Professional Documents

Culture Documents

PPF STATEMENT TITLE

Uploaded by

Sudheesh TKOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PPF STATEMENT TITLE

Uploaded by

Sudheesh TKCopyright:

Available Formats

Page 1of1 M - 41596465-1

0004/PPFGB/0/1-1/2020/41596465-1

MR.SUDHEESH T K

THOTTAMKUNNATH,KALLIPADAM,SHORANUR, 33667777

NEAR SN COLLEGE

Your Base Branch : 215,FREE PRESS HOUSE,FREE

PALAKKAD

PRESS MARG,NARIMAN POINT,

KERALA - INDIA - 679122

MUMBAI ,MAHARASHTRA 400021

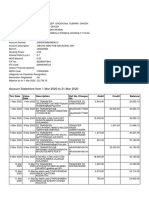

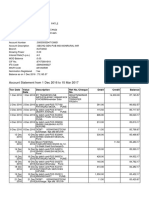

Statement of Public Provident Fund Account

Statement for Customer ID: 548623634 as on Mar 31,2020 PAN : AVZPT7831N

ACCOUNT TYPE ACCOUNT NUMBER DATE OF A/C OPENING TRANSFER IN DATE BALANCE ` NOMINATION

Public Provident Fund (PPF)Scheme,2019 000418231531 31-01-2020 NA 15,132.00 Registered

TOTAL 15,132.00

Statement of transactions in Public Provident Fund Account 000418231531 for the period Apr 01,2019 to Mar 31,2020

DATE PARTICULARS DEPOSITS ` WITHDRAWALS ` BALANCE `

01-04-2019 Balance Brought Forward 0.00 Cr

31-01-2020 Trf frm SB 266101000154 5,000.00 Cr 5,000.00 Cr

07-02-2020 Trf frm SB 266101000154 5,000.00 Cr 10,000.00 Cr

04-03-2020 INF/INFT/20200304124651/Self 5,000.00 Cr 15,000.00 Cr

31-03-2020 000418231531:Int.Pd:31-01-2020 to 31-03-2020 132.00 Cr 15,132.00 Cr

Total : 15,132.00 Cr 0.00 Dr 15,132.00 Cr

Sincerely,

ICICI Bank Limited

This is a system-generated statement. Hence, it does not require any signature.

Public Provident Fund Scheme Guidelines :

1. The Public Provident Fund Scheme is a statutory scheme of the Central Government framed under the provisions of Public Provident Fund Act, 2019

2. An individual can open a Public Provident Fund account in his/her own name. Individual can also open an additional account on behalf of each minor of whom he/she is the guardian. He/She can subscribe any amount in

multiples of Rs. 50 not less than Rs. 500 and not more than Rs.1,50,000 in a year in all accounts put together. A year for the purpose of the scheme is financial year.

3. Only one PPF account can be opened by an individual in one name. If two accounts are opened by the subscriber in his name by mistake, the second account will be treated as irregular account and will not carry any

interest.

4. The subscriptions can be deposited in lump sum or in convenient instalments.

5. The balance in the fund earns interest as per the rate fixed by the Central Government from time to time. The interest will be allowed for a calender month on the lowest balance at the credit of an account between the

close of the 5th day and the end of the month.

6. The account can be closed on maturity i.e. after expiry of 15 years from the closure of the financial year in which initial subscription was made.

7. PPF account can be continued after maturity for a block period of 5 years.

8. A subscriber can take loan from the fund and can make a withdrawal as per the rule prescribed by Central Government under the provisions of Public Provident Fund Act, 2019.

9. A subscriber may nominate one or more person.

10. The interest credited to the customer is totally exempt from income tax and the amount standing to the credit of the subscriber is totally exempt from wealth tax.

11. The account office can condone default in payment of subscriptions in the PPF account by charging a fee of Rs.50/- for each year of default, along with arrears of subscriptions at the rate of Rs.500/- per year.

This is an authorised statement and can be submitted as proof for tax benefit

Subscription to Public Provident Fund qualify for deduction under section 80C of Income Tax Act

Corporate Office: ICICI Bank Ltd., ICICI Bank Towers, Bandra-Kurla complex, Mumbai - 400051, India. www.icicibank.com

Registered Office: ICICI Bank Tower, Near Chakli Circle, Old Padra Road, Vadodara, Gujarat. Pin – 390 007. Category of service: Banking and Financial Services.

Registration No. MIV/ST/Bank & Finc/4.

This is an authenticated intimation/statement. CIN : L65190GJ1994PLC021012

Customers are requested to immediately notify the Bank of any discrepancy in the statement

SR184792217_BS_DB_SS_16032021

You might also like

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document2 pagesHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971golu84No ratings yet

- Ref - No. 2203166-16309213-4: Prashant KaushikDocument4 pagesRef - No. 2203166-16309213-4: Prashant KaushikVicky GunaNo ratings yet

- MOBILE SERVICES TITLEDocument2 pagesMOBILE SERVICES TITLEASHVINKUMAR NIKAMNo ratings yet

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDocument2 pagesStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits Balancech shanmugamNo ratings yet

- Emergency Amount After Due Date: 18002669944 (Tollfree) (022) - 68759400, (022) - 24012400Document2 pagesEmergency Amount After Due Date: 18002669944 (Tollfree) (022) - 68759400, (022) - 24012400jaswal.jagdevNo ratings yet

- Mr. Augustin Mathew's bank statement summary for January 2016Document1 pageMr. Augustin Mathew's bank statement summary for January 2016AUGUSTINMATHEWNo ratings yet

- LT Bill Dec16Document2 pagesLT Bill Dec16nahkbceNo ratings yet

- Tax Invoice: Taxes RateDocument1 pageTax Invoice: Taxes RateSUBHAM SINGHNo ratings yet

- Monthly Bank StatementDocument3 pagesMonthly Bank StatementRamesh UpadhyaNo ratings yet

- Op Transaction History 29!03!2018Document2 pagesOp Transaction History 29!03!2018Avinash GuptaNo ratings yet

- A Summary of Your Relationship/s With Us:: Patil Nikhil BhimraoDocument8 pagesA Summary of Your Relationship/s With Us:: Patil Nikhil BhimraoGlobal printNo ratings yet

- 701018-Icea Uganda Money Market FundDocument1 page701018-Icea Uganda Money Market FundChrispus MutabuuzaNo ratings yet

- Nagad Account Statement 01302823917 04oct2023Document1 pageNagad Account Statement 01302823917 04oct2023mstfztbNo ratings yet

- CASA Statement 1606148149984Document2 pagesCASA Statement 1606148149984akundonlot filemNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument11 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceHEES GPT NZB 005No ratings yet

- State Bank of India Account Statement for ETASTY FOODS from 20/07/2019 to 04/08/2019Document2 pagesState Bank of India Account Statement for ETASTY FOODS from 20/07/2019 to 04/08/2019Jayesh RavalNo ratings yet

- Islam Bank PDFDocument1 pageIslam Bank PDFmdshufiyan42No ratings yet

- CreditCardStatement625385 - 2077 - 13-Sep-19Document1 pageCreditCardStatement625385 - 2077 - 13-Sep-19muhammad baqirNo ratings yet

- SBI Statement July 2017-2018 PDFDocument2 pagesSBI Statement July 2017-2018 PDFSai SameerNo ratings yet

- Account StatementDocument3 pagesAccount StatementRonald MyersNo ratings yet

- Your Personal Chequing Account StatementDocument1 pageYour Personal Chequing Account Statementwalid djelataNo ratings yet

- Account Statement From 1 Mar 2020 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Mar 2020 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSubhadeep GhoshNo ratings yet

- Bill Oct 16Document1 pageBill Oct 16deeNo ratings yet

- Mr. HEMANT's bank account statement from Apr 2020 to Jun 2020Document2 pagesMr. HEMANT's bank account statement from Apr 2020 to Jun 2020Akash SinghNo ratings yet

- Jasper ReportDocument2 pagesJasper ReportMubarak Ali ShinwariNo ratings yet

- Please PAY: TOTAL: $21,306.06 BY: 12-DEC-2022Document1 pagePlease PAY: TOTAL: $21,306.06 BY: 12-DEC-2022Joan davisNo ratings yet

- Feb2017Document4 pagesFeb2017mageshminiNo ratings yet

- 01-Jul-2021Document1 page01-Jul-2021SardarNo ratings yet

- Ooccmkn01 PDFDocument1 pageOoccmkn01 PDFnnuuyy 22No ratings yet

- Procap Financial Services Pvt. LTDDocument9 pagesProcap Financial Services Pvt. LTDDekrouf SysNo ratings yet

- FIXED LINE Bill 01244035539 398994083Document3 pagesFIXED LINE Bill 01244035539 398994083Alankar GuptaNo ratings yet

- Account Statement SummaryDocument2 pagesAccount Statement SummarySakthivelu NNo ratings yet

- E StatementDocument1 pageE Statementmdyakubhnk85No ratings yet

- NagadDocument1 pageNagadK.M.TowfiqeUzZaman Shanto100% (2)

- Estatement (1) (1) (1) - 2Document1 pageEstatement (1) (1) (1) - 2Riyadh BenaidNo ratings yet

- Bank statement summary for March 2018Document1 pageBank statement summary for March 2018Jagannath MandalNo ratings yet

- Do Not PAY This Bill: TOTAL: - $3,671.50Document1 pageDo Not PAY This Bill: TOTAL: - $3,671.50francinederbyNo ratings yet

- Statement of AccountDocument1 pageStatement of AccountNarayanamma MNo ratings yet

- OpTransactionHistoryUX331 03 2020Document3 pagesOpTransactionHistoryUX331 03 2020hemasundarcNo ratings yet

- 2203 PCDocument21 pages2203 PCAdvance Microsoft ExcelNo ratings yet

- CDB ReportDocument9 pagesCDB ReportBruce FerreiraNo ratings yet

- Muhammad Azhar Tariq S/O Manzoor Ahmad H No 29 ST No 13 Eden Palace HomeDocument1 pageMuhammad Azhar Tariq S/O Manzoor Ahmad H No 29 ST No 13 Eden Palace HomeJavaid AshrafNo ratings yet

- Tempfile 2Document1 pageTempfile 2Osama FahadNo ratings yet

- Titas Gas & Electricity Bill Payment June 2023Document4 pagesTitas Gas & Electricity Bill Payment June 2023YousufNo ratings yet

- Passbookstmt PDFDocument3 pagesPassbookstmt PDFRohitSinghBishtNo ratings yet

- Statement MergedDocument4 pagesStatement MergedRaghav SharmaNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument9 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLohit MataniNo ratings yet

- AdvanceReceipt2021 06 09 08 49 45Document3 pagesAdvanceReceipt2021 06 09 08 49 45Sakthi Saravana PerumalNo ratings yet

- E-Bill From Enagic India PDFDocument3 pagesE-Bill From Enagic India PDFHitesh ChavdaNo ratings yet

- Credit Card Statement SummaryDocument1 pageCredit Card Statement SummaryPsycho Bro100% (1)

- JEEVES Invoice PDFDocument1 pageJEEVES Invoice PDFBijay BeheraNo ratings yet

- Account statement showing transactions from Dec 2016 to Feb 2017Document4 pagesAccount statement showing transactions from Dec 2016 to Feb 2017AnuAnuNo ratings yet

- Stetment 10Document4 pagesStetment 10varaprasadNo ratings yet

- Account StatementDocument12 pagesAccount StatementDavidRiyazMithraNo ratings yet

- Payslip PDFDocument1 pagePayslip PDFAnonymous csjSQ0nNhNo ratings yet

- Bank Statement 1 Fusionn 1 PDFDocument6 pagesBank Statement 1 Fusionn 1 PDFBenny BerniceNo ratings yet

- For Billing Enquiry Visit Https://selfcare - Tikona.inDocument1 pageFor Billing Enquiry Visit Https://selfcare - Tikona.incyberabadNo ratings yet

- Statement of Public Provident Fund Account: Ms - Neha Raghubar YadavDocument2 pagesStatement of Public Provident Fund Account: Ms - Neha Raghubar YadavNeha100% (1)

- Indian Bank Statement Jan-Feb 2019Document2 pagesIndian Bank Statement Jan-Feb 2019sangaviNo ratings yet

- QT22017Document2 pagesQT22017Anandan GunasekaranNo ratings yet

- Evolution of Mobile Communication from 1G to 5GDocument6 pagesEvolution of Mobile Communication from 1G to 5GSudheesh TKNo ratings yet

- Evolution of Mobile Communication from 1G to 5GDocument6 pagesEvolution of Mobile Communication from 1G to 5GSudheesh TKNo ratings yet

- PPF STATEMENT TITLEDocument1 pagePPF STATEMENT TITLESudheesh TKNo ratings yet

- PPF STATEMENT TITLEDocument1 pagePPF STATEMENT TITLESudheesh TKNo ratings yet

- PPF STATEMENT TITLEDocument1 pagePPF STATEMENT TITLESudheesh TKNo ratings yet

- PPF STATEMENT TITLEDocument1 pagePPF STATEMENT TITLESudheesh TKNo ratings yet

- CSI ZG524 Middleware MidSem 1613548677625Document99 pagesCSI ZG524 Middleware MidSem 1613548677625Sudheesh TKNo ratings yet

- Foreign Portfolio Investments in India: Causes and Impact/TITLEDocument25 pagesForeign Portfolio Investments in India: Causes and Impact/TITLElogeshNo ratings yet

- Instruction: Write Your Name and Answer in A Journal/paper. Submit A MAXIMUM OF 6 PICTURES OnlyDocument1 pageInstruction: Write Your Name and Answer in A Journal/paper. Submit A MAXIMUM OF 6 PICTURES Onlyhokage astroNo ratings yet

- Kelompok 2 Schedule InvestasiDocument12 pagesKelompok 2 Schedule InvestasiRima WahyuNo ratings yet

- Fim01-Fundamental of Financial Management 01 - An Overview of Financial Management J. Villena, Cpa Financial ManagementDocument4 pagesFim01-Fundamental of Financial Management 01 - An Overview of Financial Management J. Villena, Cpa Financial ManagementJomar VillenaNo ratings yet

- Muhammad Syahrin Bin Zulkefly 2019848422 BA242 5B FIN657 Sir Mohd Husnin Bin Mat YusofDocument3 pagesMuhammad Syahrin Bin Zulkefly 2019848422 BA242 5B FIN657 Sir Mohd Husnin Bin Mat YusofsyahrinNo ratings yet

- Mortgage Loan Case StudiesDocument8 pagesMortgage Loan Case StudiesFurkhan SyedNo ratings yet

- Statute of Limitations For Collecting A DebtDocument2 pagesStatute of Limitations For Collecting A DebtmikotanakaNo ratings yet

- Acquiring New Knowledge: Module 26 AgricultureDocument10 pagesAcquiring New Knowledge: Module 26 AgricultureAngelica Sanchez de VeraNo ratings yet

- DNB Bank in Lithuania overviewDocument9 pagesDNB Bank in Lithuania overviewDonata BrukmanaitėNo ratings yet

- Business Plan GEMDocument33 pagesBusiness Plan GEMpavanikaveesha9562No ratings yet

- fm3 Chapter02Document165 pagesfm3 Chapter02catherinephilippouNo ratings yet

- FIN 735 IntroductionDocument23 pagesFIN 735 IntroductionKetki PatilNo ratings yet

- Court Upholds Tax Deductions But Limits Professional FeesDocument3 pagesCourt Upholds Tax Deductions But Limits Professional Feesjleo1No ratings yet

- Homework Chapter 4Document4 pagesHomework Chapter 4Thu Giang TranNo ratings yet

- 50 Kpis Cheat Sheet by Nicolas BoucherDocument1 page50 Kpis Cheat Sheet by Nicolas Boucherniah100% (1)

- Instructor's Manual Chapter 4 Time Value of MoneyDocument21 pagesInstructor's Manual Chapter 4 Time Value of MoneyReginoSaynoValenzuelaNo ratings yet

- General client profile and engagement detailsDocument2 pagesGeneral client profile and engagement detailsAbhiNo ratings yet

- Part III Money Market (Revised For 2e)Document31 pagesPart III Money Market (Revised For 2e)Harun MusaNo ratings yet

- FABM2 Module 04 (Q1-W5)Document5 pagesFABM2 Module 04 (Q1-W5)Christian Zebua100% (1)

- Option Greek - The Option GuideDocument6 pagesOption Greek - The Option GuidePINALNo ratings yet

- IAS 37 PRactice QuestionsDocument4 pagesIAS 37 PRactice Questionsfurqan83% (6)

- A Project On Camparative Study Between Private Sector and Public Sector BanksDocument75 pagesA Project On Camparative Study Between Private Sector and Public Sector Banksthaheerhauf1234No ratings yet

- Reliance Retail Limited Tax Invoice: Original For RecipientDocument1 pageReliance Retail Limited Tax Invoice: Original For RecipientalokNo ratings yet

- Valuation Analysis of Initial Public Offer (IPO) : The Case of IndiaDocument16 pagesValuation Analysis of Initial Public Offer (IPO) : The Case of IndiaAdarsh P RCBSNo ratings yet

- 2006-07 - GrasimDocument117 pages2006-07 - GrasimrNo ratings yet

- Audit Data MapDocument553 pagesAudit Data MapDarma Bonar TampubolonNo ratings yet

- JhunjhunwalaDocument12 pagesJhunjhunwalapercysearchNo ratings yet

- LEI Bulk - 1000 ItemsDocument542 pagesLEI Bulk - 1000 ItemsVyacheslavNo ratings yet

- Fixed Asset and Depreciation Schedule: Instructions: InputsDocument5 pagesFixed Asset and Depreciation Schedule: Instructions: InputsPatrick GhariosNo ratings yet

- Ratios to Evaluate Financial Position & PerformanceDocument15 pagesRatios to Evaluate Financial Position & PerformanceKeith Joshua GabiasonNo ratings yet