Professional Documents

Culture Documents

Religare Morning Digest

Uploaded by

Maruthee SharmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Religare Morning Digest

Uploaded by

Maruthee SharmaCopyright:

Available Formats

Religare Morning Digest

June 10, 2020

Nifty Outlook

Markets lost over a percent in a volatile trading session, tracking weak global cues. After

opening on a flat note, the index gradually inched higher but weakness in the European

markets triggered a sharp decline in the latter half. Finally, the Nifty index ended near to

10,050 levels, almost at the day’s low. On the sector front, all the indices, barring

healthcare and realty, witnessed selling pressure and ended in the red with banks, telecom

and energy being the top losers.

Since our markets are currently dancing to the global tunes, the outcome of the US Fed

meet and performance of the global markets would be closely watched. We may see

further profit-taking in the index and 9950-9850 zone would act as a cushion. Traders

should prefer hedged positions and maintain their focus on stock selection.

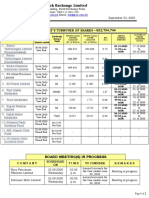

VWAP (Expiry till date) Max OI (Call) Max OI (Put)

NIFTY 10080 11000 9000

News

PSP Projects reported Q4FY20 revenue at Rs 456 cr, up by 35% YoY. Its net profit increased by 14% YoY at Rs 34 cr.

Adani Green Energy has received a big solar project from Solar Energy Corporation of India. According to the agreement, the 8 GW of solar development projects

will be implemented over the next five years.

BHEL has successfully commissioned one 270 MW thermal unit at the Bhadradri Thermal Power Project in Telangana.

Sectors to watch FII & DII Cash Segment (Rs. in Cr.) Trade Stats

Sector Name Outlook Category Amt. MTD FYTD NO OF CONTRACTS TURNOVER IN CR

IT STABLE IDXFUTS 683536 36942

FII** 813 14739 23448

IDXOPT 22851124 1316858

BANKS STABLE

DII** -1238 -2838 9339 STKFUTS 1129777 60100

FMCG BULLISH th

**Provisional data as on 8 June, 2020

Research Disclaimer: https://www.religareonline.com/disclaimer 1

Religare Morning Digest

June 10, 2020

Investment Pick - Britannia Industries Ltd.

Scrip CMP Recommendation Price Target Duration

Britannia Industries Ltd. 3,415.70 3,467 4,029 9-12 Months

Incorporated in 1918, Britannia Ind. Ltd. (BRIT) is India's leading packaged foods company. BRIT’s product portfolio includes Biscuits, Bread, Cakes, Rusk, and Dairy

products including cheese, beverages, milk and yoghurt.

We believe for the next 1-2 years company’s growth would be driven by healthy product portfolio, focus on growing revenue in Hindi belt areas, improving operating

efficiencies and strong distribution channel. Therefore, we recommend a buy on the stock with a target price of Rs 4,029..

CACT Calendar - June 2020 (Cash Dividend)

Sun Mon Tue Wed Thu Fri Sat

07 08 09 10 11 12 13

Great Eastern Shipping Co. Ltd. Esab India Ltd. Kansai Nerolac Paints Ltd.

(Interim Dividend - Rs. - 2.7000) (Interim Dividend - Rs. - 70.0000) (Dividend - Rs. - 3.1500)

Nestle India Ltd. Tata Coffee Ltd.

(Final Dividend - Rs. - 61.0000) (Dividend - Rs. - 1.5000

Huhtamaki Ppl Limited

(Final Dividend - Rs. - 3.0000)

Welspun Enterprises Ltd

(Final Dividend - Rs. - 2.0000)

CACT Calendar - June 2020 (Buy Back of Shares) CACT Calendar - June 2020 (Amalgamation)

Sun Mon Tue Wed Thu Fri Sat Sun Mon Tue Wed Thu Fri Sat

07 08 09 10 11 12 13 07 08 09 10 11 12 13

Tanla Solutions Ltd. Max India Ltd

Economic Calendar - June 2020 CACT Calendar - June 2020 (Spin Off)

Sun Mon Tue Wed Thu Fri Sat Sun Mon Tue Wed Thu Fri Sat

07 08 09 10 11 12 13 07 08 09 10 11 12 13

M3 Money Supply CPI (YoY) (May) Max India Ltd

Cumulative Industrial Production (Apr)

Industrial Production (YoY) (Apr)

Manufacturing Output (MoM) (Apr)

Research Disclaimer: https://www.religareonline.com/disclaimer 2

Religare Morning Digest

June 10, 2020

Result Calendar - June 2020

Sun Mon Tue Wed Thu Fri Sat

07 08 09 10 11 12 13

20 Microns Ltd. Amradeep Industries Ltd. Bansal Roofing Products Ltd Allied Digital Ser- Castrol India Ltd. Bharat Heavy

vices Ltd. Electricals Ltd.

Abbott India Ltd. Amraworld Agrico Ltd. Century Textiles & Industries Ecs Biztech Ltd

Ltd. Banco Products C.J.Gelatine Prod-

Adroit Infotech Ltd Bombay Dyeing & (India) Ltd. Eicher Motors Ltd. ucts Ltd.

Mfg.Co.Ltd. Dhanuka Agritech Ltd.

Chalet Hotels Ltd Dic India Ltd. Geojit Financial Ser- Jasch Industries

Century Enka Ltd. Dwarikesh Sugar Industries Ltd. vices Ltd Ltd.

Coromandel Engineer- Dixon Technologies

ing Company Ltd. Cupid Trades & Finance Genus Power Infrastructures Ltd. (India) Ltd Gujarat Industries Tamboli Capital

Ltd. Power Co.Ltd. Ltd.

Dai-Ichi Karkaria Ltd. Orient Green Power Company E.I.D.-Parry (India)

Eclerx Services Ltd. Ltd. Ltd. Hindalco Industries Vinati Organics

Faze Three Ltd. Ltd. Ltd.

Gujarat Pipavav Port Ltd. Grp Ltd. Iifl Wealth Manage-

Gujarat State Petronet ment Ltd Iol Chemicals &

Ltd. Hero Motocorp Ltd. Hsil Ltd. Pharmaceuticals

Inspirisys Solutions Ltd.

Inox Leisure Ltd. Ishan Dyes & Chemicals Indian Hotels Co.Ltd. Ltd

Ltd. Kinetic Trust Ltd.

Integra Engineering Jamna Auto Industries Ltd. Jk Agri Genetics Ltd

India Ltd. Jsg Leasing Ltd K.M.Sugar Mills Ltd.

Jindal Stainless (Hisar) Ltd Prem Somani Finan-

Nova Publications India Kirloskar Ferrous Indus- cial Services Ltd. Mahindra & Mahin-

Ltd tries Ltd. Kartik Investments Trust Ltd. dra Ltd.

Redington (India)

Pvr Ltd. Krbl Ltd. Lyka Labs Ltd. Ltd. Mangalore Chemi-

cals & Fertilizers

Roselabs Finance Ltd. Mangalore Refinery & Munoth Communication Ltd Shriram City Union Ltd.

Petrochemicals Ltd. Finance Ltd.

Sal Automotive Ltd Mahanagar Gas Ltd Pudumjee Paper

National Standard (India) Sundram Fasteners Products Ltd

Sumeru Industries Ltd. Ltd. Pratik Panels Ltd. Ltd.

Sukhjit Starch &

Themis Medicare Ltd. Pranavaditya Spinning Ranjeet Mechatronics Ltd Westlife Develop- Chemicals Ltd.

Mills Ltd. ment Ltd.

Titan Company Limited Shankara Building Products Ltd Suprajit Engineer-

Psp Projects Ltd ing Ltd.

Suraj Ltd.

Sanathnagar Enterprises Sutlej Textiles &

Limited Tanla Solutions Ltd. Industries Ltd.

Shree Ganesh Biotech T T Ltd. Vascon Engineers

(India) Ltd Ltd

Vani Commercials Ltd

Teamlease Services Ltd Vtm Ltd.

Voltamp Transformers Ltd.

Research Disclaimer: https://www.religareonline.com/disclaimer 3

Religare Morning Digest

June 10, 2020

Religare Investment Calls

Name of the Company Reco Date Reco Price Target Price Upside % Previous day Closing Price

CRISIL 01-Aug-17 1,858 2,419 30.2% 1,446.2

LIC Housing Finance 09-Aug-17 681 748 9.8% 253.6

Force Motors 25-Jan-18 3,250 4,197 29.1% 902.7

Avanti Feeds 12-Feb-18 835 967 15.8% 471.0

Sutlej Textiles 20-Aug-18 53 62 17.8% 24.0

Wim Plast 21-Nov-18 740 922 24.6% 349.8

Fiem Industries 22-Nov-18 588 807 37.2% 292.9

Time Technoplast 12-Dec-18 102 128 25.6% 35.7

Century Plyboards 28-Feb-19 163 224 36.8% 110.2

Swaraj Engines 03-May-19 1,379 1,675 21.5% 1,249.3

Castrol India 03-May-19 150 184 22.4% 126.0

Ambuja Cement 07-May-19 220 251 13.9% 187.8

Godrej Consumer Products 09-May-19 636 829 30.3% 659.4

VIP Ind. 10-May-19 436 534 22.4% 259.2

Rajesh Exports 21-May-19 669 852 27.4% 478.9

Jamna Auto Industries 24-May-19 58 62 6.9% 30.6

ITC 27-May-19 292 337 15.3% 198.5

Nilkamal 30-May-19 1,227 1,614 31.6% 1,082.6

Zee Entertainment Enterprises 25-Jul-19 391 467 19.4% 192.4

ELGI Equipments 09-Aug-19 245 313 27.6% 153.6

Capacit’e Infraprojects 19-Aug-19 221 292 32.1% 106.1

Apollo Tyres 07-Nov-19 169 199 17.8% 104.8

Ashok Leyland 14-Nov-19 81 90 11.1% 50.8

Minda Corporation 14-Nov-19 92 127 38.0% 63.0

For Religare Investment calls performance click here

Research Disclaimer: https://www.religareonline.com/disclaimer 4

Religare Morning Digest

June 10, 2020

Religare Investment Calls

Name of the Company Reco Date Reco Price Target Price Upside % Previous day Closing Price

Mahindra & Mahindra 20-Nov-19 561 695 23.9% 478.8

Cummins India 31-Jan-2020 585 705 20.5% 953.3

Wonderla Holidays 31-Jan-2020 253 345 36.4% 390.4

Teamlease Services 04-Feb-2020 2,474 2,955 19.4% 136.4

Colgate Palmolive 04-Feb-2020 1,351 1,646 21.8% 1,790.2

Marico 07-Feb-2020 306 405 32.2% 1,375.1

Subros 10-Feb-2020 267 321 20.2% 333.9

Navneet Education 12-Feb-2020 90 116 28.9% 173.7

Emami 13-Feb-2020 293 383 30.8% 73.5

Godrej Agrovet 13-Feb-2020 559 618 10.5% 202.3

Voltas 14-Feb-2020 687 791 15.1% 397.5

IFB Industries 19-Feb-2020 522 770 47.5% 547.9

The Ramco Cement 19-Feb-2020 789 902 14.3% 409.6

Tech Mahindra 07-May-2020 513 654 27.5% 612.9

Maruti Suzuki India 15-May-2020 5,114 5,886 15.1% 586.2

Havells India 21-May-2020 470 577 22.8% 5,662.3

Bharti Airtel 27-May-2020 559 709 26.8% 546.4

Crompton Greaves Consumer 29-May-2020 219 248 13.2% 567.8

Bajaj Auto 03-Jun-2020 2,796 2,998 7.2% 223.4

Larsen Toubro 08-Jun-2020 961 1,219 26.8% 2,791.2

KEI Industries 08-Jun-2020 352 397 12.8% 333.9

Britannia Industries 08-Jun-2020 3,467 4,029 16.2% 3,415.7

For Religare Investment calls performance click here

Research Disclaimer: https://www.religareonline.com/disclaimer 5

Religare Morning Digest

June 10, 2020

Religare Must Have Stocks

The Indian markets have plunged ~11% after briefly enjoying their all-time highs around the time of the union budget 2019. Post budget, disappointments due to

lack of any big bang announcements to provide stimulus to the economy led to markets’ fall. Further, several other factors such as weak corporate earnings for

April-June quarter too aggravated the weak sentiments pertaining to economic slowdown. Going forward, expensive valuation of Nifty suggests that further

correction cannot be ruled out unless there is a strong earnings recovery in the coming quarters. Moreover, looming threat of global economic recession may also

continue to impact the direction of the markets.

At a time when there is no clear direction emerging from the indices, focus on quality investments can still help the investors meet their goals. We believe at this

juncture, there are quite a few good stocks available for investors seeking healthy returns over at least 2 years. In this product, we are endorsing a ‘buy-and-hold’

investment philosophy that shall earn you healthy returns (15-20% CAGR) over the long-term. For this purpose, we have chosen five stocks that could offer healthy

upside potential.

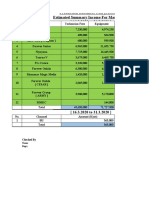

Company Name Sector Reco. Price CMP

Axis Bank Ltd. Banking 664 420.05

Berger Paints (I) Ltd. Paints 364 490.45

Britannia Industries Ltd. FMCG 2,467 3,415.70

HDFC Life Insurance Company Ltd. Insurance 517 506.85

Titan Company Ltd. Retail 1,074 997.10

For detailed report click here

Research Disclaimer: https://www.religareonline.com/disclaimer 6

Religare Morning Digest

June 10, 2020

In this product of Switch Over Strategy, we are recommending to exit stocks like BHEL, DLF and

GMR Infra as these have underperformed grossly due to their dismal/subdued financial performance

and corporate governance issues. Hence, it would be prudent at this stage to Exit these stocks and

invest in established companies like Escorts Ltd, ICICI Prudential Life Insurance, and Marico.

Switch From Switch Into

BHEL Escorts

DLF ICICI Pru Life Insurance

GMR Infra Marico

For detailed report click here

Research Disclaimer: https://www.religareonline.com/disclaimer 7

Religare Morning Digest

June 10, 2020

Research Product Basket

For every client, the advisor must allocate a specific proportion of funds for trading and investing depending on the risk taking ability and willingness of the client

and their investment goals.

The below mentioned product basket tries to address the way to deal with the trading portfolio (cash/derivative) for optimum effectiveness of research calls.

It is recommended to divide your trading funds for various types of calls and not invest the entire amount for 1 or 2 calls only.

For cash market trading For 1L margin*

Call / Product Call Frequency No. of calls Avg open call duration % funds allocated Total Per Call

Intraday Calls Intraday 2-3 < 1 day 25% 25,000 8,000

Live / RMD Calls Daily 3-4 3 - 4 days 30% 30,000 4,000

Master Pick Weekly 1 1 month 15% 15,000 5,000

Religare Alpha Opportunity NA 2 - 3 months 20% 20,000 As per weightage

Cash NA 10% 10,000

These calls are flashed live on Ms Lync and ODIN with the purpose of squaring off positions on the same day. As a policy, we restrict our

Intraday Calls

intraday cash market calls to less than 4 calls a day. Hence, funds should be allocated accordingly to have provision to trade in all calls.

2 super ideas are flashed in RMD daily with a view of 3-4 days. Additionally as per market opportunity, we flash live calls during the day

Live / RMD Calls (including BTST calls). 3-4 such calls are made on a daily basis which might be open for 3-4 days. Funds should be allocated keeping in mind that

there will be 7-8 such open calls daily.

This is our weekly recommendation shortlisted on the basis of techno-funda analysis. 15% of funds is recommended to be allocated for Master

Master Pick

Pick considering that there will be 3 open calls. The average open duration for this call will be 1 month.

This is a portfolio of 8-10 stocks which are held with a view of 2-3 months. It is recommended to allocate 20% of funds for building this portfolio

Religare Alpha

which will provide stability to the overall trading portfolio.

Cash 10% surplus cash in the portfolio should be kept for the purposes of allocating it to opportunities as and when they arrive .

For derivative market trading For 1L margin*

Call / Product Call Frequency No. of calls Avg open call duration % funds allocated Total Per Call

Derivative Ideas Daily 1-2 1 - 3 days 40% 40,000 40,000

Live calls Intraday / Daily 1-2 3 - 4 days 50% 50,000 50,000

Cash NA 10% 10,000

1 derivative idea is shared in RMD daily. It can be a plain vanilla F&O buy/sell call or an option strategy. Funds should be allocated assuming 2

Derivative Ideas

such calls will be open at any time. These calls are open for 3-4 days on an average.

These calls are flashed on MS Lync and ODIN during live market hours. These calls can be intraday or with a view of 2-3 days. Funds should be

Live Calls

allocated considering 2 such calls will be open at any time. 3/4 times, these calls will be on Nifty / Bank Nifty only.

Cash It is recommended to hold 10% cash to capitalize on any opportunity that may arise in markets.

Research Disclaimer: https://www.religareonline.com/disclaimer 8

Religare Morning Digest

June 10, 2020

Research Analysts

Ajit Mishra ajit.mishra@religare.com

Himanshu Sharma himanshu.sharma1@religare.com

Khadija Mantri khadija.mantri@religare.com

Manoj M Vayalar manoj.vayalar@religare.com

Nirvi Ashar nirvi.ashar@religare.com

Rohit Khatri rohit.khatri@religare.com

Suhanee Shome suhanee.shome@religare.com

Research Disclaimer: https://www.religareonline.com/disclaimer 9

Religare Morning Digest

June 10, 2020

Before you use this research report , please ensure to go through the disclosure inter-alia as required under Securities and Exchange Board of India (Research Analysts)

Regulations, 2014 and Research Disclaimer at the following link : https://www.religareonline.com/disclaimer

Specific analyst(s) specific disclosure(s) inter-alia as required under Securities and Exchange Board of India (Research Analysts) Regulations, 2014 is/are as under:

Statements on ownership and material conflicts of interest , compensation– Research Analyst (RA)

[Please note that only in case of multiple RAs, if in the event answers differ inter-se between the RAs, then RA specific answer with respect to questions under F (a) to F(j)

below , are given separately]

S. No. Statement Answer

Yes No

I/we or any of my/our relative has any financial interest in the subject company? [If answer is yes, nature of Interest is given below this table] No

I/we or any of my/our relatives, have actual/beneficial ownership of one per cent. or more securities of the subject company, at the end of the month No

immediately preceding the date of publication of the research report or date of the public appearance?

I/we or any of my/our relative, has any other material conflict of interest at the time of publication of the research report or at the time of public No

appearance?

I/we have received any compensation from the subject company in the past twelve months? No

I/we have managed or co-managed public offering of securities for the subject company in the past twelve months? No

I/we have received any compensation for brokerage services from the subject company in the past twelve months? No

I/we have received any compensation for products or services other than brokerage services from the subject company in the past twelve months? No

I/we have received any compensation or other benefits from the subject company or third party in connection with the research report? No

I/we have served as an officer, director or employee of the subject company? No

I/we have been engaged in market making activity for the subject company? No

Nature of Interest ( if answer to F (a) above is Yes : ……………………………………………………………………………………………………………………

Name(s) with Signature(s) of RA(s).

[Please note that only in case of multiple RAs and if the answers differ inter-se between the RAs, then RA specific answer with respect to questions under F (a) to F(j) above ,

are given below]

SS..No. Name(s) of RA. Signtures of Serial Question of question which the signing RA Yes No.

RA needs to make a separate declaration / answer

Copyright in this document vests exclusively with RBL. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any

other person or published, copied, in whole or in part, for any purpose, without prior written permission from RBL. We do not guarantee the integrity of any emails or

attached files and are not responsible for any changes made to them by any other person.

Research Disclaimer: https://www.religareonline.com/disclaimer 10

You might also like

- RHB Equity 360° (Lafarge, Adventa Technical: Top Glove, Hai-O) - 14/06/2010Document3 pagesRHB Equity 360° (Lafarge, Adventa Technical: Top Glove, Hai-O) - 14/06/2010Rhb InvestNo ratings yet

- CHAITANYA BHARATHI INSTITUTE PLACEMENT REPORT 2020-21Document5 pagesCHAITANYA BHARATHI INSTITUTE PLACEMENT REPORT 2020-21Sonu AshfaqNo ratings yet

- Today'S Turnover of Shares - 582,794,744: CompanyDocument2 pagesToday'S Turnover of Shares - 582,794,744: Companymuzzammil17No ratings yet

- 4 PDFDocument2 pages4 PDFRÁvi DadheechNo ratings yet

- Titan Investor PPT Q1'FY23Document59 pagesTitan Investor PPT Q1'FY23aditya162No ratings yet

- Fiac6212ea c19 WusDocument12 pagesFiac6212ea c19 WusarronyeagarNo ratings yet

- Mba-Ii Section - A Week 10 Report (7 April To 14 April) : Annaam Bin Muhammad Haris Amir Hira Naeem Muggo Kinza AdnanDocument11 pagesMba-Ii Section - A Week 10 Report (7 April To 14 April) : Annaam Bin Muhammad Haris Amir Hira Naeem Muggo Kinza AdnanHaris AmirNo ratings yet

- FY 2076/77 IPOs and RightsDocument132 pagesFY 2076/77 IPOs and Rightsbibek dhakalNo ratings yet

- Ipo Note Oimex Electrode LimitedDocument7 pagesIpo Note Oimex Electrode LimitedSajjadul MawlaNo ratings yet

- ITR Filing for Individual Himmat Singh for AY 2019-20Document3 pagesITR Filing for Individual Himmat Singh for AY 2019-20ashishrpgNo ratings yet

- RHB Equity 360° (KFC, SP Setia Technical: WTK) - 30/03/2010Document3 pagesRHB Equity 360° (KFC, SP Setia Technical: WTK) - 30/03/2010Rhb InvestNo ratings yet

- Market Update: New Economic Model: Broad Framework Unveiled-30/03/2010Document3 pagesMarket Update: New Economic Model: Broad Framework Unveiled-30/03/2010Rhb InvestNo ratings yet

- Stcs (Scotland) LTD Annual Report and Unaudited Accounts For The Year Ended 31 January 2020Document11 pagesStcs (Scotland) LTD Annual Report and Unaudited Accounts For The Year Ended 31 January 2020Jacqueline GrayNo ratings yet

- SMTP Iv Soh 0 L 4 N RHig SGi JW QT Ex W69 CMG ZAYz 5 MWVDocument1 pageSMTP Iv Soh 0 L 4 N RHig SGi JW QT Ex W69 CMG ZAYz 5 MWVprabindraNo ratings yet

- Eastern Combined Cement Business Plan for Rwanda PlantDocument219 pagesEastern Combined Cement Business Plan for Rwanda Plantم. هاني الحطاميNo ratings yet

- Viviana Power Tech ledger accountDocument2 pagesViviana Power Tech ledger accountDhruv ParekhNo ratings yet

- O LKN B0 Yli L26 ZZ Uw NL JL H8 A C6 HTM Adn NNFVAC7 JRDocument2 pagesO LKN B0 Yli L26 ZZ Uw NL JL H8 A C6 HTM Adn NNFVAC7 JRramdularisaphiNo ratings yet

- EAPL BATTERY DIVISION SCRUTINY OBSERVATIONSDocument12 pagesEAPL BATTERY DIVISION SCRUTINY OBSERVATIONSparam.ginniNo ratings yet

- SCB - Proposed Disposal Signing of SPADocument18 pagesSCB - Proposed Disposal Signing of SPAJeff WongNo ratings yet

- Mutual Funds Association Of Pakistan NAV Returns Performance Summary Report for Exchange Traded Funds (ETFsDocument1 pageMutual Funds Association Of Pakistan NAV Returns Performance Summary Report for Exchange Traded Funds (ETFsafnaniqbalNo ratings yet

- Wipro Sita Corp CotivitiDocument2 pagesWipro Sita Corp CotivitiBhanu PrakashNo ratings yet

- RHB Equity 360° (Digi, Plantation, Gamuda Technical: Berjaya Corp) - 11/03/2010Document3 pagesRHB Equity 360° (Digi, Plantation, Gamuda Technical: Berjaya Corp) - 11/03/2010Rhb InvestNo ratings yet

- ExamDocument3 pagesExamMIN THANTNo ratings yet

- Subiect Lstapril Reference: and Export of To For And: Board Fax EmailDocument8 pagesSubiect Lstapril Reference: and Export of To For And: Board Fax EmailANJALI MNo ratings yet

- PNL Statement of ABL Group of MEANA1010Document3 pagesPNL Statement of ABL Group of MEANA1010uodal rajNo ratings yet

- RHB Equity 360° (ILB, B-Toto, Dialog Technical: Axiata) - 13/05/2010Document3 pagesRHB Equity 360° (ILB, B-Toto, Dialog Technical: Axiata) - 13/05/2010Rhb InvestNo ratings yet

- News Just In:: Et 500 CompaniesDocument2 pagesNews Just In:: Et 500 CompaniesAshutosh ApteNo ratings yet

- Mba-Ii Section - A Week 7 Report (16 To 24 March) : Annaam Bin Muhammad Haris Amir Hira Naeem Muggo Kinza AdnanDocument10 pagesMba-Ii Section - A Week 7 Report (16 To 24 March) : Annaam Bin Muhammad Haris Amir Hira Naeem Muggo Kinza AdnanHaris AmirNo ratings yet

- Shantiniketan Properties Pvt. Ltd. Shantiniketan Properties P. LTD., SDocument1 pageShantiniketan Properties Pvt. Ltd. Shantiniketan Properties P. LTD., Sdaljeet singhNo ratings yet

- Bsbfia412-Case Study 2019Document15 pagesBsbfia412-Case Study 2019Pattaniya KosayothinNo ratings yet

- Today's Top Research Idea Market Snapshot: Tata Consumer (AGIC: CEO Track) : Steadily Walking The Talk!Document20 pagesToday's Top Research Idea Market Snapshot: Tata Consumer (AGIC: CEO Track) : Steadily Walking The Talk!Equity NestNo ratings yet

- Abridged ProspectusDocument8 pagesAbridged ProspectusJeeva BharathiNo ratings yet

- 2242 3d Printronics GantryDocument2 pages2242 3d Printronics GantryRupen AryalNo ratings yet

- RHB Equity 360° (Tanjong, Plantation Technical: Sunway) - 13/04/2010Document3 pagesRHB Equity 360° (Tanjong, Plantation Technical: Sunway) - 13/04/2010Rhb InvestNo ratings yet

- Analyze SQMI Renuka Coalindo Tbk company reportDocument3 pagesAnalyze SQMI Renuka Coalindo Tbk company reportElusNo ratings yet

- Union Budget 2018-19 - Impact - 010218 - Retail-03-February-2018-1648255817Document16 pagesUnion Budget 2018-19 - Impact - 010218 - Retail-03-February-2018-1648255817Chinmayananda khandaiNo ratings yet

- RHB Equity 360° (Timber, Banks Technical: Ramunia, Petra Perdana) - 05/04/2010Document3 pagesRHB Equity 360° (Timber, Banks Technical: Ramunia, Petra Perdana) - 05/04/2010Rhb InvestNo ratings yet

- Governing Hybrid Organizations at The Interface of Business & Government-The Case of PsesDocument16 pagesGoverning Hybrid Organizations at The Interface of Business & Government-The Case of Psessandeep eNo ratings yet

- Q1FY22 ResultsDocument14 pagesQ1FY22 ResultsrohitnagrajNo ratings yet

- Grand Test 2 BFD CFAP 4 Dec 22 with Solution ST Academy (Sir Saud Tariq)Document14 pagesGrand Test 2 BFD CFAP 4 Dec 22 with Solution ST Academy (Sir Saud Tariq)aimanraees10No ratings yet

- Fertiliser Firms' Working Capital Borrowings Set To Rise - ICRA - The Economic TimesDocument2 pagesFertiliser Firms' Working Capital Borrowings Set To Rise - ICRA - The Economic TimesccckakakNo ratings yet

- Quill Capita Trust: 1HFY12/10 Gross Revenue Grows 3% YoY - 30/07/2010Document3 pagesQuill Capita Trust: 1HFY12/10 Gross Revenue Grows 3% YoY - 30/07/2010Rhb InvestNo ratings yet

- RHB Equity 360° - 29 July 2010 (Hai-O, APM, PLUS, WCT, Daibochi Technical: E&O)Document3 pagesRHB Equity 360° - 29 July 2010 (Hai-O, APM, PLUS, WCT, Daibochi Technical: E&O)Rhb InvestNo ratings yet

- RHB Equity 360° (Timber Technical: Kulim) - 07/09/2010Document3 pagesRHB Equity 360° (Timber Technical: Kulim) - 07/09/2010Rhb InvestNo ratings yet

- Ambit Capital ReportDocument52 pagesAmbit Capital ReportsheokandameetNo ratings yet

- S AXoxyvnfpt ZVC 7 IJbxw NVRKK 0 CC VRgdhpra 4 I RNDocument2 pagesS AXoxyvnfpt ZVC 7 IJbxw NVRKK 0 CC VRgdhpra 4 I RNprabindraNo ratings yet

- RHB Equity 360° (Tanjong, Telecommunications, Top Glove, BToto Technical: Genting) - 16/03/2010Document3 pagesRHB Equity 360° (Tanjong, Telecommunications, Top Glove, BToto Technical: Genting) - 16/03/2010Rhb InvestNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- Production Indirect Cost 16-31.3.2020Document51 pagesProduction Indirect Cost 16-31.3.2020aung ye kyawNo ratings yet

- IJM Plantations Berhad: Buys More Land in Indonesia - 04/08/2010Document2 pagesIJM Plantations Berhad: Buys More Land in Indonesia - 04/08/2010Rhb InvestNo ratings yet

- ITC FY20 audited resultsDocument1 pageITC FY20 audited resultsSai KishoreNo ratings yet

- Morning India 20210319 Mosl Mi Pg020Document20 pagesMorning India 20210319 Mosl Mi Pg020vikalp123123No ratings yet

- Thailand'S: Top Local KnowledgeDocument9 pagesThailand'S: Top Local KnowledgeVishan SharmaNo ratings yet

- Titan Q3 FY22 Earnings PresentationDocument37 pagesTitan Q3 FY22 Earnings Presentationalim shaikhNo ratings yet

- ITC FirstcallDocument15 pagesITC Firstcallsumitjain_amcap5571No ratings yet

- Vinati Organics Annuat Report 2010-11Document72 pagesVinati Organics Annuat Report 2010-11mgrreddyNo ratings yet

- Aditya Vision Limited: Puonrals SeDocument44 pagesAditya Vision Limited: Puonrals SeContra Value BetsNo ratings yet

- PPF STATEMENT TITLEDocument1 pagePPF STATEMENT TITLESudheesh TKNo ratings yet

- CSR Data Sheet Company WiseDocument8 pagesCSR Data Sheet Company Wisenikita.dubeyNo ratings yet

- Nifty and Bank Nifty trend analysisDocument4 pagesNifty and Bank Nifty trend analysisMaruthee SharmaNo ratings yet

- Money Trend: CNX Nifty CMP 10431Document4 pagesMoney Trend: CNX Nifty CMP 10431Maruthee SharmaNo ratings yet

- 16 Dec 2020 PDFDocument1 page16 Dec 2020 PDFMaruthee SharmaNo ratings yet

- 07april 2021 India DailyDocument65 pages07april 2021 India DailyMaruthee SharmaNo ratings yet

- Money Trend: CNX Nifty CMP 10761Document4 pagesMoney Trend: CNX Nifty CMP 10761Maruthee SharmaNo ratings yet

- Nifty and Bank Nifty trend analysisDocument4 pagesNifty and Bank Nifty trend analysisMaruthee SharmaNo ratings yet

- Sarvatobhadra Chakra and Astrological Predictions (Chi FF)Document69 pagesSarvatobhadra Chakra and Astrological Predictions (Chi FF)Manish Kumar100% (7)

- Money Trend: CNX Nifty CMP 10739Document4 pagesMoney Trend: CNX Nifty CMP 10739Maruthee SharmaNo ratings yet

- Money Trend: CNX Nifty CMP 10761Document4 pagesMoney Trend: CNX Nifty CMP 10761Maruthee SharmaNo ratings yet

- Money Trend: CNX Nifty CMP 10603Document4 pagesMoney Trend: CNX Nifty CMP 10603Maruthee SharmaNo ratings yet

- Diwali Picks 2019Document19 pagesDiwali Picks 2019Pushparaj ThangarajNo ratings yet

- Money Trend: CNX Nifty CMP 10602Document4 pagesMoney Trend: CNX Nifty CMP 10602Maruthee SharmaNo ratings yet

- MCX trading hours revisedDocument1 pageMCX trading hours revisedSachin ShirnathNo ratings yet

- Federal Bank-Sept13 19Document6 pagesFederal Bank-Sept13 19Maruthee SharmaNo ratings yet

- 004 Udemy-Course-Order-LatestDocument1 page004 Udemy-Course-Order-LatestGino FabrizioNo ratings yet

- Ts Intallation PDFDocument8 pagesTs Intallation PDFMaruthee SharmaNo ratings yet

- 23rd May 2020: MubarakDocument20 pages23rd May 2020: MubarakMaruthee SharmaNo ratings yet

- 004 Udemy-Course-Order-LatestDocument1 page004 Udemy-Course-Order-LatestGino FabrizioNo ratings yet

- Ts Intallation PDFDocument8 pagesTs Intallation PDFMaruthee SharmaNo ratings yet

- Smart Investment English Issue No. 13Document48 pagesSmart Investment English Issue No. 13Maruthee SharmaNo ratings yet

- Press Release On Extension of Lockdown and Issue of New Guidelines DT 01.05.2020Document7 pagesPress Release On Extension of Lockdown and Issue of New Guidelines DT 01.05.2020The WireNo ratings yet

- Fundamental Research Report: Chembond Chemicals LTDDocument4 pagesFundamental Research Report: Chembond Chemicals LTDMaruthee SharmaNo ratings yet

- ABM Weekly Techno-Derivatives Snapshot 27 April 2020 PDFDocument46 pagesABM Weekly Techno-Derivatives Snapshot 27 April 2020 PDFvikuNo ratings yet

- Weekly Technical PicksDocument4 pagesWeekly Technical PicksMaruthee SharmaNo ratings yet

- 5 Chart PatternsDocument11 pages5 Chart Patternsac4scrn DC67% (3)

- Dalal Street 7 June PDFDocument85 pagesDalal Street 7 June PDFMaruthee SharmaNo ratings yet

- Profiting India Multi Trillion USD Stock Markets MR Kuntal ShahDocument40 pagesProfiting India Multi Trillion USD Stock Markets MR Kuntal ShahNivantNo ratings yet

- Intraday PredictionDocument4 pagesIntraday PredictionMaruthee SharmaNo ratings yet

- Rakesh Jhunjhunwala PDFDocument6 pagesRakesh Jhunjhunwala PDFMaruthee SharmaNo ratings yet

- Introduction To Google SheetDocument14 pagesIntroduction To Google SheetJohn Rey Radoc100% (1)

- Invoice Request for Digitize Global InovasiDocument1 pageInvoice Request for Digitize Global InovasiAsa Arya SudarmanNo ratings yet

- Hierarchical Afaan Oromoo News Text ClassificationDocument11 pagesHierarchical Afaan Oromoo News Text ClassificationendaleNo ratings yet

- Q3 SolutionDocument5 pagesQ3 SolutionShaina0% (1)

- PowerHA SystemMirror Session 2 OverviewDocument80 pagesPowerHA SystemMirror Session 2 OverviewFabrice PLATELNo ratings yet

- Concrete Mixer Truck SinotrukDocument2 pagesConcrete Mixer Truck SinotrukTiago AlvesNo ratings yet

- Rguhs Dissertation PharmacyDocument6 pagesRguhs Dissertation PharmacyWhatAreTheBestPaperWritingServicesSingapore100% (1)

- WhatsoldDocument141 pagesWhatsoldLuciana KarajalloNo ratings yet

- Lesson Plan in ESPDocument4 pagesLesson Plan in ESPkaren daculaNo ratings yet

- Enzyme KineticsDocument13 pagesEnzyme KineticsMohib100% (1)

- Get TRDocDocument209 pagesGet TRDoc10131No ratings yet

- Al-Jahiz (781-869) : ZoologyDocument25 pagesAl-Jahiz (781-869) : ZoologyJA QuibzNo ratings yet

- MBA Regular Part-I (Sem I)Document17 pagesMBA Regular Part-I (Sem I)Jasdeep SinghNo ratings yet

- Introduction To Human Anatomy & Physiology: Prepared by Mr. Abhay Shripad Joshi Yash Institute of Pharmacy AurangabadDocument18 pagesIntroduction To Human Anatomy & Physiology: Prepared by Mr. Abhay Shripad Joshi Yash Institute of Pharmacy AurangabadMourian AmanNo ratings yet

- Far Eastern University Institute of Tourism and Hotel Management Tourism Management Program 1 Semester A.Y. 2019 - 2020Document46 pagesFar Eastern University Institute of Tourism and Hotel Management Tourism Management Program 1 Semester A.Y. 2019 - 2020Mico BolorNo ratings yet

- Kak MhamadDocument1 pageKak MhamadAyub Anwar M-SalihNo ratings yet

- Practical Problems On CustomsDocument13 pagesPractical Problems On Customsnousheen riya67% (3)

- MPU 2232 Chapter 5-Marketing PlanDocument27 pagesMPU 2232 Chapter 5-Marketing Plandina azmanNo ratings yet

- Cse 3003: Computer Networks: Dr. Sanket Mishra ScopeDocument56 pagesCse 3003: Computer Networks: Dr. Sanket Mishra ScopePOTNURU RAM SAINo ratings yet

- Raoult's law and colligative propertiesDocument27 pagesRaoult's law and colligative propertiesGøbindNo ratings yet

- Steady State Modeling and Simulation of The Oleflex Process For Isobutane Dehydrogenation Considering Reaction NetworkDocument9 pagesSteady State Modeling and Simulation of The Oleflex Process For Isobutane Dehydrogenation Considering Reaction NetworkZangNo ratings yet

- #5130 Long Dress With Short Sleeves InstructionDocument2 pages#5130 Long Dress With Short Sleeves Instructionmr kdramaNo ratings yet

- Cultural DiffusionDocument2 pagesCultural DiffusionNicole Aguarin SwinNo ratings yet

- The History of Coins and Banknotes in Mexico: September 2012Document35 pagesThe History of Coins and Banknotes in Mexico: September 2012Mladen VidovicNo ratings yet

- Boost productivity and networking with a co-working café in Iligan CityDocument4 pagesBoost productivity and networking with a co-working café in Iligan CityJewel Cabigon0% (1)

- Infrastructure Finance Project Design and Appraisal: Professor Robert B.H. Hauswald Kogod School of Business, AUDocument2 pagesInfrastructure Finance Project Design and Appraisal: Professor Robert B.H. Hauswald Kogod School of Business, AUAida0% (1)

- 2010 - Caliber JEEP BOITE T355Document484 pages2010 - Caliber JEEP BOITE T355thierry.fifieldoutlook.comNo ratings yet

- SAC SINGLAS Accreditation Schedule 15 Apr 10Document5 pagesSAC SINGLAS Accreditation Schedule 15 Apr 10clintjtuckerNo ratings yet

- Handwashing and Infection ControlDocument23 pagesHandwashing and Infection ControlLiane BartolomeNo ratings yet

- Barcode BasicsDocument3 pagesBarcode Basicsnikhilbajpai_88No ratings yet