Professional Documents

Culture Documents

Chapter 5 Section 127

Chapter 5 Section 127

Uploaded by

Madelyn Jane IgnacioCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 5 Section 127

Chapter 5 Section 127

Uploaded by

Madelyn Jane IgnacioCopyright:

Available Formats

Shall include

shares of

stock of a

corporation Held as

Section 127(A) NIRC capital assets

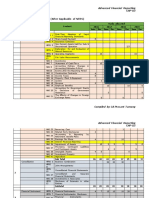

Tax on sale, barter or exchange of shares of stock listed and traded through the local

stock Refers to any domestic corporation

- Based on 6/10 of 1% of Gross Selling Price (1/2 of 1% previous)

Stock

Transaction Tax

The following sellers or transferors of stock are liable to this tax

1) Individual taxpayer, whether citizen or alien;

2) Corporate taxpayer, whether domestic or foreign; and

3) Other taxpayers not falling under (a) and (b) above, such as estate, trust, trust

funds and pension funds, among others.

Paid to whom? Bureau of Internal Revenue (BIR)

Paid when? Within five (5) banking days from the date of collection thereof

The taxes imposed under this section (sec 127A) shall not apply to the following:

1) Dealers in securities

2) Investor in shares of stock in a mutual fund company, as defined in Section 22

(BB) of the Tax Code, as amended, in connection with the gains realized by said

investor upon redemption of said shares of stock in a mutual fund company;

and

3) All other persons, whether natural or juridical, who are specifically exempt from

national internal revenue taxes under existing investment incentives and other

special laws.

Note: The VAT rate in case of a dealer in securities is based on gross income, not on

gross sales or receipts.

Definition of terms

Shares of stock – shall include shares of stock of a corporation

Local Stock Exchange – refers to any domestic organization

Shares listed and traded through the local stock exchange – refers to all sales

Stockbroker – includes all persons whose business is, for other brokers

Dealers in securities – means merchant

Closely held

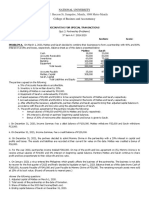

Section 127(B) NIRC corporations

Tax on shares of stock sold or exchanged through the Initial Public Offering

- Based on Gross Selling Price; or

- Based on Gross value in money of the shares of stock sold, etc., in accordance

with the shares of stock sold, etc., to the total outstanding shares of stock after

listing in the local stock exchange.

Ratio/Proportion Percentage tax

Up to 25% 4%

Over 25% but not over 33

2%

1/3%

Over 33 1/3% 1%

Persons liable to tax on IPO

1) Issuing corporation – “Primary offering” - issuer

2) Shareholders – “Secondary offering” – selling shareholder

The taxes imposed under this section (sec 127A) shall not apply to the following:

1) Dealers in securities

2) Investor in shares of stock in a mutual fund company, as defined in Section 22

(BB) of the Tax Code, as amended, in connection with the gains realized by said

investor upon redemption of said shares of stock in a mutual fund company;

and

3) All other persons, whether natural or juridical, who are specifically exempt from

national internal revenue taxes under existing investment incentives and other

special laws.

Definition of terms

Gross selling price refers to the total amount of money or its equivalent which the

purchaser pays the seller as consideration for the shares of stock

Gross value in money means the “fair value”

Initial Public Offering (IPO) refers to public offering of shares of stock made for the

first time in the Local Stock Exchange

Closely Held Corporation means any corporation at least fifty percent (50%) in value

of outstanding capital stock of at least fifty percent (50%) of the total combined voting

power of all classes of stock entitled to vote is owned directly or indirectly by or for not

more than twenty (20) individuals

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Securities Regulation Code Reviewer ComrevDocument7 pagesSecurities Regulation Code Reviewer ComrevNiel Edar Balleza100% (1)

- Affidavit of ObligationDocument2 pagesAffidavit of Obligationsomebody991122No ratings yet

- Airthread SolutionDocument30 pagesAirthread SolutionSrikanth VasantadaNo ratings yet

- Afar Midterm Major Exam Key Answer PDFDocument4 pagesAfar Midterm Major Exam Key Answer PDFMadelyn Jane IgnacioNo ratings yet

- Financial Management Chapter 17 FinanciaDocument11 pagesFinancial Management Chapter 17 FinanciaKomal Mubeen100% (1)

- Chaper 4 Completing The Accounting CycleDocument41 pagesChaper 4 Completing The Accounting CycleAssassin ClassroomNo ratings yet

- At 04 Audit Evidence and Audit Documentation PDFDocument6 pagesAt 04 Audit Evidence and Audit Documentation PDFMadelyn Jane IgnacioNo ratings yet

- At 03 Introduction To Public Accountancy PDFDocument5 pagesAt 03 Introduction To Public Accountancy PDFMadelyn Jane IgnacioNo ratings yet

- At 05 Preliminary Engagement Activities PDFDocument4 pagesAt 05 Preliminary Engagement Activities PDFMadelyn Jane IgnacioNo ratings yet

- Chapter 2 Exempt ImportationsDocument2 pagesChapter 2 Exempt ImportationsMadelyn Jane IgnacioNo ratings yet

- Introduction To Financial Statements AuditDocument6 pagesIntroduction To Financial Statements AuditMadelyn Jane IgnacioNo ratings yet

- Chapter 1 Consumption TaxDocument5 pagesChapter 1 Consumption TaxMadelyn Jane IgnacioNo ratings yet

- 12943Document4 pages12943Madelyn Jane IgnacioNo ratings yet

- Chapter 2 Estate TaxDocument4 pagesChapter 2 Estate TaxMadelyn Jane IgnacioNo ratings yet

- Natsem Income and Wealth ReportDocument40 pagesNatsem Income and Wealth ReportABC News OnlineNo ratings yet

- Governmental Entities: Special Funds and Government-Wide Financial StatementsDocument76 pagesGovernmental Entities: Special Funds and Government-Wide Financial StatementsSri UtamiNo ratings yet

- Delta Partners Corporate BrochureDocument8 pagesDelta Partners Corporate BrochurejamesoksNo ratings yet

- Miga Professionals Program PDFDocument2 pagesMiga Professionals Program PDFPaul Ivan Beppe a Yombo Paul IvanNo ratings yet

- Letter of Credit SampleDocument4 pagesLetter of Credit SampleJasonry BolongaitaNo ratings yet

- Thirteen: Financial Statement AnalysisDocument16 pagesThirteen: Financial Statement AnalysisMiiMii Imperial AyusteNo ratings yet

- Cfa Mock 3Document9 pagesCfa Mock 3jayNo ratings yet

- RbiDocument6 pagesRbiAnjali RaiNo ratings yet

- Quiz On Taxation-Donor's TaxDocument2 pagesQuiz On Taxation-Donor's TaxRey PerosaNo ratings yet

- Coinbase Pricing & Fees DisclosuresDocument6 pagesCoinbase Pricing & Fees Disclosuresnausher81No ratings yet

- 7-RETIREMENT AND PENSION PLANNING (Starting Early Retirement Planning)Document34 pages7-RETIREMENT AND PENSION PLANNING (Starting Early Retirement Planning)adib palidoNo ratings yet

- Annual Report and Accounts 2017Document274 pagesAnnual Report and Accounts 2017AlezNgNo ratings yet

- Wolfsberg's CBDDQ Glossary 220218 v1.0Document16 pagesWolfsberg's CBDDQ Glossary 220218 v1.0jawed travelNo ratings yet

- Nationwide Junior ISA Ts and CsDocument4 pagesNationwide Junior ISA Ts and CsSpartacus UkinNo ratings yet

- Cost of Capital (Cost of Debts, Cost of Preferred Stocks, Wacc)Document3 pagesCost of Capital (Cost of Debts, Cost of Preferred Stocks, Wacc)Jerel Aaron FojasNo ratings yet

- Real SimpleDocument62 pagesReal Simplebandgar_007No ratings yet

- Entries of AccountsDocument6 pagesEntries of AccountsNaveen Shankar MauwalaNo ratings yet

- Terms and Conditions: Æ ON Credit Service (M) BerhadDocument19 pagesTerms and Conditions: Æ ON Credit Service (M) BerhadKhazwan AriffNo ratings yet

- Advanced Financial Reporting Marks WeightageDocument3 pagesAdvanced Financial Reporting Marks WeightagePrashant TamangNo ratings yet

- Accounting Standard 21Document13 pagesAccounting Standard 21api-3828505100% (1)

- Krassimir Petrov - Intto To Credit Default SwapsDocument13 pagesKrassimir Petrov - Intto To Credit Default SwapsAntonio Luis SantosNo ratings yet

- Related Party: Kim Nicole M. Reyes, CPADocument30 pagesRelated Party: Kim Nicole M. Reyes, CPAAbby ManilaNo ratings yet

- Reviewer On Partnership Problems - Q2 PDFDocument3 pagesReviewer On Partnership Problems - Q2 PDFAdrian Montemayor33% (3)

- Master CardDocument13 pagesMaster CardNilotpal ChakmaNo ratings yet

- Instructions For Form 2210: Underpayment of Estimated Tax by Individuals, Estates, and TrustsDocument5 pagesInstructions For Form 2210: Underpayment of Estimated Tax by Individuals, Estates, and TrustsIRSNo ratings yet