0% found this document useful (0 votes)

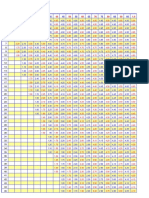

156 views1 pageMACRS Recovery Percentages by Year

This document shows the applicable percentages used to calculate depreciation deductions under the Modified Accelerated Cost Recovery System (MACRS) for different property classes over various years of recovery. Property is placed into classes of 3, 5, 7, 10, 15, or 20 years and each class specifies the depreciation percentage allowed for each year of the recovery period with the highest percentages in the early years declining over time.

Uploaded by

Josselyn SanchezCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

156 views1 pageMACRS Recovery Percentages by Year

This document shows the applicable percentages used to calculate depreciation deductions under the Modified Accelerated Cost Recovery System (MACRS) for different property classes over various years of recovery. Property is placed into classes of 3, 5, 7, 10, 15, or 20 years and each class specifies the depreciation percentage allowed for each year of the recovery period with the highest percentages in the early years declining over time.

Uploaded by

Josselyn SanchezCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd