Professional Documents

Culture Documents

05 - Notes On Noncurrent Asset Held For Sale

05 - Notes On Noncurrent Asset Held For Sale

Uploaded by

Lalaine ReyesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

05 - Notes On Noncurrent Asset Held For Sale

05 - Notes On Noncurrent Asset Held For Sale

Uploaded by

Lalaine ReyesCopyright:

Available Formats

NONCURRENT ASSET HELD FOR SALE

Noncurrent asset may be an individual asset, like land and building, or a disposal group

Disposal group – group of assets to be disposed of, by sale or otherwise, together as a group in a

single transaction, and liabilities directly associated with those assets that will be transferred in the

transaction

o Includes goodwill acquired in a business combination if the group is a cash generating unit

to which goodwill has been allocated

Noncurrent asset held for sale

PFRS 5, p. 6: a noncurrent asset or disposal group is classified as held for sale if the carrying amount

will be recovered principally through a sale transaction rather than through continuing use

Conditions for classification as held for sale

1. Asset or disposal group is available for immediate sale in the present condition (“sold as seen”)

2. Sale must be highly probable

Definition of highly probable

1. Management must be committed to a plant to sell the asset or disposal group

2. Initiate active program to locate a buyer and complete the plan

3. Expected to be a “completed sale” within one year from date of classification as held for sale

4. Asset or disposal group must be actively marketed at a reasonable sale price in relation to FV

5. Actions required to complete the plan indicate that it is unlikely that the plan will be significantly

changed or withdrawn

Measurement of asset held for sale

PFRS 5, p. 15: measure NCAHS at the LOWER of carrying amount or fair value less cost of disposal

o Cost of disposal – excludes finance cost and income tax expense

o Shall not be depreciated

Write-down to fair value less cost of disposal

If FVLCD < CA write-down is treated as impairment loss

If the NCA is a disposal group, the impairment loss is apportioned across the assets

o Priority: goodwill (full)

o Excess: allocate prorate to NCA based on CARRYING AMOUNT

Subsequent increase in fair value

PFRS 5, p. 21: if there is a subsequent increase in FVLCD, an entity shall recognize a gain but not in

excess of any impairment loss previously recognized

Revalued asset classified as held for sale

PFRS 5, p. 18: when an entity adopts the revaluation model for the measurement of assets, any asset

classified as held for sale should be revalued to fair value immediately prior to the classification as

held for sale

Additional revaluation surplus = fair value at classification date – carrying amount at that date

Any cost of disposal at classification date = impairment loss for the period (deducted from the asset

held for sale)

Subsequent year-end measurement: lower of carrying amount and fair value less cost of disposal

Abandoned noncurrent asset

PFRS 5, p. 13: an entity shall not classify as held for sale a noncurrent asset or disposal group that is

to be abandoned

Carrying amount will be recovered principally through continuing use or the noncurrent asset it to

be used until the end of its economic life

Temporarily abandoned

PFRS 5, p.14: shall not account for a NCA that has been temporarily abandoned taken out of use as if

it had been abandoned

Change in classification

Circumstances could arise leading to the NCA no longer classified as held for sale

PFRS 5, p. 27: the entity shall measure the NCA that ceases to be classified as held for sale at the

LOWER of:

o Carrying amount before asset was classified as held for sale adjusted for any depreciation or

amortization that would have been recognized if asset had not been classified as held for sale

o Recoverable amount at the date of the subsequent decision not to sell

Presentation of asset classified as held for sale

PFRS 5, p. 3: assets classified as NC in accordance with PAS 1 shall not be reclassified as CA until they

meet the criteria to be classified as held for sale

PFRS 5, p. 38: if the NCA is a disposal group classified as held for sale, assets and liabilities of the

group shall be presented separately and cannot be offset as a single amount

o “noncurrent assets classified as held for sale”

o “liabilities directly associated with noncurrent assets classified as held for sale”

Change in method of disposal

IASB amended IFRS 5 to clarify the accounting treatment when an entity reclassifies an asset or

disposal group from “held for sale” to “held for distribution to owners” or vice versa without any time

lag

o The change in classification is considered a continuation of the original plan of disposal

o Entity shall continue to apply the “held for sale” or “held for distribution” accounting (FVLCD

vs CA, lower)

o At the time of reclassification, the entity shall recognize any impairment loss or subsequent

increase in FV less cost of disposal or distribution

o Change in classification does not, in itself, extent the period in which a sale has to be

completed

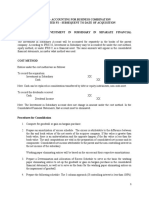

Method Initial Subsequent Initial Subsequent Reclassification

measurement as measurement as measurement as measurement as back to PPE

PPE PPE reclassified NCAHS reclassified NCAHS

COST acquisition cost carrying amount LOWER of CA and LOWER of CA and LOWER of:

(depreciated value) FVLCD FVLCD CA had there been

no reclassification

and

Recoverable amount

REVALUATION acquisition cost revalued amount FVLCD LOWER of CA and LOWER of:

FVLCD CA had there been

update to FV before no reclassification

reclassifying

CD = imp loss and

Recoverable amount

You might also like

- Audit of The Revenue and Collection CycleDocument5 pagesAudit of The Revenue and Collection CycleLalaine ReyesNo ratings yet

- Notes On Excise TaxesDocument19 pagesNotes On Excise TaxesLalaine ReyesNo ratings yet

- Quiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2Document31 pagesQuiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2marie aniceteNo ratings yet

- BSA181A Interim Assessment Bapaud3X: PointsDocument8 pagesBSA181A Interim Assessment Bapaud3X: PointsMary DenizeNo ratings yet

- Depletion Notes: Disclaimer: Not EntirelyDocument3 pagesDepletion Notes: Disclaimer: Not EntirelyRes GosanNo ratings yet

- Defined Benefit Plan (Exercises With Answers)Document3 pagesDefined Benefit Plan (Exercises With Answers)Jennifer AdvientoNo ratings yet

- Afar 02 - Partnership DissolutionDocument8 pagesAfar 02 - Partnership DissolutionMarie GonzalesNo ratings yet

- Investment in Associate Summary - A Project of Barters PHDocument5 pagesInvestment in Associate Summary - A Project of Barters PHEvita Faith LeongNo ratings yet

- Afar NotesDocument20 pagesAfar NotesChristian James Umali BrionesNo ratings yet

- CONCEPTUAL FRAMEWORK HandoutDocument6 pagesCONCEPTUAL FRAMEWORK HandoutRuby RomeroNo ratings yet

- Answers - Chapter 1 Vol 2rvsedDocument8 pagesAnswers - Chapter 1 Vol 2rvsedjamflox50% (2)

- Depreciated Separately.: Property, Plant and EquipmentDocument5 pagesDepreciated Separately.: Property, Plant and EquipmentEmma Mariz GarciaNo ratings yet

- Intangible Assets: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrenceDocument1 pageIntangible Assets: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrencekrizzmaaaayNo ratings yet

- Seth Harvey Hendeve IPPPE ME QuizDocument4 pagesSeth Harvey Hendeve IPPPE ME Quizjeams vidalNo ratings yet

- Sec 2. Par. 2 of The 1987 ConstitutionDocument15 pagesSec 2. Par. 2 of The 1987 ConstitutionTroisNo ratings yet

- Darantan, KC T. - FAR Module 6Document3 pagesDarantan, KC T. - FAR Module 6Li LiNo ratings yet

- GAARDDocument2 pagesGAARDAnonymoustwohundresNo ratings yet

- Intacc 3 HWDocument7 pagesIntacc 3 HWMelissa Kayla ManiulitNo ratings yet

- CA51024-MODULE 3 - Lecture NotesDocument11 pagesCA51024-MODULE 3 - Lecture NotesNia BranzuelaNo ratings yet

- Chapter 8 Entry Strategies in Global BusinessDocument3 pagesChapter 8 Entry Strategies in Global BusinessMariah Dion GalizaNo ratings yet

- Direct Method or Cost of Goods Sold MethodDocument2 pagesDirect Method or Cost of Goods Sold MethodNa Dem DolotallasNo ratings yet

- Introduction To Audit of CashDocument16 pagesIntroduction To Audit of CashDummy GoogleNo ratings yet

- INTACC2 Wasting AssetsDocument10 pagesINTACC2 Wasting Assetsbobo tangaNo ratings yet

- Cash & Cash Equivalents Composition & Other Topics CashDocument5 pagesCash & Cash Equivalents Composition & Other Topics CashEurich Gibarr Gavina EstradaNo ratings yet

- Solution Chapter 6Document17 pagesSolution Chapter 6Mazikeen DeckerNo ratings yet

- Profe03-Activity Chapter 8Document3 pagesProfe03-Activity Chapter 8eloisa celisNo ratings yet

- Advanced Financial Accounting and Reporting: G.P. CostaDocument27 pagesAdvanced Financial Accounting and Reporting: G.P. CostaryanNo ratings yet

- June 9-Acquisition of PPEDocument2 pagesJune 9-Acquisition of PPEJolo RomanNo ratings yet

- Chapter 3 Liquidation Based ValuationDocument5 pagesChapter 3 Liquidation Based ValuationMaurice AgbayaniNo ratings yet

- Accounting - Answer Key Quiz - Investments in Associates and Additional ConceptsDocument2 pagesAccounting - Answer Key Quiz - Investments in Associates and Additional ConceptsNavsNo ratings yet

- Final Exam 10 PDF FreeDocument12 pagesFinal Exam 10 PDF FreeMariefel OrdanezNo ratings yet

- Prelim ExaminationDocument9 pagesPrelim ExaminationShannel Angelica Claire RiveraNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument4 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- 7.1 Accounting ChangesDocument3 pages7.1 Accounting ChangesBrian VillaluzNo ratings yet

- Intacc 3Document102 pagesIntacc 3sofiaNo ratings yet

- Basic Accounting Equation Exercises 2Document2 pagesBasic Accounting Equation Exercises 2Ace Joseph TabaderoNo ratings yet

- 05 Comprehensive Income PDFDocument2 pages05 Comprehensive Income PDFMimi YayaNo ratings yet

- Topic 2 - Strategi Marketing BudgetingDocument30 pagesTopic 2 - Strategi Marketing BudgetingCleo Coleen FortunadoNo ratings yet

- Lyceum of The Philippines University Manila College of Business AdministrationDocument166 pagesLyceum of The Philippines University Manila College of Business AdministrationVanessa SisonNo ratings yet

- Investment Property Is Defined As Property (Land and Building of Part of A Building or Both) HeldDocument11 pagesInvestment Property Is Defined As Property (Land and Building of Part of A Building or Both) HeldRNo ratings yet

- Quiz2 ParCorDocument8 pagesQuiz2 ParCorStephanie gasparNo ratings yet

- Chap 3 PDFDocument8 pagesChap 3 PDFJohanna VidadNo ratings yet

- Homework On Statement of Cash FlowsDocument2 pagesHomework On Statement of Cash FlowsAmy SpencerNo ratings yet

- Dry RunDocument5 pagesDry RunMarc MagbalonNo ratings yet

- Midterm Quiz 2Document11 pagesMidterm Quiz 2SGwannaBNo ratings yet

- 05 Quiz 1acctDocument2 pages05 Quiz 1acctPalileo KidsNo ratings yet

- Activity #4 Corporate LiquidationDocument3 pagesActivity #4 Corporate LiquidationddddddaaaaeeeeNo ratings yet

- Apino Jan Dave T. BSA 4-1 QuizDocument14 pagesApino Jan Dave T. BSA 4-1 QuizRosemarie RamosNo ratings yet

- 2402 Corporate LiquidationDocument7 pages2402 Corporate LiquidationFernando III PerezNo ratings yet

- Quiz On Partnership FormationDocument2 pagesQuiz On Partnership FormationVher Christopher DucayNo ratings yet

- Chapter 18 Shareholders Equity - Docx-1Document14 pagesChapter 18 Shareholders Equity - Docx-1kanroji1923No ratings yet

- CFAS.100 - Diagnostic Test Part 1Document4 pagesCFAS.100 - Diagnostic Test Part 1Mika MolinaNo ratings yet

- 14-6: A (At Fair Value at Date of Acquisition) 14-7: D: Total Net Income P1,800,000Document26 pages14-6: A (At Fair Value at Date of Acquisition) 14-7: D: Total Net Income P1,800,000Love FreddyNo ratings yet

- Unit 7 Audit of IntangiblesDocument10 pagesUnit 7 Audit of IntangiblesVianca Isabel PagsibiganNo ratings yet

- Department of Accountancy: Cash and Cash EquivalentsDocument3 pagesDepartment of Accountancy: Cash and Cash EquivalentsAsterism LoneNo ratings yet

- Answers - V2Chapter 1 2012Document10 pagesAnswers - V2Chapter 1 2012Christopher Diaz0% (1)

- Intangibles Assignment - Valix 2017Document3 pagesIntangibles Assignment - Valix 2017Shinny Jewel VingnoNo ratings yet

- Sol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsDocument10 pagesSol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsMiguel Amihan100% (1)

- Solman ch21 DayagDocument6 pagesSolman ch21 DayagMayeth BotinNo ratings yet

- Effect of Working Capital Management and Financial Leverage On Financial Performance of Philippine FirmsDocument9 pagesEffect of Working Capital Management and Financial Leverage On Financial Performance of Philippine FirmsGeorgina De LiañoNo ratings yet

- Valix Financial Accounting Summary Chapter 8: Non Current Assets Held For SaleDocument3 pagesValix Financial Accounting Summary Chapter 8: Non Current Assets Held For SaleAnne Eiko Gizelle Lumbayon0% (1)

- 06 - Notes On Discontinued OperationsDocument3 pages06 - Notes On Discontinued OperationsLalaine ReyesNo ratings yet

- 00 - Notes On Accounting ProcessDocument7 pages00 - Notes On Accounting ProcessLalaine ReyesNo ratings yet

- 02 - Notes On Statement of Comprehensive IncomeDocument2 pages02 - Notes On Statement of Comprehensive IncomeLalaine ReyesNo ratings yet

- 04 - Notes On Interim ReportingDocument2 pages04 - Notes On Interim ReportingLalaine ReyesNo ratings yet

- Reflection Paper 1Document2 pagesReflection Paper 1Lalaine ReyesNo ratings yet

- Reyes - Lalaine - Cost - CVP AnalysisDocument5 pagesReyes - Lalaine - Cost - CVP AnalysisLalaine ReyesNo ratings yet

- Classroom Notes On LBTDocument5 pagesClassroom Notes On LBTLalaine ReyesNo ratings yet

- Classroom Notes On DSTDocument6 pagesClassroom Notes On DSTLalaine ReyesNo ratings yet

- Kali KiriDocument146 pagesKali Kiribavaji vNo ratings yet

- PreviewpdfDocument68 pagesPreviewpdfwong alusNo ratings yet

- Faith Whitehouse ResumeDocument2 pagesFaith Whitehouse Resumeapi-605922307No ratings yet

- Recent Research Progress in Solid State Friction-Stir Welding of Aluminium-Magnesium Alloys: A Critical ReviewDocument40 pagesRecent Research Progress in Solid State Friction-Stir Welding of Aluminium-Magnesium Alloys: A Critical ReviewbharatNo ratings yet

- Primero de Secundaria INGLES 1 III BimestreDocument5 pagesPrimero de Secundaria INGLES 1 III BimestreTania Barreto PenadilloNo ratings yet

- TodesDocument10 pagesTodesjxbalcazarNo ratings yet

- # 126 Blue Dairy Corporation v. NLRCDocument2 pages# 126 Blue Dairy Corporation v. NLRCSor ElleNo ratings yet

- Q1W4 News Issues Presentation Different MediaDocument13 pagesQ1W4 News Issues Presentation Different MediaDaisiree Pascual100% (3)

- Nov 30 Solon Wants Probe On The Status of The Coconut Water IndustryDocument1 pageNov 30 Solon Wants Probe On The Status of The Coconut Water Industrypribhor2No ratings yet

- Titanium Minerals 5th-Edition BrochureDocument4 pagesTitanium Minerals 5th-Edition BrochureRovil KumarNo ratings yet

- Emotional Intelligence and AcaDocument10 pagesEmotional Intelligence and AcaSassy BlaireNo ratings yet

- SBTA1502Document119 pagesSBTA1502Vishnupriya MuruganNo ratings yet

- PentagramDocument14 pagesPentagramEr MightNo ratings yet

- Mindmap Chap10Document1 pageMindmap Chap10ameliaNo ratings yet

- 100 Project Topic For Python GUI From Beginner To Advanced LevelDocument4 pages100 Project Topic For Python GUI From Beginner To Advanced Levellalit amitNo ratings yet

- CME538 Week1 - Lecture2Document19 pagesCME538 Week1 - Lecture2Siu Kai CheungNo ratings yet

- Updated CV - Rishi RanjanDocument4 pagesUpdated CV - Rishi Ranjanrishiranjan04No ratings yet

- Intro To ProgramingDocument7 pagesIntro To ProgramingLandel SmithNo ratings yet

- 07 Rwanda Education Statistical Year2016Document90 pages07 Rwanda Education Statistical Year2016Mwizerwa GhadNo ratings yet

- The Yellow Wallpaper by Charlotte Perkins GilmanDocument8 pagesThe Yellow Wallpaper by Charlotte Perkins GilmanJYH53No ratings yet

- Marketing Strategy of ICICI BankDocument10 pagesMarketing Strategy of ICICI BankHunny VermaNo ratings yet

- English Language Tenses in To Pashto LanguageDocument9 pagesEnglish Language Tenses in To Pashto LanguageSamiullah100% (4)

- Chemical Engineering: A Level/IB Requirements by College For 2021 EntryDocument9 pagesChemical Engineering: A Level/IB Requirements by College For 2021 EntryJames BondNo ratings yet

- Red Like Roses For String Quartet From RWBYDocument12 pagesRed Like Roses For String Quartet From RWBYBrayan PortillaNo ratings yet

- Cadbury Strategic AnalysisDocument5 pagesCadbury Strategic AnalysisUJJAL SAHU100% (1)

- Power Homes Unlimited CorporationDocument20 pagesPower Homes Unlimited CorporationRaiya AngelaNo ratings yet

- Satellite IsolationDocument11 pagesSatellite Isolationmajid shahzadNo ratings yet

- ANSTEY, P.R. - The Philosophy of John Locke - New Perspectives - Routledge, 2003Document225 pagesANSTEY, P.R. - The Philosophy of John Locke - New Perspectives - Routledge, 2003Gabriel Viana SilveiraNo ratings yet

- A Brief Look On Gaussian Integrals Quantum Field Theory William O. StraubDocument8 pagesA Brief Look On Gaussian Integrals Quantum Field Theory William O. StraubMartinAlfonsNo ratings yet

- Los Angeles v. Preferred Communications, Inc., 476 U.S. 488 (1986)Document7 pagesLos Angeles v. Preferred Communications, Inc., 476 U.S. 488 (1986)Scribd Government DocsNo ratings yet