Professional Documents

Culture Documents

As Introduced 129th General Assembly Regular Session H. B. No. 3 2011-2012

Uploaded by

wmdtvmattOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

As Introduced 129th General Assembly Regular Session H. B. No. 3 2011-2012

Uploaded by

wmdtvmattCopyright:

Available Formats

As Introduced

129th General Assembly

Regular Session H. B. No. 3

2011-2012

Representatives Grossman, Hottinger

Cosponsors: Representatives Adams, J., Martin, McClain, Boose, Huffman,

Maag, Brenner, Thompson, Hayes, Okey, Slaby, Newbold, Ruhl, Hite, Sears,

Derickson, Dovilla, Gonzales, Blair, Kozlowski, Uecker, Henne, Stautberg,

Combs, Roegner, Peterson

A BILL

To amend sections 5731.02, 5731.19, and 5731.21 of 1

the Revised Code to repeal the estate tax for the 2

estates of individuals dying on or after January 3

1, 2011. 4

BE IT ENACTED BY THE GENERAL ASSEMBLY OF THE STATE OF OHIO:

Section 1. That sections 5731.02, 5731.19, and 5731.21 of the 5

Revised Code be amended to read as follows: 6

Sec. 5731.02. (A) A tax is hereby levied on the transfer of 7

the taxable estate, determined as provided in section 5731.14 of 8

the Revised Code, of every person dying on or after July 1, 1968, 9

and before January 1, 2011, who at the time of death was a 10

resident of this state, as follows: 11

If the taxable estate is: The tax shall be: 12

Not over $40,000 2% of the taxable estate 13

Over $40,000 but not over $800 plus 3% of the excess over 14

$100,000 $40,000

Over $100,000 but not over $2,600 plus 4% of the excess over 15

H. B. No. 3 Page 2

As Introduced

$200,000 $100,000

Over $200,000 but not over $6,600 plus 5% of the excess over 16

$300,000 $200,000

Over $300,000 but not over $11,600 plus 6% of the excess 17

$500,000 over $300,000

Over $500,000 $23,600 plus 7% of the excess 18

over $500,000.

(B) A credit shall be allowed against the tax imposed by 19

division (A) of this section equal to the lesser of five hundred 20

dollars or the amount of the tax for persons dying on or after 21

July 1, 1968, but before January 1, 2001; the lesser of six 22

thousand six hundred dollars or the amount of the tax for persons 23

dying on or after January 1, 2001, but before January 1, 2002; or 24

the lesser of thirteen thousand nine hundred dollars or the amount 25

of the tax for persons dying on or after January 1, 2002. 26

Sec. 5731.19. (A) A tax is hereby levied upon the transfer of 27

so much of the taxable estate of every person dying on or after 28

July 1, 1968, and before January 1, 2011, who, at the time of his 29

death, was not a resident of this state, as consists of real 30

property situated in this state, tangible personal property having 31

an actual situs in this state, and intangible personal property 32

employed in carrying on a business within this state unless 33

exempted from tax under the provisions of section 5731.34 of the 34

Revised Code. 35

(B) The amount of the tax on such real and tangible personal 36

property shall be determined as follows: 37

(1) Determine the amount of tax which would be payable under 38

Chapter 5731. of the Revised Code if the decedent had died a 39

resident of this state with all his the decedent's property 40

situated or located within this state; 41

(2) Multiply the tax so determined by a fraction, the 42

H. B. No. 3 Page 3

As Introduced

denominator of which shall be the value of the gross estate 43

wherever situated and the numerator of which shall be the said 44

gross estate value of the real property situated and the tangible 45

personal property having an actual situs in this state and 46

intangible personal property employed in carrying on a business 47

within this state and not exempted from tax under section 5731.34 48

of the Revised Code. The product shall be the amount of tax 49

payable to this state. 50

(C) In addition to the tax levied by division (A) of this 51

section, an additional tax is hereby levied on such real and 52

tangible personal property determined as follows: 53

(1) Determine the amount of tax which would be payable under 54

division (A) of section 5731.18 of the Revised Code, if the 55

decedent had died a resident of this state with all his the 56

decedent's property situated or located within this state; 57

(2) Multiply the tax so determined by a fraction, the 58

denominator of which shall be the value of the gross estate 59

wherever situated and the numerator of which shall be the said 60

gross estate value of the real property situated and the tangible 61

property having an actual situs in this state and intangible 62

personal property employed in carrying on a business within this 63

state and not exempted from tax under section 5731.34 of the 64

Revised Code. The product so derived shall be credited with the 65

amount of the tax determined under division (B) of this section. 66

Sec. 5731.21. (A)(1)(a) Except as provided under division 67

(A)(3) of this section, the executor or administrator, or, if no 68

executor or administrator has been appointed, another person in 69

possession of property the transfer of which is subject to estate 70

taxes under section 5731.02 or division (A) of section 5731.19 of 71

the Revised Code, shall file an estate tax return, within nine 72

months of the date of the decedent's death, in the form prescribed 73

H. B. No. 3 Page 4

As Introduced

by the tax commissioner, in duplicate, with the probate court of 74

the county. The return shall include all property the transfer of 75

which is subject to estate taxes, whether that property is 76

transferred under the last will and testament of the decedent or 77

otherwise. The time for filing the return may be extended by the 78

tax commissioner. 79

(b) The estate tax return described in division (A)(1)(a) of 80

this section shall be accompanied by a certificate, in the form 81

prescribed by the tax commissioner, that is signed by the 82

executor, administrator, or other person required to file the 83

return, and that states all of the following: 84

(i) The fact that the return was filed; 85

(ii) The date of the filing of the return; 86

(iii) The fact that the estate taxes under section 5731.02 or 87

division (A) of section 5731.19 of the Revised Code, that are 88

shown to be due in the return, have been paid in full; 89

(iv) If applicable, the fact that real property listed in the 90

inventory for the decedent's estate is included in the return; 91

(v) If applicable, the fact that real property not listed in 92

the inventory for the decedent's estate, including, but not 93

limited to, survivorship tenancy property as described in section 94

5302.17 of the Revised Code or transfer on death property as 95

described in sections 5302.22 and 5302.23 of the Revised Code, 96

also is included in the return. In this regard, the certificate 97

additionally shall describe that real property by the same 98

description used in the return. 99

(2) The probate court shall forward one copy of the estate 100

tax return described in division (A)(1)(a) of this section to the 101

tax commissioner. 102

(3) A person shall not be required to file a return under 103

H. B. No. 3 Page 5

As Introduced

division (A) of this section if the decedent was a resident of 104

this state and the value of the decedent's gross estate is 105

twenty-five thousand dollars or less in the case of a decedent 106

dying on or after July 1, 1968, but before January 1, 2001; two 107

hundred thousand dollars or less in the case of a decedent dying 108

on or after January 1, 2001, but before January 1, 2002; or three 109

hundred thirty-eight thousand three hundred thirty-three dollars 110

or less in the case of a decedent dying on or after January 1, 111

2002. No return shall be filed for estates of decedents dying on 112

or after January 1, 2011. 113

(4)(a) Upon receipt of the estate tax return described in 114

division (A)(1)(a) of this section and the accompanying 115

certificate described in division (A)(1)(b) of this section, the 116

probate court promptly shall give notice of the return, by a form 117

prescribed by the tax commissioner, to the county auditor. The 118

auditor then shall make a charge based upon the notice and shall 119

certify a duplicate of the charge to the county treasurer. The 120

treasurer then shall collect, subject to division (A) of section 121

5731.25 of the Revised Code or any other statute extending the 122

time for payment of an estate tax, the tax so charged. 123

(b) Upon receipt of the return and the accompanying 124

certificate, the probate court also shall forward the certificate 125

to the auditor. When satisfied that the estate taxes under section 126

5731.02 or division (A) of section 5731.19 of the Revised Code, 127

that are shown to be due in the return, have been paid in full, 128

the auditor shall stamp the certificate so forwarded to verify 129

that payment. The auditor then shall return the stamped 130

certificate to the probate court. 131

(5)(a) The certificate described in division (A)(1)(b) of 132

this section is a public record subject to inspection and copying 133

in accordance with section 149.43 of the Revised Code. It shall be 134

kept in the records of the probate court pertaining to the 135

H. B. No. 3 Page 6

As Introduced

decedent's estate and is not subject to the confidentiality 136

provisions of section 5731.90 of the Revised Code. 137

(b) All persons are entitled to rely on the statements 138

contained in a certificate as described in division (A)(1)(b) of 139

this section if it has been filed in accordance with that 140

division, forwarded to a county auditor and stamped in accordance 141

with division (A)(4) of this section, and placed in the records of 142

the probate court pertaining to the decedent's estate in 143

accordance with division (A)(5)(a) of this section. The real 144

property referred to in the certificate shall be free of, and may 145

be regarded by all persons as being free of, any lien for estate 146

taxes under section 5731.02 and division (A) of section 5731.19 of 147

the Revised Code. 148

(B) An estate tax return filed under this section, in the 149

form prescribed by the tax commissioner, and showing that no 150

estate tax is due shall result in a determination that no estate 151

tax is due, if the tax commissioner within three months after the 152

receipt of the return by the department of taxation, fails to file 153

exceptions to the return in the probate court of the county in 154

which the return was filed. A copy of exceptions to a return of 155

that nature, when the tax commissioner files them within that 156

period, shall be sent by ordinary mail to the person who filed the 157

return. The tax commissioner is not bound under this division by a 158

determination that no estate tax is due, with respect to property 159

not disclosed in the return. 160

(C) If the executor, administrator, or other person required 161

to file an estate tax return fails to file it within nine months 162

of the date of the decedent's death, the tax commissioner may 163

determine the estate tax in that estate and issue a certificate of 164

determination in the same manner as is provided in division (B) of 165

section 5731.27 of the Revised Code. A certificate of 166

determination of that nature has the same force and effect as 167

H. B. No. 3 Page 7

As Introduced

though a return had been filed and a certificate of determination 168

issued with respect to the return. 169

Section 2. That existing sections 5731.02, 5731.19, and 170

5731.21 of the Revised Code are hereby repealed. 171

You might also like

- Taxation - Donors-Tax - Quizzer - 2018Document6 pagesTaxation - Donors-Tax - Quizzer - 2018Kenneth Bryan Tegerero Tegio67% (6)

- Introduction To Transfer Taxation (Presentation Slides)Document16 pagesIntroduction To Transfer Taxation (Presentation Slides)KezNo ratings yet

- USCODE 2011 Title26 SubtitleB Chap11 SubchapA PartII Sec2014Document3 pagesUSCODE 2011 Title26 SubtitleB Chap11 SubchapA PartII Sec2014Paco GilNo ratings yet

- Estate Tax: Sec. 84 To Sec. 97 National Internal Revenue CodeDocument29 pagesEstate Tax: Sec. 84 To Sec. 97 National Internal Revenue CodeJoie Tarroza-LabuguenNo ratings yet

- Nature of Estate and Donor's TaxDocument18 pagesNature of Estate and Donor's TaxSheila Mae Hoybia Urgel100% (2)

- House Bill 1524Document13 pagesHouse Bill 1524augustapressNo ratings yet

- LLC Loophole LSC Analysis and BillDocument21 pagesLLC Loophole LSC Analysis and BillFinney Law Firm, LLCNo ratings yet

- 83 (B) ElectionDocument2 pages83 (B) ElectionjbcairnsNo ratings yet

- Estate Tax ReturnDocument36 pagesEstate Tax ReturnMikee TanNo ratings yet

- Ab - 103 - Taxation - Personal Income and Corportation TaxesDocument156 pagesAb - 103 - Taxation - Personal Income and Corportation TaxesCalWonkNo ratings yet

- H.B. 1168Document12 pagesH.B. 1168Anthony WarrenNo ratings yet

- Estate TaxDocument10 pagesEstate TaxCharrie Grace PabloNo ratings yet

- Tax Chapter 5 Draft IIDocument88 pagesTax Chapter 5 Draft IIRuiz, CherryjaneNo ratings yet

- HB1465Document6 pagesHB1465Madison HardcastleNo ratings yet

- Conveyancer's Certificate - Section 15B (3) (A)Document1 pageConveyancer's Certificate - Section 15B (3) (A)secretaryNo ratings yet

- AN ACT CONCERNING AN EXPANSION OF THE HISTORIC HOMES TAX CREDIT: Rep Pat DillonDocument10 pagesAN ACT CONCERNING AN EXPANSION OF THE HISTORIC HOMES TAX CREDIT: Rep Pat DillonPatricia DillonNo ratings yet

- Irc ViDocument265 pagesIrc VihenrydpsinagaNo ratings yet

- ESTATE TAX ProceduresDocument9 pagesESTATE TAX ProceduresTolits BarsyNo ratings yet

- Part 3 - 58 of 1962 Income Tax Act - 2021.03.01 - To DateDocument254 pagesPart 3 - 58 of 1962 Income Tax Act - 2021.03.01 - To DateCedric PoolNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledDocument6 pagesBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledAdeline HoodhemwinfordNo ratings yet

- Tax Exemption Rulings RequirementsDocument7 pagesTax Exemption Rulings RequirementsArjam B. BonsucanNo ratings yet

- Title 5 Municipal Finance and TaxationDocument4 pagesTitle 5 Municipal Finance and Taxationfoof faafNo ratings yet

- Long Title General Description:: 31a-32a-101 31a-32a-106 59-10-114 59-10-1002.2Document9 pagesLong Title General Description:: 31a-32a-101 31a-32a-106 59-10-114 59-10-1002.2Jeremy PetersonNo ratings yet

- SB 19Document4 pagesSB 19Lindsey BasyeNo ratings yet

- Treat v. Commr. of RevenueDocument4 pagesTreat v. Commr. of RevenueEthan OkuraNo ratings yet

- Pa Taxpayers - GREATDocument20 pagesPa Taxpayers - GREATBlaiberteNo ratings yet

- Ultra-Millionaire Tax ActDocument15 pagesUltra-Millionaire Tax ActAustin DeneanNo ratings yet

- Estate Tax Documentary RequirementsDocument4 pagesEstate Tax Documentary RequirementsBINAYAO NAIZA MAENo ratings yet

- Estate and Donor's TaxDocument6 pagesEstate and Donor's TaxKimberly SendinNo ratings yet

- Revenue Regulations No. 2-2003Document22 pagesRevenue Regulations No. 2-2003Kiko RoxasNo ratings yet

- Estate Tax - BIRDocument15 pagesEstate Tax - BIRdolina.joeyNo ratings yet

- Jessa B. Regalario Ms. Tabernilla V-Bsa F. Schedule and Computation of The Tax Estate Tax Imposed On Net EstateDocument8 pagesJessa B. Regalario Ms. Tabernilla V-Bsa F. Schedule and Computation of The Tax Estate Tax Imposed On Net EstatejessaNo ratings yet

- Estate Taxation & Donor's Tax ExercisesDocument12 pagesEstate Taxation & Donor's Tax ExercisesAnonymous JqiHOYWmsNo ratings yet

- SPONSOR: Rep. Kowalko & Rep. Keeley & Rep. Lynn & Rep. Potter & Sen. Peterson Reps. Baumbach, J. Johnson, OsienskiDocument4 pagesSPONSOR: Rep. Kowalko & Rep. Keeley & Rep. Lynn & Rep. Potter & Sen. Peterson Reps. Baumbach, J. Johnson, OsienskiKevinOhlandtNo ratings yet

- Deduction For Residences in Inventory - 2013 SSL Draft, The Council of State GovernmentsDocument3 pagesDeduction For Residences in Inventory - 2013 SSL Draft, The Council of State Governmentsbvoit1895No ratings yet

- Estate and Donor's Tax RatesDocument15 pagesEstate and Donor's Tax Ratesmiss independentNo ratings yet

- Revenue Regulations 02-03Document22 pagesRevenue Regulations 02-03Anonymous HIBt2h6z7No ratings yet

- 06 Chap 13 14 Mamalateo 2019 Tax BookDocument65 pages06 Chap 13 14 Mamalateo 2019 Tax BookJeremias CusayNo ratings yet

- Michigan Auto Insurance BillDocument120 pagesMichigan Auto Insurance BillMLive.comNo ratings yet

- (B18-2019) (Taxation Laws)Document56 pages(B18-2019) (Taxation Laws)Khayakazi NtondiniNo ratings yet

- Estate Tax RatesDocument5 pagesEstate Tax RatesJohn Carlos WeeNo ratings yet

- Estate Tax EssentialsDocument10 pagesEstate Tax EssentialsVernnNo ratings yet

- Long Title General DescriptionDocument18 pagesLong Title General DescriptionCasie ForbesNo ratings yet

- Secretary of Finance Vs Illarde and CabalunaDocument8 pagesSecretary of Finance Vs Illarde and Cabalunajetzon2022No ratings yet

- Delhi Registration of Births and Deaths Rules, 1999Document15 pagesDelhi Registration of Births and Deaths Rules, 1999Latest Laws TeamNo ratings yet

- H.B. 220 Pretrial Detention AmendmentsDocument27 pagesH.B. 220 Pretrial Detention AmendmentsAdam ForgieNo ratings yet

- (84 StatDocument14 pages(84 Statmaria-bellaNo ratings yet

- Shall File A Return Under OathDocument17 pagesShall File A Return Under OathMixx MineNo ratings yet

- SB - 86 - Tax Administration FTB - SBEDocument37 pagesSB - 86 - Tax Administration FTB - SBECalWonkNo ratings yet

- Chapter 14Document6 pagesChapter 14Rahul HungeNo ratings yet

- HR 2580, Immigration and Nationality Act Amendments of 1965Document12 pagesHR 2580, Immigration and Nationality Act Amendments of 1965nolu chanNo ratings yet

- SB 864Document2 pagesSB 864Sinclair Broadcast Group - EugeneNo ratings yet

- TRAIN (Changes) ???? Pages 2, 6, 10, 14, 15 PDFDocument5 pagesTRAIN (Changes) ???? Pages 2, 6, 10, 14, 15 PDFblackmail1No ratings yet

- Real Estate Taxation SolutionsDocument4 pagesReal Estate Taxation SolutionsMiggy Zurita100% (5)

- Title 8 USC 1452b1 Federal Procedure To Become A National But NotDocument2 pagesTitle 8 USC 1452b1 Federal Procedure To Become A National But Nototis tolbertNo ratings yet

- House and Land Rent Tax Act 2023 1966Document9 pagesHouse and Land Rent Tax Act 2023 1966Samish DhakalNo ratings yet

- Congressional Redistricting Regional Hearing ScheduleDocument1 pageCongressional Redistricting Regional Hearing ScheduleohiohousegopNo ratings yet

- Early Bird Special Press ReleaseDocument1 pageEarly Bird Special Press ReleasewmdtvmattNo ratings yet

- Wilson Reading Veteran ReadDocument2 pagesWilson Reading Veteran ReadwmdtvmattNo ratings yet

- A Pledge To AmericaDocument48 pagesA Pledge To AmericawmdtvmattNo ratings yet

- National DebtDocument1 pageNational DebtwmdtvmattNo ratings yet

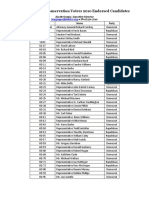

- 2010 Endorsed Candidates Press Release List 97-2003Document1 page2010 Endorsed Candidates Press Release List 97-2003wmdtvmattNo ratings yet

- Mary Swain Flyer IIDocument2 pagesMary Swain Flyer IIwmdtvmattNo ratings yet

- SubSB5 Comparative SynopsisDocument9 pagesSubSB5 Comparative SynopsiswmdtvmattNo ratings yet

- Committee AssignmentsDocument4 pagesCommittee AssignmentswmdtvmattNo ratings yet

- Pix in ParksDocument3 pagesPix in ParkswmdtvmattNo ratings yet

- VFW-PAC Endorses BoehnerDocument1 pageVFW-PAC Endorses BoehnerwmdtvmattNo ratings yet

- Press Release VOA Traffic Pattern 9.28.10Document1 pagePress Release VOA Traffic Pattern 9.28.10wmdtvmattNo ratings yet

- Second Letter To DSShawneevalleyDocument8 pagesSecond Letter To DSShawneevalleywmdtvmattNo ratings yet

- Cite As State Ex Rel. Varnau v. Wenninger, 2010-Ohio-3813.Document5 pagesCite As State Ex Rel. Varnau v. Wenninger, 2010-Ohio-3813.wmdtvmattNo ratings yet

- Future of Ohio JobsDocument1 pageFuture of Ohio JobsJimmy SheppardNo ratings yet

- OEC Complaint CombsDocument3 pagesOEC Complaint CombswmdtvmattNo ratings yet

- Economist StatementDocument9 pagesEconomist StatementwmdtvmattNo ratings yet

- Carter FundraiserDocument1 pageCarter FundraiserwmdtvmattNo ratings yet

- DisapprovalDocument2 pagesDisapprovalwmdtvmattNo ratings yet

- Ohio House GOP Government Reform PackageDocument1 pageOhio House GOP Government Reform PackageohiohousegopNo ratings yet

- Ohio Where Are The JobsDocument18 pagesOhio Where Are The JobswmdtvmattNo ratings yet

- Meranda Vs Gusweiler216 3Document14 pagesMeranda Vs Gusweiler216 3wmdtvmattNo ratings yet

- De Wine LetterDocument2 pagesDe Wine LetterwmdtvmattNo ratings yet

- Chris Vs Jenny DismissalDocument3 pagesChris Vs Jenny DismissalwmdtvmattNo ratings yet

- 02.03.10 - Government Reform PackageDocument1 page02.03.10 - Government Reform PackagewmdtvmattNo ratings yet

- OH-18 NW21 Permit ReleaseDocument1 pageOH-18 NW21 Permit ReleasewmdtvmattNo ratings yet

- Ohio Sup CT Race Concerns 3-5Document2 pagesOhio Sup CT Race Concerns 3-5wmdtvmattNo ratings yet

- BrokerCheck ReportDocument19 pagesBrokerCheck ReportwmdtvmattNo ratings yet

- Retherford Campaign Brochure 2Document1 pageRetherford Campaign Brochure 2wmdtvmattNo ratings yet

- Fractional share formula for estate tax marital deductionDocument1 pageFractional share formula for estate tax marital deductioninboxnewsNo ratings yet

- TAX Final-PreboardDocument14 pagesTAX Final-PreboardMarjorie BernasNo ratings yet

- Vanishing Deduction - Sample ComputationDocument4 pagesVanishing Deduction - Sample ComputationKathyrn Ang-ZarateNo ratings yet

- Case: Action To Recover From The Defendant, Collector of Internal Revenue, Certain Sums of Money PaidDocument6 pagesCase: Action To Recover From The Defendant, Collector of Internal Revenue, Certain Sums of Money PaidJulian DubaNo ratings yet

- Chapter 2 - Transfer Taxes and Basic SuccessionDocument5 pagesChapter 2 - Transfer Taxes and Basic SuccessionRitzchalle Garcia-OalinNo ratings yet

- BPI Vs PosadasDocument4 pagesBPI Vs PosadasRomelyne MaligayaNo ratings yet

- Nat Res CaseDocument22 pagesNat Res CaseChester BryanNo ratings yet

- Estate Tax and Donors TaxDocument19 pagesEstate Tax and Donors Taxtalla aldover100% (1)

- Estate Tax Exercises On Gross EstateDocument5 pagesEstate Tax Exercises On Gross EstateGileah ZuasolaNo ratings yet

- ACT26 Ch05 Net-Taxable-EstateDocument7 pagesACT26 Ch05 Net-Taxable-EstateMark BajacanNo ratings yet

- Estate TaxDocument21 pagesEstate TaxPatrick ArazoNo ratings yet

- 1 Full TextDocument50 pages1 Full TextLady Paul SyNo ratings yet

- 6.2 Due Diligence Checklist Template V2 3Document3 pages6.2 Due Diligence Checklist Template V2 3Fábio Miguel AzedoNo ratings yet

- 1 CIR vs. GonzalesDocument3 pages1 CIR vs. GonzalesJan Michael Dela CruzNo ratings yet

- (Digest) Dizon vs. CTADocument7 pages(Digest) Dizon vs. CTAGuiller C. Magsumbol100% (1)

- Train LawDocument3 pagesTrain LawJereme BalbinNo ratings yet

- Dizon V CTA DigestDocument4 pagesDizon V CTA DigestJelena SebastianNo ratings yet

- 1.4 Real-Estate-Taxation With Problems and Answers - REBDocument82 pages1.4 Real-Estate-Taxation With Problems and Answers - REBgore.solivenNo ratings yet

- TRAIN Law (PWC Philippines) PDFDocument16 pagesTRAIN Law (PWC Philippines) PDFYzar VelascoNo ratings yet

- Decedent Estate - Alternative Affidavit Demonstrating No Requirement For Irs Transfer CertificateDocument3 pagesDecedent Estate - Alternative Affidavit Demonstrating No Requirement For Irs Transfer CertificateAlexis RieraNo ratings yet

- RR No. 6-2019 - IRR Estate Tax AmnestyDocument5 pagesRR No. 6-2019 - IRR Estate Tax AmnestyAlexander Julio ValeraNo ratings yet

- Estate Taxation GuideDocument9 pagesEstate Taxation GuideMichelle GubatonNo ratings yet

- RPH FinalsDocument2 pagesRPH FinalsHagia CanapiNo ratings yet

- Taxation IIDocument72 pagesTaxation IIArnold OniaNo ratings yet

- Calculating Gross Estate for Estate TaxDocument11 pagesCalculating Gross Estate for Estate TaxBiboy GSNo ratings yet

- Taxation On Estates and TrustsDocument31 pagesTaxation On Estates and TrustsAndrea Renice S. FerriolNo ratings yet

- Bar Examination Taxation Law 2006-20015Document102 pagesBar Examination Taxation Law 2006-20015Joelito CalunodNo ratings yet

- REYES Bar Reviewer On Taxation II (v.3)Document164 pagesREYES Bar Reviewer On Taxation II (v.3)Glory Be93% (14)