Professional Documents

Culture Documents

WL00152 TaxStatement Feb2024

Uploaded by

gauthamchentuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WL00152 TaxStatement Feb2024

Uploaded by

gauthamchentuCopyright:

Available Formats

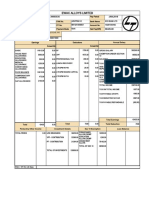

Employee Details

Company Name : Wiz Logtec Private Limited

Employee Name : Drakshayini Veerabhadrachari

Employee Code : WL00152

Tax Statement as on Feb 2024

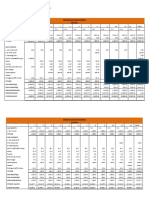

Sl. Description Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar TOTAL

1 TAX STRUCTURE NEW NEW NEW OLD OLD OLD OLD OLD OLD OLD OLD OLD

2 BASIC PAY 35,485.00 35,485.00 35,485.00 35,485.00 35,485.00 35,485.00 35,485.00 35,485.00 35,485.00 35,485.00 35,485.00 35,485.00 4,25,820.00

3 HOUSE RENT ALLOWANCE 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 2,12,916.00

4 SPECIAL ALLOWANCE 13,484.00 13,484.00 13,484.00 13,484.00 13,484.00 13,484.00 13,484.00 13,484.00 13,484.00 13,484.00 13,484.00 13,484.00 1,61,808.00

5 GROSS INCOME FROM SALARY 8,00,544.00

6 GROSS SALARY INCLUDING PERQ 8,00,544.00

7 RENT PAID BY EMPLOYEE 8,000.00 8,000.00 8,000.00 8,000.00 8,000.00 8,000.00 8,000.00 8,000.00 8,000.00 8,000.00 8,000.00 8,000.00 96,000.00

8 SALARY FOR HRA EXEMPTION(10%) 3,549.00 3,549.00 3,549.00 3,549.00 3,549.00 3,549.00 3,549.00 3,549.00 3,549.00 3,549.00 3,549.00 3,549.00 42,582.00

9 RENT PAID LESS 10% (A) 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 53,424.00

SALARY FOR HRA EXEMPTION(40%/50%)

10 14,194.00 14,194.00 14,194.00 14,194.00 14,194.00 14,194.00 14,194.00 14,194.00 14,194.00 14,194.00 14,194.00 14,194.00 1,70,328.00

(B)

11 ACTUAL HRA RECEIVED (C) 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 17,743.00 2,12,916.00

12 HRA EXEMPTION (MIN OF (A,B,C)) 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 4,452.00 -53,424.00

13 TOTAL EXEMPTION -53,424.00

14 INCOME AFTER SECTION(10) 7,47,120.00

15 STANDARD DEDUCTION -50,000.00

16 PROFESSIONAL TAX 0.00 400.00 200.00 200.00 200.00 200.00 200.00 200.00 200.00 200.00 200.00 200.00 -2,400.00

17 TAX ON EMPLOYEMENT -2,400.00

18 INCOME AFTER SECTION (16) 6,94,720.00

19 INCOME FROM HOUSE PROPERTY -2,00,000.00

20 GROSS TOTAL INCOME 4,94,720.00

21 PF CONTRIBUTION 4,258.00 4,258.00 4,258.00 4,258.00 4,258.00 4,258.00 4,258.00 4,258.00 4,258.00 4,258.00 4,258.00 4,258.00 51,096.00

22 HOUSING LOAN PRINCIPAL REPAYMENT 35,352.00

23 TOTAL INVESTMENTS 86,448.00

24 DEDUCTION U/S 80CCCE 86,448.00

25 TOTAL INVESTMENTS DEDUCTABLE -86,448.00

26 TOTAL CHAPTER VI(A) DEDUCTIONS -86,448.00

27 NET TAXABLE INCOME 4,08,272.00

28 TAX SLAB RATE 10.00 10.00 10.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00 0.00 5.00

29 TAX ON TOTAL INCOME 7,913.60

30 TAX INCLUDING SURCHARGE 7,913.60

31 TAX REBATE U/S 87A -7,913.60

32 TAX DEDUCTED TILL PREVIOUS MONTHS 0.00 2,841.00 2,842.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 5,683.00

33 TAX PAYABLE /REFUNDABLE -5,683.00

34 TAX PER MONTH -5,683.00

35 EMPLOYER PF 51,096.00

TOTAL EMPLOYER NPS, PF SUPER

36 51,096.00

ANNUATION

This is a computer generated document, hence no signature is required.

You might also like

- 2021 Turbo Tax ReturnDocument4 pages2021 Turbo Tax ReturnEmonee WellsNo ratings yet

- TaxStatement Mar2022Document1 pageTaxStatement Mar2022SiddharthNo ratings yet

- Pricing Calculator Screen PrintingDocument3 pagesPricing Calculator Screen PrintingNicholas JohnNo ratings yet

- LARSEN & TOUBRO LIMITEDDocument1 pageLARSEN & TOUBRO LIMITEDArun PVNo ratings yet

- Dec 2022Document1 pageDec 2022n1234567890987654321No ratings yet

- Ewac Alloys Limited: Uan No Aadhar NoDocument1 pageEwac Alloys Limited: Uan No Aadhar NoNapoleon DasNo ratings yet

- Fortis Hospital February 2019 PayslipDocument1 pageFortis Hospital February 2019 PayslipmkumarsejNo ratings yet

- Axis Bank LTD Payslip For The Month of April - 2021: Leave DetailsDocument2 pagesAxis Bank LTD Payslip For The Month of April - 2021: Leave Detailssalma saifiNo ratings yet

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- Axis Bank LTD Payslip For The Month of August - 2019Document3 pagesAxis Bank LTD Payslip For The Month of August - 2019Venkateswarlu KamaniNo ratings yet

- Pascual V CIRDocument1 pagePascual V CIRJocelyn MagbanuaNo ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- Web Payslip 266675 202304Document2 pagesWeb Payslip 266675 202304prabhat.finnproNo ratings yet

- View Certi If CateDocument1 pageView Certi If CateMahfuzur Rahman0% (3)

- Form No.35 Appeal To The Commissioner of Income Tax (Appeals) - 1, NashikDocument3 pagesForm No.35 Appeal To The Commissioner of Income Tax (Appeals) - 1, NashikNitin RautNo ratings yet

- GSIS V City TreasurerDocument2 pagesGSIS V City Treasurerav783No ratings yet

- Tax Statement As On Oct 2023: Employee DetailsDocument1 pageTax Statement As On Oct 2023: Employee DetailsParthiban ManiNo ratings yet

- Tax Planner As On Feb 2021: Employee DetailsDocument2 pagesTax Planner As On Feb 2021: Employee DetailsdamallNo ratings yet

- Employee tax statement May 2022Document1 pageEmployee tax statement May 2022thotada durga prasadNo ratings yet

- Employee tax statement for Circor Flow Technologies India Pvt LtdDocument1 pageEmployee tax statement for Circor Flow Technologies India Pvt LtdElakkiyaNo ratings yet

- File 07092023201232728Document3 pagesFile 07092023201232728dummysold7No ratings yet

- Dec 2022Document1 pageDec 2022kumarsanjeevsskNo ratings yet

- Serv Let ControllerDocument2 pagesServ Let ControllerANAND RADHAWALNo ratings yet

- Components Earnings: Amounts Are in INRDocument1 pageComponents Earnings: Amounts Are in INRDheeraj KumarNo ratings yet

- Components Earnings: Amounts Are in INRDocument1 pageComponents Earnings: Amounts Are in INRDheeraj KumarNo ratings yet

- Tax ComputationDocument2 pagesTax Computationng28No ratings yet

- Web Payslip 266675 202305Document2 pagesWeb Payslip 266675 202305prabhat.finnproNo ratings yet

- Pay SlipsDocument6 pagesPay Slipsshubneet775No ratings yet

- Web Payslip 266675 202306Document2 pagesWeb Payslip 266675 202306prabhat.finnproNo ratings yet

- Appendices To The Business Plan-1Document5 pagesAppendices To The Business Plan-1smile ChristianNo ratings yet

- Well'S Consulting Services Worksheet For The Month Ended January 31, 2X1XDocument1 pageWell'S Consulting Services Worksheet For The Month Ended January 31, 2X1Xariane pileaNo ratings yet

- Servlet ControllerDocument2 pagesServlet ControllerRJNo ratings yet

- YAP FEB 15Document1 pageYAP FEB 15mikel bautistaNo ratings yet

- 12 - January 2024 PayslipDocument1 page12 - January 2024 PayslipaigbevascoNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- Alameda NHSDocument7 pagesAlameda NHSRufa Mae BarbaNo ratings yet

- Analyze Financial Records Trial BalanceDocument40 pagesAnalyze Financial Records Trial BalanceJam SurdivillaNo ratings yet

- Ais ExerciseDocument26 pagesAis ExerciseLele DongNo ratings yet

- Monthly Salary BreakdownDocument6 pagesMonthly Salary Breakdownjohn frits gerard mombayNo ratings yet

- Accou NT No. Account Name Trial Balance Adjustment Income Statement Debit Credit Debit Credit DebitDocument44 pagesAccou NT No. Account Name Trial Balance Adjustment Income Statement Debit Credit Debit Credit DebitJam SurdivillaNo ratings yet

- Untitled Spreadsheet - Sheet1Document1 pageUntitled Spreadsheet - Sheet1gnssgtld7No ratings yet

- Salary SlipDocument2 pagesSalary Slipprnali.vflNo ratings yet

- VRCM9179 Feb 2023Document1 pageVRCM9179 Feb 2023Alluzz AmiNo ratings yet

- Total Cheltuieli Din Care 482,016,993.00 298,821,592.62 288,901,344.34 (460,878.28) 288,440,466.06 193,576,526.94 0.60Document5 pagesTotal Cheltuieli Din Care 482,016,993.00 298,821,592.62 288,901,344.34 (460,878.28) 288,440,466.06 193,576,526.94 0.60CNo ratings yet

- Acf 353Document3 pagesAcf 353Andy AsanteNo ratings yet

- Axis Bank LTD Payslip For The Month of May - 2021Document2 pagesAxis Bank LTD Payslip For The Month of May - 2021Suman DasNo ratings yet

- 99018037_MAR_2023Document1 page99018037_MAR_2023gaurav sharmaNo ratings yet

- Beg. Balance Sales Journal Voucher Registry Check Register Cash Receipt Account TitleDocument12 pagesBeg. Balance Sales Journal Voucher Registry Check Register Cash Receipt Account TitleFred WilsonNo ratings yet

- Apurbapatra: P TaltnneDocument2 pagesApurbapatra: P TaltnneAPURBA PATRANo ratings yet

- Beg. Balance Sales Journal Voucher Registry Check Register Cash ReceiptDocument4 pagesBeg. Balance Sales Journal Voucher Registry Check Register Cash ReceiptFred WilsonNo ratings yet

- Monthly Budget BreakdownDocument2 pagesMonthly Budget BreakdownBảo Anh NguyễnNo ratings yet

- Taxation AssessmentDocument8 pagesTaxation AssessmentBhanumati BhunjunNo ratings yet

- YTD Payslip-2022-2023Document1 pageYTD Payslip-2022-2023NIRAJ VIVEKNo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- Ratio Analysis Calculator: Particulars Current YearDocument14 pagesRatio Analysis Calculator: Particulars Current YearVivek GoswamiNo ratings yet

- Estimated Balance Sheet 2020 PDFDocument2 pagesEstimated Balance Sheet 2020 PDFsantosh ghotekarNo ratings yet

- AccountingDocument1 pageAccountingHannaniah Pabico100% (6)

- Xoriantlive 28051007Document1 pageXoriantlive 28051007susilaNo ratings yet

- Web Payslip 266675 202308Document2 pagesWeb Payslip 266675 202308prabhat.finnproNo ratings yet

- Name of Company Worksheet for the period endedDocument11 pagesName of Company Worksheet for the period endedRaymond RocoNo ratings yet

- Quikchex 2020 Tax Comparison CalculatorDocument1 pageQuikchex 2020 Tax Comparison CalculatorSankar rajNo ratings yet

- Bagh 2022Document282 pagesBagh 2022Farooq MaqboolNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Tax Invoice SummaryDocument3 pagesTax Invoice SummaryHarsh PatelNo ratings yet

- Hallmark Projects: Project - Hallmark Vicinia Apartments at NarsingiDocument1 pageHallmark Projects: Project - Hallmark Vicinia Apartments at Narsingikrishna TejaNo ratings yet

- Parmjit Singh Comp Ay 202324Document2 pagesParmjit Singh Comp Ay 202324SANJEEV KUMARNo ratings yet

- Akshar Agri India Bill of SupplyDocument1 pageAkshar Agri India Bill of SupplyAvnish JainNo ratings yet

- Philippine corporate tax rates and exemptionsDocument3 pagesPhilippine corporate tax rates and exemptionsRosemarie CruzNo ratings yet

- Payslip Name: Juan Dela Cruz Month: January 1-31, 2020 Contract SalaryDocument3 pagesPayslip Name: Juan Dela Cruz Month: January 1-31, 2020 Contract SalaryTESDAR12 SKTESDANo ratings yet

- Delivery Summary: Order DateDocument4 pagesDelivery Summary: Order Datemohammad AmirNo ratings yet

- F 1040 SeDocument2 pagesF 1040 SeseihnNo ratings yet

- Tax Invoice for Striped CaprisDocument1 pageTax Invoice for Striped CaprissahajathallamNo ratings yet

- Statement of Salary Income of Sukanta Karmakar (2011005216), Junior Engineer (Civil)Document1 pageStatement of Salary Income of Sukanta Karmakar (2011005216), Junior Engineer (Civil)s kNo ratings yet

- Survey of Manila RatesDocument5 pagesSurvey of Manila RatesMarcus DoroteoNo ratings yet

- Financial Compliance and Tax Liabilities ReportDocument3 pagesFinancial Compliance and Tax Liabilities Reportimran javed100% (2)

- IPPIS Payslip by Employee No P 061223Document2 pagesIPPIS Payslip by Employee No P 061223bazookaogenyi15No ratings yet

- Personal Tax Checklist-Turbo TaxDocument3 pagesPersonal Tax Checklist-Turbo TaxMortgage MississaugaNo ratings yet

- Medical ParentDocument1 pageMedical ParentRanjeet SinghNo ratings yet

- Ahmad Riaz 100330070 ACCT 3320 (A10) Assignment #1Document3 pagesAhmad Riaz 100330070 ACCT 3320 (A10) Assignment #1Ahmad RiazNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument1 pageCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasMARJONNo ratings yet

- Document 1510 4516Document54 pagesDocument 1510 4516rubyhien46tasNo ratings yet

- Chapter 7 Federal Taxation Textbook SolutionsDocument26 pagesChapter 7 Federal Taxation Textbook SolutionsReese Parker0% (1)

- Document 1Document8 pagesDocument 1Marco Alexander O. AgtagNo ratings yet

- HPCL, 3/C, DR Ambedkar Road, Near Nehru Memorial Hall, Camp, Pune-411001Document1 pageHPCL, 3/C, DR Ambedkar Road, Near Nehru Memorial Hall, Camp, Pune-411001Sangram MundeNo ratings yet

- Chapter - 5 Time & Value of SupplyDocument16 pagesChapter - 5 Time & Value of SupplyRaja BahlNo ratings yet

- Capital Gains Tax: Australian TreasuryDocument14 pagesCapital Gains Tax: Australian Treasurylaila rahmaNo ratings yet

- Ramo 4-86Document3 pagesRamo 4-86RB BalanayNo ratings yet