Professional Documents

Culture Documents

2nd Semester AY 2019-2020 Fundamentals of Accountancy Part 1

Uploaded by

Hans MosquedaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2nd Semester AY 2019-2020 Fundamentals of Accountancy Part 1

Uploaded by

Hans MosquedaCopyright:

Available Formats

2ND SEMESTER A.Y.

2019-2020

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS AND MANAGEMENT PART 1

COMPLETION OF THE ACCOUNTING CYCLE FOR MERCHANDISING

ADJUSTING ENTRIES

The application of the accrual basis of accounting requires adjusting entries for the following:

1. Accrued income or uncollected income

2. Accrued expenses or unpaid expenses

3. Prepaid expenses or expenses paid in advance

4. Unearned income or income received/collected in advance

5. Depreciation of fixed assets

6. Estimated loss from uncollectible accounts

7. Ending merchandising inventory or unsold merchandise at the end of the accounting period

Chapter 6 discusses the first five items enumerated above. This chapter will have an additional

discussion for those items requiring adjustments and shall include a detailed discussion about estimated

uncollectible accounts and inventory adjustments.

ESTIMATED UNCOLLECTIBLE ACCOUNTS

Regardless of the utmost care exercised in granting credit to customers and the efficiency of collection

methods adopted, a portion of the receivables may turn out to be uncollectible. Because failure to

collect the receivables, the advance provision for uncollectible accounts is recorded as an operating

expense in the same period that the revenue from related sales is recognized. This is an application of

the matching process of income determination.

Pro-forma adjusting entry to record the estimated uncollectible accounts will be:

Doubtful Accounts Expense xx

Allowance for Doubtful Accounts xx

Estimated loss on uncollectible accounts

The estimate for doubtful accounts may be based on either sales or the outstanding receivables at the

end of the accounting period.

SALES PERCENTAGE METHOD

When the base used in computing the charge to doubtful accounts is sales (either the gross sales or the

net sales), debit goes to Doubtful Accounts Expense and the credit to Allowance for Doubtful Accounts.

You multiply the uncollectible percentage by the sales base without looking into the existing balance of

the contra-asset account, Allowance for Doubtful Account.

The following December 31 data were obtained from the books before an adjustment was made:

Debit Credit

Accounts Receivable 100,000

Allowance for Doubtful Accounts 3,000

Sales 500,000

Sales Returns and Allowances 20,000

One-half of 1% of net sales will probable be uncollected.

Give the adjusting entry for the estimated uncollectible accounts under each of the following

independent assumptions and compute its net realizable value.

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 1

2ND SEMESTER A.Y. 2019-2020

AJE: Dec 31 Doubtful Accounts Expense 2,400

Allowance for Doubtful Accounts 2,400

Estimated loss on uncollectible accounts

The uncollectible account is computed as (P500,000 - P20,000) x 0.005 = P2,400.

At the end of the current year, its net realizable value will be:

Accounts Receivable P100,000

Less: Allowance for Doubtful Accounts 5,400

Net Realizable Value P 94,600

Allowance for Doubtful Accounts

End Bal. 5,400 Beg. Bal. 3,000

Adjustment 2,400

RECEIVABLES AS BASE

When receivables are used as the basis for adjustment, the allowance is adjusted to a certain

percentage of receivable or the allowance is adjusted to an amount determined from the aging schedule.

This emphasizes the current net realizable value of the receivables, hence it focuses more on the

statement of financial position rather than on the income statement. The longer a customer’s account

remains outstanding, the less likely that it will be collected. So, we can base the estimate of uncollectible

accounts on how long the accounts have been outstanding.

PERCENTAGE OF RECEIVABLE

Doubtful Accounts Expense is debited and Allowance for Doubtful Accounts is credited for an amount

that brings the allowance balance. The required allowance balance is the amount arrived at by

multiplying the loss percentage by the outstanding receivables. This will serve as the desired ending

balance of Allowance for Doubtful Accounts.

The following December 31 data were obtained from the books before an adjustment was made:

Debit Credit

Accounts Receivable 100,000

Allowance for Doubtful Accounts 3,000

Sales 500,000

Sales Returns and Allowances 20,000

5% of outstanding accounts are doubtful.

Give the adjusting entry for the estimated uncollectible accounts under each of the following

independent assumptions and compute its net realizable value.

AJE: Dec 31 Doubtful Accounts Expense 2,000

Allowance for Doubtful Accounts 2,000

Estimated loss on uncollectible accounts

The uncollectible account is computed as P100,000 x 0.05 = P5,000 - P3,000 = P2,000.

As what you have noticed, when using the percentage of receivables, credit beginning balance of

Allowance for Doubtful Accounts is deducted from its ending balance to arrive at the adjusted amount

of uncollectible account. On the other hand, if it is a debit beginning balance, then add.

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 2

2ND SEMESTER A.Y. 2019-2020

At the end of the current year, its net realizable value will be:

Accounts Receivable P100,000

Less: Allowance for Doubtful Accounts 5,000

Net Realizable Value P 95,000

Allowance for Doubtful Accounts

End Bal. 5,000 Beg. Bal. 3,000

Adjustment 2,000

AGING OF RECEIVABLES

Determining the length of time the accounts are outstanding, whether or not it is beyond its due date

and classifying each receivable as either not yet due or past due is a process called aging of receivables.

The number of days an account is past due is determined from the due date of the individual customer’s

account to the date the aging schedule is prepared which is considered the cut-off date in determining

the age of the receivables. A sliding scale of percentages based on industry or company experience, is

used to estimate the amount of uncollectibles in each age class. A series of loss percentages is applied to

the different age groups and the total amount determined is the required allowance balance. The

allowance balance before adjustment is subtracted from the required allowance balance and the

difference is debited to Doubtful Accounts Expense and credited to Allowance for Doubtful Accounts.

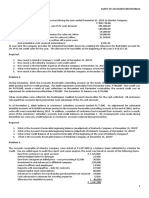

The Accounts Receivable clerk of ECQ Company prepared the following partially completed aging of

receivables schedule as of the end of business on November 30.

Customer Balance Not Past Days Past Due

Due 1 - 30 31 - 60 61 - 90 Over 90

Subtotal P872,500 P540,000 P180,000 P78,500 P42,300 P31,700

The following accounts were unintentionally omitted from the aging schedule:

Customer Balance Due Date

Corona Industries P25,000 August 24

COVID-19 Trading 8,500 September 3

Dovolyu Inc. 35,000 October 17

Lockdown Mart 6,500 November 5

Natoy Corp. 12,000 December 3

ECQ Company has a past history of uncollectible accounts as shown bellow:

Age Class Percentage of Uncollectibility

Not past due 2%

1-30 days past due 4%

31-60 days past due 10%

61-90 days past due 20%

Over 90 days past due 40%

Requirements:

1. Determine the number of days due for each of the preceding accounts.

Corona Industries August 24 - November 30 = 98 days old

COVID-19 Trading September 3 - November 30 = 88 days old

Dovolyu Inc. October 17 - November 30 = 44 days old

Lockdown Mart November 5 - November 30 = 25 days old

Natoy Corp. Due on December 3 = not yet due

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 3

2ND SEMESTER A.Y. 2019-2020

2. Complete the aging of receivables schedule. Estimate the allowance for doubtful accounts, based on

the aging of receivables schedule

Customer Balance Not Past Days Past Due

Due 1 - 30 31 - 60 61 - 90 Over 90

Subtotal P872,500 P540,000 P180,000 P 78,500 P 42,300 P 31,700

Corona Industries 25,000 25,000

COVID-19 Trading 8,500 8,500

Dovolyu Inc. 35,000 35,000

Lockdown Mart 6,500 6,500

Natoy Corp. 12,000 12,000

Total P959,500 P552,000 P186,500 P113,500 P 50,800 P 56,700

Uncollectibility Rate x 2% x 4% x 10% x 20% x 40%

Required Bal. of ADA P 62,690 P 11,040 P 7,460 P 11,350 P 10,160 P 22,680

3. Assume that the allowance for doubtful accounts for ECQ Company has a credit balance of P6,890

before adjustment on November 30. Journalize the adjusting entry for uncollectible accounts as of

November 30.

Allowance for Doubtful Accounts

End Bal. 62,690 Beg. Bal. 6,890

Adjustment 55,800

AJE: Nov 30 Doubtful Accounts Expense 55,800

Allowance for Doubtful Accounts 55,800

Estimated loss on uncollectible accounts

At the end of the current year, its net realizable value will be:

Accounts Receivable P959,500

Less: Allowance for Doubtful Accounts 62,690

Net Realizable Value P896,810

Positive indicators of the worthlessness of a customer’s account include bankruptcy, disappearance of

the customer and repeated attempts to collect that proved futile. There are two (2) alternative

methods of writing off the customer’s accounts that are worthless, namely: the direct write-off method

and the allowance method.

Direct Method Allowance Method

Doubtful Accounts Expense xx Allowance for Doubtful Accounts xx

Accounts Receivable xx Accounts Receivable xx

Write-off of customer’s accounts Write-off of customer’s accounts

If the customer whose accounts were previously written off will come back to pay his accounts, then the

seller will first reverse the entry made to write off the accounts in order to restore the balance of the

said customer’s accounts. This will be followed by an entry recording the subsequent collection.

Direct Method Allowance Method

Accounts Receivable xx Accounts Receivable xx

Doubtful Accounts Expense xx Allowance for Doubtful Accounts xx

Recovery of accounts previously written-off Recovery of accounts previously written-off

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 4

2ND SEMESTER A.Y. 2019-2020

Direct Method Allowance Method

Cash xx Cash xx

Accounts Receivable xx Accounts Receivable xx

Collection of accounts previously written-off Collection of accounts previously written-off

Note: If the problem is silent, Allowance Method is assumed.

INVENTORY ADJUSTMENT

The adjusting entries are the same under both periodic and perpetual inventory systems except for

merchandise inventory. When the periodic inventory is used, cost of goods sold is not recorded on the

date of sale. Whether a company uses a periodic or perpetual inventory system, a physical count should

be conducted at least once a year. This is also done in compliance with BIR requirement. At the end of

the accounting period, a physical count is taken to determine the cost of the inventory on hand. The

cost of goods sold during the period is reported in a separate section in the income statement or the

computation of which may be shown in detail in the accompanying notes to financial statements. The

following entries pertaining to inventory balances may be shown as part of the adjusting entries for the

period if Adjusting Method is used by the company or alternatively may be shown as part of the closing

entries if Direct Extension Method or Closing Method is used.

Pro-forma entries:

Income Summary xx

Merchandise Inventory xx

To close the beginning inventory

After this entry has been recorded and posted, the balance of the merchandise inventory account will be

zero.

Merchandise Inventory xx

Income Summary xx

To set up inventory end

After this second entry has been recorded and posted, the balance of the merchandise inventory

account is the amount of the merchandise of inventory end.

As pointed out in the previous chapter, under the perpetual inventory system, a company maintains a

separate merchandise inventory account in the ledger. During the period, this account shows the

amount of merchandise for sale at any time. No adjustments are required for the merchandise inventory

account at the end of the accounting period because its account balance shows the amount of goods

that should be on hand. If the physical count confirms this account balance, no adjusting entries are

needed. However, trading businesses may experience some loss of inventory due to shoplifting,

employee theft or stolen inventory or errors made in recording or counting inventory. As a result, the

physical inventory taken at the end of the accounting period may differ from the amount of inventory

shown in the records. When the amount of inventory per records is larger than the amount of inventory

per physical count, the difference is often called inventory shrinkage or inventory shortage.

On December 31, 2019, the end of the calendar year period, the inventory records showed P350,000

debit balance of merchandise inventory account but per physical inventory taken on that date, only

P330,000 is on hand or is actually available. The adjusting entry will be:

AJE: Dec 31 Cost of Goods Sold 20,000

Merchandise Inventory 20,000

Inventory shortage

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 5

2ND SEMESTER A.Y. 2019-2020

After recording and posting this adjusting entry to the ledger, the inventory records agree with the

actual physical count at the end of the accounting period. Since no system of procedures and safeguards

can totally eliminate it, inventory shrinkage is often considered a normal cost of operations. However, if

the amount of inventory shrinkage is abnormally large, it may be disclosed on the income statement

under a separate account Loss from Merchandise Inventory Shrinkage or Loss from Inventory Shortage.

Such computation will be explained in detail in the notes to financial statements.

INVENTORY ERRORS

In the process of maintaining inventory records and the physical count of goods on hand, errors may

occur. It is quite easy to overlook goods on hand, count goods twice, or simply make mathematical

mistakes. Therefore, it is important that accountants and business owners fully understand the effects

of inventory errors and grasp the need to be careful to get these numbers as correct as possible. In the

statement of financial position, ending inventory errors will have the same effect on total assets and

owner’s equity and no effect on liabilities. In the income statement of the current year:

1. An error in beginning inventory will have a reverse effect on net income.

2. An error in ending inventory will have a similar effect on net income.

3. If ending inventory errors are not corrected in the following period, their effect on net income for that

period is reversed.

To summarize, any errors in reporting inventory based on physical inventory will misstate the ending

inventory, current assets, total assets, and owner’s equity on the statement of financial position. It will

also misstate the cost of goods sold, gross profit and net income on the income statement.

WORKSHEETS

A worksheet is a multicolumn form that may be used to facilitate preparation of adjusting entries and

financial statements. By means of a worksheet, the accountant will be able to assemble the unadjusted

trial balance, adjustments, adjusted trial balance, income statement, statement of changes in owner’s

equity and the statement of financial position or balance sheet on one columnar sheet of paper before

adjusting and closing entries are actually placed in the books.

Remember that a worksheet is not a journal and worksheet preparation is merely discretionary or

optional on the part of the bookkeeper or accountant. The items found on the adjustments column of

the worksheet will have to be recorded in the general journal and posted later to the general ledger.

The adjusted balances of the accounts will be shown in the adjusted trial balance which is prepared to

check the equality of the debits and credits after posting the adjustments made.

The preparation of a worksheet for a merchandising business is basically similar to the preparation of a

worksheet for a service business except that there are new account titles introduced. In the worksheet

presentation, there 2 alternative ways of presenting merchandise inventory, the Adjusting Method and

the Closing Method (also known as the Direct Extension Method).

For the Adjusting Method, there are two entries: 1) to close merchandise inventory beginning, we debit

Income Summary and credit Merchandise Inventory beginning; and 2) to set up merchandise inventory

end, we debit Merchandise Inventory ending and credit Income Summary.

For the Closing Method or Direct Extension Method, we extend the merchandise inventory beginning to

adjusted trial balance debit column and income statement debit column while merchandise inventory

end is set up in the income statement credit column and statement of financial position debit column.

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 6

2ND SEMESTER A.Y. 2019-2020

FINANCIAL STATEMENTS

Entities report information in the form of financial statements issued on a periodic basis. These financial

statements are most useful if they are prepared and supplied to the various accounting users on a timely

basis. The income statement, statement of changes in owner’s equity and statement of cash flows are

prepared for a specific period of time, while the statement of financial position or the balance sheet

reports data at a specific date. Every set of financial statements is accompanied by explanatory notes

and supporting schedules that are considered integral part of the statements. Notes to financial

statements consist of a summary of the accounting policies applied, comments on individual items

included in the financial statements which also include additional information.

GENERAL REQUIREMENTS

Philippine Accounting Standards (PAS) 1 “Presentation of Financial Statements” sets out the general

requirements relating to the form and content of financial statements. As pointed out from Chapter 7 of

your book, the financial statements should include the primary statements such as the income

statement, statement of changes in owner’s equity, cash flow statement and statement of financial

position. In addition to the primary statements, it must include a summary or statement of accounting

policies and explanatory notes. Each set of financial statements should identify the following

information:

1. name of the reporting entity;

2. whether the financial statements cover the individual entity or a group of entities;

3. presentation currency and units;

4. date covered by the report or the reporting period; and

5. any changes to this information during the period.

FORMS OF INCOME STATEMENT

The revised PAS 1 provides that an entity shall present on the face of the income statement an analysis

of expenses using a classification based on either the function of expenses or their nature within the

entity, whichever provides information that is reliable and more relevant. It does not prescribe any

format. Management must choose which format, functional or natural, is most appropriate.

The new standard simply states that because each method of presentation has merit for different types

of entities, management is required to select the most relevant and reliable information. The standard

further states that when the functional presentation or cost of sales approach is used, additional

disclosure is necessary for the nature of the expenses because the nature of the expenses is useful in

predicting future cash flows. It is believed that the cost of sales method would provide more relevant

information to the users aside from the fact that it is simple and easy to understand. However, the

operating result and net profit are the same regardless of which method is used by the reporting entity.

FUNCTIONAL PRESENTATION

This is the traditional and common form of income statement which is also known as the cost of sales

method. This form classifies expenses according to their function as part of cost of sales, selling

activities, administrative activities and other activities. Entities classifying expenses by function shall

disclose additional information on the nature of expenses. Allocation of costs can be arbitrary and

involves considerable judgement.

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 7

2ND SEMESTER A.Y. 2019-2020

Business Name

Income Statement

For the period ended December 31, 201A

Sales P xx

Less Sales Returns and Allowances P xx

Sales Discounts xx xx

Net Sales P xx

Less Cost of Goods Sold:

Merchandise Inventory beginning P xx

Add Net Purchases:

Gross Purchases P xx

Add Freight-in xx

Total P xx

Less Purchases Returns and Allowances P xx

Purchases Discounts xx xx xx

Cost of Goods Available for Sale P xx

Less Merchandise Inventory end xx xx

Gross Profit or Gross Margin or Gross Income P xx

Add Other Revenues and Gains:

Interest Revenue P xx

Rent Revenue xx

Commission Revenue xx

Gain on Sale of Fixed Assets xx xx

Total Income P xx

Less Expenses:

Selling Expenses:

Sales Salaries Expense P xx

SSS Contributions - sales xx

PhilHealth Contributions - sales xx

Pag-IBIG Contributions - sales xx

Sales Commissions xx

Store Supplies Expense xx

Freight out or Delivery Expense xx

Depreciation Expense - Store Equipment xx P xx

General and Administrative Expenses:

Office Salaries P xx

Bonuses xx

Office Supplies Expense xx

Taxes and Licenses xx

Doubtful Accounts Expense xx

SSS Contributions - office xx

PhilHealth Contributions - office xx

Pag-IBIG Contributions - office xx

Depreciation Expense - Office Equipment xx xx

Other Expenses and Losses:

Loss on Sale of Fixed Assets P xx

Casualty Loss from Earthquake xx xx

Finance Costs:

Interest Expense on bank loans P xx

Interest Expense on bonds payable xx xx xx

Pre-tax Income or Taxable Income or Net Income Before Tax P xx

Less Income Tax xx

Net Income After Tax (Net Loss) P xx

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 8

2ND SEMESTER A.Y. 2019-2020

NATURAL PRESENTATION

This income statement presentation is referred to as the nature of expense method. Under this form,

expenses are aggregated according to their nature and not allocated among the various functions within

the entity. The natural expenses are the expenses themselves. The expenses which are of the same

nature are grouped or aggregated and presented as one item.

Business Name

Income Statement

For the period ended December 31, 201A

Sales P xx

Less Sales Returns and Allowances P xx

Sales Discounts xx xx

Net Sales P xx

Add Other Income and Gains xx

Investment Income xx

Total Income P xx

Less Expenses:

Increase or Decrease in Inventory P xx*

Net Purchases:

Gross Purchases P xx

Less Purchases Returns and Allowances P xx

Purchases Discounts xx xx

Total P xx

Add Freight-in xx xx

Sales Commission xx

Advertising Expense xx

Supplies Expense xx

Freight out or Delivery Expense xx

Depreciation Expense xx

Taxes and Licenses xx

Doubtful Accounts Expense xx

Other Expenses and Losses:

Loss on Sale of Fixed Assets P xx

Casualty Loss from Earthquake xx xx

Finance Cost:

Interest Expense on bank loans xx xx

Pre-tax Income or Taxable Income or Net Income Before Tax P xx

Less Income Tax xx

Net Income After Tax (Net Loss) P xx

*Increase in inventory will be in parenthesis and deducted while decrease in inventory will be added.

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 9

2ND SEMESTER A.Y. 2019-2020

COMPREHENSIVE ILLUSTRATION

Let us have a sample problem that would illustrate the remaining steps of the accounting cycle for a

trading or merchandising business. The chart of account of Easy Q Trading is shown below:

Easy Q Trading

Chart of Accounts

Assets Income

101 Cash 401 Sales

110 Notes Receivable 402 Sales Returns and Allowances

112 Accounts Receivable 403 Sales Discounts

113 Allowance for Doubtful Accounts 410 Commissions Revenue

120 Interest Receivable 411 Interest Revenue

122 Merchandise Inventory

130 Supplies Cost

132 Prepaid Rent 510 Purchases

134 Prepaid Insurance 512 Purchases Returns and Allowances

140 Land 514 Purchases Discount

150 Building 516 Freight-in

151 Accumulated Depreciation - Building

160 Equipment Expenses

161 Accumulated Depreciation - Equipment 520 Insurance Expense

522 Supplies Expense

Liabilities 525 Rent Expense

210 Notes Payable 530 Doubtful Accounts Expense

212 Accounts Payable 540 Depreciation Expense - Building

220 Interest Payable 545 Depreciation Expense - Equipment

225 Unearned Commissions Revenue 550 Interest Expense

560 Loss on Sale of Equipment

Owner’s Equity 580 Miscellaneous Expense

301 Y. Ghana, Capital

302 Y. Ghana, Drawing

350 Income Summary

The following are the account balances of Easy Q Trading on December 31, 2019, the end of a

semi-annual period.

Cash P 15,060 Y. Ghana, Drawing 4,500

Notes Receivable 4,000 Sales 827,600

Accounts Receivable 75,000 Sales Returns and Allowances 1,200

Allowance for Doubtful Accounts 500 Sales Discounts 920

Merchandise Inventory, July 1, 2019 120,000 Commissions Revenue 760

Prepaid Rent 3,600 Interest Revenue 450

Land 50,000 Purchases 630,800

Building 300,000 Purchases Returns and Allowances 1,600

Accumulated Depreciation - Building 90,000 Purchases Discount 5,000

Equipment 12,000 Freight-in 2,200

Accumulated Depreciation - Equipment 4,200 Insurance Expense 2,400

Notes Payable 6,000 Supplies Expense 2,200

Accounts Payable 26,000 Loss on Sale of Equipment 330

Y.Ghana, Capital 263,300 Miscellaneous Expense 1,200

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 10

2ND SEMESTER A.Y. 2019-2020

Additional Information:

a. Supplies used during the period amounted to P1,700.

b. Payment of rental of an out-of-town bodega made at the start of the period is good for 3 years.

c. Unearned commissions at the end of the year, P120.

d. The insurance is a one-year premium on fire insurance policy effective September 1, 2019.

e. Estimated uncollectible accounts, 3% of outstanding customer’s accounts.

f. Estimated annual rate of depreciation: Building 5%; Equipment 10%.

g. The notes payable represents a 120-day 12% note dated October 2, 2019. Interest and principal are

payable at maturity date.

h. The notes receivable represents a 90-day 6% note dated December 1, 2019. Interest and principal are

collectible at maturity date.

i. Unsold merchandise at the close of the year amounted to P160,000.

Requirements:

1. Prepare a 12-column and a 10-column worksheet. (Please see worksheets on a separate file)

2. Journalize the adjusting entries.

3. Prepare the income statement using the natural and functional presentation of expenses.

4. Prepare the statement of changes in owner’s equity.

5. Prepare a classified statement of financial position in report form.

6. Journalize the closing entries.

7. Prepare the post-closing trial balance.

8. Prepare the reversing entries.

ADJUSTING ENTRIES

2019 Particulars Debit Credit

Dec 31 Supplies 500

Supplies Expense 500

Unused supplies

Rent Expense 600

Prepaid Rent 600

Expired rental

Commissions Revenue 120

Unearned Commissions Revenue 120

Unearned commissions

Prepaid Insurance 1,600

Insurance Expense 1,600

Unexpired insurance

Doubtful Accounts Expense 1,750

Allowance for Doubtful Accounts 1,750

Uncollectible accounts for the period

Depreciation Expense - Building 7,500

Accumulated Depreciation - Building 7,500

Depreciation for six months

Depreciation Expense - Equipment 600

Accumulated Depreciation -Equipment 600

Depreciation for six months

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 11

2ND SEMESTER A.Y. 2019-2020

2019 Particulars Debit Credit

Dec 31 Interest Expense 180

Interest Payable 180

Unpaid Interest (P6,000 x 0.12 x 90/360)

Interest Receivable 20

Interest Revenue 20

Accrued interest earned (P4,000 x 0.06 x 30/360)

Income Summary 120,000

Merchandise Inventory - July 1 120,000

To close merchandise inventory beginning

Merchandise Inventory - December 31 160,000

Income Summary 160,000

To set up inventory end

Methods used for deferrals depend on the given account from the unadjusted trial balance. For

prepayments, Asset method is used when the given account is an asset (letter b) and Expense method

when the given is an expense (letters a & d). For pre-collections, Liability Method is used when a liability

account is given and Income Method for an income account (letter c). Percentage of receivables is used

for uncollectible accounts (letter e). Straight-line method is assumed for depreciation (letter f). Interests

are accrued (letters g & h). The last two journal entries (letter i) are part of the end of the accounting

period adjustments if the company is using the Adjusting Entry Method. These adjusting entries will be

recorded in the general journal and thereafter will be posted to the general ledger. The adjusted

balances obtained for each account are the balances that will be reflected in the company’s financial

statements.

FINANCIAL STATEMENTS

Natural Presentation

Easy Q Trading

Income Statement

For the semi-annual ended December 31, 2019

Sales P 827,600

Less Sales Returns and Allowances P 1,200

Sales Discounts 920 2,120

Net Sales P 825,480

Add Other Income and Gains:

Commissions Revenue P 640

Interest Revenue 470 1,110

Total Income P 826,590

Less Expenses:

Increase in Inventory P (40,000)

Net Purchases 626,400

Insurance Expense 800

Supplies Expense 1,700

Rent Expense 600

Doubtful Accounts Expense 1,750

Depreciation Expense - Building 7,500

Depreciation Expense - Equipment 600

Miscellaneous Expense 1,200

Other Expenses and Losses:

Loss on Sale of Equipment 330

Finance Costs:

Interest Expense 180 601,060

Net Income Before Tax P 225,530

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 12

2ND SEMESTER A.Y. 2019-2020

Functional Presentation

Easy Q Trading

Income Statement

For the semi-annual ended December 31, 2019

Sales P 827,600

Less Sales Returns and Allowances P 1,200

Sales Discounts 920 2,120

Net Sales P 825,480

Less Cost of Goods Sold:

Merchandise Inventory, July 1, 2019 P 120,000

Add Net Purchases:

Gross Purchases P 630,800

Add Freight-in 2,200

Total P 633,000

Less Purchases Returns and Allowances P 1,600

Purchases Discounts 5,000 6,600 626,400

Cost of Goods Available for Sale P 746,400

Less Merchandise Inventory, December 31 160,000 586,400

Gross Profit or Gross Margin or Gross Income P 239,080

Add Other Revenues and Gains:

Commissions Revenue P 640

Interest Revenue 470 1,110

Total Income P 240,190

Less Expenses:

Selling Expenses:

Doubtful Accounts Expense P 1,750

General and Administrative Expenses:

Insurance Expense P 800

Supplies Expense 1,700

Rent Expense 600

Depreciation Expense - Building 7,500

Depreciation Expense - Equipment 600

Miscellaneous Expense 1,200 12,400

Other Expenses and Losses:

Loss on Sale of Equipment 330

Finance Costs:

Interest Expense 180 14,660

Net Income Before Tax P 225,530

Easy Q Trading

Statement of Changes in Owner’s Equity

For the semi-annual ended December 31, 2019

Y. Ghana, Capital - July 1, 2019 P 263,300

Add Net Income 225,530

Total P 488,830

Less Y. Ghana, Drawing 4,500

Y. Ghana, Capital - December 31, 2019 P 484,330

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 13

2ND SEMESTER A.Y. 2019-2020

Report Form

Easy Q Trading

Statement of Financial Position

December 31, 2019

Assets

Current Assets:

Cash P 15,060

Notes Receivable 4,000

Accounts Receivable P 75,000

Allowance for Doubtful Accounts 2,250 72,750

Interest Receivable 20

Merchandise Inventory 160,000

Supplies 500

Prepaid Rent 3,000

Prepaid Insurance 1,600

Total Current Assets P 256,930

Non-current Assets:

Property, Plant and Equipment:

Land P 50,000

Building P 300,000

Less Accumulated Depreciation - Building 97,500 202,500

Equipment P 12,000

Less Accumulated Depreciation - Equipment 4,800 7,200 259,700

Total Assets P 516,630

Liabilities and Owner’s Equity

Current Liabilities:

Notes Payable P 6,000

Accounts Payable 26,000

Interest Payable 180

Unearned Commissions Revenue 120

Total Liabilities P 32,300

YY. Ghana, Capital 484,330

Total Liabilities and Owner’s Equity P 516,630

CLOSING ENTRIES

2019 Particulars Debit Credit

Dec 31 Sales 827,600

Commissions Revenue 640

Interest Revenue 470

Purchases Returns and Allowances 1,600

Purchases Discount 5,000

Income Summary 835,310

To close nominal accounts with credit balances

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 14

2ND SEMESTER A.Y. 2019-2020

2019 Particulars Debit Credit

Dec 31 Income Summary 649,780

Sales Returns and Allowances 1,200

Sales Discounts 920

Purchases 630,800

Freight-in 2,200

Insurance Expense 800

Supplies Expense 1,700

Rent Expense 600

Doubtful Accounts Expense 1,750

Depreciation Expense - Building 7,500

Depreciation Expense - Equipment 600

Interest Expense 180

Loss on Sale of Equipment 330

Miscellaneous Expense 1,200

To close nominal accounts with debit balances

Income Summary 225,530

Y. Ghana, Capital 225,530

To close income summary account

Y. Ghana, Capital 4,500

Y. Ghana, Drawing 4,500

To close drawing to capital

The second to the last closing entry is the entry needed to close the credit excess balance of the Income

Summary account in the ledger which at the same time is the entry to record the net profit for six (6)

months.

Easy Q Trading

Post-closing Trial Balance

December 31, 2019

Account Titles Debit Credit

Cash P 15,060

Notes Receivable 4,000

Accounts Receivable 75,000

Allowance for Doubtful Accounts P 2,250

Interest Receivable 20

Merchandise Inventory 160,000

Supplies 500

Prepaid Rent 3,000

Prepaid Insurance 1,600

Land 50,000

Building 300,000

Accumulated Depreciation - Building 97,500

Equipment 12,000

Accumulated Depreciation - Equipment 4,800

Notes Payable 6,000

Accounts Payable 26,000

Interest Payable 180

Unearned Commissions Revenue 120

Y. Ghana, Capital 484,330

Total P 621,180 P 621,180

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 15

2ND SEMESTER A.Y. 2019-2020

The post-closing trial balance is prepared from the permanent accounts in the general ledger.

Remember that the balance of each account is computed after every posting. This post-closing trial

balance provides evidence that the journalizing and posting of closing entries have been properly

completed and shows that the accounting equation is in balance at the end of an accounting period. But

just like any other trial balance, it does not prove that all transactions have been recorded or that the

ledger is accurate. It will still balance even if there was an omission in journalizing or posting or even if

there was duplication in journalizing and posting a transaction.

NATURE OF REVERSING ENTRIES

After the books have been closed and the post-closing trial balance has proven the equality of the debits

and credits in the ledger, certain adjusting entries have an important effect on otherwise routine

transactions that occur in the next accounting period and so it is preferable to prepare the so-called

reversing entries. These reversing entries are optional (which means that they may or may not be made)

and if made, they shall be dates as of the first day of the next accounting period.

The use of reversing entries generally simplifies the analysis of transactions and reduces the likelihood

of errors in the subsequent recording of transactions. They are made for convenience and consistency in

the handling of accrued and deferred items. Only the following adjusting entries will be reversed:

1. Accrued or Uncollected Revenues

2. Accrued or Unpaid Expenses

3. Unearned Income under Income Method

4. Prepaid Expenses under the Expense Method

Such reversing entry made eliminates the balance of a statement of financial position account that was

recognized in the adjusting entry. These reversing entries are posted to the general ledger after which

the books are ready for the next accounting period and the successive steps in the accounting cycle are

then repeated. With the increased use of computerized accounting systems , data entry personnel may

be inputting routine accounting entries. In such an environment, reversing entries may be useful, since

these individuals may not recognize the impact of adjusting entries on the related transactions in the

following period.

REVERSING ENTRY FOR ACCRUED INCOME

Accrued Income for the present accounting period is usually collected in the next accounting period. If

no reversing entry is made, this accrued income when received in the future must necessarily be

credited to the Accrued Income account. However, if there is a reversing entry, all income collected in

the future, whether accrued or not, can be uniformly credited to the Income account. To illustrate the

optional use of reversing entries, consider the given cases below:

Case 1

During the month of December, only P20,000 out of the agreed monthly rental of P50,000 was collected

on December 23. An adjusting entry was made on December 31, 2019 for the uncollected rental of

P30,000. On January 18, 2020, the accrued rental of P30,000 and the January rental were received.

With Reversing Entry Without Reversing Entry

12/23/19 Cash 20,000 12/23/19 Cash 20,000

Rent Revenue 20,000 Rent Revenue 20,000

Partial collection for Partial collection for

December rental December rental

12/31/19 Rent Receivable 30,000 12/31/19 Rent Receivable 30,000

Rent Revenue 30,000 Rent Revenue 30,000

Accrued December rental Accrued December rental

12/31/19 Rent Revenue 50,000 12/31/19 Rent Revenue 50,000

Income Summary 50,000 Income Summary 50,000

To close revenue account To close revenue account

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 16

2ND SEMESTER A.Y. 2019-2020

With Reversing Entry Without Reversing Entry

1/1/2020 Rent Revenue 30,000 No Reversing entry is made.

Rent Receivable 30,000

To reverse the adjusting entry

1/18/2020 Cash 80,000 1/18/2020 Cash 80,000

Rent Revenue 80,000 Rent Receivable 30,000

Collected the balance from the Rent Revenue 50,000

December rental and also the Collected the balance from the

January rental December rental and also the

January rental

You will notice in the above illustration that when a reversing entry is made, the subsequent collections

will be credited outright to a revenue account since the asset account Rent Receivable is eliminated or

closed after posting the reversing entry in the general ledger.

REVERSING ENTRY FOR ACCRUED EXPENSE

Accrued Expenses of the current period are usually paid in the next accounting period. If the adjusting

entries for accrued expenses are not reversed, the payment of accrued expenses in the next accounting

period must necessarily be debited to a Payable or Accrued Expense account. However, if there are

reversing entries for these items, all expenses paid in the future, whether accrued or not, can be

consistently debited to the Expense account.

Case 2

On December 31, 2019, the company has accrued taxes amounting to P1,500. On January 3`, 2020,

taxes amounting to P2,000 are paid which included the accrual from last year.

With Reversing Entry Without Reversing Entry

12/31/19 Taxes 1,500 12/31/19 Taxes 1,500

Taxes Payable 1,500 Taxes Payable 1,500

Unpaid taxes in 2019 Unpaid taxes in 2019

12/31/19 Income Summary 1,500 12/31/19 Income Summary 1,500

Taxes 1,500 Taxes 1,500

To close an expense account To close an expense account

1/1/2020 Taxes Payable 1,500 No Reversing entry is made.

Taxes 1,500

To reverse the adjusting entry

1/31/2020 Taxes 2,000 1/31/2020 Taxes 500

Cash 2,000 Taxes Payable 1,500

Paid the December accrued taxes Cash 2,000

and also the tax due in January Paid the December accrued taxes

and also the tax due in January

As illustrated in case no. 2, when reversing entry is made, subsequent payment of expenses will be

debited or charged to an expense account that is equal to the actual amount paid. This means that the

January 31, taxes being an expense account will be debited for the amount paid since the liability

account Taxes Payable is eliminated or closed after the reversing entry is posted to the general ledger.

Whether the bookkeeper opted to prepare the reversing entries or not, both will have the same effect

on the accounting records provided that they are accurately recorded in the books.

The entry to record the subsequent collection of an accrued revenue or the subsequent payment of an

accrued expense will depend on whether a reversing entry is made or not.

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 17

2ND SEMESTER A.Y. 2019-2020

The reversing entries of Easy Q Trading are shown below:

2020 Particulars Debit Credit

Jan 1 Supplies Expense 500

Supplies 500

Unearned Commissions Revenue 120

Commissions Revenue 120

Insurance Expense 1,600

Prepaid Insurance 1,600

Interest Payable 180

Interest Expense 180

Interest Revenue 20

Interest Receivable 20

You will notice that in reversing entries as shown above, a statement of financial position or balance

sheet account is recorded opposite to its normal balance, thereby closing or eliminating the balance of

that account. At this point, you know already the reason or reasons why it is preferable to put up

reversing entries in the books. The use of reversing entries will not change the amounts reported in the

financial statements. They will only simplify the recording of the subsequent transactions.

Finally, all is well that ends well. May you have understood the lessons despite being deprived from the

conventional learning system. This is quite a struggle to all of you. Nevertheless, this pandemic will not

stop you from acquiring the power of knowledge. May you continue to seek more information from

your day-to-day experiences in order to achieve greater glory. As future accountants and businessmen,

always remember to act, count and think. Take care and God bless.

“Act. Count. Think.”

Stay safe and healthy everyone! :)

-End-

Joemel D. Dakay, CPA

Steffi Kay D. Pantino, CPA

Earnst John M. Quijano, CPA

Acc 01 Teachers

ACC 01 | Fundamentals of Accountancy, Business and Management Part 1 18

You might also like

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Small Business Accounting Guide to QuickBooks Online: A QuickBooks Online Cheat Sheet for Small Businesses, Churches, and NonprofitsFrom EverandSmall Business Accounting Guide to QuickBooks Online: A QuickBooks Online Cheat Sheet for Small Businesses, Churches, and NonprofitsNo ratings yet

- Chapter 5 Estimation of Doubtful Accounts 5 PDF FreeDocument8 pagesChapter 5 Estimation of Doubtful Accounts 5 PDF FreeryseNo ratings yet

- 8.7.1 Allowance MethodDocument5 pages8.7.1 Allowance MethodAkkamaNo ratings yet

- Module 6 - Estimation of Doubtful AccountsDocument4 pagesModule 6 - Estimation of Doubtful Accountsjustine cabanaNo ratings yet

- Intermediate Accounting 1 Receivables DIY ProblemsDocument11 pagesIntermediate Accounting 1 Receivables DIY ProblemsMay Ramos100% (1)

- Audit of Receivable PDFDocument7 pagesAudit of Receivable PDFRyan Prado Andaya100% (1)

- 08 - Receivables PDFDocument2 pages08 - Receivables PDFJamie ToriagaNo ratings yet

- Chapter 11 Adjusting EntriesDocument91 pagesChapter 11 Adjusting EntriesMelessa Pescador100% (1)

- Audit Receivables Part 1 ProgramDocument19 pagesAudit Receivables Part 1 ProgramErika PanganNo ratings yet

- Required Ending Allowance For Doubtful AccountsDocument4 pagesRequired Ending Allowance For Doubtful AccountsAngelica SamonteNo ratings yet

- Estimating Doubtful AccountsDocument24 pagesEstimating Doubtful Accountsジェロスミ プエブラスNo ratings yet

- Accounting Cycle StepsDocument18 pagesAccounting Cycle Stepsyna kyleneNo ratings yet

- Acc CH 4Document16 pagesAcc CH 4Tajudin Abba RagooNo ratings yet

- FABM1 Q4 M1 Preparing-Adjusting-EntriesDocument14 pagesFABM1 Q4 M1 Preparing-Adjusting-EntriesXedric JuantaNo ratings yet

- RecivablesDocument12 pagesRecivablesGizaw BelayNo ratings yet

- ARSOP 2.0 Allowance For Doubtful AccountsDocument5 pagesARSOP 2.0 Allowance For Doubtful AccountsSelenge DaaduuNo ratings yet

- ACC101 - Accounting for ReceivablesDocument15 pagesACC101 - Accounting for Receivablesinfinite_dreamsNo ratings yet

- Acc CH 4Document15 pagesAcc CH 4Bicaaqaa M. AbdiisaaNo ratings yet

- Chapter 4.3 Accounts ReceivableDocument5 pagesChapter 4.3 Accounts ReceivableCABRERA ABIGAIL P.No ratings yet

- Module 2 - Topic 2 (Estimation of Doubtful Accounts)Document6 pagesModule 2 - Topic 2 (Estimation of Doubtful Accounts)GRACE ANN BERGONIONo ratings yet

- CH09Document28 pagesCH09Will TrầnNo ratings yet

- VII-ADJUSTING Answer ENTRIES-DOUBTFUL ACCOUNTSDocument4 pagesVII-ADJUSTING Answer ENTRIES-DOUBTFUL ACCOUNTSHassanhor Guro BacolodNo ratings yet

- INTACC 1: Trade and Other ReceivablesDocument6 pagesINTACC 1: Trade and Other Receivablesdanica rozelNo ratings yet

- Audit of Accounts ReceivablesDocument5 pagesAudit of Accounts ReceivablesIzza Mae Rivera KarimNo ratings yet

- I. Multiple ChoicesDocument7 pagesI. Multiple ChoicesAlain Fung Land MakNo ratings yet

- Unit 3: Completion of The Accounting Cycle For A Merchandising BusinessDocument8 pagesUnit 3: Completion of The Accounting Cycle For A Merchandising BusinessChristine Joyce MagoteNo ratings yet

- Irrecoverable Debts & Provision For Irrecoverables DebtsDocument5 pagesIrrecoverable Debts & Provision For Irrecoverables DebtsYomi AmvNo ratings yet

- Regression Analysis MethodDocument6 pagesRegression Analysis MethodMiccah Jade CastilloNo ratings yet

- ReceivablesDocument61 pagesReceivablesJeanetteNo ratings yet

- Manage Receivables RiskDocument15 pagesManage Receivables RiskJean BritoNo ratings yet

- Cash To Accrual Single Entry With AnswersDocument9 pagesCash To Accrual Single Entry With AnswersHazel PachecoNo ratings yet

- 01 - Accounting For Trades and Other ReceivablesDocument5 pages01 - Accounting For Trades and Other ReceivablesCatherine CaleroNo ratings yet

- Accounts Receivable Recognition, Measurement and Estimating Bad DebtsDocument4 pagesAccounts Receivable Recognition, Measurement and Estimating Bad DebtsMisiah Paradillo JangaoNo ratings yet

- FAR 2 Answer KeyDocument5 pagesFAR 2 Answer KeyMary Rose VillamorNo ratings yet

- CASH TO ACCRUAL SINGLE ENTRY With ANSWERSDocument8 pagesCASH TO ACCRUAL SINGLE ENTRY With ANSWERSRaven SiaNo ratings yet

- Financial Accounting, 4eDocument47 pagesFinancial Accounting, 4eEka Aliyah FauziNo ratings yet

- CFAS AR Methods of EstimationDocument3 pagesCFAS AR Methods of EstimationRojun Kristufer MedenillaNo ratings yet

- Administer Subsidiary Accounts and Ledgers GuideDocument42 pagesAdminister Subsidiary Accounts and Ledgers Guidegizachew alekaNo ratings yet

- ACC101 Chapter7new PDFDocument23 pagesACC101 Chapter7new PDFJana Kryzl DibdibNo ratings yet

- Audit of Receivables CaseDocument4 pagesAudit of Receivables CaseJohn Victor Mancilla MonzonNo ratings yet

- Chapter 9 - Accounting For ReceivablesDocument10 pagesChapter 9 - Accounting For ReceivablesMajan Kaur100% (1)

- HW On Receivables CDocument5 pagesHW On Receivables CAmjad Rian MangondatoNo ratings yet

- ADJUSTING ENTRIES Part 3Document5 pagesADJUSTING ENTRIES Part 3MOCHI SSABELLENo ratings yet

- Bad Debt Expense $ 7,100 Sales Returns and Allowances (40,000)Document8 pagesBad Debt Expense $ 7,100 Sales Returns and Allowances (40,000)Miccah Jade CastilloNo ratings yet

- Revenue Recognition and Receivables ExplainedDocument24 pagesRevenue Recognition and Receivables ExplainedKapil GoyalNo ratings yet

- Impairment of ReceivablesDocument15 pagesImpairment of ReceivablesNicole Daphne FigueroaNo ratings yet

- Adamson University Intermediate Accounting 1 quizDocument8 pagesAdamson University Intermediate Accounting 1 quizKhai Ed PabelicoNo ratings yet

- Accounting Concepts and PrinciplesDocument30 pagesAccounting Concepts and PrinciplesKristine Lei Del MundoNo ratings yet

- BAC 223 Topic TwoDocument39 pagesBAC 223 Topic TwoGABRIEL KAMAU KUNG'UNo ratings yet

- Accounting Concepts and Principles ExplainedDocument16 pagesAccounting Concepts and Principles ExplainedKristine Lei Del MundoNo ratings yet

- Accounting For Receivables PDFDocument23 pagesAccounting For Receivables PDFjess calderonNo ratings yet

- Day 1A - Receivables - AM SeatworkDocument7 pagesDay 1A - Receivables - AM SeatworkdgdeguzmanNo ratings yet

- M7F Adjusting Process Doubtful AccountsDocument6 pagesM7F Adjusting Process Doubtful AccountsCharles Eli AlejandroNo ratings yet

- ValixDocument12 pagesValixJESTONI RAMOSNo ratings yet

- Unit 9Document5 pagesUnit 9Anonymous Fn7Ko5riKTNo ratings yet

- Accounting For ReceivablesDocument19 pagesAccounting For ReceivablesMrinal Kanti DasNo ratings yet

- Accounts Receivable ManagementDocument3 pagesAccounts Receivable ManagementPeter KoprdaNo ratings yet

- ACC 255 08 OutlineDocument9 pagesACC 255 08 Outlineadi zilbrshtiinNo ratings yet

- ReceivablesDocument58 pagesReceivablesHannah OrosNo ratings yet

- Unemployment 1Document18 pagesUnemployment 1Hans MosquedaNo ratings yet

- Mark LogoDocument1 pageMark LogoHans MosquedaNo ratings yet

- Rationale+Significance of StudyDocument5 pagesRationale+Significance of StudyHans MosquedaNo ratings yet

- Perfromance Task 1: Tech 01S Applying The Basics of Image Editing and Photo EffectsDocument6 pagesPerfromance Task 1: Tech 01S Applying The Basics of Image Editing and Photo EffectsHans MosquedaNo ratings yet

- Chapter 1, Lesson 1: A Framework For MarketingDocument7 pagesChapter 1, Lesson 1: A Framework For MarketingVinza AcobNo ratings yet

- Mark LogoDocument1 pageMark LogoHans MosquedaNo ratings yet

- PALIHUGPRINTDocument62 pagesPALIHUGPRINTHans MosquedaNo ratings yet

- Summary Sheet - Group 3 Block BDocument13 pagesSummary Sheet - Group 3 Block BHans MosquedaNo ratings yet

- Double Elimination Tournament ExplainedDocument11 pagesDouble Elimination Tournament ExplainedHans MosquedaNo ratings yet

- OKAYNANIDocument84 pagesOKAYNANIHans MosquedaNo ratings yet

- Rev1 41Document49 pagesRev1 41Hans MosquedaNo ratings yet

- Key Activities 8. Key Partners 1. Value Propositions 4. Customer Relationships 2. Customer SegmentsDocument3 pagesKey Activities 8. Key Partners 1. Value Propositions 4. Customer Relationships 2. Customer SegmentsHans MosquedaNo ratings yet

- PALIHUGPRINTDocument62 pagesPALIHUGPRINTHans MosquedaNo ratings yet

- All Referneces MGTDocument6 pagesAll Referneces MGTHans MosquedaNo ratings yet

- Application For Registration: Republic of The Philippines Department of Finance Bureau of Internal Revenue BIR Form NoDocument4 pagesApplication For Registration: Republic of The Philippines Department of Finance Bureau of Internal Revenue BIR Form Nophoebemariealhambra1475No ratings yet

- Introduction to Table Tennis Equipment & RulesDocument10 pagesIntroduction to Table Tennis Equipment & RulesHans MosquedaNo ratings yet

- Revised Chap 1-40Document4 pagesRevised Chap 1-40Hans MosquedaNo ratings yet

- ENGDocument3 pagesENGHans MosquedaNo ratings yet

- Key Activities 8. Key Partners 1. Value Propositions 4. Customer Relationships 2. Customer SegmentsDocument3 pagesKey Activities 8. Key Partners 1. Value Propositions 4. Customer Relationships 2. Customer SegmentsHans MosquedaNo ratings yet

- Table TennisDocument16 pagesTable TennisHans MosquedaNo ratings yet

- Table TennisDocument16 pagesTable TennisHans MosquedaNo ratings yet

- Sample Salon Business ModelDocument1 pageSample Salon Business ModelHans MosquedaNo ratings yet

- Roles and Responsibilities of Table Tennis OfficialsDocument3 pagesRoles and Responsibilities of Table Tennis OfficialsHans Mosqueda100% (1)

- BusmodelfinalDocument1 pageBusmodelfinalHans MosquedaNo ratings yet

- Logistics of Low Cost Country SourcingDocument19 pagesLogistics of Low Cost Country SourcingrnaveeNo ratings yet

- Financial Statement Analysis: True or FalseDocument24 pagesFinancial Statement Analysis: True or FalseGabrielle Marie RiveraNo ratings yet

- Ratio Analysis of IJMDocument26 pagesRatio Analysis of IJMawaismaqbool83% (6)

- Akoto-Lamptey Lois 2012 Tesis - InglesDocument70 pagesAkoto-Lamptey Lois 2012 Tesis - InglesMichael Alexander Respicio LazoNo ratings yet

- AckmidtocDocument9 pagesAckmidtocraakesh_rrNo ratings yet

- Ashok Leyland A9Document19 pagesAshok Leyland A9Nupoor JainNo ratings yet

- The Perfect Order SEBDocument7 pagesThe Perfect Order SEBEduardo El Khouri BuzatoNo ratings yet

- Leading Erp Software: For Growing ManufacturersDocument5 pagesLeading Erp Software: For Growing ManufacturersManan TyagiNo ratings yet

- AFAR 1 - Flexible Learning Module - Midterm Topic 1 - Cost Concepts and Cost BehaviorDocument19 pagesAFAR 1 - Flexible Learning Module - Midterm Topic 1 - Cost Concepts and Cost BehaviorKezNo ratings yet

- Multiple Choice Quiz: Interactive OM Updates and ErrataDocument2 pagesMultiple Choice Quiz: Interactive OM Updates and ErrataLaura Carson0% (1)

- Online Auction Company - Business Plan1Document17 pagesOnline Auction Company - Business Plan1Chittranshu VermaNo ratings yet

- Rasna's Internal Analysis and Strengths Supported its International Expansion StrategyDocument42 pagesRasna's Internal Analysis and Strengths Supported its International Expansion StrategyKim TeayungNo ratings yet

- 2 Week Activity Predetermined OH Rates and Separating Mixed CostsDocument6 pages2 Week Activity Predetermined OH Rates and Separating Mixed CostsAlrac GarciaNo ratings yet

- PresentationDocument50 pagesPresentationapi-351891588No ratings yet

- Heizer - 01 Operations and ProductivityDocument37 pagesHeizer - 01 Operations and ProductivityDawood HusainNo ratings yet

- Cost II Chap I-1Document52 pagesCost II Chap I-1Etsub SamuelNo ratings yet

- Project Report On Times of IndiaDocument50 pagesProject Report On Times of IndiaPradeep Astropy BhuvaNo ratings yet

- Case - The Oakland School DistrictDocument3 pagesCase - The Oakland School DistrictTaimoorMasood0% (1)

- Reading 13 Integration of Financial Statement Analysis TechniquesDocument15 pagesReading 13 Integration of Financial Statement Analysis Techniquestaichinhtientien62aNo ratings yet

- Computer Role in Modern AccountingDocument10 pagesComputer Role in Modern AccountingSanjeet Kumar100% (6)

- Optimize SAP APO PPDS Production Planning and Detailed SchedulingDocument77 pagesOptimize SAP APO PPDS Production Planning and Detailed Schedulingmanish161286% (7)

- Solution Chapter 11Document38 pagesSolution Chapter 11Anonymous CuUAaRSNNo ratings yet

- Real Estate Development - Accounting ChallengesCADocument35 pagesReal Estate Development - Accounting ChallengesCA891966100% (1)

- The 5 C's of BankingDocument5 pagesThe 5 C's of BankingEman SultanNo ratings yet

- 8-Understand The Concept of Perpetual and Periodic InventoryDocument60 pages8-Understand The Concept of Perpetual and Periodic InventoryAyesha TahirNo ratings yet

- MBA 2nd Semester Operations Management Study MaterialDocument140 pagesMBA 2nd Semester Operations Management Study MaterialViraja GuruNo ratings yet

- Making Money For Business: Currencies, Profit, and Long-Term Thinking by B. Lietaer and G. HallsmithDocument6 pagesMaking Money For Business: Currencies, Profit, and Long-Term Thinking by B. Lietaer and G. Hallsmithuser909No ratings yet

- SYLLABUS PHAD 1 EditedDocument5 pagesSYLLABUS PHAD 1 Edited;'SiLeNt';No ratings yet

- What Is LIFO Reserve - Definition Meaning ExampleDocument6 pagesWhat Is LIFO Reserve - Definition Meaning ExampleDanish HameedNo ratings yet

- Week 8 Homework - Part 2 - Financial AccountingDocument5 pagesWeek 8 Homework - Part 2 - Financial Accountinglamvolamvo0912No ratings yet