Professional Documents

Culture Documents

Tutorial 1 PDF

Uploaded by

Lee HansOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutorial 1 PDF

Uploaded by

Lee HansCopyright:

Available Formats

UNIVERSITI TUNKU ABDUL RAHMAN

FACULTY OF ACCOUNTING AND MANAGEMENT

ACADEMIC YEAR 2019/2020

BACHELOR OF ACCOUNTING (HONS)

TUTORIAL 1

SCOPE OF CHARGE

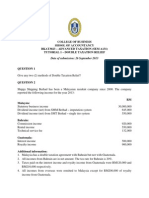

Question 1

(a) Explain the scope of charge and the basis of taxation in Malaysia under the Income

Tax Act, 1967.

(b) State the classes of income on which tax are chargeable under the Income Tax Act

1967.

Question 2

State five types each of the direct taxes and indirect taxes

Question 3

The following chargeable person has Malaysian source of income and remittance of foreign

source of income for the basis year of 2019.

Foreign source of income

Chargeable persons Malaysian source of received / remitted to

income (RM) Malaysia (RM)

Encik Ali (Resident) 10,000 28,000

Ms Janet (Non-resident) 30,000 56,000

Satu Sdn Bhd (Resident co. but 120,000 200,000

Not in specialised business)

Gold Berhad (Resident co. in 730,000 800,000

specialised business)

Required:

Explain whether the Malaysian source and foreign sources of income are chargeable to

Malaysian tax for the year of assessment 2019.

You might also like

- Tax MCQsDocument173 pagesTax MCQsHarleen Kaur100% (1)

- Revision Questions 2020 Part VDocument18 pagesRevision Questions 2020 Part VJeffrey KamNo ratings yet

- A231 Tuto Q Topic 2-4 2023-10-24 05 - 02 - 28Document7 pagesA231 Tuto Q Topic 2-4 2023-10-24 05 - 02 - 28amyNo ratings yet

- t1q Rca2 Ya2020 Intro & RDocument2 pagest1q Rca2 Ya2020 Intro & RHaananth SubramaniamNo ratings yet

- Week 6Document3 pagesWeek 6xinghe666No ratings yet

- Tutorial 1 DTA QDocument2 pagesTutorial 1 DTA QCheah Han MingNo ratings yet

- Tutorial Chapter 1Document5 pagesTutorial Chapter 1Miera FrnhNo ratings yet

- f6MYS 2019 DecDocument11 pagesf6MYS 2019 DecChoo LeeNo ratings yet

- Tax 2 RevisionDocument5 pagesTax 2 RevisionSoon Mei QiNo ratings yet

- Tax AssignmentDocument11 pagesTax AssignmentAM NerdyNo ratings yet

- Acca TX Mys DEC 2019 Sample QuestionsDocument24 pagesAcca TX Mys DEC 2019 Sample QuestionsShazwanieSazaliNo ratings yet

- Test 1 Tax 667 - Mac 2019Document4 pagesTest 1 Tax 667 - Mac 2019Fakhrul Haziq Md FarisNo ratings yet

- Assignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdDocument11 pagesAssignment BFN3114 Tax Planning TRIMESTER 3, 2020/2021: No Student Name Student IdSweethaa ArumugamNo ratings yet

- A201 Mid Assessment QDocument5 pagesA201 Mid Assessment QSanthiya MogenNo ratings yet

- BBA BIM BBM 2nd Semester Model Question AllDocument22 pagesBBA BIM BBM 2nd Semester Model Question AllGLOBAL I.Q.No ratings yet

- Malaysia: Taxation of International ExecutivesDocument23 pagesMalaysia: Taxation of International ExecutivesPeng LimNo ratings yet

- T2Q Rca22020 - EiDocument3 pagesT2Q Rca22020 - EiHaananth SubramaniamNo ratings yet

- HW 20 June 2020 Name: Mohamad Fidri Bin Shamsudin Class: Atx-C Lecturer: Ms NabilahDocument12 pagesHW 20 June 2020 Name: Mohamad Fidri Bin Shamsudin Class: Atx-C Lecturer: Ms NabilahPutera IzwanNo ratings yet

- Labuan PyqDocument8 pagesLabuan PyqNuratika Mat SaatNo ratings yet

- Final Examination On F-206Document3 pagesFinal Examination On F-206Rafia TasnimNo ratings yet

- Tutorial 8 Question - Tax AdministrationDocument5 pagesTutorial 8 Question - Tax Administration璇詠No ratings yet

- MBA183F3: RamaiahDocument5 pagesMBA183F3: Ramaiahvijay shetNo ratings yet

- TA5E (Taxation Laws)Document2 pagesTA5E (Taxation Laws)V.Vidhya VasiniNo ratings yet

- 0456Document4 pages0456Usman Shaukat Khan100% (1)

- Financial Management - II CA QPDocument4 pagesFinancial Management - II CA QPSivaramkrishna KasilingamNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Degree - Tax667 PDFDocument10 pagesFaculty - Accountancy - 2022 - Session 1 - Degree - Tax667 PDFNur Athirah Binti MahdirNo ratings yet

- Accountants of Pakistan: Assignment Questions - (Fall-2013 Session) Business Taxation Semester - 4Document8 pagesAccountants of Pakistan: Assignment Questions - (Fall-2013 Session) Business Taxation Semester - 4Adil HashmiNo ratings yet

- Allama Iqbal Open University, Islamabad Warning: (Department of Commerce)Document3 pagesAllama Iqbal Open University, Islamabad Warning: (Department of Commerce)Adeel AbbasNo ratings yet

- (April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document3 pages(April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Bcoc 136Document4 pagesBcoc 136Pranav KarwaNo ratings yet

- Taxation ManagementDocument2 pagesTaxation ManagementAdnan MurtazaNo ratings yet

- Assignment 2 Tax 2 AgiDocument12 pagesAssignment 2 Tax 2 Agiiknowu250No ratings yet

- Aditya Sharma - II Mid Term PaperDocument4 pagesAditya Sharma - II Mid Term PaperAditya SharmaNo ratings yet

- Macroeconomics AoU51KrAEpDocument6 pagesMacroeconomics AoU51KrAEpJannat MalhotraNo ratings yet

- TAXATIONDocument15 pagesTAXATIONNameles WaranNo ratings yet

- 71668bos57670 Inter p4q PDFDocument11 pages71668bos57670 Inter p4q PDFmonikaNo ratings yet

- TAX517 - Feb 2022Document14 pagesTAX517 - Feb 2022IZZAH FAQIHAH AHMAD HARRISNo ratings yet

- P6mys 2010 Jun ADocument11 pagesP6mys 2010 Jun AmandyNo ratings yet

- Taxation: Assignment # 6Document3 pagesTaxation: Assignment # 6Mahnoor AabidNo ratings yet

- Income Tax Assessment and Procedure - 1Document3 pagesIncome Tax Assessment and Procedure - 1amaljacobjogilinkedinNo ratings yet

- Business Taxation Final TermDocument1 pageBusiness Taxation Final Termzahid abbasNo ratings yet

- Guideline Answers: Professional ProgrammeDocument131 pagesGuideline Answers: Professional ProgrammeArham SoganiNo ratings yet

- Amendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORDocument45 pagesAmendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORTitan KNo ratings yet

- Personal Taxation Final QuestionsDocument5 pagesPersonal Taxation Final QuestionsKarthik RamanathanNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument23 pagesFinal Examination: Suggested Answers To QuestionsRanadeep ReddyNo ratings yet

- Double Taxation Relief: Tax SupplementDocument5 pagesDouble Taxation Relief: Tax SupplementlalitbhatiNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential BM/APR 2007/ECO211/164/210/219Document12 pagesUniversiti Teknologi Mara Final Examination: Confidential BM/APR 2007/ECO211/164/210/219T S Akmal RidzuanNo ratings yet

- Tutorial 3 QDocument3 pagesTutorial 3 Q謝中豪No ratings yet

- Soalan Assignment Tax Bab 7 Sem 6Document9 pagesSoalan Assignment Tax Bab 7 Sem 6Vasant SriudomNo ratings yet

- T4Q RCA2 2020 Personal Tax Comp FocusDocument3 pagesT4Q RCA2 2020 Personal Tax Comp FocusHaananth SubramaniamNo ratings yet

- Taxation MalawiDocument15 pagesTaxation MalawiCean Mhango100% (1)

- A221 MC 9 - StudentDocument4 pagesA221 MC 9 - StudentNajihah RazakNo ratings yet

- Exam Module3 PDFDocument11 pagesExam Module3 PDFKen ChiaNo ratings yet

- Tutorial 3: Employment and Personal Taxation: Universiti Tunku Abdul Rahman Faculty of Business and FinanceDocument2 pagesTutorial 3: Employment and Personal Taxation: Universiti Tunku Abdul Rahman Faculty of Business and FinanceKAY PHINE NGNo ratings yet

- Guideline Answers: Professional ProgrammeDocument115 pagesGuideline Answers: Professional ProgrammeArham SoganiNo ratings yet

- Acc2054 Mts Tutorial 2 QDocument2 pagesAcc2054 Mts Tutorial 2 QChigoziem OnyekawaNo ratings yet

- Poa T - 7Document3 pagesPoa T - 7SHEVENA A/P VIJIANNo ratings yet

- MBA193F3: RamaiahDocument4 pagesMBA193F3: Ramaiahvijay shetNo ratings yet

- Mega Test PDFDocument73 pagesMega Test PDFFalak HanifNo ratings yet

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesFrom EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesNo ratings yet

- 4 A TUTORIAL 4 AnswerDocument6 pages4 A TUTORIAL 4 AnswerLee HansNo ratings yet

- Accounting Firm Internship Lists Deloitte Accounting FirmDocument3 pagesAccounting Firm Internship Lists Deloitte Accounting FirmLee HansNo ratings yet

- Deceased Person, Trust and SettlementDocument12 pagesDeceased Person, Trust and SettlementLee HansNo ratings yet

- Tutorial 9 Questions Mfrs 112 Income Taxes (Part 1) - Lazar and HuangDocument4 pagesTutorial 9 Questions Mfrs 112 Income Taxes (Part 1) - Lazar and HuangLee HansNo ratings yet

- Tutorial 8Document3 pagesTutorial 8Lee HansNo ratings yet

- Universiti Tunku Abdul Rahman Faculty of Accountancy and ManagementDocument14 pagesUniversiti Tunku Abdul Rahman Faculty of Accountancy and ManagementLee HansNo ratings yet

- Universiti Tunku Abdul Rahman (Utar) Faculty of Accountancy and ManagementDocument8 pagesUniversiti Tunku Abdul Rahman (Utar) Faculty of Accountancy and ManagementLee HansNo ratings yet

- Faculty of Accountancy and Management (Fam)Document37 pagesFaculty of Accountancy and Management (Fam)Lee HansNo ratings yet

- Assignment June 2020 Question-ModeratedDocument5 pagesAssignment June 2020 Question-ModeratedLee HansNo ratings yet