Professional Documents

Culture Documents

Exam 5 May 2011, Answers Exam 5 May 2011, Answers

Uploaded by

candiceOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exam 5 May 2011, Answers Exam 5 May 2011, Answers

Uploaded by

candiceCopyright:

Available Formats

lOMoARcPSD|4415854

Exam 5 May 2011, answers

Financial Accounting for Companies (University of South Africa)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Candice Colley (candicecolley@gmail.com)

lOMoARcPSD|4415854

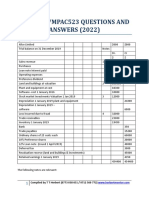

FAC2601 – MAY/ JUNE 2011

Question 1

One shot Ltd

Statement of comprehensive income for the year ended 28 February 2011

Note R

Revenue (20 520 000 / 1.14) 18 000 000

Cost of sales *(10 800 000)

Gross profit (18 000 000 x 40%) 7 200 000

Other income (40 000 + 3 600 + 1 600 + 5 000 + 13 000 ) 63 200

Distribution expenses (107 200)

Administrative expenses (6 776 400 – 27 600 – 32 000) (6 716 800)

Other expenses (8 000)

Finance costs (27 600 + 32 000 + 22 500 (C3)) (82 100)

Profit before tax 1 349 100

Income tax expense 2 ( 76 000)

Profit for the year 273 100

Other comprehensive income 816 000

Gain on available for sale financial assets (80 000 – 64 000) 16 000

Gains on property revaluation (600 000 + 200 000) 800 000

Total comprehensive income for the year 1 089 100

1. Notes to the statement of comprehensive income

1. Profit before tax

Revenue

Revenue consists of sales to customers and excludes vat 18 000 000

Income from subsidiary

Interest received 5 000

Fair value adjustment 40 000

Profit on sale of vehicle 13 000

Income from other financial assets

Listed investments – held at fair value through profit and loss

Dividends received 3 600

Unlisted investment – available for sale

Dividends received 1 600

Downloaded by Candice Colley (candicecolley@gmail.com)

lOMoARcPSD|4415854

Expenses

Directors remuneration

Executive directors 14 000

Emoluments (13 600 + 7 200 + 8 000 + 280 000 + (280 000 x 5%) 322 800

Less: paid by subsidiary ( 8 000)

Total paid by company 314 800

Non – executive directors

Emoluments 7 200

Auditors remuneration

Audit fees (9000 - 4200) 4 800

Travel expenses 4 200

Depreciation (58 000 + 48 000 + 40 000) 146 000

2. Income tax expense

SA normal tax

Current year 76 000

Downloaded by Candice Colley (candicecolley@gmail.com)

lOMoARcPSD|4415854

Question 2

One Shot Ltd

Note R

Statement of financial position at 28 February 2011

Assets

Non- current assets 3 461 000

Property plant and equipment 1 3 201 000

Investment in subsidiary 2 180 000

Available for sale financial asset 3 80 000

Current assets 963 000

Other financial assets 3 200 000

Trade receivables 3 190 000

Inventory 4 540 000

Cash and cash equivalents 33 000

Total assets 4 424 000

Notes to the statement of financial position

1. Property, plant and equipment

Land Buildings Delivery Machinery Total

vehicle and

equipment

Carrying amount – 1 March 2010 200 000 - 70 000 200 000

Cost 200 000 - 140 000 320 000

Accumulated depreciation - - (70 000) (120 000)

Additions at cost - 1 800 000 340 000

Revaluation during the year 200 000 600 000

Depreciation for the year (48 000) (58 000) (40 000)

Disposals at carrying amount (63 000)

Carrying amount – 28 February 400 000 2 352 000 289 000 160 000 3 201 000

2011

Cost 400 000 2 400 000 340 000 320 000

Accumulated depreciation - (48 000) (51 000) (160 000)

Land and buildings are owner occupied, situated on Erf 90, Riviera. The land and buildings

were revalued on the 31 August 2010 by Mr Smit, a sworn appraiser according to the gross

replacement basis.

Downloaded by Candice Colley (candicecolley@gmail.com)

lOMoARcPSD|4415854

2. Investment in subsidiary

Shares at cost 120 000

Loan to subsidiary 60 000

180 000

3. Other financial assets

Non- current financial assets

Available for sale financial asset

800 ordinary shares in Cringe (Pty) Ltd at directors’ valuation 80 000

Current financial assets

Trade receivables 172 000

Loans to personnel 18 000

190 000

Listed investments – held at fair value through profit and loss

4 000 ordinary shares in Babe Ltd at fair value 200 000

4. Inventory

Inventory consists of:

Raw material 16 000

Finished goods 484 000

Work in progress 40 000

540 000

Downloaded by Candice Colley (candicecolley@gmail.com)

lOMoARcPSD|4415854

Question 3

One shot Ltd

Note

Equity and liabilities 4 396 000

Share capital 5 3 070 000

Retained earnings 710 000

Other components of equity 616 000

Non – current liabilities

Interest bearing borrowings 7 550 000

Current liabilities 759 100

SARS – vat output ( 2 520 000 – 2 020 000) 500 000

Current portion of long term loan 7 50 000

SARS (76 000 – 32 400) 43 600

Trade and other payables (22 500 + 143 000) 165 500

Total equity and liabilities 5 705 100

Notes to the statement of financial position

5.

Share capital

Authorised

1 600 000 ordinary shares of R2 each

200 000 10% non - cumulative preference shares of R5 each

100 000 12% cumulative preference shares of R4 each

Issued 3 070 000

1 300 000 ordinary shares of R2 each 2 620 000

54 000 10% non - cumulative preference shares of R5 each 270 000

45 000 12% cumulative preference shares of R4 each 180 000

5. Other components of equity

Non – distributable reserves

Revaluation surplus 800 000

Distributable reserves

Mark to market reserve 16 000

816 000

Downloaded by Candice Colley (candicecolley@gmail.com)

lOMoARcPSD|4415854

6.

Interest bearing borrowings

Secured

12% debentures 400 000

Unsecured loan 150 000

Long term portion 200 000

Less: current portion (50 000)

550 000

The debentures are secured by a first mortgage bond over land and

buildings and are redeemable on 31 March 2014

Downloaded by Candice Colley (candicecolley@gmail.com)

lOMoARcPSD|4415854

Question 4 (only for students that registered in 2011)

4.1

a) Amortisation table

Date Pmt Capital Interest O/S Bal

01/07/2007 360,000

31/12/2007 70,000 30,328 39,672 329,672

30/06/2008 70,000 33,670 36,330 296,002

31/12/2008 70,000 37,381 32,619 258,621

30/06/2009 70,000 41,500 28,500 217,121

31/12/2009 70,000 46,073 23,927 171,048

30/06/2010 70,000 51,151 18,849 119,898

31/12/2010 70,000 56,787 13,213 63,110

30/06/2011 70,000 63,110 6,890 0

b) Journal entries

Date Description Debit Credit

01/07/2007 Machine @ Cost (SOFP) 360,000

Finance lease liability (SOFP) 360,000

31/12/2007 Finance lease liability (SOFP) 30,328

Finance charges (SOCI) 39,672

Bank 70,000

30/06/2008 Finance lease liability (SOFP) 33,670

Finance charges (SOCI) 36,330

Bank 70,000

30/06/2008 Depreciation (SOCI) 72,000

Accumulated depreciation (SOFP) 72,000

[360 000 / 5 years]

Downloaded by Candice Colley (candicecolley@gmail.com)

lOMoARcPSD|4415854

Downloaded by Candice Colley (candicecolley@gmail.com)

lOMoARcPSD|4415854

4.2) (Only for students that wrote supplementary exam)

One shot Ltd

Statement of changes in equity for the year ended 28 February 2011

Ordinary 10% non – 12% Retained Mark to Revaluation Total

share cumulative cumulative earnings market surplus

capital preference preference reserve

share share

capital capital

Balance – 1 March 2010 2 000 000 220 000 180 000 787 600 - -

Total comprehensive income for the year 273 100 16 000 600 000

Capitalisation issue 200 000 (200 000)

Ordinary shares issued 420 000

10% non – cumulative preference shares 50 000

issued (10 000 x 5)

Share issue expenses written off (12 000)

Preliminary expenses written off (6 000)

Dividends paid

Ordinary dividends (65 000)

10% non – cumulative preference (24 500)

dividends

12% cumulative preference dividends (43 200)

Balance – 28 February 2011 2 620 000 270 000 180 000 710 000 16 000 600 000

Downloaded by Candice Colley (candicecolley@gmail.com)

You might also like

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Q5 Vikings LimitedDocument2 pagesQ5 Vikings Limitedamosmalusi5No ratings yet

- FAC1602 Exam PackDocument25 pagesFAC1602 Exam PackNthabeza De Ntha MogaleNo ratings yet

- Ans Jan 2018 Far410Document8 pagesAns Jan 2018 Far4102022478048No ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- Financial Accounts Assingnment 3Document5 pagesFinancial Accounts Assingnment 3Zakarya KhanNo ratings yet

- Fin ZC415 Ec-3r First Sem 2019-2020Document5 pagesFin ZC415 Ec-3r First Sem 2019-2020srideviNo ratings yet

- F7 (FR) Workbook (Mix)Document6 pagesF7 (FR) Workbook (Mix)Aye Myat ThawtarNo ratings yet

- Consolidated Financial Statements of Prather Company and SubsidiaryDocument7 pagesConsolidated Financial Statements of Prather Company and SubsidiaryImelda100% (1)

- Accounting PracticeDocument24 pagesAccounting PracticeLloydNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- Support Material Financial Statement PDFDocument6 pagesSupport Material Financial Statement PDFsanele dlaminiNo ratings yet

- The Financial Statements of CF LTDDocument4 pagesThe Financial Statements of CF LTDKIMBERLY MUKAMBANo ratings yet

- Cash Flow QN 3Document4 pagesCash Flow QN 3Takudzwa LanceNo ratings yet

- ALICE LIMITED FINANCIAL STATEMENTSDocument44 pagesALICE LIMITED FINANCIAL STATEMENTSTawanda Tatenda HerbertNo ratings yet

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- AFE5008-B Exam Type Question-2-Model AnswerDocument2 pagesAFE5008-B Exam Type Question-2-Model AnswerDiana TuckerNo ratings yet

- SVS Ltd. trial balance analysisDocument6 pagesSVS Ltd. trial balance analysisVigneswar SundaramurthyNo ratings yet

- Fimd Training Unit 1 - Financial Analysis-ActivitiesDocument8 pagesFimd Training Unit 1 - Financial Analysis-ActivitiesErrol ThompsonNo ratings yet

- Accounting Exercises On Cash FlowsDocument2 pagesAccounting Exercises On Cash FlowsMicaella GoNo ratings yet

- National Officers Academy December Mock Exams Accountancy Paper 1Document5 pagesNational Officers Academy December Mock Exams Accountancy Paper 1faraz hassanNo ratings yet

- Cash Flow Statement - QuestionDocument27 pagesCash Flow Statement - Questionhamza khanNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Cash FlowDocument8 pagesCash FlowTarmak LyonNo ratings yet

- TP1-W2-S3-R0 Sri Annisa KatariDocument3 pagesTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariNo ratings yet

- (Nikolay TSD) LCBB4001 Accounting Fundamentals-A1Document24 pages(Nikolay TSD) LCBB4001 Accounting Fundamentals-A1munnaNo ratings yet

- PROJ Jul22 BBAHONS AFM8 Final 20221205090359Document10 pagesPROJ Jul22 BBAHONS AFM8 Final 20221205090359Melokuhle MhlongoNo ratings yet

- Tutorial 4 - Consolidated Statement of Cash FlowsDocument6 pagesTutorial 4 - Consolidated Statement of Cash FlowsFatinNo ratings yet

- Attempt All Questions: Summer Exam-2015Document25 pagesAttempt All Questions: Summer Exam-2015ag swlNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Q3 NNF LimitedDocument2 pagesQ3 NNF Limitedamosmalusi5No ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- Eva Trading Group AssignmentDocument8 pagesEva Trading Group AssignmentDoreen OngNo ratings yet

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Document15 pagesCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNo ratings yet

- Homework+-+WaterkloofDocument3 pagesHomework+-+WaterkloofIrfaan CassimNo ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- Financial Statements for Aleesya BhdDocument12 pagesFinancial Statements for Aleesya Bhdanis athirahNo ratings yet

- Kunci Jawaban ICAEW Part 2Document4 pagesKunci Jawaban ICAEW Part 2Dendi RiskiNo ratings yet

- Adam's Learning Centre, Lahore: Interpretation of Financial StatementsDocument10 pagesAdam's Learning Centre, Lahore: Interpretation of Financial StatementsMasood Ahmad AadamNo ratings yet

- Adam's Learning Centre, Lahore: Interpretation of Financial StatementsDocument10 pagesAdam's Learning Centre, Lahore: Interpretation of Financial StatementsMasood Ahmad AadamNo ratings yet

- Accounting journal entries and trial balancesDocument15 pagesAccounting journal entries and trial balancesSamuel PurbaNo ratings yet

- CSTUDY Jul22 BBAHONS AFM8 Final 20221205090450Document8 pagesCSTUDY Jul22 BBAHONS AFM8 Final 20221205090450Melokuhle MhlongoNo ratings yet

- Facn311 Test 1 Solution 2019Document10 pagesFacn311 Test 1 Solution 20196lackzamokuhleNo ratings yet

- Presentation1 ReshmaDocument26 pagesPresentation1 ReshmaJOE NOBLE 2020519No ratings yet

- Cash Flow 8 AprilDocument17 pagesCash Flow 8 AprilMayank MalhotraNo ratings yet

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- Revision ExamsDocument3 pagesRevision ExamsBandile MhlongoNo ratings yet

- Accounting I Mar 2022Document4 pagesAccounting I Mar 2022Ishmaal KhanNo ratings yet

- 15 Sole Trader - 2020Document34 pages15 Sole Trader - 2020Philile NkwanyanaNo ratings yet

- Group RepoprtingDocument3 pagesGroup RepoprtingPaulNo ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- Financial Statements of Limited CompaniesDocument6 pagesFinancial Statements of Limited CompaniesFazal Rehman Mandokhail50% (2)

- AFS SolutionsDocument19 pagesAFS SolutionsRolivhuwaNo ratings yet

- O Level Accounts Important QuestionsDocument55 pagesO Level Accounts Important QuestionsibrahoNo ratings yet

- IAS 7 Cash Flow Statement QuestionDocument3 pagesIAS 7 Cash Flow Statement QuestionamitsinghslideshareNo ratings yet

- SOLUTION DEC 2018 No TicksDocument8 pagesSOLUTION DEC 2018 No Ticksanis izzatiNo ratings yet

- SQA Accounting Assignment 1 02000759Document4 pagesSQA Accounting Assignment 1 02000759SENITH J100% (1)

- Exam 4 June 2018, Questions Exam 4 June 2018, QuestionsDocument10 pagesExam 4 June 2018, Questions Exam 4 June 2018, QuestionscandiceNo ratings yet

- Exam 1 June 2017, Questions Exam 1 June 2017, QuestionsDocument10 pagesExam 1 June 2017, Questions Exam 1 June 2017, QuestionscandiceNo ratings yet

- Fac2601-2013-10 - Answers PDFDocument12 pagesFac2601-2013-10 - Answers PDFcandiceNo ratings yet

- Exam 4 October 2018, Questions Exam 4 October 2018, QuestionsDocument9 pagesExam 4 October 2018, Questions Exam 4 October 2018, QuestionscandiceNo ratings yet

- Fac2601-2013-6 - Answers PDFDocument9 pagesFac2601-2013-6 - Answers PDFcandiceNo ratings yet

- Exam 6 October 2017, Questions Exam 6 October 2017, QuestionsDocument10 pagesExam 6 October 2017, Questions Exam 6 October 2017, QuestionscandiceNo ratings yet

- Exam 14 October 2013, Questions Exam 14 October 2013, QuestionsDocument9 pagesExam 14 October 2013, Questions Exam 14 October 2013, QuestionscandiceNo ratings yet

- Exam 2 June 2013, Questions Exam 2 June 2013, QuestionsDocument11 pagesExam 2 June 2013, Questions Exam 2 June 2013, QuestionscandiceNo ratings yet

- Exam 14 May 2012, Questions Exam 14 May 2012, QuestionsDocument10 pagesExam 14 May 2012, Questions Exam 14 May 2012, QuestionscandiceNo ratings yet

- Exam 14 October 2012, Answers Exam 14 October 2012, AnswersDocument9 pagesExam 14 October 2012, Answers Exam 14 October 2012, AnswerscandiceNo ratings yet

- Exam 5 May 2012, Answers Exam 5 May 2012, AnswersDocument10 pagesExam 5 May 2012, Answers Exam 5 May 2012, AnswerscandiceNo ratings yet

- Exam 14 October 2012, Questions Exam 14 October 2012, QuestionsDocument10 pagesExam 14 October 2012, Questions Exam 14 October 2012, QuestionscandiceNo ratings yet

- Exam 14 June 2014, Questions Exam 14 June 2014, QuestionsDocument11 pagesExam 14 June 2014, Questions Exam 14 June 2014, QuestionscandiceNo ratings yet

- Tutorial Letter 101/3/2016: Financial Accounting For CompaniesDocument36 pagesTutorial Letter 101/3/2016: Financial Accounting For CompaniescandiceNo ratings yet

- 2014 101 3 PDFDocument39 pages2014 101 3 PDFcandiceNo ratings yet

- DSC1520 2017 11 e 1Document23 pagesDSC1520 2017 11 e 1candiceNo ratings yet

- Exam 3 June 2011, Questions Exam 3 June 2011, QuestionsDocument7 pagesExam 3 June 2011, Questions Exam 3 June 2011, QuestionscandiceNo ratings yet

- 2014 202 1Document16 pages2014 202 1candiceNo ratings yet

- Aui2601 2014 103 3Document48 pagesAui2601 2014 103 3candiceNo ratings yet

- Aui2601 2012 10 e 1Document9 pagesAui2601 2012 10 e 1candiceNo ratings yet

- Aui2601 TL 2013 202 - 2Document15 pagesAui2601 TL 2013 202 - 2candiceNo ratings yet

- Tutorial Letter 202 - 2015 - 1Document13 pagesTutorial Letter 202 - 2015 - 1candiceNo ratings yet

- 2014 101 3 PDFDocument39 pages2014 101 3 PDFcandiceNo ratings yet

- Aui2601 2014 103 3Document48 pagesAui2601 2014 103 3candiceNo ratings yet

- Aui2601 2012 6 e 1Document8 pagesAui2601 2012 6 e 1candiceNo ratings yet

- Aui2601 2012 10 e 1Document9 pagesAui2601 2012 10 e 1candiceNo ratings yet

- Private Equity FundamentalsDocument7 pagesPrivate Equity FundamentalsDIVYANSHU SHEKHARNo ratings yet

- Capital BudgetingDocument26 pagesCapital Budgetingkkv_phani_varma5396No ratings yet

- 00K - Antifragile Asset Allocation Model - GioeleGiordano - 1st PlaceDocument19 pages00K - Antifragile Asset Allocation Model - GioeleGiordano - 1st Placenaren.bansalNo ratings yet

- Pestel 2Document20 pagesPestel 2Yingying SheNo ratings yet

- I190378914 1Document6 pagesI190378914 1Appie KoekangeNo ratings yet

- Risk & Return: Risk of A Portfolio-Uncertainty Main ViewDocument47 pagesRisk & Return: Risk of A Portfolio-Uncertainty Main ViewKazi FahimNo ratings yet

- FM - Assignment I - Kubra FatimaDocument15 pagesFM - Assignment I - Kubra FatimaFaryal MughalNo ratings yet

- BAAR 2016-2017 - AwihaoDocument43 pagesBAAR 2016-2017 - AwihaoJerwin Cases Tiamson100% (1)

- HW 11 SolutionDocument5 pagesHW 11 SolutionPepe BufordNo ratings yet

- Me Formulas and Review ManualDocument162 pagesMe Formulas and Review ManualLynel Arianne TaborNo ratings yet

- Shiori Bano - Assignment in AccstraDocument8 pagesShiori Bano - Assignment in AccstraShr BnNo ratings yet

- Alligation PDFDocument34 pagesAlligation PDFmosh kumarNo ratings yet

- Customer Profitability Analysis: A Tool for Maximizing ProfitsDocument12 pagesCustomer Profitability Analysis: A Tool for Maximizing ProfitsShabana Shaik P100% (1)

- TRADE FIXED INCOME SECURITIESDocument15 pagesTRADE FIXED INCOME SECURITIESChetal BholeNo ratings yet

- Definition of Financial ManagementDocument5 pagesDefinition of Financial Managementzainabqaisar07No ratings yet

- Earnings Management: Good, Bad or Downright Ugly?: by Paul DunmoreDocument7 pagesEarnings Management: Good, Bad or Downright Ugly?: by Paul DunmoreKaiWenNgNo ratings yet

- Comparable Companies - U.S.-Based Steel Manufacturer Companies With FY16 Projected Revenue Between $1 Billion and $20 BillionDocument2 pagesComparable Companies - U.S.-Based Steel Manufacturer Companies With FY16 Projected Revenue Between $1 Billion and $20 Billion/jncjdncjdnNo ratings yet

- Origin OF Merchant Banking (Evolution)Document11 pagesOrigin OF Merchant Banking (Evolution)aquisandyNo ratings yet

- Key-Market Leader Book2Document33 pagesKey-Market Leader Book2alankenvis50% (4)

- Analyze Gross Profit VariationDocument25 pagesAnalyze Gross Profit Variationmiles1280No ratings yet

- Britannia, 18th February, 2013Document10 pagesBritannia, 18th February, 2013Angel BrokingNo ratings yet

- Mass Marketing Rural IndiaDocument3 pagesMass Marketing Rural IndiaZoravar Sher Singh KalsiaNo ratings yet

- 2.5 Ratio Analysis For Lingkaran Trans Kota Holdings Berhad 2.0.1. Current RatioDocument10 pages2.5 Ratio Analysis For Lingkaran Trans Kota Holdings Berhad 2.0.1. Current RatioNurul JannahNo ratings yet

- Exercises IAS 32 and IAS 39Document3 pagesExercises IAS 32 and IAS 39Gustavo Almeida100% (1)

- I Prime Capital PDFDocument46 pagesI Prime Capital PDFSindhu Thomas100% (2)

- BSE SB Cancellation New FormatDocument4 pagesBSE SB Cancellation New FormatabcNo ratings yet

- Bloomberg Businessweek USA - 05 03 2018Document84 pagesBloomberg Businessweek USA - 05 03 2018Anh ThànhNo ratings yet

- Case Study 16-3 Bill FrenchDocument28 pagesCase Study 16-3 Bill FrenchShah 6020% (2)

- R Woods Trading and Balance Sheet AccountsDocument2 pagesR Woods Trading and Balance Sheet AccountsMurari NayuduNo ratings yet

- Aim/ Objective of Project:: Reason Behind The StudyDocument24 pagesAim/ Objective of Project:: Reason Behind The StudyMahesh BhorNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- NLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsFrom EverandNLP:The Essential Handbook for Business: The Essential Handbook for Business: Communication Techniques to Build Relationships, Influence Others, and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (4)

- Business Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsFrom EverandBusiness Valuation: Private Equity & Financial Modeling 3 Books In 1: 27 Ways To Become A Successful Entrepreneur & Sell Your Business For BillionsNo ratings yet

- Emprender un Negocio: Paso a Paso Para PrincipiantesFrom EverandEmprender un Negocio: Paso a Paso Para PrincipiantesRating: 3 out of 5 stars3/5 (1)

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Full Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperFrom EverandFull Charge Bookkeeping, For the Beginner, Intermediate & Advanced BookkeeperRating: 5 out of 5 stars5/5 (3)

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungFrom EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungRating: 4 out of 5 stars4/5 (1)