Professional Documents

Culture Documents

Investment and Portfolio Management

Uploaded by

HAMZA WAHEED0 ratings0% found this document useful (0 votes)

9 views3 pagesthis is the discription

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentthis is the discription

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pagesInvestment and Portfolio Management

Uploaded by

HAMZA WAHEEDthis is the discription

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

\

Assignment

INVESTMENT AND PORTFOLIO MANAGE

SUBMITTED TO:

SIR HASSAN BIN GHAFOOR

SUBMITTED BY:

HAMZA WAHEED

ID# F2018275004

University of Management and Technology

School of Professional Advancement

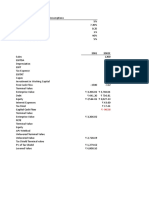

EQUITY VALUATION SOLUTION

Question No- 1

PKR' 000 Year 0 Year 1 Year 2 Year 3 PKR' 000 Year 1 Year 2 Year 3

Net Income / (Loss) OR PAT / (LAT) (300) (50) 2,800 PAT/LAT (300) (50) 2,800

Depreciation & Ammortization 165 175 190 Depreciation 165 175 190

Current Assets / CA 150 140 130 125 Decrease / Increase in CA 10 10 5

Current Liabilities / CL 250 235 220 190 Decrease / Increase in CL (15) (15) (30)

Capital Expenditure / CAPEX 100 105 115 130 Decrease / Increase in CAPEX (5) (10) (15)

Borrowings / Loan 750 765 780 800 Decrease / Increase in Loan 15 15 20

Dividend Payout Ratio 65% 65% 65% FCFE (130) 125 2,970

Interest Rate 11% 11% 11% 10% CAPM 17% 17% 17%

Market / Equity Risk Premium- MRP / ERP 5% 5% 5% 6% Terminal Value 21,850

Terminal Growth Rate 3% Discount Factor 0.85 0.73 0.62

Market Return PV of Cashflows (111) 91 15,388

Company Beta 1.2 Sum of PV 15,367

No. of Shares 5,000 Target Price / Share 3.07

Current Share Price in PKR 5 Gain or (loss) in % 38.60%

Total Dividends 1,820

1- Calculate target price / share using FCF and Dividend Discount model. CAPM 17% 17% 17%

2- Calculate gain / loss by assuming if investment made at current price. Terminal Value 13,390

Discount Factor 0.85 0.73 0.62

capm = Rf + B( Rm-Rf) (RM-RF)= MRP or ERP PV of Cashflows 9,430

terminal value = last year CF(1+g)/ last year capm - g Sum of PV 9,430

dicount fector = (1+capm)^-n Target Price / Share 1.88

PV of CF = DF X Free CF Gain or (loss) in % -62.27%

gain or loss % =target price - current share price / current share price

divident yeild = dividend per share / buying price per share

EQUITY VALUATION SOLUTION

Question No- 2

PKR' 000 Year 0 Year 1 Year 2 Year 3 PKR' 000 Year 1 Year 2 Year 3

Net Income / (Loss) OR PAT / (LAT) (300) 250 1,100 PAT/LAT (300) 250 1,100

Depreciation & Ammortization 135 140 145 Depreciation 135 140 145

Current Assets / CA 120 115 105 95 Decrease / Increase in CA 5 10 10

Current Liabilities / CL 250 265 280 295 Decrease / Increase in CL 15 15 15

Capital Expenditure / CAPEX 100 102 104 106 Decrease / Increase in CAPEX (2) (2) (2)

Borrowings / Loan 765 775 790 810 Decrease / Increase in Loan 10 15 20

Dividend Retention Ratio 30% 30% 30% FCFE (137) 428 1,288

Interest Rate 12% 12% 12% 11% CAPM 18% 18% 18%

Market / Equity Risk Premium- MRP / ERP 7% 7% 7% 8% Terminal Value 10,403

Terminal Growth Rate 5% Discount Factor 0.84 0.72 0.61

Market Return 19% 19% 19% 19% PV of Cashflows (115) 308 7,132

Company Beta 0.9 Sum of PV 7,324

No. of Shares 3,000 Target Price / Share 2.44

Current Share Price in PKR 12 Gain or (loss) in % -79.66%

Total Dividends 175 770

1- Calculate target price / share using FCF and Dividend Discount model. CAPM 18% 18% 18%

2- Calculate gain / loss by assuming if investment made at current price. Terminal Value 6,219

Discount Factor 9.84 0.72 0.61

PV of Cashflows 126 4,254

capm = Rf + B( Rm-Rf) Sum of PV 4,380

terminal value = last year CF(1+g)/ last year capm - g Target Price / Share 1.46

dicount fector = (1+capm)^-n Gain or (loss) in % -87.83%

PV of CF = DF X Free CF

gain or loss % =target price - current share price / current share price

You might also like

- Valuation ExerciseDocument5 pagesValuation ExercisechandrikaaddalaNo ratings yet

- DCF Valuation TemplateDocument15 pagesDCF Valuation TemplateDEV DUTT VASHIST 22111116No ratings yet

- Corporate Valuation: Group - 2Document6 pagesCorporate Valuation: Group - 2RiturajPaulNo ratings yet

- Fin Model Class9 Merger Model Using DCF MethodologyDocument1 pageFin Model Class9 Merger Model Using DCF MethodologyGel viraNo ratings yet

- Start File DCF ExerciseDocument13 pagesStart File DCF ExerciseshashankNo ratings yet

- Group Project 2 Sabry Zamato SolutionDocument5 pagesGroup Project 2 Sabry Zamato SolutionSyafahani SafieNo ratings yet

- Pepsico DCF Valuation SolutionDocument45 pagesPepsico DCF Valuation SolutionSuryapratap KhuntiaNo ratings yet

- Gulf Takeover ExcelDocument7 pagesGulf Takeover ExcelNarinderNo ratings yet

- Display Formats of Budget 08-09 FinalDocument23 pagesDisplay Formats of Budget 08-09 FinalFazal4822No ratings yet

- Determining Cash Flows for Investment AnalysisDocument19 pagesDetermining Cash Flows for Investment AnalysisJack mazeNo ratings yet

- Deleum 2Q10Results UpdateDocument3 pagesDeleum 2Q10Results Updatelimml63No ratings yet

- Eva ProblemsDocument10 pagesEva ProblemsROSHNY DAVIS100% (1)

- 1cr4dm8kl 930744Document4 pages1cr4dm8kl 930744DGLNo ratings yet

- Class 1 7th Feb OxygenDocument17 pagesClass 1 7th Feb OxygenAmit JainNo ratings yet

- Share & Business Valuation Case Study Question and SolutionDocument6 pagesShare & Business Valuation Case Study Question and SolutionSarannyaRajendraNo ratings yet

- Heriot-Watt University Finance - December 2020 Section I Case StudiesDocument13 pagesHeriot-Watt University Finance - December 2020 Section I Case StudiesSijan PokharelNo ratings yet

- CALCULATION OF FREE CASH FLOWS for LBO VALUATIONDocument5 pagesCALCULATION OF FREE CASH FLOWS for LBO VALUATIONAyushi GuptaNo ratings yet

- To Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenDocument4 pagesTo Calculate Equity Value Through DCF Analysis: DATA INPUTS - Those Highlighted Are Those GivenYash ModiNo ratings yet

- The Bell 07 October 2010Document3 pagesThe Bell 07 October 2010Khawaja UsmanNo ratings yet

- Target ExerciseDocument18 pagesTarget ExerciseJORGE PUENTESNo ratings yet

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwNo ratings yet

- Basic Assumptions: Particulars ($000) 2001 2002 E 2003 EDocument7 pagesBasic Assumptions: Particulars ($000) 2001 2002 E 2003 EMuskan ValbaniNo ratings yet

- Date of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J ContactDocument11 pagesDate of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J Contactapi-3702531No ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Sampa Video Solution Harvard Case Solution 1Document10 pagesSampa Video Solution Harvard Case Solution 1Héctor SilvaNo ratings yet

- Workshop 2Document11 pagesWorkshop 2Trần Ánh DươngNo ratings yet

- UKAF4034 ACR Tutorial3 Q - OpSegmentsDocument7 pagesUKAF4034 ACR Tutorial3 Q - OpSegmentstan JiayeeNo ratings yet

- Retirement of BondsDocument16 pagesRetirement of BondsEUNICE LAYNE AGCONo ratings yet

- Busi 331 Project 1 Marking Guide: HandbookDocument28 pagesBusi 331 Project 1 Marking Guide: HandbookDilrajSinghNo ratings yet

- Chapter 8 ed 18Document27 pagesChapter 8 ed 18Audi WibisonoNo ratings yet

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Brand CoDocument7 pagesBrand CoCamila VillamilNo ratings yet

- FM. Final Exam (December 2019)Document12 pagesFM. Final Exam (December 2019)elodie Helme GuizonNo ratings yet

- DCF Guide ExampleDocument4 pagesDCF Guide ExampleAlexander RiosNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- Docshare - Tips - Sampa Video Solution Harvard Case Solution PDFDocument10 pagesDocshare - Tips - Sampa Video Solution Harvard Case Solution PDFnimarNo ratings yet

- Problem 7 AlkDocument8 pagesProblem 7 AlkAldi HerialdiNo ratings yet

- DCF Valuation Compact (Complete) - 3Document4 pagesDCF Valuation Compact (Complete) - 3amr aboulmaatyNo ratings yet

- Confusion Plcs SolutionsDocument8 pagesConfusion Plcs SolutionsJen Hang WongNo ratings yet

- Acquisition Cash FlowDocument3 pagesAcquisition Cash Flowkaeya alberichNo ratings yet

- Power Plant Financial AnalysisDocument16 pagesPower Plant Financial AnalysisGaurav BasnyatNo ratings yet

- DCFValuation JKTyre1Document195 pagesDCFValuation JKTyre1Chulbul PandeyNo ratings yet

- FMA Assignment Sem1 2019HB58032Document7 pagesFMA Assignment Sem1 2019HB58032rageshNo ratings yet

- ©2016 Devry/Becker Educational Development Corp. All Rights ReservedDocument12 pages©2016 Devry/Becker Educational Development Corp. All Rights ReservedUjjal ShiwakotiNo ratings yet

- DCF valuation of company with assumptionsDocument6 pagesDCF valuation of company with assumptionsbhavin shahNo ratings yet

- JK Tyres - 20020141022 - 20020141004Document80 pagesJK Tyres - 20020141022 - 20020141004AKANSH ARORANo ratings yet

- Chapter 1: Investment Recommendation: How We Have Derived The Summed Up ValueDocument4 pagesChapter 1: Investment Recommendation: How We Have Derived The Summed Up ValueMd. Mehedi HasanNo ratings yet

- ACR Tutorial 3 (Group 3)Document3 pagesACR Tutorial 3 (Group 3)tan JiayeeNo ratings yet

- Main Assumptions: Chapter 5: Financial PlanDocument5 pagesMain Assumptions: Chapter 5: Financial PlanValeria Quispe ToribioNo ratings yet

- Financial Performance Evaluation of Smithson PlcDocument5 pagesFinancial Performance Evaluation of Smithson PlcAyesha SheheryarNo ratings yet

- HO 2 - Tugela Finance Report - 2014.model AnswerDocument1 pageHO 2 - Tugela Finance Report - 2014.model AnswerSaud HidayatullahNo ratings yet

- Cost of ProductionDocument27 pagesCost of Productionfaisal197No ratings yet

- Financial Management ProjectDocument59 pagesFinancial Management ProjectFaizan MoazzamNo ratings yet

- Valution ModelDocument10 pagesValution ModelVivek WaradeNo ratings yet

- Final Account Take OverDocument1 pageFinal Account Take OverNugroho PratomoNo ratings yet

- Valuation of A FirmDocument13 pagesValuation of A FirmAshish RanjanNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- BFD Past Paper Analysis - For Summer 2021 ExamsDocument7 pagesBFD Past Paper Analysis - For Summer 2021 ExamsMuhammad Yahya100% (1)

- Course Outline (Akshat)Document7 pagesCourse Outline (Akshat)Saritha RajNo ratings yet

- Piotroski F-Score: Calculation ProcedureDocument2 pagesPiotroski F-Score: Calculation ProcedureSudershan ThaibaNo ratings yet

- Capital Budgeting: Assistant Professor MGM Institute of Management MBA (Finance), NET+JRF, Ph.D. (Pursuing)Document61 pagesCapital Budgeting: Assistant Professor MGM Institute of Management MBA (Finance), NET+JRF, Ph.D. (Pursuing)veera kaurNo ratings yet

- Strategic Approach Oil Gas PDFDocument6 pagesStrategic Approach Oil Gas PDFEdzwan RedzaNo ratings yet

- Chapter 1: Investment LandscapeDocument60 pagesChapter 1: Investment Landscapekavya pillala100% (1)

- VC Detailed LinkedinDocument45 pagesVC Detailed LinkedinMichael BuryNo ratings yet

- Project On VodafoneDocument51 pagesProject On Vodafonepankajsingla25278688% (8)

- Saapataar Adventure Park QuotationDocument2 pagesSaapataar Adventure Park Quotationagni.tuphanNo ratings yet

- 13.1 Introduction To The Balance of Payments Answer KeyDocument4 pages13.1 Introduction To The Balance of Payments Answer KeySOURAV MONDALNo ratings yet

- Ch02: Financial Assets, Money and Financial TransactionsDocument10 pagesCh02: Financial Assets, Money and Financial TransactionsAbi VillaNo ratings yet

- Corporate TaxationDocument94 pagesCorporate Taxationvishal budhirajaNo ratings yet

- Business Finance (4th G)Document3 pagesBusiness Finance (4th G)Medarly Amor YanocNo ratings yet

- ECMT2130: Semester 2, 2020 Assignment: Geoff Shuetrim Geoffrey - Shuetrim@sydney - Edu.au University of SydneyDocument7 pagesECMT2130: Semester 2, 2020 Assignment: Geoff Shuetrim Geoffrey - Shuetrim@sydney - Edu.au University of SydneyDaniyal AsifNo ratings yet

- Capital Structure and Firm Performance EDocument12 pagesCapital Structure and Firm Performance EBasilio MaliwangaNo ratings yet

- The Cost of Capital: © 2019 Pearson Education LTDDocument8 pagesThe Cost of Capital: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- International Accounting and Finance StrategiesDocument42 pagesInternational Accounting and Finance StrategiesLeo BaboNo ratings yet

- 7 Mistakes People Make When Choosing A Financial AdvisorDocument1 page7 Mistakes People Make When Choosing A Financial AdvisorSulemanNo ratings yet

- H030TR PDF EngDocument5 pagesH030TR PDF EngKa CiNo ratings yet

- Factors Influencing Investors' Decisions in Stock MarketDocument7 pagesFactors Influencing Investors' Decisions in Stock MarketJeetNo ratings yet

- Money and CouplesDocument20 pagesMoney and CouplesTom ChoNo ratings yet

- Derivatives Mishaps and What We Can Learn From Them: Big Losses by Financial InstitutionsDocument1 pageDerivatives Mishaps and What We Can Learn From Them: Big Losses by Financial InstitutionsUten nstNo ratings yet

- State Driven InvestmentsDocument27 pagesState Driven InvestmentsLotti LottiNo ratings yet

- MusharakahDocument15 pagesMusharakahSarmad BashirNo ratings yet

- Micro Saas ValuationDocument6 pagesMicro Saas ValuationaddyNo ratings yet

- Honda Marketing Strategy Segmentation and TargetingDocument6 pagesHonda Marketing Strategy Segmentation and Targeting17460920-076No ratings yet

- The Role of Ratio Analysis in Business Decisions A Case Study of O. Jaco Bros. Ent. (Nig.) LTD., Aba, Abia StateDocument112 pagesThe Role of Ratio Analysis in Business Decisions A Case Study of O. Jaco Bros. Ent. (Nig.) LTD., Aba, Abia StateIbrahim Olasunkanmi AbduLateefNo ratings yet

- UTI Scam: Robbery Through Other Means: What Is The UTI ?Document3 pagesUTI Scam: Robbery Through Other Means: What Is The UTI ?Joseph JenningsNo ratings yet

- Unit-II ADocument26 pagesUnit-II APaytm KaroNo ratings yet

- Goldman Sachs IB Summer Analyst ProgramDocument6 pagesGoldman Sachs IB Summer Analyst ProgramSandra DeeNo ratings yet