Professional Documents

Culture Documents

Encik Nordin Tax Relief: Total Income

Encik Nordin Tax Relief: Total Income

Uploaded by

Farhana Borhan0 ratings0% found this document useful (0 votes)

31 views2 pagesThis document contains Encik Nordin Tax's income and relief information for tax purposes. It lists his total income of RM196,300 which includes his gross salary of RM135,000, annual bonus of RM35,000, and allowances of RM2,800. It then lists the total relief amount of RM70,550 which includes self-relief, medical expenses, education costs, and other lifestyle expenses. After subtracting the total relief from the total income, the taxable income is RM125,750. Based on the tax brackets, the individual owes RM3,480 in taxes after deducting rebates.

Original Description:

Original Title

Assignment on Tax

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains Encik Nordin Tax's income and relief information for tax purposes. It lists his total income of RM196,300 which includes his gross salary of RM135,000, annual bonus of RM35,000, and allowances of RM2,800. It then lists the total relief amount of RM70,550 which includes self-relief, medical expenses, education costs, and other lifestyle expenses. After subtracting the total relief from the total income, the taxable income is RM125,750. Based on the tax brackets, the individual owes RM3,480 in taxes after deducting rebates.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views2 pagesEncik Nordin Tax Relief: Total Income

Encik Nordin Tax Relief: Total Income

Uploaded by

Farhana BorhanThis document contains Encik Nordin Tax's income and relief information for tax purposes. It lists his total income of RM196,300 which includes his gross salary of RM135,000, annual bonus of RM35,000, and allowances of RM2,800. It then lists the total relief amount of RM70,550 which includes self-relief, medical expenses, education costs, and other lifestyle expenses. After subtracting the total relief from the total income, the taxable income is RM125,750. Based on the tax brackets, the individual owes RM3,480 in taxes after deducting rebates.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Nur farhana binti borhan

201952777

BA249 3A

Assignment on Tax

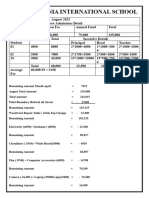

Encik Nordin Tax Relief

Total Income RM

Gross Salary 135,000

Annual Bonus 35,000

Allowances 2,800

Wife (2000 x 12) 24,000

Total Aggregate Income 196,800

(-) Donation to Tabung Bersamamu (500)

Total Income 196,300

Total Relief RM

Self-Relief 9,000

Special equipment for Huda 6,000

Self-education fees 7,000

Medical expenses for Huda 3,000

Disabled child 6,000

Lifestyle:-

Textbook/magazine 1,500

NST subscription 400

Laptop 2,500

Tennis (sport equipment) 500

Unifi 1,200

A-level program 2,000

Degree level 8,000

EPF 4,000

PRS 1,200

Contribution to SOCSO 250

Nur farhana binti borhan

201952777

BA249 3A

Child kindergarten (500 x 12) 1,000

Child under age-18 2,000

Parent’s treatment expenses 5,000

Wife 4,000

Education insurance 3,000

Family Takaful 3,000

Total Relief 70,550

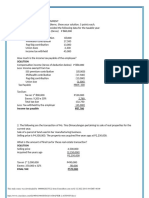

Total Income – Total Relief

=125,750

1st – 100,000 = 10,900

2nd 25,750 = (25,750 x 24%)

= 6,180

(-) Rebate

Zakat salaries + zakat fitrah

2,600 + 100

= 6,180 – 2,700

Tax = 3,480

You might also like

- Answer Tutorial 3 Partnership Part 2Document3 pagesAnswer Tutorial 3 Partnership Part 2athirah jamaludin100% (1)

- ClincherDocument3 pagesClincherClyde Ramos100% (2)

- Personal Financial PlanningDocument7 pagesPersonal Financial Planningatma afisah100% (1)

- FABM 2 Module 9 Income Tax DueDocument11 pagesFABM 2 Module 9 Income Tax DueJOHN PAUL LAGAO100% (1)

- M012-Consumer Mathematics (Taxation)Document5 pagesM012-Consumer Mathematics (Taxation)Tan Jun YouNo ratings yet

- Taxation Malaysia Home Acca GlobalDocument12 pagesTaxation Malaysia Home Acca GlobalLee Yee Mei100% (1)

- Exclusions and Inclusions - MANTUANODocument8 pagesExclusions and Inclusions - MANTUANODonita MantuanoNo ratings yet

- Example Taxation Question FIN533Document2 pagesExample Taxation Question FIN533Muhamad IhsanNo ratings yet

- Example Tax PlanningDocument16 pagesExample Tax PlanningHAZIQ ZIKRI BAHARUDDINNo ratings yet

- PFP T8Document7 pagesPFP T8stellaNo ratings yet

- In Class Exercise - Personal TaxDocument3 pagesIn Class Exercise - Personal TaxNur AsnadirahNo ratings yet

- Answer Revision SetDocument3 pagesAnswer Revision Setathirah jamaludinNo ratings yet

- (KMS1013) Assignment 2 by Group 19Document10 pages(KMS1013) Assignment 2 by Group 19Nur Sabrina AfiqahNo ratings yet

- Chapter 9 - TutorialDocument7 pagesChapter 9 - TutorialNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Tutorial Personal Income TaxDocument6 pagesTutorial Personal Income TaxQin Yi NgNo ratings yet

- Assignment 2 TaxDocument7 pagesAssignment 2 TaxTebashiniNo ratings yet

- Chap 6 Relief and RebateDocument15 pagesChap 6 Relief and RebateKelvin OngNo ratings yet

- TAXATIONDocument15 pagesTAXATIONNameles WaranNo ratings yet

- ABFT2020 Tutorial 8 and 9 - Relief and Personal TaxationDocument10 pagesABFT2020 Tutorial 8 and 9 - Relief and Personal TaxationHuilunNgoNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument5 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Example AssociateDocument5 pagesExample AssociateDiana KNo ratings yet

- Tax267 Ex3Document4 pagesTax267 Ex3SITI NUR DIANA SELAMATNo ratings yet

- Grant Funding ProposalDocument4 pagesGrant Funding Proposalapi-356011071No ratings yet

- Sheikh Hasina University Netrokona: Income CertificateDocument1 pageSheikh Hasina University Netrokona: Income CertificateAsaduzzaman Khan PoranNo ratings yet

- Kidzania International SchoolDocument2 pagesKidzania International SchoolPrecious PearlNo ratings yet

- Income Taxation Answer ExamDocument5 pagesIncome Taxation Answer Examyezaquera100% (1)

- Notes For Topic 6 Format Tax Computation: Chargeable Income (RM) Calculation (RM) Rate (%) Tax (RM)Document7 pagesNotes For Topic 6 Format Tax Computation: Chargeable Income (RM) Calculation (RM) Rate (%) Tax (RM)Ifa ChanNo ratings yet

- T11 Relief&Rebates Student Oct 2021Document5 pagesT11 Relief&Rebates Student Oct 2021CHAN KER XINNo ratings yet

- F6mys Jun 2011 QuDocument10 pagesF6mys Jun 2011 Qutoushiga100% (1)

- Fifth PartDocument17 pagesFifth PartMahsinur RahmanNo ratings yet

- Exercise Week 13Document3 pagesExercise Week 13Yusri HuzaimiNo ratings yet

- Bir - Train Tot - Transfer TaxesDocument2 pagesBir - Train Tot - Transfer TaxesGlo GanzonNo ratings yet

- Line Item BudgetDocument7 pagesLine Item Budgetapi-348246900No ratings yet

- Line Item BudgetDocument7 pagesLine Item Budgetapi-348246900No ratings yet

- Assignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdDocument11 pagesAssignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdSweethaa ArumugamNo ratings yet

- F6mys 2010 Dec QDocument12 pagesF6mys 2010 Dec QJeejuNo ratings yet

- Mantuano DeducDocument28 pagesMantuano DeducDonita MantuanoNo ratings yet

- Foundations in Taxation (Malaysia)Document20 pagesFoundations in Taxation (Malaysia)ShazwanieSazaliNo ratings yet

- Taxation (Malaysia) : March/June 2017 - Sample QuestionsDocument12 pagesTaxation (Malaysia) : March/June 2017 - Sample QuestionsIntan SyuhadaNo ratings yet

- Activity 19. in This Activity You Will Assemble The Data in Order For You To PrepareDocument2 pagesActivity 19. in This Activity You Will Assemble The Data in Order For You To PrepareVibe VreeNo ratings yet

- Advanced Taxation (Malaysia) : March/June 2017 - Sample QuestionsDocument12 pagesAdvanced Taxation (Malaysia) : March/June 2017 - Sample QuestionsKiyong TanNo ratings yet

- Sample BudgetDocument109 pagesSample BudgetAnjannette SantosNo ratings yet

- Manager Salary StructureDocument1 pageManager Salary StructureBlanc Kohle Energy Private LimitedNo ratings yet

- Taxation (Malaysia) : September/December 2016 - Sample QuestionsDocument12 pagesTaxation (Malaysia) : September/December 2016 - Sample QuestionsGary Danny Galiyang100% (1)

- T4 Other Income Q 1-2020-2021Document2 pagesT4 Other Income Q 1-2020-2021Putri Nurin Hasnida HassanNo ratings yet

- PT1 Sept 2022 Exams Question Paper G1, G2, G3 22 July 2022Document13 pagesPT1 Sept 2022 Exams Question Paper G1, G2, G3 22 July 2022stacyyauNo ratings yet

- Livre de Paie AnnuelDocument7 pagesLivre de Paie AnnuelElie fontenel MoubedaNo ratings yet

- INSTRUCTION SHEET 3 and Annexure D - Fee Structure (2023)Document6 pagesINSTRUCTION SHEET 3 and Annexure D - Fee Structure (2023)Khushank themathemagicianNo ratings yet

- Cbtax01 Chapter 2 ActivityDocument2 pagesCbtax01 Chapter 2 ActivityDamayan XeroxanNo ratings yet

- F6mys 2017 Sept Dec QDocument12 pagesF6mys 2017 Sept Dec QMuhammad ZabhaNo ratings yet

- Tax FinalDocument8 pagesTax FinalAssignments HelperNo ratings yet

- ACC 3013 Revision Material..Document22 pagesACC 3013 Revision Material..falnuaimi001No ratings yet

- Chapter 8 - Answer TutorialDocument3 pagesChapter 8 - Answer TutorialNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Income Tax Rates YA2016Document4 pagesIncome Tax Rates YA2016Kelvin LeongNo ratings yet

- Advanced Taxation (Malaysia) : Professional Pilot Paper - Options ModuleDocument10 pagesAdvanced Taxation (Malaysia) : Professional Pilot Paper - Options ModuleTeneswari RadhaNo ratings yet

- Tutorial Questions Week1Document6 pagesTutorial Questions Week1HuiMinHorNo ratings yet

- E1049217251 12520 1322185717213Document5 pagesE1049217251 12520 1322185717213Sumit PattanaikNo ratings yet

- Atx Mock QDocument12 pagesAtx Mock QstacyyauNo ratings yet

- Tutorial 5 (Class)Document3 pagesTutorial 5 (Class)fujinlim98No ratings yet