Professional Documents

Culture Documents

Company Registration Thailand

Uploaded by

Paras Mittal0 ratings0% found this document useful (0 votes)

31 views6 pagesCompany Registration Thailand

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCompany Registration Thailand

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views6 pagesCompany Registration Thailand

Uploaded by

Paras MittalCompany Registration Thailand

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

What is Company Registration in Thailand?

Thailand is economically progressing country. There is presence of

sufficient infrastructure and an efficient workforce with the support from the

government.

For setting up business in Thailand following are the different Business

Structures and necessary steps that need to be taken.

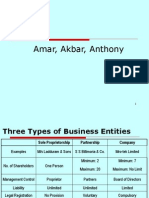

Types of Business Structures

Partnership

In Thailand, there are three general types of partnerships:

Unregistered Ordinary Partnerships;

Registered Ordinary Partnerships;

Limited Partnerships.

Limited Companies

Here are the following types of limited companies:

Private or closely held companies which is governed by the Civil and

Commercial Code and

Public companies which is governed by the Public Company Act.

Private Limited Companies

In Thailand, Private Limited Companies have characteristics which are

similar to Western corporations. Under this type of company, formation

process includes registration of a constitutive document such as

Memorandum of Association which is Articles of Incorporation and Articles

of Association which is also referred as By-laws.

There is a requirement of minimum seven shareholders at all times. This

type of company may be wholly owned by aliens. Aliens participation is

generally allowed up to maximum 49 percent in case of those activities

which are reserved for Thai nationals

Public Limited Companies

In Thailand, Public Limited Companies are subject to compliance with the

prospectus, approval, and other requirements, offer shares, debentures,

and warrants to the public.They may apply to list their securities on the

Stock Exchange of Thailand (SET). For the purpose of formation and

registration of the memorandum of association minimum 15 promoters are

required. There is a requirement for promoters that they must hold their

shares for a minimum of two years before they can be transferred. Board of

Directors must have minimum five members and at least half of them Thai

nationals.

Joint Venture

Joint venture is described as a group of persons entering into an

agreement in order to carry on a business together. Under the Civil and

Commercial Code, Joint Venture has not yet been recognized as a legal

entity. However under the Revenue Code, it classifies it as a single entity

and income is subject to corporate taxation.

Representative Office

Representative office is limited to engaging in non-profit activities. Under

this, at least one of the following purposes would need to be sought for the

purposes of limited “non-trading” activities:

Business is related to search for the source of goods or services in

Thailand for the headquarters overseas

It is related to check the quality and quantity of the product ordered

by the headquarters overseas

Give advice to the headquarters regarding the goods to order

Information supply to the customers in Thailand of the headquarters’

products

Reporting of the economic movement in Thailand to the headquarters

INCORPORATION PROCESS

Step 1: Name Reservation

Proposed name must not be the same or similar to that of other companies.

The name reservation guidelines should be observed of the Business

Development Office in the Ministry of Commerce. Approved name will be

valid for 30 days. No extension is allowed.

Step 2: Memorandum of Association

Memorandum of Association must include the successfully reserved name

of the company and this Memorandum of Association is required to be filed

with the Business Development Office. Memorandum of Association will

also mention where the company will be located, business objectives and

capital to be registered with the names of the seven promoters.

It must be noted that capital information must include the number of shares

and the par value. Authorized capital, although partly paid, must all be

issued.

Under this, there are no minimum capital requirements, but the amount of

the capital should be adequate enough for the intended business operation.

Step 3: Statutory Meeting

After the above-mentioned steps, a statutory meeting is convened in which

the articles of incorporation and bylaws are approved and the Board of

Directors is elected and an auditor appointed. Under this, minimum 25

percent of the par value of each subscribed share must be paid.

Step 4: Registration

After this, there is a requirement of submitting an application by the

directors to establish the company within the period of three months from

the date of the Statutory Meeting.

Step 5: Tax Registration

Every business liable for income tax must obtain a tax I.D. card and

number within 60 days of incorporation from the Revenue Department.

Each business earning more than 600,000 baht per annum must register

for VAT when they reach the limit 600,000 baht within 30 days.

You might also like

- Company Registration in USADocument8 pagesCompany Registration in USAParas Mittal0% (1)

- Business RegistrationDocument5 pagesBusiness RegistrationgithireNo ratings yet

- Petition for issuance of second owner's duplicate titleDocument2 pagesPetition for issuance of second owner's duplicate titlebernard jonathan Gatchalian100% (1)

- Company Registration IrelandDocument9 pagesCompany Registration IrelandParas MittalNo ratings yet

- Ra 7431Document43 pagesRa 7431api-3845840100% (2)

- Company Formation and Legal AspectsDocument3 pagesCompany Formation and Legal AspectsJayan PrajapatiNo ratings yet

- EXPORT DOCUMENTATION AND PROCEDURES GUIDEDocument44 pagesEXPORT DOCUMENTATION AND PROCEDURES GUIDEKomal Singh100% (2)

- Housing Finance CompanyDocument6 pagesHousing Finance CompanyParas MittalNo ratings yet

- NEw IC 38 SummaryDocument80 pagesNEw IC 38 SummaryMadhup tarsolia100% (2)

- Register Your Business for Credibility and BenefitsDocument6 pagesRegister Your Business for Credibility and BenefitsEncar Marie Salvante NicolasNo ratings yet

- Forms of Business EntityDocument20 pagesForms of Business EntityMain Daiictian HuNo ratings yet

- Establishing A Business in IndonesiaDocument29 pagesEstablishing A Business in IndonesiaGeysa Pratama EriatNo ratings yet

- Company Registration FranceDocument4 pagesCompany Registration FranceParas MittalNo ratings yet

- Entrepreneurship LAS 5 Q4 Week 5 6Document10 pagesEntrepreneurship LAS 5 Q4 Week 5 6Desiree Jane SaleraNo ratings yet

- Company Registration in IndiaDocument17 pagesCompany Registration in IndiaAavana CorporateNo ratings yet

- A Business Guide To Thailand 2011 1317913244 Phpapp02 111006100313 Phpapp02Document129 pagesA Business Guide To Thailand 2011 1317913244 Phpapp02 111006100313 Phpapp02Freeman HuNo ratings yet

- Setting Up A BusinessDocument11 pagesSetting Up A BusinessFaye TienNo ratings yet

- Topic: Registration of A Company Is Just Like Issuance of Birth Certificate To A Human BeingDocument8 pagesTopic: Registration of A Company Is Just Like Issuance of Birth Certificate To A Human Beingزین گھمنNo ratings yet

- Company EstablishmentDocument13 pagesCompany EstablishmentKrishna Singh RajputNo ratings yet

- Company Registration in CambodiaDocument5 pagesCompany Registration in CambodiatangbunnaNo ratings yet

- LegalDocument32 pagesLegalAkriti SinghNo ratings yet

- Doing Business in Tanzania, Questions and AnswersDocument26 pagesDoing Business in Tanzania, Questions and Answersimran hameerNo ratings yet

- University Malaysia Kelantan (UMK) : Course NameDocument18 pagesUniversity Malaysia Kelantan (UMK) : Course NameshobuzfeniNo ratings yet

- Register Compny in PakDocument8 pagesRegister Compny in PakMuhammad SaadNo ratings yet

- Faq - PacraDocument8 pagesFaq - PacraJohn BandaNo ratings yet

- Types of Business Entities in India and Requirements for a Private Limited CompanyDocument5 pagesTypes of Business Entities in India and Requirements for a Private Limited CompanyAnshul GuptaNo ratings yet

- Assignment Business LawDocument6 pagesAssignment Business LawAndy ChilaNo ratings yet

- Establish Business in Tanzania and Become SuccessfulDocument40 pagesEstablish Business in Tanzania and Become SuccessfulHance MwikwabeNo ratings yet

- Chapter 7: Forms of Small Business Ownership, Registering and OrganizingDocument77 pagesChapter 7: Forms of Small Business Ownership, Registering and OrganizingEmerson CruzNo ratings yet

- Legal Requirement For Formation and Operation of CompanyDocument5 pagesLegal Requirement For Formation and Operation of CompanyHusnainShahidNo ratings yet

- Establishing An EntityDocument32 pagesEstablishing An EntityAbhishek RaiNo ratings yet

- How to form & register a Pvt Ltd company in BangladeshDocument16 pagesHow to form & register a Pvt Ltd company in BangladeshAbrar SakibNo ratings yet

- Final Exam Law 101Document2 pagesFinal Exam Law 101Phanith CheaNo ratings yet

- A Partnership FirmDocument3 pagesA Partnership FirmSudhakshar KumarNo ratings yet

- Registration of A Pubic Limited Company in PakistanDocument23 pagesRegistration of A Pubic Limited Company in PakistansikandarishaqNo ratings yet

- 463 1Document17 pages463 1noughalNo ratings yet

- Procedure To Setup Business in IndiaDocument30 pagesProcedure To Setup Business in IndiaNitin JainNo ratings yet

- L&T Ass#3Document3 pagesL&T Ass#3Zubair AhmedNo ratings yet

- 8 Types of Companies in MalaysiaDocument9 pages8 Types of Companies in MalaysiaYingfang HuangNo ratings yet

- Documents Required For Company Registration - Taxguru - inDocument6 pagesDocuments Required For Company Registration - Taxguru - inVyom RajNo ratings yet

- Business Law AssignmentDocument24 pagesBusiness Law AssignmentShailesh KhodkeNo ratings yet

- Formation - of - Company by Rajat JhinganDocument14 pagesFormation - of - Company by Rajat Jhinganrajat_marsNo ratings yet

- What Are The Type of Business Entities Available in India?Document24 pagesWhat Are The Type of Business Entities Available in India?Pritam DeuskarNo ratings yet

- Establishing A Business in CambodiaDocument2 pagesEstablishing A Business in CambodiaSovan Meas100% (1)

- Legal procedures for starting a company in IndiaDocument4 pagesLegal procedures for starting a company in Indiaaslam khanNo ratings yet

- Business Law: How To From & Register A PVT LTD Company IN BangladeshDocument17 pagesBusiness Law: How To From & Register A PVT LTD Company IN BangladeshAronno SharmaNo ratings yet

- T.Y.Bcom: Name: Arshiya Shaikh Class: Division: 1 Roll No: 14 Topic: Registration ProcedureDocument6 pagesT.Y.Bcom: Name: Arshiya Shaikh Class: Division: 1 Roll No: 14 Topic: Registration ProcedureArshiya ShaikhNo ratings yet

- How To Register Your Company or LLPDocument8 pagesHow To Register Your Company or LLPanoop82No ratings yet

- C C C VDocument9 pagesC C C VCAJayeshparakhNo ratings yet

- Doing Business in India: Premier of Saskatchewan, CanadaDocument5 pagesDoing Business in India: Premier of Saskatchewan, CanadaCorporate ProfessionalsNo ratings yet

- CODE:BBA 1004: November Semester 2011Document36 pagesCODE:BBA 1004: November Semester 2011Happii MikoNo ratings yet

- Register Company Singapore GuideDocument17 pagesRegister Company Singapore GuideStikcon PmcNo ratings yet

- Types of Business Entities in IndiaDocument13 pagesTypes of Business Entities in IndiaDipali MahalleNo ratings yet

- Assignment 10Document4 pagesAssignment 1068 DEEPAK GAUNDNo ratings yet

- Export-import theory summaryDocument10 pagesExport-import theory summaryDavid Manuel Torregroza JineteNo ratings yet

- Sole Proprietorships Dominate Bangladeshi BusinessesDocument2 pagesSole Proprietorships Dominate Bangladeshi BusinessesRocky AhmedNo ratings yet

- Evidencia #5 Sumary, Export Import TheoryDocument8 pagesEvidencia #5 Sumary, Export Import Theoryjuliana muñozNo ratings yet

- Characteristics of Ownership in MyanmarDocument2 pagesCharacteristics of Ownership in MyanmarShin ThantNo ratings yet

- Business Laws Bangladesh GuideDocument7 pagesBusiness Laws Bangladesh GuideNafisul AbrarNo ratings yet

- Session 6 - Business Formalisation: Objectives of The TopicDocument6 pagesSession 6 - Business Formalisation: Objectives of The TopicFatimah AbdulrahmanNo ratings yet

- Lab Study Note-2021Document78 pagesLab Study Note-2021elizabeth shrutiNo ratings yet

- LLP Registration for NRIs and Foreign NationalsDocument4 pagesLLP Registration for NRIs and Foreign NationalsNavin SuranaNo ratings yet

- Be A Sole Proprietorship, Partnership or Corporation?Document14 pagesBe A Sole Proprietorship, Partnership or Corporation?Imelda Maria Tania RosarioNo ratings yet

- Companies Act 2013 provisions on OPC, small companies, dormant companies and women directorsDocument6 pagesCompanies Act 2013 provisions on OPC, small companies, dormant companies and women directorsGunjan LalwaniNo ratings yet

- TDS FilingDocument3 pagesTDS FilingLopamudracsNo ratings yet

- IEC RegistrationDocument6 pagesIEC RegistrationParas MittalNo ratings yet

- NBFC RegistrationDocument28 pagesNBFC RegistrationParas MittalNo ratings yet

- Business Plan ConsultantDocument13 pagesBusiness Plan ConsultantParas MittalNo ratings yet

- Company Registration in ChinaDocument10 pagesCompany Registration in ChinaParas MittalNo ratings yet

- Alteration of MOA ServicesDocument8 pagesAlteration of MOA ServicesParas MittalNo ratings yet

- Company Registration OmanDocument4 pagesCompany Registration OmanParas MittalNo ratings yet

- What Is RERA (Real Estate Regulatory Act) ?Document11 pagesWhat Is RERA (Real Estate Regulatory Act) ?Paras MittalNo ratings yet

- What Is Outbound Investment Structuring?Document9 pagesWhat Is Outbound Investment Structuring?Paras MittalNo ratings yet

- What Is RNI Registration?: Registrar of Newspapers For India (RNI)Document4 pagesWhat Is RNI Registration?: Registrar of Newspapers For India (RNI)Paras Mittal100% (1)

- Microfinance Company RegistrationsDocument5 pagesMicrofinance Company RegistrationsParas MittalNo ratings yet

- Company Registration PolandDocument4 pagesCompany Registration PolandParas MittalNo ratings yet

- Company Registration NorwayDocument5 pagesCompany Registration NorwayParas MittalNo ratings yet

- Peer To Peer Lending LicenseDocument15 pagesPeer To Peer Lending LicenseParas MittalNo ratings yet

- Prepaid Instruments LicenseDocument6 pagesPrepaid Instruments LicenseParas MittalNo ratings yet

- Mutual Fund RegistrationDocument4 pagesMutual Fund RegistrationParas MittalNo ratings yet

- Ayush LicenseDocument7 pagesAyush LicenseParas MittalNo ratings yet

- Company Registration SweedenDocument3 pagesCompany Registration SweedenParas MittalNo ratings yet

- MSME SSI RegistrationDocument4 pagesMSME SSI RegistrationParas MittalNo ratings yet

- Venture Capital CompanyDocument6 pagesVenture Capital CompanyParas MittalNo ratings yet

- Iso 27001 LicenseDocument3 pagesIso 27001 LicenseParas MittalNo ratings yet

- Money Currency Exchanger LicenseDocument5 pagesMoney Currency Exchanger LicenseParas MittalNo ratings yet

- Alternative Investment Fund RegistrationDocument6 pagesAlternative Investment Fund RegistrationParas MittalNo ratings yet

- Credit Rating Agency RegistrationDocument3 pagesCredit Rating Agency RegistrationParas MittalNo ratings yet

- Hence, The List of The Bar Is As Discussed BelowDocument3 pagesHence, The List of The Bar Is As Discussed BelowParas MittalNo ratings yet

- Company Registration NewzealandDocument5 pagesCompany Registration NewzealandParas MittalNo ratings yet

- Working With Sexual Issues in Systemic Therapy by Desa Markovic PDFDocument13 pagesWorking With Sexual Issues in Systemic Therapy by Desa Markovic PDFsusannegriffinNo ratings yet

- Basic Microeconomics Semi Final Exam ReviewDocument3 pagesBasic Microeconomics Semi Final Exam ReviewEnergy Trading QUEZELCO 1No ratings yet

- WHO Report On COVID-19 - April 22, 2020Document14 pagesWHO Report On COVID-19 - April 22, 2020CityNewsTorontoNo ratings yet

- Free Tuition Fee Application Form: University of Rizal SystemDocument2 pagesFree Tuition Fee Application Form: University of Rizal SystemCes ReyesNo ratings yet

- Mumbai to Goa Flight Ticket BookingDocument3 pagesMumbai to Goa Flight Ticket BookingDarshNo ratings yet

- ELSS V/s SCSS For A Retired InvestorDocument13 pagesELSS V/s SCSS For A Retired InvestorMayuri SonawaneNo ratings yet

- Dealey Field Day 10 FlyerDocument1 pageDealey Field Day 10 FlyercooperrebeccaNo ratings yet

- Mitchell and Schofield CPD LawsuitDocument22 pagesMitchell and Schofield CPD LawsuitWKRCNo ratings yet

- Computation of Basic and Diluted Eps Charles Austin of The PDFDocument1 pageComputation of Basic and Diluted Eps Charles Austin of The PDFAnbu jaromiaNo ratings yet

- Notes On Collective NounsDocument7 pagesNotes On Collective NounsTuisyen Dewan Hj Ali50% (2)

- Lily Nunez Statement Regarding Harassment Complaint Against LAUSD School Board President Richard VladovicDocument1 pageLily Nunez Statement Regarding Harassment Complaint Against LAUSD School Board President Richard VladovicLos Angeles Daily NewsNo ratings yet

- Madiha Riasat: ObjectiveDocument3 pagesMadiha Riasat: Objectivecallraza19No ratings yet

- Joan L Cary: Please Remember, You Are Restricted From Using This Information ForDocument6 pagesJoan L Cary: Please Remember, You Are Restricted From Using This Information ForAliyaNo ratings yet

- RC Guided Practice - (Time Bound)Document6 pagesRC Guided Practice - (Time Bound)Stuti RawatNo ratings yet

- 516 Application CarDocument2 pages516 Application Carazamkhan13No ratings yet

- Mindmap: English Grade 5Document19 pagesMindmap: English Grade 5Phương HoàngNo ratings yet

- P15a PPT SlidesDocument18 pagesP15a PPT Slidesdiktiedu5984No ratings yet

- Constitutional Law 1 Syllabus and Cases on Legislative and Executive DepartmentsDocument13 pagesConstitutional Law 1 Syllabus and Cases on Legislative and Executive DepartmentsAdrian AlamarezNo ratings yet

- bài tập unit 4Document5 pagesbài tập unit 4Hiền PhạmNo ratings yet

- Managerial Accounting and Cost ConceptsDocument61 pagesManagerial Accounting and Cost ConceptsFederico SalernoNo ratings yet

- History of The Alphabet Sejarah AbjadDocument29 pagesHistory of The Alphabet Sejarah AbjadEmian MangaNo ratings yet

- Fallacies EssayDocument1 pageFallacies EssayrahimNo ratings yet

- Final Gaz Commerce Regular Part 1 2016Document222 pagesFinal Gaz Commerce Regular Part 1 2016Arbab JhangirNo ratings yet

- Thời gian làm bài: 180 phút (Đề thi gồm 10 trang, thí sinh làm bài ngay vào đề thi này)Document11 pagesThời gian làm bài: 180 phút (Đề thi gồm 10 trang, thí sinh làm bài ngay vào đề thi này)Hải VũNo ratings yet

- An Inscribed Nabataean Bronze Object DedDocument15 pagesAn Inscribed Nabataean Bronze Object Dedejc1717No ratings yet

- Deriv Investments (Europe) LimitedDocument9 pagesDeriv Investments (Europe) LimitedİHFKİHHKİCİHCİHCDSNo ratings yet

- Enhancing Role of SMEs in Indian Defence Industry1 PDFDocument84 pagesEnhancing Role of SMEs in Indian Defence Industry1 PDFINDIRA PALNINo ratings yet