Professional Documents

Culture Documents

The Emergence and Stabilization of Extreme Inflationary Pressures in The Philippines

Uploaded by

Charles MateoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Emergence and Stabilization of Extreme Inflationary Pressures in The Philippines

Uploaded by

Charles MateoCopyright:

Available Formats

NATIONAL UNIVERSITY

Manila, Philippines

The Emergence and Stabilization of

Extreme Inflationary Pressures in the

Philippines

A Project Innovated Proposed Product

Presented to

The Faculty of College of Business and Accountancy

Accountancy Program

National University

_______________________________

In Partial Fulfillment of the

Requirements for the course

ECONOMIC DEVELOPMENT

“’’’’’’’’

_______________________________

Presented by:

Almera, Yuan Andrei O.

Mateo, Charles Kenneth T.

Mabitado, Berna Rose

Reyes, Angelique Francyne P.

Presented to:

MR.IRENEO R. AGUILAN

August 15, 2019

COLLEGE OF BUSINESS AND ACCOUNTANCY

1

NATIONAL UNIVERSITY

Manila, Philippines

INTRODUCTION :

From the mid-1980s, the growing macroeconomic instability in the Soviet Union

has been connected to two primary components: first is the flow issue of a huge

government budget deficiency and rapid credit development, and the stock "monetary

overhang" of excess purchasing at prevailing levels of controlled prices and interest

rates. The greater part of overabundance request weight has showed up as

"repressed inflation" and a lack of products, instead of as open cost increments. In

1990, the official inflation rate pace of around 5 % was still at conventional single digit

levels, and even the most alternative estimates assessments would put it well in the

lower double digits. From the beginning of 1991, and slightly earlier in some portion of

the republics, arrangement policy clearly shifted towards an attemp to discharge some

inflationary weight through a blend of regulatory price increases and direct partial

compensation incomes. The outcome was a quick speeding up of inflation, with official

files in the first quarter of 1991 demonstrating a value level that was 22 % than in a

similar quarter of the first year. In many republics, an a lot bigger hop showed itself on

2 April, when the Soviet government raised fixed retail costs or value roofs for certain

merchandise, while freeing the costs of others. Official evaluations demonstrate this

expanded normal retail costs by 60 to 70 % however Given this was an recent

administrative increase, its effect on the center pace of expansion is as yet indistinct.

While few would presumably guarantee that continued value rises as of now arrive at

the 50% for every month limit frequently utilized to characterize hyperinflation, most

visualizations are at a further speeding up of cost rises. While some anticipate a value

COLLEGE OF BUSINESS AND ACCOUNTANCY

2

NATIONAL UNIVERSITY

Manila, Philippines

ascent of around 150 % during 1991, warnings of a collapse into hyperinflation are

winding up always normal. These are sounded by Soviet polticians of various

influences, what's more, by residential and outside market analysts acquainted with

the Soviet economy. However, past general admonitions, we are uninformed of

studies which have analyzed the potential for outrageous expansion in the Soviet

Union all the more intently. mid-twentieth century Europe, Latin America and Israel

during the 1980s, and Poland in 1989 are incorporated into the dialog. These

encounters demonstrate the trouble of foreseeing precisely if and when hyperinflation

may happen. A few nations have confronted immense terms of exchange stuns

without high swelling. During the 1980s, both Mexico and Italy ran spending

deficiencies in the scope of 12-15 % of GDP, yet value rises never came to

hyperinflationary levels. Elements isolating reparable, constantly high, and

extraordinary swelling are undefined and differing. Vulnerability is exacerbated by the

inalienable shakiness of outrageous expansion. It isn't exceptional to watch significant

lots in which inflationary weights have all the earmarks of being leveled out. At that

point, when an imperceptible limit has been crossed, or the principles of the game

change, any further stun can all of a sudden "set the house ablaze in a matter of

seconds". Hence, we will not make forecasts about short-run Soviet swelling. Our

objective is basically to decide if the present Soviet Union offers fertile ground for

extraordinary swelling to develop and develop, and what may be done to diminish this

potential. We will do this in a few phases. Area II portrays the kinds of stuns which

have hit different economies before hyperinflation, drawing correlations with the

present Soviet economy. Segment III continues so also for the spread systems of

COLLEGE OF BUSINESS AND ACCOUNTANCY

3

NATIONAL UNIVERSITY

Manila, Philippines

inflation.Therefore, this case study is intended to evaluate and aims to answer the

following:

1.) How does the market are being affected by the inflation here in the Philippines?

2) What are the major factors that caused the emergence and and stabilization of the

extreme inflationary pressures in the Philippines?

3.) What are the advantages and disadvantages of having Extreme Inflationary

Pressures in the Philippines?

Background of the Study:

COLLEGE OF BUSINESS AND ACCOUNTANCY

4

NATIONAL UNIVERSITY

Manila, Philippines

Inflationary Pressures in the Philippines are slowly getting down. Inflationary

pressure occurs when general price level rise due to pressure from demand or supply

side factors. Whereas the Inflation in the Philippines is still considered as a threat for

its macroeconomic stability. Stated by the government that the economic team is glad

to report to the public that the country’s inflation rate is pointing towards a downward

path. Meaning the Philippines has slowly having the inflation rate going down. As per

The Philippine Statistics Authority that, while the year-on-year headline inflation in

October 2018 was steady at 6.7 percent, seasonally adjusted month-on-month

inflation eased further to 0.3 percent. September adjustments in the overall price level

in Metro Manila alone slowed down further to 6.1 percent, while inflation outside Metro

Manila remained at 6.8 percent. While currently in 2019, The Philippines’ headline

inflation went up by 3.2 percent in May 2019. Inflation in April 2019 was recorded at

3.0 percent, and in May 2018, 4.6 percent.

Government officials are one of the factors that affects the outcome of the

economic growth of our country. Many of the government officials are corrupt. Which

is one of the major problems here in the Philippines. The government allots money for

a certain project but our officials use only some of the money given and put the

remaining money in their pockets.

One factor also is the National Debt that we owe to foreign countries such as the

United States. If the countries debts increased, chances are that the government can

come up with two options such as: they will tasked the Bangko Sentral ng Pilipinas

COLLEGE OF BUSINESS AND ACCOUNTANCY

5

NATIONAL UNIVERSITY

Manila, Philippines

(BSP) to print more money to pay off the debt or by either raising taxes to all of the

employees or workers.

Cost-Push Effect is another key factor that triggers the inflation in our country. It

basiscally means that when companies are faced with increased input costs like raw

goods and materials or wages, they will preserve their profitability by passing this

increased cost of production onto the consumer in the form of higher prices. (Pat,

2011)

Exchange Rates may affect the outcome of the economic growth of the

Philippines because increasing exposure to foreign investors and foreign

marketplaces causes Inflation. Exchange rates are also necessary in an increasingly

global economy because it is one of the most important factors in determining our rate

of inflation. (Pat, 2011)

COLLEGE OF BUSINESS AND ACCOUNTANCY

6

You might also like

- The Effect of Inflation To The Economic Growth of The PhilippinesDocument27 pagesThe Effect of Inflation To The Economic Growth of The PhilippinesDivina Gonzales64% (14)

- 8.1 Assignment - Regular Income TaxDocument3 pages8.1 Assignment - Regular Income TaxCharles Mateo0% (1)

- Mahagun MywoodsDocument149 pagesMahagun MywoodsBikki Kumar100% (1)

- Course Outline - ECO101 BRAC UniversityDocument2 pagesCourse Outline - ECO101 BRAC UniversitySaiyan IslamNo ratings yet

- Econ Emergence Sept 5 2019Document13 pagesEcon Emergence Sept 5 2019Charles MateoNo ratings yet

- Team - Performance Economies in The WorldDocument5 pagesTeam - Performance Economies in The WorldMuz VelaNo ratings yet

- Thesis On Inflation and Economic Growth in PakistanDocument7 pagesThesis On Inflation and Economic Growth in Pakistanbsbbq7qp100% (2)

- CD TC TT2Document26 pagesCD TC TT2Xuanhoa TdNo ratings yet

- Inflation Rate ThesisDocument6 pagesInflation Rate ThesisBuyCheapPapersMiramar100% (2)

- UntitledDocument2 pagesUntitledmarielle taladtadNo ratings yet

- Debt Super CycleDocument3 pagesDebt Super Cycleocean8724No ratings yet

- Term Paper Inflation in The Philippines and Possible Ways To Reduce Its Impact.Document6 pagesTerm Paper Inflation in The Philippines and Possible Ways To Reduce Its Impact.Mark Gabriel DangaNo ratings yet

- Performance TaskDocument19 pagesPerformance TaskNadine Ailet CornelNo ratings yet

- Role of Rbi in Controlling InflationDocument23 pagesRole of Rbi in Controlling Inflationrakshitajain100% (1)

- Fiscal Sustainability of Assam - 13Document20 pagesFiscal Sustainability of Assam - 13rakesh.rnbdjNo ratings yet

- Final Exam Econ 2Document8 pagesFinal Exam Econ 2Ysabel Grace BelenNo ratings yet

- Unit 2. Market Economy vs. Planned Economy: 1. After Reading The Text, Provide Answers To The Following QuestionsDocument3 pagesUnit 2. Market Economy vs. Planned Economy: 1. After Reading The Text, Provide Answers To The Following Questionsmihaela007mNo ratings yet

- Q10 - What Are The Four Macroeconomic Goals For Any CountryDocument4 pagesQ10 - What Are The Four Macroeconomic Goals For Any CountryMagdalena DefitaNo ratings yet

- Activity 8 - Sanchez - Benitez - Natalia - MIECDocument6 pagesActivity 8 - Sanchez - Benitez - Natalia - MIECMuz VelaNo ratings yet

- Globalization and Global DisinflationDocument36 pagesGlobalization and Global DisinflationOkechukwu MeniruNo ratings yet

- Kenyatta University.: Curbing Inflation For Economic Growth: The Causes of Persistently High Inflation Rates in KenyaDocument12 pagesKenyatta University.: Curbing Inflation For Economic Growth: The Causes of Persistently High Inflation Rates in KenyaMainSq19No ratings yet

- Growth Recoveries From CollapsesDocument69 pagesGrowth Recoveries From CollapsesCesar PetitNo ratings yet

- ECDEVDocument13 pagesECDEVPatricia Mae CruzNo ratings yet

- Stagflation Is Generally Attributed To British Politician Iain Macleod, Who Coined The TermDocument8 pagesStagflation Is Generally Attributed To British Politician Iain Macleod, Who Coined The Term89hariharanNo ratings yet

- Jefas: Macroeconomic Determinants of Public Debt in The PhilippinesDocument22 pagesJefas: Macroeconomic Determinants of Public Debt in The PhilippinesNhi NguyễnNo ratings yet

- Expert Explains - What Are The Real Causes of InflationDocument6 pagesExpert Explains - What Are The Real Causes of InflationUdbhavNo ratings yet

- Chapter One For Ijeoma IG CLASS-1Document77 pagesChapter One For Ijeoma IG CLASS-1Onyebuchi ChiawaNo ratings yet

- INFLATION and DEFLATION - What Truly Causes Each What Lies Ahead and Why Woody BrockDocument24 pagesINFLATION and DEFLATION - What Truly Causes Each What Lies Ahead and Why Woody BrockVas RaNo ratings yet

- Inflation (Oneil)Document4 pagesInflation (Oneil)pkpatel187No ratings yet

- Macroeconomics Final RequirementDocument4 pagesMacroeconomics Final RequirementPrincess-Diana Tomas CorpuzNo ratings yet

- Indonesian Economic Slowdown 1.1Document15 pagesIndonesian Economic Slowdown 1.1Havidz IbrahimNo ratings yet

- IEPR133FQ0711Document5 pagesIEPR133FQ0711Sunainaa ChadhaNo ratings yet

- Inflation and Its CureDocument3 pagesInflation and Its CureSabyasachi SahuNo ratings yet

- SPEX Issue 19Document9 pagesSPEX Issue 19SMU Political-Economics Exchange (SPEX)No ratings yet

- Cruz, D Longexam Bsma2-1Document4 pagesCruz, D Longexam Bsma2-1Dianne Mae Saballa CruzNo ratings yet

- Inflation in EthiopiaDocument22 pagesInflation in Ethiopiadeninaanteneh758No ratings yet

- Applied Term PaperDocument8 pagesApplied Term PapershaguftaNo ratings yet

- Aguilar Pos 312 FR TPDocument3 pagesAguilar Pos 312 FR TPLove GambaNo ratings yet

- 02 Final Marketing Appraisal - Environmental AnalysisDocument24 pages02 Final Marketing Appraisal - Environmental Analysisapi-3838281100% (2)

- 15 February 2011: Please Read The Important Disclosures and Disclaimers On Pp. 9-10.glDocument10 pages15 February 2011: Please Read The Important Disclosures and Disclaimers On Pp. 9-10.glAquila99999No ratings yet

- World Economy 2011Document48 pagesWorld Economy 2011Arnold StalonNo ratings yet

- World Economic Situation and Prospects 2011Document48 pagesWorld Economic Situation and Prospects 2011Iris De La CalzadaNo ratings yet

- Iasbaba'S Daily Current Affairs - 26Th July, 2016: ArchivesDocument8 pagesIasbaba'S Daily Current Affairs - 26Th July, 2016: ArchivesramNo ratings yet

- Managing The Growth-Inflation Balance in India: Current Considerations and Long-Term Perspectives Subir GokarnDocument11 pagesManaging The Growth-Inflation Balance in India: Current Considerations and Long-Term Perspectives Subir Gokarnrajibmishral7125No ratings yet

- EFE Pricenomics ArticleDocument12 pagesEFE Pricenomics ArticleKamlesh RajpurohitNo ratings yet

- Indicators of Successful EconomyDocument9 pagesIndicators of Successful EconomyAli Zafar0% (1)

- Chile's Growth Opportunities and Challenges To Development: Rodrigo Vergara Governor Central Bank of Chile April 28, 2016Document8 pagesChile's Growth Opportunities and Challenges To Development: Rodrigo Vergara Governor Central Bank of Chile April 28, 2016harshnvicky123No ratings yet

- Gokrn SpeechDocument13 pagesGokrn Speechashwini.krs80No ratings yet

- Fiscal Policy and Its Effect To Argentine EconomyDocument4 pagesFiscal Policy and Its Effect To Argentine EconomyGrace KeyNo ratings yet

- Inflation 2. The Inflation Rate 3. The Consumer Price Index (CPI)Document13 pagesInflation 2. The Inflation Rate 3. The Consumer Price Index (CPI)Van AnhNo ratings yet

- Economic IndicatorsDocument4 pagesEconomic IndicatorsAbdullah Al FayazNo ratings yet

- tiểu luận 2 bằng tiếng anhDocument39 pagestiểu luận 2 bằng tiếng anhPhương AnhNo ratings yet

- Introduction of InflationDocument45 pagesIntroduction of InflationSandeep ShahNo ratings yet

- International Monetary and Financial Committee: Thirtieth M Eeting October 11, 2014Document21 pagesInternational Monetary and Financial Committee: Thirtieth M Eeting October 11, 2014IEco ClarinNo ratings yet

- Macroeconomics Assignment #1: Name EnrollmentDocument5 pagesMacroeconomics Assignment #1: Name EnrollmentSajida HussainNo ratings yet

- Politica Fiscal Inglés PapersDocument62 pagesPolitica Fiscal Inglés PapersOmar David Ramos VásquezNo ratings yet

- Effects of Inflation in Our CountryDocument16 pagesEffects of Inflation in Our CountrySohaib JavedNo ratings yet

- Micro-Foundations of Macroeconomic Development: Nclusive Rowth AND NflationDocument19 pagesMicro-Foundations of Macroeconomic Development: Nclusive Rowth AND NflationVinod YadavNo ratings yet

- ES2011Document309 pagesES2011adityaverma7No ratings yet

- Macroprudential Policies in ComlombiaDocument29 pagesMacroprudential Policies in ComlombiaThành Mai TiếnNo ratings yet

- Inflation Monetary Policy: Fiscal Discipline Refers To A State of An Ideal Balance Between Revenues andDocument3 pagesInflation Monetary Policy: Fiscal Discipline Refers To A State of An Ideal Balance Between Revenues andJhonard GaliciaNo ratings yet

- Block 1 MEC 008 Unit 1Document12 pagesBlock 1 MEC 008 Unit 1Adarsh Kumar GuptaNo ratings yet

- Enterprises, Industry and Innovation in the People's Republic of China: Questioning Socialism from Deng to the Trade and Tech WarFrom EverandEnterprises, Industry and Innovation in the People's Republic of China: Questioning Socialism from Deng to the Trade and Tech WarNo ratings yet

- Movie Review FormatDocument2 pagesMovie Review FormatCharles MateoNo ratings yet

- Lesson 10: - The Philippines: A Century Hence - Annotation of Antonio Morga's Sucesos de Las Islas FilipinasDocument10 pagesLesson 10: - The Philippines: A Century Hence - Annotation of Antonio Morga's Sucesos de Las Islas FilipinasCharles MateoNo ratings yet

- Role of Business in Social and Economic DevelopmentDocument12 pagesRole of Business in Social and Economic DevelopmentCharles MateoNo ratings yet

- Prepared By: Ms. Monica TiglaoDocument63 pagesPrepared By: Ms. Monica TiglaoCharles MateoNo ratings yet

- Does Satan Have Dignity?Document2 pagesDoes Satan Have Dignity?Charles MateoNo ratings yet

- DSDSDSD 56Document2 pagesDSDSDSD 56Charles MateoNo ratings yet

- Man's Short Life and Foolish AmbitionDocument1 pageMan's Short Life and Foolish AmbitionCharles Mateo100% (3)

- 865 Domingo Santiago St. Sampaloc Manila: Erbal and Written Communication Skills Interpersonal SkillsDocument2 pages865 Domingo Santiago St. Sampaloc Manila: Erbal and Written Communication Skills Interpersonal SkillsCharles MateoNo ratings yet

- Prepared By: Ms. Monica TiglaoDocument63 pagesPrepared By: Ms. Monica TiglaoCharles MateoNo ratings yet

- Mathematics Behind Humanities and Arts, Mystery of Mathematics, Math Is The Hidden Secret To Understanding The WorldDocument1 pageMathematics Behind Humanities and Arts, Mystery of Mathematics, Math Is The Hidden Secret To Understanding The WorldCharles MateoNo ratings yet

- NSTP ReviewerDocument7 pagesNSTP ReviewerCharles MateoNo ratings yet

- FinmanDocument9 pagesFinmanCharles MateoNo ratings yet

- Lesson 2 EthicsDocument20 pagesLesson 2 Ethicselle lee100% (1)

- Lesson 3 EthicsDocument26 pagesLesson 3 EthicsCharles MateoNo ratings yet

- Sandys SlidesCarnivalDocument40 pagesSandys SlidesCarnivalEman KhanNo ratings yet

- 1 PFRS 3 Business CombinationDocument30 pages1 PFRS 3 Business CombinationCharles MateoNo ratings yet

- 4.1 Assignment - Final Tax On Passive Income (To Be Answered in Lecture)Document6 pages4.1 Assignment - Final Tax On Passive Income (To Be Answered in Lecture)Charles Mateo100% (3)

- Read MeDocument1 pageRead MeCharles MateoNo ratings yet

- Read MeDocument1 pageRead MeAndri Wahyu SukmonoNo ratings yet

- Objectives and Scope of Financial ManagementDocument62 pagesObjectives and Scope of Financial ManagementCharles MateoNo ratings yet

- BT InstallDocument1 pageBT InstallCharles MateoNo ratings yet

- AhaShare.comDocument1 pageAhaShare.comFuad JahićNo ratings yet

- Sandys SlidesCarnivalDocument40 pagesSandys SlidesCarnivalEman KhanNo ratings yet

- Income Taxes: ProblemsDocument12 pagesIncome Taxes: ProblemsCharles MateoNo ratings yet

- Problem Related To Income TaxesDocument11 pagesProblem Related To Income TaxesCharles MateoNo ratings yet

- 4.2 Summary Lecture - Final Tax and CGT (Make Up Class)Document2 pages4.2 Summary Lecture - Final Tax and CGT (Make Up Class)Charles MateoNo ratings yet

- TB-Raiborn - Capital Bud GettingDocument43 pagesTB-Raiborn - Capital Bud Gettingtophey100% (1)

- Part 1 - Income TaxesDocument31 pagesPart 1 - Income TaxesCharles MateoNo ratings yet

- 1 PFRS 3 Business CombinationDocument30 pages1 PFRS 3 Business CombinationCharles MateoNo ratings yet

- Chapter 3. - Budgeting: SECTION 314. Form and Content. - (A) Local Government Budgets ShallDocument8 pagesChapter 3. - Budgeting: SECTION 314. Form and Content. - (A) Local Government Budgets ShallTerele Aeron Maddara OñateNo ratings yet

- Learning Objectives: National DifferencesDocument6 pagesLearning Objectives: National DifferencesPhan Bich HopNo ratings yet

- Macro Tut 1Document6 pagesMacro Tut 1TACN-2M-19ACN Luu Khanh LinhNo ratings yet

- R - Qa1406 - Hanx7a - Bank State LoanDocument8 pagesR - Qa1406 - Hanx7a - Bank State Loanuvaisul89No ratings yet

- Farm Show Complex MapDocument1 pageFarm Show Complex MapNia TowneNo ratings yet

- Product Brochure Garanteed IncomeDocument24 pagesProduct Brochure Garanteed IncomemahammjNo ratings yet

- Ministry of TourismDocument4 pagesMinistry of TourismVruddhi GalaNo ratings yet

- Chapter4.3 - NEU 2020 - IFRS. Part 1 - NCADocument18 pagesChapter4.3 - NEU 2020 - IFRS. Part 1 - NCAPhương NhungNo ratings yet

- Sustanable DevelopmentDocument10 pagesSustanable Developmentsushant dawaneNo ratings yet

- Foundations of Finance 8th Edition Keown Test BankDocument5 pagesFoundations of Finance 8th Edition Keown Test BankJenniferDiazqmfsi100% (58)

- Farm Barns South Dakota MPSDocument75 pagesFarm Barns South Dakota MPSEdson Alves dos Santos JuniorNo ratings yet

- Supplier Creation Form Version Oct17Document2 pagesSupplier Creation Form Version Oct17Fishing FieldNo ratings yet

- Modul 1 Aviation Management IntroductionDocument16 pagesModul 1 Aviation Management IntroductionSALLSAE •No ratings yet

- Marshall Defined An Equilibrium Price As One at Which TheDocument1 pageMarshall Defined An Equilibrium Price As One at Which Thetrilocksp SinghNo ratings yet

- Course Map MA2Document7 pagesCourse Map MA2Areeb AhmadNo ratings yet

- Module.1 Session 7, 8, 9 & 10Document109 pagesModule.1 Session 7, 8, 9 & 10Khushal ThakerNo ratings yet

- Industrial Policy of IndiaDocument27 pagesIndustrial Policy of Indianeeraj sharma mbaNo ratings yet

- Facility Location: Where Should A Plant or Service Facility Be Located?Document15 pagesFacility Location: Where Should A Plant or Service Facility Be Located?Aa BbNo ratings yet

- PMI SL Purchasing Managers' IndexDocument2 pagesPMI SL Purchasing Managers' IndexSemitha KanakarathnaNo ratings yet

- Engineering EconomyDocument4 pagesEngineering EconomyBVS CollegesNo ratings yet

- Lux Equity Sicav Are PDFDocument248 pagesLux Equity Sicav Are PDFJ. BangjakNo ratings yet

- Clemons Vs NoltingDocument9 pagesClemons Vs NoltingKatrina BudlongNo ratings yet

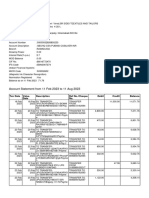

- Account Statement From 11 Feb 2023 To 11 Aug 2023Document8 pagesAccount Statement From 11 Feb 2023 To 11 Aug 2023vinodbommadeniNo ratings yet

- Urban Development DirectorateDocument14 pagesUrban Development Directoraterohan angelNo ratings yet

- How To Draw SD Levels 1.1Document1 pageHow To Draw SD Levels 1.1Martin KedorNo ratings yet

- Chapter 1Document16 pagesChapter 1Alif MohammedNo ratings yet

- Pharmaceutical Industry AnalysisDocument8 pagesPharmaceutical Industry AnalysisMARIA M (RC2153001011009)No ratings yet

- Essay - Universal Basic IncomeDocument5 pagesEssay - Universal Basic IncomeAsfa SaadNo ratings yet