Professional Documents

Culture Documents

Essay 2

Essay 2

Uploaded by

HernanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Essay 2

Essay 2

Uploaded by

HernanCopyright:

Available Formats

FUSION AVIANCA AND UNITED AIRLINES

Hernan Arias Funieles; 200092917

Avianca Holdings is an air-commercial consortium resulting from the merger of the

Colombian airline Avianca, and the Salvadoran airline TACA, based in Panama City.

Which was created in February 2010 by SYNERGY GROUP, which is the majority

shareholder of this company, whose company belongs to German Efromovich, who bought

Avianca after falling into bankruptcy in 2004 and thus making it the second airline Largest

in Latin America.

SYNERGY GROUP (owner of Avianca) contracted a debt of 450 million dollars, whose

loan was granted by United Airlines, which was agreed to be paid in five annual

installments, where Synergy group used as collateral most of the shares of the company

Avianca Holdings for this loan. This debt was contracted in order to settle a debt that it had

with the Elliot Management Corp. hedge fund. However, the Synergy Group company

failed to comply with one of the financial guarantees that were previously stipulated in the

financing agreement with United Airlines. that allowed United Airlines to take possession

of Avianca's shares and thus merging and gaining power over this company.

It can be said that corporate mergers are seen as a resurgence, where mistakes committed in

the past can be rectified, Avianca Holdings SA was in the process of redefining corporate

strategy, which was based on a growth and expansion model, the which is now focused on

profitability and operational efficiency, so one of the benefits that this merger will bring is

that the airlines will have coverage in the United States, Argentina, Belize, Bolivia, Chile,

Colombia, Costa Rica, Ecuador, El Salvador, Guyana, French Guyana, Guatemala,

Honduras, Nicaragua, Panama, Paraguay, Peru, Suriname, Uruguay and Venezuela. The

CEO of Avianca, Hernán Rincón, said that "this alliance will allow Avianca's airlines to

strengthen their position as a first-class player in the airline industry in the Americas;

because with United and Copa we will expand our service reach in the continent to offer

better connectivity to our customers. " However, this merger is having negative

consequences, because they are leaving doubts in investors for the impact on the company,

since the price of Avianca's stock had a significant drop in the market, also having a

powerful partner has its negative consequences , since United Airlines increased its market

share this can lead to disputes or conflicts of interest where there may be a power struggle,

and consequently incoordination in decision making.

However, the advantages are many, since, United Airlines is a leading company in the air

transport market like Avianca, which provides a combination of resources and experience

in the type of business, which in this case is the commercial airline, In addition to an

increase in capital in order to increase profitability and the relationship between the two

parties would be closer, so that they support each other in the achievement of objectives.

In conclusion, mergers represent a good business strategy for companies, everything

depends on the performance you have, with respect to corporate governance, I think that

United Airlines being one of the leading companies, can complement or redefine some

government concepts in Avianca Holdings, in such a way that more clarity and

understanding is added in the corporate development, and in this way to achieve the

objectives previously set.

REFERENCES

https://www.eltiempo.com/economia/empresas/acuerdo-de-avianca-y-united-airlines-299982

http://ir.united.com/corporate-governance/board-of-directors

http://ir.united.com/company-information/company-overview

https://www.reportur.com/colombia/2018/12/10/united-da-millonario-prestamo-los-duenos-avianca/

https://www.larepublica.co/empresas/la-letra-menuda-del-acuerdo-entre-united-airlines-y-avianca-holdings-

2855500

http://aviancaholdings.com/Spanish/gobierno-corporativo/default.aspx

http://aviancaholdings.com/Spanish/inicio/default.aspx

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- ACCA Financial Management Dec Mock - Questions PDFDocument18 pagesACCA Financial Management Dec Mock - Questions PDFAmilah Fadhlin100% (1)

- Wec13 01 Rms 20230112Document26 pagesWec13 01 Rms 20230112Vanessa Ng0% (1)

- Dishant Patle Data Analyst Offer LetterDocument3 pagesDishant Patle Data Analyst Offer LetterYasinNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ISO 27001 Gap Analysis ChecklistDocument6 pagesISO 27001 Gap Analysis Checklistlijo jacob70% (10)

- Ratio ANALYSIS OF CEAT TYRESDocument37 pagesRatio ANALYSIS OF CEAT TYRESS92_neha100% (1)

- Write Your Final Answers BelowDocument24 pagesWrite Your Final Answers BelowFrancis Lloyd TongsonNo ratings yet

- Business Plan Template PreferredDocument25 pagesBusiness Plan Template PreferredYusuf SotomiwaNo ratings yet

- IMC Lecture 9, Finding The Big IdeaDocument10 pagesIMC Lecture 9, Finding The Big IdeaRaj VinaikaNo ratings yet

- Ch02 Suppl Case XeroxDocument2 pagesCh02 Suppl Case XeroxPamela50% (2)

- BAJAJ AUTO MBA Porject Report Prince DudhatraDocument58 pagesBAJAJ AUTO MBA Porject Report Prince DudhatrapRiNcE DuDhAtRaNo ratings yet

- Capacity UtilisationDocument17 pagesCapacity UtilisationRaniiiNo ratings yet

- (Yoram (Jerry) Wind, Vijay Mahajan) Convergence Ma (BookFi) PDFDocument364 pages(Yoram (Jerry) Wind, Vijay Mahajan) Convergence Ma (BookFi) PDFnambi2rajanNo ratings yet

- Sectorial PPT AgricultureDocument47 pagesSectorial PPT AgriculturePuneet AroraNo ratings yet

- Mba Dissertation Reports in FinanceDocument4 pagesMba Dissertation Reports in FinancePapersWritingHelpSingapore100% (1)

- Puneet Garg-CVDocument2 pagesPuneet Garg-CVpuneet gargNo ratings yet

- Sriguru's ResumeDocument5 pagesSriguru's ResumeTriptiNo ratings yet

- Chapter 5 - FinalDocument10 pagesChapter 5 - FinalFalguni ChaudhariNo ratings yet

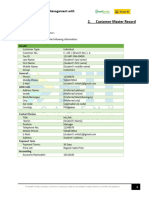

- Customer Master Record: Smartbooks Operations Management With Analytics Workbook Exercise 2.1Document8 pagesCustomer Master Record: Smartbooks Operations Management With Analytics Workbook Exercise 2.1jennicaashley.chua.engNo ratings yet

- Group 4 Business Plan 1Document31 pagesGroup 4 Business Plan 1Christine EscuetaNo ratings yet

- Bannari Amman Sugars LimitedDocument74 pagesBannari Amman Sugars LimitedSanthoshkumar ThangavelNo ratings yet

- Assignment - Exam PaperDocument6 pagesAssignment - Exam PaperAsadulla KhanNo ratings yet

- Marketplace Analysis For E-CommerceDocument29 pagesMarketplace Analysis For E-CommerceSocheath YemNo ratings yet

- Human Resource Practices of Nabil Bank LimitedDocument29 pagesHuman Resource Practices of Nabil Bank LimitedSaroj KhadkaNo ratings yet

- The Potentials and Challenges of Blockchain Application in FinTech in The Developing Countries - A Mauritius ExperienceDocument7 pagesThe Potentials and Challenges of Blockchain Application in FinTech in The Developing Countries - A Mauritius ExperienceThe IjbmtNo ratings yet

- Business Analysis Techniques : Paul TurnerDocument25 pagesBusiness Analysis Techniques : Paul TurnerRiserNo ratings yet

- With Hundreds of Millions of CustomersDocument4 pagesWith Hundreds of Millions of CustomersSapnaNo ratings yet

- Ncnda ImpfaDocument14 pagesNcnda ImpfaBona VenturaNo ratings yet

- Dissertation Project Report On FinanceDocument5 pagesDissertation Project Report On FinanceGhostWriterForCollegePapersDesMoines100% (1)

- Management 2e: The Nature of ManagementDocument30 pagesManagement 2e: The Nature of ManagementManish BhargavaNo ratings yet

- How Ebay Failed in ChinaDocument6 pagesHow Ebay Failed in ChinaitsarNo ratings yet