Professional Documents

Culture Documents

Iffii - : Ifltfiffiffi$uffiffiililt

Uploaded by

Jessie SanchezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Iffii - : Ifltfiffiffi$uffiffiililt

Uploaded by

Jessie SanchezCopyright:

Available Formats

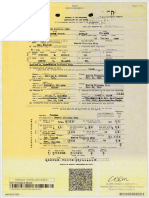

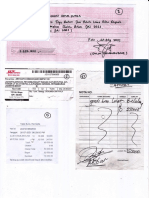

Blll BCS/

!te*1

,t Republic 0f the Phitippines

Oepartffent of Finance

gures.i ot lnle.nal Revenue

BIR Ftrm NE. Annual I ncome Tax Return

1701 lndividuals {including MIXED lncome Earner),

January 2018 {ENCS)

Prge I

Estates and Trusts

Ente. all .equired inlormation t! CAFI IAL LETTERS usicg BLt{CK ink- ilrart( all appii.abie

bcxfi

Ifltfiffiffi$uffiffiililt 1"01 0.1I8ErutrS F1

"x' IT,lUST the

I FortheY%r(yyyy) IEQiE.* 2 Arrended Retxm? fYs 6lto Shsd PtritrC Reiun? fys 6No

PART I BACKGROUND INFORMATION OF TAXPAYER/F'LER

Taxpayer ldentiimlion Number (Tllj)

ffi* S55-* iffii-- Fs5"-- ROO Code

!ffi8

Taxsayef Type 1', Sinsie Pr@ridar Proiesioai f g*"1e f rrusa f cer*spatla Eama

Alphanum€ric Tax Code {ATCJ # |rc1-: Br"i** ir**scrddurkd lT Rdt€s f &@ fr* profEslon-GrsdEstsd tr Rab6 f

,is=r4

mrg ukrd tn*G$dBrd lTts6b6

f tlgt 1 comps{aa{@ lrrgg f' :6fs gre;rw tnma*y. ff n* f' qfiz blcre ir@ Frofu*e-e* lT ftrts f *fi6 tfxed tllffiB8% i? Rds

I Taxpayei$ liame {Last Nanie, Firsl Narne, triddte Namei,€STATF

OF iFirst !{aine. tJiidle Name, Last Name)ffRUST

{F;rsi Name, Middte }Iame. Lasl Name)

=AO:

, JESSEL,

g Rsgisis.ed Addrss ad{,.E ftkqM

irrdi.ai+ L:ohrdei, dls kCflERttsl+iri]Ma{fu. $eROae*pddc.AtsM

Sa{o ae*h}i *!rS 6lR Fflnt &c 1s5l

?47-c ST SFDI/| CiTY

9A :lP code

liios--

0 0ate ol Birth ifi,{tull0$i}1 fy) 'l Enail . rdress

t'l

:

1 2 citi:enstrip

13 Clain*agFd€€tgnT4SreS6? 14 Foeign T;r fOrrnb$. if applisble

lFrLtPtNo f yes {X No

1 5 Conlact Number tlandtineicethhone Ns,)

{6 ci'/i! s*nJs (;i aFplicrbie}

14531s81 Single , Manied a'LegallySeparated . Widoder

t 7 l{ maried, spcuse has income'l f ,8 slaks {^

Yes No F,liins Jainr F'ilinc f sepamts Filing

g incrrne EX€ldPT frln lncctre ia:a,> fiyo 6 as ?0 !ri41e ftbieri i. *pEclAt_iF*s.ggREHTtAL RATE? f yes {t ruo

8f y6s, fill out also eolislidalis* ol ALL aclivities p€r Tex Rcg'me {Pa't X}j

llf yte, fill oul alss mnsrlida{ion cf Aj-L astiY;tite FB. Tar Rsgime {pert Xll

t1A tfe*roU ct *eductiffi i6ho6se cne,:

I GBduated Rat€s

2{ Tax Rate' (Cfloose Methsd of Deductlo. in iteh 2lA) ' ltemi:ed Deduction : Cpriorral Standard Deddctjon iOSDi

(choose one) 140% ai Gross iSec,

' A% ifl iieu of Graduat3d Rates under Sec. 24{A} & p€rcentage Tax under Sec. 1 1 6 of NIRC

iavailable if gre s;aiesirsr"iFts ard olher non{FeBling incorne dc nol ex.*d itr# reillioa p*se {F31,{}i

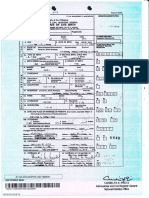

PART N . TAX PAYABLE It" 43 Cenlavos il Lss

Pafiicular A, B.

Due (Fronr Part Vl liem 5) 205,16?-00 0.oo

Less; Total Tax Creditslpayments iFroft part Vll i(etr 10]

158.753.*0 0.00

Tax Payablel(Overpayme.rt) iltErr A2 le* !ter :.3)

6,414,il0 0.00

Lessi Pafiion af iax Payab{e Allsre.d ,or 2ft6 lrstallfr*nl io be piid cr cr betore

October 1 5 (5C% or less of ltem 22) 0.00 0.00

{k"m ?4 L6s ,tem 25) s,414.00 0,00

Add: Peralties 27 lnterest

0.00

28 Surchsrge 0.00 0.00

29 compromise

0.00

Total Penallies isuFt of ltffis ?7 t+ ?g)

3.| Total AHoqnt Payabl€{$rerpa}B€Bt} {Sun af !teF$ :6 6Dd '}0} 6,414-00

1 i 0,00

Aggregate Amaunt Payalrlei(Oyerpayfrent) i$Lnr of ttem! 26 and 30] 6,414.00

li overpayftert. mark one r.lJ box o.ly_ {Once tle lh+ice is made. fre same is irre.seable)

' .

To be retunded To be issued a Tax Cieciif Cet.iifiste fICC) Ic hre carried over as a lax crecjil ior next y€ar./quader

perjury

ate

and aolrect, It the Frevisions of the i{aiienai lrrternal as amended, there.F" my to

procs5$ing informati6h as undsr the "Bata {R.A. No. o1 73) and (tf sigDed by

M 33 :"luroer o1 Ahacnme{s 00

A

FART III - DETAILS OF PAYI'ENT

P6rtieula16

34 CashlBanir Oebrt lVemo

35 ctect

35 lax Oebit r..,teno

3? otnes belowJ

Iiaehihe vaiidalionlRevenue o{$cial Receipt Detalls ill not tle{l wtrh an Au&orized Aqdrt Bark} Stamp ot Heceruflg OfiicetAAB end ilale of Receipt

(8.O's Sig*alureJBank T€litr's Iriijail

iOTE: 'The BIR Dala Pn'vacv Fr

BiR Form No.

1701 Annual Income Tax Return

ianuary 2018 (ENCSi lndividuals {including MIXED lncome Earner},

Page 2 Estates and Trusts ,

lIOJ PT

'1JlEE'.J[.S

PART I\I - lnfsrmation of

I Spause3 Ta:payer ldBnlification Number filNi

2 RDO Code

,

3 FiterhspouseType (* f **-T"1,1:.'

singleFmprietor f cmgelsatim..*"1..-.

. .

Aiphanumeric Tax code {ATC} f not: B*in* t *Fc.€dus@d r Rscs f fi&4leElmFdd#GrsdudedtTRa* f nrlsu*"au*GB6H€dtTR#

f tBtt compwtion tnmme f larss*in***dti fiqrte f llo1TrrmrekdnProtssihsliffRsk .* Xu6Mitedhffie{16rRd1e

5 Spouse's Name flasl Narne, Frs, I&rre Middle ttame)

6 Contact Number

7 Citizenship i

I Ctaiming Foreian Tax Credits? yes No g Foreign tax numb et iil apptHbte)

10 Income EXEItiiPT from lnGome Tax? i yes No 1 1 tnmnre sutrjec't 1o SPECIALIPREFEEEHTIAL iATE? yes , No

flf yes' fill out also cssolidation of ALL activities per Tax Regime {Fart x)l (lt yes, till out also consolidati6 sf ALL activities per Tax Regime (part x}t

1 2A Merhod ql ileduction idroose 6ne)

Graduated Rates

1 2 Tax Rale. (Choose i!.lethod ot Dedu6t;oD in ltetr : l A) ltemEed Deduction Optional Standa(, Deductron {OSD)

ir}loose onei l$ec. 34(A-J). t{tRcl l,l0% cf G.ffi Sales/'iecdpts/*eeenues,/Fees JSer. 34iL), Nti{cjl

' 8ti

in lisu of Gredlaled fiates under $ec. 24(A) & Percenrale Tax under Sec. .i

16 of tilRC

Iayailable if gross salesr'receipts and lriler nBn-sperating inadms do nor erceed lhree miilion pesos (P3Mil

PART V. of Tax

Gross tompensatiotr lnrcl*s and tax Withheld

iAitaEh A'Jditioitaf Sllesa/s, iiff€ssaryJ

Items ard 2, enter the required lnformalion fsr Eslch of

!rur eniDloyels and nra* {n wether the ,ntDrmation for the Taxpayer or lhe SpEuSe. On Item 34, enter the

Gross and Totai t3x l4/rlhheld for lhe and cn liem for tlE t{6T 6ek € 5' uP)

a-bJafie of €mplcyer

a

r TaxFayer

Sp0use

:.**

b. Emptcyertrru

I f- f*

Taxpaya I

?

Spousa

I

({;ontinuation al Tabla Ahove}

, h.EmproyersrrN i I I I

.' -

,t

i.cqlplrg4*t i11ffi'.,_ : ,--."1._' :-- -, _ -, _ri.

iar ty'rhh.il*

s.00 0.00

0.00 0.00

Cross Ccrocnsatlon lncome a.d Totar Tax !^,lith,re;d ,ot

tA

*' ' nnn

TAXPAYER (To Fart V Schedr/e Z ltern 1A End part Vll lta,ne SAI 0.o0 U. UU

2E Gross CcnD:nsaticn lrcome and 1 otar Tax llitlrne.d lcr

*" SPOUSE {To PartV Sohedule Z ltem 48 and padVll lteme 58) c.00 f-** s.oo

2 . Taxable Compensation lncome

fDO HOT eilter Cenbvd6; ,tS Cenbvos or l*s dmp dowl 5t rr mdre

particula.s A B. Spouse

Gross Corngensation income {From part yscfie#ille 1 ltem 3ALigBti

Lass: NorTsffillie i

6 Trrab;e Ccnpensation

Exsrnpt Compens3t$fl

lncorne iltem 4 Less llem S!

0.00

nnn

0.00

r

r*

0.&0

0.00

0.00

7 Tax Due-eompensation lncome ilfen 6 x alttiimble lncame Tax Ra!e) 0.00 0.00

3 - T*xablB Braslit€ss al'csflre r*fes, frl rn ,feF6s t lo ff ,f* ffat tn &re tax r*fe, frrrn rfsms fS &

3.A - For Tax Rates

$ Sales/revenues/receiplElFees

f-*-iE37{ffiB.oo'

9

1

Less: Sales Retums, AllowanceB and

S Net SalesrReveffueslRsceiptsiFoes ftten I issi- ll€tr

Discilnts

g)

18,323.368.0C

0.00 r

f---*offi

0,00

0.00

1 1 Les: Cost of Saleslservices (appliczbie only if av"iling ltemized Deductians) tl,+so,osz.oo r****---6"ffi'

1 2 Gross lncomel(Los6) from Operation $teil 1O tess tten i1)

l-essr Ded!crofrs Altowaitle ur!der Existing Laws

f"** 6^BfuT?30 I 0.00

3 Ordinary A.ilowable tiemized Deductions (Frcm parl L/ SchedrJa 4

1

Special Allowable ltearized Deductiorls {Fren pai

lten lEj 5,822,756.00 f*-**-*--***T3o

44

, nttowabte for Net Operating Loss Camy' Over (NOLCOi

V Srhedule S \tern 3 andfilr

parl V Sctreflrle 5

T 0.00 r*-*- o'ool

'e_* ltem il ar,d/or ltetr 13)

{From

0.00 0.00

1 S

"olal

Allorvable ltemi?€d Dedrctiofl* (Si$fr ct tiitns 13 ia ti) 5,822.756.00 r

) 0.00

OR

1 ? Optionat Standard Deduction {ASDi i40% af tten 1E} 0.00 0.00

Ner lncome/LLost\ tll hemized: Ilen 1 2 Le6 ttafr iSt LlztA /rem ,n Less ltem

,sR t4

1

1,050.556.00

Add: Orhei Non-Operalihg lncotre (specf, bctad)

19 0.00 0.00

20 0.00 0.00

I

3,t

2?

Anrouni Receiyedlshtsre

- ' Pannechrp (cPPr

Torel Other Non.Op€rating lnc0rr€

in lnccme by ts

isrm ol

Par$rer from Ganeral professionel

fi.e ils lg ra 21]

0.o0

0.00

rr

I

0.00

0.00

Taxable lncomeBusiness (SrJr7 oflie,ns ?8 ird 221 I 556. 0.00

Total Taxable lncome - Compeasstion & Eusiaes lSam of lle ms 6 and 23) 1,050,556.00 0"00

rq Total Tax Due{omperction and Busines lncome {urdet,fnduated fttei.t 20S,162.00

" ,lrcr 14 v dDpucable lncomp ax Ratel ( lo Pafi \'l lteilt 1)

I LOO

BIR Form Na.

17A1 Annual lncome Tax Return

January 2018 (ENCS)

Individuals (including MIXED Income Earner!,

Page s Estates and Trusts J

N

I OY

3-B - For 8% FIat Income Tax Rate

lrloT rnter CertryG: ,19 Cstavos or l6s dmp down; 50 ot moE round

ParticulaE A. TaxpayerlFiler g. Spouse

26 Sales/ReverrueslReceipts/Fees fnel ofsa/es returns, allawances

Add: Oilier Non,OFcr6tiRg lncorne (spefjr|y betowl

and di€counfs)

I o.oo 0.00

27

0.00 0.00

28 Totai lncome /Sum of ftems 26 and 2Z)

re

0.00 0.00

29

Less; Allowable reduction from gross sales/ffieipls anc othel arcn-nparaling

ircrfie

of purely self-employed indirrduis ,ra;or proiuiJoi.i",, iir" r*ornt or pzss.000 **

30

31

{n6l appliC3bie i{ with canrpensation incemei

Taxable lnconre{Losi {ttem 28 Less ltem 2g)

Tax Due-Busin€ss lncome (ltem S0 xBr; Flat lncome

-fax

Rate)

re 0.oo {

o.So

0.00

0.00

Total Tax Due-Compen$ation & Business lncome (under flat ratexsum of ltems

7 and 31) (To Part Vl ltem I i 0.00 n Aa

u urj

ule4-

re

Allovyable ltemized Deductions {attach additiona! sheet/s. if

1 Amortizations

0.00

2 uao LJebts

I 0.00 0.00

3 Charilable 3nd Other Contributions

0.00 0.0c

4 Depleticn

0.00 0.00

5 Depreciation

f-*ts,ffi.'o"o

6 Enlertainnlent. Amusement and Reaeation

Fringe Eeneiits

re 0.00

i

0.00

0.00

0.00

lnterest

0.00 , 0,00

Losses

o.o0 o.00

1 0 Perisicn Trusts

****

o.o0 0.00

11 Rental

0.00 0.00

12 Research and Development

0.00 000

13 SataAes, Wages and Allowances

1 0.00

"3s4^s1oso

14 SSS, GSIS, Philheatrh, HDMF and Other Conrriburions

0.00 0.00

1 5 Tares and Licenses

-

244,17,1-tA 0.00

1 6 Transportation and Trave!

i*******?TsFs?.oo 0.00

7 Others (Deductions Subject to Withholding Tax and Other Expenses) ispecrfi trelow: Add addilrbnal sheeffsj, if necasaryl

a Janitorial and ltlessengarial Seruices

0.00 0.00

b Proiessional Fees

0.00 i

C Secunly Serviaes

0.00 i 0.00

d ICATION, LIGHT, WA R, OFFICE SU 0-00

t S I:lir?,:,1?#HY3i," itemized Deductions fsurn cr fienrs 1 to 17d) (ra part v

5,822,755.00 0.00

ule5- Allowable ltemized Beductions adddrbnai sheel/s-,

rffi

rl

2

ljE-Ig:rrv-"rtliiFl .- _?sff-qli.?n

re Legal Basis

0.00

I Amount

0.00

0,00

3 Tola! Special Allcwable ltemized Deduclions-Taxpayer/Fller (Sum cf lletns , and 2) (Tt par! V SchedLte 3.A ltetn 144) 0.00

5.B - Spouse

4r %

J 0.00 0.00

5 0.00

6 Total speciai Aliowable itemized Deductroars-SFarise tsum of ltems 4 and 5) {To part V Schetjule 3.A }tam 148}

.****----TIo 0.0G

6- of Het Loss Over

6"A " CoraputaUon ol NOLCO

Iles*iptiotr A. Taxpayer/Filer B. Spouse

1 Gross lncon,'e 0.00 0.00

Less; Ordinary Ailov/able ltemized Deductions

0.00 0.00

q Net Operating Loss lllern 1 lsss li€in ?) iTc Scheduie 6.A.1 ttem 7A atldlar

u $cheCale 6.A.2 ltetn 1?A) 0.00 :

0.00

6.A"1 - TaxpeysrlFileros Deteiled Computation of Available NOLC0

Net operatinq i.gss E- Net Operating Lcss

B. NOLCO Appiiead D. NOLCO Appliead

C. NOLCO Expired

Year lncured A. Amount Previous Yearis Cunent Yeaf

(Unappiied)

I{e=A-(8+c}D,

4 0.00 l 0.00, 0.00i r*

0.00 0.00

5l 0,00 '

0.00 0"00 ' 0.00 0"00

E fi.00 t|=LJrl 0^00 0.00 0.00

I

BtrR Forrn Ne.

17A1 Annual Income Tax Return

January 2018 {ENCS)

lndividuals {including MIXED lncome Earner},

Page 4 Estates and Trusts ilr

i I01 flaEtJ*s F4

DOY

ofSctedule

5.A.2 - Spouse's Detailed Computation of Available

NOLCO

Net Operating Loss

B. NOLCO Appliead

Applieac E Net operating Loss

Year lncuned Previous yearls c. NoLCo Expired D' NoLCo

veir

r*

A. Amount

cunenr

09 *- t,.lY;7r1,81t,r

10

0.00 0.00 ili'il f-***-*6.0r T*****--Tril

0.00 0.00 i 0.00 o.bo 0.00

1{ 0.00 0.o0 l- o.bd 0.00 f-*0ffi

12 0.00 l 0.00 l

0.00 0.00 0.00

1 3 Total NOLCO - Spouse (SLm af ltens gD ro 12D)(Io part y

Srhedu te 3.A ltf;rrl 158)

PART VI - Summary of lncome Tax Due

f-*- o.oo'

1 Regular Rate-tn6ome Tax Due (From part V, Either ltem 25

:'- "

re

ar ttem SZ) 205,167.00 b.OO

2 Special Rate-lncome Tax Due fFrom partx ttem 178/1TF)

0.00

3 Less: Shar6 oi ether Govemment Ag€ncy,

d Net Sp*cial Raie-income Tax Due/Share of National Govt.

if renilied directly to lha Agetliy 0.00 I o.oo

2

rere

frrefi Less ltem J)

0.00 0.00

$ Total lncome Tax Due /Io pai l! ltem 22)

PART Vlt. Tac

1 Frior Year's Excess Credits

0.00 0.00

2 Tax Payments for the Firet Three (3) euarlers

17,284.00 0.00

3 Creditahle Tax Withheld for the First Th.ee (3) euartes

73,728.8Q 0.00

4 Creditable Tax Withheld per BtR Form No. 2307 for the 4th euaner

| 107.741.00 000

5 Tax yurthhetd per BIR Fontr No. 2316

-C.rgdllafle iFtom pai V SDhe{iute I it,m

" sAdtSBd) 0.00 000

6 Tax Paid in Return Previously Filed, if this is an Amended Retsrrr

Foreign Tax Credits, ilapplrcabie

I o.oo 0.00

| 0.00 0.00

B Special Tax Credits, it applicable (To paft Vilf ftem E)

U

^

I0

Other Tax CrBdits/Paymenhs (specity)

|

Tota! Tax CreditslFayments (Surn ofcerns

..'.@

I to g] {Ta part tt $em ZJ)

0.00

0.00

198,753.00

re 0.00

0,00

PART VIII - Tax Relief Ayailmen!

- Spacial Rate

1' reoulat

lncome Tax Orherwise Due ipad X ttefi 168 andlor tten

,TSSIITulcome tax

rcte)

Tax R*ilef on special Allowable ltemized Deduction*

X applit 4ble regulat income lax rcie )

{part

16F

x ltalr}lg and/ol

X applicabie

lter{t lF

re 0.00

0.00

0.00

SuU-f+tat - Tax Retiet (Sunt of ttems

re

l3 1 and 2)

0.00 0.00

l{ Less: lncorne T ax Due (From part X ftem 1 lB anilor ltem 1 7F)

0.00

5 Tax Relief Availment Before Special Tax Credit frtem tess ltern 4i

'3 0,00 0.00

6 AdC: Special Tax Cred(, if any (Fro,,t patt Vil ltem B)

0.00 0.00

7 Total Tax Relief Availment-SpECIAL iSum of ltems S arxl 6)

0.00 ,00

re

Vlll"8 - Exempt

g

-

g

tncorne Tax Othsnilrse Due ipartX#em 16A anrl/or lten 158 X applicable

-!99,u,.t31tncome

reqular

-Tax_Reiref

tax ralel,

on.Speoal Allowable ltemized Ded$ctlo rE (pad X ftemZA and/or llenr

re re

re

| tr appilcaote regular income lay rate )

^ 0.00

{ 0 Totat Tax Ref ief Avaiiment-EXEMpT (sun of ltens

PART lX - Reconciliation of Net tncome

I and g}

Books Taxafole lncome additlonal

r

if

0.00

Particulars A" TaxpayerlFil*r B. Spouse

1 Net inc.me/(Loss) per Books

0.00

re

ACC; Nofl-Deduciible Expenses,Taxable Other lncome

2i

3

re re

4,

$ total lsum a! ltetns 1 and 4)

re 1,050,557.00

I 0.oo

0.00

0.00

Less: A) Non"Taxable lncome and lnmme Subjected to FinalTax

6l 0.00 0.oo

7tr 0.00 0.00

Ei $peciat,'Otit€r Allowabls Deduclicns

o

U

0.00 0.00

b.oo t1.00

1 O Total fsum o, ,iems 5 lo g|

0,0s 0.00

You might also like

- EU RegiDocument1 pageEU RegiAcbcb BoardNo ratings yet

- Hafiz AkbarDocument7 pagesHafiz AkbarLosta NataNo ratings yet

- 0605 BIR FormDocument1 page0605 BIR FormVertex Projects Manila Inc.No ratings yet

- (Oa : t0tlrl ?GL ?ep1sf, T F (RTCR Lty't l?0l1 6f: Frled Il6Document2 pages(Oa : t0tlrl ?GL ?ep1sf, T F (RTCR Lty't l?0l1 6f: Frled Il6jesusdelolmosorrocheNo ratings yet

- 7e6 - Mesin Bending PipeDocument2 pages7e6 - Mesin Bending PipeReza AuliyaNo ratings yet

- Legalities 1Document19 pagesLegalities 1MaiNe KEhNo ratings yet

- Sio Dan SiloDocument10 pagesSio Dan Silosafety pt pcsNo ratings yet

- Su ..,T T'.T H: F L/RF HiDocument1 pageSu ..,T T'.T H: F L/RF HiJefry AjaNo ratings yet

- Hlittl6Rn: LtsmhanrsDocument2 pagesHlittl6Rn: LtsmhanrsLab BolesaNo ratings yet

- RMC No 61 2016Document6 pagesRMC No 61 2016miron68No ratings yet

- L.em, M R #&ffic I:: Snri.n:ffirr Ffsn$iflfi (O&Document2 pagesL.em, M R #&ffic I:: Snri.n:ffirr Ffsn$iflfi (O&Mhiel Salonga LptNo ratings yet

- Alat Longsoran 1 Dan 2Document22 pagesAlat Longsoran 1 Dan 2Iwan Iqo UANo ratings yet

- Belarmino, Jeremeh S.Document15 pagesBelarmino, Jeremeh S.Ramy AbdallaNo ratings yet

- Keysys Inc Si#0126Document4 pagesKeysys Inc Si#0126JM SantosNo ratings yet

- Aprikt&Ffig - Flores: Vla 15 October F (EetingDocument2 pagesAprikt&Ffig - Flores: Vla 15 October F (EetingRenz Christopher TangcaNo ratings yet

- Img 20201227 0002Document1 pageImg 20201227 0002Akansha PrasadNo ratings yet

- Fp#Esi$: $ufi (BHH Fraya Ii (&SR Peraf (Gi (,at SardDocument1 pageFp#Esi$: $ufi (BHH Fraya Ii (&SR Peraf (Gi (,at SardMuhammad Fikri Hidayat FikriNo ratings yet

- .TRR Eegeur (T: AreountDocument1 page.TRR Eegeur (T: Areountjha.sofcon5941No ratings yet

- Img 20220713 0002Document1 pageImg 20220713 0002Aliefz KurniawanzNo ratings yet

- MoolDocument1 pageMoolkrishna emitraNo ratings yet

- Mahesh RaiDocument11 pagesMahesh RaiSandip KumarNo ratings yet

- CLL - 4 - Cr. .Ffi,#hi"t: G T) T'TDocument9 pagesCLL - 4 - Cr. .Ffi,#hi"t: G T) T'TDarwin SolanoyNo ratings yet

- W Tfu Ffi T: Sb6Qttq (Rerrfrdgirrfr FrrfiDocument1 pageW Tfu Ffi T: Sb6Qttq (Rerrfrdgirrfr FrrfiAK TRIPATHINo ratings yet

- Mar PsaDocument2 pagesMar PsaMar CorpuzNo ratings yet

- SlybusDocument4 pagesSlybusNasim UddinNo ratings yet

- FFFL QRFTL: T-Fi - T.-RrtffiDocument4 pagesFFFL QRFTL: T-Fi - T.-RrtffiPawan Kumar RaiNo ratings yet

- Formulir Izin Kerja (FIK)Document2 pagesFormulir Izin Kerja (FIK)Rony HchNo ratings yet

- 2010 06 04 - DR 1Document1 page2010 06 04 - DR 1Zach EdwardsNo ratings yet

- 055 Po MKM - Homkm 03 2021Document1 page055 Po MKM - Homkm 03 2021Ahmad SyukriNo ratings yet

- Physicatr" Corytrple.?' H Repcirt: FSRFT (-1?9Document2 pagesPhysicatr" Corytrple.?' H Repcirt: FSRFT (-1?9Ganesh SawantNo ratings yet

- Essay CollectionDocument2 pagesEssay Collectionislamiclife639No ratings yet

- Img 20221212 0002Document7 pagesImg 20221212 0002Rohit KumarNo ratings yet

- Page 1Document1 pagePage 1SUSHMA GOWDANo ratings yet

- 4 Tender Document NH58 E FlyoverDocument296 pages4 Tender Document NH58 E FlyoverShri Laxmilal PatelNo ratings yet

- Img 20180626 0001Document1 pageImg 20180626 0001Nathaniel Gutierez MangubatNo ratings yet

- COR (Niño - 1W) PDFDocument1 pageCOR (Niño - 1W) PDFNiño T IracNo ratings yet

- MT 654 MTB 654 PDFDocument2 pagesMT 654 MTB 654 PDFEnrique Lara QuinteroNo ratings yet

- 911 Taxpayer AssistanceDocument1 page911 Taxpayer Assistanceapi-3826089No ratings yet

- STR R", ,:I/ Lli (.,ra: Rffisr RXDocument3 pagesSTR R", ,:I/ Lli (.,ra: Rffisr RXAjay GuptaNo ratings yet

- Navoday Nidhi BankDocument3 pagesNavoday Nidhi BankRangnath DeshmukhNo ratings yet

- Saepudin ZohriDocument1 pageSaepudin ZohriRahayu AyuNo ratings yet

- ! - Ffi ( - LL Nr.."o !: K (TTC RDocument4 pages! - Ffi ( - LL Nr.."o !: K (TTC RYogesh YadavNo ratings yet

- Ffontssffr (R: Üate: Ûti. FR Forma InvüiceDocument1 pageFfontssffr (R: Üate: Ûti. FR Forma InvüiceCHIMIE SERVICENo ratings yet

- StrucEng 1 1 1 1 1Document28 pagesStrucEng 1 1 1 1 1aman3327No ratings yet

- Img 20230412 0001Document4 pagesImg 20230412 0001DIGITAL SEVANo ratings yet

- Zone 7 ServiceDocument1 pageZone 7 ServiceVishal BharleNo ratings yet

- Img 20230419 0001Document1 pageImg 20230419 0001April Thea VillaruzNo ratings yet

- Oleic Acid 75% (Pacific Oleo - Malaysia) 18.01.2023Document2 pagesOleic Acid 75% (Pacific Oleo - Malaysia) 18.01.2023anishNo ratings yet

- DM No. 130 S. 2020Document2 pagesDM No. 130 S. 2020oranisouthNo ratings yet

- Img 20131016 0001 NewDocument1 pageImg 20131016 0001 NewAnca MarcelaNo ratings yet

- Ad 202403Document10 pagesAd 202403Masudur RahmanNo ratings yet

- 1976 11Document132 pages1976 11Sandip JadhavNo ratings yet

- Scan Nota Juli GalihDocument5 pagesScan Nota Juli Galihariyanto wibowoNo ratings yet

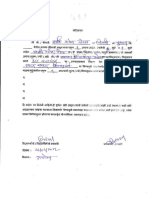

- Clarifications HindiDocument2 pagesClarifications HindiAmrish TrivediNo ratings yet

- ROHITDOMICILE CompressedDocument1 pageROHITDOMICILE CompressedDeepak VermaNo ratings yet

- NNNNDocument2 pagesNNNNHimanshu DasNo ratings yet

- QT$RR: RfiqsDocument1 pageQT$RR: RfiqsMD. NASIF HOSSAIN IMONNo ratings yet

- AffidaviteDocument1 pageAffidaviteVishal IngleNo ratings yet

- Listrik BayarDocument1 pageListrik BayarSeto SetoNo ratings yet

- Dsgsgsgs GHDHSDFDocument1 pageDsgsgsgs GHDHSDFJessie SanchezNo ratings yet

- Dsgsgsgs GHDHSDFDocument1 pageDsgsgsgs GHDHSDFJessie SanchezNo ratings yet

- Portfolio: Results-Based Performance Management System (RPMS)Document6 pagesPortfolio: Results-Based Performance Management System (RPMS)Jessie SanchezNo ratings yet

- The Power To Change The WorldDocument54 pagesThe Power To Change The Worldgeewai2009No ratings yet

- Ohm's Law Lab Experiment: Title: Piece de Resistance TheoryDocument3 pagesOhm's Law Lab Experiment: Title: Piece de Resistance TheoryJessie SanchezNo ratings yet

- Division Memorandum: Division of Lanao Del NorteDocument3 pagesDivision Memorandum: Division of Lanao Del NorteJessie SanchezNo ratings yet

- Science - 5 E Model - Simple CircuitsDocument3 pagesScience - 5 E Model - Simple CircuitsJessie SanchezNo ratings yet

- Matrix of Curriculum Standards (Competencies) With Corresponding Recommended Flexible Learning Delivery Mode and Materials Per Grading PeriodDocument11 pagesMatrix of Curriculum Standards (Competencies) With Corresponding Recommended Flexible Learning Delivery Mode and Materials Per Grading PeriodJessie SanchezNo ratings yet

- Lanao Del Norte Division Malingao Central Elementary SchoolDocument1 pageLanao Del Norte Division Malingao Central Elementary SchoolJessie SanchezNo ratings yet

- Competency Based Learning Material (SMAW-TM) : Instructional MaterialsDocument2 pagesCompetency Based Learning Material (SMAW-TM) : Instructional MaterialsJessie SanchezNo ratings yet

- Competency Based Learning Material (SMAW-TM) : Instructional MaterialsDocument2 pagesCompetency Based Learning Material (SMAW-TM) : Instructional MaterialsJessie SanchezNo ratings yet

- K To 12 Carpentry Learning ModulesDocument118 pagesK To 12 Carpentry Learning ModulesHari Ng Sablay100% (13)

- Learner Enrollment and Survey Form: Grade Level and School InformationDocument2 pagesLearner Enrollment and Survey Form: Grade Level and School Informationnicole marqueses93% (71)

- DETAILED LESSON PLAN in GRADE 7Document6 pagesDETAILED LESSON PLAN in GRADE 7Jessie Sanchez100% (6)

- Vinzons-Chato vs. Fortune Tobacco Corporation PDFDocument12 pagesVinzons-Chato vs. Fortune Tobacco Corporation PDFAnonymousNo ratings yet

- SG 2Document29 pagesSG 2creatine2No ratings yet

- City of Hamilton Cemeteries Business Plan Strateg - PW15075AppADocument26 pagesCity of Hamilton Cemeteries Business Plan Strateg - PW15075AppAThe Hamilton SpectatorNo ratings yet

- Offer: Computer Consultancy Ref: TCSL/DT20184254932/Chennai Date: 22/08/2018Document17 pagesOffer: Computer Consultancy Ref: TCSL/DT20184254932/Chennai Date: 22/08/2018shilpa100% (1)

- Hotel Industry Overview - August 2007 - Accounting PrinciplesDocument1 pageHotel Industry Overview - August 2007 - Accounting PrinciplesthihamynNo ratings yet

- Philippines, Plaintiff, Versus Quirico Ungab, Accused " and To RestrainDocument5 pagesPhilippines, Plaintiff, Versus Quirico Ungab, Accused " and To RestrainLeBron DurantNo ratings yet

- GST in India - An IntroductionDocument24 pagesGST in India - An IntroductionMehak KaushikkNo ratings yet

- 12 Jurisdiction Collector of CustomsDocument2 pages12 Jurisdiction Collector of CustomsHaRry PeregrinoNo ratings yet

- Court of Appeal of LyonDocument44 pagesCourt of Appeal of LyonWalktheWalkNo ratings yet

- Tds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary ComplianceDocument1 pageTds On Provison of Expenses (Tax Gls Open For Direct Manual Posting On 17.04.23 & 18.04.23 Only by Corporate Office) Urgent & Statuary ComplianceArvind Kumar GuptaNo ratings yet

- Validate Print HelpDocument2 pagesValidate Print HelpGaurav AgarwalNo ratings yet

- March BIR RulingsDocument13 pagesMarch BIR Rulingscarlee014No ratings yet

- General Powers and Attributes of Local Government UnitsDocument8 pagesGeneral Powers and Attributes of Local Government Unitsustfan100% (6)

- Nhai RFPDocument18 pagesNhai RFPdaobvpNo ratings yet

- MidTerm-Govt.-accounting-RAMOS, ROSEMARIE CDocument12 pagesMidTerm-Govt.-accounting-RAMOS, ROSEMARIE Cagentnic100% (1)

- CA Intermediate ABC Analysis and Marks Weightage Mentoring 1679573700Document6 pagesCA Intermediate ABC Analysis and Marks Weightage Mentoring 1679573700Anil ReddyNo ratings yet

- Financing Affordable Housing and Infrastructure in Cities Towards Innovative Land and Property TaxationDocument74 pagesFinancing Affordable Housing and Infrastructure in Cities Towards Innovative Land and Property TaxationNicola HumanNo ratings yet

- Conversation Phase QUESTIONSDocument21 pagesConversation Phase QUESTIONSIsabelNo ratings yet

- Ubl Swot & Pest AnalysisDocument6 pagesUbl Swot & Pest AnalysisChaudhry Salman WarraichNo ratings yet

- TextDocument15 pagesTextMerecia SmithNo ratings yet

- 693-Article Text-1187-2-10-20210911Document16 pages693-Article Text-1187-2-10-20210911FachrumNo ratings yet

- Gender Equality in Employment: The Experience of KazakhstanDocument16 pagesGender Equality in Employment: The Experience of KazakhstanShaheer KhawarNo ratings yet

- Proposed Marijuana Spacing Requirement OrdinanceDocument113 pagesProposed Marijuana Spacing Requirement OrdinanceMalachi BarrettNo ratings yet

- City of Rochester F22 Proposed Budget June 3 Version PDFDocument599 pagesCity of Rochester F22 Proposed Budget June 3 Version PDFNews 8 WROCNo ratings yet

- Amount Chargeable (In Words) E. & O.EDocument1 pageAmount Chargeable (In Words) E. & O.EManish JaiswalNo ratings yet

- VAT On Down-Payments - SAP BlogsDocument15 pagesVAT On Down-Payments - SAP BlogsraulNo ratings yet

- Magna Carta For Senior Citizens and PWDS: Declaration of Policies and ObjectivesDocument12 pagesMagna Carta For Senior Citizens and PWDS: Declaration of Policies and ObjectivesLumingNo ratings yet

- GHHHGDocument2 pagesGHHHGDiana ElenaNo ratings yet

- BEP Teh Daun KelorDocument3 pagesBEP Teh Daun KelorFabianov von JavaNo ratings yet

- RemediesDocument32 pagesRemediesrav danoNo ratings yet