Professional Documents

Culture Documents

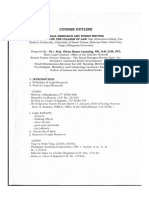

BOC

Uploaded by

Lovelyn Bergano Dela CruzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BOC

Uploaded by

Lovelyn Bergano Dela CruzCopyright:

Available Formats

1.

Smuggling Case

>>6.4B worth of shabu was smuggled into PH from China

>>Gov't seized the said shabu in a warehouse in QC

Questions:

>>Was it subject to Customs Duty? How was it measured?

>>Who is considered smuggler?

>>Who should be held liable?

>>Selectivity system issue.

If there is overpayment in Customs Duty, there will be overpayment in VAT and vice

versa.

>Customs Duty is part of computing VAT

Methods of Valuation

>Retains te "Transaction Value System" - the price paid by the importer for the

sale of goods for export in the PH.

Duty Rates under Special Lws

>EO No. 57 - duty rate on Capital Equipment

Outright smuggling

>arises when goods and articles of commerce are brought into the country without

the required importation documents, or are disposed of in the local market without

having been cleared by the BOC or other authorized government agencies, to evade

the payment of correct taxes, duties and other charges.

Technical Smuggling

>an act of fraudulently, falsifying or erroneously declaring imported goods

entering a country. Outright smuggling is bringing in goods without complete

government importation documents

Post Clearance Audit

>Within 3 years from the date of final payment of duties and taxes or Customs

Clearance as the case may be.

>Coverage of Audit is 3 years from date of issuance of ANL

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- JD CurriculumDocument7 pagesJD CurriculumLovelyn Bergano Dela CruzNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Dela Cruz - Billion Dollar CharlieDocument1 pageDela Cruz - Billion Dollar CharlieLovelyn Bergano Dela CruzNo ratings yet

- Ceferina Lopez Tan v. Spouses Antazo, GR 187208, 23 February 2011.Document7 pagesCeferina Lopez Tan v. Spouses Antazo, GR 187208, 23 February 2011.Lovelyn Bergano Dela CruzNo ratings yet

- Atty. Galahad R.A. Pe Benito Feu Institute of Law Environmental Law SCHOOL YEAR 2019-20Document7 pagesAtty. Galahad R.A. Pe Benito Feu Institute of Law Environmental Law SCHOOL YEAR 2019-20Lovelyn Bergano Dela CruzNo ratings yet

- Study Plan 1 Year - 1 Semester Subject Unit: Constitutional Law I (FAILED) 3Document3 pagesStudy Plan 1 Year - 1 Semester Subject Unit: Constitutional Law I (FAILED) 3Lovelyn Bergano Dela CruzNo ratings yet

- LegRes Course OutlineDocument8 pagesLegRes Course OutlineLovelyn Bergano Dela CruzNo ratings yet

- Case ListDocument20 pagesCase ListLovelyn Bergano Dela CruzNo ratings yet

- Buac v. ComelecDocument17 pagesBuac v. ComelecLovelyn Bergano Dela CruzNo ratings yet

- Final Memorial For The Respondent JD4104Document13 pagesFinal Memorial For The Respondent JD4104Lovelyn Bergano Dela CruzNo ratings yet