Professional Documents

Culture Documents

Top 10 Insurance Companies by The Metrics

Uploaded by

Enoc SilvaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Top 10 Insurance Companies by The Metrics

Uploaded by

Enoc SilvaCopyright:

Available Formats

PERSONAL FINANCE INSURANCE

Top 10 Insurance

Companies By The

Metrics

BY ADAM HAYES | Updated Aug 8, 2019

TABLE OF CONTENTS

Largest by Market Capitalization

Largest by Sales

The Bottom Line

EXPAND +

There are a number of ways to rank the size of

insurance companies. Companies can be

measured by their market capitalization (the

value of the company on a stock exchange) or

by using sales figures, such as net premiums

written in a year or how many policies were

sold.

Advertisement

Advertisement

K E Y TA K E A W AYS

Insurance companies are important

players in the global financial

economy, although they may not be as

flashy as investment banks or hedge

funds.

Insurance companies come in many

sizes and specialize in different policy

lines, from health to life to property &

casualty.

Here we compare some of the largest

insurers by market cap and by

premium sales.

Largest by Market Capitalization

Investors can buy shares of publicly traded

companies in the insurance industry. The

largest insurance companies as of 2018 by

market capitalization on the world stock

exchanges were:

Advertisement

Advertisement

Non-health Insurance Companies:

Market

Company Name

Capitalization

Berkshire Hathaway

( $308 billion

BRK.A)

China Life Insurance

$80 billion

(LFC)

Allianz (AZSEY) $76.8 billion

American

International Group $72.3 billion

(AIG)

Ping An of China

$65.6 billion

(PNGAY)

MetLife (MET) $59.4 billion

AXA (

$57.8 billion

AXA)

AIA Group Hong

$54.4 billion

Kong (AAIGF)

ING Groep (ING) $54.4 billion

Zurich Insurance

$45.4 Billion

(ZURVY)

Advertisement

Advertisement

(Source: Thompson Reuters)

Health Insurance and Managed Health

Care Companies:

Company Name Market

Capitalization

United Healthcare

$91.8 billion

(UNH)

Wellpoint (

$34.3 billion

WLP)

Aetna (AET) $29.8 billion

CIGNA Corp. (CI) $26.8 billion

Humana (HUM) $21.1 billion

Centene Corp. (CNC) $5.7 billion

Health Net, Inc. (

$3.9 billion

HNT)

WellCare Health

$3.1 billion

Plans (WCG)

Healthspring (

$3.7 billion

HS)

Molina Healthcare

$2.4 billion

(MOH)

(Source: Thompson Reuters)

Not all insurance companies are publicly

traded. In fact, many insurers are structured as

mutual companies where policy holders of

participating policies are essentially partial

owners of the company. The mutual company

model for an insurance company dates back

hundred of years, and there are certain benefits

conferred on policyholders that do not exist

with publicly traded (stock company) insurers.

Largest Insurance Companies by

Sales and Product Line

It is useful to differentiate between the type of

insurance, or line, that is being considered

when considering the largest insurance

companies. Using sales data is helpful as some

of the largest insurance companies in the

United States are not publicly traded and

therefore their market value is not easily

ascertained.

Property & Casualty

Property casualty insurers write policies

covering property such as real estate,

dwellings, cars and other vehicles. They also

write policies dealing with liabilities that may

be incurred by accident or negligence related

to those properties to defray the cost of

lawsuits or medical damages resulting from

such incidents.

The top U.S. property casualty companies in

2018 by net premiums written (the amount of

money that non-life policies can expect to

receive over the life of the contract, less

commissions and costs) are:

Net Premiums

Company

Written

State Farm Group $64.6 billion

Berkshire Hathaway

$46.0 billion

(BRK.A)

Allstate Insurance

$30.6 billion

Group (ALL)

Liberty Mutual $28.6 billion

Progressive

Insurance Group $27.1 billion

(PGR)

Travelers Group

$24.5 billion

(TRV)

USAA Group $19.6 billion

Nationwide Group $18.8 billion

Farmers Insurance

$14.3 billion

Group

American

International Group $14.2 billion

(AIG)

(Source A.M. Best)

Life Insurance Companies

Life Insurance companies promise to pay out a

lump sum benefit upon the death of the

insured. Although actuarial science has created

mortality tables to accurately estimate the

future liability of policies to be paid, having

financial strength ensures that these

companies can meet all of their obligations

while still earning a profit.

Life Insurance companies in the U.S. can be

ranked by direct premium written (the amount

of new policies written directly and not re-

insured). For 2018:

Total Direct Market

Company

Premium Share

Metropolitan

$12.6 billion 7.87%

Group (MET)

Northwestern

$10.1 billion 6.29%

Mutual

New York Life

$8.8 billion 5.48%

Group

Prudential of

$8.6 billion 5.33%

America (PRU)

Lincoln

$6.9 billion 4.30%

National

MassMutual $6.6 billion 4.15%

Aegon (AEG) $4.6 billion 2.90%

John Hancock $4.4 billion 2.84%

State Farm $4.0 billion 2.73%

Guardian Life

$3.8 billion 2.38%

Insurance Co.

(Source: NAIC)

Health Insurance Companies

Health insurance companies provide policies to

cover all or part of policyholder's health and

medical costs. Policies may be purchased

individually or through an employer.

Technically, the United States government is

the largest health insurance provider in

America through the Medicare program, Social

Security and with Medicaid administered by

individual states.

The largest non-government sponsored U.S.

health insurance companies measured by total

direct premium collected in 2016 was:

Total Direct Market

Company

Premium Share

UnitedHealth

$125 billion 12.90%

Group (UNH)

Kaiser

Foundation $72.6 billion 7.46%

Group

Anthem Inc

$59.8 billion 6.15%

Group

Aetna Group

(AET $54.3 billion 5.58%

)

Humana

$53.8 billion 5.53%

Group

HCSC Group $32.3 billion 3.31%

Centene Corp

$25.7 billion 2.64%

Group

Cigna Health

$24.0 billion 2.47%

Group (CI)

Molina

Healthcare Inc $17.8 billion 1.83%

Group

Independence

Health Group $17.0 billion 1.75%

Inc Group

(Source: NAIC. Note: The sales data on

insurance companies is from 2016, the last year

of available data.)

The Bottom Line

Ranking the largest insurance companies can

be done in a number of ways. Shares of

publicly traded companies can be bought to

help build a well-diversified investment

portfolio that has exposure to the financial and

healthcare sectors. Identifying which types of

insurance a company primarily deals with

helps determine which firms are competitors

and which really are not. Looking at sales

figures, or premiums collected in a year, one

can also see how public companies stack up

against privately held or mutual companies

which make up a large segment of the industry.

Compete Risk Free with

$100,000 in Virtual Cash

Put your trading skills to the test with our FREE

Stock Simulator. Compete with thousands of

Investopedia traders and trade your way to the

top! Submit trades in a virtual environment

before you start risking your own money.

Practice trading strategies so that when you're

ready to enter the real market, you've had the

practice you need. Try our Stock Simulator

today >>

Related Articles

H E A LT H I N S U R A N C E

Best Health

Insurance

Companies

CO R P O R AT E

INSURANCE

A Brief Overview

of the Insurance

Sector

BUSINESS

ESSENTIALS

Mutual vs. Stock

Insurance

Companies:

What's the

Difference?

INSURANCE

World's Top 10

Insurance

Companies

STOCKS

How To Invest In

Insurance

Companies

LIFE INSURANCE

8 Biggest Life

Insurance

Companies (PRU,

MET)

Related Terms

Understanding Insurance Claims

An insurance claim is a formal request by a

policyholder to an insurance company for coverage

or compensation for a covered loss or policy event.

The insurance company validates the claim and, once

approved, issues payment to the insured. more

American Association Of Insurance

Services (AAIS)

The American Association of Insurance Services is an

advisory organization that develops insurance policy

forms and loss experience rating information. more

Term Life Insurance

Term life insurance is a type of life insurance that

guarantees payment of a death benefit during a

specified time period. more

Alliance of American Insurers (AAI)

The Alliance Of American Insurers is a coalition

consisting primarily of property-casualty insurance

carriers. more

Understanding Liability Insurance

Liability insurance provides the insured party with

protection against claims resulting from injuries and

damage to people and/or property. more

Actuarial Service

Actuarial service is one way corporations determine,

assess, and plan for the financial impact of risk.

Actuarial science is used to evaluate and predict

future payouts for insurance and other financial

industries. more

TRUSTe

Terms of Use Contact Us News

Advertise Dictionary Careers

Contact Us News

Investopedia is part of the Dotdash publishing

family.

T h e B a l a n ce | L i fe w i re | Tr i p S a v v y |

T h e S p r u ce and m o re

Ad

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Perjanjian Joint Venture Indofood & AsahiDocument5 pagesPerjanjian Joint Venture Indofood & AsahivicapriyantoNo ratings yet

- Articles of Incorporation OF Ambyence Clothing IncorporatedDocument3 pagesArticles of Incorporation OF Ambyence Clothing IncorporatedShirley Lucas EsagaNo ratings yet

- Wells Fargo Banker and 9 Others Charged With Insider TradingDocument47 pagesWells Fargo Banker and 9 Others Charged With Insider TradingLisa Stinocher OHanlonNo ratings yet

- Chapter 4 - Investments in Equity SecuritiesDocument51 pagesChapter 4 - Investments in Equity SecuritiesYel100% (2)

- SWI Zondo Submission Gupta Enterprise TransnetDocument110 pagesSWI Zondo Submission Gupta Enterprise TransnetDylanNo ratings yet

- NLU Jodhpur Top Recruiters: 1. Top National Law FirmsDocument19 pagesNLU Jodhpur Top Recruiters: 1. Top National Law FirmsManish VermaNo ratings yet

- Business English 2 2022 d4Document78 pagesBusiness English 2 2022 d4salisa maulidahNo ratings yet

- The Difference Between Corporate and Business Law Is ThatDocument3 pagesThe Difference Between Corporate and Business Law Is ThatMaheen AhmedNo ratings yet

- Two Case Studies in Mergers and Acquisitions: Why Some Succeed While Others Fail?Document8 pagesTwo Case Studies in Mergers and Acquisitions: Why Some Succeed While Others Fail?HARSHBHATTERNo ratings yet

- Capital StructureDocument16 pagesCapital StructureAfif YasriNo ratings yet

- Reviewer-Stock ValuationDocument7 pagesReviewer-Stock ValuationSheira Mae GuzmanNo ratings yet

- Annual Report Roti 2011Document122 pagesAnnual Report Roti 2011StefanyNo ratings yet

- Final Placement Report 2012 SJMSOM IITBDocument4 pagesFinal Placement Report 2012 SJMSOM IITBRKNo ratings yet

- Lecture 1 - Introduction To AccountingDocument8 pagesLecture 1 - Introduction To Accounting1999996No ratings yet

- 6 ACCT 2A&B C. OperationDocument10 pages6 ACCT 2A&B C. OperationShannon Mojica100% (1)

- Book Building ProcessDocument17 pagesBook Building Processmukesha.kr100% (9)

- Advance Accounting 2 by GuerreroDocument15 pagesAdvance Accounting 2 by Guerreromarycayton77% (13)

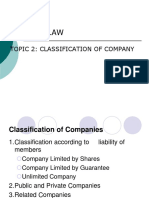

- TOPIC 2 - Classification of CompanyDocument24 pagesTOPIC 2 - Classification of CompanyShahrizatSmailKassimNo ratings yet

- Cla 10Document2 pagesCla 10Von Andrei MedinaNo ratings yet

- DownloadDocument8 pagesDownloadGellerteNo ratings yet

- Reserve Bank of India: Main ObjectivesDocument5 pagesReserve Bank of India: Main Objectiveskannan_mbaNo ratings yet

- IDFC-AMC 2021 Annual-ReportDocument63 pagesIDFC-AMC 2021 Annual-ReportvinitNo ratings yet

- Master Circular For Stock BrokersDocument209 pagesMaster Circular For Stock BrokersNilesh NayeeNo ratings yet

- Group 3b. Law AssignmentDocument6 pagesGroup 3b. Law AssignmentKELVINNo ratings yet

- Chapter 8-10 Test BankDocument80 pagesChapter 8-10 Test BankELSA SYAFIRA ANANTANo ratings yet

- Uti SunderDocument1 pageUti SunderSairam PrasathNo ratings yet

- Pepsico 2014 Annual Report - Final Pages 2Document2 pagesPepsico 2014 Annual Report - Final Pages 2hi hiNo ratings yet

- Ifrs at A Glance IFRS 3 Business CombinationsDocument5 pagesIfrs at A Glance IFRS 3 Business CombinationsNoor Ul Hussain MirzaNo ratings yet

- Wework Corporate GovernanceDocument11 pagesWework Corporate GovernanceArchana SarmaNo ratings yet

- KEI Cable CatalogueDocument114 pagesKEI Cable CatalogueMousum100% (1)