Professional Documents

Culture Documents

How To Raise Money PDF

Uploaded by

Yash SOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How To Raise Money PDF

Uploaded by

Yash SCopyright:

Available Formats

va l u e ta inm e n t

RESOURCES FOR ENTREPRENEURS (#1)

How to raise money by Patrick Bet-David

10 Questions to ask before raising money:

1. Is your company at the point where you should even be considering raising money?

2. If you were not able to raise money, how would you make your business idea work?

3. How will the money you raise be used?

4. What does an ideal investor for your business look like?

5. Do you want to go big or have control of the business?

6. Do you want accountability?

a. Most entrepreneurs don’t like people telling them what to do. That’s exactly what happens with VC’s.

Can you handle that? (They’re different from banks. Banks just give money and look for interest.)

7. Have you done enough research about the industry?

8. How unique and different is your idea?

9. Have you done the Math? What is the value of your company?

10. Are you building to sell? Investors want to see returns in 5-7 years.

The 6 ways to raise money

01. Boot strap

1. Your own savings

1. ROBS (Rollover for business startup)

a. Put your retirement (401k) account into your business without paying taxes.

b. This works best with those with over $50k in your retirement account.

2. HELOC & Credit cards

1. 25% of business owners use a heloc to start a business

a. 15% equity

b. 620 equity score.

02. Traditional bank or S.B.A loan

a. It’s the slowest or the most difficult one to do. You will need:

i. A high net worth

ii. Credit over 700

iii. Equity in a home

iv. Business plan

b. Community Advantage Loan up to $250k

c. Microloan program up to $50k

i. Industry experience.

ii. Typically 30% of your own money in the business to qualify for this.

all rights reserved. patrick bet-david and valuetainment media ©2018

03. Crowd funding

a. Small amounts from a large amount of people

b. Fundable

c. Kickstarter

d. Indigogo

04. Incubators and accelerators

Organizations geared toward speeding up the growth and success of startup and early stage companies.

They're often a good path to different types of capital from angel investors,

state governments, economic-development and other investors.

05. Angel investors:

Angel investor: Individual wealthy person investing their own personal money. (Less than a $1,000,000)

1. Warm market: Friends and family.

Set the expectation up front

a. This could be a rich dad, uncle, aunt, friends, a dad who likes you.

b. What to say? I need $25k and I want you to know that you won’t see any return for at least 3 years.

2. Cold market:

Look for positive signs:

a. If your friends and family support the idea

b. If you have your own money put into it

c. If they know that you’re going to do this with or without them.

d. Show how your business could 10X.

06. Venture debt / Venture capital (VC’s)

What is a venture capitalist? a business who holds private equity that’s been invested in other private companies.

They will generally demand a board seat. They usually come in with over $1,000,000

Ideally, you’re looking for Series A funding:

1. More favorable rates than revenue backed funding

2. They want to have relationship with one of your investors.

3. Silicon Valley Bank is venture debt.

What Angel Investors and & Venture Capitalists are looking for? (more demanding)

1. Massive returns 10X

2. In 5 to 10 years.

3. A coachable CEO

4. A Strong team

• A Founder with a vision

• Team members with technical skills

all rights reserved. patrick bet-david and valuetainment media ©2018

5. An idea with key differentiators

6. If you take VC money, you’re committing to an exponential growth of the business.

7. Looking for VC money can be a full time job. It can take upwards of 6-12 months. Can your

business survive during that period?

Different ways of gathering leads

1. Through top-tier business schools.

2. Through your industry friends.

3. Through your mentors.

4. Angel lists. LinkedIn and different sites.

How to approach A cold angel investor: Send an email

following these guidelines

1. Do research on the person you’re sending an email to.

2. Don’t do a copy and paste type of a message.

3. Make it personable (reference a book or an interview they did that you watched or mention

something you have in common or admire about them.)

4. Send a short email. In the email include:

a. The connection

b. Who you are

c. The Idea

d. Promo/link

Sample email:

Dear John, I really enjoyed your book/podcast that you did, especially chapter/the part

where you talked about the importance of being focused on one sector at a time. I am a (enter age)

graduate of (Insert school) or executive of Google/Snapchat/Merrill Lynch, based out of (City, State) who’s working

on an idea to (short description) Describe what you’re doing in 1-2 sentences. 1 is better than 2.

If possible a link of what you’ve built so far.

How to increase the chances of having professional angel investors listen to you.

1. Have a person who introduces you to them.

2. Find out if someone in your network knows someone you want to get a meeting with.

3. Be patient.

The Best way to raise money:

Build a real business.

Use your own money.

Don’t beg. Attract.

Let the money come to you.

all rights reserved. patrick bet-david and valuetainment media ©2018

You might also like

- Adventure Junkie: How to Be Adventurous, Get Rid of Boredom, and Make Life InterestingFrom EverandAdventure Junkie: How to Be Adventurous, Get Rid of Boredom, and Make Life InterestingRating: 2 out of 5 stars2/5 (1)

- Go Do!: For People Who Have Always Wanted to Start a BusinessFrom EverandGo Do!: For People Who Have Always Wanted to Start a BusinessNo ratings yet

- Entrepreneurial Financing: Funding Your Startup: EDS 411 Dr. Maxwell OlokundunDocument22 pagesEntrepreneurial Financing: Funding Your Startup: EDS 411 Dr. Maxwell OlokundunAkande AyodejiNo ratings yet

- 30 Day Challenge To Social FreedomDocument3 pages30 Day Challenge To Social FreedomSai TejaNo ratings yet

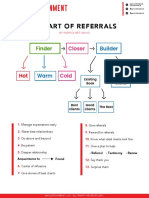

- The Art of ReferralsDocument2 pagesThe Art of ReferralsFabioNo ratings yet

- Money Marking Words PDFDocument2 pagesMoney Marking Words PDFFiras MNo ratings yet

- How To Prepare For Your WeekDocument2 pagesHow To Prepare For Your WeekВладимир ИвковићNo ratings yet

- 20 Business MistakesDocument6 pages20 Business Mistakesdidier okaNo ratings yet

- VT 2018 Business Assessment 1 PDFDocument5 pagesVT 2018 Business Assessment 1 PDFShreyas TawareNo ratings yet

- Real Affirmations: Resources For EntrepreneursDocument2 pagesReal Affirmations: Resources For EntrepreneursManolisTsompanoglouNo ratings yet

- 15 MovesDocument4 pages15 MovesSimone Borsellino100% (1)

- VTPDF HowtoMeasureDecision-v2Document3 pagesVTPDF HowtoMeasureDecision-v2DewiNo ratings yet

- Mistakes Companies Make With Customer ServiceDocument3 pagesMistakes Companies Make With Customer ServiceBharat GalaniNo ratings yet

- 10 Business Models ValuetainmentDocument2 pages10 Business Models Valuetainmentaashish1507No ratings yet

- The 20 Rules of Money - Patrick Bet-DavidDocument15 pagesThe 20 Rules of Money - Patrick Bet-DavidAnonymous HsoXPy100% (2)

- What Drives You?: AdvancementDocument3 pagesWhat Drives You?: AdvancementMohamed S Husain100% (1)

- How To Increase Your Net Worth: (Including Our Investments)Document3 pagesHow To Increase Your Net Worth: (Including Our Investments)Meghal SivanNo ratings yet

- Doing The Impossible-WorkbookDocument20 pagesDoing The Impossible-Workbookbadararshi100% (1)

- The 20 Rules of Money - Patrick Bet-DavidDocument8 pagesThe 20 Rules of Money - Patrick Bet-DavidMichael WarrenNo ratings yet

- PBD Top 100 Books - Patrick Bet-DavidDocument93 pagesPBD Top 100 Books - Patrick Bet-DavidGeorge MarchanNo ratings yet

- Grant CardoneDocument35 pagesGrant CardoneRichard Wootton100% (1)

- Proposed Purchase StructureDocument1 pageProposed Purchase StructureSebiNo ratings yet

- Grant EmailDocument8 pagesGrant EmailDaniel Romeo Daraban100% (3)

- Grant Cardone CourseDocument1 pageGrant Cardone CourseasfddasNo ratings yet

- The Most Epic Grant Cardone Quotes Even Written DownDocument24 pagesThe Most Epic Grant Cardone Quotes Even Written DownmebratuNo ratings yet

- Top 50 Questions To Ask Before You Get EngagedDocument6 pagesTop 50 Questions To Ask Before You Get EngagedAnubhav Srivastava100% (1)

- Harbour Club Day 2 Special Report - The Harbour Club Mergers and Aquisitions Strtegies For SMEsDocument30 pagesHarbour Club Day 2 Special Report - The Harbour Club Mergers and Aquisitions Strtegies For SMEsBrian HughesNo ratings yet

- Additional Reading: Cardone Channel in YoutubeDocument2 pagesAdditional Reading: Cardone Channel in Youtubeteetosz0% (4)

- Checklist Business OnlineDocument4 pagesChecklist Business OnlineMaria Sánchez100% (2)

- Daniel PeñaDocument13 pagesDaniel Peñacesar50% (2)

- WWW Reddit Com Search Q Toastmasters 20book PDFDocument3 pagesWWW Reddit Com Search Q Toastmasters 20book PDFabdah liadara0% (2)

- How To Set Up Your Business For Under $1000Document102 pagesHow To Set Up Your Business For Under $1000Manoj Kumar100% (3)

- Test 44Document1 pageTest 44thomas ardaleNo ratings yet

- WWW Abraham Com Jay Abraham Breakthroughs at Palos VerdesDocument40 pagesWWW Abraham Com Jay Abraham Breakthroughs at Palos VerdesMuchamad AlfansyahNo ratings yet

- Golden Rules For Types of AccountsDocument4 pagesGolden Rules For Types of AccountsABDUL FAHEEMNo ratings yet

- Find Your DealDocument5 pagesFind Your DealMaria Sánchez0% (1)

- The Unity Group Agglomeration OverviewDocument27 pagesThe Unity Group Agglomeration OverviewEric ClareNo ratings yet

- Unbreakable Business ChallengeDocument34 pagesUnbreakable Business Challengearturo7942100% (1)

- Never Before Revealed Secrets FreeDocument35 pagesNever Before Revealed Secrets FreesethNo ratings yet

- Be A DealmakerDocument36 pagesBe A DealmakerDes100% (1)

- RM+2 0+Module+1+TranscriptsDocument34 pagesRM+2 0+Module+1+Transcriptssibejeb466No ratings yet

- 2k A Day FormulaDocument7 pages2k A Day FormulaTyler K. Moore100% (5)

- The Ultimate Questionnaire by Patrick Bet David v1 PDFDocument14 pagesThe Ultimate Questionnaire by Patrick Bet David v1 PDFShri50% (4)

- This Free PDF Summary Here: My Free Book To Living Your Dream Life"Document6 pagesThis Free PDF Summary Here: My Free Book To Living Your Dream Life"gk80823No ratings yet

- Part 1 Small Chat For 23 MinsDocument4 pagesPart 1 Small Chat For 23 MinslifedesignreNo ratings yet

- The Four Key Zones of Business Information (Continued)Document2 pagesThe Four Key Zones of Business Information (Continued)JohnStarksNo ratings yet

- Cardone CourseoutlineDocument33 pagesCardone CourseoutlineYadgar Rashid100% (2)

- Dan Pena - Speaking at CSUNDocument3 pagesDan Pena - Speaking at CSUNfeederdude100% (4)

- Tai Lopez Conference 10/6/17Document8 pagesTai Lopez Conference 10/6/17Iulian PrefacNo ratings yet

- How To Set Up Your Business For Under 1000 PDFDocument102 pagesHow To Set Up Your Business For Under 1000 PDFChrissy Hungary100% (4)

- PenaDocument2 pagesPenaClaude PeñaNo ratings yet

- How To Get Started With Zero MONEY - It S NEVER TOO LATEDocument2 pagesHow To Get Started With Zero MONEY - It S NEVER TOO LATEvalentinNo ratings yet

- The Closer Script: (Pull Out The Hot Buttons! Let Them Tell You How To Sell Them.)Document8 pagesThe Closer Script: (Pull Out The Hot Buttons! Let Them Tell You How To Sell Them.)DMG SATYA PRASAD100% (1)

- 5 Traits PDFDocument7 pages5 Traits PDFTatiana Correa100% (1)

- 10 Ways To Guarantee Your ProsperityDocument17 pages10 Ways To Guarantee Your ProsperityReynaldo MarinNo ratings yet

- The Cheat Sheet: Instant CashDocument17 pagesThe Cheat Sheet: Instant CashhyogaxtehNo ratings yet

- Extreme Productivity BlueprintDocument14 pagesExtreme Productivity BlueprintZeesun12100% (2)

- Million Dollar Ad SwipesDocument8 pagesMillion Dollar Ad Swipesfunnel40% (5)

- 06-Wrong Ways To Source DealsDocument6 pages06-Wrong Ways To Source DealsYash SNo ratings yet

- 1 - Product Research: Step A: Idea GenerationDocument7 pages1 - Product Research: Step A: Idea GenerationYash SNo ratings yet

- Touch List Items Home Health & Fitness ElectronicsDocument3 pagesTouch List Items Home Health & Fitness ElectronicsYash SNo ratings yet

- PRSTQS Techniques 201118829123120Document1 pagePRSTQS Techniques 201118829123120Yash SNo ratings yet

- Jacknisolsiq Tsla Research Rev0102221Document28 pagesJacknisolsiq Tsla Research Rev0102221Yash SNo ratings yet

- Joel Bauer TrainingDocument1 pageJoel Bauer TrainingYash SNo ratings yet

- 10-1. How To Buy A Facebook GroupDocument4 pages10-1. How To Buy A Facebook GroupYash SNo ratings yet

- 01-John Assaraf S M A MindsetDocument11 pages01-John Assaraf S M A MindsetYash SNo ratings yet

- Product Research Cheat Sheet (2018) : 1. Wacky Product Idea SitesDocument12 pagesProduct Research Cheat Sheet (2018) : 1. Wacky Product Idea SitesYash SNo ratings yet

- Product Listing Secrets For Amazon SellersDocument4 pagesProduct Listing Secrets For Amazon Sellersbianca06bofNo ratings yet

- IAK AsNJ SDocument8 pagesIAK AsNJ SYash SNo ratings yet

- Austin's Cover Letter Example - Cultivated CultureDocument1 pageAustin's Cover Letter Example - Cultivated CultureYash SNo ratings yet

- Breakdown of Amazon Seller Fees - Jjahdjjnmember VersionDocument6 pagesBreakdown of Amazon Seller Fees - Jjahdjjnmember VersionYash SNo ratings yet

- How To Label Products: Barcode OptionsDocument2 pagesHow To Label Products: Barcode OptionsYash SNo ratings yet

- ILIJIQJKSJIQSMK The Million Dollar Seller S 11 Steps To Find A Winning ProductDocument1 pageILIJIQJKSJIQSMK The Million Dollar Seller S 11 Steps To Find A Winning ProductYash SNo ratings yet

- SDSIJMKHK - Freedom Ticket Webinar 2018 Slides PDFDocument326 pagesSDSIJMKHK - Freedom Ticket Webinar 2018 Slides PDFYash SNo ratings yet

- 12Document1 page12Yash SNo ratings yet

- 12Document1 page12Yash SNo ratings yet

- 12Document1 page12Yash SNo ratings yet

- Austin Belcak Resume (Example)Document2 pagesAustin Belcak Resume (Example)Franco LopezNo ratings yet

- 4343DCJGJIJDAmazon Seller Secrets Revealed - Volume 1 - Getting Started On Amazon - Final PDFDocument58 pages4343DCJGJIJDAmazon Seller Secrets Revealed - Volume 1 - Getting Started On Amazon - Final PDFYash SNo ratings yet

- 12Document1 page12Yash SNo ratings yet

- 12Document1 page12Yash SNo ratings yet

- 12Document1 page12Yash SNo ratings yet

- 12Document1 page12Yash SNo ratings yet

- 12Document1 page12Yash SNo ratings yet

- 12Document1 page12Yash SNo ratings yet

- 12Document1 page12Yash SNo ratings yet

- 12Document1 page12Yash SNo ratings yet

- 12Document1 page12Yash SNo ratings yet

- Architect's Letter To Village of La GrangeDocument13 pagesArchitect's Letter To Village of La GrangeDavid GiulianiNo ratings yet

- The Mystery of Belicena Villca - Nimrod de Rosario - Part-1Document418 pagesThe Mystery of Belicena Villca - Nimrod de Rosario - Part-1Pablo Adolfo Santa Cruz de la Vega100% (1)

- Internship Report Quetta Serena HotelDocument33 pagesInternship Report Quetta Serena HotelTalha Khan43% (7)

- 1Document4 pages1vikram270693No ratings yet

- Perceptions of Borders and Human Migration: The Human (In) Security of Shan Migrant Workers in ThailandDocument90 pagesPerceptions of Borders and Human Migration: The Human (In) Security of Shan Migrant Workers in ThailandPugh JuttaNo ratings yet

- Project Management: The Fate of The VasaDocument5 pagesProject Management: The Fate of The VasaAyush parasharNo ratings yet

- Fernan DebateDocument2 pagesFernan DebateJULLIE CARMELLE H. CHATTONo ratings yet

- Wassel Mohammad WahdatDocument110 pagesWassel Mohammad WahdatKarl Rigo Andrino100% (1)

- Document 1Document3 pagesDocument 1Micky YnopiaNo ratings yet

- Cross-Border InsolvencyDocument3 pagesCross-Border InsolvencySameeksha KashyapNo ratings yet

- Omore ReportDocument38 pagesOmore ReportSameer Ur RahmanNo ratings yet

- UNEP Directory March 2021Document34 pagesUNEP Directory March 2021Perera KusalNo ratings yet

- PDFDocument6 pagesPDFShowket IbraheemNo ratings yet

- CH 03Document21 pagesCH 03leisurelarry999100% (1)

- Framework PDFDocument16 pagesFramework PDFEunice BernalNo ratings yet

- HandoutDocument2 pagesHandoutDino ZepcanNo ratings yet

- SM Project For McomDocument38 pagesSM Project For McomSamar AsilNo ratings yet

- Basic Concepts of Internet of ThingsDocument2 pagesBasic Concepts of Internet of Thingsmukhlis softNo ratings yet

- Before The Hon'Ble Supereme Court of IndiaDocument32 pagesBefore The Hon'Ble Supereme Court of IndiaAnkit Singh0% (2)

- Sysmex Report 2021: Fiscal 2020 (April 1, 2020 To March 31, 2021)Document49 pagesSysmex Report 2021: Fiscal 2020 (April 1, 2020 To March 31, 2021)郑伟健No ratings yet

- Ward Planning GuidelinesDocument159 pagesWard Planning GuidelinesHemant Chandravanshi100% (1)

- mODES OF TRANSFER OF PROPERTYDocument3 pagesmODES OF TRANSFER OF PROPERTYBhavneet SinghNo ratings yet

- Investor / Analyst Presentation (Company Update)Document48 pagesInvestor / Analyst Presentation (Company Update)Shyam SunderNo ratings yet

- TP 2Document3 pagesTP 2api-282173119No ratings yet

- Justice Tim VicaryDocument5 pagesJustice Tim Vicaryاسماعيل الرجاميNo ratings yet

- Ansi B16.30 Asme FlangeDocument22 pagesAnsi B16.30 Asme FlangePedro Nelvedir Barrera CelyNo ratings yet

- 21 ST Century Lit Module 3Document6 pages21 ST Century Lit Module 3aljohncarl qui�onesNo ratings yet

- Inset Program Design - Final 2024Document10 pagesInset Program Design - Final 2024Emelyn NombreNo ratings yet

- Book of Mormon: Scripture Stories Coloring BookDocument22 pagesBook of Mormon: Scripture Stories Coloring BookJEJESILZANo ratings yet

- All You Need To Know About Track Visitor PermitsDocument2 pagesAll You Need To Know About Track Visitor PermitsGabriel BroascaNo ratings yet