and returned within the 24-

The dispositive portion of the trial court’s Decision reads: hour clearing period, the drawee bank cannot be held liable.

Would such an implication apply in the case of materially

WHEREFORE, judgment is hereby rendered dismissing both altered checks returned within 24 hours after discovery?

the complaint and the counterclaim. Costs shall, however be This Court finds nothing in the letter of the above-cited C.B.

assessed against the plaintiff. Circular that would justify a negative answer. Nonetheless,

the drawee bank could still be held liable in certain

SO ORDERED.7

instances. Even if the return of the check/s in question is

Petitioner appealed the trial court’s Decision before the done within 24 hours after discovery, if it can be shown that

Court of Appeals. the drawee bank had been patently negligent in the

performance of its verification function, this Court finds no

The Ruling of the Court of Appeals reason why the said bank should be relieved of liability.

In its 10 October 1991 Decision, 8 the Court of Appeals Although banking practice has it that the presumption of

reversed the trial court’s Decision. Applying Section 4(c) of clearance is conclusive when it comes to the application of

Central Bank Circular No. 580, series of 1977, 9 the Court of the 24-hour clearing period, the same principle may not be

Appeals held that checks that have been materially altered applied to the 24-hour period vis-a-vis material alterations in

shall be returned within 24 hours after discovery of the the sense that the drawee bank which returns materially

alteration. However, the Court of Appeals ruled that even if altered checks within 24 hours after discovery would be

the drawee bank returns a check with material alterations conclusively relieved of any liability thereon. This is because

after discovery of the alteration, the return would not relieve there could well be various intervening events or factors that

the drawee bank from any liability for its failure to return could affect the rights and obligations of the parties in cases

the checks within the 24-hour clearing period. The Court of such as the instant one including patent negligence on the

Appeals explained: part of the drawee bank resulting in an unreasonable delay

in detecting the alterations. While it is true that the pertinent

Does this mean that, as long as the drawee bank returns a

proviso in C.B. Circular No. 580 allows the drawee bank to

check with material alteration within 24 hour[s] after

return the altered check within the period "provided by law

discovery of such alteration, such return would have the

for filing a legal action", this does not mean that this would

effect of relieving the bank of any liability whatsoever

entitle or allow the drawee bank to be grossly negligent and,

despite its failure to return the check within the 24- hour

inspite thereof, avail itself of the maximum period allowed

clearing house rule?

by the above-cited Circular. The discovery must be made

within a reasonable time taking into consideration the facts

Negotiable Instruments Page 2

and circumstances of the case. In other words, the 3. Whether the motion for reconsideration filed by

aforementioned C.B. Circular does not provide the drawee respondent was out of time thus making the 10 October 1991

bank the license to be grossly negligent on the one hand nor Decision final and executory.12

does it preclude the collecting bank from raising available

defenses even if the check is properly returned within the The Ruling of This Court

24-hour period after discovery of the material alteration. 10

Filing of the Petition under both Rules 45 and 65

The Court of Appeals rejected the trial court’s opinion that

Respondent asserts that the petition should be dismissed

petitioner could have verified the status of the checks by

outright since petitioner availed of a wrong mode of appeal.

telephone call since such imposition is not required under

Respondent cites Ybañez v. Court of Appeals13 where the Court

Central Bank rules. The dispositive portion of the 10 October

ruled that "a petition cannot be subsumed simultaneously

1991 Decision reads:

under Rule 45 and Rule 65 of the Rules of Court, and neither

PREMISES CONSIDERED, the decision appealed from is may petitioners delegate upon the court the task of

hereby REVERSED and the defendant-appellee Philippine determining under which rule the petition should fall."

National Bank is declared liable for the value of the fifteen

The remedies of appeal and certiorari are mutually exclusive

checks specified and enumerated in the decision of the trial

and not alternative or successive. 14 However, this Court may

court (page 3) in the amount of P1,447,920.00

set aside technicality for justifiable reasons. The petition

SO ORDERED.11 before the Court is clearly meritorious. Further, the petition

was filed on time both under Rules 45 and 65. 15 Hence, in

Respondent filed a motion for reconsideration of the 10 accordance with the liberal spirit which pervades the Rules

October 1991 Decision. In its 9 August 1994 Amended of Court and in the interest of justice, 16 we will treat the

Decision, the Court of Appeals reversed itself and affirmed petition as having been filed under Rule 45.

the Decision of the trial court dismissing the complaint.

Alteration of Serial Number Not Material

In reversing itself, the Court of Appeals held that its 10

October 1991 Decision failed to appreciate that the rule on The alterations in the checks were made on their serial

the return of altered checks within 24 hours from the numbers.

discovery of the alteration had been duly passed by the

Sections 124 and 125 of Act No. 2031, otherwise known as

Central Bank and accepted by the members of the banking

the Negotiable Instruments Law, provide:

system. Until the rule is repealed or amended, the rule has to

be applied. SEC. 124. Alteration of instrument; effect of. ― Where a

negotiable instrument is materially altered without the

Petitioner moved for the reconsideration of the Amended

assent of all parties liable thereon, it is avoided, except as

Decision. In its 16 July 1997 Resolution, the Court of Appeals

against a party who has himself made, authorized, or

denied the motion for lack of merit.

assented to the alteration and subsequent indorsers.

Hence, the recourse to this Court.

But when an instrument has been materially altered and is in

The Issues the hands of a holder in due course, not a party to the

alteration, he may enforce payment thereof according to its

Petitioner raises the following issues in its Memorandum: original tenor.

1. Whether the checks were materially altered; SEC. 125. What constitutes a material alteration. ― Any

alteration which changes:

2. Whether respondent was negligent in failing to recognize

within a reasonable period the altered checks and in not (a) The date;

returning the checks within the period; and

(b) The sum payable, either for principal or interest;

Negotiable Instruments Page 3

(c) The time or place of payment; alteration (generally, changes on items other than those

required to be stated under Sec. 1, N.I.L.) and spoliation

(d) The number or the relations of the parties; (alterations done by a stranger) will not avoid the

instrument, but the holder may enforce it only according to

(e) The medium or currency in which payment is to be

its original tenor.

made;

xxxx

or which adds a place of payment where no place of

payment is specified, or any other change or addition which The case at the bench is unique in the sense that what was

alters the effect of the instrument in any respect, is a material altered is the serial number of the check in question, an item

alteration. which, it can readily be observed, is not an essential requisite

for negotiability under Section 1 of the Negotiable

The question on whether an alteration of the serial number

Instruments Law. The aforementioned alteration did not

of a check is a material alteration under the Negotiable

change the relations between the parties. The name of the

Instruments Law is already a settled matter. In Philippine

drawer and the drawee were not altered. The intended

National Bank v. Court of Appeals, this Court ruled that the

payee was the same. The sum of money due to the payee

alteration on the serial number of a check is not a material

remained the same. x x x

alteration. Thus:

xxxx

An alteration is said to be material if it alters the effect of the

instrument. It means an unauthorized change in an The check’s serial number is not the sole indication of its

instrument that purports to modify in any respect the origin. As succinctly found by the Court of Appeals, the

obligation of a party or an unauthorized addition of words name of the government agency which issued the subject

or numbers or other change to an incomplete instrument check was prominently printed therein. The check’s issuer

relating to the obligation of a party. In other words, a was therefore sufficiently identified, rendering the referral to

material alteration is one which changes the items which are the serial number redundant and inconsequential. x x x

required to be stated under Section 1 of the Negotiable

Instrument[s] Law. xxxx

Section 1 of the Negotiable Instruments Law provides: Petitioner, thus cannot refuse to accept the check in question

on the ground that the serial number was altered, the same

Section 1. ― Form of negotiable instruments. An instrument being an immaterial or innocent one.17

to be negotiable must conform to the following

requirements: Likewise, in the present case the alterations of the serial

numbers do not constitute material alterations on the checks.

(a) It must be in writing and signed by the maker or drawer;

Incidentally, we agree with the petitioner’s observation that

(b) Must contain an unconditional promise or order to pay a the check in the PNB case appears to belong to the same

sum certain in money; batch of checks as in the present case. The check in

the PNB case was also issued by the Ministry of Education

(c) Must be payable on demand, or at a fixed or

and Culture. It was also drawn against PNB, respondent in

determinable future time;

this case. The serial number of the check in the PNB case is 7-

(d) Must be payable to order or to bearer; and 3666-223-3 and it was issued on 7 August 1981.

(e) Where the instrument is addressed to a drawee, he must Timeliness of Filing of Respondent’s Motion for Reconsideration

be named or otherwise indicated therein with reasonable

Respondent filed its motion for reconsideration of the 10

certainty.

October 1991 Decision on 6 November 1991. Respondent’s

In his book entitled "Pandect of Commercial Law and motion for reconsideration states that it received a copy of

Jurisprudence," Justice Jose C. Vitug opines that "an innocent the 10 October 1991 Decision on 22 October 1991. 18 Thus, it

appears that the motion for reconsideration was filed on

Negotiable Instruments Page 4

time. However, the Registry Return Receipt shows that

counsel for respondent or his agent received a copy of the 10

October 1991 Decision on 16 October 1991, 19 not on 22

October 1991 as respondent claimed. Hence, the Court of

Appeals is correct when it noted that the motion for

reconsideration was filed late. Despite its late filing, the

Court of Appeals resolved to admit the motion for

reconsideration "in the interest of substantial justice."20

There are instances when rules of procedure are relaxed in

the interest of justice. However, in this case, respondent did

not proffer any explanation for the late filing of the motion

for reconsideration. Instead, there was a deliberate attempt

to deceive the Court of Appeals by claiming that the copy of

the 10 October 1991 Decision was received on 22 October

1991 instead of on 16 October 1991. We find no justification

for the posture taken by the Court of Appeals in admitting

the motion for reconsideration. Thus, the late filing of the

motion for reconsideration rendered the 10 October 1991

Decision final and executory.

The 24-Hour Clearing Time

The Court will not rule on the proper application of Central

Bank Circular No. 580 in this case. Since there were no

material alterations on the checks, respondent as drawee

bank has no right to dishonor them and return them to

petitioner, the collecting bank.21 Thus, respondent is liable to

petitioner for the value of the checks, with legal interest from

the time of filing of the complaint on 16 March 1982 until full

payment.22 Further, considering that respondent’s motion

for reconsideration was filed late, the 10 October 1991

Decision, which held respondent liable for the value of the

checks amounting to P1,447,920, had become final and

executory.

WHEREFORE, we SET ASIDE the 9 August 1994 Amended

Decision and the 16 July 1997 Resolution of the Court of

Appeals. We rule that respondent Philippine National Bank

is liable to petitioner International Corporate Bank, Inc. for

the value of the checks amounting to P1,447,920, with legal

interest from 16 March 1982 until full payment. Costs against

respondent.

SO ORDERED.

Quisumbing, Chairperson, Carpio-Morales, Tinga, Velasco, Jr.,

J.J., concur.

Footnotes

Negotiable Instruments Page 5

1 10

Petitioner denonimated the petition as filed under both Rollo, pp. 53-54.

Rule 45 and Rule 65 of the 1997 Rules of Civil Procedure.

11

Id. at 58.

2

Penned by Associate Justice Serafin V.C. Guingona with

12

Associate Justices Jorge S. Imperial and Justo P. Torres, Jr., Id. at 251-252.

concurring. Rollo, pp. 25-34. 13

323 Phil. 643 (1996).

3

Penned by Associate Justice Jorge S. Imperial with 14

Ligon v. CA, 355 Phil. 503 (1998).

Associate Justices Ramon U. Mabutas, Jr. and Hilarion L.

Aquino, concurring. Rollo, p. 23. 15

Nuñez v. GSIS Family Bank, G.R. No. 163988, 17

4

November 2005, 475 SCRA 305.

Now the Union Bank of the Philippines.

16

5

Id.

The first 14 checks were the subject of the complaint while

the last check was included in the amended complaint. 17

326 Phil. 504 (1996), 511-516.

6

The deposit slip of Check No. 7-4697922-3 was not 18

CA rollo, p. 86.

presented before the trial court.

19

Id. at 73.

7

Rollo, p. 295.

20

Id. at 90.

8

Penned by Associate Justice Serafin V.C. Guingona with

21

Associate Justices Luis A. Javellana and Jorge S. Imperial, PNB v. CA, supra note 17.

concurring. Rollo, pp. 47-58.

22

Article 2209, Civil Code.

9

Section 4(c) provides:

SECTION 4. Clearing Procedures.

xxxx

(c) Procedure for Returned Items

Items which should be returned for any reason whatsoever

shall be presented not later than the next regular clearing for

local exchanges. Out-of-town exchanges shall be returned

within the period specified in the Memorandum to

Authorized Agent Banks announcing the opening of clearing

facilities in each of the authorized regional clearing centers. x

xx

Items which have been the subject of a material alteration or

items bearing a forged endorsement when such

endorsement is necessary for negotiation shall be returned

within twenty-four (24) hours after discovery of the

alteration or the forgery but in no event beyond the period

fixed or provided by law for filing of a legal action by the

returning bank/branch, institution or entity against the

bank/branch, institution or entity sending the same.

xxxx

Negotiable Instruments Page 6

You might also like

- G.R. No. 129910 September 5, 2006 The International Corporate Bank, Inc., Petitioner, Court of Appeals and Philippine National Bank, RespondentsDocument7 pagesG.R. No. 129910 September 5, 2006 The International Corporate Bank, Inc., Petitioner, Court of Appeals and Philippine National Bank, RespondentsMark Catabijan CarriedoNo ratings yet

- G.R. No. 129910Document11 pagesG.R. No. 129910lou annNo ratings yet

- The Int'l Corp Bank Vs CADocument5 pagesThe Int'l Corp Bank Vs CARhona MarasiganNo ratings yet

- International Corporate Bank v. CADocument9 pagesInternational Corporate Bank v. CAfaye wongNo ratings yet

- G.R. No. 129910 September 5, 2006 THE International Corporate Bank, INC., Petitioner, Court of Appeals and Philippine National Bank, RespondentsDocument44 pagesG.R. No. 129910 September 5, 2006 THE International Corporate Bank, INC., Petitioner, Court of Appeals and Philippine National Bank, RespondentsJohn Carlo DizonNo ratings yet

- National Bank Notes and Checks (Sec. 184-198)Document8 pagesNational Bank Notes and Checks (Sec. 184-198)Rona TumaganNo ratings yet

- THE INTERNATIONAL CORPORATE BANK, INC, VS. CA and PNB - G.R. NO. 129910 PDFDocument7 pagesTHE INTERNATIONAL CORPORATE BANK, INC, VS. CA and PNB - G.R. NO. 129910 PDFJulie Rose FajardoNo ratings yet

- International Corporate Bank v. CADocument13 pagesInternational Corporate Bank v. CAGia DimayugaNo ratings yet

- The International Corporate Bank, Inc., Petitioner, Court of Appeals and Philippine National Bank, Respondents. The CaseDocument30 pagesThe International Corporate Bank, Inc., Petitioner, Court of Appeals and Philippine National Bank, Respondents. The CaseTiff DizonNo ratings yet

- 2) International-Corporate-Bank-Inc.-vs.-Court-of-AppealsDocument15 pages2) International-Corporate-Bank-Inc.-vs.-Court-of-AppealsShien TumalaNo ratings yet

- Icb VS CaDocument6 pagesIcb VS CaAllyza SantosNo ratings yet

- International Corporate Bank Vs CA and PNB - GR 129910Document9 pagesInternational Corporate Bank Vs CA and PNB - GR 129910Krister VallenteNo ratings yet

- Full Text Report Cases NegoDocument23 pagesFull Text Report Cases Negosally deeNo ratings yet

- Amended Complaint: First Cause of ActionDocument10 pagesAmended Complaint: First Cause of ActionRoy PersonalNo ratings yet

- Macalinao V Bpi and Neri V UyDocument10 pagesMacalinao V Bpi and Neri V UyOpnkwatro SampalocNo ratings yet

- Macalinao v. Bank of The Philippine Islands - G.R. No. 175490, September 17, 2009Document11 pagesMacalinao v. Bank of The Philippine Islands - G.R. No. 175490, September 17, 2009Tris LeeNo ratings yet

- Petitioner Vs Vs Respondent: Second DivisionDocument7 pagesPetitioner Vs Vs Respondent: Second DivisionCamille CruzNo ratings yet

- Cu v. Small Business Guarantee and Finance Corp., G.R. No. 211222, August 7, 2017 Full TextDocument8 pagesCu v. Small Business Guarantee and Finance Corp., G.R. No. 211222, August 7, 2017 Full TextJohn Ludwig Bardoquillo PormentoNo ratings yet

- Macalinao v. BPIDocument9 pagesMacalinao v. BPIPristine DropsNo ratings yet

- Macalinao vs. Bank of The Philippine Islands, 600 SCRA 67 (2009)Document12 pagesMacalinao vs. Bank of The Philippine Islands, 600 SCRA 67 (2009)Jennifer ArcadioNo ratings yet

- Macalinao Vs BPIDocument9 pagesMacalinao Vs BPIRency TanNo ratings yet

- Metropolitan Bank and Trust Co. v. Chiok20190301-5466-117r1snDocument27 pagesMetropolitan Bank and Trust Co. v. Chiok20190301-5466-117r1snitsmestephNo ratings yet

- ALLIED BANK v. BPI 2013 PDFDocument11 pagesALLIED BANK v. BPI 2013 PDFsamjuan1234No ratings yet

- Compromise Agreement - AguinaldoDocument6 pagesCompromise Agreement - AguinaldoPatrice Noelle RamirezNo ratings yet

- Macalinao vs. Bank of The Philippine Islands, 600 SCRA 67, G.R. No. 175490 September 17, 2009Document7 pagesMacalinao vs. Bank of The Philippine Islands, 600 SCRA 67, G.R. No. 175490 September 17, 2009Daysel FateNo ratings yet

- G.R. No. 172652 PDFDocument2 pagesG.R. No. 172652 PDFMuni CoffeeNo ratings yet

- 15 - MBTC v. ChiokDocument21 pages15 - MBTC v. ChiokJaysieMicabaloNo ratings yet

- Macalinao V BpiDocument9 pagesMacalinao V BpiChristiane Marie BajadaNo ratings yet

- Macalinao v. Bank of The Philippine Islands, G.R. No. 175490, (September 17, 2009), 616 PHIL 60-73Document10 pagesMacalinao v. Bank of The Philippine Islands, G.R. No. 175490, (September 17, 2009), 616 PHIL 60-73Al Jay MejosNo ratings yet

- Macalinao v. BpiDocument6 pagesMacalinao v. BpiCaren deLeonNo ratings yet

- MBTC v. ChiokDocument11 pagesMBTC v. ChiokDelight IgnacioNo ratings yet

- CE CASECNAN WATER AND ENERGY COMPANY INC. vs. CIRDocument6 pagesCE CASECNAN WATER AND ENERGY COMPANY INC. vs. CIRJaysonNo ratings yet

- Negotiable InstrumentsDocument52 pagesNegotiable InstrumentsHp AmpsNo ratings yet

- Petitioner: VICENTE GO, Petitioner Respondent: Metropolitan Bank and Trust Co., Session: 10 Topic: PromissoryDocument8 pagesPetitioner: VICENTE GO, Petitioner Respondent: Metropolitan Bank and Trust Co., Session: 10 Topic: PromissoryRona TumaganNo ratings yet

- Manager's CheckDocument32 pagesManager's CheckKasandra ClaudineNo ratings yet

- MotionDocument8 pagesMotionaira tizonNo ratings yet

- WONG Vs CADocument6 pagesWONG Vs CAKeej DalonosNo ratings yet

- Opinion WrittingDocument10 pagesOpinion WrittingJoey WongNo ratings yet

- METROPOLITAN BANK Vs THE FIRST NATIONAL CITY BANKDocument5 pagesMETROPOLITAN BANK Vs THE FIRST NATIONAL CITY BANKKeej DalonosNo ratings yet

- Allied Vs PetitionDocument11 pagesAllied Vs PetitionCherlene TanNo ratings yet

- Receivables: Class Discussion QuestionsDocument46 pagesReceivables: Class Discussion QuestionsYudhiCopoeSiregarNo ratings yet

- G.R. No. 172652Document19 pagesG.R. No. 172652Hp AmpsNo ratings yet

- 04 - GR - No. - 168274 - Far East Bank vs. Gold Palace PDFDocument7 pages04 - GR - No. - 168274 - Far East Bank vs. Gold Palace PDFAmnesia BandNo ratings yet

- PRC V. Ca G.R. No. 118794: Deficiency Income TaxDocument6 pagesPRC V. Ca G.R. No. 118794: Deficiency Income TaxJopan SJNo ratings yet

- Traders Royal Bank vs. RPNDocument5 pagesTraders Royal Bank vs. RPNKhiarraNo ratings yet

- Far East Bank Trust Company v. Gold Palace CaseDocument8 pagesFar East Bank Trust Company v. Gold Palace CaseWayne Michael NoveraNo ratings yet

- Banko Filipino vs. DiazDocument16 pagesBanko Filipino vs. DiazSherwin Anoba CabutijaNo ratings yet

- Jai-Alai Corporation of Philippines v. Bank of Philippine IslandsDocument6 pagesJai-Alai Corporation of Philippines v. Bank of Philippine IslandsMary Joyce YuNo ratings yet

- AT - 05 - 09 - 45 - 52 - Aele 3Document8 pagesAT - 05 - 09 - 45 - 52 - Aele 3Brian Garate RomanNo ratings yet

- G.R. No. 163494 JESUSA T. DELA CRUZ, Petitioner People of The Philippines, Respondent Decision Reyes, J.Document11 pagesG.R. No. 163494 JESUSA T. DELA CRUZ, Petitioner People of The Philippines, Respondent Decision Reyes, J.Lizzette GuiuntabNo ratings yet

- Ga Problem SolvingDocument9 pagesGa Problem SolvinggarciarhodjeannemarthaNo ratings yet

- Armando GoDocument5 pagesArmando Govmanalo16No ratings yet

- Premiere Development Bank, Petitioner, Central Surety & Insurance Company, Inc., Respondent. Nachura, J.Document48 pagesPremiere Development Bank, Petitioner, Central Surety & Insurance Company, Inc., Respondent. Nachura, J.bittersweetlemonsNo ratings yet

- Tax1. Cases. 6. O. 4. Power To Tax Involves Power To Destroy - 10.taxpayer's SuitDocument90 pagesTax1. Cases. 6. O. 4. Power To Tax Involves Power To Destroy - 10.taxpayer's SuitLecdiee Nhojiezz Tacissea SalnackyiNo ratings yet

- Ileana Dr. Macalinao, G.R. No. 175490: Republic of The Philippines Supreme Court ManilaDocument13 pagesIleana Dr. Macalinao, G.R. No. 175490: Republic of The Philippines Supreme Court ManilaJoy Navaja DominguezNo ratings yet

- SC Decision On BIR Commissioner Vs Manila Doctors HospitalDocument13 pagesSC Decision On BIR Commissioner Vs Manila Doctors HospitalRapplerNo ratings yet

- ActivityDocument1 pageActivityUwuuUNo ratings yet

- Philippine Refining Company (Now Known As "Unilever Philippines (PRC), Inc."), Petitioner, vs. Court of Appeals, Court of Tax Appeals, and The Commissioner of Internal Revenue, G.R. No. 118794Document5 pagesPhilippine Refining Company (Now Known As "Unilever Philippines (PRC), Inc."), Petitioner, vs. Court of Appeals, Court of Tax Appeals, and The Commissioner of Internal Revenue, G.R. No. 118794Mae TrabajoNo ratings yet

- Josias Guillen Estado de CuentaDocument4 pagesJosias Guillen Estado de Cuentaxbkkwt86ddNo ratings yet

- Moral TortDocument19 pagesMoral Tortwenny capplemanNo ratings yet

- Case 2Document15 pagesCase 2wenny capplemanNo ratings yet

- Norma Del Socorro VDocument34 pagesNorma Del Socorro Vwenny capplemanNo ratings yet

- How To Remove VirusDocument1 pageHow To Remove Viruswenny capplemanNo ratings yet

- Case 2bDocument62 pagesCase 2bwenny capplemanNo ratings yet

- Cse 2Document9 pagesCse 2wenny capplemanNo ratings yet

- CasesDocument7 pagesCaseswenny capplemanNo ratings yet

- Sereno CaseDocument20 pagesSereno Casewenny capplemanNo ratings yet

- Dissolution Concept: Yu Vs NLRCDocument10 pagesDissolution Concept: Yu Vs NLRCwenny capplemanNo ratings yet

- Case Simplify FinalsDocument11 pagesCase Simplify Finalswenny capplemanNo ratings yet

- General Principles in Statutory ConstructionDocument1 pageGeneral Principles in Statutory Constructionwenny capplemanNo ratings yet

- Page 4-6 Insurance Law Outline SY 2020-2021Document3 pagesPage 4-6 Insurance Law Outline SY 2020-2021wenny capplemanNo ratings yet

- Bullets Finals Cases + CodalsDocument22 pagesBullets Finals Cases + Codalswenny capplemanNo ratings yet

- Pari Materia Pari Materia: Cross-ReferencesDocument1 pagePari Materia Pari Materia: Cross-Referenceswenny capplemanNo ratings yet

- Syllabus Human RightsDocument1 pageSyllabus Human Rightswenny capplemanNo ratings yet

- Azerbaijan - WikipediaDocument311 pagesAzerbaijan - Wikipediawenny capplemanNo ratings yet

- Per CuriamDocument5 pagesPer Curiamwenny capplemanNo ratings yet

- Sunlife Assurance of Canada vs. CA GR No. 105135 June 22 1995Document4 pagesSunlife Assurance of Canada vs. CA GR No. 105135 June 22 1995wenny capplemanNo ratings yet

- Eleazaro A. Samson For Plaintiffs-Appellants. Abello & Macias For Defendant-AppelleeDocument3 pagesEleazaro A. Samson For Plaintiffs-Appellants. Abello & Macias For Defendant-Appelleewenny capplemanNo ratings yet

- Remedies Procedural Remedies: Petition For Review & Re-Opening of Decree of RegistrationDocument2 pagesRemedies Procedural Remedies: Petition For Review & Re-Opening of Decree of Registrationwenny capplemanNo ratings yet

- Sales ExamDocument3 pagesSales Examwenny capplemanNo ratings yet

- Vda. de Canilang vs. CA 223 SCRA 443 June 17 1993Document8 pagesVda. de Canilang vs. CA 223 SCRA 443 June 17 1993wenny capplemanNo ratings yet

- Legal Reasearch CaseDocument5 pagesLegal Reasearch Casewenny capplemanNo ratings yet

- Grepalife vs. CA. 303 SCRA 113 October 13 1999Document5 pagesGrepalife vs. CA. 303 SCRA 113 October 13 1999wenny capplemanNo ratings yet

- TAN CHAY Digest and OriginalDocument5 pagesTAN CHAY Digest and OriginalRoberts SamNo ratings yet

- Lawrence & Ross For Appellant. Gibbs, Mcdonough & Johnson For AppelleesDocument6 pagesLawrence & Ross For Appellant. Gibbs, Mcdonough & Johnson For Appelleeswenny capplemanNo ratings yet

- Great Pacific Life Ass. CO. vs. CA and Ngo Hing GR No. L 31845 April 30 1979Document5 pagesGreat Pacific Life Ass. CO. vs. CA and Ngo Hing GR No. L 31845 April 30 1979wenny capplemanNo ratings yet

- G.R. No. 200784 August 7, 2013 Malayan Insurance Company, Inc., Petitioner, Pap Co., Ltd. (Phil. Branch), RespondentDocument12 pagesG.R. No. 200784 August 7, 2013 Malayan Insurance Company, Inc., Petitioner, Pap Co., Ltd. (Phil. Branch), Respondentwenny capplemanNo ratings yet

- O.F. Santos & P.C. Nolasco For Petitioners. Ferry, de La Rosa and Associates For Private RespondentDocument5 pagesO.F. Santos & P.C. Nolasco For Petitioners. Ferry, de La Rosa and Associates For Private Respondentwenny capplemanNo ratings yet

- Agrente vs. West Coast Life Insurance Co. 51 Phil 725 March 19 1928Document6 pagesAgrente vs. West Coast Life Insurance Co. 51 Phil 725 March 19 1928wenny capplemanNo ratings yet

- Dacut Vs CA Digest PDFDocument2 pagesDacut Vs CA Digest PDFMariz EreseNo ratings yet

- Zaragoza Vs TanDocument4 pagesZaragoza Vs TanADNo ratings yet

- LOCGOV 09 - 10 - 2020 LTO VelezDocument6 pagesLOCGOV 09 - 10 - 2020 LTO VelezDon King MamacNo ratings yet

- Too Many Doctrines From This Case LDocument4 pagesToo Many Doctrines From This Case LprishNo ratings yet

- MERCEDES S. GATMAYTAN, vs. FRANCISCO DOLOR (SUBSTITUTED BY HIS HEIRS) AND HERMOGENA DOLORDocument3 pagesMERCEDES S. GATMAYTAN, vs. FRANCISCO DOLOR (SUBSTITUTED BY HIS HEIRS) AND HERMOGENA DOLORMARIA KATHLYN DACUDAONo ratings yet

- Agra Chap 3 CasesDocument114 pagesAgra Chap 3 CasesMaria Isabella MirallesNo ratings yet

- Not PrecedentialDocument12 pagesNot PrecedentialScribd Government DocsNo ratings yet

- Civil Cases For DigestDocument33 pagesCivil Cases For DigestMarivicTalomaNo ratings yet

- Alma Nudo Atenza V PPDocument95 pagesAlma Nudo Atenza V PPQin ZiNo ratings yet

- Jerry Sharpe v. State of North Carolina, 4th Cir. (2016)Document3 pagesJerry Sharpe v. State of North Carolina, 4th Cir. (2016)Scribd Government DocsNo ratings yet

- DARAB Rules of Procedures 2009Document4 pagesDARAB Rules of Procedures 2009John W. B. Fuentes IINo ratings yet

- (L.) Diamond Farms vs. SPFLDocument14 pages(L.) Diamond Farms vs. SPFLDom Robinson BaggayanNo ratings yet

- Case 2.211044 PDFDocument23 pagesCase 2.211044 PDFDhen GaniaNo ratings yet

- I. 2-3. Scope, Applicability, Admissibility Cases (Evid)Document29 pagesI. 2-3. Scope, Applicability, Admissibility Cases (Evid)Jimi SolomonNo ratings yet

- 2 J PLUS ASIA v. UTILITYDocument3 pages2 J PLUS ASIA v. UTILITYWally CalaganNo ratings yet

- Co vs. RosarioDocument4 pagesCo vs. RosariooscarletharaNo ratings yet

- CPC Assignment - Suits by PaupersDocument19 pagesCPC Assignment - Suits by PaupersSunil Kumar.K.SNo ratings yet

- Lim Tiu v. Ruiz y RementeriaDocument1 pageLim Tiu v. Ruiz y Rementeriak santosNo ratings yet

- Lozano Vs Delos SantosDocument2 pagesLozano Vs Delos SantosJan MartinNo ratings yet

- Aznar III vs. Bernad: - Second Div IsionDocument10 pagesAznar III vs. Bernad: - Second Div IsionFatima MagsinoNo ratings yet

- Donald Ray Bass v. David Graham, Assistant Warden H.H. Hardy, Laundry Supervisor J. Lafoon, R.N. Doctor Thompson, 14 F.3d 593, 4th Cir. (1994)Document2 pagesDonald Ray Bass v. David Graham, Assistant Warden H.H. Hardy, Laundry Supervisor J. Lafoon, R.N. Doctor Thompson, 14 F.3d 593, 4th Cir. (1994)Scribd Government DocsNo ratings yet

- Tanjanco Vs CADocument3 pagesTanjanco Vs CAMary Divina FranciscoNo ratings yet

- Trials To Special Civil Actions DigestsDocument154 pagesTrials To Special Civil Actions DigestsJoyNo ratings yet

- R.K.ashram LoD and Synopsis SLPDocument19 pagesR.K.ashram LoD and Synopsis SLPManmohan StingNo ratings yet

- David Vs CADocument1 pageDavid Vs CAcharmdelmo100% (3)

- Heirs of Sofia Quirong v. Development Bank of The PhilippinesDocument11 pagesHeirs of Sofia Quirong v. Development Bank of The PhilippinesArnold BagalanteNo ratings yet

- Joan F. Lane, D/B/A Lane & Co. v. The First National Bank of Boston, 871 F.2d 166, 1st Cir. (1989)Document20 pagesJoan F. Lane, D/B/A Lane & Co. v. The First National Bank of Boston, 871 F.2d 166, 1st Cir. (1989)Scribd Government DocsNo ratings yet

- Domingo Lucenario For Petitioners. Ernesto A. Atienza For Private RespondentsDocument4 pagesDomingo Lucenario For Petitioners. Ernesto A. Atienza For Private RespondentsChristine Rose Bonilla LikiganNo ratings yet

- Rivelisa Realty vs. First Sta. Clara Builders, MOTION TO EXTEND TIME (2014)Document2 pagesRivelisa Realty vs. First Sta. Clara Builders, MOTION TO EXTEND TIME (2014)Janine AranasNo ratings yet

- Not PrecedentialDocument4 pagesNot PrecedentialScribd Government DocsNo ratings yet

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesRating: 5 out of 5 stars5/5 (1)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)

- The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicFrom EverandThe Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicRating: 5 out of 5 stars5/5 (1)

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsFrom EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNo ratings yet

- Building Your Empire: Achieve Financial Freedom with Passive IncomeFrom EverandBuilding Your Empire: Achieve Financial Freedom with Passive IncomeNo ratings yet

- Legal Guide for Starting & Running a Small BusinessFrom EverandLegal Guide for Starting & Running a Small BusinessRating: 4.5 out of 5 stars4.5/5 (9)

- The Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysFrom EverandThe Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysNo ratings yet

- How to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessFrom EverandHow to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessNo ratings yet

- Indian Polity with Indian Constitution & Parliamentary AffairsFrom EverandIndian Polity with Indian Constitution & Parliamentary AffairsNo ratings yet

- Global Bank Regulation: Principles and PoliciesFrom EverandGlobal Bank Regulation: Principles and PoliciesRating: 5 out of 5 stars5/5 (2)