Professional Documents

Culture Documents

Eagle Eye 8th June

Eagle Eye 8th June

Uploaded by

dhamu0202Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eagle Eye 8th June

Eagle Eye 8th June

Uploaded by

dhamu0202Copyright:

Available Formats

Engulfing bear

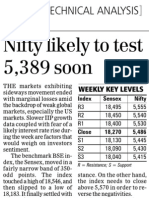

Markets on June 8, 2009: Realty and Metal lead the turn down

The Indian markets ended the day on a weak note as selling activity persisted till the final

minutes of trade. Towards the end of the day, the overall decline to advance ratio was

poised at 6.5 to 1 on the BSE. Sensex ended the day lower by around 437 points, while

the Nifty closed lower by about 157 points. Stocks from the mid-cap and small-cap

spaces ended the day on a weak note as well, recording losses of 5.45% and 5.8%

respectively. On daily candlesticks charts, Sensex has formed a bearish engulfing pattern

(a bearish reversal pattern) around 61.8% retracement level of the entire fall from 21k,

which is not a good sign. On hourly chart we are having a negative divergence, which

indicates that Nifty should at least fall back up to the lower line of the channel. Also the

market has violated the hourly averages, one more reason for the bears to cheer.

Hourly momentum indicator KST has given a negative crossover. Our short-term bias is

revised down for the target of 4200 with reversal packed at 4640, while our mid-term bias

is still up for the targets of 4850 with reversal packed at 3861 respectively.

Selling activity was witnessed in stocks from across the board led by realty, metal,

banking and capital goods. Stocks from the IT space, on the other hand, ended the day in

the green. From the 30 stocks of Sensex Wipro (up 3%), Infosys (up 3%) and TCS (up

2%) led the pack of gainers, while Jaiprakash Associates (down 10%), DLF (down 10%)

and Tata Steel (down 10%) led the pack of losers.

You might also like

- Eagle Eye 18th JuneDocument1 pageEagle Eye 18th Junedhamu0202No ratings yet

- Eagle Eye 3rd JuneDocument1 pageEagle Eye 3rd Junedhamu0202No ratings yet

- Eagle Eye 1st JuneDocument1 pageEagle Eye 1st Junedhamu0202No ratings yet

- Eagle Eye 9th JuneDocument1 pageEagle Eye 9th Junedhamu0202No ratings yet

- Eagle Eye 9th JuneDocument1 pageEagle Eye 9th Junedhamu0202No ratings yet

- Eagle Eye 16th JulyDocument1 pageEagle Eye 16th Julydhamu0202No ratings yet

- Eagle Eye 10th JuneDocument1 pageEagle Eye 10th Junedhamu0202No ratings yet

- Eagle Eye 4th JuneDocument1 pageEagle Eye 4th Junedhamu0202No ratings yet

- Eagle Eye 12th JuneDocument1 pageEagle Eye 12th Junedhamu0202No ratings yet

- The 10 Biggest Falls in Sensex HistoryDocument8 pagesThe 10 Biggest Falls in Sensex HistorydineshpgcentreNo ratings yet

- Eagle Eye 22th JuneDocument1 pageEagle Eye 22th Junedhamu0202No ratings yet

- Eagle Eye 22th JuneDocument1 pageEagle Eye 22th Junedhamu0202No ratings yet

- Eagle Eye 10th JulyDocument1 pageEagle Eye 10th Julydhamu0202No ratings yet

- Eagle Eye 30th JuneDocument1 pageEagle Eye 30th Junedhamu0202No ratings yet

- Biggest Falls in Indian Stock Market HistoryDocument2 pagesBiggest Falls in Indian Stock Market HistoryDilipkumar J oe18d018No ratings yet

- Eagle Eye 1st JulyDocument1 pageEagle Eye 1st Julydhamu0202No ratings yet

- Eagle Eye 13th AugustDocument1 pageEagle Eye 13th Augustdhamu0202No ratings yet

- Eagle Eye 11th FebDocument1 pageEagle Eye 11th Febdhamu0202No ratings yet

- Eagle Eye 19th JuneDocument1 pageEagle Eye 19th Junedhamu0202No ratings yet

- Eagle Eye 14th AugustDocument1 pageEagle Eye 14th Augustdhamu0202No ratings yet

- Business Standard 12 June 2011Document1 pageBusiness Standard 12 June 2011n.harshaNo ratings yet

- Summary 1Document3 pagesSummary 1Bablu GanjhuNo ratings yet

- Daily Equity ReportDocument5 pagesDaily Equity ReportJijoy PillaiNo ratings yet

- Alankit Assignments LTD: 1 - PageDocument14 pagesAlankit Assignments LTD: 1 - Pagertaneja008No ratings yet

- Dipak STK MKTDocument9 pagesDipak STK MKTdipak_pandey_007No ratings yet

- End-Session Sensex Hits Over 11-1/2-Week Closing Low As Fiis Press SalesDocument1 pageEnd-Session Sensex Hits Over 11-1/2-Week Closing Low As Fiis Press SalessankalptiwariNo ratings yet

- Eagle Eye 15th JuneDocument1 pageEagle Eye 15th Junedhamu0202No ratings yet

- Premarket Technical&Derivative Ashika 18.11.16Document4 pagesPremarket Technical&Derivative Ashika 18.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Eagle Eye 17th JuneDocument1 pageEagle Eye 17th Junedhamu0202No ratings yet

- Iiww 050811Document8 pagesIiww 050811chetanrudani108No ratings yet

- Daily Market OutlookDocument5 pagesDaily Market OutlookshadabvakilNo ratings yet

- Equity Weekly Technical Report 2 Deceber To 6 DecemberDocument7 pagesEquity Weekly Technical Report 2 Deceber To 6 DecemberSunil MalviyaNo ratings yet

- India Infoline Weekly WrapDocument8 pagesIndia Infoline Weekly WrappasamvNo ratings yet

- Financial Express - Oct 28, 2008 - Sensex Recovers After 8k BreachDocument2 pagesFinancial Express - Oct 28, 2008 - Sensex Recovers After 8k BreachJagannadhamNo ratings yet

- Eagle Eye 26th JuneDocument1 pageEagle Eye 26th Junedhamu0202No ratings yet

- Moneytoday - Sept 26, 2008 - Sensex Ends 445 Points DownDocument1 pageMoneytoday - Sept 26, 2008 - Sensex Ends 445 Points DownJagannadhamNo ratings yet

- Eagle Eye 7th AugustDocument1 pageEagle Eye 7th Augustdhamu0202No ratings yet

- Daily Report: 4th SEPT. 2013Document7 pagesDaily Report: 4th SEPT. 2013api-212478941No ratings yet

- Currency Daily Report, June 26 2013Document4 pagesCurrency Daily Report, June 26 2013Angel BrokingNo ratings yet

- Sensex FallsDocument3 pagesSensex FallsDynamic LevelsNo ratings yet

- Premarket Technical&Derivative Ashika 25.11.16Document4 pagesPremarket Technical&Derivative Ashika 25.11.16Rajasekhar Reddy AnekalluNo ratings yet

- ETF Review - Sep 2016: Retail ResearchDocument10 pagesETF Review - Sep 2016: Retail Researcharun_algoNo ratings yet

- Eagle Eye 16th MarDocument1 pageEagle Eye 16th Mardhamu0202No ratings yet

- Currency Report: MF Global Daily ReportDocument5 pagesCurrency Report: MF Global Daily ReportTarique kamaalNo ratings yet

- Equity Weekly News 03 Feb To 07 Feb 2014Document6 pagesEquity Weekly News 03 Feb To 07 Feb 2014Sunil MalviyaNo ratings yet

- Stock Market Review July 30Document2 pagesStock Market Review July 30Dipika KukrejaNo ratings yet

- Technical Trend: (05 July 2011) Equity Market: India Daily UpdateDocument4 pagesTechnical Trend: (05 July 2011) Equity Market: India Daily UpdateTirthankar DasNo ratings yet

- Nifty Metal IndexDocument4 pagesNifty Metal IndexDynamic LevelsNo ratings yet

- Daily Metals and Energy Report, May 24 2013Document6 pagesDaily Metals and Energy Report, May 24 2013Angel BrokingNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Currency Daily Report, May 24 2013Document4 pagesCurrency Daily Report, May 24 2013Angel BrokingNo ratings yet

- Currency Daily Report, March 26Document4 pagesCurrency Daily Report, March 26Angel BrokingNo ratings yet

- How To Read Open Interest and Price MovementsDocument5 pagesHow To Read Open Interest and Price MovementsJayadevanTJNo ratings yet

- Teknikal - 05 09 16eDocument1 pageTeknikal - 05 09 16eAnonymous yH9XlnNo ratings yet

- DC 1Document1 pageDC 1hemanggorNo ratings yet

- Eagle Eye 11th AugustDocument1 pageEagle Eye 11th Augustdhamu0202No ratings yet

- Calcutta News - Oct 24, 2008 - Spreading Contagion Brings Key Equities Index Below 10000Document2 pagesCalcutta News - Oct 24, 2008 - Spreading Contagion Brings Key Equities Index Below 10000JagannadhamNo ratings yet

- MHI News - Oct 10, 2008 - Markets End in Red On US Bailout Plan UncertaintyDocument1 pageMHI News - Oct 10, 2008 - Markets End in Red On US Bailout Plan UncertaintyJagannadhamNo ratings yet

- Currency Daily Report, June 05 2013Document4 pagesCurrency Daily Report, June 05 2013Angel BrokingNo ratings yet

- Eagle Eye 16th JulyDocument1 pageEagle Eye 16th Julydhamu0202No ratings yet

- Eagle Eye 17th JulyDocument1 pageEagle Eye 17th Julydhamu0202No ratings yet

- Eagle Eye 14th JulyDocument1 pageEagle Eye 14th Julydhamu0202No ratings yet

- Eagle Eye 16th MarDocument1 pageEagle Eye 16th Mardhamu0202No ratings yet

- Eagle Eye 26th JuneDocument1 pageEagle Eye 26th Junedhamu0202No ratings yet

- Eagle Eye 22th JuneDocument1 pageEagle Eye 22th Junedhamu0202No ratings yet

- Eagle Eye 30th JuneDocument1 pageEagle Eye 30th Junedhamu0202No ratings yet

- Eagle Eye 10th JulyDocument1 pageEagle Eye 10th Julydhamu0202No ratings yet

- Eagle Eye 1st JuneDocument1 pageEagle Eye 1st Junedhamu0202No ratings yet

- Eagle Eye 10th JuneDocument1 pageEagle Eye 10th Junedhamu0202No ratings yet

- Eagle Eye 18th JuneDocument1 pageEagle Eye 18th Junedhamu0202No ratings yet

- Eagle Eye 19th JuneDocument1 pageEagle Eye 19th Junedhamu0202No ratings yet

- Eagle Eye 22th JuneDocument1 pageEagle Eye 22th Junedhamu0202No ratings yet

- Eagle Eye 9th JuneDocument1 pageEagle Eye 9th Junedhamu0202No ratings yet

- Eagle Eye 1st JulyDocument1 pageEagle Eye 1st Julydhamu0202No ratings yet

- Eagle Eye 12th JuneDocument1 pageEagle Eye 12th Junedhamu0202No ratings yet

- Eagle Eye 15th JuneDocument1 pageEagle Eye 15th Junedhamu0202No ratings yet

- Eagle Eye 17th JuneDocument1 pageEagle Eye 17th Junedhamu0202No ratings yet