Professional Documents

Culture Documents

Proof of Cash: Intermediate Accounting Part 1

Uploaded by

Steffanie OlivarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Proof of Cash: Intermediate Accounting Part 1

Uploaded by

Steffanie OlivarCopyright:

Available Formats

Intermediate Accounting Part 1

Proof of Cash

A proof of cash is an expanded reconciliation in that it includes proof of receipts and disbursements.

This approach may be useful in discovering possible discrepancies in handling cash particularly when

cash receipts have been recorded but have not been deposited.

A four-column worksheet is necessary, although under the adjusted balance method, an 8-column

worksheet may be required.

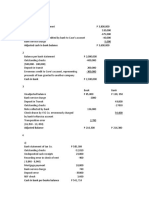

The two-dated bank reconciliation of Sam Makulet Company was presented below:

January 31 February 28

Balance per book 50000 70000

Balance per bank 84000 124000

Book debits 200000

Book credits 180000

Bank debits 130000

Bank credits 170000

Deposit in transit 40000 75000

Outstanding checks 65000 119000

NSF checks 5000 1000

Service charge 1000

Note collected by bank 15000 20000

Prepare a proof of cash.

Exercise 1: Efficient Company showed the following information:

Cash in bank balance, March 31 300,000

Book credits for April 720,000

Book debits for April 800,000

Bank statement balance, March 31 330,000

Bank debits 530,000

Bank credits 700,000

The following transactions appeared in the months of March and April:

March April

Note collected by bank 60,000 100,000

Service charge 8,000 2,000

NSF Check 20,000 30,000

Deposits in transit 80,000 220,000

Outstanding checks 178,000 372,000

Prepare a proof of cash.

1|Page AK Sampang

You might also like

- Bank Reconciliation ProblemsDocument2 pagesBank Reconciliation ProblemsCris Jung80% (5)

- CASH AND CASH EQUIVALENTS BALANCESDocument8 pagesCASH AND CASH EQUIVALENTS BALANCESRonel CaagbayNo ratings yet

- Trade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofDocument11 pagesTrade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofJude SantosNo ratings yet

- Cash and Cash Equivalents GuideDocument33 pagesCash and Cash Equivalents GuideKaren Estrañero LuzonNo ratings yet

- Bank ReconciliationDocument3 pagesBank ReconciliationRaphy Leonardo Mallari Ortañez60% (5)

- Factoring of ReceivablesDocument2 pagesFactoring of Receivablesronnelson pascual100% (1)

- Ia1.activity 3Document1 pageIa1.activity 3kathie alegarme100% (1)

- Proof of Cash ProblemDocument4 pagesProof of Cash ProblemHtiduj Oretubag50% (4)

- Impairment of Loans and Receivable FinancingDocument17 pagesImpairment of Loans and Receivable FinancingGelyn CruzNo ratings yet

- Chapter 11 Answers RepportDocument12 pagesChapter 11 Answers RepportJudy56% (16)

- P. Lete ProblemsDocument6 pagesP. Lete ProblemsPaul Andrei Lete33% (9)

- Fin 1 Valix Chap 6Document24 pagesFin 1 Valix Chap 6Christian SampagaNo ratings yet

- Chapter-8-Bank-Reconciliation-Problems - Prelim - SENSIBLE COMPANY BANK RECONCILIATION Dec-31 BOOK BALANCE Cash Balance Per Ledger Add Credit Memo TOTALDocument22 pagesChapter-8-Bank-Reconciliation-Problems - Prelim - SENSIBLE COMPANY BANK RECONCILIATION Dec-31 BOOK BALANCE Cash Balance Per Ledger Add Credit Memo TOTALDianne Baltazar67% (12)

- Pa1 1402Document11 pagesPa1 1402Joris YapNo ratings yet

- FAR.0727 - Cash and Cash EquivalentsDocument7 pagesFAR.0727 - Cash and Cash EquivalentsDenise Abbygale Ganzon100% (1)

- Intermediate Accounting 1 - Loans Receivable ProblemsDocument1 pageIntermediate Accounting 1 - Loans Receivable ProblemsJanidelle Swiftie67% (3)

- 1 Far Answer KeyDocument25 pages1 Far Answer KeyAngelie0% (1)

- Assignment No. 2 (Solution)Document5 pagesAssignment No. 2 (Solution)Christine MalayoNo ratings yet

- Bak ReconDocument1 pageBak ReconFlorimar Lagda100% (1)

- Loans and Receivables Sample Problems 2Document2 pagesLoans and Receivables Sample Problems 2Bryce Bihag60% (5)

- Adjustments Unreleased Check: SM Investments Corporation Had The Following Account Balances at December 31, 2019Document3 pagesAdjustments Unreleased Check: SM Investments Corporation Had The Following Account Balances at December 31, 2019Regina Mae CatamponganNo ratings yet

- ReceivablesDocument5 pagesReceivableshellohello0% (1)

- Problem 6-8 Answer A Savage CompanyDocument6 pagesProblem 6-8 Answer A Savage CompanyJurie BalandacaNo ratings yet

- Ia 2Document2 pagesIa 2Nadine SofiaNo ratings yet

- RECEIVABLESDocument28 pagesRECEIVABLESClarice Ilustre Guintibano100% (1)

- Vain Company Requirement: Prepare Journal Entries On The Books of Assignor Debit CreditDocument1 pageVain Company Requirement: Prepare Journal Entries On The Books of Assignor Debit CreditAnonnNo ratings yet

- Ama AccountingDocument3 pagesAma AccountingGabriel JacaNo ratings yet

- Accounting for Bad Debts MethodsDocument5 pagesAccounting for Bad Debts Methodshoneyjoy salapantanNo ratings yet

- Pamela Company #11Document7 pagesPamela Company #11Yassi CurtisNo ratings yet

- Pract 1Document12 pagesPract 1Kylie TarnateNo ratings yet

- Proof of CashDocument7 pagesProof of CashPeachy80% (5)

- Adjust Accounts Receivable, Allowances and Notes ReceivableDocument6 pagesAdjust Accounts Receivable, Allowances and Notes ReceivablekrizzmaaaayNo ratings yet

- Fifo MethodDocument1 pageFifo MethodRegina Mae CatamponganNo ratings yet

- This Study Resource Was: Problem 1Document2 pagesThis Study Resource Was: Problem 1Michelle J UrbodaNo ratings yet

- Bank Reconciliation: Sample ProblemsDocument39 pagesBank Reconciliation: Sample ProblemsXENA LOPEZ78% (9)

- Cash and Cash Equivalents of Swiss CompanyDocument16 pagesCash and Cash Equivalents of Swiss CompanyLyca Mae CubangbangNo ratings yet

- Final Page 15Document1 pageFinal Page 15Hatake KakashiNo ratings yet

- S1.16 - Receivable Financing - StudentDocument8 pagesS1.16 - Receivable Financing - StudentCyndy Villapando100% (1)

- Chapter 3 (IA Proof Od Cash) PDFDocument6 pagesChapter 3 (IA Proof Od Cash) PDFBaby MushroomNo ratings yet

- Audit of Invest. in Equity and Debt SecuritiesDocument23 pagesAudit of Invest. in Equity and Debt SecuritiesJoseph SalidoNo ratings yet

- Accounts ReceivableDocument2 pagesAccounts ReceivableMike MikeNo ratings yet

- Seatwork 2B ASSIGNDocument5 pagesSeatwork 2B ASSIGNYzzabel Denise L. Tolentino100% (1)

- Accounts ReceivableDocument3 pagesAccounts Receivablealford sery Cammayo0% (1)

- Journal Entries for Petty Cash Fund SystemsDocument2 pagesJournal Entries for Petty Cash Fund SystemsMae JessaNo ratings yet

- CashDocument7 pagesCashhellohello100% (1)

- BSA 7 - Interest Income and Impairment of Held-to-Maturity InvestmentDocument2 pagesBSA 7 - Interest Income and Impairment of Held-to-Maturity InvestmentGray JavierNo ratings yet

- Periodic or Perpetual (Same) : Specific IdentificationDocument10 pagesPeriodic or Perpetual (Same) : Specific Identificationhoneyjoy salapantanNo ratings yet

- Bedlam Company December Cash Proof ReportDocument2 pagesBedlam Company December Cash Proof ReportChristy HabelNo ratings yet

- Long Examination Cash Set ADocument3 pagesLong Examination Cash Set AprechuteNo ratings yet

- P1 Day3 RMDocument6 pagesP1 Day3 RMabcdefg0% (2)

- DocxDocument5 pagesDocxLorraine Mae Robrido100% (2)

- 13 Acctg Ed 1 - Loan ReceivableDocument17 pages13 Acctg Ed 1 - Loan ReceivableNath BongalonNo ratings yet

- Account ReceivableDocument10 pagesAccount ReceivableHarold B. Lacaba0% (1)

- FA REV PRB - Prelim Exam Wit Ans Key LatestDocument13 pagesFA REV PRB - Prelim Exam Wit Ans Key LatestLuiNo ratings yet

- ACCT102 - A Alexis Bang CangDocument4 pagesACCT102 - A Alexis Bang CangAccounting 201No ratings yet

- Saint Ferdinand College Accounting Review ProblemsDocument2 pagesSaint Ferdinand College Accounting Review ProblemsRhea Mae CarantoNo ratings yet

- 2.3.1 Proof of Cash, Accounts Receivable, Bad Debts Expense-1Document17 pages2.3.1 Proof of Cash, Accounts Receivable, Bad Debts Expense-1Beverly BantagNo ratings yet

- Inacc 1 Chap 3 Act PDFDocument12 pagesInacc 1 Chap 3 Act PDFSharmin Reula50% (2)

- Bank-Reconciliation IADocument10 pagesBank-Reconciliation IAAnaluz Cristine B. CeaNo ratings yet

- Assignment 2 ACFAR 1231 Bank ReconciliationDocument3 pagesAssignment 2 ACFAR 1231 Bank ReconciliationkakaoNo ratings yet

- Business TaxDocument34 pagesBusiness TaxSteffanie OlivarNo ratings yet

- VAT On ImportationDocument69 pagesVAT On ImportationSteffanie OlivarNo ratings yet

- 3STMA - Types of StrategiesDocument35 pages3STMA - Types of StrategiesSteffanie OlivarNo ratings yet

- Business and Transfer Taxation: TO Consumption TaxesDocument40 pagesBusiness and Transfer Taxation: TO Consumption TaxesKC GutierrezNo ratings yet

- Smile S M I L E: Haring Agic N Ove VerywhereDocument16 pagesSmile S M I L E: Haring Agic N Ove VerywhereSteffanie OlivarNo ratings yet

- Chapter 06Document39 pagesChapter 06Steffanie OlivarNo ratings yet

- CMW Final Compre 2019 2020Document2 pagesCMW Final Compre 2019 2020Steffanie OlivarNo ratings yet

- Chapter 07Document52 pagesChapter 07Steffanie OlivarNo ratings yet

- Chapter 07Document52 pagesChapter 07Steffanie OlivarNo ratings yet

- Writing A Blog: Prepared By: Nikki Joy C. Garcia, LPTDocument27 pagesWriting A Blog: Prepared By: Nikki Joy C. Garcia, LPTSteffanie OlivarNo ratings yet

- Smile S M I L E: Haring Agic N Ove VerywhereDocument16 pagesSmile S M I L E: Haring Agic N Ove VerywhereSteffanie OlivarNo ratings yet

- CMW Final Compre 2019 2020Document2 pagesCMW Final Compre 2019 2020Steffanie OlivarNo ratings yet

- Purposive Communication (Professional Writing) : Submitted byDocument2 pagesPurposive Communication (Professional Writing) : Submitted bySteffanie OlivarNo ratings yet

- Chapter 06Document39 pagesChapter 06Steffanie OlivarNo ratings yet

- Settings:: in Euston) American West (Desert & Salt Lake City)Document1 pageSettings:: in Euston) American West (Desert & Salt Lake City)Steffanie OlivarNo ratings yet

- SIGNALDocument1 pageSIGNALSteffanie OlivarNo ratings yet

- Art App Elements & PrinciplesDocument1 pageArt App Elements & PrinciplesSteffanie OlivarNo ratings yet

- CPC Oral Exam ScheduleDocument2 pagesCPC Oral Exam ScheduleSteffanie OlivarNo ratings yet

- Book Cover: Prepared By: Nikki Joy C. Garcia, Bsed/EnglishDocument4 pagesBook Cover: Prepared By: Nikki Joy C. Garcia, Bsed/EnglishSteffanie OlivarNo ratings yet

- Checklist For Creating Blog: TopicDocument2 pagesChecklist For Creating Blog: TopicSteffanie OlivarNo ratings yet

- Explaining the Benefits of Being MultilingualDocument114 pagesExplaining the Benefits of Being MultilingualSteffanie OlivarNo ratings yet

- Writing A Blog: Prepared By: Nikki Joy C. Garcia, LPTDocument27 pagesWriting A Blog: Prepared By: Nikki Joy C. Garcia, LPTSteffanie OlivarNo ratings yet

- Classified AdsDocument1 pageClassified AdsSteffanie OlivarNo ratings yet

- Classified AdsDocument1 pageClassified AdsSteffanie OlivarNo ratings yet

- ACTIVITY Anne FrankDocument2 pagesACTIVITY Anne FrankSteffanie OlivarNo ratings yet

- Application Letter SampleDocument1 pageApplication Letter SampleSteffanie OlivarNo ratings yet

- Book Cover: Prepared By: Nikki Joy C. Garcia, Bsed/EnglishDocument4 pagesBook Cover: Prepared By: Nikki Joy C. Garcia, Bsed/EnglishSteffanie OlivarNo ratings yet

- A STUDY IN SCARLET InformationsDocument10 pagesA STUDY IN SCARLET InformationsSteffanie OlivarNo ratings yet

- Explaining the Benefits of Being MultilingualDocument114 pagesExplaining the Benefits of Being MultilingualSteffanie OlivarNo ratings yet

- Purposive Communication (Professional Writing) : Submitted byDocument2 pagesPurposive Communication (Professional Writing) : Submitted bySteffanie OlivarNo ratings yet

- Labor JurisdictionDocument37 pagesLabor JurisdictionChoystel Mae Artigas100% (1)

- Archaeology - The Telltale ArtDocument15 pagesArchaeology - The Telltale ArtShubha PujariNo ratings yet

- Chapter 2Document16 pagesChapter 2ChuYumNo ratings yet

- Basic Calculus L2Document14 pagesBasic Calculus L2Abbie MalutoNo ratings yet

- United States v. Paul Anthony Watson, 947 F.2d 955, 10th Cir. (1991)Document2 pagesUnited States v. Paul Anthony Watson, 947 F.2d 955, 10th Cir. (1991)Scribd Government DocsNo ratings yet

- Science 5 Quiz Bee ReviewerDocument7 pagesScience 5 Quiz Bee ReviewerRommel Urbano Yabis50% (2)

- Process Costing NotesDocument3 pagesProcess Costing NotesVenu Gudla100% (1)

- A Study On Marketing Practices in Select PDFDocument137 pagesA Study On Marketing Practices in Select PDFSadik SadikaramaniNo ratings yet

- Establishment of Measurement Objectives: PGT 202E Basic Educational Measurement and EvaluationDocument38 pagesEstablishment of Measurement Objectives: PGT 202E Basic Educational Measurement and EvaluationmaslianaNo ratings yet

- 2023 - 002075129500001316312023 - Error CJALDocument7 pages2023 - 002075129500001316312023 - Error CJALFabian Quiroz VergelNo ratings yet

- Acute cholecystitis pathogenesis, diagnosis and clinical featuresDocument38 pagesAcute cholecystitis pathogenesis, diagnosis and clinical featuresAdrian BăloiNo ratings yet

- MC Sampler Pack PDFDocument195 pagesMC Sampler Pack PDFVedaste Ndayishimiye100% (2)

- Book Review of Conceptualising Integration in CLIL and Multilingual EducationDocument5 pagesBook Review of Conceptualising Integration in CLIL and Multilingual EducationAigul AitbaevaNo ratings yet

- Alternative Certification 2010Document12 pagesAlternative Certification 2010Michelle Seno Son GonzalesNo ratings yet

- Basic Selectivity - How Oracle Calculates SelectivityDocument7 pagesBasic Selectivity - How Oracle Calculates SelectivityJack WangNo ratings yet

- Rights of Indigenous Peoples ActDocument29 pagesRights of Indigenous Peoples ActJella BandalanNo ratings yet

- Plunket, Patricia (Editora) - Domestic Ritual in Ancient Mesoamerica PDFDocument148 pagesPlunket, Patricia (Editora) - Domestic Ritual in Ancient Mesoamerica PDFJesus CaballeroNo ratings yet

- EUROPEAN LAW: HISTORY AND INSTITUTIONSDocument32 pagesEUROPEAN LAW: HISTORY AND INSTITUTIONSDavidNo ratings yet

- OMCC Board ResolutionDocument1 pageOMCC Board ResolutionOrient MansionNo ratings yet

- LT033 PDFDocument38 pagesLT033 PDFAlexandr ChuvakovNo ratings yet

- Gancayco Vs Quezon CityDocument4 pagesGancayco Vs Quezon CityAlan Jay CariñoNo ratings yet

- Qatar Airways FS 31 March 2019 (En)Document62 pagesQatar Airways FS 31 March 2019 (En)HusSam Ud DinNo ratings yet

- 2021 4 12 Jennifer EnglertDocument77 pages2021 4 12 Jennifer Englertdiana winklerNo ratings yet

- RacismDocument23 pagesRacismRaj KrishnaNo ratings yet

- Reaction Paper XDocument2 pagesReaction Paper XRichmond Amurao95% (22)

- Astm - C338Document3 pagesAstm - C338KuNtii Devi VerdejofNo ratings yet

- Article 405: The Penal-Code With AmendmentsDocument2 pagesArticle 405: The Penal-Code With Amendmentsropal salamNo ratings yet

- Architecture Statement of PurposeDocument4 pagesArchitecture Statement of PurposeAZAR HOSNo ratings yet

- Restrict Group Access in QV 9 Using ADDocument7 pagesRestrict Group Access in QV 9 Using ADBea BoocNo ratings yet

- De Onde Eu Te VejoDocument2 pagesDe Onde Eu Te VejoBianca Oliveira CoelhoNo ratings yet