Professional Documents

Culture Documents

Accounting Class No. 6 (Case 12)

Uploaded by

Мария Николенко0 ratings0% found this document useful (0 votes)

9 views2 pagesOriginal Title

Accounting class no. 6 (case 12)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pagesAccounting Class No. 6 (Case 12)

Uploaded by

Мария НиколенкоCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Accounting Lecturer:

University of Economics in Wrocław dr Wojciech Hasik

Case no. 12. (no dev.)

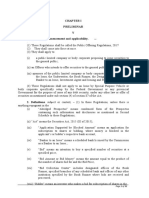

The balance sheet as at 31st March 20...r. is as below:

As at As at

Assets 31/03/0x Equity & Liabilities 31/03/0x

A. Fixed Assets A. Owners' Equity

I Intangible fixed assets I Share equity 645 000,-

II Tangible fixed assets 350 000,-

1. Machines and equipment 350 000,- B. Liabilities & provisions for liabil.

B. Current Assets III Short term liabilities

I Inventories 350 000,- 2. To other entities

1. Raw materials 100 000,- a) credits & loans 40 000,-

3. Finished goods 250 000,- d) trade payables 18 000,-

II Trade receivables 3 000,-

III Short term investments g) VAT due 6 300,-

Cash at vault 1 000,-

Cash at bank 5 000,-

Short term deferrals 300,-

Total Assets 709 300,- Total Equity & Liabilities 709 300,-

The additional information from the trial balance:

➢ Accumulated depreciation 10 000,-

Your task is to:

I. open the ledger accounts concerting additional data from trial balance

II. perform the accounting entries of below transactions:

1. Invoice VAT no. 105/02/1 from supplier Mining Wisznia Ltd. for purchased sand:

a) net value (5 tons @120) 600,-

b) transport 100,-

c) VAT 22% 49,-

d) total 749,-

2. Invoice VAT no. 342/072 from supplier Mining Bystrzyca Ltd. for purchased sand:

a) net value (2 tons @160) 320,-

b) VAT 22% 70,-

c) total 390,-

3. The premium for office spaces insurance for annual period was paid 3 600,-

4. Settlement of insurance premium (to be deferred within 12 months) ………

5. Sand from Mining Bystrzyca was delivered (delivery measured at purchasing price) …….

6. Sand delivery from Mining Bystrzyca was settled - VAT treatment (possible in the moment of invoice

submitting)

7. Sand from Mining Wisznia Ltd. was delivered (delivery measured at purchasing price) …….

8. Invoice VAT no. 34556234 from energy supplier consumed energy:

a) net value 300,-

b) VAT 22% 66,-

c) total 366,-

9. Settlement of energy consumption expense …….

10. Sand delivery from Mining Wisznia was settled:

a) accounting for transport costs

b) VAT treatment

11. Settlements of deferred costs of insurance to be allocated in current period 300,-

12. Settlements of transportation costs 100,-

13. Materials were disposed from the warehouse for production site 5 000,-

Accounting Lecturer:

University of Economics in Wrocław dr Wojciech Hasik

14. Settlement of cost of materials consumed in production process:

a) direct production consumption 3 000,-

b) indirect materials for production 1 500,-

c) materials consumed for general purposes 500,-

III. interpret the essence of closing balances of account Other deferrals

You might also like

- Lecture 7 Documentary CreditDocument12 pagesLecture 7 Documentary CreditМария НиколенкоNo ratings yet

- The Operation of A Back-To-Back CreditDocument1 pageThe Operation of A Back-To-Back CreditМария НиколенкоNo ratings yet

- XII. Outward and Inward Collection of Documents in Domestic and Foreign Currency TradeDocument3 pagesXII. Outward and Inward Collection of Documents in Domestic and Foreign Currency TradeМария НиколенкоNo ratings yet

- Topic 4 Quantitative TechniquesDocument29 pagesTopic 4 Quantitative TechniquesМария НиколенкоNo ratings yet

- Topic 2 Sources of InformationDocument26 pagesTopic 2 Sources of InformationМария НиколенкоNo ratings yet

- Topic 3 Focus GroupDocument22 pagesTopic 3 Focus GroupМария НиколенкоNo ratings yet

- Topic 3 In-Depth InterviewDocument19 pagesTopic 3 In-Depth InterviewМария НиколенкоNo ratings yet

- Topic 3 Qualitative Data AnalysisDocument23 pagesTopic 3 Qualitative Data AnalysisМария НиколенкоNo ratings yet

- Flexible Work SchedulesDocument11 pagesFlexible Work SchedulesМария НиколенкоNo ratings yet

- Topic 2 Research DesignDocument23 pagesTopic 2 Research DesignМария НиколенкоNo ratings yet

- Topic 2 Problem Definition and Research ObjectivesDocument23 pagesTopic 2 Problem Definition and Research ObjectivesМария НиколенкоNo ratings yet

- Accounting Class No. 2-3 (Case 4-7)Document2 pagesAccounting Class No. 2-3 (Case 4-7)Мария НиколенкоNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Reading 38 Market EfficiencyDocument20 pagesReading 38 Market EfficiencyNeerajNo ratings yet

- ABSL ISOP March 2023Document30 pagesABSL ISOP March 2023Sagar ShahNo ratings yet

- Cost of Capital 1Document7 pagesCost of Capital 1Tinatini BakashviliNo ratings yet

- A Minor Project Report On: "Mutual Fund Investments"Document24 pagesA Minor Project Report On: "Mutual Fund Investments"Srijan RishiNo ratings yet

- FIN 440: Individual Assignment Total: 50Document12 pagesFIN 440: Individual Assignment Total: 50ImrAn KhAnNo ratings yet

- Corporate Governance: Theory and Practice: Dr. Malek Lashgari, CFA, University of Hartford, West Hartford, CTDocument7 pagesCorporate Governance: Theory and Practice: Dr. Malek Lashgari, CFA, University of Hartford, West Hartford, CTNaod MekonnenNo ratings yet

- Stock Exchange Consolidation and Cross-Border Investment: An Empirical AssessmentDocument34 pagesStock Exchange Consolidation and Cross-Border Investment: An Empirical AssessmentBatoul ShokorNo ratings yet

- Unlocking-Wealth-through-Indices-RB Thulane PDFDocument94 pagesUnlocking-Wealth-through-Indices-RB Thulane PDFMathias100% (1)

- Uts Trading BlueprintDocument4 pagesUts Trading BlueprintBudi Mulyono100% (1)

- Risk Parity Is About BalanceDocument4 pagesRisk Parity Is About Balancejrf230100% (1)

- 6409-Article Text-22422-1-10-20120709 PDFDocument10 pages6409-Article Text-22422-1-10-20120709 PDFAmosh ShresthaNo ratings yet

- Kochi Airport - PPP Model Study: A Project OnDocument10 pagesKochi Airport - PPP Model Study: A Project Onsankhaghosh04No ratings yet

- 2go Group IncDocument7 pages2go Group IncSheenah FerolinoNo ratings yet

- IDLC Annualreport 2011Document240 pagesIDLC Annualreport 2011Shah Rashid0% (1)

- Tread MarketDocument19 pagesTread Marketshrikant choudekarNo ratings yet

- 2019 Trafigura Annual ReportDocument100 pages2019 Trafigura Annual ReportBachir CamaraNo ratings yet

- (Hoff) Novel Ways of Implementing Carry Alpha in CommoditiesDocument13 pages(Hoff) Novel Ways of Implementing Carry Alpha in CommoditiesrlindseyNo ratings yet

- CAPM - Assumptions & Extensions Group3Document14 pagesCAPM - Assumptions & Extensions Group3Srilekha BasavojuNo ratings yet

- Sai Ppfas MF PDFDocument138 pagesSai Ppfas MF PDFRaghu RamanNo ratings yet

- FBLA Securities and InvestmentsDocument8 pagesFBLA Securities and InvestmentsAdriel Williams100% (1)

- Public Offering Regulations 2017Document41 pagesPublic Offering Regulations 2017Ismail yousufNo ratings yet

- Components of Capital AccountDocument10 pagesComponents of Capital AccountadilscribdNo ratings yet

- TowerXchange Journal Issue 4Document140 pagesTowerXchange Journal Issue 4Jahanzaib RiazNo ratings yet

- 2018 - CSP - Sustainable Finance Capabilities of Private Banks - Report - #2Document47 pages2018 - CSP - Sustainable Finance Capabilities of Private Banks - Report - #2AllalannNo ratings yet

- Fakultas Ekonomi Dan Bisnis Universitas TrisaktiDocument19 pagesFakultas Ekonomi Dan Bisnis Universitas TrisaktiYoel Wahyu KristianNo ratings yet

- Top 6 Digital Assets: Online Millionaires ClubDocument5 pagesTop 6 Digital Assets: Online Millionaires ClubMohamed IsmailNo ratings yet

- Exercise 5Document3 pagesExercise 5Kenon Joseph HinanayNo ratings yet

- Is Systematic Value Investing Dead 51520Document41 pagesIs Systematic Value Investing Dead 51520Kostas IordanidisNo ratings yet

- Intermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020Document7 pagesIntermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020ohmyme sungjaeNo ratings yet

- Bafs s4 Personal Finance CHDocument3 pagesBafs s4 Personal Finance CHapi-516803253No ratings yet