Professional Documents

Culture Documents

2nd TAX SYLLABUS - CONTINUATION

Uploaded by

Shiela AdlawanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2nd TAX SYLLABUS - CONTINUATION

Uploaded by

Shiela AdlawanCopyright:

Available Formats

IV.

Gross Income

A. Gross Income Defined, Sec. 32 (A), NIRC

B. Gross Income v. Net Income v. Taxable Income, Sec. 31, NIRC

C. Sources of Income Subject to Tax - RMC 50-2018

1. Compensation income

Sec. 32(A) (1), NIRC

Sec. 78 (A), NIRC

Sec. 2.78.1 (A), RR 2-98, as amended

Sec. 2(a) to (e), RR 8-2018

RMC No. 034-08

Backwages - BIR Ruling No. DA-073-2008

Convenience of the Employer Rule

Collector v. Henderson, 1 SCRA 649

i. Fringe Benefits

Definition - Sec. 33 (B), NIRC

Tax base - Sec. 2.79 (D) (1) (2), Revenue Regs. 2-98, as amended

ii. Exceptions - Sec. 33 (C), NIRC; Sec. 2.79 (D) (3), RR 2-98, as amended

Exempt under special laws

Retirement insurance and hospitalization benefit plans

Benefits to rank and file employees - Sec. 2(m), RR 8-2018

iii. De minimis benefits RR 03-98

RR 10-00

RR 05-08

RR 010-08

RR 005-11

RR 008-12

RR 001-15

Sec. 6, RR 11-2018

iv. Bonuses, 13th month pay, other benefits, unless exempt in Sec. 32 (8), NIRC

v. GSIS, SSS, Philhealth, Pag-ibig contributions and union dues

2. Income from Business, Sec. 32(A) (2), NIRC

3. Professional Income, Sec. 32 (A) (2), NIRC; Sec. 2 (n), RR 8-2018

----

4. Income from dealings in property, Sec. 32 (A) (3), NIRC

Rodriguez v. Collector, 28 SCRA 1119

Gonzales v. CTA, 14 SCRA 71

Gutierrez v. CTA, IO 1 Phil 1 73

i. Type of properties aa. ordinary assets bb. capital assets

- What is capital asset

Sec. 39(A) (1 ), NIRC

Rev. Regs. 07-03

- Distinction between ordinary asset and capital asset.

- Long term capital gain v. short term capital gain Sec. 39 (B), NIRC

ii. Types of gains from dealings in property

aa. Ordinary income v. capital gain, Sec. 39 and Sec. 22 (Z), NIRC

bb. Actual v. presumed gain, Secs. 6 (E), 24(D), 27(D)(5), 100, NIRC

cc. Net capital gain (loss), Sec. 39(A) (2) and (3), NIRC

Tuason v. Lingad, 58 SCRA 170

Ferrer v. Collector, 5 SCRA 1022 Calasanz v. Commissioner, 144

SCRA 664 Gonzales v. CTA, Ibid.

iii. Special rules pertaining to income/loss from dealings in property

aa. Computation of the amount of the gain (loss), Sec. 40(A), NIRC

- Basis of the property sold, Sec. 40(B), NIRC

- Basis of property exchanged in corporate adjustment, Sec. 40

(C) (5), NIRC

- Recognition of gain/loss in exchange of property General rule,

Sec. 40 (C) (1), NIRC

Exceptions

- Where no gain/loss shall be recognized, Sec. 40 (C) (2), NIRC

Revenue Memorandum Order (RMO) 17-16

Meaning of tax-free exchange/merger/ consolidation/ de

facto merger, Sec. 40(C) (6), NIRC

Com v. Rufino, 148 SCRA42

RMO 26-92

Rev. Regs. 18-2001

Rev. Memorandum Ruling (RMR) No. 01-01

RMR 01-02

RMO 32-2001

RMO 17-2002

RMR02-2002

----

- Transaction where gain is recognized but not the loss

Exchange not solely in kind

Sec. 40 (C)(3), NIRC

Sec. 40 (C)(4) NIRC

Wash sales/compared with short elling

Sec. 38, NIRC

Sec. 39, (F) (I), NIRC

Transactions between related taxpayers

Sec. 36 (B)

Illegal transactions

Sec. 96 RR 2-40

- Gains and losses attributable to the failure to exercise privileges

or options to buy/sell property, Sec. 39 (F) (2), NIRC

- Percentage of gain or loss taken into account (note: for

individuals only); holding period rule, Sec. 39 (B) NIRC

bb. Income tax treatment of capital loss

- Capital loss limitation rule (applicable to both corporations and

individuals), Sec. 39 (C) NIRC

- Net loss Carry-Over Rule (applicabl only to individuals), Sec. 39 (D),

NIRC

iv. Income from dealings in capital asset ubject to special rules

aa. Dealing in real property situated in the Philippines

RR 07-03

RR 13-99

RR 8-98

RMC 45-02

bb. Dealings in shares of stock of Philippines corporations

Definition of 'shares'

Sec. 22(L), NIRC

shares listed and traded in the stock exchange

Sec. 127 (A), NIRC

shares not listed and traded in the stock exchange

Sec. 24(C), NIRC

Sec. 27(D)(2) NIRC

Sec. 28(A)(7)( c) NIRC

Sec. 127, NIRC

Sec 55 RR 2-40

RR 6-2008

RR 6-2013

RMC 73-07

----

cc. Other capital assets

v. Sale of Principal Residence

Sec. 24(D) (2), NIRC

RR 13-99, as amended by RR 14-2000, RR 17- 03, RR 30-03

5. Passive investment income

a. Interest income

Sec. 32(A)(4) NIRC

Sec. 24(B)(1) NIRC

Sec. 22(Y) NIRC

Sec. 22(FF) NIRC

Sec. 28 (A) (4), NIRC

Sec. 27(D)(3), NIRC

Sec. 28 (B) (5) (a), NIRC

Sec. 57, RR 2-40

Rev. Regs. 10-98

RMC 018-11

RMC 07-15

b. Dividend Income, Sec. 32 (A) (7), NIRC

i. Dividends, defined, Sec. 73 (A) (first paragraph) NIRC

ii. Kinds of dividends

aa. Cash dividend

bb. Stock dividend — Sec. 73 (B), NIRC

cc. Property dividend

dd. Liquidating dividend

Sec. 24 (B) (2), NIRC

Sec. 25 (A) (2) and (B), NIRC

Sec. 28 (A) (7) (d), NIRC

Sec. 28 (B) (5) (a), NIRC

Sec. 73 (D), NIRC

Commissioner v. Wander Phils., 160 SCRA 573

ee. Disguised dividend

RMO 31-90

Secs. 250-253, 58, 71 RR 2-40

CIR v. Manning, 66 SCRA 14

Republic v. dela Rama, 18 SCRA 861

c. Royalty income

Sec. 24 (B) (1), NIRC

Sec. 25 (A) (2), NIRC

Sec. 27 (D) (1), NIRC

Sec. 28 (A) (7) (a), NIRC

Sec. 28 (B) (1), NIRC

Sec. 42 (A) (4), NIRC

RMC 44-05

RMC 77-2003

d. Rental income

Sec. 32 (A) (5), NIRC

Sec. 28 (B) (2); (3); (4), NIRC

Sec. 74, 79, 58 RR 2-40

Limpan v. CIR, 17 SCRA 703

----

i. Lease of Personal Property

ii. Lease of real property

iii. Tax Treatment of

aa. Leasehold improvements by lessee - Sec. 49, RR 2-40

bb. VAT added tor rental/paid by the lessee

cc. Advance rental

6. Annuities/Proceeds from life insurance/other type of insurance

Sec. 32(A) (8), NIRC

Sec. 48 RR 2-40

7. Prizes and awards, Sec. 32(A)(9), NIRC

8. Pensions/retirement benefits/separation pay, Sec. 32(A)(l0), NIRC

9. Partner's distributive ssharese from the net income of the GPP - Secs. 26 and 32 (A) (11 ),

NIRC

10. Income from any source whatever

a. Forgiveness of indebtedness, Sec. 50, RR 2-40

b. Recovery of accounts previously written off,

Sec. 34(E)(l ), NIRC;

tax benefit rule - RR 05-99

c. Receipt of tax refunds or credit, Sec. 34(C)(l), NIRC

d. Campaign contributions - RR 007-11

D. Situs/Sources of Income

1. Meaning of situs of income

2. Classification of income as to source

Sec. 42 (A) and (B), NIRC

Sec. 152-165, RR2

a. Gross or taxable income from sources within the Philippines

Sec. 42(A), (B), NIRC

Sec. 28(A)(3)(a) and (b), NIRC

Commissioner v. BOAC, Ibid.

NDC v. Commissioner ( 151 SCRA 4 72), Ibid.

Howden v. Collector (13 SCRA 601 ), Ibid.

b. Gross or taxable income from sources without the Philippines, Sec. 42 (C) and

(D), NIRC

c. Income partly within/partly without the Philippines, Sec. 42 (E), NIRC

3. Source Rules in determining income from within and without

a. Interests - residence of debtor

b. Dividends - residence of corporation paying dividend

c. Services - place of performance of service

d. Rentals and royalties - location of property or interest in such property

e. Sale of real property - location of real property

f. Sale of personal property - place of sale/title passage rule

g. Shares of stock of domestic corporation - place of incorporation of the

corporation whose shares are sold

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Tax1 Syllabus SY 2021-2022Document31 pagesTax1 Syllabus SY 2021-2022Shanon Cristy GacaNo ratings yet

- Quicknotes in Income TaxDocument13 pagesQuicknotes in Income TaxTrelle DiazNo ratings yet

- 2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFDocument73 pages2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFCris Anonuevo100% (1)

- Pre-Trial & Rights of The AccusedDocument112 pagesPre-Trial & Rights of The AccusedShiela AdlawanNo ratings yet

- QDEDocument14 pagesQDEShiela AdlawanNo ratings yet

- Income Tax Final Exam 1st Sem 2019 2020 BSA PDFDocument11 pagesIncome Tax Final Exam 1st Sem 2019 2020 BSA PDFMae Dela Pena100% (1)

- Final Taxation PreboardDocument14 pagesFinal Taxation PreboardEmerita Modesto25% (4)

- Chapter 13 Principles of DeductionDocument5 pagesChapter 13 Principles of DeductionJason Mables100% (1)

- Income Tax Schemes, Accounting Periods, Accounting Methods and Reporting C4Document73 pagesIncome Tax Schemes, Accounting Periods, Accounting Methods and Reporting C4Diane CassionNo ratings yet

- DOJ Circular No. 70Document3 pagesDOJ Circular No. 70Sharmen Dizon Gallenero100% (1)

- Sec Memo No. 8, s2013Document2 pagesSec Memo No. 8, s2013Jennilyn TugelidaNo ratings yet

- 2nd TAX SYLLABUS - CONTINUATIONDocument5 pages2nd TAX SYLLABUS - CONTINUATIONShiela AdlawanNo ratings yet

- TAX SYLLABUS With NOTESDocument41 pagesTAX SYLLABUS With NOTESShiela AdlawanNo ratings yet

- CASES Arrange Per YearDocument1 pageCASES Arrange Per YearShiela AdlawanNo ratings yet

- Part 4 Cases (Full Text)Document5 pagesPart 4 Cases (Full Text)Shiela AdlawanNo ratings yet

- LTD SYLLABUS With NOTESSDocument9 pagesLTD SYLLABUS With NOTESSShiela AdlawanNo ratings yet

- Corpo DoctrinesDocument40 pagesCorpo DoctrinesShiela AdlawanNo ratings yet

- (6-6-91) Sec Op Sacred Heart Memorial CorpDocument2 pages(6-6-91) Sec Op Sacred Heart Memorial CorpShiela AdlawanNo ratings yet

- G.R. No. 164317 - Ching v. Secretary of JusticeDocument33 pagesG.R. No. 164317 - Ching v. Secretary of JusticePatrick D GuetaNo ratings yet

- Interport Resources Corp Vs Securities Specialists, Inc., 792 SCRA 155 (2016)Document9 pagesInterport Resources Corp Vs Securities Specialists, Inc., 792 SCRA 155 (2016)Shiela AdlawanNo ratings yet

- Powell 1994 PDFDocument33 pagesPowell 1994 PDFJhosiel GarcíaNo ratings yet

- Wilson Gamboa V Secretary Teves, GR No. 176579, June 28, 2011Document35 pagesWilson Gamboa V Secretary Teves, GR No. 176579, June 28, 2011Shiela AdlawanNo ratings yet

- ABS-CBN V Gozon, 753 SCRA 1 (2015)Document23 pagesABS-CBN V Gozon, 753 SCRA 1 (2015)Shiela AdlawanNo ratings yet

- Filipinas Broadcasting Network V AMEC-BCCM, GR 141994, January 17, 2005Document11 pagesFilipinas Broadcasting Network V AMEC-BCCM, GR 141994, January 17, 2005Shiela AdlawanNo ratings yet

- ABS-CBN V Court of Appeals, 301 SCRA 589 (1999)Document19 pagesABS-CBN V Court of Appeals, 301 SCRA 589 (1999)Shiela AdlawanNo ratings yet

- Asset Privatization Trust V Court of Appeals, 300 SCRA 579 (1998) PDFDocument41 pagesAsset Privatization Trust V Court of Appeals, 300 SCRA 579 (1998) PDFShiela AdlawanNo ratings yet

- 22.2 Resolution - Gamboa - v. - TevesDocument105 pages22.2 Resolution - Gamboa - v. - TevesShiela AdlawanNo ratings yet

- First Lepanto-Taisho Insurance Corporation V Chevron, 663 SCRA 309 (2012)Document8 pagesFirst Lepanto-Taisho Insurance Corporation V Chevron, 663 SCRA 309 (2012)Shiela AdlawanNo ratings yet

- Full Text PropertyDocument32 pagesFull Text PropertyShiela AdlawanNo ratings yet

- Intro ReportDocument24 pagesIntro ReportShiela AdlawanNo ratings yet

- Full Text PropertyDocument32 pagesFull Text PropertyShiela AdlawanNo ratings yet

- Submitted To: Ms. Faria AkterDocument11 pagesSubmitted To: Ms. Faria Akterfarzana mahmudNo ratings yet

- WESTERN MINOLCO CORPORATION v. CIRDocument8 pagesWESTERN MINOLCO CORPORATION v. CIRKhate AlonzoNo ratings yet

- Inventories: Additional Valuation Issues Answers To QuestionsDocument60 pagesInventories: Additional Valuation Issues Answers To QuestionsMaldin JeremiaNo ratings yet

- Allowable Deductions SEC. 86. Computation of Net Estate. - For The Purpose of The Tax Imposed in ThisDocument5 pagesAllowable Deductions SEC. 86. Computation of Net Estate. - For The Purpose of The Tax Imposed in ThisJenny Rose Castro FernandezNo ratings yet

- Paper Industries Corporation of The PhilippinesDocument3 pagesPaper Industries Corporation of The PhilippinesCalagui Tejano Glenda JaygeeNo ratings yet

- Handout - 03 CorporationDocument10 pagesHandout - 03 CorporationKiyo KoNo ratings yet

- TAX QsDocument131 pagesTAX QsUser 010897020197No ratings yet

- PT Unitex LaptahunanDocument108 pagesPT Unitex LaptahunanbereniceNo ratings yet

- 10 Consolidated Mines, Inc. Vs Commissioner of Internal RevenueDocument21 pages10 Consolidated Mines, Inc. Vs Commissioner of Internal RevenueHey it's RayaNo ratings yet

- Financial Position of Nishat Mills LimitedDocument87 pagesFinancial Position of Nishat Mills Limitedzeshan khaliq80% (5)

- An Overall Financial Analysis of Tesla: Jingyuan FangDocument6 pagesAn Overall Financial Analysis of Tesla: Jingyuan FangShahmala PerabuNo ratings yet

- MCQs On Taxation LawDocument18 pagesMCQs On Taxation LawAli Asghar RindNo ratings yet

- FA - Quiz1 - Answers - All VersionDocument22 pagesFA - Quiz1 - Answers - All VersionAgANo ratings yet

- Slides On The Ethiopian Tax System2Document26 pagesSlides On The Ethiopian Tax System2yebegashetNo ratings yet

- RMC No 67-2012Document5 pagesRMC No 67-2012evilminionsattackNo ratings yet

- Western Leyte College of Ormoc, Inc. Prelim Exam in Taxation I October 10, 2020Document2 pagesWestern Leyte College of Ormoc, Inc. Prelim Exam in Taxation I October 10, 2020Marc William SorianoNo ratings yet

- Chapter 5 - Corporate Income Tax A. Corporations Subject To Income TaxDocument2 pagesChapter 5 - Corporate Income Tax A. Corporations Subject To Income TaxPJDNo ratings yet

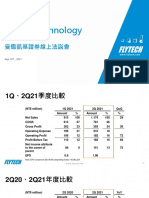

- Flytech TechnologyDocument7 pagesFlytech TechnologyLouis ChenNo ratings yet

- Allowable DeductionsDocument4 pagesAllowable DeductionsdailydoseoflawNo ratings yet

- Income Tax Calculator 2013-14Document2 pagesIncome Tax Calculator 2013-14kirang gandhiNo ratings yet

- 3RD Year Diagnostic ExamDocument30 pages3RD Year Diagnostic ExamRoisu De KuriNo ratings yet

- Beleza NaturalDocument22 pagesBeleza NaturalTejas MahajanNo ratings yet

- Special CorporationsDocument12 pagesSpecial CorporationsDinah BaluyutNo ratings yet

- Long QuizDocument14 pagesLong QuizMaritesNo ratings yet