Professional Documents

Culture Documents

An Empirical Analysis of Factors Influencing Inves

Uploaded by

ParthOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Empirical Analysis of Factors Influencing Inves

Uploaded by

ParthCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/274990926

An Empirical Analysis of Factors Influencing Investment in

Mutual Funds in India

Article in Global Business Review · August 2014

DOI: 10.1177/0972150914535136

CITATIONS READS

14 2,831

1 author:

Deepak Chawla

International Management Institute

97 PUBLICATIONS 491 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Developing an instrument to assess the state of Knowledge Management (KM) implementation in Indian manufacturing and service

sector organizations View project

Driving Green marketing in a developing country: Reducing the attitude-behaviour gap View project

All content following this page was uploaded by Deepak Chawla on 25 May 2016.

The user has requested enhancement of the downloaded file.

Military-Madrasa-Mullah

A Global Threat 493

Article Complex 493

An Empirical Analysis Global Business Review

15(3) 493–503

of Factors Influencing Investment © 2014 IMI

SAGE Publications

in Mutual Funds in India Los Angeles, London,

New Delhi, Singapore,

Washington DC

DOI: 10.1177/0972150914535136

http://gbr.sagepub.com

Deepak Chawla

Abstract

The study is based on a sample of 431 respondents chosen using convenience sampling to understand

the mutual fund buying behaviour of the individual investors. The article identifies the various attrib-

utes that investors consider important while investing in mutual fund. There are two underlying

factors of importance that are extracted namely Credibility of the fund and Miscellaneous features

of the fund. The relationship of these factors with demographic variables is ascertained. The article

suggests recommendations for the mutual fund companies and suggestions for future research.

Keywords

Factor analysis, mutual funds, ANOVA, entry and exit load, past performance, tax benefits

Financial markets play a vital role in the economic development of a country. They facilitate the allocation

of scarce resources by transferring them from savers to borrowers, thereby accelerating investment

activities in the economy.

One of the most popular financial investments is mutual funds, which pool the savings of a large

number of investors who share a common financial goal based on trust. The money thus collected is

invested in capital market instruments such as shares, debentures and other securities. Investors get the

number of units based on the amount invested and the net asset value of the units. The income earned is

shared among the investors in proportion to the number of units held by them. A mutual fund is an

investment that suits the needs of the common man. It is an indirect form of investment in the capital

market that has the advantages of diversification, professional management, low-cost investment,

liquidity and tax benefit. The primary objective is to provide better returns to the investor by minimizing

the risk associated with capital markets. The most common features of mutual fund units are low unit

cost. The first mutual fund in India was launched by the Unit Trust of India (UTI) in the mid-1960s, and

since then, mutual funds have come a long way as an investment option.

The history of the mutual fund industry in India can be divided into four phases. The first phase

(1964–1987) began with the establishment of the UTI in 1963. Set up by the Reserve Bank of India

(RBI), the UTI also functioned under its regulatory and administrative control. The first scheme of the

UTI was launched in 1964. At the end of 1988, the UTI had assets worth ` 670,000 million under its

Deepak Chawla is a Distinguished Professor at the International Management Institute, New Delhi, India.

E-mail: dchawla@imi.edu. India Quarterly, 66, 2 (2010): 133–149

Downloaded from gbr.sagepub.com by guest on August 26, 2015

494 Deepak Chawla

management. The second phase (1987–1993) saw the entry of the public sector, mutual funds set up by

public sector banks, Life Insurance Corporation (LIC), as well as the General Insurance Corporation

(GIC). At the end of 1993, the mutual fund industry had assets of ` 470,040 million under its

management. During the third phase (1993–2003), the private sector funds entered the fray in 1993. The

erstwhile Kothari Pioneer (now merged with Franklin Templeton) was the first private sector mutual

fund registered in July 1993. At the end of January 2003, there were 33 mutual funds with total

assets of ` 1,218,050 million. The fourth phase (since February 2003) began with the repeal of the UTI

Act 1963 in February 2003. The UTI was bifurcated into two separate entities:

1. The specified undertaking of the UTI, with assets of ` 298,350 million under its management

as at the end of January 2003, representing broadly, the assets of US 64 scheme, assured

return and certain other schemes.

2. The UTI mutual fund, sponsored by the State Bank of India (SBI), Punjab National Bank (PNB),

Bank of Baroda (BOB) and LIC. It is registered with the Securities and Exchange Board

of India (SEBI) and functions under the Mutual Fund Regulations. With the bifurcation of

the erstwhile UTI, which had more than ` 76,000 million of assets under management in

March 2000 and with the setting up of UTI mutual fund and with recent mergers taking

place among different private sector funds, the industry has entered current phase of con-

solidation and growth. At the end of March 2008, there were 33 mutual funds, which managed

assets of ` 505,152 million.

There are now three types of mutual fund schemes:

1. By structure—open-ended schemes, close-ended schemes and interval schemes.

2. By investment objective—growth schemes, income schemes, balanced schemes and money

market schemes.

3. By other features—tax saving schemes and special schemes (index schemes and sector specified

schemes).

Mutual funds are designed to provide maximum benefit to the investors. The fund manager has a research

team to achieve the objectives of the scheme. A mutual fund has the following advantages:

1. The investment is in a well-diversified portfolio of securities, irrespective of whether the amount

invested is big or small.

2. As the investment is in a diversified portfolio of securities, the associated risk is less compared

to merely investing in two or three securities. If some of the securities of the portfolio react

negatively due to some economic or political factors, others will react positively. Thus, the

overall effect of risk is much less in mutual fund compared to portfolios managed by individual

investors.

3. The funds are managed by fund managers who undertake a lot of research and have better

investment management skills than individual investors.

4. Mutual funds are far more liquid than shares, as they can be redeemed easily and quickly.

5. By virtue of having large volume, mutual funds have lower transaction cost, the benefit of which

is passed on to the investors.

Global Business Review, 15, 3 (2014): 493–503

Downloaded from gbr.sagepub.com by guest on August 26, 2015

An Empirical Analysis of Factors Influencing Investment in Mutual Funds in India 495

6. As required by the regulator, mutual funds provide investors with updated information pertaining

to the market and schemes, thereby providing transparency.

7. The interests of mutual fund investors are regulated, as all funds are registered with SEBI, which

enforces complete transparency.

8. Mutual funds offer a lot of flexibility and convenience, as investors can easily switch schemes

and their options.

However, mutual funds also have some disadvantages:

1. Investors do not have a say in the decision-making process of a fund manager, which may come

in the way of achieving the investor’s financial objectives. Moreover, information gathering is

costly, and brokers or the agents often do not disclose all relevant information about the investment

at the time of purchase.

2. Irrespective of the performance of the fund, investors have to pay investment management

fees and fund distribution costs as a proportion of the value of investment as long as they hold

the unit.

3. Mutual funds offer much less in return as compared to direct investment in the capital market.

Literature Review

As per Gupta (1993), investors perceive all types of mutual fund schemes as safe. However, they have a

distinct liking for close-ended, pure equity and growth schemes. The research of Singh and Vanita (2002)

also indicate that the investment in mutual funds is not perceived to be risky, but the preference is for

open-ended schemes. Mutual funds are ranked lower in comparison to investment in Public Provident

Fund (PPF), National Savings Certificate (NSC) and LIC policies. According to them, an important

reason for investment in mutual funds is saving of tax. Sikdar and Surjit (1996) also found tax savings to

be an important reason for investment in mutual funds by salaried and self-employed people. However,

Santhi and Gurunathan (2011) mention that the participation of Indian investors in tax saving mutual

funds is comparatively less than other safer investment areas like insurance, postal deposit schemes and

fixed deposits (FDs).

The relative importance of various factors like past performance of mutual funds, their size and

cost of transaction are used by investors as criteria in investment in mutual funds. Past performance is

given due consideration in the work of Bogle (1992), Ippolito (1992), Ramasamy and Young (2003),

Sikdar and Singh (1996), Singh and Chander (2004) and Wilcox (2003). The size of the fund was

found to be an important consideration in the work of Pollet and Wilson (2008) and Ramasamy and

Young (2003).

Alexander et al. (1997) are of the view that investors are knowledgeable about cost, risk and returns

associated with mutual funds. This is supported by Wilcox (2003), who found that educated investors

demonstrate basic knowledge of finance in their investment decision. However, Mehry (2004) differs,

stating that mutual fund investors are ignorant. Moreover, agents are only concerned about incentives

and commissions they get by selling schemes rather than about the quality of products. They do not

explain the risk factors to the investors associated with the fund. This view is supported by Feverborn

Global Business Review, 15, 3 (2014): 493–503

Downloaded from gbr.sagepub.com by guest on August 26, 2015

496 Deepak Chawla

(2001), who states that individual investors will continue to be misled by companies that sell new funds.

These companies are not completely honest and transparent in their approach.

Barker and Odean (2001) are of the view that women are less confident in their investment decisions

compared to men. Similar views are expressed by Sunden and Surette (1998), who they state that women

are more risk averse than men. Powell and Ansic (1997) are of the view that women are less able

financial decision makers than men. A similar view is advocated by Oakley (2000), who states that

women are less effective and competent than men in the area of financial investment. The result is that

investors prefer to invest in funds managed by males. However, the findings of Stanley et al. (2003) are

different. Comparing the performance and investment behaviour of female- and male-managed fixed

income mutual funds, they found no significant difference in terms of performance, risk and other fund

characteristics. However, they found net asset flow into funds managed by males to be higher, especially

in the initial years of managing funds.

A number of studies have been conducted on the performance of mutual funds under varying

conditions. The work of Badrinath and Gubellini (2012) examines the performance of mutual fund

across the business cycle. This is done by disaggregating funds into different investment objectives to

determine which funds show cyclical performance. The results indicate that both small-cap and mid-cap

growth equity fund are able to contribute to performance, whereas value funds are not able to do so.

Chang et al. (2012) compared the financial performance of green and traditional mutual funds. A total of

131 green mutual funds were compared with the traditional mutual funds in their respective Morning

Star categories on various measures of performance. It was found that green mutual funds gave lower

returns compared to traditional mutual funds in their respective Morning Star categories. The performance

of green mutual funds has also been studied on a risk-adjusted basis. Trainor (2012), who examined the

risk-adjusted performance of individual mutual funds that investors used to invest in this asset class,

found that past performance did influence future performance and investors should invest in top

performing funds with the lowest expense ratio. Arugaslan et al. (2008) evaluated the performance of 50

large US-based international equity funds using risk adjusted returns during 1994–2003. They used risk-

adjusted performance M2 to evaluate equity funds. The results indicate that funds with the highest

average returns may lose their attractiveness to investors once the degree of risk embedded into the funds

is forced into the analysis. Further, some funds in which the average unadjusted returns do not stand out

may look very attractive once their low risk is taken into performance. Research by Drachter et al. (2007)

examines decision processes in general fund companies and their impact on fund performance. The

results show that behaviour of managers depends heavily on the characteristics of the funds and that of

the funds’ company.

Some researchers have examined the behaviour of investors while investing in mutual funds. For

example, Hou (2012) examined the return persistence and investors’ timing ability of 200 domestic

equity mutual funds in Taiwan between 1996 and 2009. It emerged that the funds that had performed

well in the previous year continued to do so in the following year. However, investors’ timing per

formance was negatively related to fund performance. Watson and Funck (2012) investigated the

trading behaviour of short-term seller and found an increase in short selling with the level of

cloudiness. They found a decrease in short selling three days prior to a cloudy day. Allen and Parwards

(2006) examined mutual fund investors’ response to merger of Australian mutual fund companies. Using

regression analysis to find the impact of mergers on different types of parties in the merger, they found

that mergers did not result in increased money flows. On the contrary, investors withdrew from target

funds prior to and after the merger.

Global Business Review, 15, 3 (2014): 493–503

Downloaded from gbr.sagepub.com by guest on August 26, 2015

An Empirical Analysis of Factors Influencing Investment in Mutual Funds in India 497

Objectives of the Present Study

The literature cited above does not discuss the investment behaviour of investors in mutual funds in the

sense that no attempt is made to extract the important underlying factors of investment, their relative

importance and their relationship with demographic variables. The present work takes care of these

limitations. Specifically, the objectives of this study are the following:

1. To understand the mutual fund buying behaviour of individual investors.

2. To identify the various attributes which investors consider important while investing in mutual

funds.

3. To extract the underlying factors of importance and their relative considerations for investors.

4. To examine whether these extracted factors vary with demographic variables.

Methodology

An exploratory research was conducted by reviewing the literature on the subject, followed by

unstructured interviews with investors and investment consultants dealing with mutual funds. All this

helped in identifying the variables on the subject. A structured questionnaire was prepared using these

variables. Eleven attributes were identified that are considered important by investors while investing in

a mutual fund. These were measured on a 5-point scale, where 1 = very unimportant, 2 = unimportant,

3 = neither important nor unimportant, 4 = important and 5 = very important. Besides the demographic

questions, there were questions on investment behaviour. The survey instrument was pretested with

15 respondents and in the light of the feedback obtained, the questionnaire was revised. An online

survey was conducted to obtain the responses. Some of the respondents were personally contacted to

fill the questionnaire. A sample of 431 useable responses was obtained. It was found that for some of

the questions, a blank was left by the respondents. Such questions were omitted from the analysis and

the sample size was reduced accordingly.

A reliability test using Cronbach’s alpha was conducted on an importance of 11 attributes measured

on interval scale. The value of Cronbach’s alpha was found to be 0.781, which is quite high. A factor

analysis was conducted on these items. The importance of factors was found by computing the average

factor score for each factor. The factor scores are compared for each of the demographic variables using

one-way ANOVA.

Results

A demographic profile of the respondent is given in Table 1.

It is clear from the Table 1 that 64.7 per cent respondents are in the age group of 25–35 years, 87.4

per cent male, 71.9 per cent postgraduate, 80.3 per cent married, 79.8 per cent working in the private

sector, 45.7 per cent with an annual family income of ` 10 lakh and above and 85.5 per cent living in

metropolitan cities. There are on an average 2.15 people working in the family, while an average of

1.42 people are financially dependent on the respondent.

Global Business Review, 15, 3 (2014): 493–503

Downloaded from gbr.sagepub.com by guest on August 26, 2015

498 Deepak Chawla

Table 1. Demographic Profile of the Respondents

Variable Description Percentage

Age (years) < 25 9.1

25–35 64.7

36–50 23.6

More than 50 2.6

Sex Male 87.4

Female 12.6

Educational qualification Graduation 28.1

Postgraduation and above 71.9

Marital status Single 39.7

Married 60.3

Profession Private sector 79.8

Public sector and government 11.7

Business 4.5

Self-employed 1.0

Any other 3.1

Annual family income Up to ` 250,000 3.4

` 250,001–500,000 16.8

` 500,001–750,000 17.3

` 750,001–1,000,000 16.8

Above ` 1,000,000 45.7

Place of current residence Metropolitan city 88.5

Non-metropolitan city 11.5

Source: Authors’ findings.

Table 2. Source of Information for Purchase of Mutual Funds

Investment Instrument Numbers Percentage* (per cent)

Recommendation of friends and family members 175 40.9

Recommendation of the broker 147 34.3

Performance record of the issuing company 242 56.5

Radio 3 0.7

Television 55 12.9

Newspaper 122 28.5

Others 88 20.6

Total 428

Source: Authors’ findings.

Note: *Total exceeds 100 per cent because of multiplicity of answers.

The sources of information for the purchase of mutual funds are given in Table 2.

The most important source of information on purchase of mutual fund is the performance record

of the issuing company (56.5 per cent), followed by recommendation of friends and family members

(40.5 per cent), the recommendation of the broker (34.3 per cent) and the newspaper (28.5 per cent).

In our study, past performance is found to be more important compared to other factors. This goes in

Global Business Review, 15, 3 (2014): 493–503

Downloaded from gbr.sagepub.com by guest on August 26, 2015

An Empirical Analysis of Factors Influencing Investment in Mutual Funds in India 499

accordance with the results of the research conducted by Bogle (1992), Ippolito (1992), Ramasamy and

Young (2003), Sikdar and Singh (1996), Singh and Chander (2004) and Wilcox (2003).

As regards the investment behaviour of consumers, it is seen that 87.4 per cent of the respondents

themselves take investment decisions. Approximately 33 per cent of the respondents save more than

` 200,000 annually, whereas about 30 per cent save ` 50,000–100,000. More than 45 per cent of the

respondents spend less than 25 per cent, whereas about 34 per cent spend 26–40 per cent of their saving

in mutual funds. About 52 per cent of respondents monitor the performance of the mutual funds that they

have invested in less than once a month, whereas 22 per cent do it 1–3 times a month.

The respondents were asked to state the two most important funds for investment in mutual funds (see

Table 3). It is seen that the most preferred fund is growth fund (78.1 per cent), followed by tax saving

funds (68.4 per cent) and balanced funds (20.2 per cent).

When asked to state the motives for investment in mutual funds, the most important reason

was tax savings (68.3 per cent) higher returns (59 per cent) and capital appreciation (54.3 per cent;

see Table 4).

Tax saving was also found to be an important factor in the study of Sikdar and Surjit (1996). Besides

mutual funds, investment in shares, PPF, FDs and the NSC were considered important instruments of

investment by 71, 66.4, 48.7 and 29 per cent of respondents respectively (see Table 5).

Table 3. Two Most Important Funds of the Investors

Investment Instrument Numbers Percentage* (per cent)

Balanced fund 87 20.2

Growth fund 336 78.1

Debt funds 11 2.6

Tax saving funds 294 68.4

Sectoral funds 70 16.3

Income fund 25 5.8

Others 9 2.1

Total 430

Source: Authors’ findings.

Note: *Total exceeds 100 per cent because respondents were asked to choose two responses.

Table 4. Motive for Investment in Mutual Funds

Investment Instrument Numbers Percentage* (per cent)

Tax saving 293 68.3

Regular income 51 11.9

Capital appreciation 233 54.3

Higher returns 253 59.0

Safety 67 15.6

Others 14 3.3

Total 429

Source: Authors’ findings.

Note: *Total exceeds 100 per cent because of multiplicity of answers.

Global Business Review, 15, 3 (2014): 493–503

Downloaded from gbr.sagepub.com by guest on August 26, 2015

500 Deepak Chawla

Table 5. Investment in Various Instruments besides Mutual Fund

Investment Instrument Numbers Percentage* (per cent)

Shares 296 71.0

Bonds 74 17.7

Post office savings 112 26.9

NSC 121 29.0

FDs 203 48.7

PPF 277 66.4

Others 61 14.6

Total 417

Source: Authors’ findings.

Note: *Total exceeds 100 per cent because of multiplicity of answers.

The PPF and NSC are also considered important in the work of Singh and Vanita (2002), where in fact

these instruments are rated higher than mutual funds. The FDs and post office savings are also rated

higher than mutual funds in the research of Santhi and Gurunathan (2011).

Out of the 11 attributes considered, past performance, reputation of the company issuing the fund,

portfolio of the investment, tax benefits and transparency of fund manager were considered important by

93, 84.9, 84.6, 71.9 and 71.5 per cent respectively. Add-ons provided by the funds were important only

to 24 per cent of the respondents.

A factor analysis was conducted on the 11 attributes. The Kaiser-Meyer-Olkin (KMO) statistic was

found to be 0.85 (> 0.5) and Bartlett’s test of sphericity was found to be significant. These showed that

the conditions for applicability of factor analysis were satisfied.

There were two factors that were extracted using principal component method explaining 45.256

per cent total variations. The principal component matrix was rotated and a factor loading above 0.5

was used for naming the two factors. The rotated component matrix is presented in Table 6.

The first factor comprised variables—past performance record, performance of portfolio manager,

reputation of company issuing fund, portfolio of investment, favourable rating by rating agency and

Table 6. Rotated Component Matrix

Attribute Component 1 Component 2

Past performance record 0.773 0.123

Entry and exit load 0.125 0.527

Performance of the portfolio manager 0.678 0.120

Reputation of the company issuing the fund 0.571 0.311

Portfolio of the investment 0.759 0.118

Favourable rating by rating agency 0.611 0.098

Transparency of fund manager 0.698 0.140

Add-ons provided by the funds –0.013 0.671

Declaration of NAV on daily basis 0.359 0.407

Lock in period of the closed-ended funds 0.109 0.735

Tax benefits available on MF 0.313 0.549

Source: Authors’ findings.

Global Business Review, 15, 3 (2014): 493–503

Downloaded from gbr.sagepub.com by guest on August 26, 2015

An Empirical Analysis of Factors Influencing Investment in Mutual Funds in India 501

transparency of the fund manager. This factor was named as ‘credibility of the fund’ and explained

27.942 per cent of the variations. The second contained the variables—entry and exit load, add-on

provided by the mutual fund, lock-in period of closed ended funds and tax benefits available on mutual

funds. This factor was named as ‘miscellaneous features of the fund’ and accounted for 17.314 per cent

of the variations.

The average factor score for the two extracted factors was computed as 4.07 and 3.46 for the factors

credibility of funds and miscellaneous features of fund, respectively. This shows that the credibility of

fund is considered to be the most important factor while investing in a mutual fund.

As mentioned earlier, to determine whether the two factors vary across demographic variables such

as age, sex, educational qualification, marital status, profession and income, a one-way ANOVA is

performed with factor score as dependent variable and each of the demographic variables as factor. It is

found that the credibility of the fund significantly varies with gender and profession (p value less than

0.05). This is significantly higher for male investors compared to female investors. The results are in line

with the work of Barker and Odean (2001) and Powell and Ansic (1997), where they state that women

are less able as decision makers. When it comes to profession, it is seen that businessmen are most

concerned with the credibility of fund, followed by the public sector and the government employees. The

self-employed are least bothered about it. Among the remaining demographic variables, there was no

statistical difference. In case of the second factor, namely, miscellaneous features of the fund, it is found

that significant variations exist in case of age, educational qualification and marital status. As regards the

second factor, that is, miscellaneous features of the fund, single persons attach significantly higher

importance to it than married people. This is not surprising, as married people, because of increased

family responsibilities, would have already invested elsewhere in miscellaneous features provided by the

fund. This could perhaps be the reason for their lack of interest in this factor. Further, it is observed that

graduates show more interest in the miscellaneous features than postgraduates. The interest of younger

investors (aged less than 25) is the highest in this factor and it reduces with age. A plausible reason for

this could be that with age, added responsibilities creep in and accordingly, they already invest in these

features and do not wait for mutual funds to come up with these facilities.

Interpretation of Results and Recommendations

It has been found that past performance of the issuing company, tax-saving funds and growth funds

with capital appreciation are the important considerations for investors in a mutual fund. It is

surprising to know from our study that more than 54 per cent of investors want a capital appreciation

and higher return along with tax savings and low risk. This shows that investors have very high

expectations from the fund managers, whom they expect to generate a high return with minimum

possible risk. This is contradictory to the famous theory in finance that ‘high return is associated with

high risk’. Since the mutual funds face under constant pressure to invest in securities that are likely to

give much higher returns than the risk-free instruments. As the cost of capital to the investor is much less

in risk-free investments, which is just the risk-free rate, the return from mutual fund is risk-free rate

plus risk premium. Mutual fund companies would succeed if they are able to provide premium to the

investors. Otherwise, it will be difficult for them to compete with the risk-free instruments. This is more

the case with equity schemes and growth schemes. Our result is concurrent with many researchers who

Global Business Review, 15, 3 (2014): 493–503

Downloaded from gbr.sagepub.com by guest on August 26, 2015

502 Deepak Chawla

have conducted research in different periods, which shows that past performance is an important factor

for investment by the investors and majority of the investors themselves take investment decisions.

Therefore, fund managers put all their efforts to generate high returns to have a stable record of

performance and have competitive advantage. It may be worth noting that investment in mutual funds if

redeemed after one year of investment is tax free. This aspect may be highlighted while advertising for

mutual funds.

The results indicate that two factors are considered important by investors while investing in mutual

funds. These, in order of importance, are credibility of fund and miscellaneous features of fund. Since

the results have indicated that the general public, business people and employees of public sector and

government attach a lot of importance to the credibility of the fund, the credibility factor should be

emphasized at the time of issuing mutual funds.

The second factor, namely, the miscellaneous features of the fund, is considered important by younger,

unmarried people. This factor comprises of variables like entry and exit load, add-ons provided by the

funds, lock-in period of the closed-ended funds and tax benefits available on mutual funds. All these

variables are considered very important by most of investors with the exception of add-ons provided by

the mutual funds which is considered important by slightly above 50 per cent respondents.

Limitations and Suggestions for Future Research

The main limitations of the study are that the sample is skewed towards respondents residing in

metropolitan cities (Delhi, Mumbai, Kolkatta, Chennai and Banglore), with annual family income of

more than ` 10 lakh, working in the private sector, in the age group 25–35 years, with postgraduate

degree and above. It is seen that 88.5 per cent of respondents reside in metropolitan cities 45.7 per cent

have income above ` 10 lakh, about 80 per cent work for the private sector, 65 per cent are in the age of

25–35 years and 72 per cent with postgraduate degrees. The sample could have been more representative.

Further, it is known that mutual funds are meant for small investors with meagre savings and low income.

This is not the case in this study. Therefore, it may be difficult to generalize these results.

It is suggested that the study may be replicated with the majority of respondents from middle income

and lower category belonging to Tier 1, Tier 2 and Tier 3 cities of India. Further, a considerable proportion

of respondents should be from 50-plus age group, as mutual funds are perceived to be less risky, and

older people tend to be risk averse. Further, the selection of respondents from various professions should

be uniform.

Acknowledgements

The author is grateful to the anonymous referees of the journal for their extremely useful suggestions to improve the

quality of the article. Usual disclaimers apply.

References

Alexander, Gordan J., Jones, Jonathan D., & Nigro, Peter J. (1997). Mutual fund investing through employee

sponsored pension plans—invest knowledge and policy implications. Managerial Finance, 23(8), 5–29.

Allen, David E., & Parwada, Jerry T. (2006). Investor’s response to mutual fund company mergers. International

Journal of Managerial Finance, 2(2), 121–135.

Global Business Review, 15, 3 (2014): 493–503

Downloaded from gbr.sagepub.com by guest on August 26, 2015

An Empirical Analysis of Factors Influencing Investment in Mutual Funds in India 503

Arugaslan, Omar, Edwards, Ed., & Samant, Ajay (2008). Risk adjusted performance of international mutual funds.

Managerial Finance, 34(1), 5–22.

Badrinath, Swaminathan G., & Gubelline, Stefano (2012). Does conditional mutual fund outperformance exist?

Managerial Finance, 38(12), 1160–1183.

Barker, B.M., & Odean, T. (2001). Boys will be boys: gender overconfidence, and common stock investment.

Quarterly Journal of Economics, 116(1), 261–292.

Bogle, J.C. (1992). Selecting equity mutual funds. The Journal of Portfolio Management, 18(2), 94–110.

Chang, C., Edward, Nelson, Walt A., & Witte, H. Doug (2012). Do green mutual funds perform well? Management

Research View, 35(8), 693–708.

Drachter, Kerstin, Kemf, Alexander, & Wagner, Michael (2007). Decision process in German mutual fund compa-

nies: evidence from a telephone survey. International Journal of Managerial Finance, 3(1), 49–69.

Feverborn, Thomas A. (2001). Misplaced marketing. Journal of Consumer Marketing, 18(1), 7–9.

Gupta, L.C. (1993). MutualFunds and Asset Preferences: Household Investor Survey 2nd Round. New Delhi:

Society for Capital Market Research and Development.

Ippolito, R. (1992). Consumers reaction to measures of poor quality: evidence from mutual funds. Journal of Law

and Economics, 35(1), 45–70.

Mehry, K.D. (2004). Problems of mutual funds in India. Finance India, 18(1), 220–224.

Oakley, J.G. (2000). Gender based barriers to senior management positions: understanding the scarcity of female

CEOs. Journal of Business Ethics, 27(4), 321–334.

Pollet, Joshnu M., & Wilson, Mungo (December 2008). How does size affect mutual fund behavior? The Journal of

Finance, LXIII(6), 2941–2969.

Powell, M., & Anisic, D. (1997). Gender differences in risk behavior in financial decision-making: are women really

more risk averse? American Economic Review, l(89), 381–385.

Ramasamy, B., & Young, M.C.H. (2003). Evaluating mutual funds in an emerging markets: factors that matter to

financial advisors. International Journal of Bank Marketing, 21(3), 122–136.

Santhi, N.S., & Gurunathan, K. Balanaga (2011). An analysis of investors’ attitude towards tax saving mutual funds

in India. European Journal of Economics, Finance and Administrative Sciences, (41), 54–64.

Sikdar, S., & Singh, A.P. (1996). Financial services: investment in equity and mutual funds—a behavioural study.

In B.S. Bhatia & G.S. Batra (Eds), Management of Financial Services (Chapter 10, pp. 136–145). New Delhi:

Deep and Deep Publications.

Singh, J., & Chander, S. (2004). An empirical analysis of perception of investors towards mutual funds. Finance

India, XVIII(4), 1673–1692.

Singh, Y.P., & Vanita. (2002). Mutual fund investors’ perceptions and preferences. A Survey, 55(3), 8–20.

Stanley, A.M., Baird, S.B., & Frye, M.B. (2003). Do female mutual fund managers manage differently? The Journal

for Financial Research, XXVI(1), 1–18.

Sunden, A.E., & Surette, B.J. (1998). Gender differences in the allocation of assets in retirement savings plans.

American Economic Review, 88, 207–211.

Tony, Chieh-Tse, H. (2012). Return persistence and investment timing decisions in Taiwanese domestic equity

mutual funds, Managerial Finance, 38(9), 873–891.

Trainor, W.J. (2012). Performance measurement of high yield bond mutual funds. Management Research Review,

33(6), 609–619.

Watson, E., & Funck, M.C. (2012). A cloudy day in the market: short selling behavioural bias or trading strategy.

International Journal of Managerial Finance, 8(3), 238–255.

Wilcox, R.T. (2003). Bargain hunting or star gazing? Investors’ preferences for stock mutual funds, Journal of

Business, 70(4), 645–663.

Global Business Review, 15, 3 (2014): 493–503

Downloaded from gbr.sagepub.com by guest on August 26, 2015

View publication stats

You might also like

- Mutual Funds in India: Structure, Performance and UndercurrentsFrom EverandMutual Funds in India: Structure, Performance and UndercurrentsNo ratings yet

- Gaurav AgarwalDocument37 pagesGaurav AgarwalShashankPandeyNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Performance EvaluationDocument14 pagesPerformance EvaluationAsit kumar BeheraNo ratings yet

- Summary of Jason A. Scharfman's Private Equity Operational Due DiligenceFrom EverandSummary of Jason A. Scharfman's Private Equity Operational Due DiligenceNo ratings yet

- Investers Preference Towards Mutual FundsDocument24 pagesInvesters Preference Towards Mutual FundsritishsikkaNo ratings yet

- Benefits Management: How to Increase the Business Value of Your IT ProjectsFrom EverandBenefits Management: How to Increase the Business Value of Your IT ProjectsRating: 4 out of 5 stars4/5 (1)

- Understanding Mutual Funds and Their BenefitsDocument89 pagesUnderstanding Mutual Funds and Their BenefitsashivadiNo ratings yet

- SSRN-id3090997 - MFDocument8 pagesSSRN-id3090997 - MFsameer balamNo ratings yet

- Dissertation On Mutual FundDocument63 pagesDissertation On Mutual Fundarkaprava ghosh92% (12)

- A Study On Performance of Selected Mutual Funds in HDFC Bank at AnantapurDocument5 pagesA Study On Performance of Selected Mutual Funds in HDFC Bank at AnantapurEditor IJTSRDNo ratings yet

- Analysis of Investment Pattern of Mutual Funds Investors - An Empirical Study in OrissaDocument23 pagesAnalysis of Investment Pattern of Mutual Funds Investors - An Empirical Study in OrissaVandita KhudiaNo ratings yet

- Study On Mutual Fund InvestmentDocument38 pagesStudy On Mutual Fund InvestmentAditya Singh100% (1)

- Project On Mutual FundDocument109 pagesProject On Mutual FundPrajwal AlvaNo ratings yet

- A Summer Project Report On: "Comparative Study of Mutual Funds in India"Document55 pagesA Summer Project Report On: "Comparative Study of Mutual Funds in India"Pooja AdhikariNo ratings yet

- Ap19 PDFDocument9 pagesAp19 PDFAnuradhaNo ratings yet

- Study of Sector Wise Allocation of Selected Schemes of ELSS Mutual FundsDocument9 pagesStudy of Sector Wise Allocation of Selected Schemes of ELSS Mutual FundsAnuradhaNo ratings yet

- Project On Mutual FundDocument112 pagesProject On Mutual FundSharn GillNo ratings yet

- BBA ProjectDocument51 pagesBBA ProjectRaghava PrusomulaNo ratings yet

- Mutual Fund InvstDocument109 pagesMutual Fund Invstdhwaniganger24No ratings yet

- Mutual Funds Performance Analysis: A Selection Criteria For InvestorDocument4 pagesMutual Funds Performance Analysis: A Selection Criteria For Investorspandanan33No ratings yet

- Dissertation Report On Mutual Funds Industry in IndiaDocument12 pagesDissertation Report On Mutual Funds Industry in IndiaDeepika verma88% (8)

- Performance Analysis of Mutual Fund: A Comparative Study of The Selected Debt Mutual Fund Scheme in IndiaDocument5 pagesPerformance Analysis of Mutual Fund: A Comparative Study of The Selected Debt Mutual Fund Scheme in IndiaaqsakhanaljedeelNo ratings yet

- INTERNSHIP REPORT ON 15 DAYS INTERNSHIP PROGRAM AT SUMIT CEPLDocument25 pagesINTERNSHIP REPORT ON 15 DAYS INTERNSHIP PROGRAM AT SUMIT CEPLNarendra Singh100% (1)

- Behavioural Analysis of Individual Investors Towards Selection of Mutual Fund Schemes: An Empirical StudyDocument7 pagesBehavioural Analysis of Individual Investors Towards Selection of Mutual Fund Schemes: An Empirical StudyAlphonseGeorgeNo ratings yet

- Comparison of Different Types of Mutual Funds and Their PerformanceDocument34 pagesComparison of Different Types of Mutual Funds and Their PerformanceRahul Srivastav BedaantNo ratings yet

- Sip ProjectDocument69 pagesSip ProjectSdNo ratings yet

- Analysis of Mutual Funds With Reference To Equity FundsDocument8 pagesAnalysis of Mutual Funds With Reference To Equity FundsAbhishekNo ratings yet

- PENAM S B.com A Brief Study of Mutual Fund Offered by Indian Financial InstitutionDocument25 pagesPENAM S B.com A Brief Study of Mutual Fund Offered by Indian Financial InstitutionServer IssueNo ratings yet

- Satish Sbi-Internship ReportDocument62 pagesSatish Sbi-Internship ReportSatish Kumar100% (1)

- A Study On Performance Evaluation of Selected Balanced Funds in Karvy Stock Broking LTD., TirupatiDocument7 pagesA Study On Performance Evaluation of Selected Balanced Funds in Karvy Stock Broking LTD., Tirupatisree anugraphicsNo ratings yet

- Comparative Analysis On Selected Public Sector and Private Sector Mutual Funds in India With Special Reference To Growth FundsDocument9 pagesComparative Analysis On Selected Public Sector and Private Sector Mutual Funds in India With Special Reference To Growth Fundsparmeen singhNo ratings yet

- ResearchPaper PDFDocument13 pagesResearchPaper PDFKiran Kumar NNo ratings yet

- Comparative Analysis of Mutual Funds - KotakDocument13 pagesComparative Analysis of Mutual Funds - Kotakmohammed khayyumNo ratings yet

- "A Comparative Analysis of Mutual Funds" (: Bachelor of Commerce (Honors)Document35 pages"A Comparative Analysis of Mutual Funds" (: Bachelor of Commerce (Honors)Harish MavelilNo ratings yet

- FI613Document10 pagesFI613thanglapallyhemalathaNo ratings yet

- Analysis of Investment Pattern of Mutual Funds Investors - An Empirical Study in OrissaDocument23 pagesAnalysis of Investment Pattern of Mutual Funds Investors - An Empirical Study in OrissaAnkita RanaNo ratings yet

- Challengesin MutualfundindustryDocument8 pagesChallengesin Mutualfundindustrypreksha adeNo ratings yet

- Equity Research and Fundamental Analysis of Oil and Gas SectorDocument45 pagesEquity Research and Fundamental Analysis of Oil and Gas Sectordevak shelarNo ratings yet

- Test of Sharpe Ratio On Selected Mutual Fund SchemesDocument10 pagesTest of Sharpe Ratio On Selected Mutual Fund SchemesPritam ChandaNo ratings yet

- A Comparative Analysis of Mutual Funds in Private Sector Bank & Public Sector BankDocument84 pagesA Comparative Analysis of Mutual Funds in Private Sector Bank & Public Sector BankSami Zama0% (1)

- "Mutual Funds Is The Better Investments Plan": A Project Report ONDocument17 pages"Mutual Funds Is The Better Investments Plan": A Project Report ONJay Prakash KhampariyaNo ratings yet

- "Systematic Investment Plan: Sbi Mutual FundDocument60 pages"Systematic Investment Plan: Sbi Mutual Fundy2810No ratings yet

- Portfolio Management of Mutual FundsDocument88 pagesPortfolio Management of Mutual FundsMohit UpadhyayNo ratings yet

- Minor Research Paper FINAL 1Document30 pagesMinor Research Paper FINAL 1Deep ChoudharyNo ratings yet

- Project AnkitDocument78 pagesProject AnkitAnkit Chhabra100% (1)

- Problems and Prospects of Mutual Funds in India With Reference To NJ India Invest Private LTDDocument7 pagesProblems and Prospects of Mutual Funds in India With Reference To NJ India Invest Private LTDPraveen HJNo ratings yet

- Pratim SIP FinalDocument74 pagesPratim SIP Finalpratim shindeNo ratings yet

- Analysis of Mutual Fund PerformanceDocument7 pagesAnalysis of Mutual Fund PerformanceMahaveer ChoudharyNo ratings yet

- Naveen Synapsis 2Document6 pagesNaveen Synapsis 2Naveen Kumar NcNo ratings yet

- Study On MVMFDocument60 pagesStudy On MVMFManîsh SharmaNo ratings yet

- "Systematic Investment Plan: Sbi Mutual FundDocument60 pages"Systematic Investment Plan: Sbi Mutual FundStudent ProjectsNo ratings yet

- Analysis of Portfolio of Mutual FundsDocument97 pagesAnalysis of Portfolio of Mutual FundsAarnesh_Karamc_176473% (11)

- "Mutual Funds Is The Better Investments Plan": Master of Business AdmimistrationDocument18 pages"Mutual Funds Is The Better Investments Plan": Master of Business AdmimistrationJay Prakash Khampariya100% (1)

- Bharti Project ReportDocument107 pagesBharti Project ReportBharti SinghNo ratings yet

- Sbi Life Insurance Ajmer ": A Project Report ONDocument65 pagesSbi Life Insurance Ajmer ": A Project Report ONdeepak_keswani86No ratings yet

- Project MiniDocument30 pagesProject MiniRaja SekharNo ratings yet

- Growth of Indian Mutual Funds IndustryDocument105 pagesGrowth of Indian Mutual Funds IndustryrahulprajapNo ratings yet

- A Study On Investors Perception TowardsDocument5 pagesA Study On Investors Perception Towardspratik kumbharNo ratings yet

- Chapter IDocument83 pagesChapter IAruna TalapatiNo ratings yet

- Individual Behavior PDFDocument49 pagesIndividual Behavior PDFParthNo ratings yet

- Swami and Friends at The Malgudi Post Office: Indian Institute of Management Ahmedabad A00012Document4 pagesSwami and Friends at The Malgudi Post Office: Indian Institute of Management Ahmedabad A00012ParthNo ratings yet

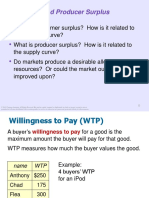

- In This Chapter, Look For The Answers To These QuestionsDocument30 pagesIn This Chapter, Look For The Answers To These QuestionsParthNo ratings yet

- Little PDFDocument23 pagesLittle PDFParthNo ratings yet

- Consumer and Producer Surplus PDFDocument28 pagesConsumer and Producer Surplus PDFParthNo ratings yet

- Demand, Supply and Market Equilibrium With Examples PDFDocument61 pagesDemand, Supply and Market Equilibrium With Examples PDFm3gp13 yoNo ratings yet

- In This Chapter, Look For The Answers To These QuestionsDocument35 pagesIn This Chapter, Look For The Answers To These QuestionsParthNo ratings yet

- Price Ceiling and Price FloorsDocument15 pagesPrice Ceiling and Price FloorsParthNo ratings yet

- In This Chapter, Look For The Answers To These QuestionsDocument31 pagesIn This Chapter, Look For The Answers To These QuestionsParth100% (1)

- 4 - HRPDocument17 pages4 - HRPParthNo ratings yet

- Short Run Decisions PDFDocument2 pagesShort Run Decisions PDFShivamKhareNo ratings yet

- Is LMDocument39 pagesIs LMParthNo ratings yet

- MacroEcon PDFDocument196 pagesMacroEcon PDFParthNo ratings yet

- ICDL Advanced Spreadsheets 2.0Document228 pagesICDL Advanced Spreadsheets 2.0m3gp13 yo100% (1)

- 2 - Strategic HRMDocument20 pages2 - Strategic HRMRemonNo ratings yet

- 6 - SelectionDocument22 pages6 - SelectionParthNo ratings yet

- 3 - Analysis & Design of WorkDocument33 pages3 - Analysis & Design of WorkShivamKhareNo ratings yet

- Philip Kotler's Marketing Management SummaryDocument238 pagesPhilip Kotler's Marketing Management SummaryOmar Hasan100% (3)

- 5 - RecruitmentDocument13 pages5 - RecruitmentParthNo ratings yet

- 3 - Analysis & Design of WorkDocument33 pages3 - Analysis & Design of WorkShivamKhareNo ratings yet

- 4 - HRPDocument17 pages4 - HRPParthNo ratings yet

- 1 - Introduction To HRMDocument18 pages1 - Introduction To HRMRemonNo ratings yet

- 2 - Strategic HRMDocument20 pages2 - Strategic HRMRemonNo ratings yet

- 5 - RecruitmentDocument13 pages5 - RecruitmentParthNo ratings yet

- Spearman Correlation for Nonparametric DataDocument7 pagesSpearman Correlation for Nonparametric DataJohn Edward Villacorta100% (1)

- Test Bank For Consumer Behavior 10th Edition by SchiffmanDocument33 pagesTest Bank For Consumer Behavior 10th Edition by SchiffmanShorouqamr100% (1)

- 1 - Introduction To HRMDocument18 pages1 - Introduction To HRMRemonNo ratings yet

- Online Grocery Retailing - Building The Last Mile To The Customer - IMD - Stud...Document16 pagesOnline Grocery Retailing - Building The Last Mile To The Customer - IMD - Stud...ParthNo ratings yet

- Does Consumer Buying Behaviour Change During Economic CrisisDocument17 pagesDoes Consumer Buying Behaviour Change During Economic CrisisParthNo ratings yet

- CleanSpiritz Case Questions & Presentation GuidelinesDocument1 pageCleanSpiritz Case Questions & Presentation GuidelinesParthNo ratings yet

- Decision Inputs Quarterly ReportsDocument363 pagesDecision Inputs Quarterly ReportsNick ChongsanguanNo ratings yet

- Demat and RematDocument18 pagesDemat and RematParam BainsNo ratings yet

- The IB Business of Trading: Market Making, Arbitrage, Repo and Prime BrokerageDocument78 pagesThe IB Business of Trading: Market Making, Arbitrage, Repo and Prime BrokerageNgọc Phan Thị BíchNo ratings yet

- Ifr Asia November 21 2020 PDFDocument42 pagesIfr Asia November 21 2020 PDFSafetaNo ratings yet

- Bitcoin Sec ShaverDocument2 pagesBitcoin Sec ShaverMossad NewsNo ratings yet

- Role of Corporate Governance in Stock ExchangeDocument11 pagesRole of Corporate Governance in Stock ExchangeBhavesh YadavNo ratings yet

- Unit ThreeDocument22 pagesUnit ThreeEYOB AHMEDNo ratings yet

- Order in The Matter of Mondal Construction Company LimitedDocument24 pagesOrder in The Matter of Mondal Construction Company LimitedShyam SunderNo ratings yet

- Comparative Study of Money and Capital MarketsDocument75 pagesComparative Study of Money and Capital Marketscybertron cafe100% (1)

- The Philippine Financial SystemDocument10 pagesThe Philippine Financial Systemgester kentNo ratings yet

- Merchant Banking and Financial Services Two Marks Questions and AnswersDocument8 pagesMerchant Banking and Financial Services Two Marks Questions and AnswersadammurugeshNo ratings yet

- Attorney/Compliance OfficerDocument3 pagesAttorney/Compliance Officerapi-79104713No ratings yet

- Demat Acount TradebullsDocument23 pagesDemat Acount TradebullsMihir SenNo ratings yet

- SEBI Moot Court Competition MemorialDocument32 pagesSEBI Moot Court Competition MemorialdiwakarNo ratings yet

- (Kresna Sekuritas) BBRI (Hold) - 1Q19 Review End of Its Re-Rating WaveDocument7 pages(Kresna Sekuritas) BBRI (Hold) - 1Q19 Review End of Its Re-Rating WaveHuda TheneutralismeNo ratings yet

- Capital Structure and ProfitabilityDocument70 pagesCapital Structure and ProfitabilityMamilla BabuNo ratings yet

- Marketing and Investment Banking II RelationshipsDocument12 pagesMarketing and Investment Banking II RelationshipsAliElkhatebNo ratings yet

- Types of InvestmentDocument10 pagesTypes of InvestmentHitesh ChawlaNo ratings yet

- Basics of Stock MarketDocument5 pagesBasics of Stock MarketArun KC0% (1)

- Chapter 1Document8 pagesChapter 1Jarra AbdurahmanNo ratings yet

- Cases Session 6Document37 pagesCases Session 6Robee Marie IlaganNo ratings yet

- Open OfferDocument9 pagesOpen OfferraghuNo ratings yet

- AOI Template SECDocument15 pagesAOI Template SECEdison Flores0% (1)

- Paymate India Limited Ipo Draft Red Herring ProspectusDocument387 pagesPaymate India Limited Ipo Draft Red Herring ProspectusSandesh ShettyNo ratings yet

- Post-Sanction Monitoring of Industrial Advances in Indian BankDocument127 pagesPost-Sanction Monitoring of Industrial Advances in Indian BankChiranjit Basu100% (4)

- Through The Looking Glass #17 - Dream International (1126 HK)Document12 pagesThrough The Looking Glass #17 - Dream International (1126 HK)bodaiNo ratings yet

- CSP EnglishDocument172 pagesCSP EnglishJaykumar BehanwalNo ratings yet

- AFS 2020 Annual ReportDocument178 pagesAFS 2020 Annual ReportN.a. M. TandayagNo ratings yet

- Investor Perception On Investment AvenuesDocument55 pagesInvestor Perception On Investment AvenuesVenkatrao Vargani100% (1)

- Nishat Chunian Limited: Annual Report 2019Document192 pagesNishat Chunian Limited: Annual Report 2019XOAnim3No ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (82)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Minding Your Own Business: A Common Sense Guide to Home Management and IndustryFrom EverandMinding Your Own Business: A Common Sense Guide to Home Management and IndustryRating: 5 out of 5 stars5/5 (1)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeFrom EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeRating: 5 out of 5 stars5/5 (4)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningFrom EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningRating: 4.5 out of 5 stars4.5/5 (8)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonFrom EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonRating: 5 out of 5 stars5/5 (9)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherFrom EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherRating: 5 out of 5 stars5/5 (14)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- Retirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyFrom EverandRetirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyNo ratings yet

- Minimalist Living Strategies and Habits: The Practical Guide To Minimalism To Declutter, Organize And Simplify Your Life For A Better And Meaningful LivingFrom EverandMinimalist Living Strategies and Habits: The Practical Guide To Minimalism To Declutter, Organize And Simplify Your Life For A Better And Meaningful LivingNo ratings yet

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayFrom EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayRating: 3.5 out of 5 stars3.5/5 (2)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitFrom EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitNo ratings yet

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)From EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Rating: 3.5 out of 5 stars3.5/5 (9)