Professional Documents

Culture Documents

Topic 1: Introduction To Financial Accounting

Uploaded by

kietOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 1: Introduction To Financial Accounting

Uploaded by

kietCopyright:

Available Formats

Topic 1: Introduction to Financial Accounting

Jenny set up her catering business on 1 June 2020. For the month of June 2020, the following

transactions occurred:

(1) Jenny purchased equipment for $9,000. She paid $3,000 cash and agreed to pay the

balance in 90 days.

(2) She paid wages of $1,500.

(3) She paid $500 for an advertisement in the local newspaper.

(4) She obtained a bank loan for $20,000 to finance the expansion of her business.

(5) She put $5,000 of her own money into the business.

(6) Jenny sent bills for $2,000 to customers for services provided in June. She had

received $500 by 30 June, and expected the other $1,500 in July.

Required: Record the transactions as they would affect the accounting equation.

Solution

Assets = Liabilities + Owners’ Equity

A = L + OE

(1) Equipment 9,000 Accounts Payable 6,000

Cash 3,000

(2) Cash 1,500 Wages 1,500

(3) Cash 500 Advertising expense 500

(4) Cash 20,000 Loan 20,000

(5) Cash 5,000 Capital 5,000

(6) Accounts Receivable 2,000 Sales 2,000

Accounts Receivable 500

Cash 500

You might also like

- HUM 121assignment 1Document6 pagesHUM 121assignment 1Nayeem HossainNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Revision ch1&2 1thDocument23 pagesRevision ch1&2 1thYousefNo ratings yet

- Tan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMDocument6 pagesTan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMvanessaNo ratings yet

- Problems: Set C: InstructionsDocument2 pagesProblems: Set C: InstructionsRabie HarounNo ratings yet

- Adjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingDocument9 pagesAdjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingHassan AliNo ratings yet

- Quizzes - Chapter 9 - Acctg Cycle of A Service BusinessDocument12 pagesQuizzes - Chapter 9 - Acctg Cycle of A Service BusinessAmie Jane Miranda50% (4)

- Accounting Analysis of TransactionsDocument14 pagesAccounting Analysis of TransactionscamilleNo ratings yet

- CH 01Document2 pagesCH 01flrnciairnNo ratings yet

- Name: Lecturer: Course Name: Course CodeDocument6 pagesName: Lecturer: Course Name: Course CodeJaredNo ratings yet

- 2020-06 Icmab FL 001 Pac Year Question June 2020Document3 pages2020-06 Icmab FL 001 Pac Year Question June 2020Mohammad ShahidNo ratings yet

- ACT301-Midterm Exam-Fall2020Document4 pagesACT301-Midterm Exam-Fall2020Sadiya PraptiNo ratings yet

- Quiz 9 FinacrDocument9 pagesQuiz 9 FinacrJen Ner100% (5)

- QUIZ 9 fINACRDocument9 pagesQUIZ 9 fINACRJen NerNo ratings yet

- Chapter 01 Transaction AnalysisDocument28 pagesChapter 01 Transaction Analysistanvir ahmedNo ratings yet

- Assignment POSTING TO THE LEDGERDocument7 pagesAssignment POSTING TO THE LEDGERJie SapornaNo ratings yet

- Question BankDocument21 pagesQuestion BankIan ChanNo ratings yet

- AHM13e - Chapter 01 - Key To EOC Problems and CasesDocument14 pagesAHM13e - Chapter 01 - Key To EOC Problems and CasesArunesh SN100% (1)

- ch01 PDFDocument2 pagesch01 PDFDanish BaigNo ratings yet

- Accounting Equation. AccountancyDocument3 pagesAccounting Equation. AccountancySmart GamerNo ratings yet

- Accounting Assignment1Document4 pagesAccounting Assignment1Muhammad HannanNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Vol. 1, Chapter 1 - Introduction To Accounting: Problem 1Document8 pagesVol. 1, Chapter 1 - Introduction To Accounting: Problem 1greenwellNo ratings yet

- Past Papers For Single Entry and Incomplete RecordsDocument2 pagesPast Papers For Single Entry and Incomplete RecordsMahreena IlyasNo ratings yet

- Xi Annual NewDocument5 pagesXi Annual NewPragadeshwar KarthikeyanNo ratings yet

- ACT301 Assignment-1.docx FinalDocument2 pagesACT301 Assignment-1.docx FinalPapon SarkerNo ratings yet

- Accounts Paper 1 November 2008Document9 pagesAccounts Paper 1 November 2008Munashe BinhaNo ratings yet

- Accounting Unit 4Document3 pagesAccounting Unit 4Swapan Kumar SahaNo ratings yet

- AFH Important QuestionDocument6 pagesAFH Important Questionmanassadashiv013No ratings yet

- Postal Test Papers - P5 - Intermediate - Syllabus 2012Document27 pagesPostal Test Papers - P5 - Intermediate - Syllabus 2012Viswanathan SrkNo ratings yet

- Suggested Solution: Balance Sheet Beg End Beg EndDocument8 pagesSuggested Solution: Balance Sheet Beg End Beg EndSerien SeaNo ratings yet

- Accounting MockDocument6 pagesAccounting MockGSNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Account AssignmentDocument10 pagesAccount AssignmentkanchanghengNo ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- HW CH2Document3 pagesHW CH2Minh Anh NguyễnNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Removals Exam.Document4 pagesRemovals Exam.Hashanyska JuniNo ratings yet

- Exercise Adjusting Entries To Reversing EntriesDocument2 pagesExercise Adjusting Entries To Reversing EntriesJunmirMalicVillanuevaNo ratings yet

- (Ust-Jpia) Quiz 1 Financial Accounting and Reporting Solution ManualDocument9 pages(Ust-Jpia) Quiz 1 Financial Accounting and Reporting Solution ManualRENZ ALFRED ASTRERONo ratings yet

- FDN J22 - TS 2 - P1 Account - QueDocument5 pagesFDN J22 - TS 2 - P1 Account - QueShantanu JadhavNo ratings yet

- Accounting I Terminal Spring 2021Document3 pagesAccounting I Terminal Spring 2021GuryiaNo ratings yet

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- Ent 2-2Document4 pagesEnt 2-2danielzashleybobNo ratings yet

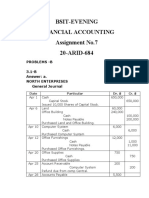

- Assignment No.7 AccountingDocument7 pagesAssignment No.7 Accountingibrar ghaniNo ratings yet

- Revision 1&2Document7 pagesRevision 1&2YousefNo ratings yet

- Michael Pirone Problem 1 (10 Points)Document15 pagesMichael Pirone Problem 1 (10 Points)Michael PironeNo ratings yet

- Accounting Cycle. FAR1Document12 pagesAccounting Cycle. FAR1Gajulin, April JoyNo ratings yet

- Frias Activity 6Document6 pagesFrias Activity 6Lars FriasNo ratings yet

- 1 Accounting Equation UniqueDocument3 pages1 Accounting Equation UniqueSohan AgrawalNo ratings yet

- AssignmentDocument10 pagesAssignmentkulfamorNo ratings yet

- Transaction & Tabular AnalysisDocument18 pagesTransaction & Tabular AnalysisMahmudul Hassan RohidNo ratings yet

- Problem 1: Beginning of Year BalancesDocument2 pagesProblem 1: Beginning of Year Balancesgabriel berwuloNo ratings yet

- Financial Analysis and ReportingDocument5 pagesFinancial Analysis and ReportingHoneyzelOmandamPonce100% (1)

- ACC290 Principles of Accounting IDocument25 pagesACC290 Principles of Accounting IG JhaNo ratings yet

- November 2022: Reg. No.Document7 pagesNovember 2022: Reg. No.kaurkarun7No ratings yet

- Practical Financial Accounting - Volume 1 (Condrado T. Valix)Document369 pagesPractical Financial Accounting - Volume 1 (Condrado T. Valix)Josh CruzNo ratings yet

- Accounting 1 QuizDocument2 pagesAccounting 1 QuizGringo KodetaNo ratings yet

- 2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Document3 pages2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Mohammad ShahidNo ratings yet

- Treatment ProcessesDocument28 pagesTreatment ProcesseskietNo ratings yet

- Water Pinch2aDocument16 pagesWater Pinch2akietNo ratings yet

- Cost EstimationDocument2 pagesCost EstimationkietNo ratings yet

- SummaryDocument3 pagesSummarykietNo ratings yet

- ACF5950-Assignment-2801656-kaidi ZhangDocument13 pagesACF5950-Assignment-2801656-kaidi ZhangkietNo ratings yet

- L3 - Intro To Kemp Pinch SoftwareDocument2 pagesL3 - Intro To Kemp Pinch SoftwarekietNo ratings yet

- ACF5950 - Assignment # 7 Semester 2 2015: The Business Has The Following Opening Balances: Additional InformationDocument2 pagesACF5950 - Assignment # 7 Semester 2 2015: The Business Has The Following Opening Balances: Additional InformationkietNo ratings yet

- Assignment 3Document4 pagesAssignment 3kietNo ratings yet

- AssignmentsDocument2 pagesAssignmentskietNo ratings yet

- Characterization OverallDocument14 pagesCharacterization OverallkietNo ratings yet

- Assignment 2 and 3Document8 pagesAssignment 2 and 3kietNo ratings yet

- Department of Accounting: ACF5950 - Assignment # 350 Semester 1 2015Document2 pagesDepartment of Accounting: ACF5950 - Assignment # 350 Semester 1 2015kietNo ratings yet

- PinchDocument4 pagesPinchkietNo ratings yet

- ACF5950 - Assignment # 109 Semester 2 2014: The Business Has The Following Opening Balances: Additional InformationDocument2 pagesACF5950 - Assignment # 109 Semester 2 2014: The Business Has The Following Opening Balances: Additional InformationkietNo ratings yet

- Delivering Projects: DR Sajad Fayezi Monash Business SchoolDocument27 pagesDelivering Projects: DR Sajad Fayezi Monash Business SchoolkietNo ratings yet

- ACF5950-Assignment-2801656-kaidi ZhangDocument13 pagesACF5950-Assignment-2801656-kaidi ZhangkietNo ratings yet

- Delivering Projects: DR Sajad Fayezi Monash Business SchoolDocument16 pagesDelivering Projects: DR Sajad Fayezi Monash Business SchoolkietNo ratings yet

- Chapter 10 Noncurrent Assets: Discussion QuestionsDocument6 pagesChapter 10 Noncurrent Assets: Discussion QuestionskietNo ratings yet

- Request For Information: AttnDocument1 pageRequest For Information: AttnkietNo ratings yet

- OPM4003 Marking Rubric: Assessment 4 - Individual Research PaperDocument1 pageOPM4003 Marking Rubric: Assessment 4 - Individual Research PaperkietNo ratings yet

- Day 2Document36 pagesDay 2kietNo ratings yet

- Q1 Here Is The Post-Adjustment Trial Balance of Status Cymbal LTD at 30 June 2019Document3 pagesQ1 Here Is The Post-Adjustment Trial Balance of Status Cymbal LTD at 30 June 2019kietNo ratings yet

- Chapter 5 Accrual Accounting Adjustments: Discussion QuestionsDocument7 pagesChapter 5 Accrual Accounting Adjustments: Discussion QuestionskietNo ratings yet

- Chapter 8 Accounts Receivable and Further Record-Keeping: Discussion QuestionsDocument3 pagesChapter 8 Accounts Receivable and Further Record-Keeping: Discussion Questionskiet100% (1)

- Chapter 3 The Double-Entry System: Discussion QuestionsDocument16 pagesChapter 3 The Double-Entry System: Discussion QuestionskietNo ratings yet

- Preworkshop PDFDocument2 pagesPreworkshop PDFkietNo ratings yet

- Modeling and Design of Heat Exchangers in A Solar-Multi Effect Distillation PlantDocument6 pagesModeling and Design of Heat Exchangers in A Solar-Multi Effect Distillation Plantkiet100% (1)

- Set 6 AnsDocument6 pagesSet 6 AnskietNo ratings yet

- Chapter 1 Introduction To Financial Accounting: Discussion QuestionsDocument7 pagesChapter 1 Introduction To Financial Accounting: Discussion QuestionskietNo ratings yet

- PC&I Assignment 4 (2016) Due 311016Document4 pagesPC&I Assignment 4 (2016) Due 311016kietNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingFrom EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingRating: 4.5 out of 5 stars4.5/5 (760)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Excel 2019: The Best 10 Tricks To Use In Excel 2019, A Set Of Advanced Methods, Formulas And Functions For Beginners, To Use In Your SpreadsheetsFrom EverandExcel 2019: The Best 10 Tricks To Use In Excel 2019, A Set Of Advanced Methods, Formulas And Functions For Beginners, To Use In Your SpreadsheetsNo ratings yet

- Beyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!From EverandBeyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!Rating: 4.5 out of 5 stars4.5/5 (8)

- Radically Simple Accounting: A Way Out of the Dark and Into the ProfitFrom EverandRadically Simple Accounting: A Way Out of the Dark and Into the ProfitRating: 4.5 out of 5 stars4.5/5 (9)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackFrom EverandThe Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackRating: 1 out of 5 stars1/5 (1)

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityFrom EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityNo ratings yet

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessFrom EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo ratings yet

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceFrom EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceRating: 4 out of 5 stars4/5 (1)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Bookkeeping: Advance Accounting Principles to Build a Successful Business (Accounting Made Simple for Non Accountants)From EverandBookkeeping: Advance Accounting Principles to Build a Successful Business (Accounting Made Simple for Non Accountants)No ratings yet

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsFrom EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsRating: 4.5 out of 5 stars4.5/5 (2)

- Accounting All-in-One For Dummies, with Online PracticeFrom EverandAccounting All-in-One For Dummies, with Online PracticeRating: 3 out of 5 stars3/5 (1)