Professional Documents

Culture Documents

Mr. BASUDEB SHARMA's tax computation AY 2020-21

Uploaded by

Basudev SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mr. BASUDEB SHARMA's tax computation AY 2020-21

Uploaded by

Basudev SharmaCopyright:

Available Formats

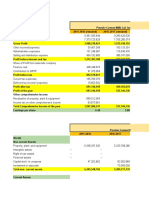

Computation of Tax Payable by Mr. BASUDEB SHARMA for AY 2020-21 Computation of Tax Payable by Mr.

Computation of Tax Payable by Mr. BASUDEB SHARMA for AY 2020-21

Gross Salary Apr-19 May-19 Jun-19 Jul-19 Aug-19 Sep-19 Oct-19 Nov-19 Dec-19 Jan-20 Feb-20 Mar-20 Total

1 Basic Salary 19,306 19,306 19,306 19,306 19,306 19,306 19,306 19,306 19,306 19,306 19,306 19,306 231,672

2 House Rent Allowance 17,292 17,292 17,292 17,292 17,292 17,292 17,292 17,292 17,292 17,292 17,292 17,292 207,504 Income from salary

3 Conveyance Allowance 16,896 16,896 16,896 16,896 16,896 16,896 16,896 16,896 16,896 16,896 16,896 16,896 202,752 1 Gross salary 765,514

4 Meg. Allowance 500 500 500 500 500 500 500 500 500 500 500 500 6,000 2 Less: Exemptions

5 Education Allowance 750 750 750 750 750 750 750 750 750 750 750 750 9,000 2.1 House Rent Allowance pending

2.1 AL.T.A 2,400

6 City Compensatory Allowance - - - - - - - - - - - - - 2.2 Conveyance allowance 50,000 (52,400)

7 Washing allowance 40 40 40 40 40 40 40 40 40 40 40 40 480 3 Taxable Salary 713,114

8 Special allowance 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 36,000

8 Other Allowance 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 3,000 36,000 4 Deductions under Chapter VIA

9 Good Work Allowance - - - - - - - - - - - - 4.1 Deduction u/s 80CCC [Pension Fund] -

10 Leave Travel Allowance - - - - - - - - - - - 19,306 19,306 4.2 Deduction u/s 80D [Medical Insurance Premia] -

11 Performance Award - - - - - - - - - - - - 4.3 Deduction u/s 80G -

12 Others (Bonus & Exgratia) - - - - - - - - - - - 16,800 16,800 4.4 Deduction u/s 192(2B) [Loss from House Property]

Total 60,784 60,784 60,784 60,784 60,784 60,784 60,784 60,784 60,784 60,784 60,784 96,890 765,514 4.5 Deduction U/s 80C * 27,801

Sub total (27,801)

B Computation of HRA 5 Total Income 685,313

1 HRA Received 17,292 17,292 17,292 17,292 17,292 17,292 17,292 17,292 17,292 17,292 17,292 17,292 207,504

2 Rent paid-10% of Salary (see note-1 below) 6,569 6,569 6,569 6,569 6,569 6,569 6,569 6,569 6,569 6,569 6,569 6,569 78,833 Tax on Total Income 49,563

3 40% of salary 7,722 7,722 7,722 7,722 7,722 7,722 7,722 7,722 7,722 7,722 7,722 7,722 92,669 Less:- tax Exempt 87A RS.2500/- -

balance Tax Payable 49,563

Exempt=B.1, B.2 or B.3 whichever is least 6,569 6,569 6,569 6,569 6,569 6,569 6,569 6,569 6,569 6,569 6,569 6,569 78,833 Add: Education Cess @4% 1983

Note-1 TOTAL TAX PAYABLE 51545 ok

Rent paid 8,500 8,500 8,500 8,500 8,500 8,500 8,500 8,500 8,500 8,500 8,500 8,500 102,000

10% of Basic 1,931 1,931 1,931 1,931 1,931 1,931 1,931 1,931 1,931 1,931 1,931 1,931 23,167 * Deduction U/s 80C 51545 17181.726

Provident Fund 27,801

C Computation of Conveyance allowance PPF -

(Actual receipt or Rs.800 p.m. whichever is l 1,600 1,600 1,600 1,600 1,600 1,600 1,600 1,600 1,600 1,600 1,600 1,600 19,200 LIC Premium

home loan principal

Tution Fees 56340 46980

D Computation of Pension Fund [sec 80CCC] Total cannot exceed Rs.100000 27,801

Amount Paid, or - (122,199)

Rs. 10000, whichever is less -

NOTE : To decrease Tax Amount, Submit the following Documents

E Computation of Medical Insurance Premia [sec 80D]

Amount Paid, or - 1 Original Copy of all Rent receipts

Rs. 10000, whichever is less - 2 Original Copy of all Tution Fees (for two children only)

3 Photocopy of LIC Prem., mediclaim prem., PPF Challan,NSC,

F Computation of Tax Payable Infrastructure Bonds, LIC Prem on pension Fund, Repayment

up to Rs.250000 Nil of Housing Loan etc.

from Rs.250001-500000 5% 12,500 4 Photocopy of Permanent Account Number (PAN)

from Rs 500001-1000000 20% 37,063

from Rs.1000001 and above 30%

Sub total 49,563 Jan.20 17185

Feb.20 17185

Mar.20 17185

51555

-10

You might also like

- DUMSSBDDDDocument3 pagesDUMSSBDDDUBCREATIONZ 2019No ratings yet

- How To Analyse REITs (Real Estate Investment Trusts)Document10 pagesHow To Analyse REITs (Real Estate Investment Trusts)paulineNo ratings yet

- BNI Transactions History ReportDocument6 pagesBNI Transactions History ReportDeti AndainiNo ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- Commission On Audit: Qualified OpinionDocument3 pagesCommission On Audit: Qualified OpinionMubarrach MatabalaoNo ratings yet

- Modules - I & IIDocument251 pagesModules - I & IIShilpi KauntiaNo ratings yet

- Receivable FinancingDocument5 pagesReceivable FinancingAphol Joyce MortelNo ratings yet

- Nabil Bank Q1 FY 2021Document28 pagesNabil Bank Q1 FY 2021Raj KarkiNo ratings yet

- Listening From CliftDocument19 pagesListening From CliftApril Toenk50% (12)

- 1967 - 202223 - REVISED - Revised 1 - Statement of IncomeDocument2 pages1967 - 202223 - REVISED - Revised 1 - Statement of IncomeSmita desaiNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- Test WorksheetDocument1 pageTest WorksheetattackcairoNo ratings yet

- Bishop Group (IAS-21 + Cashflow) : Cfap 1: A A F RDocument1 pageBishop Group (IAS-21 + Cashflow) : Cfap 1: A A F R.No ratings yet

- Chapter 5: Preparation of Financial Statements Practice ProblemsDocument27 pagesChapter 5: Preparation of Financial Statements Practice Problemsmayank shridharNo ratings yet

- Fundamentals Level – Skills Module, Paper F6 (UK) December 2014 Answers Taxation (United Kingdom) - Concise SummaryDocument9 pagesFundamentals Level – Skills Module, Paper F6 (UK) December 2014 Answers Taxation (United Kingdom) - Concise SummaryLatoya JohnsonNo ratings yet

- Book 1Document1 pageBook 1gras2007No ratings yet

- It Computation Sheet Fy 2020-21 - LopamudraDocument3 pagesIt Computation Sheet Fy 2020-21 - LopamudraGirija Prasad SwainNo ratings yet

- Acrued Liabilities (H)Document8 pagesAcrued Liabilities (H)comefromthebestNo ratings yet

- Direct Tax SolutionsDocument8 pagesDirect Tax SolutionsGaurav SoniNo ratings yet

- IT Statement 20-21Document2 pagesIT Statement 20-21Santhosh KumarNo ratings yet

- Bossier Parish School Board Proposed General Fund Budget 2010-2011Document13 pagesBossier Parish School Board Proposed General Fund Budget 2010-2011matthewscibaNo ratings yet

- Main TablesDocument1 pageMain Tablesvishalbharatshah2776No ratings yet

- Master - 10-8400 Budget Template ANSWERSDocument57 pagesMaster - 10-8400 Budget Template ANSWERSJonathan LeeNo ratings yet

- Rahul CompDocument2 pagesRahul CompCorman LimitedNo ratings yet

- Coi AmbekarDocument2 pagesCoi AmbekarCorman LimitedNo ratings yet

- APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR Projected Amount Total AmountDocument2 pagesAPR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR Projected Amount Total AmountSrinivasan PNo ratings yet

- Rasgas Company LTD Offshore Expansion Project: Train 4 (WH No.5)Document1 pageRasgas Company LTD Offshore Expansion Project: Train 4 (WH No.5)MarkyNo ratings yet

- AFA ESE 2022 SolutionsDocument8 pagesAFA ESE 2022 Solutionssebastian mlingwaNo ratings yet

- MAT Calculation SheetDocument33 pagesMAT Calculation SheetLokesh KumarNo ratings yet

- Incometax Calculation Worksheet (Old Regime) : Nippon Koei India Private Limited Ascent PayrollDocument2 pagesIncometax Calculation Worksheet (Old Regime) : Nippon Koei India Private Limited Ascent Payrollraz sharmaNo ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- Unaudited - Quarterly - Result - Q4 - 2076-77 NIBLDocument23 pagesUnaudited - Quarterly - Result - Q4 - 2076-77 NIBLManish BhandariNo ratings yet

- Profit & Loss Accounts: Wing Chair GirogioDocument3 pagesProfit & Loss Accounts: Wing Chair Girogiofarsi786No ratings yet

- Consolidated Balance Sheet of Reliance Industries: - in Rs. Cr.Document58 pagesConsolidated Balance Sheet of Reliance Industries: - in Rs. Cr.rotiNo ratings yet

- Weighted ComaniesDocument58 pagesWeighted ComaniesrotiNo ratings yet

- Quikchex 2020 Tax Comparison CalculatorDocument1 pageQuikchex 2020 Tax Comparison CalculatorSankar rajNo ratings yet

- Quiz 6 Compensation Income PDFDocument2 pagesQuiz 6 Compensation Income PDFcalliemozartNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Computation - Vijay SharmaDocument2 pagesComputation - Vijay Sharmaankit sharmaNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- $RN8C7G2Document3 pages$RN8C7G2akxerox47No ratings yet

- T2 Revised Ans. (PS & ITA)Document8 pagesT2 Revised Ans. (PS & ITA)alvinmono.718No ratings yet

- SF 2673 Conference Committee Senate Global Offer (5/16/2022)Document9 pagesSF 2673 Conference Committee Senate Global Offer (5/16/2022)FluenceMediaNo ratings yet

- Final Computaion For Government OfficeDocument24 pagesFinal Computaion For Government OfficeGagan Deep PathakNo ratings yet

- PT Finansia Multi Finance Employee Payslip for Aries RifaiDocument1 pagePT Finansia Multi Finance Employee Payslip for Aries RifaiDaniel Tommy PassarellaNo ratings yet

- Income Tax Calculation WorksheetDocument2 pagesIncome Tax Calculation Worksheetbabasahebjawale 5207No ratings yet

- PSBA REFRESHER TAXATION QUIZDocument10 pagesPSBA REFRESHER TAXATION QUIZEdnalyn CruzNo ratings yet

- 2019 Blue Book Combined PDFDocument311 pages2019 Blue Book Combined PDFhilton magagadaNo ratings yet

- 2-3mwi 2004 Dec ADocument13 pages2-3mwi 2004 Dec Aanga100% (1)

- KWASalary Maker V.4.03Document79 pagesKWASalary Maker V.4.03Prudhvi ChargeNo ratings yet

- Vishal Thakkar ComputationDocument4 pagesVishal Thakkar ComputationHemant SurgicalNo ratings yet

- Balance Sheet 1996-1997Document49 pagesBalance Sheet 1996-1997ritesh MishraNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS Certificateqwerty9999499949No ratings yet

- The Colony Towers Financial STMTSDocument8 pagesThe Colony Towers Financial STMTSRikki ThompsonNo ratings yet

- Schedule SAMPLEDocument5 pagesSchedule SAMPLEGlenda JaneoNo ratings yet

- WL00152 TaxStatement Feb2024Document1 pageWL00152 TaxStatement Feb2024gauthamchentuNo ratings yet

- Budget Proposal Highlights Barangay ExpendituresDocument4 pagesBudget Proposal Highlights Barangay ExpendituresBarangay SamputNo ratings yet

- Board's Report: Financial ResultsDocument22 pagesBoard's Report: Financial ResultsRNo ratings yet

- f6vnm 2007 Dec ADocument6 pagesf6vnm 2007 Dec APhạm Hùng DũngNo ratings yet

- Total Income StatementDocument2 pagesTotal Income StatementMohan Ganesh S/o A.MurugesanNo ratings yet

- Harkesh Kumar Singh Payslip For: SEP 2010: HDFC Bank LimitedDocument4 pagesHarkesh Kumar Singh Payslip For: SEP 2010: HDFC Bank LimitedPawan Kumar SinghNo ratings yet

- Computation PINKAL PDFDocument5 pagesComputation PINKAL PDFParthNo ratings yet

- 2015 Jun Ans-7Document1 page2015 Jun Ans-7何健珩No ratings yet

- Pay SlipDocument3 pagesPay Slipsharma_annilNo ratings yet

- Laporan Profit & Loss Manager: Borneo Group - Health DivisionDocument62 pagesLaporan Profit & Loss Manager: Borneo Group - Health Divisionrahayu siniNo ratings yet

- R Information Sheet (Wait List Id: 7472843)Document3 pagesR Information Sheet (Wait List Id: 7472843)Basudev SharmaNo ratings yet

- Iron Carbon DiagramDocument10 pagesIron Carbon DiagramVinod100% (1)

- Fan LawsDocument16 pagesFan Lawsjsrplc7952No ratings yet

- MatltestDocument21 pagesMatltesthà minh cườngNo ratings yet

- Upsetter Bearing Test ReportDocument2 pagesUpsetter Bearing Test ReportBasudev SharmaNo ratings yet

- Water PollutionDocument11 pagesWater PollutionBasudev SharmaNo ratings yet

- GD&TDocument70 pagesGD&TKarthi KeyanNo ratings yet

- Hala Arrabi Managerial Finance Assignment Chapter 3-Part 1 Multiple Choice QuestionsDocument3 pagesHala Arrabi Managerial Finance Assignment Chapter 3-Part 1 Multiple Choice QuestionsMohamad Haytham ElturkNo ratings yet

- Wa0007.Document10 pagesWa0007.Maz Izman BudimanNo ratings yet

- Exam List of AUSTDocument2 pagesExam List of AUSTMaruf KhanNo ratings yet

- Assignment 5Document17 pagesAssignment 5Beenish JafriNo ratings yet

- Annual Report 2020: Credit Suisse Group AG Credit Suisse AGDocument606 pagesAnnual Report 2020: Credit Suisse Group AG Credit Suisse AGMohammad Mahdi MozaffarNo ratings yet

- Survey QuestionDocument3 pagesSurvey QuestionAngelica Joy Daiz GuceNo ratings yet

- FINANCIAL SYSTEMS AND MARKETS CHAPTER 1Document67 pagesFINANCIAL SYSTEMS AND MARKETS CHAPTER 1Gabrielle Anne MagsanocNo ratings yet

- Ifric 17Document8 pagesIfric 17Xyriel RaeNo ratings yet

- SunTrust TemplateDocument1 pageSunTrust TemplateJustin Mason100% (2)

- Advantage of M-CommerceDocument5 pagesAdvantage of M-CommerceJiju JustinNo ratings yet

- Igcse Accounting Ratios Questionnaire PDFDocument18 pagesIgcse Accounting Ratios Questionnaire PDFAdenosineNo ratings yet

- Intacc Quiz1Document15 pagesIntacc Quiz1Armina BagsicNo ratings yet

- 0 - Employer Employee Presentation-RevisedDocument22 pages0 - Employer Employee Presentation-Revisedreetu888No ratings yet

- Conceptual Framework - Presentation and Disclosure Concepts of Capital Presentation and DisclosureDocument3 pagesConceptual Framework - Presentation and Disclosure Concepts of Capital Presentation and DisclosureEllen MaskariñoNo ratings yet

- BFS Unit 3Document13 pagesBFS Unit 3akileshbharathwaj2000No ratings yet

- EUWhoiswho ECB ENDocument13 pagesEUWhoiswho ECB ENmariangelesmillangutierrezNo ratings yet

- Answers of Doubtful Accounts AssignmentDocument4 pagesAnswers of Doubtful Accounts AssignmentGee Lysa Pascua VilbarNo ratings yet

- Imp Key Indicators of RRBs 2013Document6 pagesImp Key Indicators of RRBs 2013Pankaj SharmaNo ratings yet

- BCCPE - Registration FormDocument1 pageBCCPE - Registration Formdineshkumar1009No ratings yet

- Term Paper Excel Calculations-Premier Cement Mills Ltd.Document40 pagesTerm Paper Excel Calculations-Premier Cement Mills Ltd.Jannatul TrishiNo ratings yet

- T1 - YAL - Qns (12-5-2011Document9 pagesT1 - YAL - Qns (12-5-2011Jennifer EdwardsNo ratings yet

- Section 1.9.1 Annuity-ImmediateDocument15 pagesSection 1.9.1 Annuity-ImmediateMary Dianneil MandinNo ratings yet

- SIP-Shape by AMFI PDFDocument60 pagesSIP-Shape by AMFI PDFBiresh SalujaNo ratings yet