Professional Documents

Culture Documents

Employee Share Ownership Plan: Your at A Glance

Uploaded by

Sami Shahid Al IslamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employee Share Ownership Plan: Your at A Glance

Uploaded by

Sami Shahid Al IslamCopyright:

Available Formats

February 2019

Your Employee Share Ownership Plan at a Glance

Scotiabank offers the Employee Share Ownership Plan (ESOP) to enable you

to share in the Bank’s success in a tangible way. Contributing to ESOP helps

you achieve personal short-term and long-term financial goals, such as saving

for a home or your retirement.

Why should you join ESOP?

Invest in the future of Scotiabank

By participating in ESOP, you have the opportunity to buy Scotiabank common shares through convenient biweekly

payroll deductions. Plus, you will have voting rights and receive the value of any dividends paid as additional shares.

Receive Scotiabank contributions to purchase shares

You can contribute up to 6% of eligible earnings to a maximum of $230 through each biweekly pay ($6,000 annually)

and receive a 60% Bank match. For example, for every $2 that you contribute, Scotiabank will contribute $1.20 on

your behalf, up to a maximum of $138 each biweekly pay or $3,600 annually.

Additional voluntary contributions

You can make additional voluntary contributions of up to 25% of your eligible earnings. These contributions

are held in a separate account from your regular contributions and are not matched by Scotiabank.

Save on purchase and sale costs

Scotiabank pays administration and purchase fees for ESOP, as well as certain transaction and brokerage fees

associated with the sale of shares in your regular and additional voluntary contribution accounts.

Receive favourable tax treatment

Depending on the accounts and plans in which you participate, you may defer tax. Read on to learn how and

when your contributions and Scotiabank’s matching contributions, plus any capital gains (and/or losses) and

dividends are taxed.

Track your investment easily

You can view your transaction history and plan holdings at any time through My Employee Share Ownership Plan

located in Pay and Benefits in me@scotiabank.

This at-a-glance overview describes the key features of ESOP. For more details, refer to Your Guide to Scotiabank’s

Employee Share Ownership Plan.

Employee Share Ownership Plan at a Glance 1

Employee Share Ownership Plan at a Glance

How does the Plan work?

Key components Employee Share Ownership Plan

Eligibility If you are a regular status employee, you may join ESOP after completing six months of continuous

employment with Scotiabank. Participation is voluntary.

Your contributions You can choose to contribute any whole percentage between 1% and 6% of your eligible earnings1

in after-tax dollars. Your maximum regular contribution is $230 each biweekly pay ($6,000 annually).

Scotiabank’s Scotiabank will match 60% of your regular contributions up to a maximum of $138 each biweekly pay

contributions ($3,600 annually).

Additional voluntary You may make additional voluntary contributions up to 25% (in whole percentages) of your eligible

contributions earnings, which are not matched by Scotiabank.

Contribution You may change your contribution level or voluntarily suspend your contributions at any time through

changes your online Shareworks account (only during Window Periods, if applicable to you).

NOTE: If you stop your regular contributions, Scotiabank’s matching contribution and any additional

voluntary contributions also stop.

Allocation options Your regular Scotiabank Your additional voluntary

contributions contributions contributions

• Regular Tax Account • Employee Profit Sharing Plan • Regular Tax Account

• Registered Retirement • Deferred Profit Sharing Plan • Registered Retirement

Savings Plan Savings Plan

• Tax-Free Savings Account • Tax-Free Savings Account

Investment Both your contributions and Scotiabank’s are used to buy Scotiabank common shares. Dividends on

shares will be paid in cash and automatically re-invested in additional shares (allocated to your accounts).

Vesting Shares purchased with your regular and additional voluntary contributions are vested immediately, which

means you own these shares right away.

Shares purchased with Scotiabank’s contributions are vested after two years of participation in ESOP.

There are special vesting rules that apply in the event of retirement, death or the termination of ESOP.

Withdrawals You may make withdrawals in shares or cash. If you withdraw shares purchased with your regular

contributions within the first two years of participation in ESOP:

• You must withdraw 100% of the shares purchased with your regular contributions; and

• You lose 100% of the shares purchased with Scotiabank’s matching contributions.

After two years of participation in ESOP, you may make withdrawals of any shares (purchased with

your regular contributions or Scotiabank’s match) without restriction.

Shares purchased with your additional voluntary contributions can be withdrawn at any time.

Transfers You may transfer shares between certain accounts within ESOP, though vesting rules and restrictions apply.

Fees Scotiabank pays the transaction and brokerage fees for the first two transactions in a calendar year of

either cash withdrawals (bulk sale only) or share withdrawals. You are responsible for transaction and

brokerage fees after the first two such transactions, and at all times for fees associated with real-time

sale transactions (including limit orders).

Leaving Scotiabank You must close your ESOP account within 180 days of the date you leave Scotiabank.

If you do not close your account by the deadline, your shares will be sold, taxes and fees will be withheld

and a cheque will be mailed to your home address Solium has on record.

Window Periods From time to time, there are “Window Periods” when affected ESOP participants are restricted from

trading Scotiabank shares. You are allowed to trade during Window Periods.

1

Eligible earnings include regular earnings and eligible commissions. They do not include overtime, bonuses and other incentives (unless the plan under

which such amounts are paid provides otherwise).

Employee Share Ownership Plan at a Glance 2

Employee Share Ownership Plan at a Glance

Allocation options for your contributions

Your contributions can be allocated to the Regular Tax Account (RTA), Registered Retirement Savings Plan (RSP)

or the Tax-Free Savings Account (TFSA) or a combination of all three. The tax treatment of contributions, dividends,

gains and losses varies by account as follows:

Regular Tax Registered Retirement Tax-Free Savings

Account (RTA) Savings Plan (RSP) Account (TFSA)

Account type Non-registered Registered Tax-free savings arrangement

Tax treatment Contributions are not Contributions are Contributions are not

of contributions tax-deductible—do not tax-deductible—lower tax-deductible—do not

lower your taxable income. your taxable income. lower your taxable income.

Contribution No contribution limits other than Contributions reduce your Contributions reduce your

limits plan limits. personal RRSP contribution room. personal TFSA contribution room.

Dividends Taxable. Dividends received are Not taxable. Tax is deferred as Not taxable.

included in taxable income. long as shares remain in a

registered plan.

Capital gains Realized on the sale or deemed Recognized on share withdrawals Not recognized for tax purposes.

and/or losses disposition of shares and reported and reported for tax purposes in

for tax purposes in the same year. the year of realization.

Withdrawals Not taxable. Taxable. Withdrawals are included Not taxable.

in taxable income in the year

shares are withdrawn and are

subject to withholding tax.

Before you decide where to allocate your contributions, please review your personal financial situation to ensure you

will not exceed your annual contribution limits. Visit the Canada Revenue Agency’s (CRA) website at www.cra-arc.gc.ca

for more information.

Your personal RRSP deduction limit is located on your annual tax Notice of Assessment. For your personal TFSA

contribution room information, you can use the following CRA services:

• My Account;

• My CRA; or

• Tax Information Phone Service (TIPS).

You can also contact the CRA to receive a TFSA Contribution Room Statement or you can contact your TFSA issuer(s)

to find out about your contributions.

Employee Share Ownership Plan at a Glance 3

Employee Share Ownership Plan at a Glance

Allocation options for Scotiabank’s contributions

If you were hired before January 1, 2016—and are eligible to participate in the defined benefit component of the

Scotiabank Pension Plan, Roynat Pension Plan or Scotia Capital Inc. Pension Plan and your benefits salary is $139,000

or less—you will have two options for allocating Scotiabank’s contributions: the Employee Profit Sharing Plan or the

Deferred Profit Sharing Plan.

If you were hired on or after January 1, 2016 and before May 1, 2018 and are eligible to participate in the hybrid

pension arrangement of the Scotiabank Pension Plan, Scotiabank’s contributions will go to the Employee Profit

Sharing Plan only. This ensures CRA limits for registered plans are not exceeded.

If you were hired on or after May 1, 2018—and are eligible to participate in the defined contribution component

of the Scotiabank Pension Plan and your benefits salary is $167,500 or less—you will have two options for allocating

Scotiabank’s contributions: the Employee Profit Sharing Plan or the Deferred Profit Sharing Plan.

Employee Profit Sharing Plan (EPSP) Deferred Profit Sharing Plan (DPSP)

Account type Non-registered Registered

Tax treatment Contributions are taxable in the year they are made. Tax is deferred on contributions as long as they

of contributions stay in the DPSP.

Contribution limits No contribution limits other than plan limits. Contributions result in a Pension Adjustment,

which reduces your personal RRSP contribution

room for the following year.

Dividends Taxable. While dividends are received by the EPSP, Not taxable. Tax is deferred as long as shares

they are treated for tax purposes as if you received remain in a registered plan.

them personally.

Capital gains Realized on the sale or deemed disposition of shares Recognized on share withdrawals.

and/or losses and reported for tax purposes in the same year.

Withdrawals Generally non-taxable; however, you will realize Taxable. Withdrawals are included in taxable income

capital gains and/or losses from sales or deemed in the year shares are withdrawn and are subject to

dispositions of shares occurring after withdrawal withholding tax.

from the EPSP. This must be reported for tax

purposes in the year of realization.

Your decision to participate should be based on your personal situation. Participation is voluntary. By participating,

you acknowledge and accept the risk that the value of shares will fluctuate based on stock market performance so

that shares purchased under ESOP, when sold, may be worth more or less than their original cost. Please consult a

professional financial advisor if you are unsure of whether or not to participate.

Employee Share Ownership Plan at a Glance 4

Employee Share Ownership Plan at a Glance

Resources

To find more detailed information about ESOP, go to Ask HR in me@scotiabank or refer to Your Guide to Scotiabank’s

Employee Share Ownership Plan through the ESOP Guide link in Pay and Benefits in me@scotiabank.

If you have questions about ESOP, go to Ask HR in me@scotiabank, select Contact HR and then Contact Us.

Or, contact Solium, the administrator of ESOP, through HR Services and follow the prompts to the Employee Share

Ownership Plan.

Phone: 1-888-888-8089

TTY Line: 1-877-726-8429

This at-a-glance is a summary only. While every effort has been made to convey accurate and detailed information, official plan documents will govern

in the event of any discrepancies or special situations.

Registered trademark of the Bank of Nova Scotia

®

Employee Share Ownership Plan at a Glance 5

You might also like

- Some Challenging Questions of The Midterm ExamDocument2 pagesSome Challenging Questions of The Midterm ExamSami Shahid Al IslamNo ratings yet

- Uniform System of Accounts For HotelsDocument13 pagesUniform System of Accounts For Hotelsmagnatama80% (5)

- Stone Container CorporationDocument11 pagesStone Container CorporationMeena100% (3)

- Sams BA Interview 6 - Pizzeria 20Document5 pagesSams BA Interview 6 - Pizzeria 20Sami Shahid Al IslamNo ratings yet

- Kahoot - SWOT AnalysisDocument3 pagesKahoot - SWOT AnalysisSami Shahid Al IslamNo ratings yet

- Tla ch02Document3 pagesTla ch02api-341661305No ratings yet

- Equipment Rental Business PlanDocument16 pagesEquipment Rental Business PlanAsrat Alemu100% (2)

- Futsal ProposalDocument31 pagesFutsal ProposalOjhal Rai100% (4)

- Invest Now or Temporarily Hold Cash ?Document8 pagesInvest Now or Temporarily Hold Cash ?vouzvouz7127100% (1)

- 79 12 UPL Stock PitchDocument21 pages79 12 UPL Stock PitchSanjay RathiNo ratings yet

- Introduction To The Instructor's Manual: Chapter 01 - Investments: Background and IssuesDocument12 pagesIntroduction To The Instructor's Manual: Chapter 01 - Investments: Background and IssueschoiNo ratings yet

- DividendsDocument16 pagesDividendsJc QuismundoNo ratings yet

- Assignment 1 - Tableau - VisualizationDocument2 pagesAssignment 1 - Tableau - VisualizationSami Shahid Al IslamNo ratings yet

- Career in FPDocument17 pagesCareer in FPbadarishaNo ratings yet

- Fcffsimpleginzu ITCDocument62 pagesFcffsimpleginzu ITCPravin AwalkondeNo ratings yet

- Test 10Document22 pagesTest 10Euxine Albis100% (2)

- 01 23 19 Catalina IM Catalina Entitlement Fund PDFDocument52 pages01 23 19 Catalina IM Catalina Entitlement Fund PDFDavid MendezNo ratings yet

- Financing Decisions 2Document12 pagesFinancing Decisions 2PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Budget DiscussionDocument4 pagesBudget DiscussionLester AgoncilloNo ratings yet

- Topic 2 - Money SkillsDocument17 pagesTopic 2 - Money SkillsNjeri Timothys100% (1)

- Beyond Crisis: The Financial Performance of India's Power SectorFrom EverandBeyond Crisis: The Financial Performance of India's Power SectorNo ratings yet

- Investment Decision and Portfolio Management (ACFN 632)Document23 pagesInvestment Decision and Portfolio Management (ACFN 632)Hussen AbdulkadirNo ratings yet

- Chapter 9Document33 pagesChapter 9Annalyn Molina0% (1)

- Chapter 2 Accounting For PartnershipsDocument102 pagesChapter 2 Accounting For PartnershipsVon Lloyd Ledesma Loren100% (1)

- Share ValuationDocument7 pagesShare ValuationroseNo ratings yet

- 5 Macroeconomics PDFDocument31 pages5 Macroeconomics PDFKing is KingNo ratings yet

- Learning Journal Unit 4 15-07-2021Document3 pagesLearning Journal Unit 4 15-07-2021Winnerton GeochiNo ratings yet

- Corporate Finance and Investment AnalysisDocument80 pagesCorporate Finance and Investment AnalysisCristina PopNo ratings yet

- Bond and Equity ValuationDocument18 pagesBond and Equity Valuationclassmate0% (1)

- Session 1. Business Analysis and ValuationDocument13 pagesSession 1. Business Analysis and ValuationJasdeep SinghNo ratings yet

- Embedded Derivatives in Host Contracts Under IAS 39Document170 pagesEmbedded Derivatives in Host Contracts Under IAS 39Anonymous JqimV1ENo ratings yet

- 1 - Project Selection I - V22Document81 pages1 - Project Selection I - V22Chiara Del PizzoNo ratings yet

- Fundamentals of Banking A Project ReportDocument45 pagesFundamentals of Banking A Project Reportaftabshaikh04No ratings yet

- Relationship Between Bonds Prices and Interest RatesDocument1 pageRelationship Between Bonds Prices and Interest RatesNikhil JoshiNo ratings yet

- Session 5 - Valuing Bonds and StocksDocument51 pagesSession 5 - Valuing Bonds and Stocksmaud balesNo ratings yet

- Bond AnalysisDocument45 pagesBond AnalysisAbhishekNo ratings yet

- Schwab Individual 401 (K) : BenefitsDocument4 pagesSchwab Individual 401 (K) : BenefitsJames StampNo ratings yet

- CH 17Document39 pagesCH 17IreneNo ratings yet

- ACC601Lecture 5Document33 pagesACC601Lecture 5Joe MajchrzakNo ratings yet

- 401K EnrollmentDocument18 pages401K EnrollmentKimberly HadadNo ratings yet

- Equity Assets - LiabilitiesDocument6 pagesEquity Assets - LiabilitiesAcca IsdcNo ratings yet

- (Regular vs. Special Dividend) What Are Dividends and How Do They Work - Feb 14, 2022the Motley FoolDocument5 pages(Regular vs. Special Dividend) What Are Dividends and How Do They Work - Feb 14, 2022the Motley FoolFiliph Castillo KarlssonNo ratings yet

- What Is An IRA? - RKB Accounting & Tax ServicesDocument6 pagesWhat Is An IRA? - RKB Accounting & Tax ServicesRKB AccountingNo ratings yet

- Dividend Policy 1Document56 pagesDividend Policy 1hardika jadavNo ratings yet

- Retained EarningsDocument39 pagesRetained EarningsPrincess Aubrey BalbinNo ratings yet

- Mod 5 Dividend Decisions Handout SNDocument7 pagesMod 5 Dividend Decisions Handout SNAkhilNo ratings yet

- Stocks: Tax Free Government BondsDocument4 pagesStocks: Tax Free Government BondsRavi SinghNo ratings yet

- Lesson 6 - Statement of Financial Position (Part 2)Document9 pagesLesson 6 - Statement of Financial Position (Part 2)yana jungNo ratings yet

- Advisorkhoj ICICI Prudential Mutual Fund ArticleDocument6 pagesAdvisorkhoj ICICI Prudential Mutual Fund ArticleBIJAY KRISHNA DASNo ratings yet

- Lecture 5 - Shareholder's Equity AccountingDocument33 pagesLecture 5 - Shareholder's Equity Accountingpeter kong100% (1)

- Chapter 08 FINDocument32 pagesChapter 08 FINUnoNo ratings yet

- NISM Series 5A Chapter 8Document12 pagesNISM Series 5A Chapter 8sachinaman.2016No ratings yet

- Vantage Key FeaturesDocument6 pagesVantage Key FeaturesAlviNo ratings yet

- Taxation in Mutual FundsDocument16 pagesTaxation in Mutual Fundsvineetb553No ratings yet

- How To Save TaxDocument3 pagesHow To Save TaxVinu k mariaNo ratings yet

- Ceesay Exp19 Word Ch04 CapAssessment RetirementDocument10 pagesCeesay Exp19 Word Ch04 CapAssessment RetirementcsaysalifuNo ratings yet

- Chapter 6 - DeductionsDocument86 pagesChapter 6 - DeductionsRyan YangNo ratings yet

- Integrated Communication PlanDocument37 pagesIntegrated Communication PlanAnuruddha RajasuriyaNo ratings yet

- Lending Club Retirement GuideDocument8 pagesLending Club Retirement Guidecera66No ratings yet

- SW - Summary of Terms and ConditionsDocument2 pagesSW - Summary of Terms and Conditionsvf9jkh4wwfNo ratings yet

- Dividend Policy - 072 - MBS - 1st - Year PDFDocument5 pagesDividend Policy - 072 - MBS - 1st - Year PDFRasna ShakyaNo ratings yet

- Tax On Mutual FundsDocument7 pagesTax On Mutual FundsPramod KumarNo ratings yet

- Interest IncomeDocument4 pagesInterest Incomenikhil khajuriaNo ratings yet

- Types of Divedend PolicyDocument5 pagesTypes of Divedend PolicyPrajakta BhideNo ratings yet

- The Accounting Treatment of DividendsDocument5 pagesThe Accounting Treatment of DividendsVictor SantiagoNo ratings yet

- Capital GainDocument3 pagesCapital GainHarsh GadaNo ratings yet

- Shareholders EquityDocument25 pagesShareholders EquityJhoanna Mary PescasioNo ratings yet

- Deductions Under Section 80C For Investments in The Indian It Act 1961Document20 pagesDeductions Under Section 80C For Investments in The Indian It Act 1961saurav-maitra-3114No ratings yet

- Dividend: HistoryDocument20 pagesDividend: Historyanup bhattNo ratings yet

- A9 BUS 4064 Assignment - Personal Reflection V03Document5 pagesA9 BUS 4064 Assignment - Personal Reflection V03Sami Shahid Al IslamNo ratings yet

- IRPA AI HelpSystems Roadmap To RPA SuccessDocument7 pagesIRPA AI HelpSystems Roadmap To RPA SuccessSami Shahid Al IslamNo ratings yet

- ProcessDefinitionDocument TemplateDocument15 pagesProcessDefinitionDocument TemplateSami Shahid Al Islam100% (1)

- Invoice TemplateDocument1 pageInvoice TemplateSami Shahid Al IslamNo ratings yet

- I Individual Reflection (Instructions and Template) V01Document3 pagesI Individual Reflection (Instructions and Template) V01Sami Shahid Al IslamNo ratings yet

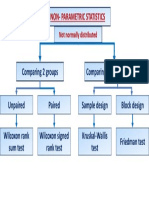

- Tests For Non-Parametric StatisticsDocument1 pageTests For Non-Parametric StatisticsSami Shahid Al IslamNo ratings yet

- University Programs Factsheet - EN PDFDocument3 pagesUniversity Programs Factsheet - EN PDFOmariNo ratings yet

- UiPath Hands-On - Class 3Document2 pagesUiPath Hands-On - Class 3Sami Shahid Al Islam0% (1)

- Scrum FoundationsDocument19 pagesScrum FoundationsSami Shahid Al IslamNo ratings yet

- Governance of Solar Mini-Grid: A Case Study of Shourobangla Solar-Diesel Hybrid Mini-Grid in Raipura, NarshingdiDocument16 pagesGovernance of Solar Mini-Grid: A Case Study of Shourobangla Solar-Diesel Hybrid Mini-Grid in Raipura, NarshingdiSami Shahid Al IslamNo ratings yet

- Vello Lae-Se-Nfv5 Auto Lens Adapter Lens Compatibility Information (Firmware Version 6)Document1 pageVello Lae-Se-Nfv5 Auto Lens Adapter Lens Compatibility Information (Firmware Version 6)James PoulsonNo ratings yet

- SyllabusDocument2 pagesSyllabusSami Shahid Al IslamNo ratings yet

- Prevalence of Solar Energy in Dhaka CityDocument19 pagesPrevalence of Solar Energy in Dhaka CitySami Shahid Al IslamNo ratings yet

- SOP Nirjhar Ruth GhoshDocument2 pagesSOP Nirjhar Ruth GhoshGazi MahfujNo ratings yet

- My Books 2017.CsvDocument787 pagesMy Books 2017.CsvSami Shahid Al Islam0% (2)

- Interesting Things About MeDocument7 pagesInteresting Things About MeSami Shahid Al IslamNo ratings yet

- Scarborough Finch Ave YMCA Centre CalendarDocument2 pagesScarborough Finch Ave YMCA Centre CalendarSami Shahid Al IslamNo ratings yet

- Presentation of Thesis ON Prevalence of Solar Energy in Dhaka CityDocument12 pagesPresentation of Thesis ON Prevalence of Solar Energy in Dhaka CitySami Shahid Al IslamNo ratings yet

- Shopping Guide CanadaDocument10 pagesShopping Guide CanadaSami Shahid Al IslamNo ratings yet

- Genigraphics Poster Template 36x48 TrifoldDocument1 pageGenigraphics Poster Template 36x48 TrifoldSami Shahid Al IslamNo ratings yet

- Date Faculty Members Alumni Students of Department of Economics Bkash Others Daily CollectionDocument1 pageDate Faculty Members Alumni Students of Department of Economics Bkash Others Daily CollectionSami Shahid Al IslamNo ratings yet

- Maladh: Detail/AddDocument12 pagesMaladh: Detail/AddSami Shahid Al IslamNo ratings yet

- GS IndiabixDocument393 pagesGS IndiabixজাবিরNo ratings yet

- Good Governance and Its Relationship To Democracy and Economic DevelopmentDocument27 pagesGood Governance and Its Relationship To Democracy and Economic DevelopmentJohnny BlanksNo ratings yet

- 33rd Bcs VivaDocument26 pages33rd Bcs VivaSami Shahid Al Islam100% (2)

- IFT Notes For Level I CFA Program: R24 Financial Analysis TechniquesDocument6 pagesIFT Notes For Level I CFA Program: R24 Financial Analysis TechniquesashwingrgNo ratings yet

- Analysis of Vodafone CaseDocument13 pagesAnalysis of Vodafone CaseRinni JainNo ratings yet

- Entrepreneurship: Summative Test inDocument3 pagesEntrepreneurship: Summative Test inMarife CulabaNo ratings yet

- Cambridge Assessment International Education: Accounting 9706/32 October/November 2017Document11 pagesCambridge Assessment International Education: Accounting 9706/32 October/November 2017Phiri Arah RachelNo ratings yet

- Fabm Week 1 Asnd 2Document5 pagesFabm Week 1 Asnd 2John Calvin GerolaoNo ratings yet

- Albemarle Benchmark Minerals Presentation Dec. 10 V - ApprovedDocument16 pagesAlbemarle Benchmark Minerals Presentation Dec. 10 V - ApprovedLuis Rolando SirpaNo ratings yet

- Tutorial Questions - Accounting Non-Profit OrganizationDocument3 pagesTutorial Questions - Accounting Non-Profit OrganizationMoriatyNo ratings yet

- Full download Solution Manual for South Western Federal Taxation 2021 Corporations Partnerships Estates and Trusts 44th Edition William a Raabe James c Young Annette Nellen William h Hoffman Jr David pdf full chapterDocument36 pagesFull download Solution Manual for South Western Federal Taxation 2021 Corporations Partnerships Estates and Trusts 44th Edition William a Raabe James c Young Annette Nellen William h Hoffman Jr David pdf full chaptermanywisegroschen3ppq100% (16)

- Adani Power LimitedDocument23 pagesAdani Power LimitedRakesh KNo ratings yet

- Summary of IAS 7Document5 pagesSummary of IAS 7Mae Gamit LaglivaNo ratings yet

- FORM-IIIBDocument3 pagesFORM-IIIBVivek PatilNo ratings yet

- Professional Ethics - , Accountancy For Lawyers and Bench-BarDocument27 pagesProfessional Ethics - , Accountancy For Lawyers and Bench-BarArpan Kamal100% (6)

- MS - 43 Solved AssignmentDocument13 pagesMS - 43 Solved AssignmentIGNOU ASSIGNMENTNo ratings yet

- Microsoft Assignment FRA Group 7Document5 pagesMicrosoft Assignment FRA Group 7Payal AgrawalNo ratings yet

- Annex B 2 RR 11 2018 PDFDocument1 pageAnnex B 2 RR 11 2018 PDFDnrxsNo ratings yet

- Module 2Document4 pagesModule 2Trúc LyNo ratings yet

- Budget 2021Document2,120 pagesBudget 2021Pawan Kumar100% (1)

- Cambridge IGCSE™: Accounting 0452/23 October/November 2020Document14 pagesCambridge IGCSE™: Accounting 0452/23 October/November 2020ATTIQ UR REHMANNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruArun VeeraniNo ratings yet

- ADVAC2Document64 pagesADVAC2Shenna Mae LibradaNo ratings yet

- AFFIDAIVTDocument2 pagesAFFIDAIVTEric EchonNo ratings yet

- IT Declaration Format-05-12-2023Document6 pagesIT Declaration Format-05-12-2023somaNo ratings yet

- The Corporation Code of The Philippines (Final)Document146 pagesThe Corporation Code of The Philippines (Final)SamJadeGadiane50% (2)

- Financial Reporting Paper 2.1Document24 pagesFinancial Reporting Paper 2.1abbeangedesireNo ratings yet

- Exercise Chapter 15Document39 pagesExercise Chapter 1521070286 Dương Thùy AnhNo ratings yet