Professional Documents

Culture Documents

Tax Year 2015: Important Tax Information Document

Uploaded by

Boldie LutwigOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Year 2015: Important Tax Information Document

Uploaded by

Boldie LutwigCopyright:

Available Formats

BARCLAYS Combined Statement For

125 S. WEST STREET

WILMINGTON, DE 19801

Form 1099-INT

Tax Year 2015

1098 - Copy B - For Payer- OMB # 1545-0901

Important Tax Information Document 1099 - INT - Copy B - For Recipient - OMB #1545-0112

1099 - C - Copy B - For Debtor - OMB # 1545-1424

1099 - MISC- Copy B - For Recipient - OMB # 1545-0115

DEPARTMENT OF THE TREASURY- INTERNAL

FEI LIU

REVENUE SERVICE.

705 FALCON CT.

BRIDGEWATER, NJ 08807 "This is important tax information and is being furnished

to the Internal Revenue Service. If you are required to

file a return, a negligence penalty or other sanction may

be imposed on you if this income is taxable and the

IRS determines that it has not been reported."

01/20/2016!Barclays!218478291!1099-INT!FEI LIU

!!3583!1535 PAYER'S FEDERAL IDENTIFICATION NUMBER

51-0407970

CUSTOMER SERV PH#

888-710-8756

RECIPIENT'S IDENTIFICATION NUMBER

XXX-XX-8291

1099-INT

KEEP FOR YOUR RECORDS

IRS AMOUNT

ACCOUNT NUMBER IRS DESCRIPTION BOX #

130000084963 4963

INTEREST INCOME 1 937.09

EARLY WITHDRAWAL PENALTY 2

INTEREST ON U.S. SAVINGS BONDS AND TREAS. OBLIGATIONS 3

FEDERAL INCOME TAX WITHHELD 4

INVESTMENT EXPENSES 5

FOREIGN TAX PAID 6

FOREIGN COUNTRY OR U.S. POSSESSION 7

TAX-EXEMPT INTEREST 8

SPECIFIED PRIVATE ACTIVITY BOND INTEREST 9

MARKET DISCOUNT 10

BOND PREMIUM 11

12

BOND PREMIUM ON TAX-EXEMPT BOND 13

TAX-EXEMPT and Tax Credit BOND CUSIP No. 14

FATCA FILING REQUIREMENT

STATE 15

STATE IDENTIFICATION NO 16

STATE TAX WITHHELD 17

***Total 1099-INT ***

INTEREST INCOME 1 937.09

EARLY WITHDRAWAL PENALTY 2 0

INTEREST ON U.S. SAVINGS BONDS AND TREAS. OBLIGATIONS 3 0

FEDERAL INCOME TAX WITHHELD 4 0

INVESTMENT EXPENSES 5 0

FOREIGN TAX PAID 6 0

Instructions for Recipient

The information provided may be different for covered and noncovered Box 9. Shows tax-exempt interest subject to the alternative minimum tax. This

securities. For a description of covered securities, see the Instructions for Form amount is included in box 8. See the Instructions for Form 6251. See the

8949. For a taxable covered security acquired at a premium, unless you notified instructions above for a tax-exempt covered security acquired at a premium.

the payer in writing in accordance with Regulations section 1.6045-1(n)(5) that

you did not want to amortize the premium under section 171,or for a tax-exempt Box 10. For a taxable or tax-exempt covered security, if you made an election

covered security acquired at a premium, your payer may report either (1) a net under section 1278(b) to include market discount in income as it accrues and you

amount of interest that reflects the offset of the amount of interest paid to you by notified your payer of the election, shows the market discount that accrued on the

the amount of premium amortization allocable to the payment(s), or (2) a gross debt instrument during the year while held by you. Report this amount on your

amount for both the interest paid to you and the premium amortization allocable income tax return as directed in the instructions for Form 1040 or 1040A. Market

to the payment(s). If you did notify your payer that you did not want to amortize discount on a tax-exempt security is includible in taxable income as interest

the premium on a taxable covered security, then your payer will only report the income.

gross amount of interest paid to you. For a noncovered security acquired at a

premium, your payer is only required to report the gross amount of interest paid Box 11. For a taxable covered security, shows the amount of premium

to you. amortization allocable to the interest payment(s), unless you notified the payer in

writing in accordance with Regulations section 1.6045-1(n)(5) that you did not

Recipient's identification number. For your protection, this form may show want to amortize bond premium under section 171. If an amount is reported in

only the last four digits of your social security number (SSN), individual taxpayer this box, see the instructions for Form 1040 (Schedule B). If an amount is not

identification number (ITIN), adoption taxpayer identification number (ATIN), or reported in this box for a taxable covered security acquired at a premium, the

employer identification number(EIN). However, the issuer has reported your payer has reported a net amount of interest in box 1 or 3, whichever is

complete identification number to the IRS. applicable. If the amount in this box is greater than the amount of interest paid on

the covered security, see Regulations section 1.171-2(a)(4).

FATCA filing requirement. If the FATCA filing requirement box is checked, the

payer is reporting on this Form 1099 to satisfy its chapter 4 account reporting

Box 13. For a tax-exempt covered security, shows the amount of premium

requirement. You also may have a filing requirement. See the Instructions for

amortization allocable to the interest payment(s). If an amount is not reported in

Form 8938.

this box for a tax-exempt covered security acquired at a premium, the payer has

Account number. May show an account or other unique number the payer reported a net amount of interest in box 8 or 9, whichever is applicable. If the

assigned to distinguish your account. amount in this box is greater than the amount of interest paid on the tax-exempt

covered security, the excess is a nondeductible loss. See Regulations section

Box 1. Shows taxable interest paid to you during the calendar year by the 1.171-2(a)(4)(ii).

payer. This does not include interest shown in box 3. May also show the total

amount of the credits from clean renewable energy bonds, new clean renewable Box 14. Shows CUSIP number(s) for tax-exempt bond(s) on which tax-exempt

energy bonds, qualified energy conservation bonds, qualified zone academy interest was paid, or tax credit bond(s) on which taxable interest was paid or tax

bonds, qualified school construction bonds, and build America bonds that must credit was allowed, to you during the calendar year. If blank, no CUSIP number

be included in your interest income. These amounts were treated as paid to you was issued for the bond(s).

during 2015 on the credit allowance dates (March 15, June 15, September 15,

and December 15). For more information, see Form 8912, Credit to Holders of Boxes 15-17. State tax withheld reporting boxes.

Tax Credit Bonds. See the instructions above for a taxable covered security

acquired at a premium. Nominees. If this form includes amounts belonging to another person(s), you are

considered a nominee recipient. Complete a Form 1099-INT for each of the other

Box 2. Shows interest or principal forfeited because of early withdrawal of time owners showing the income allocable to each. File Copy A of the form with the

savings. You may deduct this amount to figure your adjusted gross income on IRS. Furnish Copy B to each owner. List yourself as the "payer" and the other

your income tax return. See the instructions for Form 1040 to see where to take owner(s) as the "recipient." File Form(s) 1099-INT with Form 1096 with the

the deduction. Internal Revenue Service Center for your area. On Form 1096 list yourself as the

"filer." A spouse is not required to file a nominee return to show amounts owned

Box 3. Shows interest on U.S. Savings Bonds, Treasury bills, Treasury bonds, by the other spouse.

and Treasury notes. This may or may not all be taxable. See Pub. 550. This

interest is exempt from state and local income taxes. This interest is not Future Developments. For the latest information about developments related to

included in box 1. See the instructions above for a taxable covered security Form 1099-INT and its instructions, such as legislation enacted after they were

acquired at a premium. published, go to www.irs.gov/form1099int.

Box 4. Shows backup withholding. Generally, a payer must backup withhold if

you did not furnish your taxpayer identification number (TIN) or you did not

furnish the correct TIN to the payer. See Form W-9. Include this amount on your

income tax return as tax withheld.

Box 5. Any amount shown is your share of investment expenses of a single

class REMIC. If you file Form 1040, you may deduct these expenses on the

"Other expenses" line of Schedule A (Form 1040) subject to the 2% limit. This

amount is included in box 1.

Box 6. Shows foreign tax paid. You may be able to claim this tax as a deduction

or a credit on your Form 1040. See your Form 1040 instructions.

Box 7. Shows the country or U.S. possession to which the foreign tax was paid.

Box 8. Shows tax-exempt interest paid to you during the calendar year by the

payer. Report this amount on line 8b of Form 1040 or Form 1040A. This amount

may be subject to backup withholding. See box 4. See the instructions above for

a tax-exempt covered security acquired at a premium.

You might also like

- Nonemployee Compensation: Copy B For RecipientDocument1 pageNonemployee Compensation: Copy B For RecipientNubia LisboaNo ratings yet

- How To Stop Employers From Withholding Income TaxesDocument14 pagesHow To Stop Employers From Withholding Income TaxesSaleem Alhakim90% (10)

- 2022 Uber 1099-NECDocument2 pages2022 Uber 1099-NECmwgageNo ratings yet

- Irs Form 1099 BDocument9 pagesIrs Form 1099 BMikhael Yah-Shah Dean: VeilourNo ratings yet

- 9 Keland Cossia 2019 Form 1099-MISCDocument1 page9 Keland Cossia 2019 Form 1099-MISCpeter parkinsonNo ratings yet

- 1099 Form Year 2021Document8 pages1099 Form Year 2021Candy Valentine100% (1)

- Form 1099-INT - 2022 - Template1 - Document 01Document9 pagesForm 1099-INT - 2022 - Template1 - Document 01chamuditha dilshanNo ratings yet

- 2020 1099-INT WellsFargoDocument2 pages2020 1099-INT WellsFargosayma kandaf0% (1)

- 2019 Form 1099-MISCDocument1 page2019 Form 1099-MISCKeller Brown JnrNo ratings yet

- Miscellaneous Income: US - 2019 - 1099MISC - 1003104696 - 0Document2 pagesMiscellaneous Income: US - 2019 - 1099MISC - 1003104696 - 0Mark JamesNo ratings yet

- 1099 Ing PDFDocument3 pages1099 Ing PDFAnonymous wznsTFAMKMNo ratings yet

- Cor Clearing LLC The Landmark Center 1299 Farnam Street SUITE 800 OMAHA, NE 68102Document10 pagesCor Clearing LLC The Landmark Center 1299 Farnam Street SUITE 800 OMAHA, NE 68102luisNo ratings yet

- Form 1099 MISC David Kovach-1Document1 pageForm 1099 MISC David Kovach-1dolapo BalogunNo ratings yet

- Sean 2022 Tax ReturnDocument18 pagesSean 2022 Tax Returnaaakinkumi115100% (1)

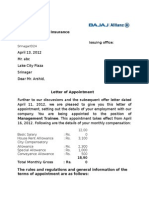

- Appointment Letter Format For Bajaj AllianzDocument4 pagesAppointment Letter Format For Bajaj Allianzmir_umaramin100% (2)

- Capital One TaxDocument2 pagesCapital One Tax16baezmcNo ratings yet

- Walmart Inc. 850 Cherry Ave., San Bruno, CA 94066: CORRECTED (If Checked)Document1 pageWalmart Inc. 850 Cherry Ave., San Bruno, CA 94066: CORRECTED (If Checked)maria rodriguezNo ratings yet

- Chapter 4 OBLICON PDFDocument5 pagesChapter 4 OBLICON PDFsampdnimNo ratings yet

- Tax FormDocument2 pagesTax FormJorge LuissNo ratings yet

- Estanislao v. EastwestDocument4 pagesEstanislao v. EastwestheyoooNo ratings yet

- CORRECTED (If Checked)Document2 pagesCORRECTED (If Checked)Dennis100% (1)

- Swe Win 2022 1099 PDFDocument2 pagesSwe Win 2022 1099 PDFKuka Win50% (2)

- Chase 1099int 2013Document2 pagesChase 1099int 2013Srikala Venkatesan100% (1)

- DRW 2021 Cash001cajj018598 V1Document8 pagesDRW 2021 Cash001cajj018598 V1Russell Chyle100% (1)

- US1099Forms - Form 1099-NEC Copy BDocument2 pagesUS1099Forms - Form 1099-NEC Copy BSaurabh ChandraNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Shipping BillDocument2 pagesShipping Billjehangir0000100% (6)

- Room Reservation FormDocument5 pagesRoom Reservation FormNicks AbellaNo ratings yet

- TAX - Documentary Stamp Tax CasesDocument9 pagesTAX - Documentary Stamp Tax CasesMarife Tubilag ManejaNo ratings yet

- Interest Income: For Questions Please Call: 1-888-464-0727Document2 pagesInterest Income: For Questions Please Call: 1-888-464-0727Lisa Nielsen-SmithNo ratings yet

- Consolidated 2020 Forms 1099 and Details: Year End MessagesDocument8 pagesConsolidated 2020 Forms 1099 and Details: Year End MessagesJennifer BarricellaNo ratings yet

- 1099 Misc John NixonDocument1 page1099 Misc John NixonpayfallusdNo ratings yet

- QRFS Olden WerldeDocument2 pagesQRFS Olden Werldespartalives75No ratings yet

- UICAnnual1099 2010 01 09 00.32.54.009000Document1 pageUICAnnual1099 2010 01 09 00.32.54.009000Paul Michael WiremanNo ratings yet

- Robinhood Crypto LLC 85 Willow Road Menlo Park, Ca 94025Document4 pagesRobinhood Crypto LLC 85 Willow Road Menlo Park, Ca 94025Jack BotNo ratings yet

- 2022 1099necDocument2 pages2022 1099necShirley MazariegosNo ratings yet

- Documents (942,202212311058, F99NEE)Document2 pagesDocuments (942,202212311058, F99NEE)LertoraNo ratings yet

- Consolidated 2018 Forms 1099 and Details: Robinhood (650) 940-2700Document8 pagesConsolidated 2018 Forms 1099 and Details: Robinhood (650) 940-2700Renjie XuNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document4 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Emelyn Ventura SantosNo ratings yet

- 2019 1099-Consol Morgan Stanley 5948 KentDocument10 pages2019 1099-Consol Morgan Stanley 5948 Kentesteysi775No ratings yet

- Brokerage Account Xxx9881 Consolidated Form 1099 2023Document10 pagesBrokerage Account Xxx9881 Consolidated Form 1099 2023gabriela.paradaNo ratings yet

- Bir1600 July52019 - 2 PDFDocument2 pagesBir1600 July52019 - 2 PDFMaureen AlapaapNo ratings yet

- Important Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Document1 pageImportant Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Victor ErazoNo ratings yet

- Google 1099-MISC 2021Document2 pagesGoogle 1099-MISC 2021sharprespaldoNo ratings yet

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMKenneth BarcottNo ratings yet

- 2023 1099necDocument2 pages2023 1099necjose.oliverosflacNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document5 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"May Joy DepalomaNo ratings yet

- Same-Day Worksheet 1010Document2 pagesSame-Day Worksheet 1010Hans GadamerNo ratings yet

- Form 1100Document1 pageForm 1100Hï FrequencyNo ratings yet

- Dimensional Service Corporation 2307Document3 pagesDimensional Service Corporation 2307Randy RosasNo ratings yet

- PC Square2307Document3 pagesPC Square2307SirManny ReyesNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Marfrancisco, Pinamalayan, Oriental MindoroDocument5 pagesCertificate of Creditable Tax Withheld at Source: Marfrancisco, Pinamalayan, Oriental MindoroChristcelda lozadaNo ratings yet

- US Internal Revenue Service: f8404 - 2003Document2 pagesUS Internal Revenue Service: f8404 - 2003IRSNo ratings yet

- Aa Aluminum Supply Inc.Document5 pagesAa Aluminum Supply Inc.Ben Carlo RamosNo ratings yet

- 1099-r Taxable Amount Example - Google SearchDocument1 page1099-r Taxable Amount Example - Google SearchAnthony KevinNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internaskiezer agrudaNo ratings yet

- Certificate of Final Tax Withheld at SourceDocument7 pagesCertificate of Final Tax Withheld at Sourcegloryfe almodalNo ratings yet

- 1600 August 2022Document1 page1600 August 2022Analyn DomingoNo ratings yet

- WandaDocument1 pageWandaJuegos DebeNo ratings yet

- Statement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GDocument1 pageStatement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GClifton WilsonNo ratings yet

- DRW 2021 Cash001cazc017382 V1Document8 pagesDRW 2021 Cash001cazc017382 V1AresNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document9 pagesAttention:: WWW - Irs.gov/form1099jahnayesullivanNo ratings yet

- 1600 WPDocument3 pages1600 WPmaureen garridoNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document8 pagesAttention:: WWW - Irs.gov/form1099Marie CaragNo ratings yet

- UI Online - Doc - 20210110165828Document2 pagesUI Online - Doc - 20210110165828Mark ThomasNo ratings yet

- 1099 HsuxixfkrDocument1 page1099 HsuxixfkrhayyandaiNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- APC PhysicsCourseDocument1 pageAPC PhysicsCourseBoldie LutwigNo ratings yet

- Dynamics Chapter 2009-05-13Document20 pagesDynamics Chapter 2009-05-13Boldie LutwigNo ratings yet

- Hera QuickstartDocument28 pagesHera QuickstartBoldie LutwigNo ratings yet

- OceanPredict19 Abstract FinalDocument1 pageOceanPredict19 Abstract FinalBoldie LutwigNo ratings yet

- Centripetal Force Lab: ObjectivesDocument4 pagesCentripetal Force Lab: ObjectivesBoldie LutwigNo ratings yet

- Fluids - Presentation 2013 10 28 1 Slide Per Page W - AnswersDocument90 pagesFluids - Presentation 2013 10 28 1 Slide Per Page W - AnswersBoldie LutwigNo ratings yet

- Circular Motion Multiple Choice Homework: PSI PhysicsDocument7 pagesCircular Motion Multiple Choice Homework: PSI PhysicsBoldie LutwigNo ratings yet

- Universal Gravitation Multiple Choice HomeworkDocument8 pagesUniversal Gravitation Multiple Choice HomeworkBoldie LutwigNo ratings yet

- Momentum - Presentation 2013 07 29 BLV 1 Slide Per PageDocument95 pagesMomentum - Presentation 2013 07 29 BLV 1 Slide Per PageBoldie LutwigNo ratings yet

- Kinematics - Presentation 2012 07 31Document168 pagesKinematics - Presentation 2012 07 31Boldie LutwigNo ratings yet

- Uniform Circular Motion: PSI AP Physics 1Document6 pagesUniform Circular Motion: PSI AP Physics 1Boldie LutwigNo ratings yet

- Aapt United States Physics Team: 216 Year 2018Document23 pagesAapt United States Physics Team: 216 Year 2018Boldie LutwigNo ratings yet

- A Coupled Momentum Method For Modeling Blood FlowDocument23 pagesA Coupled Momentum Method For Modeling Blood FlowBoldie LutwigNo ratings yet

- 2019 Israel p2Document6 pages2019 Israel p2Boldie LutwigNo ratings yet

- 242 Year 2019Document21 pages242 Year 2019Boldie LutwigNo ratings yet

- Circuits-Circuit AnalysisDocument11 pagesCircuits-Circuit AnalysisBoldie LutwigNo ratings yet

- 264 Year 2019Document24 pages264 Year 2019Boldie LutwigNo ratings yet

- Evaluation of New Models For Simulating Embankment Dam BreachDocument6 pagesEvaluation of New Models For Simulating Embankment Dam BreachBoldie LutwigNo ratings yet

- Lessons Learned Complete ListDocument7 pagesLessons Learned Complete ListBoldie LutwigNo ratings yet

- The Insider CodeDocument15 pagesThe Insider CodeJohn PatlolNo ratings yet

- IanWatson WingCambodia-2012Document22 pagesIanWatson WingCambodia-2012dmg123100% (1)

- 2017 Sec 4E5N Prelim Paper 2 - AnsDocument7 pages2017 Sec 4E5N Prelim Paper 2 - AnsDamien SeowNo ratings yet

- 166 Syllabus DiplomaDocument9 pages166 Syllabus DiplomaNandha KumarNo ratings yet

- Recovered File 1Document27 pagesRecovered File 1RoxySyazlyna0% (1)

- 1 Compare & Contrast Objective Risk and Subjective Risk?: Insurance CompanyDocument6 pages1 Compare & Contrast Objective Risk and Subjective Risk?: Insurance Companytayachew mollaNo ratings yet

- Project Problem One: Chapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsDocument6 pagesProject Problem One: Chapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsShaharyar AsifNo ratings yet

- Fdnbusm ReviewerDocument4 pagesFdnbusm ReviewerMaureen MenorNo ratings yet

- 6th Edition PBDs - GoodsDocument41 pages6th Edition PBDs - Goodsdrpjgmrmc bacNo ratings yet

- PS 4Document7 pagesPS 4Gilbert Ansah YirenkyiNo ratings yet

- DILG MC 2014-83 SSS Coverage For Contractural Gov't Employees July 18 2014Document3 pagesDILG MC 2014-83 SSS Coverage For Contractural Gov't Employees July 18 2014joreyvilNo ratings yet

- Sample Test Chap04Document9 pagesSample Test Chap04Niamul HasanNo ratings yet

- Benefits of Long-Term Loans Among Small Business Entity in Barangay Sta. Anastacia, Sto. Tomas BatangasDocument5 pagesBenefits of Long-Term Loans Among Small Business Entity in Barangay Sta. Anastacia, Sto. Tomas BatangasLimzel MañagoNo ratings yet

- Accounting 2Document1 pageAccounting 2Jomicah SimbilloNo ratings yet

- Cookie Mining Feb 2019Document5 pagesCookie Mining Feb 2019johnosborneNo ratings yet

- Partnership DissolutionDocument2 pagesPartnership DissolutionAnnie AseradoNo ratings yet

- WoltersK CaseStudy EastWestBankaDocument4 pagesWoltersK CaseStudy EastWestBankaGrand OverallNo ratings yet

- Foreign Currency TranslationDocument38 pagesForeign Currency TranslationAnmol GulatiNo ratings yet

- Synopsis DissertationDocument6 pagesSynopsis DissertationVijayendra Pratap SinghNo ratings yet

- Toyo Engineering India Private LimitedDocument4 pagesToyo Engineering India Private LimitedWaseem AnsariNo ratings yet

- Adi Bju Exp Sleeper Class (SL)Document1 pageAdi Bju Exp Sleeper Class (SL)asa.polyplastNo ratings yet

- Sasresultpart2 (OB)Document20 pagesSasresultpart2 (OB)mohitangirashNo ratings yet

- FSSA Document Center PO Box 1810 Marion, IN 46952: FSS407AE00121YU2SE8Document8 pagesFSSA Document Center PO Box 1810 Marion, IN 46952: FSS407AE00121YU2SE8Tonya JohnsonNo ratings yet