100% found this document useful (2 votes)

1K views7 pagesCurrent Liabilities Management

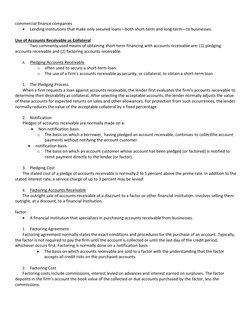

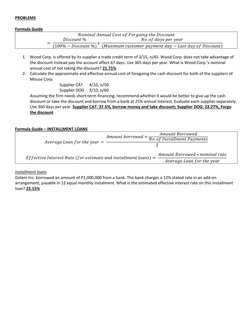

The document discusses sources of short-term financing and current liabilities management. It covers spontaneous sources like accounts payable and accruals as well as negotiated sources like bank loans and commercial paper. For bank loans, it describes types of loans like single payment notes, lines of credit, and revolving credit agreements. It also discusses secured short-term financing using accounts receivable or inventory as collateral.

Uploaded by

Jack HererCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

100% found this document useful (2 votes)

1K views7 pagesCurrent Liabilities Management

The document discusses sources of short-term financing and current liabilities management. It covers spontaneous sources like accounts payable and accruals as well as negotiated sources like bank loans and commercial paper. For bank loans, it describes types of loans like single payment notes, lines of credit, and revolving credit agreements. It also discusses secured short-term financing using accounts receivable or inventory as collateral.

Uploaded by

Jack HererCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd