Professional Documents

Culture Documents

Partnership Dissolution

Partnership Dissolution

Uploaded by

Annie Aserado0 ratings0% found this document useful (0 votes)

30 views2 pagesMiranda is being admitted as a new partner to an existing partnership. The document provides details on Miranda's potential admission under different scenarios:

1) Miranda pays Diala $125,000 for 20% of her interest.

2) Miranda invests $200,000 cash for an interest equal to her investment.

3) Miranda invests $300,000 cash for 20% interest, with original partners receiving a bonus based on capital balances.

4) Miranda invests $300,000 cash for 40% interest, with original partners receiving a bonus in the ratio of their capital balances.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMiranda is being admitted as a new partner to an existing partnership. The document provides details on Miranda's potential admission under different scenarios:

1) Miranda pays Diala $125,000 for 20% of her interest.

2) Miranda invests $200,000 cash for an interest equal to her investment.

3) Miranda invests $300,000 cash for 20% interest, with original partners receiving a bonus based on capital balances.

4) Miranda invests $300,000 cash for 40% interest, with original partners receiving a bonus in the ratio of their capital balances.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views2 pagesPartnership Dissolution

Partnership Dissolution

Uploaded by

Annie AseradoMiranda is being admitted as a new partner to an existing partnership. The document provides details on Miranda's potential admission under different scenarios:

1) Miranda pays Diala $125,000 for 20% of her interest.

2) Miranda invests $200,000 cash for an interest equal to her investment.

3) Miranda invests $300,000 cash for 20% interest, with original partners receiving a bonus based on capital balances.

4) Miranda invests $300,000 cash for 40% interest, with original partners receiving a bonus in the ratio of their capital balances.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

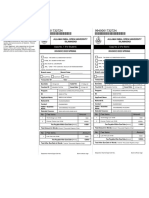

Partnership Dissolution – it is the Austria, Capital 150,000

change in the relation of the partners

Tamayo, Capital 300,000

caused by any partner ceasing to be

associated in the carrying on as Required:

distinguished from the winding up of the

business of the partnership. Prepare the entries to record Miranda’s

admission to the partnership under of

On dissolution, the partnership is not each of the following:

terminated. Most change in the

ownership of a partnership are

accomplished without interruption of its a. Miranda paid Diala P125,000 for

normal operations. 20% of Diala’s interest in the

partnership.

Causes of Dissolution b. Miranda invested P200,000 cash

in the partnership and received

1. Admission of a Partner

an interest equal to her

2. Withdrawal or Retirement of a

investment.

partner

3. Death of a partner

c. Miranda invested P300,000 cash

4. Incorporation of the Partnership

in the partnership for 20% interest

Admission of a Partner in the business. A bonus is to be

recorded for the original partners

1. Purchase of Interest from Existing

on the basis of their capital

Partner/s

balances.

2. Investment of Assets in a

Partnership

d. Miranda invested P300,000 cash

in the partnership for 40% interest

in the business. The original

Agreed Capital (AC) - total capital of the partners gave Miranda a bonus

partnership after considering the capital according to the ratio of their

credits given to each partners. capital balances on July 31,

Contributed Capital (CC)– sum of the 2021.

capital balance of old partners and

actual investment of new partner.

AC CC Bonus/AR

start

Old xxx xxx xxx

New xxx xxx xxx

Total xxx xxx xxx

Asset Revaluation – Old Partners

AC ≠ CC (asset revaluation)

AC = CC (-0-/ bonus)

Bonus (positive in new partner) – New

Partner

Partnership Dissolution – Admission

Diala, Austria, and Tamayo are partners

in Lavander Company. Their capital

balances as at July 31,2021, are as

follows:

Diala, Capital 450,000

Partnership Dissolution – Admission

Parcadilla and Tan are partners in

Nayon Partnership with capital

balances of P550,000 and P350,000,

respectively; they share income and loss

in the ratio 1:3, respectively. The

partners are considering the admission

of Conde.

Required:

Prepare the entries to record the

admission of Conde under each of the

following independent situations:

1. Conde invested P100,000 cash in the

partnership for a one-tenth interest. The

net assets of the partnership are fairly

valued.

2. Conde invested P140,000 cash in

partnership for a one-eight interest. Assets

of the partnership are fairly valued except

for equipment, which is undervalued by

P80,000. Net assets of the partnership are

to be revalued and Conde is to be

admitted.

3. Conde is to receive a one-tenth interest in

the partnership upon investing P180,000

cash. Net assets of the partnership are

fairly valued.

4. Conde is to receive a 20% interest in the

partnership upon investing P200,000 cash.

Net assets of the partnership are fairly

valued.

You might also like

- Foreign Currency TransactionDocument15 pagesForeign Currency TransactionJoemar Santos Torres88% (8)

- Retirement Planning Calculator - MR Money TVDocument6 pagesRetirement Planning Calculator - MR Money TVCath CNo ratings yet

- Accounting For Special Transactions Part 3 Course AssessmentDocument31 pagesAccounting For Special Transactions Part 3 Course AssessmentRAIN ALCANTARA ABUGANNo ratings yet

- AFARS14 General ReviewDocument15 pagesAFARS14 General ReviewBeatrice Teh100% (4)

- Partnership Formation and OperationDocument12 pagesPartnership Formation and OperationThe Brain Dump PHNo ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Partnership Dissolution and Liquidation - 497916619Document4 pagesPartnership Dissolution and Liquidation - 497916619Carl Yry BitengNo ratings yet

- Chapter 1&2Document34 pagesChapter 1&2iptrcrmlNo ratings yet

- BAC 522 Mid Term ExamDocument9 pagesBAC 522 Mid Term ExamJohn Carlo Cruz0% (1)

- Partnership Formation Enabling AssessmentDocument7 pagesPartnership Formation Enabling AssessmentVon Andrei Medina100% (2)

- Partnership Dissolution - Practice ExercisesDocument5 pagesPartnership Dissolution - Practice ExercisesVon Andrei Medina0% (2)

- Acctg 2a Answer KeyDocument5 pagesAcctg 2a Answer KeyComan Nocat Eam100% (2)

- Form W 10Document7 pagesForm W 10zigzag7842611No ratings yet

- Acctg 12 Final ExaminationDocument3 pagesAcctg 12 Final ExaminationMichael John DayondonNo ratings yet

- 1 PartnershipDocument6 pages1 PartnershipJem Valmonte100% (3)

- 2 Partnership DissolutionDocument9 pages2 Partnership DissolutionLach Mae . FloresNo ratings yet

- Afar Partnerships Ms. Ellery D. de Leon: True or FalseDocument6 pagesAfar Partnerships Ms. Ellery D. de Leon: True or FalsePat DrezaNo ratings yet

- ACT115 - Topic 5Document6 pagesACT115 - Topic 5Le MinouNo ratings yet

- PARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalDocument4 pagesPARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalErica AbegoniaNo ratings yet

- Financial Accounting and Reporting ExamDocument6 pagesFinancial Accounting and Reporting ExamVye DumaleNo ratings yet

- Partnership Formation & OperationDocument4 pagesPartnership Formation & Operationdiane pandoyosNo ratings yet

- BAFINAR - Midterm Draft (R) PDFDocument11 pagesBAFINAR - Midterm Draft (R) PDFHazel Iris Caguingin100% (1)

- Partnership DissolutionDocument3 pagesPartnership DissolutionRoselyn Balik100% (1)

- Review of PartnershipDocument13 pagesReview of PartnershipKristine BlancaNo ratings yet

- 1 Partnership ReviewDocument5 pages1 Partnership Reviewlisa jugan100% (1)

- Advanced Financial Accounting and Reporting Problem 2Document5 pagesAdvanced Financial Accounting and Reporting Problem 2Zovia LucioNo ratings yet

- MOCK BOARD May 222 Test Questions AFAR SCDocument16 pagesMOCK BOARD May 222 Test Questions AFAR SCKial PachecoNo ratings yet

- PARTNERSHIP2Document13 pagesPARTNERSHIP2Anne Marielle UyNo ratings yet

- PARTNERSHIP2Document13 pagesPARTNERSHIP2Anne Marielle Uy0% (2)

- PartnershipDocument9 pagesPartnershipChariz Audrey100% (1)

- Refresher Partnership DissolutionDocument3 pagesRefresher Partnership DissolutionbiadnescydcharyNo ratings yet

- BAFINAR - Quiz 2 ColarDocument3 pagesBAFINAR - Quiz 2 ColarRonalyn ColarNo ratings yet

- Chapter 2 - Partnership Formation ObjectivesDocument10 pagesChapter 2 - Partnership Formation ObjectivesSapphire AliasNo ratings yet

- PROBLEMS - Partnership DissolutionDocument4 pagesPROBLEMS - Partnership DissolutionA. MagnoNo ratings yet

- Final Exam Partnership CorporationDocument6 pagesFinal Exam Partnership Corporationycalinaj.cbaNo ratings yet

- 03 - Handout - Partnership DissolutionDocument4 pages03 - Handout - Partnership DissolutionJanysse CalderonNo ratings yet

- 1 - Partnership ReviewDocument6 pages1 - Partnership ReviewTherese Anne VillaricoNo ratings yet

- 1st Sem FX Acc. Set B PDFDocument5 pages1st Sem FX Acc. Set B PDFAra AlivioNo ratings yet

- QUIZ 02: Partnership Operations Name: - ID No.Document6 pagesQUIZ 02: Partnership Operations Name: - ID No.yoj cepilloNo ratings yet

- Partnership: Definition, Nature and FormationDocument19 pagesPartnership: Definition, Nature and FormationRuthchell CiriacoNo ratings yet

- Ea - Module 1 Partnership FormationDocument7 pagesEa - Module 1 Partnership FormationJoana Trinidad100% (1)

- Chapter 4 Graded Problems-1Document3 pagesChapter 4 Graded Problems-1almacen chrisNo ratings yet

- Quiz 2 KeyDocument5 pagesQuiz 2 KeyRosie PosieNo ratings yet

- Template - Acctg. Major 3 Module 2Document7 pagesTemplate - Acctg. Major 3 Module 2Ryan PatitoNo ratings yet

- Module 1.3 - Partnership Dissolution PDFDocument3 pagesModule 1.3 - Partnership Dissolution PDFMila MercadoNo ratings yet

- Problems: Volume IDocument6 pagesProblems: Volume IMigs MigsyNo ratings yet

- BADVAC2X - MOD 1 Partnership FormationDocument4 pagesBADVAC2X - MOD 1 Partnership FormationAlice WuNo ratings yet

- Quiz On Partnership DissolutionDocument4 pagesQuiz On Partnership Dissolution이삐야No ratings yet

- Afar 2019Document10 pagesAfar 2019Richard VictoriaNo ratings yet

- Partnership DissolutionDocument2 pagesPartnership Dissolutionaj7939408No ratings yet

- Week 6 Fundamentals of Partnership AnswersDocument6 pagesWeek 6 Fundamentals of Partnership AnswersHan ChinNo ratings yet

- MC Questions For FOA IIDocument9 pagesMC Questions For FOA IIGrace SustiguerNo ratings yet

- PARCOR 1 and 2Document7 pagesPARCOR 1 and 2Kim Audrey Jalalain100% (1)

- Abm QuizDocument5 pagesAbm QuizCastleclash CastleclashNo ratings yet

- Accounting 2 (Admission &withdrawal of Partners)Document6 pagesAccounting 2 (Admission &withdrawal of Partners)Zyka SinoyNo ratings yet

- Accounting Special Transaction - PartnershipDocument12 pagesAccounting Special Transaction - PartnershipMikee LajatoNo ratings yet

- Accounting For Special TransactionDocument5 pagesAccounting For Special TransactionNicole Gole CruzNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Acc 309Document5 pagesAcc 309Ampy SasutonaNo ratings yet

- Financial Management Research Paper - Juliana Honeylet L. Amper - MEMDocument10 pagesFinancial Management Research Paper - Juliana Honeylet L. Amper - MEMJuliana Honeylet L. AmperNo ratings yet

- MFI Unit 01Document13 pagesMFI Unit 01Shreejan PandeyNo ratings yet

- The Money and Capital MarketsDocument50 pagesThe Money and Capital MarketsclaytongarryNo ratings yet

- Current Scenario of Financial ServicesDocument8 pagesCurrent Scenario of Financial Servicessureshsen80% (5)

- Case Studies of Source of Business FinanceDocument4 pagesCase Studies of Source of Business FinanceAman KeshariNo ratings yet

- Soneri Bank LimittedDocument24 pagesSoneri Bank LimittednawidscribdNo ratings yet

- Shipment Details: 2 3 1 8 6 0 1 5 1 5 Inbound Charges InvoiceDocument1 pageShipment Details: 2 3 1 8 6 0 1 5 1 5 Inbound Charges Invoicewiji astutik 534No ratings yet

- Portfolio Management ServicesDocument83 pagesPortfolio Management Servicesragipanidinesh6206No ratings yet

- LK Kimia Farma Konsolidasi 31 Desember 2020Document177 pagesLK Kimia Farma Konsolidasi 31 Desember 2020Kim WooNo ratings yet

- Copy Alaska Usa Federal Credit Union Statement of AccountDocument37 pagesCopy Alaska Usa Federal Credit Union Statement of AccountВлад АнгелNo ratings yet

- DocxDocument45 pagesDocxchuchuNo ratings yet

- PF Forms FormatsDocument10 pagesPF Forms FormatsSnehal ChauhanNo ratings yet

- Write Your Name and Roll Number BelowDocument22 pagesWrite Your Name and Roll Number Belowshazia banoNo ratings yet

- ĐỀ SỐ 29Document19 pagesĐỀ SỐ 29Tú Đặng ĐìnhNo ratings yet

- GST ChallanDocument2 pagesGST Challansamaadhu100% (1)

- Allama Iqbal Fee VoucherDocument1 pageAllama Iqbal Fee VoucherSheriyarTechNo ratings yet

- Divergence (BraveFx Academy)Document12 pagesDivergence (BraveFx Academy)Mikail AdedejiNo ratings yet

- Wealth Management and Personal Financial Planning 8-10 1.PptmDocument86 pagesWealth Management and Personal Financial Planning 8-10 1.PptmHargobind CoachNo ratings yet

- A Practical Guide To Capitalisation of Borrowing Costs: November 2008Document23 pagesA Practical Guide To Capitalisation of Borrowing Costs: November 2008adi darmawanNo ratings yet

- Fred and Wilma FlintstoneDocument3 pagesFred and Wilma Flintstoneapi-270699969No ratings yet

- Narasimham Committee ReportDocument4 pagesNarasimham Committee ReportSumit MehtaNo ratings yet

- Economics 101: Without The Bull It by Mike MitroskyDocument11 pagesEconomics 101: Without The Bull It by Mike MitroskyEl Scampio100% (1)

- Ejercito V SandiganbayanDocument2 pagesEjercito V SandiganbayanAnonymous 5MiN6I78I0No ratings yet

- Journal Entries, T-Accounts - ProblemsDocument3 pagesJournal Entries, T-Accounts - ProblemsomarkezzalarabNo ratings yet

- ICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andDocument6 pagesICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andArpit GuptaNo ratings yet

- Ai Enhance Investment LCC Loi - Signed - Funding Consideration - CombinedDocument2 pagesAi Enhance Investment LCC Loi - Signed - Funding Consideration - CombinednathanNo ratings yet

- Fundamentals of Accountancy Business and Management II Module 4Document4 pagesFundamentals of Accountancy Business and Management II Module 4Rafael RetubisNo ratings yet