Professional Documents

Culture Documents

Chapter 7. Student CH 07-15 Build A Model: Assets

Chapter 7. Student CH 07-15 Build A Model: Assets

Uploaded by

seth litchfieldOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 7. Student CH 07-15 Build A Model: Assets

Chapter 7. Student CH 07-15 Build A Model: Assets

Uploaded by

seth litchfieldCopyright:

Available Formats

2/1/2012

Chapter 7. Student Ch 07-15 Build a Model

a. Using the financial statements shown below, calculate net operating working capital, total net

operating capital, net operating profit after taxes, free cash flow, and return on invested capital for

the most recent year.

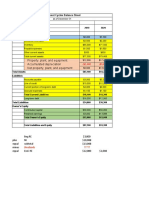

Lan & Chen Technologies: Income Statements for Year Ending December 31

(Thousands of Dollars) 2012 2011

Sales $945,000 $900,000

Expenses excluding depreciation and amortization 812,700 774,000

EBITDA $132,300 $126,000

Depreciation and amortization 33,100 31,500

EBIT $99,200 $94,500

Interest Expense 10,470 8,600

EBT $88,730 $85,900

Taxes (40%) 35,492 34,360

Net income $53,238 $51,540

Common dividends $43,300 $41,230

Addition to retained earnings $9,938 $10,310

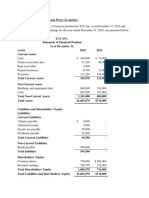

Lan & Chen Technologies: December 31 Balance Sheets

(Thousands of Dollars)

Assets 2012 2011

Cash and cash equivalents $47,250 $45,000

Short-term investments 3,800 3,600

Accounts Receivable 283,500 270,000

Inventories 141,750 135,000

Total current assets $476,300 $453,600

Net fixed assets 330,750 315,000

Total assets $807,050 $768,600

Liabilities and equity

Accounts payable $94,500 $90,000

Accruals 47,250 45,000

Notes payable 26,262 9,000

Total current liabilities $168,012 $144,000

Long-term debt 94,500 90,000

Total liabilities $262,512 $234,000

Common stock 444,600 444,600

Retained Earnings 99,938 90,000

Total common equity $544,538 $534,600

Total liabilities and equity $807,050 $768,600

Key Input Data

Tax rate 40%

Net operating working capital

Operating Operating

2012 NOWC = current assets - current liabilities

2012 NOWC = $472,500 - $141,750

2012 NOWC = $330,750

Operating Operating

2011 NOWC = current assets - current liabilities

2011 NOWC = $450,000 - $135,000

2011 NOWC = $315,000

Total net operating capital

2012 TOC = NOWC + Fixed assets

2012 TOC = $330,750 + $330,750

2012 TOC = $661,500

2011 TOC = NOWC + Fixed assets

2011 TOC = $315,000 + $315,000

2011 TOC = $630,000

Investment in total net operating capital

2012 2011

2012 Inv. In TOC = TOC - TOC

2012 Inv. In TOC = $661,500 - $630,000

2012 Inv. In TOC = $31,500

Net operating profit after taxes

2012 NOPAT = EBIT x (1-T)

2012 NOPAT = $99,200 x 60%

2012 NOPAT = $59,520

Free cash flow

2012 FCF = NOPAT - Net investment in operating capital

2012 FCF = $59,520 - $31,500

2012 FCF = $28,020

Return on invested capital

2012 ROIC = NOPAT / Total net operating capital

2012 ROIC = $59,520 / $661,500

2012 ROIC = 9.0%

b. Assume that there were 15 million shares outstanding at the end of the year, the year-end closing

stock price was $65 per share, and the after-tax cost of capital was 8%. Calculate EVA and MVA for

the most recent year.

Additional Input Data

Stock price per share $65.00

# of shares (in thousands) 15,000

After-tax cost of capital 8.0%

Market Value Added

MVA = Stock price x # of shares - Total common equity

MVA = $65.00 x 15,000 - $544,538

MVA = $975,000 - $544,538

MVA = $430,462

Economic Value Added

EVA = NOPAT - (Operating Capital x After-tax cost of capital)

EVA = $59,520 - $661,500 x 8%

EVA = $59,520 - $52,920

EVA = $6,600

You might also like

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Finding Operating and Free Cash FlowsDocument5 pagesFinding Operating and Free Cash FlowsM.TalhaNo ratings yet

- Chapter 9. CH 09-10 Build A Model: Growth SalesDocument6 pagesChapter 9. CH 09-10 Build A Model: Growth SalesMatt SlowickNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 3-14 Free Cash Flow: Bailey Corporation's Financial Statements (Dollars and Shares Are in Millions) Are ProvidedDocument8 pages3-14 Free Cash Flow: Bailey Corporation's Financial Statements (Dollars and Shares Are in Millions) Are ProvidedCASTOR, Vincent Paul0% (1)

- Financial PlanDocument12 pagesFinancial PlanNico BoialterNo ratings yet

- Financial Management - Brigham Chapter 3Document4 pagesFinancial Management - Brigham Chapter 3Fazli AleemNo ratings yet

- CH 13Document14 pagesCH 13Trang VânNo ratings yet

- CFI - FMVA Practice Exam Case Study ADocument18 pagesCFI - FMVA Practice Exam Case Study AWerfelli MaramNo ratings yet

- Glenn S Glue Stick IncDocument5 pagesGlenn S Glue Stick IncHenry KimNo ratings yet

- Adjusting Entry Multiple Choice Question and Answer KeyDocument9 pagesAdjusting Entry Multiple Choice Question and Answer Keygnzg.bela50% (2)

- Ch02 P21 Build A ModelDocument3 pagesCh02 P21 Build A ModelFelipe WeulerNo ratings yet

- Chapter 31 - Correction of Errors - v2Document931 pagesChapter 31 - Correction of Errors - v2Yolly DiazNo ratings yet

- Organic Food Store Business PlanDocument28 pagesOrganic Food Store Business PlanQueen of starsNo ratings yet

- A. Calculate Watkins's Value of OperationsDocument20 pagesA. Calculate Watkins's Value of OperationsNarmeen Khan100% (1)

- Module 4 - BEATRICE PEABODY - QuestionsDocument7 pagesModule 4 - BEATRICE PEABODY - Questionsseth litchfieldNo ratings yet

- P23-7 (SCF-Direct and Indirect Methods From Comparative Financial Statements) ChapmanDocument4 pagesP23-7 (SCF-Direct and Indirect Methods From Comparative Financial Statements) Chapmanintan dwi cahaya100% (1)

- Browning - Ch02 P15 Build A ModelDocument3 pagesBrowning - Ch02 P15 Build A ModelAdamNo ratings yet

- E. Ch02 P15 Flujo Caja, EVA, MVA SolutionDocument3 pagesE. Ch02 P15 Flujo Caja, EVA, MVA SolutionDarling Desirée Togna SalasNo ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- Chapter 3. CH 03-10 Build A Model: AssetsDocument4 pagesChapter 3. CH 03-10 Build A Model: AssetsAngel L Rolon TorresNo ratings yet

- Assignment SalmanDocument9 pagesAssignment SalmanSalman AtherNo ratings yet

- Assignment Part OneDocument3 pagesAssignment Part Onetovi0821No ratings yet

- Finance ProblemsDocument50 pagesFinance ProblemsRandallroyce0% (1)

- Problem 2-14 & 2-15Document12 pagesProblem 2-14 & 2-15Qudsiya KalhoroNo ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Hira Karim Malik Section B - Financial Ratios Practice AssignmentDocument7 pagesHira Karim Malik Section B - Financial Ratios Practice AssignmenthirakmalikNo ratings yet

- Assignment#01Document8 pagesAssignment#01Aaisha AnsariNo ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsRisha OsfordNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- Bail Am Tren LopDocument10 pagesBail Am Tren LopquyruaxxNo ratings yet

- DifferenceDocument10 pagesDifferencethalibritNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument14 pagesSolutions To End-Of-Chapter ProblemsTushar MalhotraNo ratings yet

- Financial Management (Problems)Document12 pagesFinancial Management (Problems)Prasad GowdNo ratings yet

- 3463afdcb438dc833d95f8d1814e4b36_8f5c0d43171d85063d48300fbb6274faDocument4 pages3463afdcb438dc833d95f8d1814e4b36_8f5c0d43171d85063d48300fbb6274faChelsea VisperasNo ratings yet

- University of Business& Technology: Worksheet # 4Document3 pagesUniversity of Business& Technology: Worksheet # 4nikowawaNo ratings yet

- Analisis Rasio P14-2Document4 pagesAnalisis Rasio P14-2Yoga Arif PratamaNo ratings yet

- Chapter 09. Solution For CH 09-10 Build A Model: AssetsDocument4 pagesChapter 09. Solution For CH 09-10 Build A Model: AssetsDiana SorianoNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Chapter 09. Student CH 09-10 Build A Model: AssetsDocument4 pagesChapter 09. Student CH 09-10 Build A Model: Assetsseth litchfieldNo ratings yet

- Work Sheet RatiosDocument4 pagesWork Sheet Ratiosmohammad mueinNo ratings yet

- Liquidity RatiosDocument3 pagesLiquidity RatiosMckenzie PalaganasNo ratings yet

- Tugas MK11Document2 pagesTugas MK11Nan BaeeeNo ratings yet

- CH - 04 SolutionDocument3 pagesCH - 04 SolutionSaifur R. SabbirNo ratings yet

- M1 C2 Case Study WorkbookDocument25 pagesM1 C2 Case Study WorkbookfenixaNo ratings yet

- Financial Analysis and InterpretationDocument22 pagesFinancial Analysis and Interpretationirfan_rana4uNo ratings yet

- CH4 MinicaseDocument4 pagesCH4 Minicasemervin coquillaNo ratings yet

- 386145Document10 pages386145UROOSA KHANNo ratings yet

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNo ratings yet

- Tugas 2 - Vania Olivine Danarilia (486211)Document6 pagesTugas 2 - Vania Olivine Danarilia (486211)Vania OlivineNo ratings yet

- Balance Sheet: (In Millions of Dollars) AssetsDocument8 pagesBalance Sheet: (In Millions of Dollars) AssetsThiện Nhân100% (1)

- Orchid Business Group Balance Sheet As at December 31 Assets 2012 2011Document9 pagesOrchid Business Group Balance Sheet As at December 31 Assets 2012 2011Amanuel DemekeNo ratings yet

- Nama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityDocument10 pagesNama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityAliea YenemiaNo ratings yet

- Fabricycle FinancialsDocument3 pagesFabricycle FinancialsRahul AchaяyaNo ratings yet

- Below Are Sample Questions Question 1 (1 Point) : Round The Answers To Two Decimal Places in Percentage Form.Document3 pagesBelow Are Sample Questions Question 1 (1 Point) : Round The Answers To Two Decimal Places in Percentage Form.Ayushi SinghalNo ratings yet

- CH 13Document4 pagesCH 13Sri HimajaNo ratings yet

- WA12Document2 pagesWA12IzzahIkramIllahiNo ratings yet

- IFM11 Solution To Ch08 P15 Build A ModelDocument2 pagesIFM11 Solution To Ch08 P15 Build A ModelDiana Soriano50% (2)

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsDocument9 pagesFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMNo ratings yet

- Answers To Concepts Review and Critical Thinking QuestionsDocument6 pagesAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaNo ratings yet

- SPM Example 3Document8 pagesSPM Example 3inderNo ratings yet

- Beatrice Peabody ExcelDocument4 pagesBeatrice Peabody Excelseth litchfieldNo ratings yet

- Module 3 - FILMORE ENTERPRISES - QuestionsDocument4 pagesModule 3 - FILMORE ENTERPRISES - Questionsseth litchfieldNo ratings yet

- Module 3 - Filmore EnterprisesDocument16 pagesModule 3 - Filmore Enterprisesseth litchfieldNo ratings yet

- Chapter 10. Student Ch10 P18 Build A Model: Cost of DebtDocument3 pagesChapter 10. Student Ch10 P18 Build A Model: Cost of Debtseth litchfieldNo ratings yet

- Filmore Enterprises: Risk and Rates of ReturnDocument8 pagesFilmore Enterprises: Risk and Rates of Returnseth litchfieldNo ratings yet

- Chapter 8. Student Ch08 P 8-15 Build A Model: AssetsDocument2 pagesChapter 8. Student Ch08 P 8-15 Build A Model: Assetsseth litchfield100% (1)

- Module - 2-Davis, - Michaels, - and - Co-Questions (2) UpdatesDocument5 pagesModule - 2-Davis, - Michaels, - and - Co-Questions (2) Updatesseth litchfieldNo ratings yet

- Module 2 - Davis, Michaels, and CoDocument5 pagesModule 2 - Davis, Michaels, and Coseth litchfieldNo ratings yet

- Chapter 09. Student CH 09-10 Build A Model: AssetsDocument4 pagesChapter 09. Student CH 09-10 Build A Model: Assetsseth litchfieldNo ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Module 5. Student CH 5-20 Build A Model: Dividend $2.50 $3.25 $4.23 $4.52Document5 pagesModule 5. Student CH 5-20 Build A Model: Dividend $2.50 $3.25 $4.23 $4.52seth litchfieldNo ratings yet

- Bkjuly 2022Document6 pagesBkjuly 2022deadend097No ratings yet

- 2023 - Audit - Ultj GroupDocument110 pages2023 - Audit - Ultj Groupfitayu nurillyaNo ratings yet

- Accounting Standard 29Document40 pagesAccounting Standard 29Kirti KiranNo ratings yet

- Toa Basic ConceptsDocument44 pagesToa Basic ConceptsKristine WaliNo ratings yet

- ch05 Accounting For Merchandising Operations - StudentDocument18 pagesch05 Accounting For Merchandising Operations - StudentTâm Vũ NhậtNo ratings yet

- ACCA FR S20 NotesDocument154 pagesACCA FR S20 NotesFuhad AhmedNo ratings yet

- Chapter 2 - The Recording Process Practice SolutionsDocument13 pagesChapter 2 - The Recording Process Practice SolutionsNguyễn Minh ĐứcNo ratings yet

- Ho BRDocument3 pagesHo BRSummer Star33% (3)

- BbcaDocument3 pagesBbcaMahasidhiNo ratings yet

- Ever Gotesco: Quarterly ReportDocument35 pagesEver Gotesco: Quarterly ReportBusinessWorld100% (1)

- Compre2 ReviewerDocument6 pagesCompre2 ReviewerMark Joseph OlinoNo ratings yet

- Regenerating Clinic Transactions and Tabular AnalysisDocument24 pagesRegenerating Clinic Transactions and Tabular AnalysisQuella Zairah ReyesNo ratings yet

- Adam Sugar LTD Financial AnalysisDocument20 pagesAdam Sugar LTD Financial AnalysiswamiqrasheedNo ratings yet

- Cost Accounting Practice Set (L. Payongayong)Document60 pagesCost Accounting Practice Set (L. Payongayong)rocketkaye100% (2)

- Principles of Accounting (DAC1013) : Chapter 3: Business Transaction Recording Process (3 Week)Document21 pagesPrinciples of Accounting (DAC1013) : Chapter 3: Business Transaction Recording Process (3 Week)Nur Ayyen NorminNo ratings yet

- Avco FifoDocument1 pageAvco FifoMuhammad TalhaNo ratings yet

- Consolidation (Study Hub)Document4 pagesConsolidation (Study Hub)HammadNo ratings yet

- CH 03Document6 pagesCH 03Tien Thanh DangNo ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsRisha OsfordNo ratings yet

- 2 Topsim WS2012 13 InitialsituationDocument8 pages2 Topsim WS2012 13 InitialsituationMaliha KhanNo ratings yet

- Financial Analysis - ITC - AsimBhawsinghka PDFDocument13 pagesFinancial Analysis - ITC - AsimBhawsinghka PDFAsim BhawsinghkaNo ratings yet

- Nama: Regita Pramesty Ayu P NIM: F0316104 Kelas: ADocument3 pagesNama: Regita Pramesty Ayu P NIM: F0316104 Kelas: APrabawati Kesuma BrataNo ratings yet

- İntermediate AccountingDocument15 pagesİntermediate AccountingOzan TalayNo ratings yet

- Baen 1 Module 2Document5 pagesBaen 1 Module 2Anne TeodocioNo ratings yet

- ACCOUNTING P1 GR12 QP JUNE 2023 - EnglishDocument11 pagesACCOUNTING P1 GR12 QP JUNE 2023 - Englishfanelenzima03No ratings yet

- CFI - Accounting Factsheet PDFDocument1 pageCFI - Accounting Factsheet PDFVibhuti BatraNo ratings yet

- ABM 11 Fundamentals-Of-ABM1 q3 CLAS4 Statement-Of-Financial-Position v1Document22 pagesABM 11 Fundamentals-Of-ABM1 q3 CLAS4 Statement-Of-Financial-Position v1Kim Yessamin Madarcos100% (1)