Professional Documents

Culture Documents

Rate of Duty and Tariff Valuation

Uploaded by

Welcome 19950 ratings0% found this document useful (0 votes)

9 views1 pageOriginal Title

Rate of Duty and Tariff valuation

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageRate of Duty and Tariff Valuation

Uploaded by

Welcome 1995Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

1.

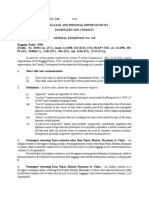

Rate of Duty and Tariff valuation (section 78)

As per Section 78 of the Customs Act the rate of duty and Tariff valuation applicable to

baggage shall be the rate and valuation in force on the date of declaration.

2. Exemption in case of Bonafide Baggage:

According to Baggage Rules, 1998 the provisions of baggage rules are applicable to three

different categories of persons (a) Residents from India (b) Tourists visiting India and

(a) Persons transferring their residence.

Rules relating to exemption (Section 79)

(a) Exemption applicable to only bonafide baggage: Bonafide baggage includes “wearing

apparel, personal effects, household effects meant for personal use of passenger or

family members travelling with him and not for sale or gift.

(b) Export certificate: Any person leaving India should take Export certificate for taking

Jewellery, Camera, Laptop etc.

(c) General free allowances: In addition to personal effects (Other than Jewellery) a

passenger of specified age is allowed general free allowance.

(d) Limited exemption to Jewellery: in the case of passenger residing abroad for over one

year. Jewellery can be imported duty free upto specified value in case of gentleman

passenger and specified value in case of lady passenger.

(e) Concessions to persons transferring residence (TR): A person who is transferring his

residence to India is eligible to bring used personal and household articles to India

without duty.

(f) Exemption to Laptop: Lap top brought by a person along with baggage is exempt

from customs duty provided the person is above 18 years of age.

Unaccompanied Baggage:

Baggage includes unaccompanied baggage brought before or after arrival of passenger

within the prescribed period. Bonafide unaccompanied luggage is also allowed under the

above rules.

Concession to Tourists: A tourist is a person who is not normally resident in India and

enters India for a stay of not more than six months in the course of twelve months period.

Tourists come for legitimate non-immigration purpose such as touring, recreation, sport,

health, study, religious pilgrimage or business.

Excemptions to Baggage of tourists: (a) Used personnel effects (b) Foreign tourists are

allowed to bring articles upto specified value for making gifts.

You might also like

- Baggage, Postage and Courier Under Custom ActDocument38 pagesBaggage, Postage and Courier Under Custom Actamin pattani100% (8)

- Baggage rules at a glance: Green/Red channels, duty allowancesDocument19 pagesBaggage rules at a glance: Green/Red channels, duty allowanceszydusNo ratings yet

- GUIDE FOR TRAVELLERS v5Document19 pagesGUIDE FOR TRAVELLERS v5varun sachdevaNo ratings yet

- Sanju (Provision Regarding Baggage)Document15 pagesSanju (Provision Regarding Baggage)sanjucadbury_sNo ratings yet

- General Provisions About BaggageDocument10 pagesGeneral Provisions About BaggageSunil VishwakarmaNo ratings yet

- Q. What Is The Rate of Customs Duty On Baggage?Document20 pagesQ. What Is The Rate of Customs Duty On Baggage?z_eguyNo ratings yet

- Guide To Travellers PDFDocument22 pagesGuide To Travellers PDFGoljanNo ratings yet

- AIR CUSTOMS CHENNAI AIRPORT BAGGAGE RULESDocument26 pagesAIR CUSTOMS CHENNAI AIRPORT BAGGAGE RULESsreeramaNo ratings yet

- Import and Export Procedure under CustomsDocument14 pagesImport and Export Procedure under Customsprayana smartwisetechNo ratings yet

- Information of TravellersDocument31 pagesInformation of Travellersimadz853No ratings yet

- Chief Commissioner of Customs Mumbai Zone - IIIDocument8 pagesChief Commissioner of Customs Mumbai Zone - IIISandeep RangapureNo ratings yet

- Baggage Rules UpdateDocument6 pagesBaggage Rules UpdateapoorvbadamiNo ratings yet

- CBEC Baggage RulesDocument16 pagesCBEC Baggage Rulesshish0iitrNo ratings yet

- Baggage RulesDocument37 pagesBaggage RulesHiteshi AggarwalNo ratings yet

- Some Definitions : Compiled by DR Renu AggarwalDocument9 pagesSome Definitions : Compiled by DR Renu AggarwalSandeep nayakaNo ratings yet

- 065 Tasnim A P Lesson2.5Document17 pages065 Tasnim A P Lesson2.5S.A.KarzaviNo ratings yet

- Guide To Baggage Rule of Indian CustomsDocument8 pagesGuide To Baggage Rule of Indian CustomsKnowledgeable IndianNo ratings yet

- ECL Notes Chpt1 PDFDocument6 pagesECL Notes Chpt1 PDFRitika JainNo ratings yet

- RBI FX RegulationsDocument4 pagesRBI FX Regulationsindiabhagat101No ratings yet

- 2006-S R O-666Document8 pages2006-S R O-666Muhammad Anwar HussainNo ratings yet

- As Globalization Took PlaceDocument3 pagesAs Globalization Took PlaceDivyansh SinghNo ratings yet

- ITFE AssignmentDocument14 pagesITFE AssignmentZubair PirachaNo ratings yet

- Nepal Baggage RulesDocument9 pagesNepal Baggage Rulesquestion markNo ratings yet

- Chapter 16Document64 pagesChapter 16Ram SskNo ratings yet

- DGFT Note Regarding Import ExportDocument11 pagesDGFT Note Regarding Import ExportSuraj GawandeNo ratings yet

- Chapter - Non Resident TaxationDocument162 pagesChapter - Non Resident TaxationsayanghoshNo ratings yet

- Airport customs documentation submission for travel assignmentDocument12 pagesAirport customs documentation submission for travel assignmentKunal SinghNo ratings yet

- Customs_IntroductionDocument19 pagesCustoms_IntroductionanshuNo ratings yet

- ForeigD FRRO Version223.6.11Document19 pagesForeigD FRRO Version223.6.11ASCI AdminNo ratings yet

- CUS NTF NO. 03/1957 DATE 08/01/1957 Exemption To Imports by Diplomats, Trade Representatives, EtcDocument18 pagesCUS NTF NO. 03/1957 DATE 08/01/1957 Exemption To Imports by Diplomats, Trade Representatives, EtcT Ankamma RaoNo ratings yet

- Foreign Exchange Management Act, 1999 (FEMA) : Prof. Dhaval BhattDocument22 pagesForeign Exchange Management Act, 1999 (FEMA) : Prof. Dhaval BhattMangesh KadamNo ratings yet

- Annex IIIDetailsof Visas 20082020Document72 pagesAnnex IIIDetailsof Visas 20082020naresh_madarapuNo ratings yet

- CTAPARTIIExemptionsDocument25 pagesCTAPARTIIExemptionsANDRE AURELLIONo ratings yet

- Digital Passenger Locator Form: WWW - Esteri.itDocument7 pagesDigital Passenger Locator Form: WWW - Esteri.itSanja ApostolskaNo ratings yet

- Exports and Its DocumentationDocument2 pagesExports and Its DocumentationbiplabmandalNo ratings yet

- BaggageDocument2 pagesBaggageamarprabhu567No ratings yet

- FEMA ACT REPLACED FERADocument20 pagesFEMA ACT REPLACED FERArashpinder singhNo ratings yet

- ITC (HS), 2012 Schedule 1 - Import PolicyDocument10 pagesITC (HS), 2012 Schedule 1 - Import Policystudent1291No ratings yet

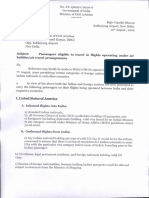

- Travel in Flights: Eligible Under AirDocument3 pagesTravel in Flights: Eligible Under AirShadab AlamNo ratings yet

- ForeigD-FRRO Version223.6.11Document19 pagesForeigD-FRRO Version223.6.11vidhyaa1011No ratings yet

- Introduction To Custom Law: Prepared by DR Renu AggarwalDocument13 pagesIntroduction To Custom Law: Prepared by DR Renu AggarwalPramod PrabhasNo ratings yet

- Travel and visa restrictions due to COVID-19 dated 12 March 2020Document1 pageTravel and visa restrictions due to COVID-19 dated 12 March 2020Sood NeerajNo ratings yet

- India Customsregulation PDFDocument3 pagesIndia Customsregulation PDFDeepak JaswalNo ratings yet

- DS 182-2013-EF - Equipaje de Mano y Menaje de Casa - Versión en InglésDocument12 pagesDS 182-2013-EF - Equipaje de Mano y Menaje de Casa - Versión en Ingléslima2OI5No ratings yet

- MiscellaneousDocument2 pagesMiscellaneousmithilesh tabhaneNo ratings yet

- NotesDocument72 pagesNotesSandeep Singh MaharNo ratings yet

- Customs ACT: Dr. Gurumurthy K H Asst. Prof. in Commerce GFGC Magadi 9448226676Document46 pagesCustoms ACT: Dr. Gurumurthy K H Asst. Prof. in Commerce GFGC Magadi 9448226676Shiva KumarNo ratings yet

- Taxation ProjectDocument12 pagesTaxation ProjectVeronicaNo ratings yet

- Imports of Gold by NrisDocument6 pagesImports of Gold by NrisRavi Kant ThakurNo ratings yet

- Regulations Applicable To Foreigners in IndiaDocument3 pagesRegulations Applicable To Foreigners in IndiapatxilNo ratings yet

- Import Procedure and RequirementsDocument12 pagesImport Procedure and RequirementsAbhinav RanjanNo ratings yet

- Chapter 12 - Customs Act 1962Document6 pagesChapter 12 - Customs Act 1962Abhay Sharma100% (1)

- Unit I - Customs DutyDocument64 pagesUnit I - Customs Duty21ubha116 21ubha116No ratings yet

- Chapter - 1 Custom Act, Definitions, TypesDocument11 pagesChapter - 1 Custom Act, Definitions, TypesTarun Kumar SinghNo ratings yet

- FEMADocument51 pagesFEMAChinmay Shirsat50% (2)

- Presented By: Abhishek Shah and Siddharth TrivediDocument20 pagesPresented By: Abhishek Shah and Siddharth TrivediSiddharthNo ratings yet

- Baggage Rules for Indian Residents Returning from AbroadDocument5 pagesBaggage Rules for Indian Residents Returning from AbroadShashi SukenkarNo ratings yet

- Uae Immigration LawDocument28 pagesUae Immigration LawHemza AbaidiaNo ratings yet

- Transaction Value of Identical GoodsDocument1 pageTransaction Value of Identical GoodsWelcome 1995No ratings yet

- Taxable EventsDocument1 pageTaxable EventsWelcome 1995No ratings yet

- Confiscation of Goods and Conveyance and Imposition of PenaltiesDocument1 pageConfiscation of Goods and Conveyance and Imposition of PenaltiesWelcome 1995No ratings yet

- Fully Exempt BaggageDocument1 pageFully Exempt BaggageWelcome 1995No ratings yet

- POWERS OF CUSTOMS OFFICERSDocument1 pagePOWERS OF CUSTOMS OFFICERSWelcome 1995No ratings yet

- Transaction Value of Identical GoodsDocument1 pageTransaction Value of Identical GoodsWelcome 1995No ratings yet

- Confiscation of Goods and Conveyance and Imposition of PenaltiesDocument1 pageConfiscation of Goods and Conveyance and Imposition of PenaltiesWelcome 1995No ratings yet

- Prohibition and Regulation of Drawback in Certain CasesDocument1 pageProhibition and Regulation of Drawback in Certain CasesWelcome 1995No ratings yet

- Warehouse Goods Rules ProceduresDocument1 pageWarehouse Goods Rules ProceduresWelcome 1995No ratings yet

- Drawback Allowable On ReDocument1 pageDrawback Allowable On ReWelcome 1995No ratings yet

- He May Specify The Limits of Any Customs AreaDocument1 pageHe May Specify The Limits of Any Customs AreaWelcome 1995No ratings yet

- Exemption by Special OrderDocument1 pageExemption by Special OrderWelcome 1995No ratings yet

- Exemption by Special OrderDocument1 pageExemption by Special OrderWelcome 1995No ratings yet

- Warehouse Goods Rules ProceduresDocument1 pageWarehouse Goods Rules ProceduresWelcome 1995No ratings yet

- Transaction Value of Identical GoodsDocument1 pageTransaction Value of Identical GoodsWelcome 1995No ratings yet

- Restrictions On Unloading and Loading of Goods On HolidaysDocument1 pageRestrictions On Unloading and Loading of Goods On HolidaysWelcome 1995No ratings yet

- Identical Similar Goods Valuation RulesDocument1 pageIdentical Similar Goods Valuation RulesWelcome 1995No ratings yet

- Powers of Customs AuthoritiesDocument1 pagePowers of Customs AuthoritiesWelcome 1995No ratings yet

- Clearance of Imported GoodsDocument1 pageClearance of Imported GoodsWelcome 1995No ratings yet

- Deductive Value MethodDocument1 pageDeductive Value MethodWelcome 1995No ratings yet

- Provision Relating To Restriction On Custody and Removal of Imported GoodsDocument1 pageProvision Relating To Restriction On Custody and Removal of Imported GoodsWelcome 1995No ratings yet

- BAGGAGEDocument1 pageBAGGAGEWelcome 1995No ratings yet

- Transaction Value of Identical GoodsDocument1 pageTransaction Value of Identical GoodsWelcome 1995No ratings yet

- Entry of Goods On ImportationDocument1 pageEntry of Goods On ImportationWelcome 1995No ratings yet

- Procedure Regarding WarehousingDocument1 pageProcedure Regarding WarehousingWelcome 1995No ratings yet

- Power To Board ConveyanceDocument1 pagePower To Board ConveyanceWelcome 1995No ratings yet

- Clearance of Goods For Home ConsumptionDocument1 pageClearance of Goods For Home ConsumptionWelcome 1995No ratings yet

- Carrying Imported GoodsDocument1 pageCarrying Imported GoodsWelcome 1995No ratings yet

- Transaction Value of Identical GoodsDocument1 pageTransaction Value of Identical GoodsWelcome 1995No ratings yet