Professional Documents

Culture Documents

A Study On Capital Budgeting in Heritage Foods Inida LTD., Kasipentla

Uploaded by

sree anugraphicsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On Capital Budgeting in Heritage Foods Inida LTD., Kasipentla

Uploaded by

sree anugraphicsCopyright:

Available Formats

“A STUDY ON CAPITAL BUDGETING IN

HERITAGE FOODS INIDA LTD., KASIPENTLA”

Project Synopsis submitted in partial fulfillment of the requirement for the

Award of the Degree of

MASTER OF BUSINESS ADMINISTRATION

Of

JAWAHARLAL NEHRU TECHNOLOGICAL UNIVERSITY,

ANANTHAPUR

By

Name: L. JAGAPATHI

Reg. No. 17AK1E0029

Under the guidance of

Dr. N. CHANDRIKA, M.B.A., Ph.D.,

Department of MBA

DEPARTMENT OF MANAGEMENT STUDIES

ANNAMACHARYA INSTITUTE OF TECHNOLOGY & SCIENCES

TIRUPATI-517520

MBA 2017-2019

STUDENT SIGNATURE: GUDIE SIGNATURE:

DATE:

AITS - TIRUPATI Page 1

1.INTRODUCTION:

The term capital budgeting includes two different words

1. Capital

2. Budgeting Capital

Capital means amount brought into the business to do the business.

Budget:

Budget is a financial plan prepared for specific period in future.

Budgeting:

All steps involved in preparing budgets is named as budgeting or simple words

building budgets is named as budgets.

CAPITAL BUDGETING :

It is a process of investing funds. Current funds which are long term activities

with view to earn more profits .Over a series of years.

budgeting means planning for capital assets. The investment decision means a decision as to

whether (or) not money should be invested in long term projects. Such projects may include:

Setting up a factory

Installing a new machinery

2. INDUSTRY PROFILE

India with. 185 million cows and 154 million buffaloes, has the largest population of

cattle in the world. Total cattle population in the country as on October 2009 stood at

339 million .more than 50% of buffaloes and 20% of cattle in the world are found in

India and most of these are milk cows and milk buffaloes .

INDIA: WORLDS LARGEST MILK PRODUCER

India has become the world's no.1 milk producing country. United States where the

milk production is anticipated to grow only marginally at 71 million tones, occupied the top

slot till 1997. In the year 1997, India's milk production was on par with the U.S at" 71 million

tones.

MARKET SIZE AND GROWTH:

Market size for milk (sold in loss/packaged from)is estimated to be 36 million metric

tones valued at Rs.470 billion; the market is currently growing at round 4% per annum in

AITS - TIRUPATI Page 2

volume terms. The milk surplus states n fndia are Uttar Pradesh, Punjab, Haryana, Rajas than,

Gujarat, Maharashtra, Andhra Pradesh, Karnataka and Tamil Nadu. The manufacturing of

milk products in concentrated in these milk surplus states. The top 6 states viz.,

3. COMPANY PROFILE

The Heritage Groups, founded in the year 1992 by Mr. Nara Chandrababu Naidu, is one of

the fastest growing public Companies in India, with five-business division viz.,Dairy, Retail,

Agri, Bakery and Renewable Energy Under its flagship Company Heritage Foods Limited

(Formerly Known as Heritage Food (India) Limited)

The annual turnover of Heritage Foods crossed Rs.2380.58 crores in financial year 2015-16.

one infrastructure subsidiary – Heritage Infra Developers Limited and other

associate companies viz., Heritage Finlease Limited, Heritage International Limited and

Heritage Agro Merine Private Limited. The annual turnover of Heritage Foods crossed Rs

347 crore in 2015–16.

Presently, Heritage’s milk products have market presence in Andhra Pradesh,

Karnataka, Kerala, Tamil Nadu and Maharastra and its retail stores across Bangalore,Chennai

and Hyderabad. Integrated agri operations are in Chittoor and Medak Districts and these are

backbone to retail operations.

In the year 1994, HFIL floated a public issue to raise resources, which was

oversubscribed 54 times and its shares are listed under B1 Category on BSE and NSE.

Heritage Foods has its headquarters in Hyderabad, Andhra Pradesh, India.

4. REVIEW OF LITERATURE:

MEANING OF CAPITALBUDGETING

'The capital budget is essentially a list of what management believes to be worthwhile

projects for the acquisition of new assets together with the estimated cost of each project."

“Capital Budgeting is a long term planning for making and financing proposed capital

outlays.”

IMPORTANCE OF CAPITAL BUDGETING:

The importance of Capital Budgeting can be understood from the fact that

an unsound investment decision may prove to be fatal to the very existence of the

AITS - TIRUPATI Page 3

organization.

The importance of Capital budgeting arises mainly due to the following:

1 .Large Investment:

Capital Budgeting decision, generally involves large investment of fund. But the

funds available with the firm are the demand for fund for exceeds resources. Hence, it is very

important for a firm to plan and control capital expenditure.

CAPITAL BUDGETING PROCESS

The Capital budgeting process involves generation of investment proposals,

Estimation of cash flows for the proposals, evaluation of cash flows, selection of

projects based on acceptance criterion, and finally the continual revaluation of

investment after their acceptance. The steps involved in capital budgeting process are

as follows.

1. Project generation

2. Project evaluation

3. Project selection

4. Project execution

SIGNIFICANE AND PRESENTATION

Capital budget decisions are among the most crucial business^ decision. A

number of factors are responsible for capital budget decisions. Care must be taken

while making capital budget decisions influence all the departments of the company

such as production,

5. Need For the Study

It is a significant to emphasize that expenditures and its benefits of an

investment should be measured in cash. In the investment analysis it is cash flow

which is important not the accounting profit. It may also be pointed out that

investment decisions affect the firm's value. The firms value will increase it

investments are profitable and to the shareholders wealth. That investment should be

evaluated on the basis of criterion which is compatible with the objective of the

AITS - TIRUPATI Page 4

shareholders wealth maximization. An investment will add to the shareholders wealth.

If it yields benefits in a excess of the minimum benefits as for the opportunity part of

capital.

6. Scope of the Study

1. The scope of the present study includes the following.

Understanding the procedure of Heritage Milk Dairy Pvt., Ltd., Hyderabad

Evaluating an investment proposal of setting up facility of Heritage Milk Dairy Pvt.,

Ltd.,

Highlighting the necessity of current of assets and current liabilities.

Explain the principles of the current assets, investment and financing.

Suggest the need of establishing a sound credit policy.

7. Objectives of study:

The study of the capital budgeting in Heritage DAIRY is being attempted with the help

of the following objectives. .

The main objective of the project is to evaluating the proposed projects undertaken by

Heritage DAIRY by applying the capital budgeting.

To promote understanding across diverse communities of the communal value of

heritage

To develop, maintain and support a wide network of contacts and volunteers

dedicated to the preservation of cultural heritage through effective practices.

To provide instructive material to develop basic skills in computers use, management,

bookkeeping and English.

To assist in the preparation for the Post-conflict situation.

8. Research methodology:

SOURCES OF DATA COLLECTION:

PRIMARY DATA:

Primary data comprises of information obtained during discussions with the officers

and staff in the financial department.

AITS - TIRUPATI Page 5

SECONDARY DATA:

Secondary data comprises of information obtained from ratio analysis and ratio

analysis estimates of other financial statements files and other important documents

maintained by the organization are also the helpful.

9.Limitations of study:

The following are the limitations of the study;

The study was conducted with the data available and analysis was made accordingly.

Detailed analysis could not be carried for the project work because of the limited time

span.

Since the study is based on the financial data that are obtained from the company's

financial statements, the limitations of financial statements shall be equally

applicable.

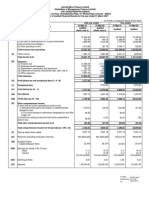

10 a. Findings, suggestions, conclusion:

The project is accepted when pay back is less than 5 years which is standard pay back

set by the management. The project gives less payback is accepted.

As per the management the minimum rate of return expected is 10%. The project

ARR greater than 40% greater than 40% is accepted.

The net income of the project is discounted at the minimum required rate return which

is grater then – 8% and NPV is positive so the project is accepted.

The capital invested is getting more return which is greater than 10%

The project showing Profitability Index is more than one. So the project is accepted.

AITS - TIRUPATI Page 6

b. suggestions:

It is concluded that the project is viable and profitable as the ARR is getting more

than 40%

The pay back indicates that the investment is fully recovered in short period.

NPV of the project is considered as better because of its higher net present value.

The IRR of the project is giving higher rate of return.

The profitability index is more than the giving value and where projects shows

NPV as positive.

To offer suggestions to Heritage foods limited to improve its financial

performance

C. Conclusion:

The budgeting exercise in HERITAGE FOODS Ltd., also covers the long term capital

budgets, including annual planning and provides long term plan for application of internal

resources and debt servicing translated in to the corporate plan.

The manual recommends the computation of NPV at a cost of capital / discount rate

specified from time to time.

A single discount rate should not be used for all the capacity budgeting projects.

The analysis of relevant facts and quantifications of anticipated results and benefits,

risk factors if any, must be clearly brought out.

Feasibility report of the project is prepared on the cost estimates and generation.

AITS - TIRUPATI Page 7

10. Bibliography:

Anunual reports from 2013-2018 of Heritage foods dairy pvt .ltd.

M.Y Khan and P.K. Jain “Finance Management”.3rd Edition Tata McGraw Hill

publishing company Ltd, New Delhi .

I.M. Pandey “Finance Management”. 9th Edition Vikas publishing House PVT, Ltd.

New Delhi

Prasana Chandra 2002 “Finance Management” 5thEdition , Tata Mc Graw Hill

publishing company Ltd, New Delhi.

Websites:

www.heritagefoods.com

www.google.com

www.wikipedia.com

WWW.FINANCE.COM

AITS - TIRUPATI Page 8

You might also like

- Working Capital MGMT at HeritageDocument79 pagesWorking Capital MGMT at HeritagePraveenNo ratings yet

- Invenory Management at Zauari Cement LimitedDocument71 pagesInvenory Management at Zauari Cement LimitedKotrabhasker GoudNo ratings yet

- Heritage 1Document32 pagesHeritage 1Tanvir KhanNo ratings yet

- Inventory and Store Management HMT Tools Limited IndustriesDocument87 pagesInventory and Store Management HMT Tools Limited IndustriesSagar Paul'g50% (2)

- Bhushan Ramekar SipDocument90 pagesBhushan Ramekar SipAkshay ShindeNo ratings yet

- New 2 Project PDFDocument56 pagesNew 2 Project PDFVishu Makwana0% (1)

- HDFC Ratio Analysis StudyDocument27 pagesHDFC Ratio Analysis StudyShine BrightNo ratings yet

- Update Project of SyamDocument84 pagesUpdate Project of Syamarjunmba119624No ratings yet

- Cash Management Project ReportDocument116 pagesCash Management Project ReportPooja RathoreNo ratings yet

- Sudha Final ProjectDocument101 pagesSudha Final Projectdurga prasadNo ratings yet

- Financial Statements AnalysisDocument11 pagesFinancial Statements Analysisferoz khanNo ratings yet

- Financial Analysis - Kotak Mahindra BankDocument43 pagesFinancial Analysis - Kotak Mahindra BankKishan ReddyNo ratings yet

- Chapter-I: 1.1 Introduction About The StudyDocument108 pagesChapter-I: 1.1 Introduction About The StudyMathi ShankarNo ratings yet

- Working Capital Management and Ratio AnalysisDocument102 pagesWorking Capital Management and Ratio AnalysisAshok KumarNo ratings yet

- RATIO ANALYSIS Projct of SugarDocument95 pagesRATIO ANALYSIS Projct of SugarBabasab Patil (Karrisatte)No ratings yet

- Reliance Mutual Funds ProjectDocument58 pagesReliance Mutual Funds ProjectShivangi SinghNo ratings yet

- A Synopsis On Inventory Management AT: Heritage Foods LimitedDocument9 pagesA Synopsis On Inventory Management AT: Heritage Foods LimitedkizieNo ratings yet

- Final Report Working Capital Management - SndhuDocument66 pagesFinal Report Working Capital Management - SndhuchanduNo ratings yet

- On Study of Cash Management at Axis BankDocument18 pagesOn Study of Cash Management at Axis BankHimanshu0% (1)

- Working Capital Management (IREL) RahulDocument78 pagesWorking Capital Management (IREL) RahulunandinipatraNo ratings yet

- Zuwari CementDocument81 pagesZuwari Cementnightking_1No ratings yet

- Sonali Shinde 51 Specialisation ProjectDocument81 pagesSonali Shinde 51 Specialisation ProjectPrashant MalpekarNo ratings yet

- Project Report On Capital Structure of RanbaxyDocument95 pagesProject Report On Capital Structure of RanbaxyAltamash Shaikh0% (1)

- Project Report Submitted in Partial Fulfillment For The Award of The Degree ofDocument67 pagesProject Report Submitted in Partial Fulfillment For The Award of The Degree ofMubeenNo ratings yet

- Financial Management - HDFCDocument7 pagesFinancial Management - HDFCmohammed khayyumNo ratings yet

- Project Report of Ratio AnalysisDocument56 pagesProject Report of Ratio AnalysisZahid Bhat100% (1)

- Project Report ON Working Capital Management IN Bharti Airtel LTDDocument84 pagesProject Report ON Working Capital Management IN Bharti Airtel LTDRam LalNo ratings yet

- Farha WCM Project-1Document110 pagesFarha WCM Project-1a NaniNo ratings yet

- Fazil Project..Document53 pagesFazil Project..Shahdab Sagari100% (1)

- Food and Inns ProjectDocument83 pagesFood and Inns ProjectGopi Nath100% (1)

- BC HDFCDocument11 pagesBC HDFCMohmmedKhayyum100% (1)

- A Study On Risk and Return Analysis of Equity Midcap Mutual Funds at Karvy Stock Broking Limited, Davangere.Document93 pagesA Study On Risk and Return Analysis of Equity Midcap Mutual Funds at Karvy Stock Broking Limited, Davangere.veer bharatNo ratings yet

- Presentation On Analysis of Mutual Fund As AnDocument19 pagesPresentation On Analysis of Mutual Fund As AnVivek GuptaNo ratings yet

- A Study On Ratio Analysis at Amar - Raja Battery LTD, PuneDocument68 pagesA Study On Ratio Analysis at Amar - Raja Battery LTD, PuneAMIT K SINGHNo ratings yet

- PHD Thesis 13Document292 pagesPHD Thesis 13Prince PatelNo ratings yet

- "Assets&liability Management"kesoramDocument51 pages"Assets&liability Management"kesoramaurorashiva1No ratings yet

- A Project On Working Capital ManagementDocument77 pagesA Project On Working Capital ManagementGurucharan SorenNo ratings yet

- The Industrial FinanceDocument36 pagesThe Industrial Financeanuradha mathuria50% (2)

- Zuari Project Report-MaheshDocument80 pagesZuari Project Report-MaheshVara Prasad0% (1)

- Summer Project On Working Capital at IFFCODocument75 pagesSummer Project On Working Capital at IFFCO3semmba75% (4)

- JK Non Performance AssetsDocument70 pagesJK Non Performance AssetsTarun100% (1)

- Summer Internship (304) RDM PROJECT MBA 3rd SEMESTERDocument87 pagesSummer Internship (304) RDM PROJECT MBA 3rd SEMESTERPawan DheraNo ratings yet

- Funds Flow Statement LancoDocument86 pagesFunds Flow Statement Lancothella deva prasadNo ratings yet

- Working Capital Management Indian Cements LTDDocument63 pagesWorking Capital Management Indian Cements LTDSri NivasNo ratings yet

- Credit Risk Sbi Project Report Mba FinanceDocument104 pagesCredit Risk Sbi Project Report Mba FinanceArpanpreet KaurNo ratings yet

- UjjijuDocument80 pagesUjjijuMannu BhardwajNo ratings yet

- ILYASD (1) (Repaired)Document67 pagesILYASD (1) (Repaired)ilyasNo ratings yet

- Customer Satisfaction Towards The Products and Services of Aiswarya Beverages Co. (Classic)Document50 pagesCustomer Satisfaction Towards The Products and Services of Aiswarya Beverages Co. (Classic)Ribu AlexanderNo ratings yet

- Conceptual School Work On Stock IndicesDocument73 pagesConceptual School Work On Stock IndicesFawaz MushtaqNo ratings yet

- Performance ProjectDocument108 pagesPerformance ProjectjayanthiNo ratings yet

- A Study On Financial Performance Analysis of Sundaram Finance LimitedDocument56 pagesA Study On Financial Performance Analysis of Sundaram Finance LimitedAnonymous lOz8e6tl0No ratings yet

- Fsa - IciciDocument85 pagesFsa - IciciMOHAMMED KHAYYUMNo ratings yet

- A Study On Financial Statement Analysis - HeritageDocument13 pagesA Study On Financial Statement Analysis - Heritagekizie100% (1)

- Working Capital ManagmentDocument58 pagesWorking Capital ManagmentSANGITA ACHARYA100% (1)

- Antima TyagiDocument89 pagesAntima TyagiShivankar TyagiNo ratings yet

- Uday Project ReportDocument53 pagesUday Project ReportudayNo ratings yet

- Green Products A Complete Guide - 2020 EditionFrom EverandGreen Products A Complete Guide - 2020 EditionRating: 5 out of 5 stars5/5 (1)

- Capital Budgeting - HeritageDocument66 pagesCapital Budgeting - HeritageAnu ShaNo ratings yet

- S A Hit Hi Project FinalDocument94 pagesS A Hit Hi Project FinalNavin ParavadaNo ratings yet

- Final Synopsis Copy (Riya Barsagade) HRM KSHITIJDocument19 pagesFinal Synopsis Copy (Riya Barsagade) HRM KSHITIJKshitij ThakurNo ratings yet

- A Synopsis Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofDocument3 pagesA Synopsis Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofsree anugraphicsNo ratings yet

- Sri Padmavati Mahila Visva Vidyalayam Sowmya SynopsisDocument4 pagesSri Padmavati Mahila Visva Vidyalayam Sowmya Synopsissree anugraphicsNo ratings yet

- GK Chowadary Front PhaggesDocument12 pagesGK Chowadary Front Phaggessree anugraphicsNo ratings yet

- A Study On Training and Development in Bharathi Cement Corporation LTD., KadapaDocument8 pagesA Study On Training and Development in Bharathi Cement Corporation LTD., Kadapasree anugraphicsNo ratings yet

- Synopsis: A Study On Working Capital Management BSNL, GunturDocument4 pagesSynopsis: A Study On Working Capital Management BSNL, Guntursree anugraphicsNo ratings yet

- P. Anil Kumar SynopsisDocument6 pagesP. Anil Kumar Synopsissree anugraphicsNo ratings yet

- Dinesh SynopsisDocument76 pagesDinesh Synopsissree anugraphicsNo ratings yet

- A Study On Financial Performance in Andhra Pradesh Mineral Development Corporation LTD., MangampetDocument7 pagesA Study On Financial Performance in Andhra Pradesh Mineral Development Corporation LTD., Mangampetsree anugraphicsNo ratings yet

- A Study On Brand Loyalty in Bharti Airtel LTD., TirupatiDocument6 pagesA Study On Brand Loyalty in Bharti Airtel LTD., Tirupatisree anugraphicsNo ratings yet

- Sri Padmavati Mahila Visvavidyalayam TirupatiDocument6 pagesSri Padmavati Mahila Visvavidyalayam Tirupatisree anugraphicsNo ratings yet

- A Study On Performance Evaluation of Selected Balanced Funds in Karvy Stock Broking LTD., TirupatiDocument7 pagesA Study On Performance Evaluation of Selected Balanced Funds in Karvy Stock Broking LTD., Tirupatisree anugraphicsNo ratings yet

- A Study On Quality of Work Life in Grindwell Norton LTD., TirupatiDocument8 pagesA Study On Quality of Work Life in Grindwell Norton LTD., Tirupatisree anugraphicsNo ratings yet

- SYNOPSIS - Shaik JafarDocument7 pagesSYNOPSIS - Shaik Jafarsree anugraphicsNo ratings yet

- A Study On Financial Statement Analysis in Tirumala Milk Products Pvt. LTD., PalamanerDocument7 pagesA Study On Financial Statement Analysis in Tirumala Milk Products Pvt. LTD., Palamanersree anugraphicsNo ratings yet

- Chandana Project SynapsisDocument6 pagesChandana Project Synapsissree anugraphicsNo ratings yet

- A Study On Brand Awareness in Heritage Foods India LTD., PakalaDocument6 pagesA Study On Brand Awareness in Heritage Foods India LTD., Pakalasree anugraphicsNo ratings yet

- A Study On Sales Promotion in Dodla Dairy PVT, LTD., PalamanerDocument5 pagesA Study On Sales Promotion in Dodla Dairy PVT, LTD., Palamanersree anugraphicsNo ratings yet

- A Study On Financial Performance in Bharathi Cement Corporation LTD., KadapaDocument8 pagesA Study On Financial Performance in Bharathi Cement Corporation LTD., Kadapasree anugraphicsNo ratings yet

- A Study On Training and Development in Bharathi Cement Corporation LTD., KadapaDocument8 pagesA Study On Training and Development in Bharathi Cement Corporation LTD., Kadapasree anugraphicsNo ratings yet

- Synopsis: A Study On Cash Flow Statement Atamararaja Batteries LTD., at KarakambadiDocument3 pagesSynopsis: A Study On Cash Flow Statement Atamararaja Batteries LTD., at Karakambadisree anugraphicsNo ratings yet

- Masum Synopsis PDFDocument3 pagesMasum Synopsis PDFsree anugraphicsNo ratings yet

- Hero Customer SatisfactionDocument15 pagesHero Customer Satisfactionsree anugraphicsNo ratings yet

- A Study On Organization Culture in Hindusthan Coca Cola Beverages Pvt. LTD., SrikalahasthiDocument9 pagesA Study On Organization Culture in Hindusthan Coca Cola Beverages Pvt. LTD., Srikalahasthisree anugraphicsNo ratings yet

- Synopsis: Astudy On ONLINE TRADING at India Infoline LTD, Palamaner (2017-2019)Document4 pagesSynopsis: Astudy On ONLINE TRADING at India Infoline LTD, Palamaner (2017-2019)sree anugraphicsNo ratings yet

- A Study On Working Capital Management in Zuari Cement LTD., YerraguntlaDocument5 pagesA Study On Working Capital Management in Zuari Cement LTD., Yerraguntlasree anugraphicsNo ratings yet

- A Study On Customer Loyalty in Bharathi Airtel LTD., TirupatiDocument5 pagesA Study On Customer Loyalty in Bharathi Airtel LTD., Tirupatisree anugraphicsNo ratings yet

- Synopsis A Study On Ratio Analysis of KBD Sugars & Distilleries Limited, PunganurDocument5 pagesSynopsis A Study On Ratio Analysis of KBD Sugars & Distilleries Limited, Punganursree anugraphicsNo ratings yet

- A Study On Customer Satisfaction in Nerolac Paints LTD., KadapaDocument8 pagesA Study On Customer Satisfaction in Nerolac Paints LTD., Kadapasree anugraphicsNo ratings yet

- Synopsis: A Study On Cash Flow Statement Atamararaja Batteries LTD., at KarakambadiDocument3 pagesSynopsis: A Study On Cash Flow Statement Atamararaja Batteries LTD., at Karakambadisree anugraphicsNo ratings yet

- Synopsis: Gandhi Institute of Technologyand Management (Gitam) VisakapatnamDocument6 pagesSynopsis: Gandhi Institute of Technologyand Management (Gitam) Visakapatnamsree anugraphicsNo ratings yet

- Articles of Incorporation Final111111111Document11 pagesArticles of Incorporation Final111111111Michelle Ann DomagtoyNo ratings yet

- Foundations in Accountancy FFA/ACCA FDocument45 pagesFoundations in Accountancy FFA/ACCA FTuyết Anh ĐồngNo ratings yet

- Responsive Document - CREW: Department of Education: Regarding For-Profit Education: 8/16/201111-00026-F (Ginns Redactions2) (PART 3)Document500 pagesResponsive Document - CREW: Department of Education: Regarding For-Profit Education: 8/16/201111-00026-F (Ginns Redactions2) (PART 3)CREWNo ratings yet

- Ica-Ja 1Document27 pagesIca-Ja 1TarikTaliHidungNo ratings yet

- ICICI Bank Ltd. Versus Official Liquidator of APS StarDocument17 pagesICICI Bank Ltd. Versus Official Liquidator of APS StarAman Kumar YadavNo ratings yet

- Bluehouse Capital - Property XpressDocument4 pagesBluehouse Capital - Property XpressProperty XpressNo ratings yet

- Tenancy Agreement (Kamal Carwash)Document3 pagesTenancy Agreement (Kamal Carwash)Syed Isamil75% (8)

- What Is The Secret Recipe For Successful Mergers and AcquisitionsDocument7 pagesWhat Is The Secret Recipe For Successful Mergers and AcquisitionsAnna SartoriNo ratings yet

- Wileyfall2010WSPctlg GenericDocument155 pagesWileyfall2010WSPctlg GenericHisbullah Kalanther LebbeNo ratings yet

- ACFDocument9 pagesACFduaa fatimaNo ratings yet

- CIMB Research On AffinDocument8 pagesCIMB Research On AffinBrian StanleyNo ratings yet

- Pos Goal Suraksha BrochureDocument10 pagesPos Goal Suraksha BrochureSudhirGajareNo ratings yet

- D. Complete The TableDocument2 pagesD. Complete The TableExequielCamisaCrusperoNo ratings yet

- 231HW1 Fall11Document2 pages231HW1 Fall11snowfxz0% (1)

- BDO Canada - Summary - IFRS-16Document7 pagesBDO Canada - Summary - IFRS-16Ernest IpNo ratings yet

- Capital Structure - RanbaxyDocument40 pagesCapital Structure - RanbaxyNooral Alfa100% (1)

- Hockey Player On EBIXDocument20 pagesHockey Player On EBIXvram2000No ratings yet

- M11 MishkinEakins3427056 08 FMI C11Document53 pagesM11 MishkinEakins3427056 08 FMI C11habiba ahmedNo ratings yet

- FIN353 IntroductionDocument22 pagesFIN353 IntroductionakasNo ratings yet

- Certificate in Accounting (IAS) Level 3/series 3-2009Document14 pagesCertificate in Accounting (IAS) Level 3/series 3-2009Hein Linn Kyaw75% (4)

- Money Market Interest RatesDocument4 pagesMoney Market Interest RatesTeffi Boyer MontoyaNo ratings yet

- Accountant Advice 2020Document306 pagesAccountant Advice 2020Jerald MirandaNo ratings yet

- Janine Mae Serpa Msme Engr. John N. Celeste, Msme, DpaDocument2 pagesJanine Mae Serpa Msme Engr. John N. Celeste, Msme, Dpajaninemaeserpa14No ratings yet

- All Journal IJM Edit3Document255 pagesAll Journal IJM Edit3lingeshNo ratings yet

- Assignment Name: Part 1. Computation Choose The Letter of The Best Answer. Highlight Your Answer. 2 Points EachDocument5 pagesAssignment Name: Part 1. Computation Choose The Letter of The Best Answer. Highlight Your Answer. 2 Points EachCacjungoyNo ratings yet

- Indent Formats 2014Document8 pagesIndent Formats 2014Ramakrishna Rao ReddyNo ratings yet

- CAT Owning PDFDocument54 pagesCAT Owning PDFErick Del Pino HurtadoNo ratings yet

- Macroeconomics Tuto c2Document1 pageMacroeconomics Tuto c2Nazri AnaszNo ratings yet

- Activity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIDocument5 pagesActivity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIBryle Jay Lape40% (5)

- (In Lakhs, Except Per Equity Share Data) : Digitally Signed Bysvraja VaidyanathanDocument9 pages(In Lakhs, Except Per Equity Share Data) : Digitally Signed Bysvraja VaidyanathanAnamika NandiNo ratings yet