Professional Documents

Culture Documents

Business Taxation

Uploaded by

OPTIMA ConsultingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Taxation

Uploaded by

OPTIMA ConsultingCopyright:

Available Formats

SEMESTER - 4

BUSINESS TAXATION [LA-402]

INTRODUCTION firms and companies, trading profit and capital gains,

This course covers Income Tax Ordinance, 2001, the Income and indirect taxes such as sales tax, customs duty and

Tax Rules, 2002 and other Tax Laws such as the Sales Tax Act, central excise duty,

1990, Customs Act, 1969 and Federal Excise Act and Rules, describe features of the direct and indirect taxes,

2005, as amended to date. describe record-keeping, filing and tax payment

requirements of principal types of taxation, relating to

OBJECTIVES business,

To provide the students with an in-depth knowledge of Tax compute for recommendations to the management on

Laws, enabling them to apply in decision-making process in issues, pertaining to tax liabilities of company or firm,

different business situations. arising from income generation and capital gains,

compute and advise on tax liabilities of individuals,

OUTCOMES arising from income receipts, capital gains, business or

On completion of this course, students should be able to: professions and other sources, and

identify and interpret principal types of taxation, such as identify foreign tax obligations, situations and apply

direct taxes on individuals, income, business individuals, appropriate methods for relieving from such tax.

Association of persons, registered and unregistered

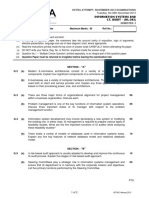

INDICATIVE GRID

PA R T SYLLABUS CONTENT AREA WEIGHTAGE

I N C O ME T A X

1. Income Tax Ordinance 2001

A 60%

2. Income Tax Rules 2002

SA L E S T A X

3. Sales Tax Act 1990

B 4. Sales Tax Rules 30%

5. Sales Tax Special Procedures

IN D IR EC T T A X

6. Customs Act, 1969

C 7. Capital Value Tax 10%

8. Federal Excise Act and Rules, 2005

TOTAL 100%

Note: The weightage shown against each section indicates, study time required for the topics in that section. This weightage

does not necessarily specify the number of marks to be allocated to that section in the examination.

RECOMMENDED BOOKS

CORE READINGS

TITLE AUTHOR PUBLISHER

Complete Income Tax Law (Latest Edition) Sheikh Asif Salam S. A. Salam Publications, Lahore.

Tax Laws of Pakistan Huzaima Bukhari / Dr. Ikramul Haq Lahore Law Publications.

Sales Tax, 1990 Tariq Najeeb Choudhry Tariq Najeeb Corporation, Lahore.

Central Excise Act, 1944 and Rules Tariq Najeeb Choudhry Tariq Najeeb Corporation, Lahore.

Customs Act, 1969 --- Government of Pakistan.

Synopsis of Taxes in Pakistan Mirza Munawar Hussain IBP Publications, Lahore.

ADDITIONAL READING

A. R. & Co. Cost and Management

Law in Practice (Income and Sales Tax) Abdul Razzaq, FCMA

Accountants, Shadman, Lahore

Conceptual Approach to Taxes Nadeem Butt, FCA Aman Publishing Company, Lahore.

You might also like

- Tolley® Exam Training: Adit Paper 1 Memory JoggersDocument58 pagesTolley® Exam Training: Adit Paper 1 Memory JoggersMohamed HusseinNo ratings yet

- How to Invest in Real Estate And Pay Little or No Taxes: Use Tax Smart Loopholes to Boost Your Profits By 40%: Use Tax Smart Loopholes to Boost Your Profits By 40%From EverandHow to Invest in Real Estate And Pay Little or No Taxes: Use Tax Smart Loopholes to Boost Your Profits By 40%: Use Tax Smart Loopholes to Boost Your Profits By 40%No ratings yet

- Commercial Space Lease LetterDocument1 pageCommercial Space Lease LetterBplo Caloocan100% (3)

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchFrom EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchRating: 5 out of 5 stars5/5 (1)

- Communication Plan September 27Document24 pagesCommunication Plan September 27Rosemarie T. BrionesNo ratings yet

- Course Code Course Title Units / Type: FO-ACAD-QAO-001/29JANUARY2020/REV.0 Page 1 of 8Document8 pagesCourse Code Course Title Units / Type: FO-ACAD-QAO-001/29JANUARY2020/REV.0 Page 1 of 8Jackie RaborarNo ratings yet

- 1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFDocument380 pages1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFBalaji TkpNo ratings yet

- Exponential Growth Decay Extra Practice W - AnswersDocument3 pagesExponential Growth Decay Extra Practice W - AnswersEdal SantosNo ratings yet

- Power Purchase AgreementDocument22 pagesPower Purchase Agreementdark webNo ratings yet

- Supply Chain Management in Big BazaarDocument25 pagesSupply Chain Management in Big Bazaarabhijit05582% (11)

- Chapter 7 Introduction To Regular Income TaxDocument18 pagesChapter 7 Introduction To Regular Income TaxDANICKA JANE ENERONo ratings yet

- Basics About Sales, Use, and Other Transactional Taxes: Overview of Transactional Taxes for Consideration When Striving Toward the Maximization of Tax Compliance and Minimization of Tax Costs.From EverandBasics About Sales, Use, and Other Transactional Taxes: Overview of Transactional Taxes for Consideration When Striving Toward the Maximization of Tax Compliance and Minimization of Tax Costs.No ratings yet

- Fundamentals of Taxation Syllabus BreakdownDocument5 pagesFundamentals of Taxation Syllabus BreakdownGLYDEL ESIONGNo ratings yet

- Course Syllabus in Fundamentals of Taxation: Course Intended Learning Outcomes (Cilo) and Time AllotmentDocument8 pagesCourse Syllabus in Fundamentals of Taxation: Course Intended Learning Outcomes (Cilo) and Time AllotmentPATATASNo ratings yet

- Study Business Taxation LawsDocument2 pagesStudy Business Taxation LawsJaved IqbalNo ratings yet

- Tos TaxationDocument2 pagesTos TaxationJilliam Sophia CanlasNo ratings yet

- Special Topics & Updates TaxationDocument7 pagesSpecial Topics & Updates TaxationMhadzBornalesMpNo ratings yet

- Chapter 2 TaxDocument2 pagesChapter 2 TaxsarahNo ratings yet

- Ebook 1698228788 7509 202401131946 59823Document4 pagesEbook 1698228788 7509 202401131946 59823Winnie GiveraNo ratings yet

- Final Module 2 TaxationDocument20 pagesFinal Module 2 TaxationJulius Earl MarquezNo ratings yet

- Symbiosis Law School, Hyderabad Academic Year 2020-21 Batch: (2017-2022) Ba/Bba LL.B Course Handout (Semester-Vii)Document16 pagesSymbiosis Law School, Hyderabad Academic Year 2020-21 Batch: (2017-2022) Ba/Bba LL.B Course Handout (Semester-Vii)Ayushi VermaNo ratings yet

- ITchap2Document14 pagesITchap2Rein ConcepcionNo ratings yet

- Le SFMDocument30 pagesLe SFMOthman TakiNo ratings yet

- Course Plan of Principle of Taxation Law PDFDocument8 pagesCourse Plan of Principle of Taxation Law PDFMuskan KhatriNo ratings yet

- Economic ActivityDocument46 pagesEconomic ActivitySabitkhattakNo ratings yet

- Taxation Law 2021Document60 pagesTaxation Law 2021eayemeyemieNo ratings yet

- C2 Tax LawsDocument6 pagesC2 Tax LawsMaimona SemaNo ratings yet

- MGT 503 Lec 01Document16 pagesMGT 503 Lec 01bc180202357 BADAR FARIDNo ratings yet

- Income Tax Chapter 2Document17 pagesIncome Tax Chapter 2Louella CunananNo ratings yet

- Bac Iv Law Course Taxation IiDocument168 pagesBac Iv Law Course Taxation IiGilbert SanoNo ratings yet

- Corporate Tax Management EDU MBA Summer 2020Document100 pagesCorporate Tax Management EDU MBA Summer 2020Foyez HafizNo ratings yet

- Department of Accounting: Taxation 200 (Tax2Ab0)Document6 pagesDepartment of Accounting: Taxation 200 (Tax2Ab0)Tawanda NgoweNo ratings yet

- Indian Direct of Vat,: PaperDocument8 pagesIndian Direct of Vat,: PaperNikhil KalyanNo ratings yet

- WK 1 Lecture 1 - Intro M'Sia Taxation and Residence Status Student 53 2033Document27 pagesWK 1 Lecture 1 - Intro M'Sia Taxation and Residence Status Student 53 2033Haananth SubramaniamNo ratings yet

- Chapter 2Document34 pagesChapter 2Marc LxmnNo ratings yet

- 1 Tax267Document13 pages1 Tax2672022890872No ratings yet

- TOS Quiz 4Document6 pagesTOS Quiz 4maria ronoraNo ratings yet

- Income Tax Introduction FinalDocument39 pagesIncome Tax Introduction FinalSammar EllahiNo ratings yet

- Workshop On Tax Obligations of NPO - October2023Document2 pagesWorkshop On Tax Obligations of NPO - October2023Waseem ParchaNo ratings yet

- Introduction to Income Taxation Course OverviewDocument9 pagesIntroduction to Income Taxation Course Overviewᜊ᜔ᜎᜀᜈ᜔ᜃ᜔ ᜃᜈ᜔ᜊᜐ᜔No ratings yet

- 2 Advanced Stage TAX Module Outline Sept 2018Document5 pages2 Advanced Stage TAX Module Outline Sept 2018Aniss1296No ratings yet

- French Vs UK GAAPDocument155 pagesFrench Vs UK GAAPKen Li0% (1)

- Cours PDF Fiscalite Des Transports Master Prof. (FSJP LF 2020) Nvo Tarif Synthese TransmissionDocument81 pagesCours PDF Fiscalite Des Transports Master Prof. (FSJP LF 2020) Nvo Tarif Synthese Transmissionmbenlock14No ratings yet

- Legal Environment For Business in Pakistan NewDocument21 pagesLegal Environment For Business in Pakistan NewAmeen NooruddinNo ratings yet

- Tax AdministrationDocument93 pagesTax AdministrationRobin LiuNo ratings yet

- Australia Taxation: Cpa Program Subject OutlineDocument6 pagesAustralia Taxation: Cpa Program Subject OutlineRainer Arthur LarocoNo ratings yet

- Australian Taxation Law 2021 Full ChapterDocument41 pagesAustralian Taxation Law 2021 Full Chapterblake.hill975100% (19)

- Income Tax Procedure PracticeU 12345 RB PDFDocument41 pagesIncome Tax Procedure PracticeU 12345 RB PDFBrindha BabuNo ratings yet

- Taxation of Salaried EmployeesDocument38 pagesTaxation of Salaried EmployeesSanjeevNo ratings yet

- BKAT3023 A211 SyllabusDocument7 pagesBKAT3023 A211 SyllabusIzzie ChenNo ratings yet

- Law of Direct TaxationDocument4 pagesLaw of Direct TaxationAshwanth M.SNo ratings yet

- CAF06PrinciplesofTaxation STDocument366 pagesCAF06PrinciplesofTaxation STSajid Ali100% (1)

- Concise Tax Legislation 2020 Full ChapterDocument41 pagesConcise Tax Legislation 2020 Full Chaptereric.prather322100% (23)

- TAX 1016 Lesson TWODocument8 pagesTAX 1016 Lesson TWOMonica MonicaNo ratings yet

- Taxation Laws - IDocument5 pagesTaxation Laws - IAadya AmbasthaNo ratings yet

- Chapter 2: Taxes, Tax Laws, and Tax AdministrationDocument9 pagesChapter 2: Taxes, Tax Laws, and Tax Administrationemielyn lafortezaNo ratings yet

- TaxationDocument64 pagesTaxationCristinaPopaM100% (10)

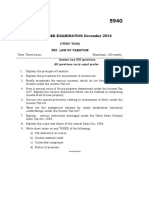

- B.A.L. DEGREE EXAMINATION December 2014: 350. Law of TaxationDocument1 pageB.A.L. DEGREE EXAMINATION December 2014: 350. Law of Taxationsiva prasadNo ratings yet

- Term PaperDocument21 pagesTerm PaperAbdulbasit AhmedeNo ratings yet

- 287 287 Domestic Tax Laws - 2013-14Document296 pages287 287 Domestic Tax Laws - 2013-14TonyNo ratings yet

- TAX MANUAL 2012-2013bDocument174 pagesTAX MANUAL 2012-2013bmsiskatemwaNo ratings yet

- A Real Estate Agent's Guide to Pay Less Tax & Build More WealthFrom EverandA Real Estate Agent's Guide to Pay Less Tax & Build More WealthNo ratings yet

- Ffa f3 SG Feb14 Aug15Document14 pagesFfa f3 SG Feb14 Aug15Adi StănescuNo ratings yet

- ACCT 210 240 Course OutlinesDocument11 pagesACCT 210 240 Course OutlinesOPTIMA ConsultingNo ratings yet

- La 403Document1 pageLa 403Javed KhanNo ratings yet

- AB1102 Accounting Ii - Course Description and ScopeDocument2 pagesAB1102 Accounting Ii - Course Description and ScopeOPTIMA ConsultingNo ratings yet

- FIT9123 S1 2020 Seminar 1 BIS Introduction - SUBMITTEDDocument26 pagesFIT9123 S1 2020 Seminar 1 BIS Introduction - SUBMITTEDOPTIMA ConsultingNo ratings yet

- FIT9123 S2 2020 Assignment1 - ERP - Failure - Factors - SUBMITTED2Document8 pagesFIT9123 S2 2020 Assignment1 - ERP - Failure - Factors - SUBMITTED2OPTIMA ConsultingNo ratings yet

- ACC213 - Assignment 2 70% Marks ReqDocument2 pagesACC213 - Assignment 2 70% Marks ReqOPTIMA ConsultingNo ratings yet

- Business Mathematics and Statistical Inference PDFDocument1 pageBusiness Mathematics and Statistical Inference PDFOPTIMA ConsultingNo ratings yet

- La 403Document1 pageLa 403Javed KhanNo ratings yet

- Advanced Financial Accounting and Corporate ReportingDocument2 pagesAdvanced Financial Accounting and Corporate ReportingOPTIMA ConsultingNo ratings yet

- Commercial Laws and Professional EthicsDocument1 pageCommercial Laws and Professional EthicsOPTIMA ConsultingNo ratings yet

- Enterprise ManagementDocument2 pagesEnterprise ManagementOPTIMA ConsultingNo ratings yet

- Business TaxationDocument1 pageBusiness TaxationOPTIMA ConsultingNo ratings yet

- Commercial Laws and Professional EthicsDocument1 pageCommercial Laws and Professional EthicsOPTIMA ConsultingNo ratings yet

- 8 ML 302 em PDFDocument2 pages8 ML 302 em PDFOPTIMA ConsultingNo ratings yet

- 11 La 402 BT PDFDocument4 pages11 La 402 BT PDFOPTIMA ConsultingNo ratings yet

- 12 La 403 CLSPDocument3 pages12 La 403 CLSPOPTIMA ConsultingNo ratings yet

- 15 Af 503 SFM PDFDocument4 pages15 Af 503 SFM PDFOPTIMA ConsultingNo ratings yet

- 7 Af 301 Fa PDFDocument4 pages7 Af 301 Fa PDFOPTIMA ConsultingNo ratings yet

- 2013 Nov QP PDFDocument4 pages2013 Nov QP PDFAhmed RazaNo ratings yet

- 9 ML 303 Isita PDFDocument2 pages9 ML 303 Isita PDFOPTIMA ConsultingNo ratings yet

- Rubric T2 ACC211 FinalDocument2 pagesRubric T2 ACC211 FinalOPTIMA ConsultingNo ratings yet

- ForecastsDocument2 pagesForecastsOPTIMA ConsultingNo ratings yet

- Activities and Questions: Maria D'souzaDocument1 pageActivities and Questions: Maria D'souzaOPTIMA ConsultingNo ratings yet

- Quotation - Householders - LAPSONDocument1 pageQuotation - Householders - LAPSONCredsureNo ratings yet

- Training in Human Resource ManagementDocument21 pagesTraining in Human Resource ManagementAlok kumarNo ratings yet

- PAS 141:2010 Specification For The Processing For Reuse of Waste and Used Electrical and Electronic Equipment (WEEE and UEEE)Document20 pagesPAS 141:2010 Specification For The Processing For Reuse of Waste and Used Electrical and Electronic Equipment (WEEE and UEEE)Ivan TtofimchukNo ratings yet

- Goodwill 23.3.23Document1 pageGoodwill 23.3.2308 Ajay Halder 11- CNo ratings yet

- Technical Appraisal: Unit 5Document16 pagesTechnical Appraisal: Unit 5DIPAKNo ratings yet

- SFM FinDocument159 pagesSFM FinAakashNo ratings yet

- Chapter 9: Legal Challenges of Entrepreneurial Ventures: True/FalseDocument6 pagesChapter 9: Legal Challenges of Entrepreneurial Ventures: True/Falseelizabeth bernalesNo ratings yet

- DetailsNewCreditAssigned Mar23 OthersecuritiesDocument16 pagesDetailsNewCreditAssigned Mar23 OthersecuritiesasamitarannumNo ratings yet

- Cylinder Receipt and Storage ProceduresDocument4 pagesCylinder Receipt and Storage ProceduresNishit SuvaNo ratings yet

- Capr 1-1Document2 pagesCapr 1-1Giovanni CambareriNo ratings yet

- Platinum Sponsorship - P100, 000.00 and UpDocument1 pagePlatinum Sponsorship - P100, 000.00 and UpGina Lee Mingrajal SantosNo ratings yet

- Finance and Accounting - PPTX For FinalDocument18 pagesFinance and Accounting - PPTX For Finalmuqaddas bibiNo ratings yet

- Anush IpDocument24 pagesAnush IpAnsh SharmaNo ratings yet

- Implementing RBI and RCM to Improve Asset ReliabilityDocument56 pagesImplementing RBI and RCM to Improve Asset ReliabilityKareem RasmyNo ratings yet

- Notice: Combined Graduate Level Examination, 2020Document63 pagesNotice: Combined Graduate Level Examination, 2020Abhay Pratap SharmaNo ratings yet

- The Prevention of Corruption Act, 1988: A Critical StudyDocument33 pagesThe Prevention of Corruption Act, 1988: A Critical StudyRAJARAJESHWARI M GNo ratings yet

- Aditya AS 22 23 2134Document1 pageAditya AS 22 23 2134Aditya AmbwaniNo ratings yet

- SW One DXP Cost Sheet (4.5BHK+Utility) Phase 2Document1 pageSW One DXP Cost Sheet (4.5BHK+Utility) Phase 2assetcafe7No ratings yet

- Use Investing in People Financial Impact of Human Resources Initiatives by Cascio and BoudreauDocument3 pagesUse Investing in People Financial Impact of Human Resources Initiatives by Cascio and BoudreauDoreen0% (1)

- College of Engineering Perumon: Print ReceiptDocument1 pageCollege of Engineering Perumon: Print ReceiptDILJITH D SNo ratings yet

- Unit 1 2018 Paper 2Document9 pagesUnit 1 2018 Paper 2Pettal BartlettNo ratings yet

- MBA Akshay Arora: SAP ID:80511020627 - : Akshay - Arora27@nmims - Edu.in - Age: 23Document2 pagesMBA Akshay Arora: SAP ID:80511020627 - : Akshay - Arora27@nmims - Edu.in - Age: 23gautam keswaniNo ratings yet

- Problem 9-21 (Pp. 420-421) : 1. Should The Owner Feel Frustrated With The Variance Reports? ExplainDocument3 pagesProblem 9-21 (Pp. 420-421) : 1. Should The Owner Feel Frustrated With The Variance Reports? ExplainCj SernaNo ratings yet

- Education System Thesis StatementDocument6 pagesEducation System Thesis Statementanneryssanchezpaterson100% (2)