Professional Documents

Culture Documents

Question 4-FS

Uploaded by

Rax-Nguajandja KapuireCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question 4-FS

Uploaded by

Rax-Nguajandja KapuireCopyright:

Available Formats

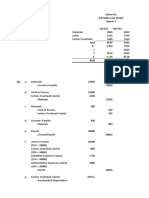

Question 4

Taku-Tau Store’s financial year-ends on 31 December each year. On 31 December

2011, the owner of Taku-Tau Store needed the financial statements in order to see

how the entity has performed during the current financial year. Unfortunately, the

bookkeeper of Taku-Tau Store was sick and could not able to prepare the financial

statements. The following list of accounts balance was provided to you by the

bookkeeper as at 31 December 2011.

N$

Capital 141 700

Land and building at cost 263 240

Motor vehicle (Cost price N$40 000) 28 800

Equipment (Cost price N$9 000) 7 290

Investment: Chineke bank (12%) 50 000

Inventory 8 500

Accounts receivables 5 200

Bank (favourable) 3 100

Cash 600

Accounts payables 9 550

Long-term loan: 18% 25 000

Provision for unpaid debts 300

Sales 381 000

Cost of sales 165 400

Sales return 1 200

Salaries and wages 27 000

Assessment rates 1 500

Prepaid insurance 380

Accrued advertisements 790

Motor vehicle expenses 4 500

Bad debts 550

Packaging materials 4 700

Insurance 2 250

Water and electricity 2 100

Telephone expenses 1 400

Advertisements 2 000

Rent income 15 600

Settlement discount received 650

Interest on investment 5 000

Bad debts recovered 120

The bookkeeper also informed you regarding the following transactions which must

still be taken into account:

1. During the inventory count at the end of the financial year 31 December 2011,

packaging materials was valued at N$980.

2. Prepaid insurance and accrued advertisement are due in the current financial

period.

3. The long-term loan was entered into on 1 July 2011. According to the

agreement interest will be payable at the end of the year.

4. Advertisement includes and amount of N$400 paid for January next year.

5. Insurance amounting to N$750 was still outstanding at the end of the current

financial year.

6. Depreciation policy of Taku-Tau Store is to depreciate all the non-current

assets using the reducing balance method at a rate of 10%, Land and

buildings are not depreciated.

7. The account of Mr Dumingu, a debtor owing Taku-Tau Store N$200 must be

written-off as irrecoverable.

8. Adjust the provision for unpaid debt to 5% of outstanding debtors.

Required:

a) Prepare journal entries to bring the adjustments into account.

b) Prepare the statement of Profit or loss of Taku-Tau Store for the year ended

31 December 2011.

c) Prepare the statement of financial position of Taku-Tau Store as at 31

December 2011.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Powers of AppointmentDocument5 pagesPowers of Appointmentscartoneros_1100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 12 Important Documents To Check Before Buying A New PropertyDocument26 pages12 Important Documents To Check Before Buying A New Propertysrinath1234No ratings yet

- Glaski v. Bank of America, JP Morgan ChaseDocument29 pagesGlaski v. Bank of America, JP Morgan ChaseMike MaunuNo ratings yet

- Impulse Wave PatternDocument13 pagesImpulse Wave Patternpuplu123No ratings yet

- A Summary of The Design ProcessDocument11 pagesA Summary of The Design ProcessRax-Nguajandja KapuireNo ratings yet

- Oblicon Reviewer 2010Document159 pagesOblicon Reviewer 2010Nath AntonioNo ratings yet

- Juarez Inc Job Order Cost Sheets (1) March 1 Job 621 Job 622Document3 pagesJuarez Inc Job Order Cost Sheets (1) March 1 Job 621 Job 622ramaNo ratings yet

- Sustainable Design Principles 5Document51 pagesSustainable Design Principles 5Rax-Nguajandja KapuireNo ratings yet

- QN 1Document2 pagesQN 1Rax-Nguajandja KapuireNo ratings yet

- Question 3-FSDocument1 pageQuestion 3-FSRax-Nguajandja KapuireNo ratings yet

- Question 6-FSDocument2 pagesQuestion 6-FSRax-Nguajandja KapuireNo ratings yet

- QN 1Document2 pagesQN 1Rax-Nguajandja KapuireNo ratings yet

- Question 2 (22 Marks)Document1 pageQuestion 2 (22 Marks)Rax-Nguajandja KapuireNo ratings yet

- Question 8 - Preparation of FSDocument4 pagesQuestion 8 - Preparation of FSRax-Nguajandja Kapuire100% (1)

- APA Style - North West UniversityDocument19 pagesAPA Style - North West UniversityRax-Nguajandja KapuireNo ratings yet

- Unit 8 - Perfect CompetitionDocument20 pagesUnit 8 - Perfect CompetitionRax-Nguajandja KapuireNo ratings yet

- Quadratic EquationsDocument1 pageQuadratic EquationsRax-Nguajandja KapuireNo ratings yet

- APA Referencing SummaryDocument16 pagesAPA Referencing SummaryRax-Nguajandja KapuireNo ratings yet

- Unit 7 - Cost and ProductionDocument25 pagesUnit 7 - Cost and ProductionRax-Nguajandja KapuireNo ratings yet

- Principles of Microeconomics (PMI511S) : Lecturer: Mr. Mally LikukelaDocument10 pagesPrinciples of Microeconomics (PMI511S) : Lecturer: Mr. Mally LikukelaRax-Nguajandja KapuireNo ratings yet

- Sustainable Design Principles 6Document52 pagesSustainable Design Principles 6Rax-Nguajandja KapuireNo ratings yet

- The Chartered Quantity SurveyorDocument23 pagesThe Chartered Quantity SurveyorRax-Nguajandja KapuireNo ratings yet

- MOCK AssignmentDocument1 pageMOCK AssignmentRax-Nguajandja KapuireNo ratings yet

- Unit 6 - Consumer Equilibrium - 2019Document9 pagesUnit 6 - Consumer Equilibrium - 2019Rax-Nguajandja KapuireNo ratings yet

- Site Visit Memorandum of UnderstandingDocument1 pageSite Visit Memorandum of UnderstandingRax-Nguajandja KapuireNo ratings yet

- Sustainable Design Principles 2Document34 pagesSustainable Design Principles 2Rax-Nguajandja KapuireNo ratings yet

- RFQ Epc Final - 01112016Document68 pagesRFQ Epc Final - 01112016TAMILNo ratings yet

- Accounting ServicesDocument10 pagesAccounting Servicesdeva nesanNo ratings yet

- 5) How Does Student Debt Effect To National EcoDocument2 pages5) How Does Student Debt Effect To National EcoApple WongNo ratings yet

- Cross-Currency SwapDocument8 pagesCross-Currency SwapVũ Trần Nhật ViNo ratings yet

- Appendix I Specimen of Advice of Maturity Date To Term Deposit Account HoldersDocument11 pagesAppendix I Specimen of Advice of Maturity Date To Term Deposit Account HoldersRuchi SharmaNo ratings yet

- Title 22Document86 pagesTitle 22Anonymous RW6ce9hFNo ratings yet

- CHAPTER 9 - Discontinued OperationDocument15 pagesCHAPTER 9 - Discontinued OperationChristian GatchalianNo ratings yet

- Project Problem One: Chapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsDocument6 pagesProject Problem One: Chapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsShaharyar AsifNo ratings yet

- Minutes of A Meeting Cannot Override Statutory Obligations in Absence of Mandatory Santification, Releasing Order of Detained King Fisher Aircrafts by Delhi High Court Set Aside by Supreme CourtDocument22 pagesMinutes of A Meeting Cannot Override Statutory Obligations in Absence of Mandatory Santification, Releasing Order of Detained King Fisher Aircrafts by Delhi High Court Set Aside by Supreme CourtLive LawNo ratings yet

- IanWatson WingCambodia-2012Document22 pagesIanWatson WingCambodia-2012dmg123100% (1)

- Youth UnemploymentDocument65 pagesYouth UnemploymentNghĩa Đức NguyễnNo ratings yet

- SSC CGL 2019 Exam Paper - GSDocument126 pagesSSC CGL 2019 Exam Paper - GSRavindra Pratap Singh KalhanshNo ratings yet

- Banking IndustryDocument10 pagesBanking IndustryManjusha JuluriNo ratings yet

- Abn Amro Credit Spread MovementDocument40 pagesAbn Amro Credit Spread MovementCatherine CrawleyNo ratings yet

- Mishkin 6ce TB Ch27Document8 pagesMishkin 6ce TB Ch27JaeDukAndrewSeoNo ratings yet

- COURSEHERO - Managing Service ProjectsDocument26 pagesCOURSEHERO - Managing Service Projectsayush modiNo ratings yet

- The Insider CodeDocument15 pagesThe Insider CodeJohn PatlolNo ratings yet

- FMO Module 2Document8 pagesFMO Module 2Sonia Dann KuruvillaNo ratings yet

- Significance of Risk Management and TakafulDocument6 pagesSignificance of Risk Management and TakafulAli MunavvaruNo ratings yet

- How To Start A Business Enterprise PDFDocument22 pagesHow To Start A Business Enterprise PDFDhana RedNo ratings yet

- Chapter 14 Since Ben HoltDocument3 pagesChapter 14 Since Ben HoltUngu PurpleNo ratings yet

- David Einhorn Speech To Value InvestorsDocument10 pagesDavid Einhorn Speech To Value InvestorsJohn CarneyNo ratings yet

- Case WockhardtDocument8 pagesCase Wockhardtrajul lakhotiaNo ratings yet

- Prospectus MPSMDocument26 pagesProspectus MPSMMohammad Abdullah abu SayedNo ratings yet