Professional Documents

Culture Documents

Date Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable Definitions

Date Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable Definitions

Uploaded by

gin cr0 ratings0% found this document useful (0 votes)

3 views9 pagesOriginal Title

totalbeta

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views9 pagesDate Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable Definitions

Date Updated: Created By: What Is This Data? Home Page: Data Website: Companies in Each Industry: Variable Definitions

Uploaded by

gin crCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 9

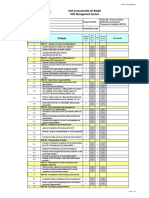

Date updated: 5-Jan-19

Created by: Aswath Damodaran, adamodar@stern.nyu.edu

What is this data? Total Beta (beta for completely undiversified investor)

Home Page: http://www.damodaran.com

Data website: http://www.stern.nyu.edu/~adamodar/New_Home_Page/data.html

Companies in each industry: http://www.stern.nyu.edu/~adamodar/pc/datasets/indname.xls

Variable definitions: http://www.stern.nyu.edu/~adamodar/New_Home_Page/datafile/variab

Industry Name Number of firms Average Unlevered Beta

Advertising 48 0.87

Aerospace/Defense 85 1.09

Air Transport 18 0.63

Apparel 50 0.76

Auto & Truck 14 0.34

Auto Parts 52 0.97

Bank (Money Center) 10 0.43

Banks (Regional) 633 0.40

Beverage (Alcoholic) 31 1.05

Beverage (Soft) 37 1.04

Broadcasting 24 0.51

Brokerage & Investment Banking 38 0.46

Building Materials 42 0.91

Business & Consumer Services 168 1.00

Cable TV 14 0.76

Chemical (Basic) 39 1.12

Chemical (Diversified) 6 1.49

Chemical (Specialty) 89 0.99

Coal & Related Energy 23 0.97

Computer Services 119 1.05

Computers/Peripherals 57 1.50

Construction Supplies 48 1.15

Diversified 23 1.14

Drugs (Biotechnology) 481 1.43

Drugs (Pharmaceutical) 237 1.38

Education 35 1.11

Electrical Equipment 116 1.18

Electronics (Consumer & Office) 19 1.22

Electronics (General) 160 0.96

Engineering/Construction 52 0.81

Entertainment 120 1.21

Environmental & Waste Services 91 0.96

Farming/Agriculture 33 0.50

Financial Svcs. (Non-bank & Insurance) 259 0.08

Food Processing 83 0.61

Food Wholesalers 18 1.23

Furn/Home Furnishings 30 0.67

Green & Renewable Energy 21 0.80

Healthcare Products 248 1.04

Healthcare Support Services 111 1.03

Heathcare Information and Technology 119 1.18

Homebuilding 31 0.72

Hospitals/Healthcare Facilities 34 0.55

Hotel/Gaming 70 0.71

Household Products 141 1.00

Information Services 71 1.05

Insurance (General) 20 0.67

Insurance (Life) 23 0.70

Insurance (Prop/Cas.) 50 0.65

Investments & Asset Management 172 0.87

Machinery 127 1.01

Metals & Mining 94 1.11

Office Equipment & Services 24 1.33

Oil/Gas (Integrated) 5 1.06

Oil/Gas (Production and Exploration) 301 1.07

Oil/Gas Distribution 20 0.62

Oilfield Svcs/Equip. 134 1.07

Packaging & Container 27 0.74

Paper/Forest Products 20 1.17

Power 51 0.35

Precious Metals 91 1.15

Publishing & Newspapers 33 0.90

R.E.I.T. 238 0.41

Real Estate (Development) 18 0.87

Real Estate (General/Diversified) 11 1.33

Real Estate (Operations & Services) 59 0.95

Recreation 72 0.81

Reinsurance 2 0.88

Restaurant/Dining 78 0.65

Retail (Automotive) 24 0.76

Retail (Building Supply) 17 0.97

Retail (Distributors) 88 0.99

Retail (General) 19 0.75

Retail (Grocery and Food) 12 0.28

Retail (Online) 79 1.34

Retail (Special Lines) 91 0.80

Rubber& Tires 4 0.24

Semiconductor 72 1.26

Semiconductor Equip 41 1.39

Shipbuilding & Marine 9 0.78

Shoe 10 0.74

Software (Entertainment) 92 1.27

Software (Internet) 44 1.31

Software (System & Application) 355 1.16

Steel 37 1.29

Telecom (Wireless) 21 0.71

Telecom. Equipment 98 1.02

Telecom. Services 67 0.74

Tobacco 17 1.13

Transportation 19 0.90

Transportation (Railroads) 10 2.08

Trucking 28 0.71

Utility (General) 18 0.17

Utility (Water) 19 0.32

Total Market 7209 0.80

Total Market (without financials) 6004 1.00

yu.edu

fied investor) US companies

New_Home_Page/data.html

pc/datasets/indname.xls

New_Home_Page/datafile/variable.htm

Average correlation with the

Average Levered Beta market Total Unlevered Beta

1.22 17.11% 5.07

1.24 29.02% 3.76

1.02 33.49% 1.89

0.93 18.27% 4.18

0.79 22.84% 1.50

1.17 23.04% 4.20

0.71 45.25% 0.95

0.57 28.82% 1.40

1.30 17.03% 6.15

1.18 19.41% 5.38

1.02 27.34% 1.86

1.21 41.15% 1.11

1.10 33.82% 2.71

1.22 23.86% 4.19

1.13 49.70% 1.53

1.55 24.29% 4.62

1.82 49.23% 3.03

1.17 29.46% 3.36

1.17 18.20% 5.31

1.27 23.60% 4.43

1.68 25.99% 5.77

1.45 33.41% 3.44

1.36 36.71% 3.12

1.51 22.28% 6.42

1.47 19.33% 7.13

1.28 21.76% 5.09

1.32 21.34% 5.54

1.19 16.04% 7.63

1.02 23.68% 4.06

1.01 32.48% 2.49

1.33 15.55% 7.81

1.19 20.11% 4.77

0.72 25.38% 1.95

0.70 25.43% 0.30

0.81 19.95% 3.06

1.62 21.78% 5.67

0.88 23.71% 2.82

1.62 14.27% 5.60

1.12 23.32% 4.46

1.15 25.09% 4.09

1.29 25.29% 4.65

0.98 25.94% 2.79

1.12 24.86% 2.22

1.01 29.40% 2.42

1.13 15.68% 6.36

1.12 40.66% 2.58

0.87 44.25% 1.52

1.11 48.45% 1.45

0.74 33.34% 1.95

1.10 27.23% 3.18

1.17 34.88% 2.90

1.32 14.96% 7.41

1.81 26.64% 5.01

1.16 37.63% 2.81

1.45 19.99% 5.37

1.07 26.85% 2.32

1.33 23.73% 4.50

1.07 44.29% 1.66

1.40 24.06% 4.87

0.54 22.55% 1.53

1.19 9.11% 12.61

1.26 27.45% 3.27

0.68 34.39% 1.19

1.19 17.22% 5.06

1.36 24.82% 5.35

1.35 19.36% 4.92

0.98 18.27% 4.43

0.97 65.13% 1.35

0.80 21.78% 2.99

1.15 24.39% 3.12

1.12 27.93% 3.46

1.44 27.80% 3.55

0.91 28.98% 2.59

0.45 12.89% 2.18

1.42 20.01% 6.72

1.07 21.56% 3.71

0.42 28.79% 0.83

1.34 33.50% 3.77

1.39 32.87% 4.23

1.08 26.27% 2.96

0.75 22.79% 3.25

1.26 16.59% 7.65

1.46 19.14% 6.82

1.23 23.25% 5.00

1.62 30.58% 4.23

1.26 19.99% 3.53

1.09 24.08% 4.25

1.22 18.56% 3.99

1.29 19.36% 5.81

1.14 39.13% 2.30

2.47 38.66% 5.38

1.22 33.35% 2.13

0.27 20.00% 0.87

0.42 18.26% 1.77

1.12 24.87% 3.23

1.21 24.00% 4.16

Total Levered Beta

7.11

4.27

3.05

5.09

3.47

5.07

1.58

1.98

7.63

6.06

3.73

2.93

3.24

5.10

2.28

6.38

3.69

3.97

6.42

5.38

6.46

4.35

3.70

6.78

7.58

5.87

6.20

7.43

4.29

3.10

8.55

5.93

2.83

2.76

4.06

7.46

3.73

11.36

4.81

4.60

5.10

3.78

4.49

3.43

7.21

2.76

1.97

2.29

2.22

4.05

3.36

8.83

6.80

3.08

7.27

3.99

5.60

2.43

5.80

2.41

13.08

4.57

1.97

6.94

5.50

6.95

5.36

1.49

3.66

4.73

4.00

5.18

3.15

3.50

7.08

4.97

1.45

3.99

4.22

4.10

3.31

7.58

7.62

5.28

5.29

6.32

4.53

6.56

6.67

2.92

6.39

3.66

1.33

2.33

4.52

5.03

You might also like

- Automotive Diagnostic Systems: Understanding OBD-I & OBD-II RevisedFrom EverandAutomotive Diagnostic Systems: Understanding OBD-I & OBD-II RevisedRating: 4 out of 5 stars4/5 (3)

- Lab 3Document8 pagesLab 3Ross LevineNo ratings yet

- Intensive Thai - Solution BookDocument18 pagesIntensive Thai - Solution Bookkawaii shoujo100% (1)

- AGC-4 Parameter List 4189340688 UKDocument206 pagesAGC-4 Parameter List 4189340688 UKJunior ReisNo ratings yet

- Bombay High AccidentDocument7 pagesBombay High AccidentsapphirerkNo ratings yet

- Wa CC EuropeDocument12 pagesWa CC EuropeADIDA69SNo ratings yet

- Industry Betas USDocument2 pagesIndustry Betas USRein Sta TeresaNo ratings yet

- List of AllDocument1,019 pagesList of AllTsd SinghNo ratings yet

- Top Companies & Industries From America, Europe AsiaDocument114 pagesTop Companies & Industries From America, Europe Asiatawhide_islamicNo ratings yet

- BUSINESSDocument4 pagesBUSINESSjmtz2355No ratings yet

- Industry Surveys: Semiconductor EquipmentDocument45 pagesIndustry Surveys: Semiconductor EquipmentsjamesmetNo ratings yet

- S&P Pharma Industry Overview - 11252010Document49 pagesS&P Pharma Industry Overview - 11252010earajesh100% (1)

- Betas Emergentes PasarunamanDocument9 pagesBetas Emergentes PasarunamanCarlos Fernando DiazNo ratings yet

- Aia Nas Tech SpecDocument3 pagesAia Nas Tech SpecAkbar ShaikNo ratings yet

- End User and End Use Declaration Form: (No Abbreviation)Document1 pageEnd User and End Use Declaration Form: (No Abbreviation)yisela arrieta cortezNo ratings yet

- Final Wireless Telecommunications Industry PaperDocument19 pagesFinal Wireless Telecommunications Industry Papervp_zarateNo ratings yet

- JD FormatDocument7 pagesJD Formatpramod1336No ratings yet

- List Current As of 9/13Document1 pageList Current As of 9/13Sharath ChandraNo ratings yet

- Documentation Page PDFDocument1 pageDocumentation Page PDFHabib Nur Syafi'iNo ratings yet

- 3300 03Document127 pages3300 03breplu_roz100% (1)

- Dot 4230 DS11Document65 pagesDot 4230 DS11Prasanna DissanayakeNo ratings yet

- S&P Semi ConductorDocument45 pagesS&P Semi Conductorcopia22No ratings yet

- Data DestructionDocument2 pagesData DestructionjohnribarNo ratings yet

- Astrological Trade Recommendations For The Companies of The Dow Jones Industrial AverageDocument1 pageAstrological Trade Recommendations For The Companies of The Dow Jones Industrial Averageapi-139665491No ratings yet

- DHS Certification DC Announcement FINAL 4-19-12Document2 pagesDHS Certification DC Announcement FINAL 4-19-12elyssaraeNo ratings yet

- MaterialsDocument12 pagesMaterialsEnoch L SNo ratings yet

- Ny IndexDocument9 pagesNy IndextalupurumNo ratings yet

- Job Completed TemplatesDocument15 pagesJob Completed TemplatesAF Dowell MirinNo ratings yet

- Stock Exchange Listed SectorsDocument3 pagesStock Exchange Listed Sectorslado17No ratings yet

- Sector Wise Stocks PDFDocument42 pagesSector Wise Stocks PDFskandmalasNo ratings yet

- Akamai Q1 US IDG Security Perimeter On Demand Webcast June 16300 BriefDocument3 pagesAkamai Q1 US IDG Security Perimeter On Demand Webcast June 16300 BriefAndrés AlbarracínNo ratings yet

- US Infrastructure Industry Spending Trends - 30th April 09Document25 pagesUS Infrastructure Industry Spending Trends - 30th April 09pkeranova07No ratings yet

- Designation / Position: Job Posting FormDocument6 pagesDesignation / Position: Job Posting FormSivakumar VedachalamNo ratings yet

- Astrological Trade Recommendations For The Companies of The Dow Jones Industrial AverageDocument1 pageAstrological Trade Recommendations For The Companies of The Dow Jones Industrial Averageapi-139665491No ratings yet

- Industry Survey - Restaurant 2011Document42 pagesIndustry Survey - Restaurant 2011Christe ClarissaNo ratings yet

- ESTA E1-44 2014automationDocument49 pagesESTA E1-44 2014automationGabriel neagaNo ratings yet

- FDA Easy on-PCDocument5 pagesFDA Easy on-PCVictor CuellarNo ratings yet

- Copia de GAS Module - 4 Years of Financial DataDocument53 pagesCopia de GAS Module - 4 Years of Financial Dataadrian5pgNo ratings yet

- U.S. Food & Drug: Administration 10903 New Hampshire Avenue Silver Spring, MD 20993Document13 pagesU.S. Food & Drug: Administration 10903 New Hampshire Avenue Silver Spring, MD 20993ryan resultsNo ratings yet

- Ansi-Esta E1-11 2008R2018Document51 pagesAnsi-Esta E1-11 2008R2018Levent BirgulNo ratings yet

- US Details New Restrictions On Chinese Supercomputer Companies - CNNDocument3 pagesUS Details New Restrictions On Chinese Supercomputer Companies - CNNSandip PudasainiNo ratings yet

- The Medical Imaging & Technology Alliance Offers Guidance On Mitigating FDA-Announced URGENT11 Vulnerabilities in Medical Imaging DevicesDocument3 pagesThe Medical Imaging & Technology Alliance Offers Guidance On Mitigating FDA-Announced URGENT11 Vulnerabilities in Medical Imaging DevicesPR.comNo ratings yet

- Astrological Trade Recommendations For The Companies of The Dow Jones Industrial AverageDocument1 pageAstrological Trade Recommendations For The Companies of The Dow Jones Industrial Averageapi-139665491No ratings yet

- Not QualittiveDocument11 pagesNot Qualittivedppl.mepNo ratings yet

- List of Sectors: IT Sector S.no Sector Name S.noDocument6 pagesList of Sectors: IT Sector S.no Sector Name S.noAravind KambhampatiNo ratings yet

- BetterInvesting Weekly Stock Screen 5-13-13Document1 pageBetterInvesting Weekly Stock Screen 5-13-13BetterInvestingNo ratings yet

- Electric Power Industry Cost EstimatesDocument45 pagesElectric Power Industry Cost Estimatesmalini72No ratings yet

- Thermally Conductive Plastics MarketDocument6 pagesThermally Conductive Plastics MarketKaran RamghariaNo ratings yet

- Renub Research: Yammer - Product Analysis of Yammer IncDocument12 pagesRenub Research: Yammer - Product Analysis of Yammer Incapi-114525849No ratings yet

- Telecom 10 K Liability and Insurance Companies Slides EHT 6 2016Document32 pagesTelecom 10 K Liability and Insurance Companies Slides EHT 6 2016innundoNo ratings yet

- House Hearing, 113TH Congress - Faa's 2020 Nextgen Mandate: Benefits and Challenges For General AviationDocument64 pagesHouse Hearing, 113TH Congress - Faa's 2020 Nextgen Mandate: Benefits and Challenges For General AviationScribd Government DocsNo ratings yet

- 2020-11-29 Tore's Election AffidavitDocument37 pages2020-11-29 Tore's Election AffidavitZlv JacomeNo ratings yet

- World Vision Ethiopia Would Like To Invite Highly Experienced Manufactures and Wholesalers For The Supply of Construction MaterialsDocument5 pagesWorld Vision Ethiopia Would Like To Invite Highly Experienced Manufactures and Wholesalers For The Supply of Construction MaterialsProNo ratings yet

- 94% of The Fortune 1000 Are Seeing Coronavirus Supply Chain Disruptions: ReportDocument6 pages94% of The Fortune 1000 Are Seeing Coronavirus Supply Chain Disruptions: ReportTushar ShrivastavNo ratings yet

- Technology Applications in AirlinesDocument29 pagesTechnology Applications in AirlinesZAIN AHMED SAYED100% (1)

- Florida First Freedom BOCC Final Report MachinesDocument7 pagesFlorida First Freedom BOCC Final Report MachinesChristopher GleasonNo ratings yet

- Supply Chain Vulnerabilities Impacting Commercial AviationFrom EverandSupply Chain Vulnerabilities Impacting Commercial AviationNo ratings yet

- Construction, Transportation, Mining & Forestry Machinery Rental Revenues World Summary: Market Values & Financials by CountryFrom EverandConstruction, Transportation, Mining & Forestry Machinery Rental Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Regulating Cross-Border Data Flows: Issues, Challenges and ImpactFrom EverandRegulating Cross-Border Data Flows: Issues, Challenges and ImpactNo ratings yet

- Air Duct Plastics World Summary: Market Values & Financials by CountryFrom EverandAir Duct Plastics World Summary: Market Values & Financials by CountryNo ratings yet

- Building & Construction Plastics Products World Summary: Market Sector Values & Financials by CountryFrom EverandBuilding & Construction Plastics Products World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Closed Circuit Television Systems Applications World Summary: Market Values & Financials by CountryFrom EverandClosed Circuit Television Systems Applications World Summary: Market Values & Financials by CountryNo ratings yet

- POH 125-02-114 Cessna R&S Feb 2017Document188 pagesPOH 125-02-114 Cessna R&S Feb 2017Abdulfetah NesredinNo ratings yet

- Al Nusri Theodicy of OptiDocument3 pagesAl Nusri Theodicy of OptimirsNo ratings yet

- Globalization Concept MapDocument7 pagesGlobalization Concept MapIntrovert DipshitNo ratings yet

- Mathematics Reviewer With AnswerDocument2 pagesMathematics Reviewer With AnswerPaolo BundocNo ratings yet

- HSE Evaluation CriteriaDocument2 pagesHSE Evaluation CriteriaChan RizkyNo ratings yet

- AODDocument8 pagesAODPrakash Mishra100% (1)

- Intellectual Property Rights An IntroductionDocument140 pagesIntellectual Property Rights An IntroductionSumatthi Devi ChigurupatiNo ratings yet

- Focalpoint Graphic Workstation: DescriptionDocument4 pagesFocalpoint Graphic Workstation: Descriptioncarlos yepezNo ratings yet

- Stat I CH - 1Document9 pagesStat I CH - 1Gizaw BelayNo ratings yet

- 9 Preventive MaintenanceDocument14 pages9 Preventive MaintenanceAlma AgnasNo ratings yet

- Presented By-Mahak Ralli Final YearDocument44 pagesPresented By-Mahak Ralli Final Yearfelaxis fNo ratings yet

- ebffiledoc_259Download textbook Antibody Engineering Methods And Protocols Damien Nevoltris ebook all chapter pdfDocument53 pagesebffiledoc_259Download textbook Antibody Engineering Methods And Protocols Damien Nevoltris ebook all chapter pdfmariano.nichols460100% (15)

- BSE Traded Stocks 03.09.2021fullDocument308 pagesBSE Traded Stocks 03.09.2021fullM StagsNo ratings yet

- Fine Woodworking Design Book SevenDocument352 pagesFine Woodworking Design Book SevenJarda KaiserNo ratings yet

- #Include #Include Using Namespace Class Private StructDocument5 pages#Include #Include Using Namespace Class Private StructSupraja MadhvarajNo ratings yet

- Module 3 OrgchemDocument7 pagesModule 3 OrgchemJHUNNTY LOZANONo ratings yet

- A Practical Guide To Cold ChainDocument22 pagesA Practical Guide To Cold Chainpramod329100% (1)

- Is16833-2018 - Annex D PDFDocument29 pagesIs16833-2018 - Annex D PDFRamboNo ratings yet

- LRFD Composite Beam DesignDocument261 pagesLRFD Composite Beam DesignJuan Carlos FloresNo ratings yet

- Pinata Project RubricDocument2 pagesPinata Project Rubricapi-272211615No ratings yet

- Vacuum Air BrakeDocument55 pagesVacuum Air BrakeAnshul Gupta100% (1)

- Annamayya Padatattva SAraM TattvaMDocument72 pagesAnnamayya Padatattva SAraM TattvaMZarathan XNo ratings yet

- Quiz 1Document2 pagesQuiz 1Jun RyNo ratings yet

- In The WOMB-National Geographic ChannelDocument2 pagesIn The WOMB-National Geographic ChannelEmanuel RodriguezNo ratings yet

- Apr-May 2021 PressDocument40 pagesApr-May 2021 Pressdara o riordainNo ratings yet

- Assignment 1 (LAB)Document7 pagesAssignment 1 (LAB)Zain NajamNo ratings yet