Professional Documents

Culture Documents

Law Relating To Banking November 2015

Uploaded by

Basilio MaliwangaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Law Relating To Banking November 2015

Uploaded by

Basilio MaliwangaCopyright:

Available Formats

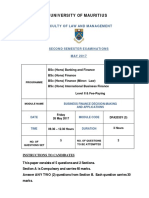

INSTITUTE OF BANKERS IN MALAWI

DIPLOMA IN BANKING EXAMINATION

SUBJECT: LAW RELATING TO BANKING (IOBM – D216)

Date: Thursday, 12th November 2015

Time Allocated: 3 hours (08:00 – 11:00 Hours)

INSTRUCTIONS TO CANDIDATES

1 This paper consists of TWO Sections, A and B.

2 Section A consists of 4 questions, each question carries 15 marks.

Answer ALL questions.

3 Section B consists of 4 questions, each question carries 20 marks. Answer

ANY TWO questions.

4 You will be allowed 10 minutes to go through the paper before the start of the

examination, you may write on this paper but not in the answer book.

5 Begin each answer on a new page.

6 Please write your examination number on each answer book used.

Answer books without examination numbers will not be marked.

7 All persons writing examinations without payment will risk expulsion from the

Institute.

8 If you are caught cheating, you will be automatically disqualified in all subjects

seated this semester.

9 DO NOT open this question paper until instructed to do so.

SECTION A (60 MARKS)

Answer ALL questions from this section.

QUESTION 1

Jones has opened an account with one of the commercial banks in Town. He has

duly filled the forms as required by the bank. Jones however is not aware what

constitutes the contract between himself and the bank with respect to implied terms.

Required:

Advise Jones on implied terms of the contract between himself and the bank ?

(Total 15 marks)

QUESTION 2

(a) X Insurance Company has been liquidated due to many financial challenges it

was facing. The Reserve Bank of Malawi is the liquidator of the company.

Required:

As a liquidator, outline five powers that Reserve Bank of Malawi has as per

Section 32 (3) of the Reserve Bank of Malawi Act? (10

marks)

(b) Differentiate between criminal conversion and theft? ( 5 marks)

(Total 15 marks)

QUESTION 3

(a) Outline powers and duties of directors as officials of a bank? (Total 15 marks)

A qualification examined by the Institute of Bankers in Malawi

QUESTION 4

Explain in detail how the following Statutes affect the confidentiality principle in

banker/customer relationship:

(a) Drug Trafficking Offences Act, 1986 (7 marks)

(b) Taxes Management Act 1970 (4 marks)

(c) Criminal Justice Act 1987 (2 marks)

(d) Companies Act 1985 (2 marks)

(Total 15 marks)

SECTION B (40 MARKS)

Answer ANY TWO questions from this section

QUESTION 5

(a) Briefly, outline the rules that are to be considered before closure of a bank

account by the bank to avoid a dispute? ( 15

marks)

(b) Discuss any three factors that must be considered by a banker when opening a

new account. (5 marks)

(Total 20 marks)

QUESTION 6

(a) The African Development Bank considers private sector development as a

major objective of its development activities. How does the bank undertake

this objective? (8 marks)

(b) Every year in Malawi, the International Monetary Fund (IMF) sends a

delegation to discuss with government and all relevant stakeholders on

economic issues affecting Malawi. However, many Malawians are not well

conversant with the functions/roles of the Fund. State six functions of the

3

A qualification examined by the Institute of Bankers in Malawi

Fund. ( 12

marks)

. (Total 20 marks)

QUESTION 7

(a) A bill payable on demand should be presented for payment as soon as

possible within a reasonable time. In certain circumstances, presentment for

payment is dispensed with. Mention four of such circumstances? ( 8 marks)

(b) Under what six conditions will a person be a holder in due course? (6 marks)

(Total 20 marks)

QUESTION 8

(a) Define undue influence and state four principles to be applied once undue

influence is alleged on the part of the bank by the guarantor? (10 marks)

(b) Explain five ways through which a valid guarantee is determined? (10 marks)

(Total 20 marks)

END OF EXAMINATION PAPER

A qualification examined by the Institute of Bankers in Malawi

You might also like

- Colored Pencil Step by StepDocument64 pagesColored Pencil Step by StepAndre Beaureau70% (37)

- Colored Pencil Step by StepDocument64 pagesColored Pencil Step by StepAndre Beaureau70% (37)

- Handbook of DrawingDocument302 pagesHandbook of DrawingTucc195% (22)

- 101 Weapons of Spiritual Warfar - D. K. Olukoya-1Document557 pages101 Weapons of Spiritual Warfar - D. K. Olukoya-1Basilio Maliwanga100% (16)

- Boy Meets Girl - Say Hello To Courtship - 180532 PDFDocument570 pagesBoy Meets Girl - Say Hello To Courtship - 180532 PDFNash Perez100% (1)

- Red de Artistas Tecnicas Shadow PDFDocument33 pagesRed de Artistas Tecnicas Shadow PDFpilar ortizNo ratings yet

- 7 QUALITIES WISE MEN WANT Kingsley OkonkwoDocument60 pages7 QUALITIES WISE MEN WANT Kingsley OkonkwoNdip Smith100% (5)

- Business Plan: Malaysian NGV SDN BHDDocument81 pagesBusiness Plan: Malaysian NGV SDN BHDMurtaza ShaikhNo ratings yet

- 115 Landslide Hazard PDFDocument5 pages115 Landslide Hazard PDFong0625No ratings yet

- Your Spiritual Weapons and How - Terry LawDocument64 pagesYour Spiritual Weapons and How - Terry LawBasilio MaliwangaNo ratings yet

- Fifth Trimester Examination - 2009 Banking ManagementDocument7 pagesFifth Trimester Examination - 2009 Banking Managementhianshu1985No ratings yet

- Building A Successful Marriage - Bishop David OyedepoDocument117 pagesBuilding A Successful Marriage - Bishop David Oyedepoemmanueloduor83% (12)

- Drawing Basics - 26 Free Beginner Drawing Techniques PDFDocument14 pagesDrawing Basics - 26 Free Beginner Drawing Techniques PDFDavid FonsecaNo ratings yet

- How To Draw Comics ComicDocument34 pagesHow To Draw Comics ComicGweedoFukin Weedo91% (11)

- 01 Helping Your Child Become A Reader ReaderDocument54 pages01 Helping Your Child Become A Reader Readerapi-309082881No ratings yet

- M1439 GHD MCL MSS 030 Rev 01 Wiring Accessories BDocument72 pagesM1439 GHD MCL MSS 030 Rev 01 Wiring Accessories BAnandu AshokanNo ratings yet

- 555 Difficult Bible Questions AnsweredDocument665 pages555 Difficult Bible Questions Answeredfer753100% (4)

- Breakthrough! Develop The 7 HabitsDocument182 pagesBreakthrough! Develop The 7 HabitsBasilio MaliwangaNo ratings yet

- Computer Systems Servicing NC II CGDocument238 pagesComputer Systems Servicing NC II CGRickyJeciel100% (2)

- Motion For Forensic Examination - Cyber CasedocxDocument5 pagesMotion For Forensic Examination - Cyber CasedocxJazz Tracey100% (1)

- The New Drawing On The Right Side of The BrainDocument314 pagesThe New Drawing On The Right Side of The BrainBasilio MaliwangaNo ratings yet

- You're Supposed To Be Wealthy HowDocument231 pagesYou're Supposed To Be Wealthy HowBasilio Maliwanga100% (1)

- Assessment Task 2 2Document10 pagesAssessment Task 2 2Pratistha GautamNo ratings yet

- Advanced Banking Law May 2013 ExamsDocument5 pagesAdvanced Banking Law May 2013 ExamsBasilio MaliwangaNo ratings yet

- Advanced Banking Law - May 2015Document4 pagesAdvanced Banking Law - May 2015Basilio MaliwangaNo ratings yet

- Law Relating To Banking Nov 2014Document4 pagesLaw Relating To Banking Nov 2014Basilio MaliwangaNo ratings yet

- Law Relating To Banking May 2015Document5 pagesLaw Relating To Banking May 2015Basilio MaliwangaNo ratings yet

- Advanced Banking Law Nov 2016Document4 pagesAdvanced Banking Law Nov 2016Basilio MaliwangaNo ratings yet

- International Trade Finance Stella - Nov 2016Document4 pagesInternational Trade Finance Stella - Nov 2016Basilio MaliwangaNo ratings yet

- Advanced Banking Law - November 2014Document4 pagesAdvanced Banking Law - November 2014Basilio MaliwangaNo ratings yet

- International Trade Finance November 2014Document5 pagesInternational Trade Finance November 2014Basilio MaliwangaNo ratings yet

- Advanced Banking Law MAY 2014 PAPERDocument4 pagesAdvanced Banking Law MAY 2014 PAPERBasilio MaliwangaNo ratings yet

- Law Relating To Banking - Nov 2013Document4 pagesLaw Relating To Banking - Nov 2013Basilio MaliwangaNo ratings yet

- Credit Risk Assessment 1 May 2011Document5 pagesCredit Risk Assessment 1 May 2011Basilio MaliwangaNo ratings yet

- Advanced Banking Law May 2016Document3 pagesAdvanced Banking Law May 2016Basilio MaliwangaNo ratings yet

- Law Relating To Banking May 2010 Main PaperDocument5 pagesLaw Relating To Banking May 2010 Main PaperBasilio MaliwangaNo ratings yet

- Law Relating To Banking May 2014Document4 pagesLaw Relating To Banking May 2014Basilio MaliwangaNo ratings yet

- Advanced Banking Law Nov 2010 Main PaperDocument4 pagesAdvanced Banking Law Nov 2010 Main PaperBasilio MaliwangaNo ratings yet

- Credit Risk Assessment 1 May 2013Document4 pagesCredit Risk Assessment 1 May 2013Basilio MaliwangaNo ratings yet

- International Trade Finance Nov 2010 Main PaperDocument6 pagesInternational Trade Finance Nov 2010 Main PaperBasilio MaliwangaNo ratings yet

- International Trade Finance - May 2013Document4 pagesInternational Trade Finance - May 2013Basilio MaliwangaNo ratings yet

- Advanced Banking Law May 2010 Main PaperDocument3 pagesAdvanced Banking Law May 2010 Main PaperBasilio MaliwangaNo ratings yet

- Credit Risk Assessment 1 - November 2015Document8 pagesCredit Risk Assessment 1 - November 2015Basilio MaliwangaNo ratings yet

- Credit Risk Ass Ii Nov 2016Document5 pagesCredit Risk Ass Ii Nov 2016Basilio MaliwangaNo ratings yet

- Credit Risk Ass 2 Nov 2014Document4 pagesCredit Risk Ass 2 Nov 2014Basilio MaliwangaNo ratings yet

- Credit Risk Assessment 1 - November 2016Document5 pagesCredit Risk Assessment 1 - November 2016Basilio MaliwangaNo ratings yet

- Credit Risk Assessment 1 Nov 2013Document4 pagesCredit Risk Assessment 1 Nov 2013Basilio MaliwangaNo ratings yet

- Credit Risk Assessment 2 - November 2015Document4 pagesCredit Risk Assessment 2 - November 2015Basilio MaliwangaNo ratings yet

- International Trade Finance - May 2015Document6 pagesInternational Trade Finance - May 2015Basilio MaliwangaNo ratings yet

- The University of The South Pacific: School of Accounting and FinanceDocument3 pagesThe University of The South Pacific: School of Accounting and FinanceTetzNo ratings yet

- BF 130Document4 pagesBF 130Dixie CheeloNo ratings yet

- International Trade Finance Nov 2011 Main PaperDocument6 pagesInternational Trade Finance Nov 2011 Main PaperBasilio MaliwangaNo ratings yet

- Question Paper Code:: Reg. NoDocument6 pagesQuestion Paper Code:: Reg. Nosaranya pugazhenthiNo ratings yet

- MBA4013 Management of Banking andDocument7 pagesMBA4013 Management of Banking andNurfaiqah AmniNo ratings yet

- 2018-JAIBB LPB NovDocument3 pages2018-JAIBB LPB NovMashiur RahmanNo ratings yet

- CM-Final-EMBA-15th BatchDocument2 pagesCM-Final-EMBA-15th BatchMmonower HosenNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument37 pagesThis Paper Is Not To Be Removed From The Examination HallsmilkshakezNo ratings yet

- International Trade Finance May 2010 Main PaperDocument9 pagesInternational Trade Finance May 2010 Main PaperBasilio MaliwangaNo ratings yet

- International Trade Finance - May 2009Document6 pagesInternational Trade Finance - May 2009Basilio MaliwangaNo ratings yet

- Credit Risk Assessment 1 - May 2015Document6 pagesCredit Risk Assessment 1 - May 2015Basilio MaliwangaNo ratings yet

- M B MDocument22 pagesM B MAparna SinghNo ratings yet

- 96th AIBB RMFI Solved-2-1Document20 pages96th AIBB RMFI Solved-2-1Shamima AkterNo ratings yet

- BA 4003 Banking and Financial ServicesDocument2 pagesBA 4003 Banking and Financial ServicesSiranjeevi GNo ratings yet

- FN1024 2020Document6 pagesFN1024 2020cookieproductorNo ratings yet

- Oct 2007Document4 pagesOct 2007azwan ayopNo ratings yet

- Great Zimbabwe University Faculty of Commerce: Department of Accounting & FinanceDocument2 pagesGreat Zimbabwe University Faculty of Commerce: Department of Accounting & FinanceARCHIBALDNo ratings yet

- Banking LawDocument3 pagesBanking LawtrizahNo ratings yet

- Banking Law NotesDocument3 pagesBanking Law NoteserickekutuNo ratings yet

- Oct 2008Document3 pagesOct 2008azwan ayopNo ratings yet

- Topic 5-1Document46 pagesTopic 5-1Priyam MikeNo ratings yet

- 2019-JAIBB PBE JulyDocument1 page2019-JAIBB PBE Julyfarhadcse30No ratings yet

- Banking XiiDocument1 pageBanking XiiNadeem AkhterNo ratings yet

- Mba Part 1 Mbad Financial Management 13415 2020Document3 pagesMba Part 1 Mbad Financial Management 13415 2020Panchu HiremathNo ratings yet

- Moodle Oct07 FIM Test QnsDocument10 pagesMoodle Oct07 FIM Test QnsNothingToKnowNo ratings yet

- Fundamentals of Commercial BanksDocument3 pagesFundamentals of Commercial BanksWesleyNo ratings yet

- Diploma in Islamic Banking Examination, October-2021 Part-I 101: Alternative Financial System Time: 3 Hours Full Marks: 100 Pass Marks: 45Document9 pagesDiploma in Islamic Banking Examination, October-2021 Part-I 101: Alternative Financial System Time: 3 Hours Full Marks: 100 Pass Marks: 45saminNo ratings yet

- 96th AIBB TMFI SolvedDocument26 pages96th AIBB TMFI SolvedShamima AkterNo ratings yet

- Part Time Introduction To BankingDocument2 pagesPart Time Introduction To BankingSamiha YusufNo ratings yet

- Banking Unit IDocument1 pageBanking Unit IGUNA SHEKHARNo ratings yet

- Bce 200-Economics of Money and BankingDocument2 pagesBce 200-Economics of Money and Bankingtonikanyange07No ratings yet

- MBA III Semester Supplementary Examinations October 2020: Code: 17E00308Document5 pagesMBA III Semester Supplementary Examinations October 2020: Code: 17E00308Beedam BalajiNo ratings yet

- Angels On Assignment - GOD's Rel - Perry StoneDocument176 pagesAngels On Assignment - GOD's Rel - Perry StoneBasilio MaliwangaNo ratings yet

- Englisch Schwer Letter-Of-Motivation Audio-1Document2 pagesEnglisch Schwer Letter-Of-Motivation Audio-1Basilio MaliwangaNo ratings yet

- A Closer Talk With God - Prayers - Kim TrujilloDocument70 pagesA Closer Talk With God - Prayers - Kim TrujilloBasilio MaliwangaNo ratings yet

- (Ebook - PDF - Graphic Design) - Learn How To DrawDocument133 pages(Ebook - PDF - Graphic Design) - Learn How To DrawBalachandran NavaratnasamyNo ratings yet

- CFR Exam GuideDocument32 pagesCFR Exam GuideNkopane MonahengNo ratings yet

- Are Your Finances Ready For A Stressful Life Event?: Also InsideDocument8 pagesAre Your Finances Ready For A Stressful Life Event?: Also InsideBasilio MaliwangaNo ratings yet

- (Ebook - PDF - Graphic Design) - Learn How To DrawDocument133 pages(Ebook - PDF - Graphic Design) - Learn How To DrawBalachandran NavaratnasamyNo ratings yet

- Lets Draw EquipmentDocument13 pagesLets Draw EquipmentAugustoEscobar RivasNo ratings yet

- Description: Tags: CitizenDocument43 pagesDescription: Tags: Citizenanon-313818No ratings yet

- Description: Tags: SucceedDocument48 pagesDescription: Tags: Succeedanon-439343No ratings yet

- WealthDocument40 pagesWealthapi-310517163No ratings yet

- CFR Exam GuideDocument32 pagesCFR Exam GuideNkopane MonahengNo ratings yet

- Sec Questions Investors Should AskDocument20 pagesSec Questions Investors Should Askhaha2012No ratings yet

- Finance: PersonalDocument44 pagesFinance: PersonalBasilio MaliwangaNo ratings yet

- LFT - Development Status and Perspectives: Prof. DR Michael SchemmeDocument7 pagesLFT - Development Status and Perspectives: Prof. DR Michael SchemmeabiliovieiraNo ratings yet

- Melissas ResumeDocument2 pagesMelissas Resumeapi-329595263No ratings yet

- ACI-20 S2 Indonesia - en PDFDocument3 pagesACI-20 S2 Indonesia - en PDFOktaNo ratings yet

- Pre Int Work Book Unit 9Document8 pagesPre Int Work Book Unit 9Maria Andreina Diaz SantanaNo ratings yet

- Science and Technology in Nation BuildingDocument40 pagesScience and Technology in Nation BuildingDorothy RomagosNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced Levelmehmet mutluNo ratings yet

- Regional Planning PDFDocument50 pagesRegional Planning PDFAayansh AnshNo ratings yet

- IoscanDocument3 pagesIoscanTimNo ratings yet

- Adverse Event Log TemplateDocument2 pagesAdverse Event Log TemplateLore LopezNo ratings yet

- Marathi Typing 30 WPM Passage PDF For Practice Arathi Typing 30 WPM Passage PDF For PracticeDocument1 pageMarathi Typing 30 WPM Passage PDF For Practice Arathi Typing 30 WPM Passage PDF For Practiceshankar jonwalNo ratings yet

- Ijrcm 2 Cvol 2 Issue 9Document181 pagesIjrcm 2 Cvol 2 Issue 9com-itNo ratings yet

- Step by Step Dilr Preparation GuideDocument22 pagesStep by Step Dilr Preparation GuideVishakha TNo ratings yet

- BF PP 2017Document4 pagesBF PP 2017Revatee HurilNo ratings yet

- Problem 4. Markov Chains (Initial State Multiplication)Document7 pagesProblem 4. Markov Chains (Initial State Multiplication)Karina Salazar NuñezNo ratings yet

- SWP-10 Loading & Unloading Using Lorry & Mobile Crane DaimanDocument2 pagesSWP-10 Loading & Unloading Using Lorry & Mobile Crane DaimanHassan AbdullahNo ratings yet

- Enidine Wire Rope IsolatorsDocument52 pagesEnidine Wire Rope IsolatorsJocaNo ratings yet

- A Brief On "The Purvanchal Expressway"Document4 pagesA Brief On "The Purvanchal Expressway"Ajay SinghNo ratings yet

- RESEARCH TEMPLATE 2023 1 AutoRecoveredDocument14 pagesRESEARCH TEMPLATE 2023 1 AutoRecoveredMark Lexter A. PinzonNo ratings yet

- LGC CasesDocument97 pagesLGC CasesJeshe BalsomoNo ratings yet

- Newcastle University Dissertation Cover PageDocument5 pagesNewcastle University Dissertation Cover PageThesisPaperHelpUK100% (1)

- Final Results Report: Curative Labs Inc. 3330 New York Ave NE Washington, DC 20002Document1 pageFinal Results Report: Curative Labs Inc. 3330 New York Ave NE Washington, DC 20002Aidan NicholsNo ratings yet

- Afirstlook PPT 11 22Document20 pagesAfirstlook PPT 11 22nickpho21No ratings yet

- Pro & Contra Hydropower: AdvantagesDocument16 pagesPro & Contra Hydropower: AdvantagesbarukomkssNo ratings yet

- C2601 Maintenance Manual V1 - 1Document45 pagesC2601 Maintenance Manual V1 - 1Tenri_Dio_9619No ratings yet