Professional Documents

Culture Documents

1 21 Take Home Exercises - Credits

Uploaded by

Cyrus DaitOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 21 Take Home Exercises - Credits

Uploaded by

Cyrus DaitCopyright:

Available Formats

This is a thirty (30) item take home exercise.

Most of the questions that follow are familiar questions in Credit Transaction being part

of Civil Law. Some relates to obligations and contracts, sales, and negotiable instruments, but

that is how questions are framed as these topics are all grafted into one subject.

Your answers should be based on the latest laws, amendments, and jurisprudence if any.

I will not give you hard time by not requiring that your answers should be hand written

and converted thereafter to photo or PDF file given the difficulty for document scanner and huge

data size thereafter. So no need for that. Just read, analyze the questions, and do your research.

Work as a group. Coordinate. Discuss with each other and validate your answer.

Encode your answers below the given questions and cite your reference. Except for the

reference, your answer to each question should be presented in such a manner as if taking the bar

examination.

Do not copy - paste. That as an insult to your brilliance, to yourself, and to your group.

Your merits will be based on correctness, briefness of explanation, and completeness.

Here you go.

1. X Corp entered into a contract with Y Corp for the construction of the latter’s warehouse.

In consideration thereof, Y Corp was obliged to pay X Corp the amount of

P50,000,000.00 within a period of one (1) month from the time of the project’s

completion. To secure the payment of the said sum, D Inc. entered into a surety

agreement with S Company.

After more than a month from the completion date of the project, C Corp

remained unpaid. Claiming that it was suffering from serious financial reverses, D In.c,

asked C Corp. for an extension of three (3) months to pay the P50,000,000.00 it still

owed , to which C Corp. agreed. However, after more than three (3) months, D Inc. still

refused to pay. Hence, C Corp. proceeded to collect the above sum from the surety, S

Company.

For its part, S Company refused the claim and raised the defense that the

extension of time granted by C Corp. to D, Inc., without its consent released it from

liability.

a. Will the defense of S Company against the claim hold water? no

b. Assuming that S Company instead refused the claim on the ground that C

Corp. has yet to exhaust D, Inc.’s property to satisfy the claim before

proceedings against it, will this defense prosper? no

2. Saachi opened a savings bank account with Shanghainese Bank. He made an initial

deposit of PhP100,000. Part of the bank opening forms that he was required to sign when

he opened the account was a Holdout Agreement which provided that, should he incur

any liability or obligation to the bank, the bank shall have the right to immediately and

automatically take over his savings account deposit. After he opened his deposit account,

the Shanghainese Bank discovered a scam wherein the funds in the account of another

depositor in the bank was withdrawn by an impostor. Shanghainese Bank suspected

Saachi to be. the impostor, and filed a criminal case of estafa against him. While the case

was still pending with the Prosecutor's office, the bank took over Saachi's savings deposit

on the basis of the Holdout Agreement.

Page 1 of 21 Take Home Exercises - Credits

a. What kind of contract is created when a depositor opens a deposit account

with a bank?

b. In this case, did the bank have the right to take over Saachi's bank deposit?

3. Sebastian, who has a pending assessment from the Bureau of Internal Revenue (BIR),

was required to post a bond. He entered into an agreement with Solid Surety Company

(SSC) for SSC to issue a bond in favor of the BIR to secure payment of his taxes, if found

to be due. In consideration of the issuance of the bond, he executed an Indemnity

Agreement with SSC whereby he agreed to indemnify the latter in the event that he was

found liable to pay the tax. The BIR eventually decided against Sebastian, and judicially

commenced action against both Sebastian and SSC to recover Sebastian's unpaid taxes.

Simultaneously, BIR also initiated action to foreclose on the bond. Even before paying

the BIR, SSC sought indemnity from Sebastian on the basis of the Indemnity Agreement.

Sebastian refused to pay since SSC had not paid the BIR anything yet, and alleged that

the provision in the Indemnity Agreement which allowed SSC to recover from him, by

mere demand, even if it (SSC) had not yet paid the creditor, was void for being contrary

to law and public policy. Can Sebastian legally refuse to pay SSC?

4. Simeon was returning to Manila after spending a weekend with his parents in Sariaya,

Quezon. He boarded a bus operated by the Sabbit Bus Line (SBL) on August 30, 2013. In

the middle of the journey, the bus collided with a truck coming from the opposite

direction, which was overtaking the vehicle in front of the truck. Though the driver of the

SBL bus tried to avoid the truck, a mishap occurred as the truck hit the left side of the

bus. As a result of the accident, Simeon suffered a fractured leg and was unable to report

for work for one week. He sued SBL for actual and moral damages. SBL raised the

defense that it was the driver of the truck who was at fault, and that it exercised the

diligence of a good father of a family in the selection and supervision of its driver.

a. Is SBL liable for actual damages? Moral damages?

b. Will SBL be liable to pay interest if it is required to pay damages, and delays

in the payment of the judgment award? What is the rate of interest, and from

when should the interest start running?

5. Zeny and Nolan were best friends for a long time already. Zeny borrowed ₱10,000.00

from Nolan, evidenced by a promissory note whereby Zeny promised to pay the loan

"once his means permit." Two months later, they had a quarrel that broke their long-

standing friendship.

Nolan seeks your advice on how to collect from Zeny despite the tenor of the

promissory note. What will your advice be? Explain your answer.

6. Kevin signed a loan agreement with ABC Bank. To secure payment, Kevin requested his

girlfriend Rosella to execute a document entitled "Continuing Guaranty Agreement"

whereby she expressly agreed to be solidarily liable for the obligation of Kevin.

Can ABC Bank proceed directly against Rosella upon Kevin's default even

without proceeding against Kevin first? Explain your answer.

7. With regard to an award of interest in the concept of actual and compensatory damages,

please state the guidelines regarding the manner of computing legal interest in the

following situations:

a. When the obligation is breached and it consists in the payment of a sum of money

like a loan or forbearance of money;

b. When the obligation does not constitute a loan or forbearance of money.

Page 2 of 21 Take Home Exercises - Credits

8. On March 13, 2008, Ariel entered into a Deed of Absolute Sale (DAS) with Noel where

the former sold his titled lot in Quezon City with an area of three hundred (300) square

meters to the latter for the price of P300,000.00. The prevailing market value of the lot

was P3,000.00 per square meter. On March 20, 2008, they executed another "Agreement

To Buy Back/Redeem Property" where Ariel was given an option to repurchase the

property on or before March 20, 2010 for the same price. Ariel, however, remained in

actual possession of the lot. Since Noel did not pay the taxes, Ariel paid the real property

taxes to avoid a delinquency sale.

On March 21, 2010, Ariel sent a letter to Noel, attaching thereto a manager's

check for P300,000.00 manifesting that he is redeeming the property. Noel rejected the

redemption claiming that the DAS was a true and valid sale representing the true intent of

the parties. Ariel filed a suit for the nullification of the DAS or the reformation of said

agreement to that of a Loan with Real Estate Mortgage. He claims the DAS and the

redemption agreement constitute an equitable mortgage. Noel however claims it is a valid

sale with pacto de retro and Ariel clearly failed to redeem the property.

As the RTC judge, decide the case with reasons.

9. Iya and Betty owed Jun P500,000.00 for advancing their equity in a corporation they

joined as incorporators. Iya and Betty bound themselves solidarily liable for the debt.

Later, Iya and Jun became sweethearts so Jun condoned the debt of P500,000.00. May lya

demand from Betty P250,000.00 as her share in the debt? Explain with legal basis.

10. Juancho, Don and Pedro borrowed P150,000.00 from their friend Cita to put up an

internet cafe orally promising to pay her the full amount after one year. Because of their

lack of business know-how, their business collapsed. Juancho and Don ended up

penniless but Pedro was able to borrow money and put up a restaurant which did well.

Can Cita demand that Pedro pay the entire obligation since he, together with the two

others, promised to pay the amount in full after one year? Defend your answer.

11. Sara borrowed P50,000.00 from Julia and orally promised to pay it within six months.

When Sara tried to pay her debt on the 8th month, Julia demanded the payment of interest

of 12o/o per annum because of Sara's delay in payment. Sara paid her debt and the

interest claimed by Julia. After rethinking, Sara demanded back from Julia the amount

she had paid as interest. Julia claims she has no obligation to return the interest paid by

Sara because it was a natural obligation which Sara voluntarily performed and can no

longer recover. Do you agree? Explain.

No, I do not agree with Julia’s argument. This situation falls into the quasi-

contract of solution indebiti and thus Julia has the obligation to return the interest

mistakenly paid by Sara.

It is clearly stated in Art. 1956 of the Civil Code that “No interest shall be due

unless it has been expressly stipulated in writing.” In this case, there is undoubtedly no

interest written in a contract. There was even no oral stipulation for it. Art. 1960 also

states that “If the borrower pays interest when there has been no stipulation therefor, the

provisions of this Code concerning solutio indebiti, or natural obligations, shall be

applied, as the case may be.” The law here is clear and applies as is where the principle of

solution indebiti should be followed. Art. 2154 concerning solution indebiti states “If

something is received when there is no right to demand it, and it was unduly delivered

through mistake, the obligation to return it arises.”

Hence, Julia received the interest when there was no right to demand it. And

therefore, the obligation of Julia to return it to Sara arises.

Page 3 of 21 Take Home Exercises - Credits

12. Donna pledged a set of diamond ring and earrings to Jane for P200,000.00 She was made

to sign an agreement that if she cannot pay her debt within six months, Jane could

immediately appropriate the jewelry for herself. After six months, Donna failed to pay.

Jane then displayed the earrings and ring set in her jewelry shop located in a mall. A

buyer, Juana, bought the jewelry set for P300,000.00.

a. Was the agreement which Donna signed with Jane valid? Explain with legal

basis.

The agreement between Donna and Jane is invalid because the stipulation to

appropriate the thing given by pledge would constitute a pactum commissorium.

Art. 2088 of the Civil Code provides that “the creditor cannot appropriate the

things given by way of pledge or mortgage, or dispose of them. Any stipulation to the

contrary is null and void.” The said provision furnishes the two elements for pactum

commissorium to exist: (1) that there should be a pledge or mortgage wherein a property is

pledged or mortgaged by way of security for the payment of the principal obligation; and

(2) that there should be a stipulation for an automatic appropriation by the creditor of the

thing pledged or mortgaged in the event of non-payment of the principal obligation within

the stipulated period.

The scenario clearly falls under this stipulation which makes the agreement between

Donna and Jane invalid for being a pactum commissorium.

b. Can Donna redeem the jewelry set from Juana by paying the amount she owed

Jane to Juana? Explain with legal basis.

Yes, Donna can redeem the jewelry. Under Art. 2098 of the Civil Code, “The

contract of pledge gives a right to the creditor to retain the thing in his possession or in

that of a third person to whom it has been delivered, until the debt is paid.” And thus the

creditor or any third person, in this case being Juana, can retain the jewelry until Donna

pays the amount she owed.

Even though the stipulation constitutes a pactum commissorium making it invalid,

the original contract of pledge is still in place and binding between Donna and Jane.

Donna, the pledger, is still the absolute owner of the thing pledged which is the jewelry

set. The sale between Jane and Juna is invalid since Jane was not the owner of the thing

when she sold it. But even though the sale is invalid, Jane is still entitled to retain the thing

in her possession. Therefore once Donna pays the amount owed, Jane is under obligation

to return the thing pledged.

c. Give an example of a pledge created by operation of law.

An example of a pledge created by operation of law or a legal pledge is a

depositary’s right of retention.

Art. 1994 of the civil code gives rise to this legal pledge in which it is states that

“The depositary may retain the thing in pledge until the full payment of what may be due

him by reason of the deposit.”

13. Due to the continuous heavy rainfall, the major streets in Manila became flooded. This

compelled Cris to check-in at Square One Hotel. As soon as Crisgot off from his Toyota

Page 4 of 21 Take Home Exercises - Credits

Altis, the Hotel’s parking attendant got the key of his car and gave him a valet parking

customer’s claim stub. The attendant parked his car at the basement of the hotel. Early in

the morning, Cris was informed by the hotel manager that his car was carnapped.

a. What contract, if any, was perfected between Cris and the Hotel when Cris

surrendered the key of his car to the Hotel’s parking attendant?

The contract perfected between Cris and the Hotel is one of a deposit. Art. 1962

defines a contract of deposit as one which is “is constituted from the moment a person

receives a thing belonging to another, with the obligation of safely keeping it and

returning the same. If the safekeeping of the thing delivered is not the principal purpose of

the contract, there is no deposit but some other contract.”

From the facts given, Cris deposited his Toyota Altis for safekeeping with the

hotel through the parking attendant. The contract of deposited was thus perfected upon his

delivery of the car.

b. What is the liability, if any, of the Hotel for the loss of Cris’ car?

Since the contract of deposit is perfected between Cris and the Hotel, the Hotel is

liable for the indemnity of the vehicle’s loss. Cris may demand the market value of his car

plus legal interest and other costs such as but not limited to attorney’s fees as was the

award given in the case of Durban Apartments vs Pioneer.

Art 1998 also reiterates this where it states “The deposit of effects made by

travelers in hotels or inns shall also be regarded as necessary. The keepers of hotels or inns

shall be responsible for them as depositaries, provided that notice was given to them, or to

their employees, of the effects brought by the guests and that, on the part of the latter, they

take the precautions which said hotel-keepers or their substitutes advised relative to the

care and vigilance of their effects.

14. Lito obtained a loan of P1,000,000 from Ferdie, payable within one year. To secure

payment, Lito executed a chattel mortgage on a Toyota Avanza and a real estate

mortgage on a 200-square meter piece of property.

a. Would it be legally significant - from the point of view of validity and

enforceability - if the loan and the mortgages were in public or private

instruments?

Yes, it would be legally significant. Art 2125 of the civil code states that “it is

indispensable, in order that a mortgage may be validly constituted, that the document in

which it appears be recorded in the Registry of Property. If the instrument is not recorded,

the mortgage is nevertheless binding between the parties.” This means that there is no

validly constituted mortgage if the agreement is merely a private document or one only in

writing but unregistered in the Registry of Property.

However, even if the mortgage was not registered in the Registry of Property, the

agreement is still binding between the parties. In this case, the mortgage may not be

enforced as to third persons while it is not yet registered.

b. Lito's failure to pay led to the extra-judicial foreclosure of the mortgaged real

property. Within a year from foreclosure, Lito tendered a manager's check to

Ferdie to redeem the property. Ferdie refused to accept payment on the ground

that he wanted payment in cash: the check does not qualify as legal tender and

does not include the interest payment. Is Ferdie's refusal justified?

Page 5 of 21 Take Home Exercises - Credits

Yes, Ferdie’s refusal is justified based on the two grounds he mentioned. First, the

manager’s check does not qualify as legal tender although it is as good as cash in business

practice. A check is not a legal tender and cannot constitute a valid tender of payment. The

delivery of it does not operate as payment.

Second, the redemption price must be paid in full which includes the interest and

other charges. It was reiterated in Metropolitan Bank and Trust Co. v. Spouses Tan, et al.,:

“The general rule in redemption is that it is not sufficient that a person offering to

redeem manifests his/her desire to do so. The statement of intention must be accompanied

by an actual and simultaneous tender of payment. This constitutes the exercise of the right

to repurchase. “

It is irrelevant whether the mortgagor offered to pay an amount to redeem. The

important matter is that the full redemption price must be paid.

15. A, B, C and D are the solidary debtors of X for P40,000. X released D from the payment

of his share of PI0,000. When the obligation became due and demandable, C turned out

to be insolvent.

Should the share of insolvent debtor C be divided only between the two other

remaining debtors, A and B?

No, D should still be included in dividing the share of insolvent debtor C. Art.

1217of the Civil Code states, “When one of the solidary debtors cannot, because of his

insolvency, reimburse his share to the debtor paying the obligation, such share shall be

borne by all his co-debtors, in proportion to the debt of each.”

Hence, even though D was released for his payment of his share, D is not

released from the responsibility towards the share of the insolvent debtor. In this case the

P10,000 share of insolvent debtor C is divided among A,B, and D.

16. Amador obtained a loan of P300,000 from Basilio payable on March25, 2012. As

security for the payment of his loan, Amador constituted a mortgage on his residential

house and lot in Basilio's favor. Cacho, a good friend of Amador, guaranteed and

obligated himself to pay Basilio, in case Amador fails to pay his loan at maturity.

a. If Amador fails to pay Basilio his loan on March 25, 2012, can Basilio compel

Cacho to pay?

No, Basilio can not compel Cacho to pay unless he has as resorted to all the legal

remedies against the debtor. Art 2058 states that “The guarantor cannot be compelled to

pay the creditor unless the latter has exhausted all the property of the debtor, and has

resorted to all the legal remedies against the debtor.”

The agreement between Cacho and Basilio is one of a Guarantor-Creditor under

Article 2047 of the Civil Code where Cacho, the guarantor, binds himself to Basilio to

fulfill the obligation of Amador in case the latter fails to do so.

b. If Amador sells his residential house and lot to Diego, can Basilio foreclose

the real estate mortgage?

No, Basilio can not foreclose the real estate mortgage just because Amador sells

the property mortgaged. Amador, the owner of the property, has full rights to the property

including alienating it. Article 2130 of the Civil Code states that, “A stipulation

forbidding the owner from alienating the immovable mortgaged shall be void.”

17. Cruz lent Jose his car until Jose finished his Bar exams. Soon after Cruz delivered the car,

Page 6 of 21 Take Home Exercises - Credits

Jose brought it to Mitsubishi Bokawkan for maintenance check up and incurred costs

of P8,000. Seeing the car's peeling and faded paint, Jose also had the car repainted

for P10,000. Answer the two questions below based on these common facts.

a. After the bar exams, Cruz asked for the return of his car. Jose said he would

return it as soon as Cruz has reimbursed him for the car maintenance and

repainting costs of P 18,000. Is Jose's refusal justified?

No, Jose’s refusal based on the ground of reimbursement of two costs is without

merit. Their contract is one of a commodatum where Cruz is the bailor and Jose is the

bailee. Article 1941 of the Civil Code states that: “The bailee is obliged to pay for the

ordinary expenses for the use and preservation of the thing loaned.” Jose is the one

responsible for the ordinary expenses which includes maintenance and check-up costs in

this case. For the repainting, Jose may still not reimburse it since he did not have the

approval of Cruz prior to the repainting.

And even though Cruz owes him anything for that matter, Jose can not retain the

car as stated in Article 1944 of the Civil Code which states: “The bailee cannot retain the

thing loaned on the ground that the bailor owes him something, even though it may be by

reason of expenses.”

b. During the bar exam month, Jose lent the car to his girlfriend, Jolie, who

parked the car at the Mall of Asia's open parking lot, with the ignition key

inside the car. Car thieves broke into and took the car. Is Jose liable to Cruz

for the loss of the car due to Jolie's negligence?

Yes, Jose is liable. It is expressly stated in Article 1942 of the civil code that the

bailee, Jose in this case, is liable for the loss of the thing even if it be through a fortuitous

event if he lends the thing to a third person, who is not a member of his household. Jolie

is the girlfriend of Jose however she is still not legally a member of his household. The

law is clear on this one and the bailee Jose is undoubtedly liable.

18. Gary is a tobacco trader and also a lending investor. He sold tobacco leaves to Homer for

delivery within a month, although the period for delivery was not guaranteed. Despite

Gary's efforts to deliver on time, transportation problems and government red tape

hindered his efforts and he could only deliver after 30 days. Homer refused to accept the

late delivery and to pay on the ground that the agreed term had not been complied with.

As lending investor, Gary granted a Pl,000,000 loan to Isaac to be paid within two

years from execution of the contract. As security for the loan, Isaac promised to deliver to

Gary his Toyota Innova within seven (7) days, but Isaac failed to do so. Gary was thus

compelled to demand payment for the loan before the end of the agreed two-year term.

a. Was Homer justified in refusing to accept the tobacco leaves?

No, Homer is not justified. He consented to the terms of the sale and thus he must

abide by it. The general rule in obligations and contracts is that there is no delay when

there is no demand. In the case given, there was no judicial or extrajudicial demand from

Gary. Hence, there was no delay and Homer can not resort to refusing the delivery.

There are exceptions to this general rule which includes:

a) The law expressly so declare

b) Time is of the essence of the contract

c) Demand would be useless

Based on these exceptions, the case does not have any of these elements.

Therefore, Homer’s action is without merits and he can not legally refuse the delivery

even if it is late.

Page 7 of 21 Take Home Exercises - Credits

b. Can Gary compel Isaac to pay his loan even before the end of the two-year

period?

No, Gary cannot compel Isaac to pay his loan before the term ends. The

agreement they had in which Isaac promised to deliver his car to secure the loan is one of

a pledge contract. However, for the contract of pledge to be perfected, the thing pledged

must be placed in the possession of the creditor. In this case, the thing pledge was not

completely delivered and therefore the contract of pledge is invalid.

Since the contract of pledge is invalid, it should not affect the principal contract of

loan which has a two year term. Gary has no legal basis in which to have the loan be paid

immediately.

19. Betty entrusted to her agent, Aida, several pieces of jewelry to be sold on commission

with the express obligation to turn over to Betty the proceeds of the sale, or to return the

jewelries if not sold in a month's time. Instead of selling the jewelries, Aida pawned them

with the Tambunting Pawnshop, and used the money for herself. Aida failed to redeem

the pawned jewelries and after a month, Betty discovered what Aida had done. Betty

brought criminal charges which resulted in Aida's conviction for estafa.

Betty thereafter filed an action against Tambunting Pawnshop for the recovery of

the jewelries. Tambunting raised the defense of ownership, additionally arguing that it is

duly licensed to engage in the pawnshop and lending business, and that it accepted the

mortgage of the jewelry in good faith and in the regular course of its business. If you

were the judge, how will you decide the case?

I will rule in favor of Betty and against the Pawnshop. Betty is unlawfully

deprived of her jewelry and thus she has a right to recover if from the current possessor

which is Tambunting Pawnshop. This situation is controlled by Article 559 of the Civil

Code which states that the possession of a movable property acquired in good faith is

equivalent to a title. This is also reiterated in the case of Dizon vs. Suntay where the

claim of good faith on the part of the pawnshop is inconsequential.

20. Buko, Fermin and Toti bound themselves solidarily to pay Ayee the amount

of P 5,000.00. Suppose Buko paid the obligation, what is his right as against his co-

debtors?

Buko has the right to claim reimbursement from Fermin and Toti proportionally.

He also has the right for interest in the amounts if his co-debtors does not reimburse

on or before the due date. It is stated in Article 1217 of the Civil Code that “He who

made the payment may claim from his co-debtors only the share which corresponds to

each, with the interest for the payment already made. If the payment is made before the

debt is due, no interest for the intervening period may be demanded.”

21. Buko, Fermin and Toti bound themselves solidarily to pay Ayee the sum of P 10,000.00.

When the obligation became due and demandable, Ayee sued Buko for the payment of

the P 10,000.00. Buko moved to dismiss on the ground that there was failure to implead

Fermin and Toti who are indispensable parties. Will the motion to dismiss prosper? Why?

No. The motion to dismiss will not prosper

The obligation here is solidary and under article 1207 of the Civil Code, in a solidary obligation,

each of the creditors is entitled to demand the payment of the entire credit, while each of the

debtors is liable for the payment of the entire debt. Moreover, under article 1216, The creditor

may proceed against any one of the solidary debtors or some or all of them simultaneously.

Page 8 of 21 Take Home Exercises - Credits

In the case at bar,Buko, Fermin and Toti solidarily owe Ayee the amount of 10, 000. In a

solidary obligation, any one or some or all of the solidary debtors simultaneously, may be made

to pay the debt so long as it has not been fully collected. Thus, Ayee can collect from Buko or

Fermin, or Toti alone, or from any of them, or all of them simultaneously. The choice is left to

the creditor to determine against whom he will enforce collection.

Here, demand is made on Buko, he cannot require Ayee to make demand also on Fermin and

Toti, or to include them as a party defendants, as Ayee has the right to proceed against any of

them. Hence, Buko alone can be compelled for the payment of the entire debt.

22. Buko, Fermin and Toti are solidary debtors of Ayee. Twelve (12) years after the

obligation became due and demandable, Buko paid Ayee and later on asked for

reimbursement of Fermin’s and Toti’s shares. Is Buko correct? Why?

No. Buko is not correct.

Under Article 1218 of the Civil Code, payment by a solidary debtor shall not entitle him to

reimbursement from his co-debtors if such payment is made after the obligation has prescribed or

become illegal.

In the case at bar, Buko, the paying debtor, cannot asked for reimbursement of Fermin’s and

Toti’s, shares because the obligation has already prescribed. Buko only paid the obligation

twelve (12) years after the obligation became due and demandable.Hence, when the obligation

has already prescribed, the paying debtor is no longer entitled to any reimbursement from his co-

debtors.

23. Buko, Fermin and Toti are solidary debtors under a loan obligation of P 300,000.00

which has fallen due. The creditor has, however, condoned Fermin’s entire share in the

debt. Since Toti has become insolvent, the creditor makes a demand on Buko to pay the

debt. How much, if any, may Buko be compelled to pay?

Buko may be compelled to pay 200,000 pesos.

Under Article 1217 par. 3 of the Civil Code, when one of the solidary debtors cannot, because of

his insolvency, reimburse his share to the debtor paying the obligation, such share shall be borne

by all his co-debtors, in proportion to the debt of each.

In the case at bar, if Toti is insolvent, both Buko and Femin shall bear his insolvency, but since

the creditor has already condoned Fermin’s entire share, only Buko shall bear Toti’s insolvency

and shall be liable to pay the amount of two-hundred thousand pesos (200,000) in proportion to

their shares.

24. Dina bought a car from Jai and delivered a check in payment of the same. Has Dina paid

the obligation? Why?

Page 9 of 21 Take Home Exercises - Credits

No, Dina has not yet paid the obligation.

Under article 1249 0f the Civil Code, the delivery of promissory notes payable to order, or bills

of exhange or other mercantile documents shall produce the effect of payment only when they

have been cashed, or when the through the fault of the creditor they have been impaired.

In the case at bar, obligations are deemed paid only when the instruments are cashed. Since, the

check has not yet been cashed, the check shall not operate as payment. Since a negotiable

instrument, like a check, is only a substitute for money and not a money, delivery of such

instrument does not, by itself , operate as a payment.

Hence, delivery of checks does not discharge Dina of her obligation. The obligation is not

extinguished and remains suspended until the payment by commercial document is actually

realized.

25. Siga-an granted a loan to Villanueva in the amount of P 540, 000.00. Such agreement was

not reduced to writing. Siga-an demanded interest which was paid by Villanueva in cash

and checks. The total amount Villanueva paid accumulated to P 1, 200, 000.00. Upon

advice of her lawyer, Villanueva demanded for the return of the excess amount of P 660,

000.00 which was ignored by Siga-an.

a. Is the payment of interest valid? Explain.

No the payment of interest was not valid

Article 1956 specifically mandates that no interest shall be due unless it has been expressly

stipulated n writing. Jurisprudence on the matter also holds that for interest to be due and

payable, two conditions must concur: a) express stipulation for the payment of interest; and b)

the agreement to pay interest is reduced in writing.

In the case at bar, there is no express stipulation for the payment of interest, failing the first

condition, moreover, the parties did not put down in writing any agreement to pay interest,

failing the second condition. The conditions for interest to be due and payable did not concur.

Thus, the collection of interest by Siga-an without any stipulation reduced in writing was not

valid and is prohibited by law.

b. Is solution indebiti applicable? Explain.

YES. Solutio indebiti can be applied.

Under Art. 1960, if the borrower pays interest when there has been no stipulation thereof, the

provisions of the Civil Code concerning solutio indebiti shall be applied.

If unstipulated interest is paid by mistake, the debtor may recover as this would be a case of

solutio indebiti or undue payment. In the case at bar, there was no stipulation reduced in writing

for the collection of interest,the collection of interest without any stipulation reduced in writing

is prohibited by law. Therefore, Villanueva can demand the return for the excess amount of

Page 10 of 21 Take Home Exercises - Credits

660,000 pesos.

26. Eulalia was engaged in the business of buying and selling large cattle. In order to secure

the financial capital, she advanced for her employees (biyaheros). She required them to

surrender TCT of their properties and to execute the corresponding Deeds of Sale in her

favor. Domeng Bandong was not required to post any security but when Eulalia

discovered that he incurred shortage in cattle procurement operation, he was required to

execute a Deed of Sale over a parcel of land in favor of Eulalia. She sold the property to

her grandneice Jocelyn who thereafter instituted an action for ejectment against the

Spouses Bandong.

To assert their right, Spouses Bandong filed an action for annulment of sale

against Eulalia and Jocelyn alleging that there was no sale intended but only equitable

mortgage for the purpose of securing the shortage incurred by Domeng in the amount

of P 70, 000.00 while employed as "biyahero" by Eulalia. Was the Deed of Sale between

Domeng and Eulalia a contract of sale or an equitable mortgage?

The deed of sale between Domeng and Eulalia is an equitable mortgage.

Under Art. 1602(par. 6) of the Civil Code, the contract shall be presumed to be an equitable

mortgage when it may be fairly inferred that the real intention of the parties is simply to secure

the payment of a debt or the performance of any other obligation.

In the case at bar,there was no sale intended,but the deed of sale was actually intended to merely

secure the payment of the shortage incurred by Domeng in the amount of 70,0000 in the conduct

of the cattle-buying operation.

Since it may be fairly inferred that the real intention was to secure payment of shortage

incurred,hence, the transaction is an equitable mortgage and not a contract of sale.

27)

a. What is the difference between “guaranty” and “suretyship”?

Guaranty and Suretyship distinguished:

a. In guaranty, the undertaking is to pay if the principal debtor cannot pay; whereas, in

suretyship, the undertaking is to pay if the principal debtor does not pay.

b. A surety and a guarantor are unlike in that the surety assumes liability as a regular party to the

undertaking, while the liability of the guarantor depends upon an independent agreement to pay

the obligation if the primary debtor fails to do so;

c. A surety is charged as an original promisor and and debtor from the beginning, while the

engagement of the guarantor is a collateral undertaking;

d. The guarantor is secondarily or subsidiarily liable,i.e., he contracts to pay, if, by the use of due

diligence, the debt cannot be paid by the principal.

On the other hand, while the contract of a surety is in essence secondary only to a valid principal

obligation, his liability to the creditor is direct, primary and absolute.

e. The Guarantor insures the solvency of the principal debtor; whereas, the surety insures the

debt.

Page 11 of 21 Take Home Exercises - Credits

b. Distinguish antichresis from usufruct.

(1) Antichresis is always created by contract, while usufruct need not arise from contract,

because it may also be constituted by law or by other acts inter vivos, such as donation, or in a

last will and testament, or by prescription.

(2) During the usufruct, the fruits belong to the usufructury not the naked owner, while the

antichretic creditor has the right to receive the fruits with the obligation to apply the fruits to the

interest, if owing, and thereafter to the principal of the credit

(3) The subject matter of antichresis is always a real property while the subject matter of usufruct

may either be real property or personal property. (4) Both create real rights, but antichresis is an

accessory contract, while usufruct when created by contract is a principal contract.

(5)In antichresis the amount of the principal and the interest charge must be in writing in order to

be valid (Article 2134, NCC) while there is no particular form required to constitute a valid

usufruct.

c. Distinguish commodatum from mutuum.

(1) Commodatum ordinarily involves something not consumable, while in muttum, the subject

matter is money or other consumable thing;

(2) In commodatum, ownership of the thing loaned is retained by the lender, while in mutuum,

the ownership transferred to the borrower;

(3) Commodatum is essentially gratuitous, while mutuum may be gratuitous or it may be

onerous, that is, with stipulation to pay interest;

(4) Commodatum may involve real or personal property, while in mutuum refers only to

personal property;

(5) Commodatum is a loan for use or temporary possession, while mutuum is a loan for

consumption.

28) Illustrate the procedure in extrajudicial foreclosure of mortgage.

Page 12 of 21 Take Home Exercises - Credits

EXTRAJUDICIAL

FORECLOSURE OF

MORTGAGE

The Mortgagee files an application

with the Sheriff’s Office to

foreclose the mortgage.

The Foreclosure filed with the

Sheriff’s Office is posted in

conspicuous places where the

property is located and published

in newspapers of general

After the posting and publication

of Notice of Sale, the sale itself is

conducted under the direction of

the Sheriff.

The Sheriff, following the proper

bidding procedures, sells the

property to the highest bidder.

The Sheriff issues a Certificate of

Sale in favour of the highest

bidder.

The Sheriff’s Certificate of

Sale is annotated on the title of

the property sold out.

Page 13 of 21 Take Home Exercises - Credits

The procedures undertaken in Extra-Judicial Foreclosure of Mortgage as follows:

1. The Mortgagee files an application with the Sheriff’s Office to foreclose the mortgage.

2. The Foreclosure filed with the Sheriff’s Office is posted in conspicuous places where the

property is located and published in newspapers of general circulation.

3. After the posting and publication of Notice of Sale, the sale itself is conducted under the

direction of the Sheriff.

4. The Sheriff, following the proper bidding procedures, sells the property to the highest bidder.

5. The Sheriff issues a Certificate of Sale in favour of the highest bidder.

6. The Sheriff’s Certificate of Sale is annotated on the title of the property sold out.

Illustrate the procedure in judicial foreclosure of mortgage.

Page 14 of 21 Take Home Exercises - Credits

JUDICIAL

FORECLOSURE OF

MORTGAGE

The Mortgagee files a petition or

complaint in court with a competent

jurisdiction over the area where the

property is situated.

The Court will conduct a trial.

The Court orders the Defendant/Debtor to

pay the debt within ninety (90) to one

hundred twenty (120) days, otherwise, the

property is sold at public auction. This is

called the “EQUITY OF REDEMPTION”

The Sheriff sells the property to

the highest bidder and submit to

the court the Certificate of Sale.

Judicial Confirmation of Sale

Page 15 of 21 Take Home Exercises - Credits

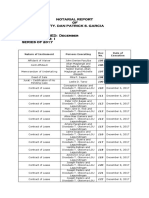

JUDICIAL FORECLOSURE UNDER RULE 68, RULES OF COURT

Page 16 of 21 Take Home Exercises - Credits

1. The mortgagee should file a petition for judicial foreclosure in the court which has jurisdiction over

the area where the property is situated

2. The court will conduct a trial. If, after trial, the court finds merit in the petition, it will render

judgment ordering the mortgagor/debtor to pay the obligation within a period not less than 90 nor

more than 120 days from the finality of judgment.

3. Within this 90 to 120 day period, the mortgagor has the chance to pay the obligation to

prevent his property from being sold. This is called the EQUITY OF REDEMPTION PERIOD.

4. If mortgagor fails to pay within the 90-120 days given to him by the court, the property shall be sold

to the highest bidder at public auction to satisfy the judgment.

5. There will be a judicial confirmation of the sale. After the confirmation of the sale, the purchaser

shall be entitled to the possession of the property, and all the rights of the mortgagor with

respect to the property are severed or terminated. The equity of redemption period actually

extends until the sale is confirmed. Even after the lapse of the 90 to 120 day period, the mortgagor can

still redeem the property, so long as there has been no confirmation of the sale yet. Therefore, the

equity of redemption can be considered as the right of the mortgagor to redeem the property

BEFORE the confirmation of the sale. After the confirmation of the sale, the mortgagor does not

have a right to redeem the property anymore.

Page 17 of 21 Take Home Exercises - Credits

Page 18 of 21 Take Home Exercises - Credits

Page 19 of 21 Take Home Exercises - Credits

1. The Mortgagee files a petition or complaint in court with a competent jurisdiction, in which

petition or complaint, he is the Plaintiff and the Mortgagor, the Defendant.

2. The Plaintiff (Mortgagee) proves the existence of the mortgage, the amount thereof, the

existence of the Principal obligation and the non-payment or non-fulfillment thereof by the

Defendant (Mortgagor) in a formal hearing.

3. If the court is satisfied, it orders the Defendant/Debtor to pay the debt within ninety (90) days,

otherwise, the property is sold at public auction.

4. The Sheriff sells the property to the highest bidder and submit to the court the Certificate of

Sale.

5. The court approves the sale of the property.

27. Narrate your best original joke. Make sure it is laughable.

---end---

Encode your complete names here:

Page 20 of 21 Take Home Exercises - Credits

Bauzon, Glenn Vincent 1-10

Buada, Jon Paul F. 11-20

Dait, Cyrus 21-30

______________________________

(Family Name, Given Name, M.I.)

Optional: Encode any remarks or one (1) academic question related to the subject. In case of the

latter, the same may or may not be answered depending on the availability of time as the

semester closes.

Important: Save your work as MS Word. The file name should be: ANSWER-CREDIT- (insert

your section), Example: ANSWER-CREDIT-2A. Then send to meshack.macwes@gmail.com on

May 21, 2020 only at any time from 12:01 AM to 11:59 PM otherwise your file may be lost

elsewhere in the mountains of e-mails being sent which may cause inconvenience to you and me.

The good Lord bless and keep you.

Page 21 of 21 Take Home Exercises - Credits

You might also like

- Take Home Test Credit Transactions May 2020Document7 pagesTake Home Test Credit Transactions May 2020Patatas SayoteNo ratings yet

- 1 21 Take Home Exercises - CreditsDocument21 pages1 21 Take Home Exercises - CreditsCyrus DaitNo ratings yet

- FInal Exam JORDAN A PROELDocument9 pagesFInal Exam JORDAN A PROELJORDAN PROELNo ratings yet

- 4a - Bar Q and A - Credit Transactions and Torts and DamagesDocument76 pages4a - Bar Q and A - Credit Transactions and Torts and Damagesnbragas100% (3)

- 1 Suretyship ProbsDocument4 pages1 Suretyship ProbsEmma SvebekNo ratings yet

- Credit FernandezDocument10 pagesCredit Fernandezpoiuytrewq9115No ratings yet

- Credit Transactions DigestDocument5 pagesCredit Transactions DigestMarcus J. ValdezNo ratings yet

- 18 Siga-An v. Villanueva RamosDocument2 pages18 Siga-An v. Villanueva RamosJenell CruzNo ratings yet

- Bar Questions 2019 2006Document3 pagesBar Questions 2019 2006Beulah Alanah EspirituNo ratings yet

- Formation of Contract: Consideration and Intention to Create Legal RelationsDocument17 pagesFormation of Contract: Consideration and Intention to Create Legal RelationsMeian GaguiNo ratings yet

- Bar Qs Cred Trans PrelimDocument4 pagesBar Qs Cred Trans PrelimAlex RabanesNo ratings yet

- RTC Acquires Jurisdiction Despite Alleged Deficiency in Filing FeesDocument126 pagesRTC Acquires Jurisdiction Despite Alleged Deficiency in Filing FeesJhai Jhai DumsyyNo ratings yet

- 1definition To Breach1A (In General-Kinds of Obligsd1)Document2 pages1definition To Breach1A (In General-Kinds of Obligsd1)Cars CarandangNo ratings yet

- Spouses Sebastian V BPI FamilyDocument3 pagesSpouses Sebastian V BPI FamilyLiamJosephNo ratings yet

- Payment Methods ComparisonDocument3 pagesPayment Methods ComparisonLaina Recel NavarroNo ratings yet

- Credtrans Activity CasesDocument5 pagesCredtrans Activity CasesChaNo ratings yet

- BANK LIABLE FOR UNAUTHORIZED WITHDRAWALSDocument6 pagesBANK LIABLE FOR UNAUTHORIZED WITHDRAWALSChaNo ratings yet

- Business Law Preboard FinalDocument7 pagesBusiness Law Preboard Finalxxxxxxxxx100% (1)

- Case Digest AssignmentDocument15 pagesCase Digest AssignmentRafaela MagsinoNo ratings yet

- Mountain View College: Harvey Nillas Ramirez - BSA 3Document3 pagesMountain View College: Harvey Nillas Ramirez - BSA 3Harvey RamirezNo ratings yet

- Blaw 1000Document2 pagesBlaw 1000Apple Trisha Mae SampayanNo ratings yet

- Agency Bar Questions 1975 2015Document11 pagesAgency Bar Questions 1975 2015Nomi ImbangNo ratings yet

- August 25 2018Document11 pagesAugust 25 2018Supply ICPONo ratings yet

- BSBA Pre Final Exam BA 2Document4 pagesBSBA Pre Final Exam BA 2marco poloNo ratings yet

- Extinguishment of ObligationsDocument4 pagesExtinguishment of ObligationsRussel SirotNo ratings yet

- Credit DigestDocument38 pagesCredit DigestKelvin ZabatNo ratings yet

- Credit CasesDocument29 pagesCredit CasesKen UyNo ratings yet

- Practical Problams - LawDocument12 pagesPractical Problams - LawApurva JhaNo ratings yet

- Spouses Ong Vs Bpi Family SavingsDocument2 pagesSpouses Ong Vs Bpi Family SavingsThe Chogs100% (1)

- BAR Answers on Obligations and Contracts 2000-2009Document17 pagesBAR Answers on Obligations and Contracts 2000-2009Frederick Barcelon67% (3)

- Banking Laws 2nd ExamDocument4 pagesBanking Laws 2nd ExamGerald Mari SagubanNo ratings yet

- I. Payment A) Agner vs. BPI Family Savings Bank, Inc. (D) : Whether or Not There Was AnDocument5 pagesI. Payment A) Agner vs. BPI Family Savings Bank, Inc. (D) : Whether or Not There Was AnFrancis DiazNo ratings yet

- Credit Transactions June 23Document5 pagesCredit Transactions June 23Trent ChimingchoiNo ratings yet

- Salce - Joshua P. - Case Digest 4Document2 pagesSalce - Joshua P. - Case Digest 4Joshua P. SalceNo ratings yet

- Truth in Lending Act ViolationDocument4 pagesTruth in Lending Act ViolationMary Anne S. AlbaNo ratings yet

- MercantileDocument123 pagesMercantileAK FernandezNo ratings yet

- 2007 2016 BAR ObliDocument10 pages2007 2016 BAR ObliTrixie Jane NeriNo ratings yet

- CDocument4 pagesCTiff DizonNo ratings yet

- Q 1 To 15 CIVIL LAW MOCK BAR QUESTIONS EDITED AND REVSIEDDocument12 pagesQ 1 To 15 CIVIL LAW MOCK BAR QUESTIONS EDITED AND REVSIEDTyroneNo ratings yet

- Outline in Credit Transactions Law I. LOAN (1933-1961)Document36 pagesOutline in Credit Transactions Law I. LOAN (1933-1961)Salman Dimaporo RashidNo ratings yet

- OBLI Sample QuestionsDocument5 pagesOBLI Sample QuestionsJulius Robert JuicoNo ratings yet

- Commercial Building Renovation Leads to Trust Receipts Law ViolationDocument11 pagesCommercial Building Renovation Leads to Trust Receipts Law ViolationAlexandrea SagutinNo ratings yet

- Carolyn M. Garcia - Vs-Rica Marie S. Thio GR No. 154878, 16 March 2007 FactsDocument8 pagesCarolyn M. Garcia - Vs-Rica Marie S. Thio GR No. 154878, 16 March 2007 FactskathNo ratings yet

- Activity - Modes of Extinguishing Obligations 2Document2 pagesActivity - Modes of Extinguishing Obligations 2Bianka SylveeNo ratings yet

- Estores Vs Spouses SupanganDocument2 pagesEstores Vs Spouses SupanganKate HizonNo ratings yet

- Estores v. Supangan ruling on interest and attorney's feesDocument3 pagesEstores v. Supangan ruling on interest and attorney's feeskbongcoNo ratings yet

- Simulated 2021 Civil Law Bar ExamDocument5 pagesSimulated 2021 Civil Law Bar ExamerosfreuyNo ratings yet

- Credit Transaction Quiz - GEPTYDocument3 pagesCredit Transaction Quiz - GEPTYVincent Adrian GeptyNo ratings yet

- Joseph Cochingyan Vs RDocument5 pagesJoseph Cochingyan Vs RJunpyo ArkinNo ratings yet

- Page 1 of 3: 5 February 2019 - OBLIDocument3 pagesPage 1 of 3: 5 February 2019 - OBLILourdes LorenNo ratings yet

- Civil Review 2, FinalsDocument4 pagesCivil Review 2, FinalsJan Gabriel VillanuevaNo ratings yet

- Saura Import Disputes DBP Loan CancellationDocument9 pagesSaura Import Disputes DBP Loan CancellationAlelie BatinoNo ratings yet

- Credit DigestsDocument76 pagesCredit DigestsMiggy CardenasNo ratings yet

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersFrom EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersRating: 3 out of 5 stars3/5 (1)

- Quit Getting Stiffed: A Texas Contractor's Guide to Collections and Lien RightsFrom EverandQuit Getting Stiffed: A Texas Contractor's Guide to Collections and Lien RightsNo ratings yet

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Ca$h is Fact: Implementing a Credit and Collections Policy From Application to Payment and BeyondFrom EverandCa$h is Fact: Implementing a Credit and Collections Policy From Application to Payment and BeyondNo ratings yet

- Boundary Dispute Between Laguna Municipalities Over Two BarangaysDocument2 pagesBoundary Dispute Between Laguna Municipalities Over Two BarangaysCyrus Dait100% (2)

- Complaint-Affidavit Written OutputDocument6 pagesComplaint-Affidavit Written OutputCyrus DaitNo ratings yet

- Quiz GameDocument20 pagesQuiz GameCyrus DaitNo ratings yet

- Rationale For The Exclusion of The Proceeds From Life InsuranceDocument9 pagesRationale For The Exclusion of The Proceeds From Life InsuranceCyrus DaitNo ratings yet

- Original RegistrationDocument18 pagesOriginal RegistrationCyrus DaitNo ratings yet

- ADRDocument7 pagesADRCyrus DaitNo ratings yet

- Commissioner of Customs and The District CollectorDocument2 pagesCommissioner of Customs and The District CollectorCyrus DaitNo ratings yet

- HILADO, VS. CIR G.R. No. L-9408, October 31, 1956Document1 pageHILADO, VS. CIR G.R. No. L-9408, October 31, 1956Cyrus DaitNo ratings yet

- Legislative DepartmentDocument28 pagesLegislative DepartmentCyrus Dait100% (1)

- Dait, Cyrus Edward C. J.D. 3BDocument1 pageDait, Cyrus Edward C. J.D. 3BCyrus DaitNo ratings yet

- Cogsa Notes: The Nature of The Contract of Carriage From Domestic Leg and Foreign Leg, Will Never ChangeDocument33 pagesCogsa Notes: The Nature of The Contract of Carriage From Domestic Leg and Foreign Leg, Will Never ChangeCyrus DaitNo ratings yet

- A Special Proceeding Is A Remedy by Which A PartyDocument8 pagesA Special Proceeding Is A Remedy by Which A PartyCyrus DaitNo ratings yet

- Dait, Cyrus Edward C.Document1 pageDait, Cyrus Edward C.Cyrus DaitNo ratings yet

- Pale SyllabusDocument23 pagesPale SyllabusCyrus DaitNo ratings yet

- ADRDocument7 pagesADRCyrus DaitNo ratings yet

- ADRDocument7 pagesADRCyrus DaitNo ratings yet

- Pale SyllabusDocument23 pagesPale SyllabusCyrus DaitNo ratings yet

- Valentin TioDocument2 pagesValentin TioCyrus DaitNo ratings yet

- Pale SyllabusDocument23 pagesPale SyllabusCyrus DaitNo ratings yet

- SpecPro 3 3Document6 pagesSpecPro 3 3Cyrus DaitNo ratings yet

- LD DDocument1 pageLD DCyrus DaitNo ratings yet

- Dait, Cyrus Edward C.Document1 pageDait, Cyrus Edward C.Cyrus DaitNo ratings yet

- Keppel Cebu ShipyardDocument3 pagesKeppel Cebu ShipyardCyrus DaitNo ratings yet

- KAZUHIRO HASEGAWA and NIPPON ENGINEERING CONSULTANDocument4 pagesKAZUHIRO HASEGAWA and NIPPON ENGINEERING CONSULTANCyrus DaitNo ratings yet

- WUUDocument1 pageWUUCyrus DaitNo ratings yet

- CASE DIGEST No. 3Document8 pagesCASE DIGEST No. 3Cyrus DaitNo ratings yet

- Borja Vs GellaDocument2 pagesBorja Vs GellaCyrus DaitNo ratings yet

- J.CASANOVAS, Plaintiff-Appellant, JNO. S. HORD, Defendant-AppelleeDocument1 pageJ.CASANOVAS, Plaintiff-Appellant, JNO. S. HORD, Defendant-AppelleeCyrus DaitNo ratings yet

- I Have Three Reasons Why Paying Tax Is A Good ThinDocument1 pageI Have Three Reasons Why Paying Tax Is A Good ThinCyrus DaitNo ratings yet

- CASE 9-16 HehehehDocument9 pagesCASE 9-16 HehehehCyrus DaitNo ratings yet

- Law of Persons - Marriage PDFDocument30 pagesLaw of Persons - Marriage PDFShangavi S100% (4)

- Conveyance of 14.25-acre farmlandDocument4 pagesConveyance of 14.25-acre farmlandIbrahimNo ratings yet

- The Family Code of The PhilippinesDocument2 pagesThe Family Code of The PhilippinesAnna GuevarraNo ratings yet

- Property Relations, Termination of Marriage and SuccessionDocument23 pagesProperty Relations, Termination of Marriage and SuccessionSidNo ratings yet

- Interpretation of Contract Documents and Exclusion of Extrinsic EvidenceDocument5 pagesInterpretation of Contract Documents and Exclusion of Extrinsic Evidencebhupendra barhatNo ratings yet

- Letters of Credit CasesDocument17 pagesLetters of Credit CasesEynab PerezNo ratings yet

- VIKASH Larsen Joining LetterDocument2 pagesVIKASH Larsen Joining LetterAPRS LIGHT HUBNo ratings yet

- Florida General Power of Attorney FormDocument5 pagesFlorida General Power of Attorney FormClari Herrera0% (1)

- Acca Corporate and Business Law (LW) (GLO) Course Examination 1Document14 pagesAcca Corporate and Business Law (LW) (GLO) Course Examination 1Issa BoyNo ratings yet

- Law Quasi Contracts FinalDocument11 pagesLaw Quasi Contracts FinalHarsh YadavNo ratings yet

- Assignment BelDocument5 pagesAssignment Belpandya rajendraNo ratings yet

- Winding Up of CompaniesDocument18 pagesWinding Up of CompaniesSanjivan ChakrabortyNo ratings yet

- Pascual vs. Cir 166 Scra 560Document5 pagesPascual vs. Cir 166 Scra 560FranzMordenoNo ratings yet

- Civil Law Must Read CasesDocument101 pagesCivil Law Must Read CasesBon Bons100% (1)

- Bar Civil Nptes 2022Document10 pagesBar Civil Nptes 2022Tin Tin0% (1)

- SARACHO, Nicole R - Corpo PaperDocument4 pagesSARACHO, Nicole R - Corpo PaperColee StiflerNo ratings yet

- Oblicon MisonDocument16 pagesOblicon MisonAlecsandra ChuNo ratings yet

- Unit 8 Special Contracts IDocument8 pagesUnit 8 Special Contracts IÁlvaro Vacas González de EchávarriNo ratings yet

- Contract To SellDocument3 pagesContract To SellEnnavy YongkolNo ratings yet

- Cond. Sale - AifDocument3 pagesCond. Sale - AifMark Lojero100% (1)

- SuccessionDocument20 pagesSuccessionCalif P. AmindatoNo ratings yet

- Security Bond by SuretyDocument1 pageSecurity Bond by SuretyRikar Dini BogumNo ratings yet

- JUANITA LOPEZ GUILAS Vs CFIDocument1 pageJUANITA LOPEZ GUILAS Vs CFIMhareyNo ratings yet

- Article 1162 - Jose Cangco v. Manila Railroad Co.Document3 pagesArticle 1162 - Jose Cangco v. Manila Railroad Co.Ryan Paul AquinoNo ratings yet

- Manlan v. BeltranDocument11 pagesManlan v. BeltranRichard BakerNo ratings yet

- Office Lease: Premises: Office NO.: Landlord: TenantDocument6 pagesOffice Lease: Premises: Office NO.: Landlord: Tenantادزسر بانديكو هادولهNo ratings yet

- Control Builder Error Code Reference EPDOC-XX17-En-430Document1,690 pagesControl Builder Error Code Reference EPDOC-XX17-En-430Zulal AliNo ratings yet

- Petitioner Vs VS: Second DivisionDocument9 pagesPetitioner Vs VS: Second DivisionDec JucoNo ratings yet

- NOTARIAL REPORT-December2017Document3 pagesNOTARIAL REPORT-December2017Danpatz GarciaNo ratings yet

- Real Property Intro Tenure and Doctrine of Estates Unit # 7Document48 pagesReal Property Intro Tenure and Doctrine of Estates Unit # 7Mario UltimateAddiction Hylton67% (3)